Zforex

zForex.com Representative

- Messages

- 28

EUR/USD Retreats to 1.0870 Support on Dollar Strength After PPI Data

The EUR/USD pair returned to the support level around 1.0870 following dollar strength after yesterday's PPI data, confirming persistent inflation. A downward breakout could drive the price toward the next level of 1.0800 followed by 1.0700.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 1.1100 | 1.1000 | 1.0950 | 1.0870 | 1.0800 | 1.0700 |

GBP/USD Breaks Support at 1.2800, Now at 1.2740

The GBP/USD pair breached the support level of 1.2800 and is now at 1.2740, which is the median line of the overall bullish channel. The current trend remains bullish, with the pair in the buying territory above the median line. However, another downward breakout could drive the price towards 1.2600.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 1.3200 | 1.3100 | 1.3000 | 1.2800 | 1.2740 | 1.2600 |

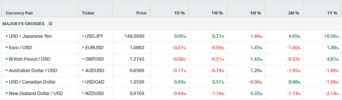

USD/JPY Rebounds for Fourth Day Ahead of BOJ Meeting Next Week

The USD/JPY pair continues its recovery for the fourth consecutive day. The market is anticipating next week's Bank of Japan (BOJ) meeting, which is expected to support the yen if the bank alters its monetary policy.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 152.00 | 149.70 | 148.00 | 146.30 | 145.00 | 144.00 |

Gold Exhibits Uncertainty Amid Forming Descending Triangle Pattern

Gold is showing uncertainty at the actual level where a descending triangle is forming. The next resistance level is set at 2200, with potential support identified around the 2140-45 range.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 2300 | 2250 | 2200 | 2140-45 | 2088 | 2055-60 |

Oil Experiences Reversal, Correcting from Resistance at 81-82

Oil is confirming a reversal movement, currently experiencing a slight correction after reaching the resistance level at 81-82. A breakout above this level could propel the price towards the next target of 84.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 88 | 84 | 82 | 78 | 76 | 73 |

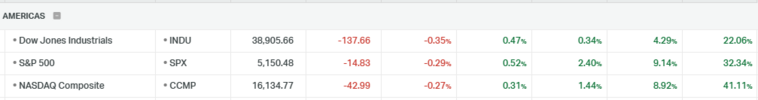

Nasdaq Range-Bound Amid Uncertainty; Potential Correction Ahead

The Nasdaq appears to be entering a price range, indicating uncertainty at the current levels. Yesterday's PPI data introduced further uncertainty, and considering next week's FOMC meeting, the market may experience a more ambiguous direction. Technically, this price action could suggest a potential correction.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 18800 | 18600 | 18400 | 18000 | 17600 | 17400 |

DAX Hits New Highs, Eyes 18,440 Amid ECB Rate Cut Expectations

The DAX is gaining momentum, achieving new peaks with 18,000 serving as the current resistance level, and aiming for the 18,440 mark next. The positive trend in European stocks is primarily driven by the widespread expectation that the ECB will reduce interest rates in June, in anticipation of a further decline in inflation towards the 2% target.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 18700 | 18440 | 18000 | 17600 | 17500 | 17300 |