Jason Rogers

FXCM Representative

- Messages

- 517

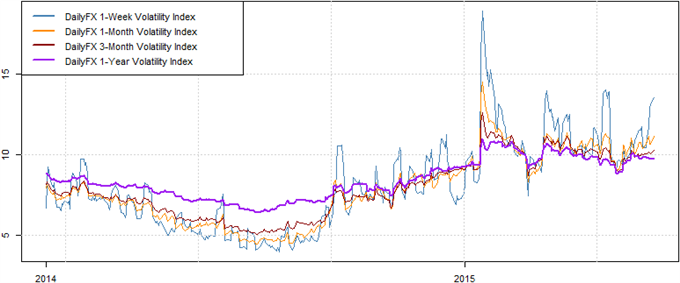

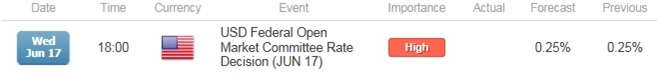

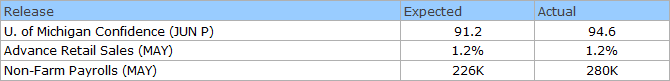

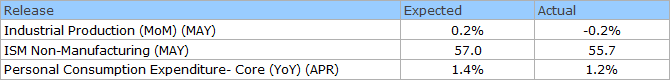

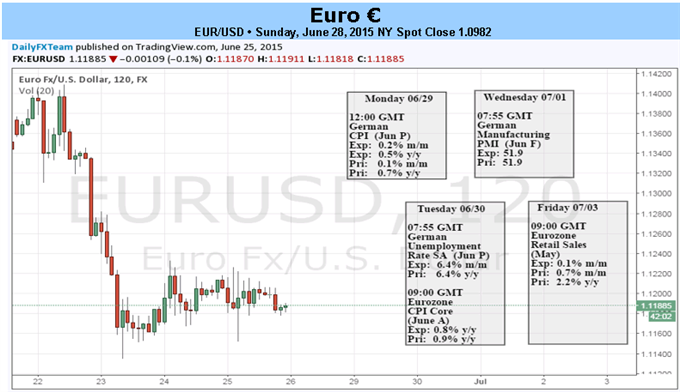

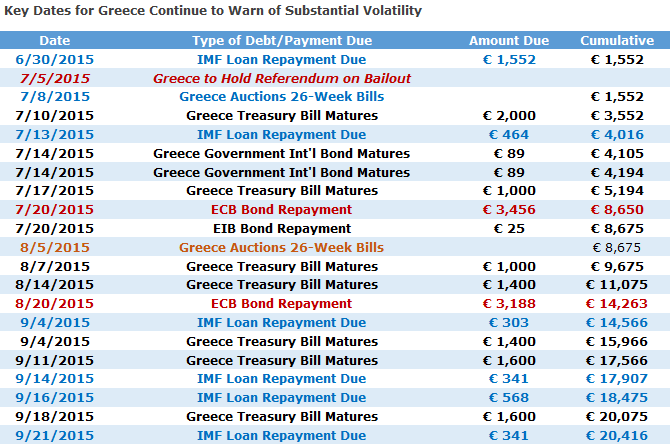

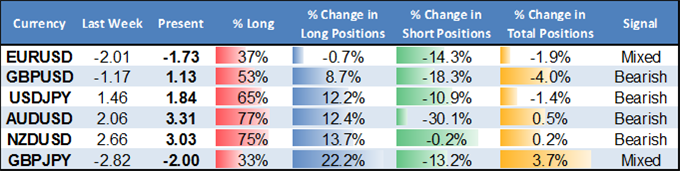

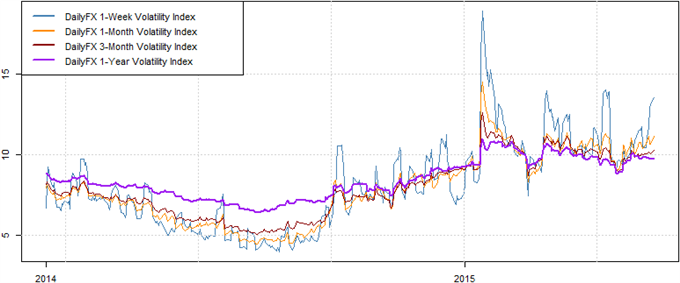

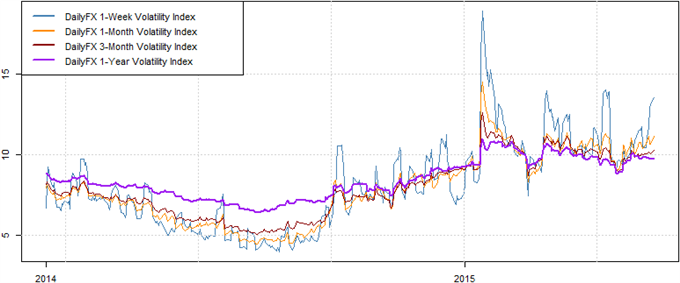

Forex volatility up on big week for economic event risk

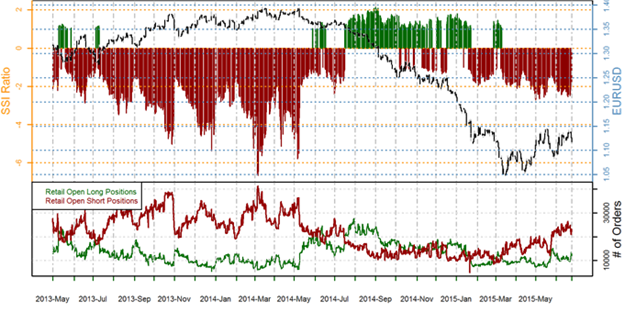

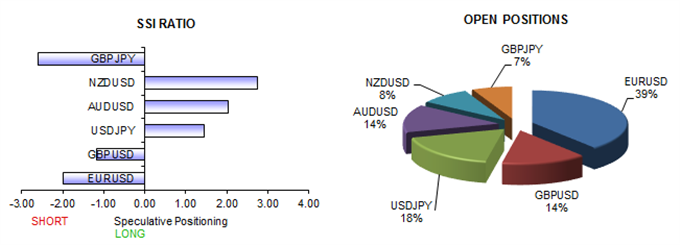

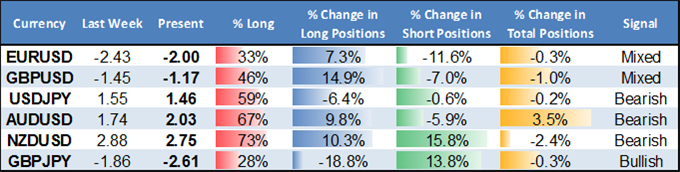

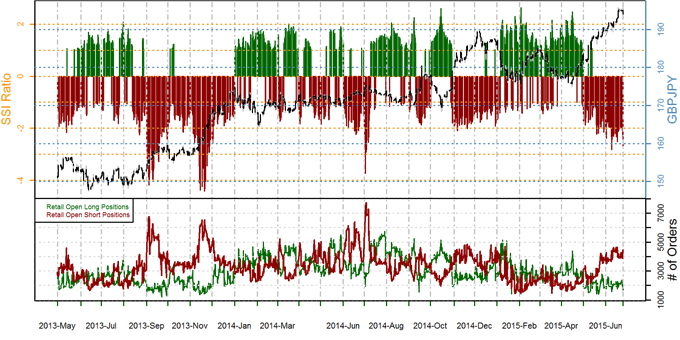

Data source: Bloomberg, DailyFX Calculations

Data source: Bloomberg, DailyFX Calculations

Please try to select the correct prefix when making a new thread in this folder.

Discuss is for general discussions of a financial company or issues related to companies.

Info is for things like "Has anyone heard of Company X?" or "Is Company X legit or not?"

Compare is for things like "Which of these 2 (or more) companies is best?"

Searching is for things like "Help me pick a broker" or "What's the best VPS out there for trading?"

Problem is for reporting an issue with a company. Please don't just scream "CompanyX is a scam!" It is much more useful to say "I can't withdraw my money from Company X" or "Company Y is not honoring their refund guarantee" in the subject line.

Keep Problem discussions civil and lay out the facts of your case. Your goal should be to get your problem resolved or reported to the regulators, not to see how many insults you can put into the thread.

More info coming soon.