FxGrow Support

Recruit

- Messages

- 58

FxGrow Fundamental Analysis – 08th March, 2017

By FxGrow Investment Research Desk

Crude Oil levels Plunges over Houston Energy Meeting, Eyes on US inventories

Fundamentals:

Crude oil levels collapsed on Tuesday with a loss $1.08 per barrel -0.2% over fears of Houston energy meeting and outcome possibilities. Shell, the Royal Dutch company nailed a contract to ramp North American shale output earlier than planned and to lock in quick returns from what has become one of its most profitable businesses, the head of Shell's unconventional energy business said.

The Anglo-Dutch company plans to make shale oil and gas in the United States, Canada and Argentina a key engine of growth in the next decade, targeting output of around 500,000 barrels of oil equivalent per day (BOE/D), Greg Guidry told Reuters in an interview.

Saudi Oil Minister Khalid al-Falih said on Tuesday that oil market fundamentals were improving as an agreement to curb supply by OPEC and non-OPEC producers took effect. Mr. Falih added that OPEC would not let rival producers take advantage of the reductions to underwrite their own production investment. OPEC cartel is expected to meet again in May, where OPEC might extend their production curbs.

"We should not get ahead of the market," Falih told a group of oil industry executives at the CERA Week energy conference. Overall, he said the production reductions have had their intended effect, citing greater price arbitrage between east and west oil markets that "indicate the cuts are biting." He said there are signs of "green shoots" of oil investment in the United States although he cautioned that a fast response from the U.S. shale industry could be discouraging for needed investment in multiyear, long-term projects in other oil supply sources outside of shale. Saudi Arabia does not want OPEC to intervene in the oil market to address long-term structural shifts, but would support measures to address "short-term aberrations." (Reuters).

China's crude oil imports rose to the second-highest level on record in February, as strong demand from independent "teapot" refiners continues to drive growth. February's imports came in at 31.78 million tons or 8.286 million barrels per day, up 3.5 percent on a year ago, Chinese customs data showed on Wednesday. Daily shipments were only behind December's record 8.57 million bpd, but up on 8.01 million bpd in January.

Conclusion: The rift continues between OPEC and US with opposed interest. OPEC benefits from high levels of oil prices since it’s their main source of income. US on the other hand, with -4.2B deficit in trade balance yesterday, and Trump's industrial and infrastructure as his main concerns, will seek excessive efforts to tackle OPEC objectives. Crude oil levels will hang between $51 and $56 until OPEC's next meeting in May with possibilities for further reductions and compliance.

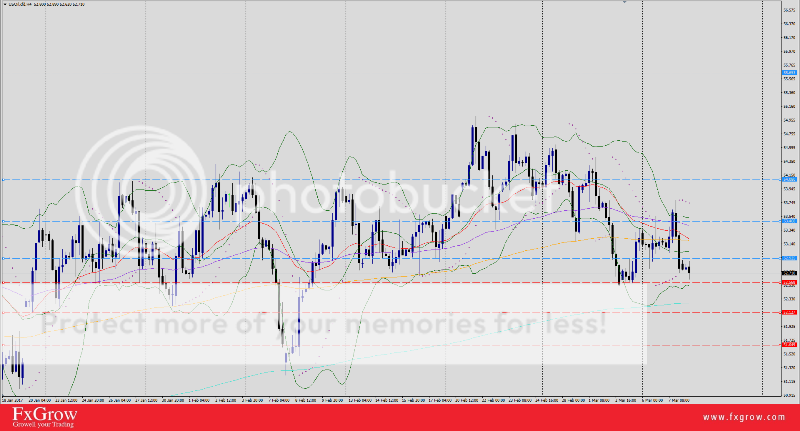

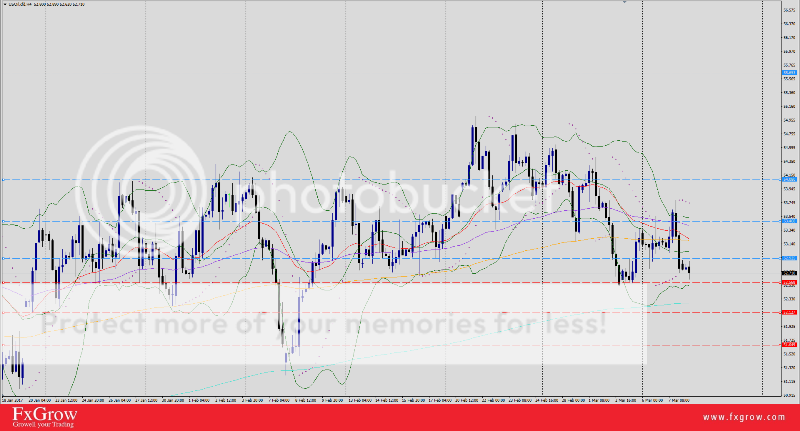

Technical:

