FxMaster

Colonel

- Messages

- 12,258

This guy is absolutely a spammer who ads for those Binary Options broker.

Indeed and she (from her profile name) already marked as a spam

This guy is absolutely a spammer who ads for those Binary Options broker.

Indeed and she (from her profile name) already marked as a spam

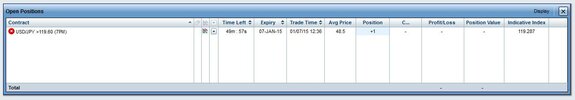

Hello Everyone, I am a binary trader from January 2012. This business is very unique as it is very simple to understand and return is massive and sometime about 500% on your initial investment (depends on your broker). To trade there are two basic types of binary options. The first, called a call, is bought when the trader expects the price of that option’s underlying asset to go up. If a given trader expects the price of that option’s underlying asset to fall, they would buy a put. With each binary option, there are two key pieces of information to remember. First is the strike price. This price level determines whether an option expires in the money or out of the money. Second is the date and time of expiry. With binary options, expiration can be as short as a few minutes and as long as several months. I am going to list some of the advantages as well as disadvantages of trading binary options.

Advantages

Your risk is defined which means you could only loose whatever you have invested.

No margin call or trade closure by broker before expiry time.

High return in very short time.

Profit from rising and falling market.

No spread so you could win even with .1 pip

Disadvantage

All most all of brokers offering binary options are not regulated.

You could loose all of your investment in few minutes.

Most of binary option brokers are illiquid and are bucket shops.

Things to consider before choosing option broker.

Till today option brokers are not regulated but some brokers are making efforts to be regulated by Cyprus Securities and Exchange Commission as most of brokers dwells in Cyprus. Only one broker is regulated by ASIC but my personal experience with them is not very good. You could search about them online. Do not invest your money if your broker claims following things :

We are market makers, Some OB (option Brokers) claims to be Market maker which is totally wrong and misleading information to traders.

If they claim to buy binaries from bank and sell them to you in which they get commission. No bank offers binary trading except some bank offers vanilla option but they are totally different from binary trading as their time period is monthly or at least weekly.

If they claim to be regulated by National Swiss Bank. Since when SNB become regulating agency for OB.

If they claim to be regulated by Reuters. WRONG ! Reuters provides platform for interbank trading as well as provides real time market data feed for various assets and is not a regulating agency.

Some broker write this statement "option price/quotes that is offered by us is not necessarily the real time of the underlying asset but rather the price that this broker is willing to offer the relevant option" This statement means that you may or may not get fair market price during expiry, fair market price is very important because you may loose big chunk of money with just with 0.1 pip although the real market price was in your favour.

Conclusion:

I have personally tried 5 different brokers (SS are available if anyone like to cross examine) and have concluded that till now OB don't offer transparency, fair option expiry price as well as funds security. You can pick different brokers and compare their expiry price and all of them would be having different expiry rates, even though most of them gets their feed from Thompson Reuters. We as a traders have to wait little more time for this business to develop to a point where we have sense of security and freedom to trade without fear.

Please feel free to comment since Sharing is caring.

Till next time.

If they claim to be regulated by National Swiss Bank. Since when SNB become regulating agency for OB.