Admiral Markets

AdmiralMarkets.com Representative

- Messages

- 95

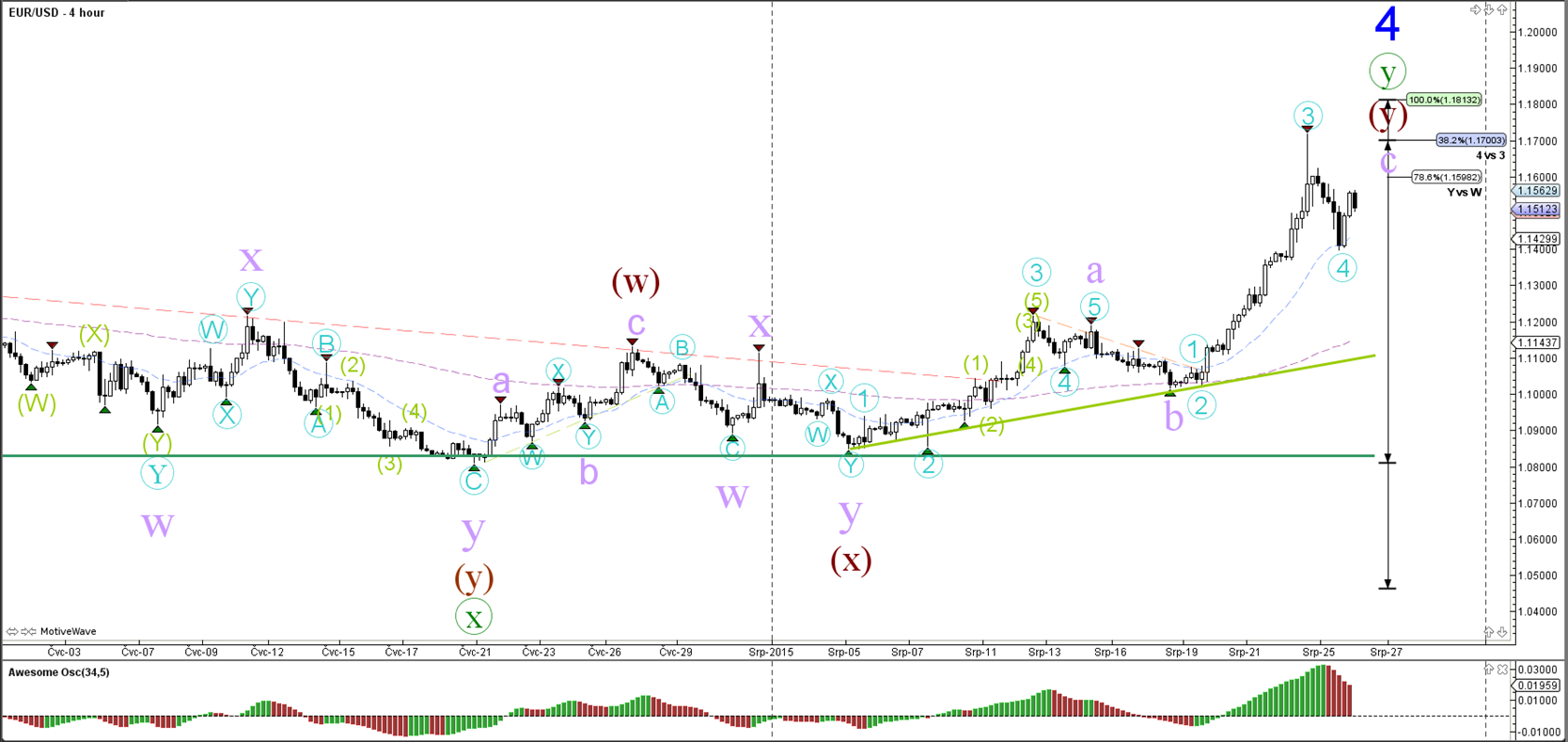

EUR/USD Bullish Thrust Capped by Wedge Resistance

EUR/USD

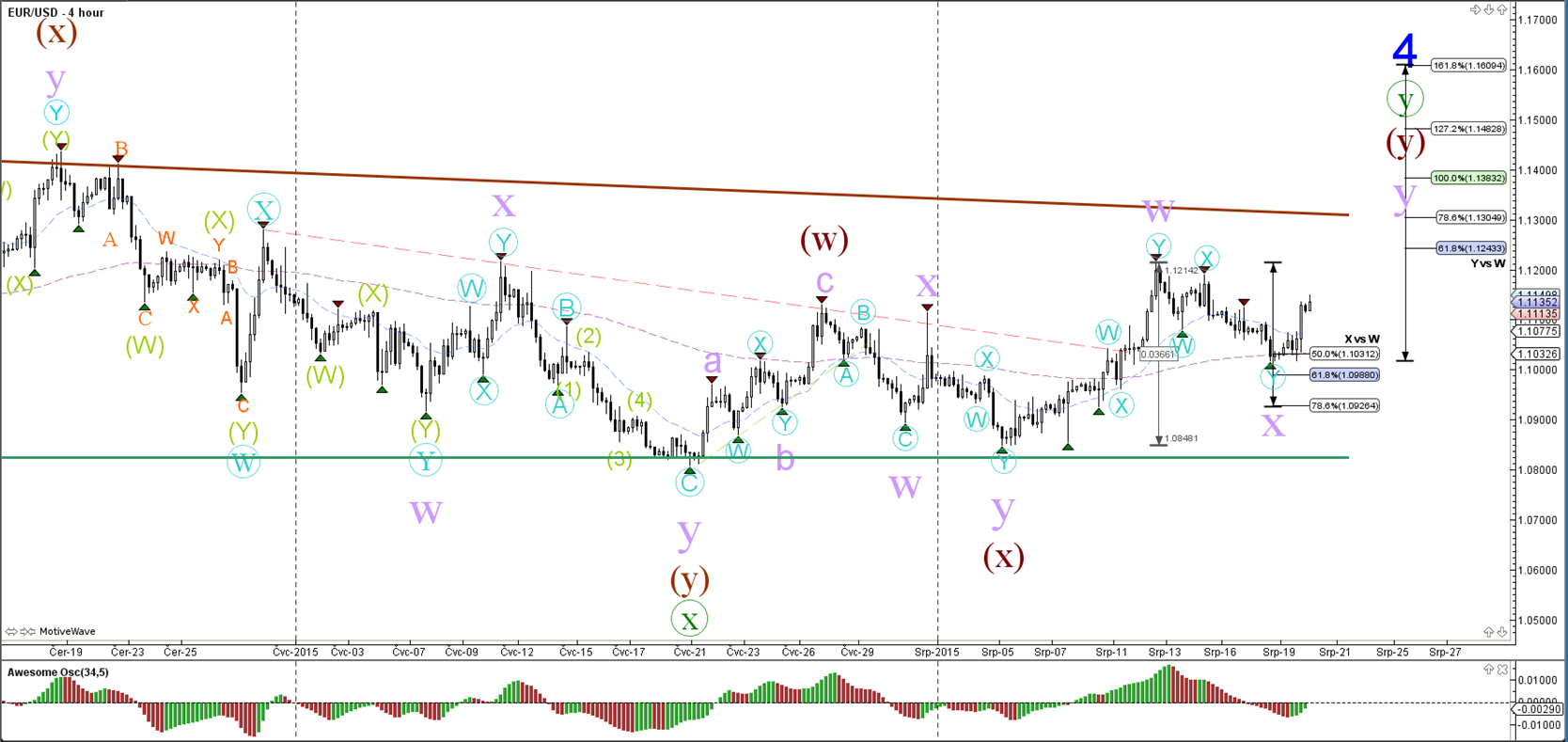

4 hour

The EUR/USD broke above the internal resistance (red) within a bigger wedge (brown/green) which could be explained by a WXY wave pattern (purple). The top of wedge (brown) could be a major resistance spot.

