ForexBrokerInc

ForexBrokerInc Representative

- Messages

- 9

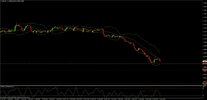

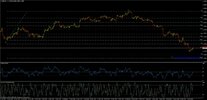

EURUSD: Euro struggles to rise above 1.1850. Current 1.1790

The first two European sessions of this week failed to see Euro above the exchange price of 1.1850. It seems that traders are happy to continue selling pullbacks as we get closer to the European Central Bank meeting scheduled for next Thursday, January 22 and the possibility of the adoption of some sort of a QE program. Next week will also see elections in Greece and ECB’s interest rate decision. As there’s not a lot of optimism in Eurozone at present time the pair is likely to test current weekly support levels at 1.1740 and later 1.16440. Should this sentiment change, a break above 1.1850 could see the pair advancing to 1.1950 – a near term resistance caused by last week’s gap.

The first two European sessions of this week failed to see Euro above the exchange price of 1.1850. It seems that traders are happy to continue selling pullbacks as we get closer to the European Central Bank meeting scheduled for next Thursday, January 22 and the possibility of the adoption of some sort of a QE program. Next week will also see elections in Greece and ECB’s interest rate decision. As there’s not a lot of optimism in Eurozone at present time the pair is likely to test current weekly support levels at 1.1740 and later 1.16440. Should this sentiment change, a break above 1.1850 could see the pair advancing to 1.1950 – a near term resistance caused by last week’s gap.