FxGrow Support

Recruit

- Messages

- 58

FxGrow Fundamental Analysis – 15th March, 2017

By FxGrow Investment Research Desk

Forex Technical Levels Ahead of FOMC Meeting

Markets and analysts have placed more than 90% for a 0.25% hike in FOMC meeting which should boost U.S Dollar and soar all rivals. In all cases, whether Yellen deliver what market is anticipating or FOMC disappoints traders, expectation of a high volatility is inevitable. Below are support and resistance for Forex majors and XAUUSD.

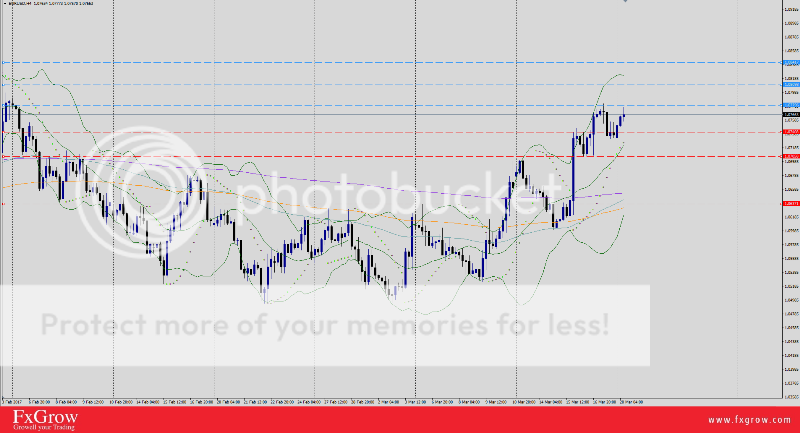

EUR/USD

Resistance levels : R1 1.0640, R2 1.0678, R3 1.0711, R4 1.0748

Support levels : S1 1.0600 , S2 1.0566 , S3 1.0537, S4 1.500

GBP/USD

Resistance levels : R1 1.2198, R2 1.2287, R3 1.2355 , R4 1.2436

Support levels : S1 1.2119 , S2 1.2052, S3 1.1984, S4 1.1906

USD/JPY

Resistance levels : R1 115.17, R2 115.59, R3 116.04, R4 116.49

Support levels : S1 114.44, S2 113.90, S3 113.41, S4 112.84

AUD/USD

Resistance levels : R1 0.7609, R2 0.7649, R3 0.7690, R4 0.7721

Support levels : S1 0.7540, S2 0.7498, S3 0.7456, 0.7419

XAUUSD or Gold

Resistance levels : R1 1211.21 , R2 1222.69, R3 1233.67, 1244.95

Support levels : S1 1195.79 , S2 1186.12, S3 1176.85, S4 1165.57

For more in depth Research & Analysis please visit FxGrow.http://fxgrow.com/analysis-educatio...cal-analysis-fxgrow-free-forex-analysis-tools

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

By FxGrow Investment Research Desk

Forex Technical Levels Ahead of FOMC Meeting

Markets and analysts have placed more than 90% for a 0.25% hike in FOMC meeting which should boost U.S Dollar and soar all rivals. In all cases, whether Yellen deliver what market is anticipating or FOMC disappoints traders, expectation of a high volatility is inevitable. Below are support and resistance for Forex majors and XAUUSD.

EUR/USD

Resistance levels : R1 1.0640, R2 1.0678, R3 1.0711, R4 1.0748

Support levels : S1 1.0600 , S2 1.0566 , S3 1.0537, S4 1.500

GBP/USD

Resistance levels : R1 1.2198, R2 1.2287, R3 1.2355 , R4 1.2436

Support levels : S1 1.2119 , S2 1.2052, S3 1.1984, S4 1.1906

USD/JPY

Resistance levels : R1 115.17, R2 115.59, R3 116.04, R4 116.49

Support levels : S1 114.44, S2 113.90, S3 113.41, S4 112.84

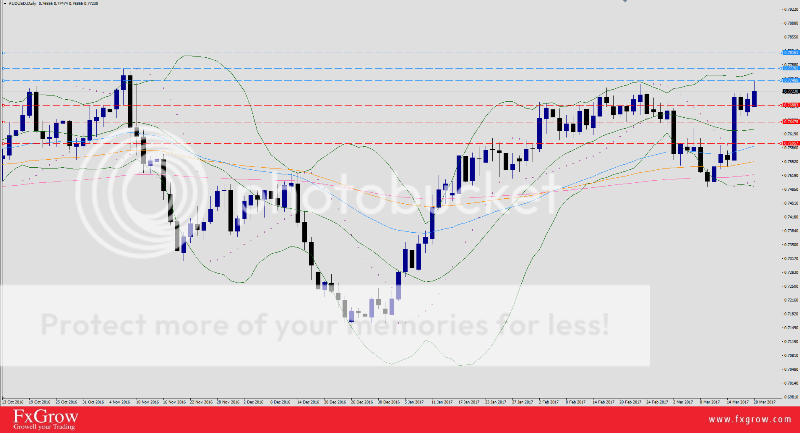

AUD/USD

Resistance levels : R1 0.7609, R2 0.7649, R3 0.7690, R4 0.7721

Support levels : S1 0.7540, S2 0.7498, S3 0.7456, 0.7419

XAUUSD or Gold

Resistance levels : R1 1211.21 , R2 1222.69, R3 1233.67, 1244.95

Support levels : S1 1195.79 , S2 1186.12, S3 1176.85, S4 1165.57

For more in depth Research & Analysis please visit FxGrow.http://fxgrow.com/analysis-educatio...cal-analysis-fxgrow-free-forex-analysis-tools

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.