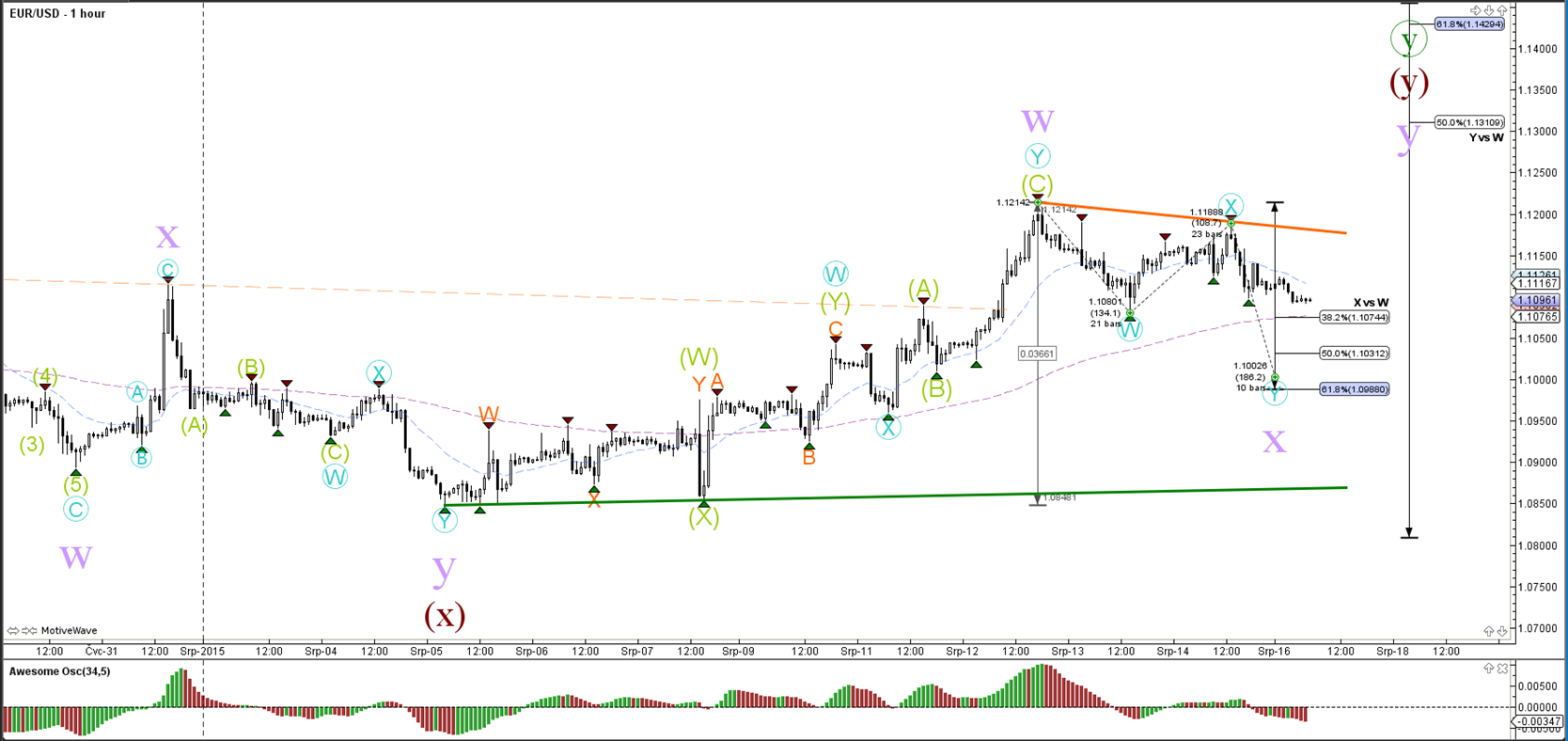

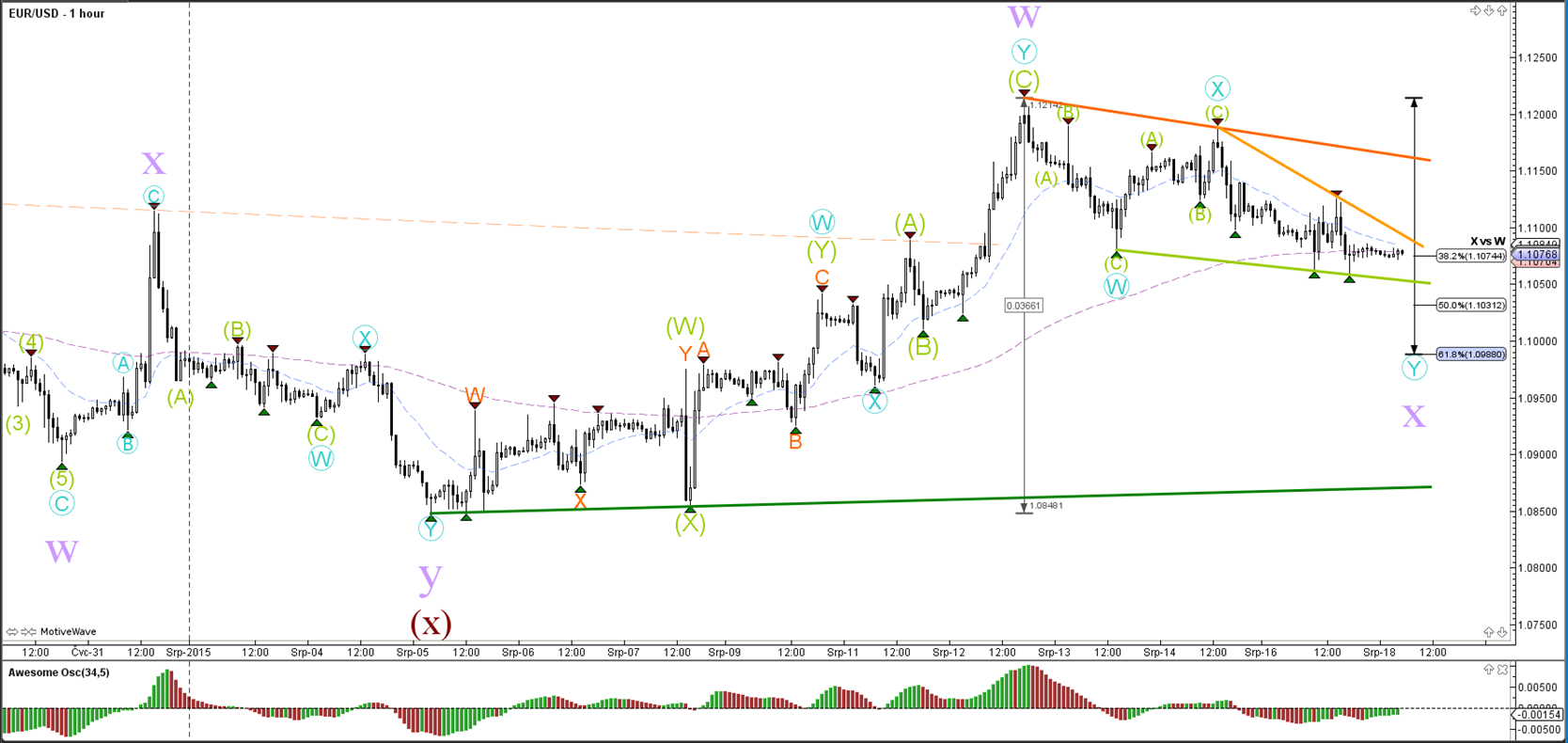

1 hour

The EUR/USD bounced at the 38.2% Fibonacci retracement level of wave X (purple) and could be moving up as part of wave Y (purple).

