alextrader79

Another multi and employee of JustForex

- Messages

- 307

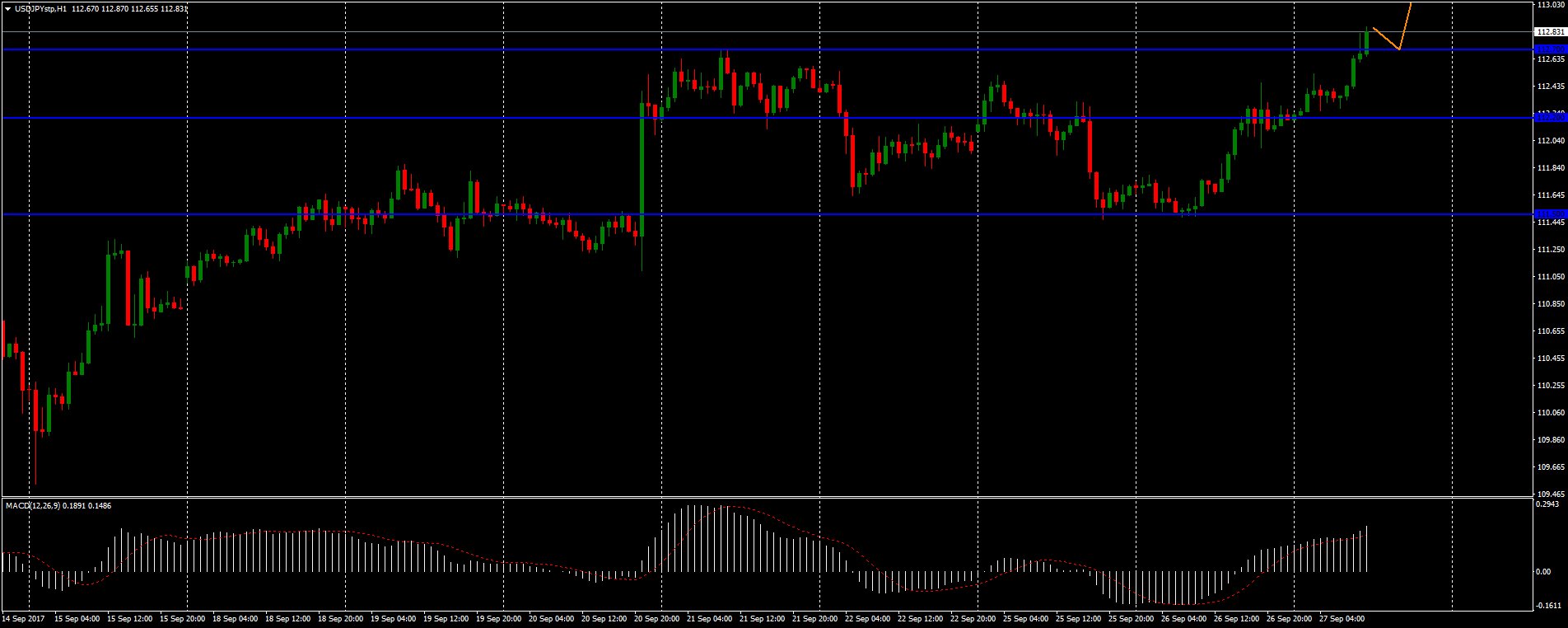

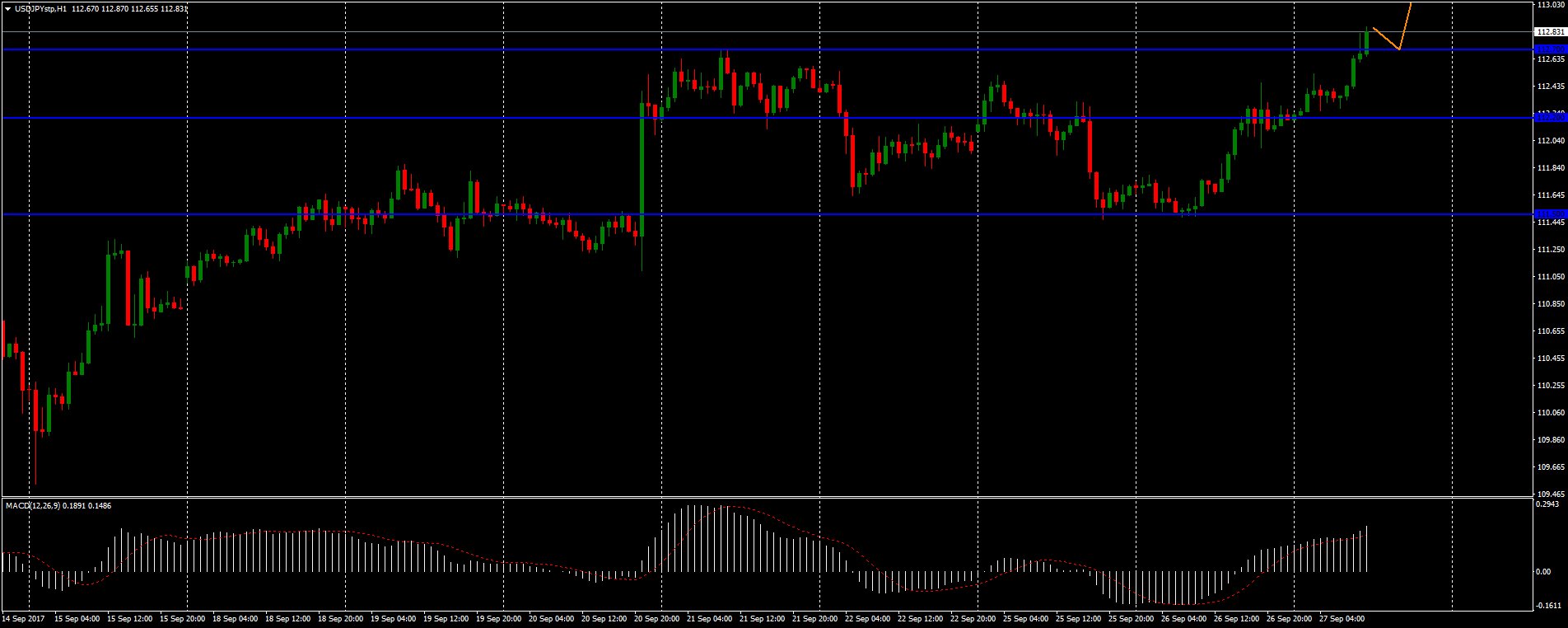

The Fed chairman supported the US dollar yesterday. Janet Yellen said that a gradual increase of the interest rate would be appropriate, despite the low inflation level in the country. The demand for USD has grown significantly. The probability of the monetary policy tightening in December 2017 exceeded 75%. At the beginning of this month, the figure was less than 40%.

I expect a bullish sentiment of USD/JPY in the near future. The price has overcome the 112.70 key resistance. I will buy the pair after the retest of this mark. The potential of the move to 113.25.

I expect a bullish sentiment of USD/JPY in the near future. The price has overcome the 112.70 key resistance. I will buy the pair after the retest of this mark. The potential of the move to 113.25.