Jason Rogers

FXCM Representative

- Messages

- 517

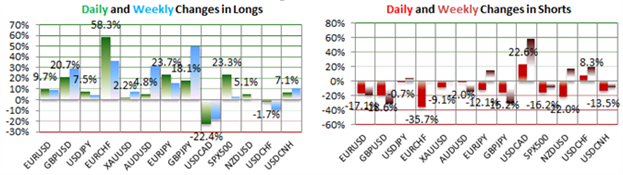

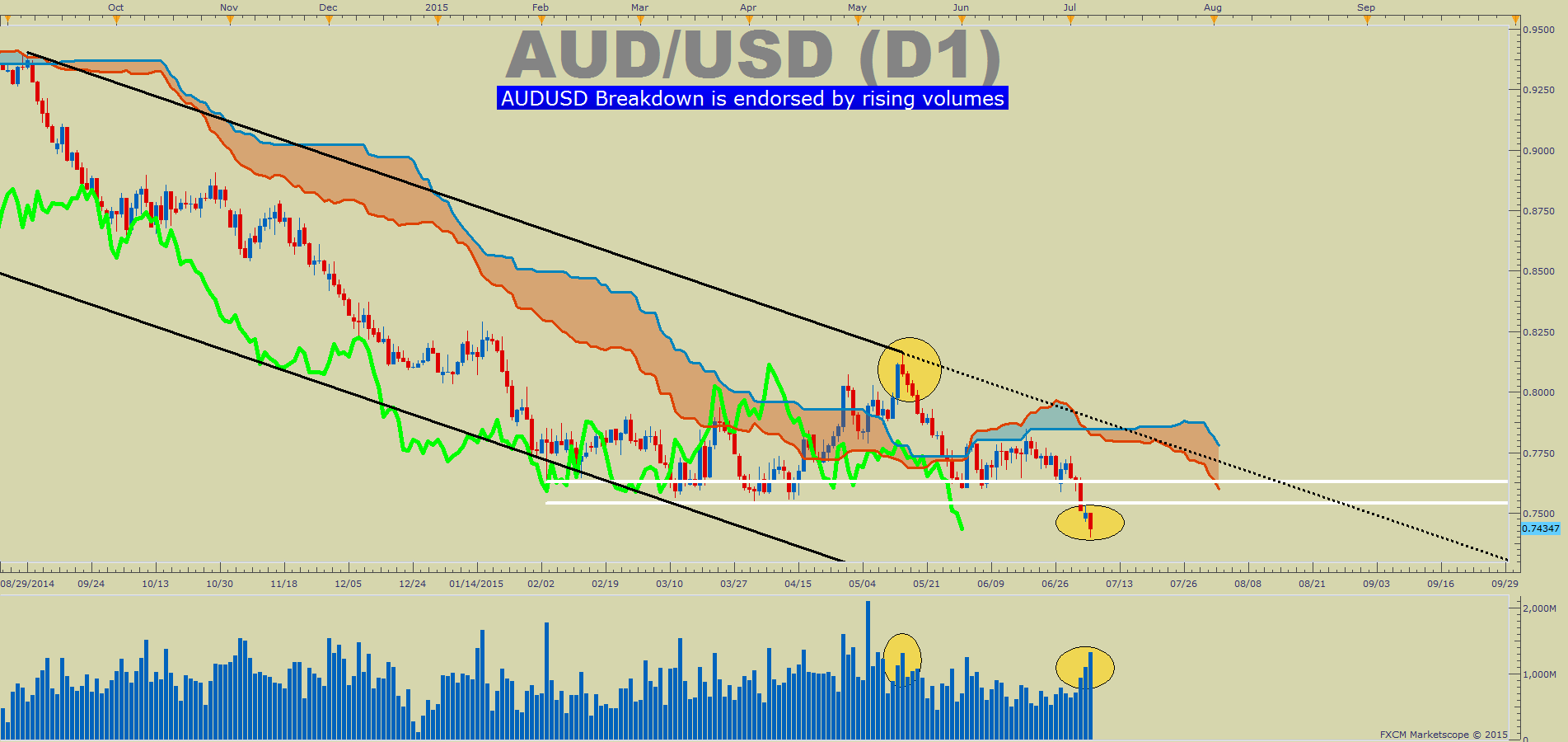

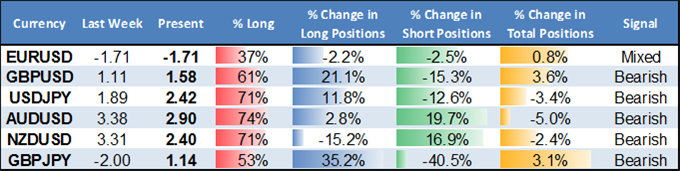

Breakout Strategies Favored on Euro Pairs

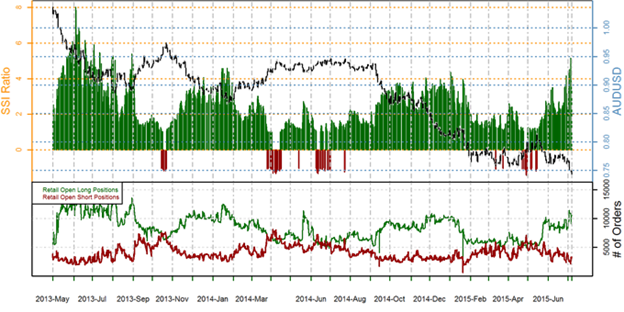