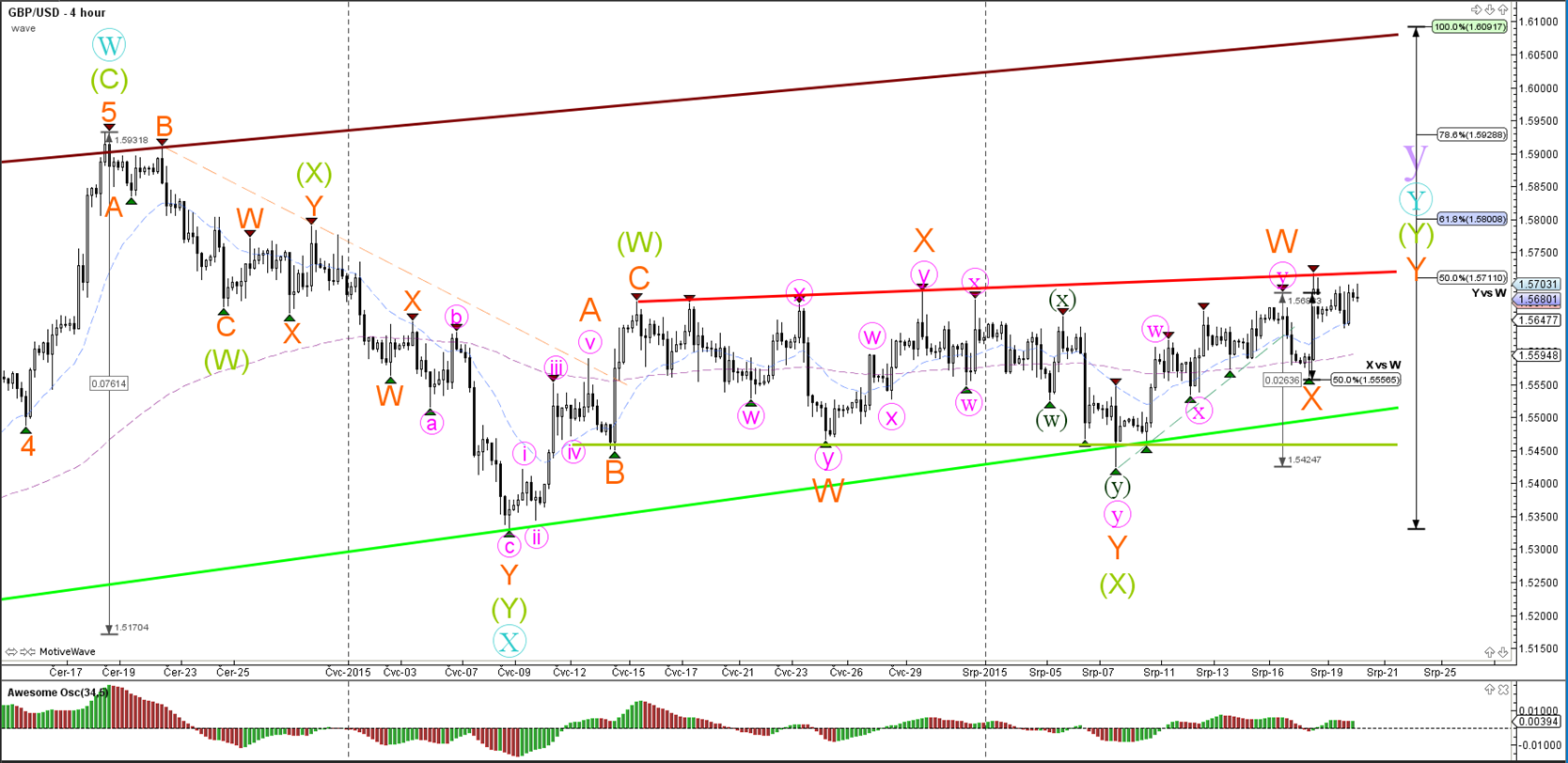

