FxGrow Support

Recruit

- Messages

- 58

FxGrow Daily Technical Analysis – 12th Jan, 2017

By FxGrow Research & Analysis Team

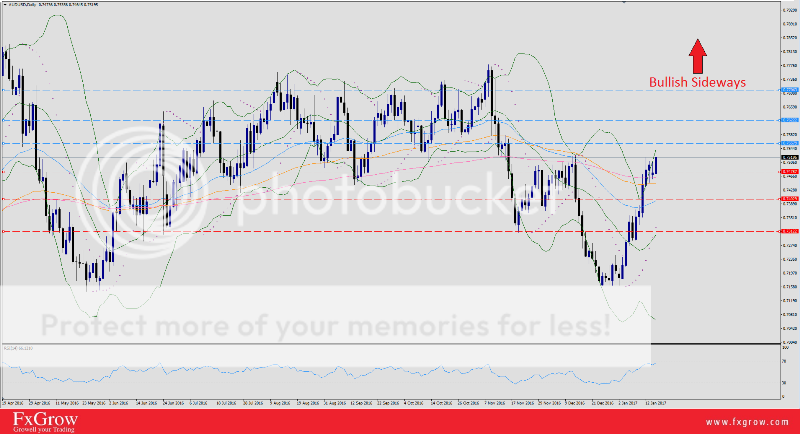

Gold Spikes Ahead of US Data

Gold extended bullish momentum this week taking advantage of weaker US dollar performance. Yesterday, Trump made an attack on local US companies which caused the US index to dilate bear forces, dropping to 100.70 9-Dec-fresh-lows. XAUUSD awaits major US news today and tomorrow both at 1:30 PM GMT and today at midnight, Yellen on behalf of US Fed will make a speech. Traders are awaiting these news to see how US dollar will perform facing strong gold performance.

Trend : Bullish Sideways

Resistance levels : R1 1213.94, R2 1222.89, R3 1232.48, R4 1142.08

Support levels : S1 1199.23, S2 1185.81, S3 1175.58, S4 1160.23

Remark : Keep an eye on US index as it's a strength measure facing gold. Also US data today will determine how gold will perform today and tomorrow.

For more in depth Research & Analysis please visit FxGrow.http://fxgrow.com/analysis-educatio...cal-analysis-fxgrow-free-forex-analysis-tools

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

By FxGrow Research & Analysis Team

Gold Spikes Ahead of US Data

Gold extended bullish momentum this week taking advantage of weaker US dollar performance. Yesterday, Trump made an attack on local US companies which caused the US index to dilate bear forces, dropping to 100.70 9-Dec-fresh-lows. XAUUSD awaits major US news today and tomorrow both at 1:30 PM GMT and today at midnight, Yellen on behalf of US Fed will make a speech. Traders are awaiting these news to see how US dollar will perform facing strong gold performance.

Trend : Bullish Sideways

Resistance levels : R1 1213.94, R2 1222.89, R3 1232.48, R4 1142.08

Support levels : S1 1199.23, S2 1185.81, S3 1175.58, S4 1160.23

Remark : Keep an eye on US index as it's a strength measure facing gold. Also US data today will determine how gold will perform today and tomorrow.

For more in depth Research & Analysis please visit FxGrow.http://fxgrow.com/analysis-educatio...cal-analysis-fxgrow-free-forex-analysis-tools

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.