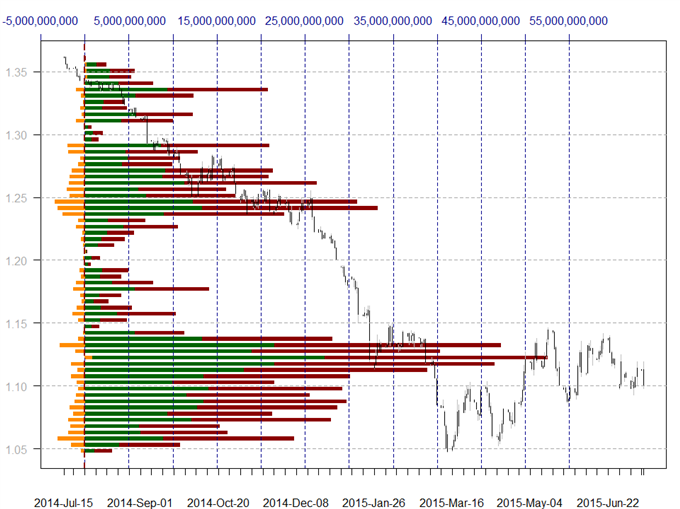

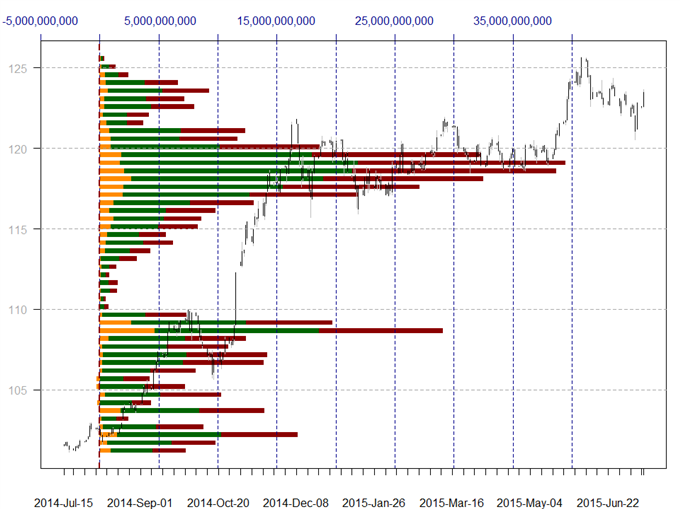

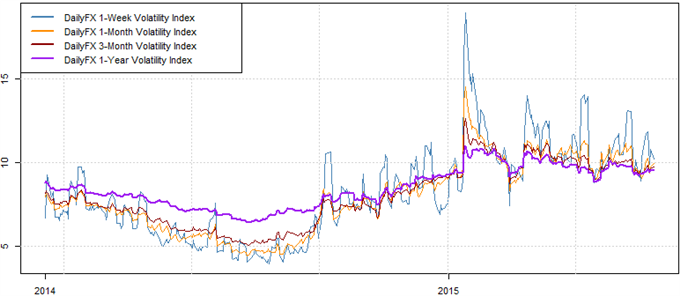

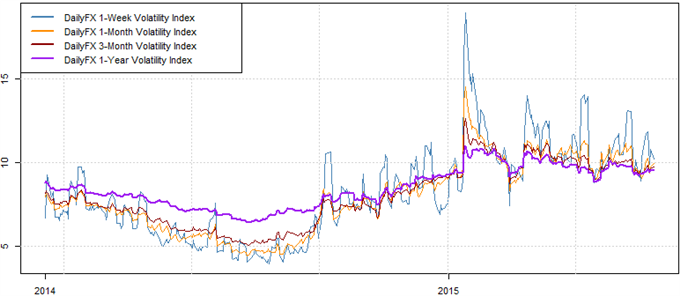

Volatility prices remain high as Greek voters rejected a Eurogroup bailout and raised the risks of a Greek exit from the Euro Zone.