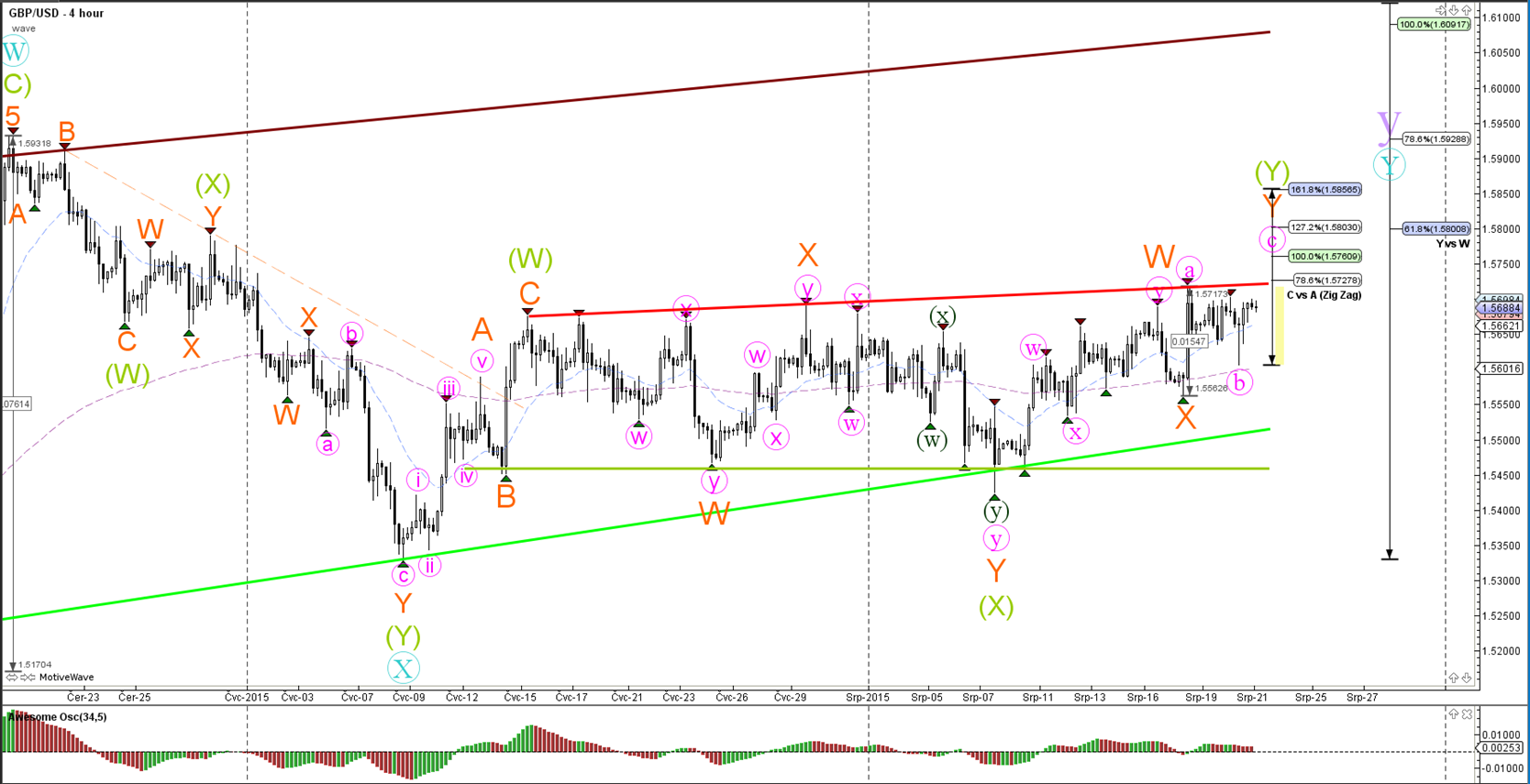

