ForexBrokerInc

ForexBrokerInc Representative

- Messages

- 9

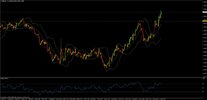

EURUSD

There’s little to be added to our Friday’s review as EURUSD continues sliding down of that 61.8% retracement seen last Friday. Today’s EU session brought EURUSD to as low as 1.0660 and current retrace to 1.07-1.0720 will be seen as another opportunity to join the bear run till 1.0620 and 1.05 respectively.

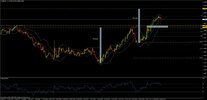

GOLD

The price of Gold withheld yesterday’s selling pressure at around $1190 per troy ounce. Increased volumes at around $1190 and continuation of the price, printing higher lows, allows suggestions that the price of gold is likely to advance above $1230/oz. With economic calendar being rather quiet for Gold this week, a gradual break above $1210 will provide a stronger signal for a new bull run. On the other side, a break below $1188 could see sharper movements down, aiming at $1170.

There’s little to be added to our Friday’s review as EURUSD continues sliding down of that 61.8% retracement seen last Friday. Today’s EU session brought EURUSD to as low as 1.0660 and current retrace to 1.07-1.0720 will be seen as another opportunity to join the bear run till 1.0620 and 1.05 respectively.

GOLD

The price of Gold withheld yesterday’s selling pressure at around $1190 per troy ounce. Increased volumes at around $1190 and continuation of the price, printing higher lows, allows suggestions that the price of gold is likely to advance above $1230/oz. With economic calendar being rather quiet for Gold this week, a gradual break above $1210 will provide a stronger signal for a new bull run. On the other side, a break below $1188 could see sharper movements down, aiming at $1170.