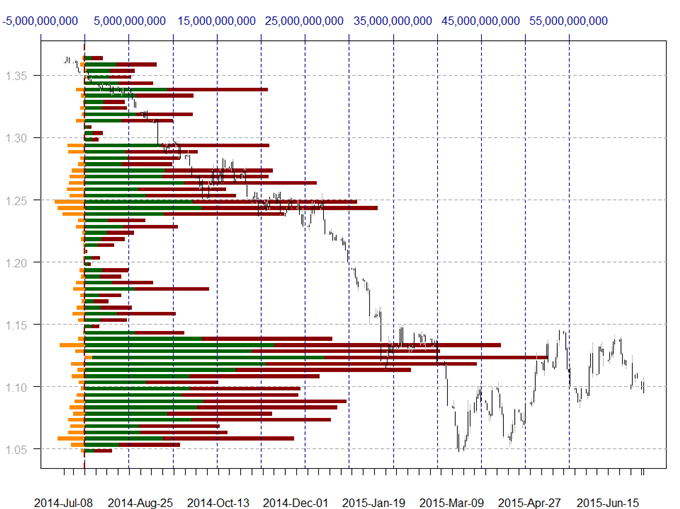

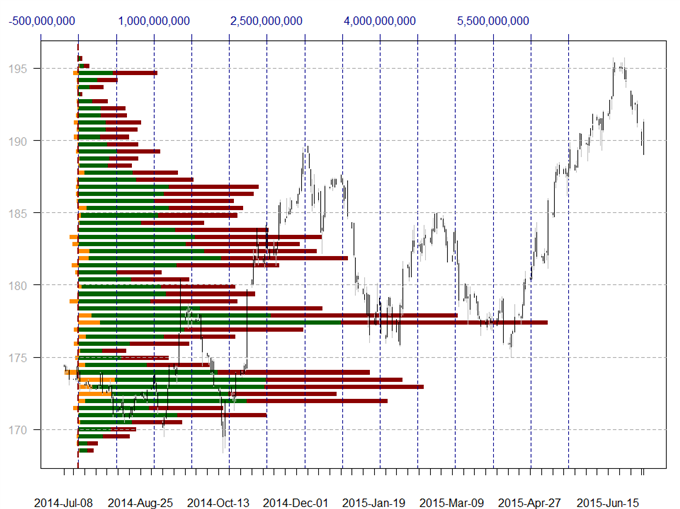

Data source: Bloomberg, DailyFX Calculations

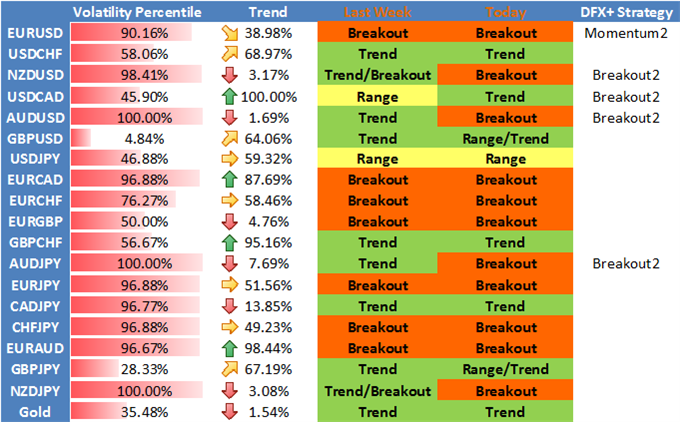

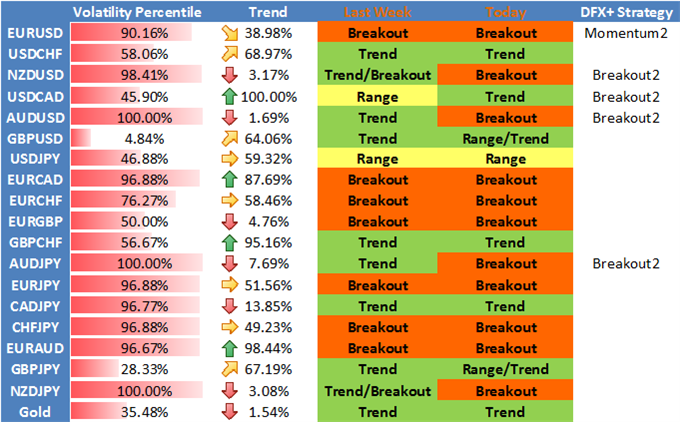

Thus current market conditions may favor our Breakout2 trading strategy in most of the especially risk-sensitive currency pairs.

Quantitative strategist David Rodriguez explains the Breakout2 trading system in his article on DailyFX.com

Volatility prices remain high as Greek voters rejected a Eurogroup bailout and raised the risks of a Greek exit from the Euro Zone.

Data source: Bloomberg, DailyFX Calculations

Thus current market conditions may favor our Breakout2 trading strategy in most of the especially risk-sensitive currency pairs.

Quantitative strategist David Rodriguez explains the Breakout2 trading system in his article on DailyFX.com