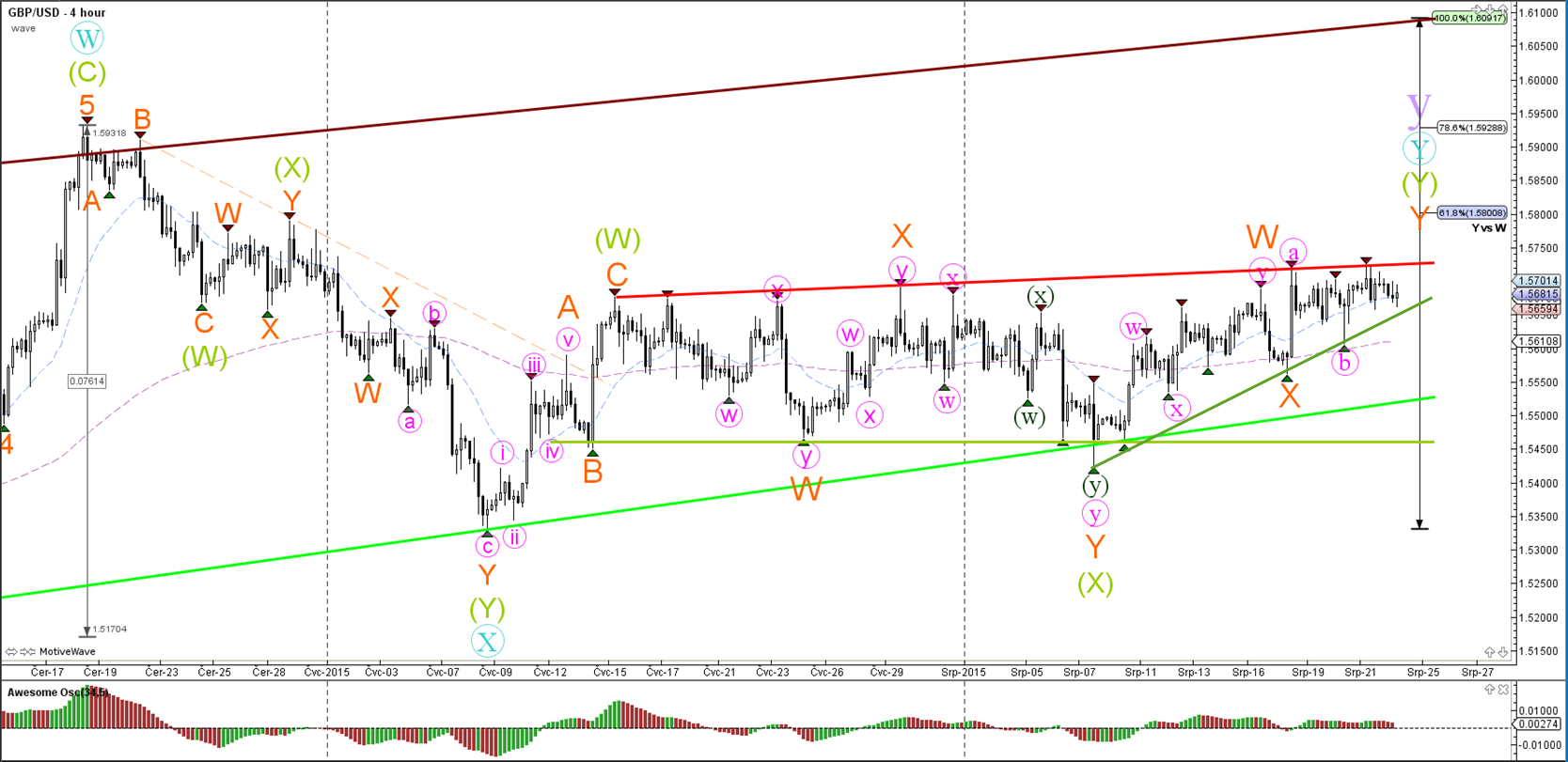

