Tusharcsfx

Recruit

- Messages

- 0

Daily Crypto Analysis – Bitcoin Dive, Ethereum at $2k, Chainlink Bubble, XRP Struggles.

Introduction

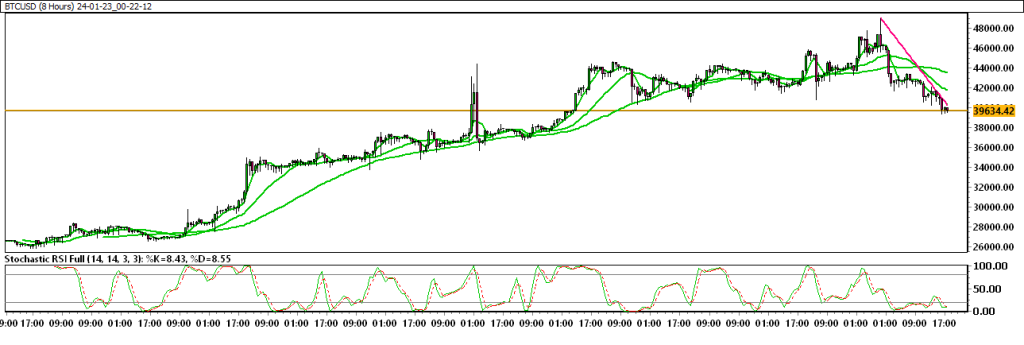

Bitcoin plunges below $40k as enthusiasm surrounding spot ETF approval diminishes. Despite initial optimism, the cryptocurrency struggles to sustain gains post-SEC approval. Ethereum faces a potential drop to $2,000 as on-chain metrics indicate profit-taking by whales. Chainlink exhibits short-term bubble risk, breaking out of a bullish channel with a potential trend reversal. XRP experiences a 9% decline as traders grapple with losses exceeding $130 million, with diminishing demand and anticipation for a Spot XRP ETF failing to halt the altcoin’s downward trajectory.Markets In Focus Today – BITCOIN

Bitcoin breaks below $40k as spot ETF hype wanes.Bitcoin fell sharply to an over seven-week low while also breaking below key levels on Tuesday as an initial boost from the approval of several spot exchange-traded funds now appeared to be waning. The world’s largest cryptocurrency saw a strong melt-up over the past year amid speculation that the Securities and Exchange Commission (SEC) would approve ETFs that directly track the price of the token- a first for U.S. markets. The token peaked at a near two-year high earlier this month, just as the SEC approved the spot ETFs. But bitcoin’s performance since the approval has been largely underwhelming, defying forecasts that the price would shoot up with the entrance of more institutional capital.

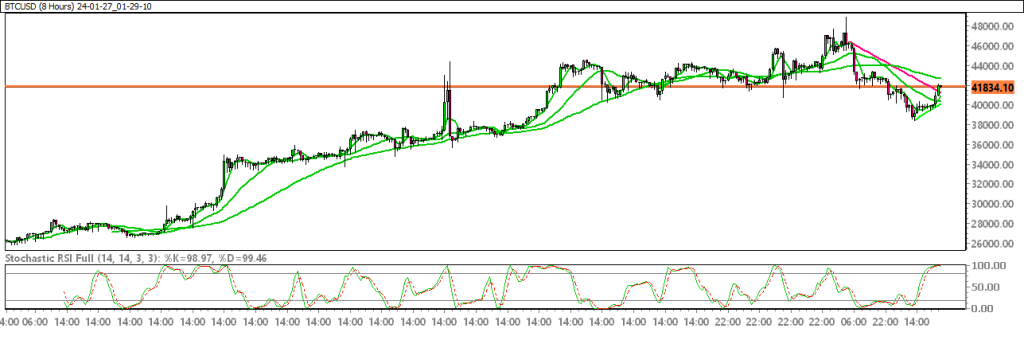

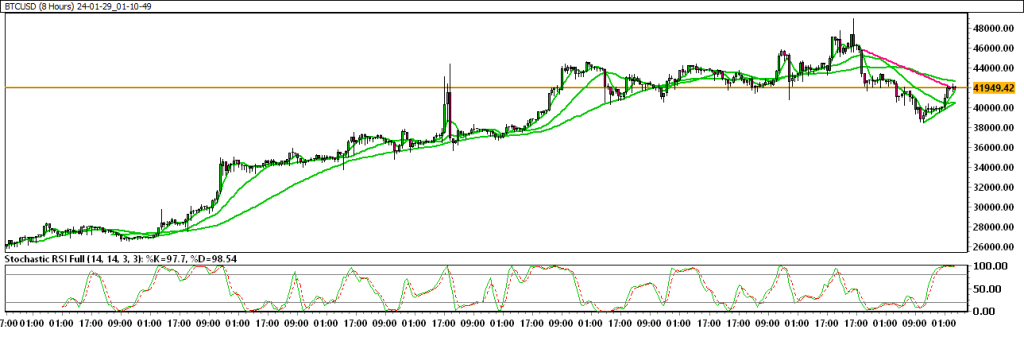

Technical Overview With Chart :

Moving Averages :

Exponential :

- MA 10 : 41519.88 | Negative Crossover | Bearish

- MA 20 : 42364.96 | Negative Crossover | Bearish

- MA 50 : 41946.62 | Negative Crossover | Bearish

Simple :

- MA 10 : 41593.45 | Negative Crossover | Bearish

- MA 20 : 43246.90 | Negative Crossover | Bearish

- MA 50 : 43159.75 | Negative Crossover | Bearish

Stochastic Oscillator : 6.17 | Sell Zone | Neutral

Resistance And Support Levels :

- R1 : 44310.51 R2 : 45983.99

- S1 : 38893.00 S2 : 37219.52

Overall Sentiment: Bearish Market Direction: Sell

Trade Suggestion: Limit Sell: 40285.04 | Take Profit: 37324.01 | Stop Loss: 42285.73ETHEREUM

READ THE FULL REPORT VISIT US - CAPITAL STREET FX