FxGrow Support

Recruit

- Messages

- 58

FxGrow Daily Technical Analysis – 04th Jan, 2017

By FxGrow Research & Analysis Team

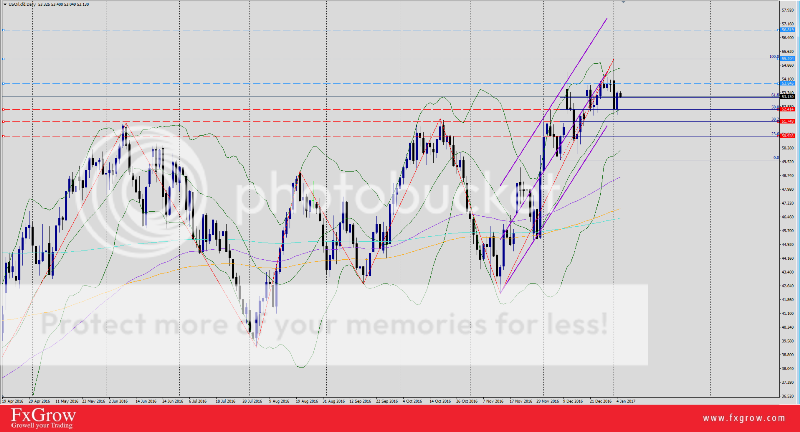

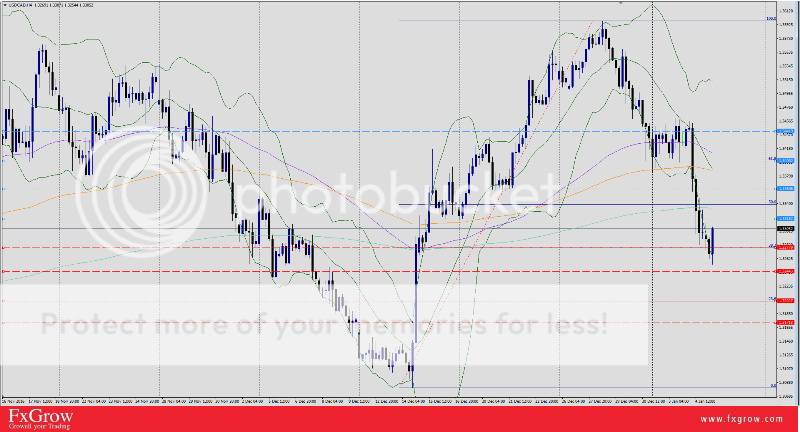

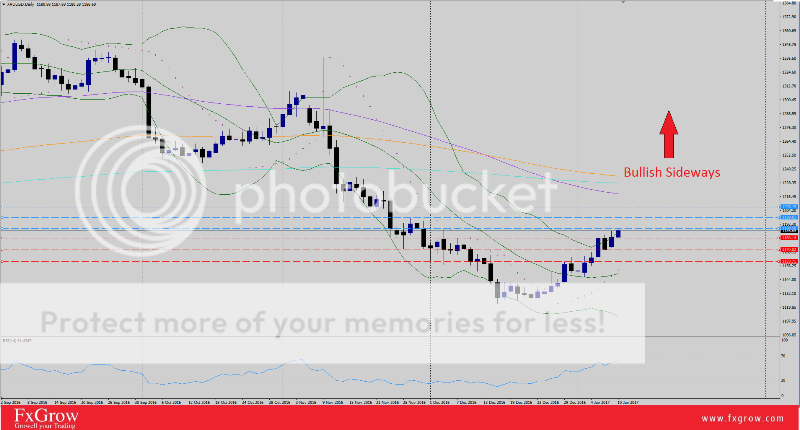

Kiwi Collapses on Negative local GDT

NZD/USD extended bearish momentum following negative local GDT, not meeting expectations. Diary price index scored -3.9% compared -0.5% in previous sessions, causing the pair to plunge to 0.6884 low, after clocking a high 0.6973. NZD/USD opened trading session with a surge at 0.6951 high, at which the cable is currently trading, taking advantage of weaker US dollar as US index dropping from 103.42 high to 102.91 low. Although the pair is showing some short-term-up-trend correction, it's still to be considered bearish taking into consideration strong US dollar even though the index is taking a rest right now after peeking to 103.81 at the end of 2016.

Trend : Bearish Sideways

Key levels to watch : Weekly Pp 0.6933

Resistance levels : R1 0.6973, R2 0.7044, R3 0.7118

Support levels : S1 0.6880, S2 0.6833, S3 0.6766

Remark : Overall the market remains bearish even though the cable is showing some slight recovery. US index is still to be considered relatively high with minor down correction. A break below S1 will cause further selloffs and wash towards S2 & S3. However, if the pair closes above R2 level, price level will trigger towards R3 level and above it the NZD/USD will shift to bullish momentum. Keep eye on US index.

For more in depth Research & Analysis please visit FxGrow.http://fxgrow.com/analysis-educatio...cal-analysis-fxgrow-free-forex-analysis-tools

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

By FxGrow Research & Analysis Team

Kiwi Collapses on Negative local GDT

NZD/USD extended bearish momentum following negative local GDT, not meeting expectations. Diary price index scored -3.9% compared -0.5% in previous sessions, causing the pair to plunge to 0.6884 low, after clocking a high 0.6973. NZD/USD opened trading session with a surge at 0.6951 high, at which the cable is currently trading, taking advantage of weaker US dollar as US index dropping from 103.42 high to 102.91 low. Although the pair is showing some short-term-up-trend correction, it's still to be considered bearish taking into consideration strong US dollar even though the index is taking a rest right now after peeking to 103.81 at the end of 2016.

Trend : Bearish Sideways

Key levels to watch : Weekly Pp 0.6933

Resistance levels : R1 0.6973, R2 0.7044, R3 0.7118

Support levels : S1 0.6880, S2 0.6833, S3 0.6766

Remark : Overall the market remains bearish even though the cable is showing some slight recovery. US index is still to be considered relatively high with minor down correction. A break below S1 will cause further selloffs and wash towards S2 & S3. However, if the pair closes above R2 level, price level will trigger towards R3 level and above it the NZD/USD will shift to bullish momentum. Keep eye on US index.

For more in depth Research & Analysis please visit FxGrow.http://fxgrow.com/analysis-educatio...cal-analysis-fxgrow-free-forex-analysis-tools

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.