FxGrow Support

Recruit

- Messages

- 58

FxGrow Fundamental Analysis – 28th Feb, 2017

By FxGrow Investment Research Desk

Sterling Declines as US Dollar Inclines, US GDP in Focus

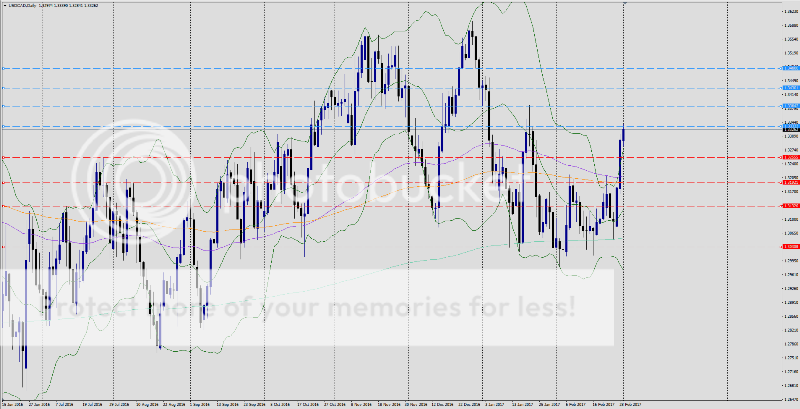

GBP/USD extended the bearish momentum for the third consecutive session this week. The pair clocked two-weeks-fresh-lows yesterday at 1.2383 pressured by reviving US Dollar yesterday as US index rallied from 100.66 low and parked at 101.18 hill, currently trading 101.11. The pair is trading 1.2432 right now, struggling to trespass it's daily pivot at 1.2437.

Other contributing fundamentals added negative weight for Sterling, starting with PM Theresa May and the possibility of releasing article 50 approaches and mid March in on her Agenda. Second, reports released by the Times saying that the UK government is preparing for a potential independence referendum in Scotland next March. Reports (Times) also mentioned that PM May has granted the green light for such referendum on the condition that it will take action after UK leaves EU.

Fundamentals :

1- US Prelim GDP q/q today at 1:30 PM GMT ( Heavy Impact )

2- US Consumer Confidence today at 3:00 PM GMT ( less Impact )

Technical :

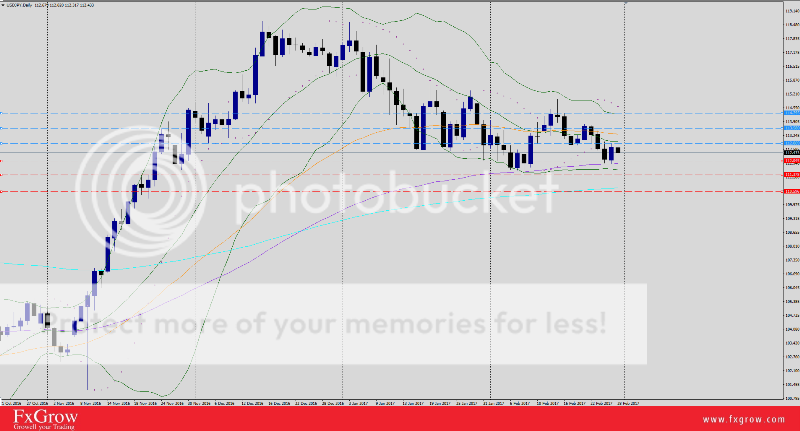

Trend : Bearish Sideways

Resistance levels : R1 1.2479, R2 1.2527, R3 1.2570

Support levels : S1 1.2412, S2 1.2371, S3 1.2325

Remark : Look forward for US data today which will impact US Dollar levels. Stalling below S1 level projects further congestion with attacks towards S2&S3 levels. Closing above R2 level is needed for a short-term-trend-reversal and above it, GBP/USD will be considered Bullish.

For more in depth Research & Analysis please visit FxGrow.http://fxgrow.com/analysis-educatio...cal-analysis-fxgrow-free-forex-analysis-tools

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

By FxGrow Investment Research Desk

Sterling Declines as US Dollar Inclines, US GDP in Focus

GBP/USD extended the bearish momentum for the third consecutive session this week. The pair clocked two-weeks-fresh-lows yesterday at 1.2383 pressured by reviving US Dollar yesterday as US index rallied from 100.66 low and parked at 101.18 hill, currently trading 101.11. The pair is trading 1.2432 right now, struggling to trespass it's daily pivot at 1.2437.

Other contributing fundamentals added negative weight for Sterling, starting with PM Theresa May and the possibility of releasing article 50 approaches and mid March in on her Agenda. Second, reports released by the Times saying that the UK government is preparing for a potential independence referendum in Scotland next March. Reports (Times) also mentioned that PM May has granted the green light for such referendum on the condition that it will take action after UK leaves EU.

Fundamentals :

1- US Prelim GDP q/q today at 1:30 PM GMT ( Heavy Impact )

2- US Consumer Confidence today at 3:00 PM GMT ( less Impact )

Technical :

Trend : Bearish Sideways

Resistance levels : R1 1.2479, R2 1.2527, R3 1.2570

Support levels : S1 1.2412, S2 1.2371, S3 1.2325

Remark : Look forward for US data today which will impact US Dollar levels. Stalling below S1 level projects further congestion with attacks towards S2&S3 levels. Closing above R2 level is needed for a short-term-trend-reversal and above it, GBP/USD will be considered Bullish.

For more in depth Research & Analysis please visit FxGrow.http://fxgrow.com/analysis-educatio...cal-analysis-fxgrow-free-forex-analysis-tools

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.