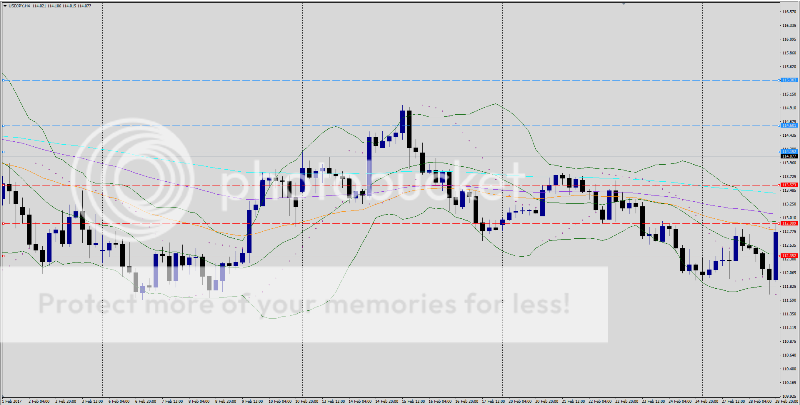

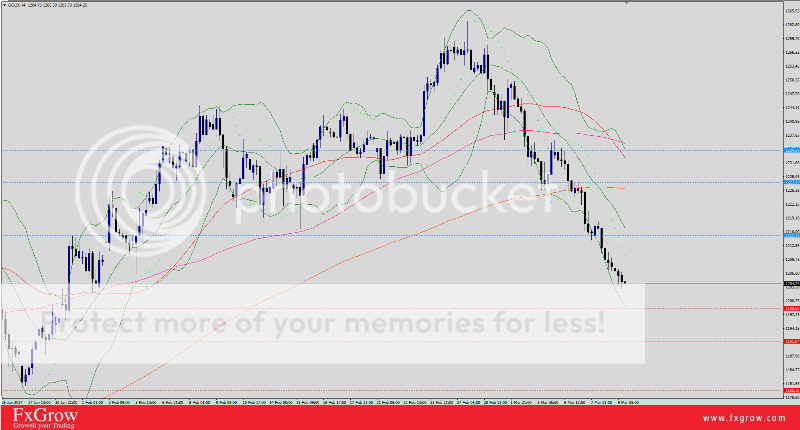

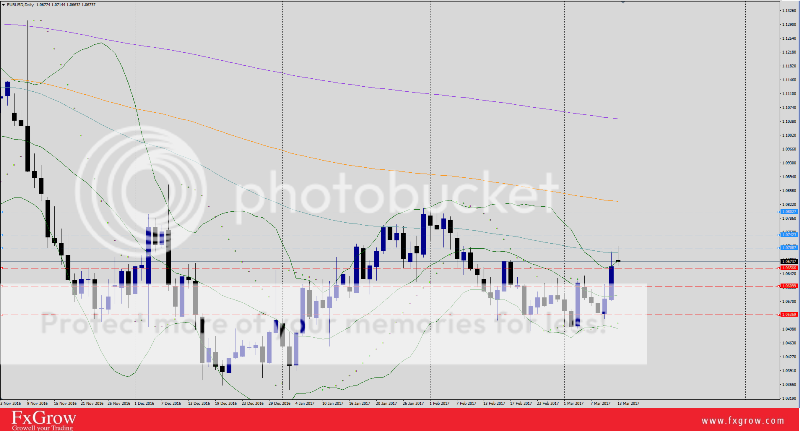

Resistance levels: R1 52.92, R2 53.46, R3 54.00

Support levels: S1 52.56, S2 52.12, S3 51.64

Remark:

Look forward for US crude inventories today at 3:30 PM GMT which will bring new levels for Crude Oil prices.

For more in depth Research & Analysis please visit FxGrow.http://fxgrow.com/analysis-educatio...cal-analysis-fxgrow-free-forex-analysis-tools

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

By FxGrow Investment Research Desk

Crude Oil levels Plunges over Houston Energy Meeting, Eyes on US inventories

Fundamentals:

Crude oil levels collapsed on Tuesday with a loss $1.08 per barrel -0.2% over fears of Houston energy meeting and outcome possibilities. Shell, the Royal Dutch company nailed a contract to ramp North American shale output earlier than planned and to lock in quick returns from what has become one of its most profitable businesses, the head of Shell's unconventional energy business said.

The Anglo-Dutch company plans to make shale oil and gas in the United States, Canada and Argentina a key engine of growth in the next decade, targeting output of around 500,000 barrels of oil equivalent per day (BOE/D), Greg Guidry told Reuters in an interview.

Saudi Oil Minister Khalid al-Falih said on Tuesday that oil market fundamentals were improving as an agreement to curb supply by OPEC and non-OPEC producers took effect. Mr. Falih added that OPEC would not let rival producers take advantage of the reductions to underwrite their own production investment. OPEC cartel is expected to meet again in May, where OPEC might extend their production curbs.

"We should not get ahead of the market," Falih told a group of oil industry executives at the CERA Week energy conference. Overall, he said the production reductions have had their intended effect, citing greater price arbitrage between east and west oil markets that "indicate the cuts are biting." He said there are signs of "green shoots" of oil investment in the United States although he cautioned that a fast response from the U.S. shale industry could be discouraging for needed investment in multiyear, long-term projects in other oil supply sources outside of shale. Saudi Arabia does not want OPEC to intervene in the oil market to address long-term structural shifts, but would support measures to address "short-term aberrations." (Reuters).

China's crude oil imports rose to the second-highest level on record in February, as strong demand from independent "teapot" refiners continues to drive growth. February's imports came in at 31.78 million tons or 8.286 million barrels per day, up 3.5 percent on a year ago, Chinese customs data showed on Wednesday. Daily shipments were only behind December's record 8.57 million bpd, but up on 8.01 million bpd in January.

Conclusion: The rift continues between OPEC and US with opposed interest. OPEC benefits from high levels of oil prices since it’s their main source of income. US on the other hand, with -4.2B deficit in trade balance yesterday, and Trump's industrial and infrastructure as his main concerns, will seek excessive efforts to tackle OPEC objectives. Crude oil levels will hang between $51 and $56 until OPEC's next meeting in May with possibilities for further reductions and compliance.

Technical:

Resistance levels: R1 52.92, R2 53.46, R3 54.00

Support levels: S1 52.56, S2 52.12, S3 51.64

Remark:

Look forward for US crude inventories today at 3:30 PM GMT which will bring new levels for Crude Oil prices.

For more in depth Research & Analysis please visit FxGrow.http://fxgrow.com/analysis-educatio...cal-analysis-fxgrow-free-forex-analysis-tools

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.