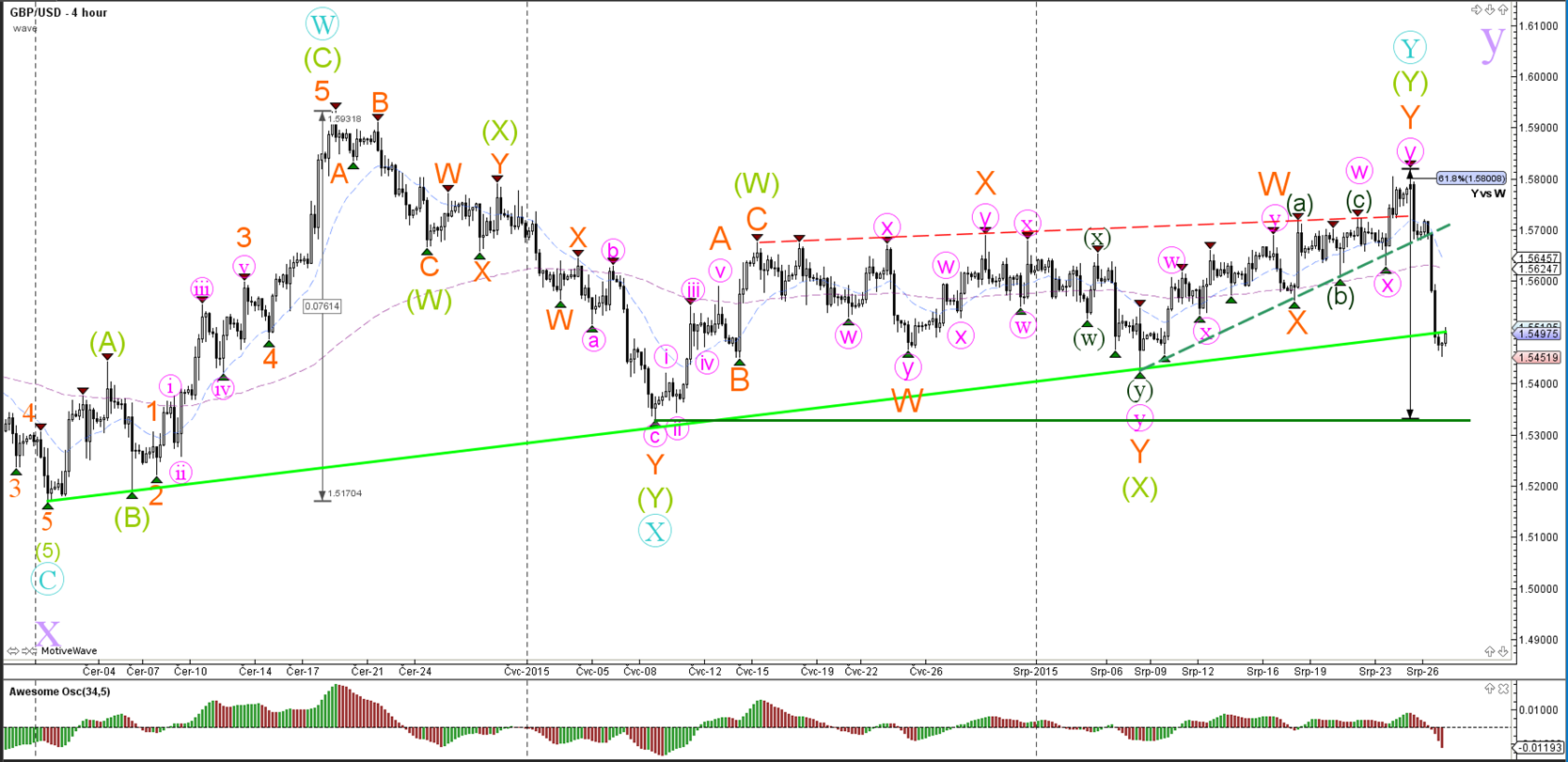

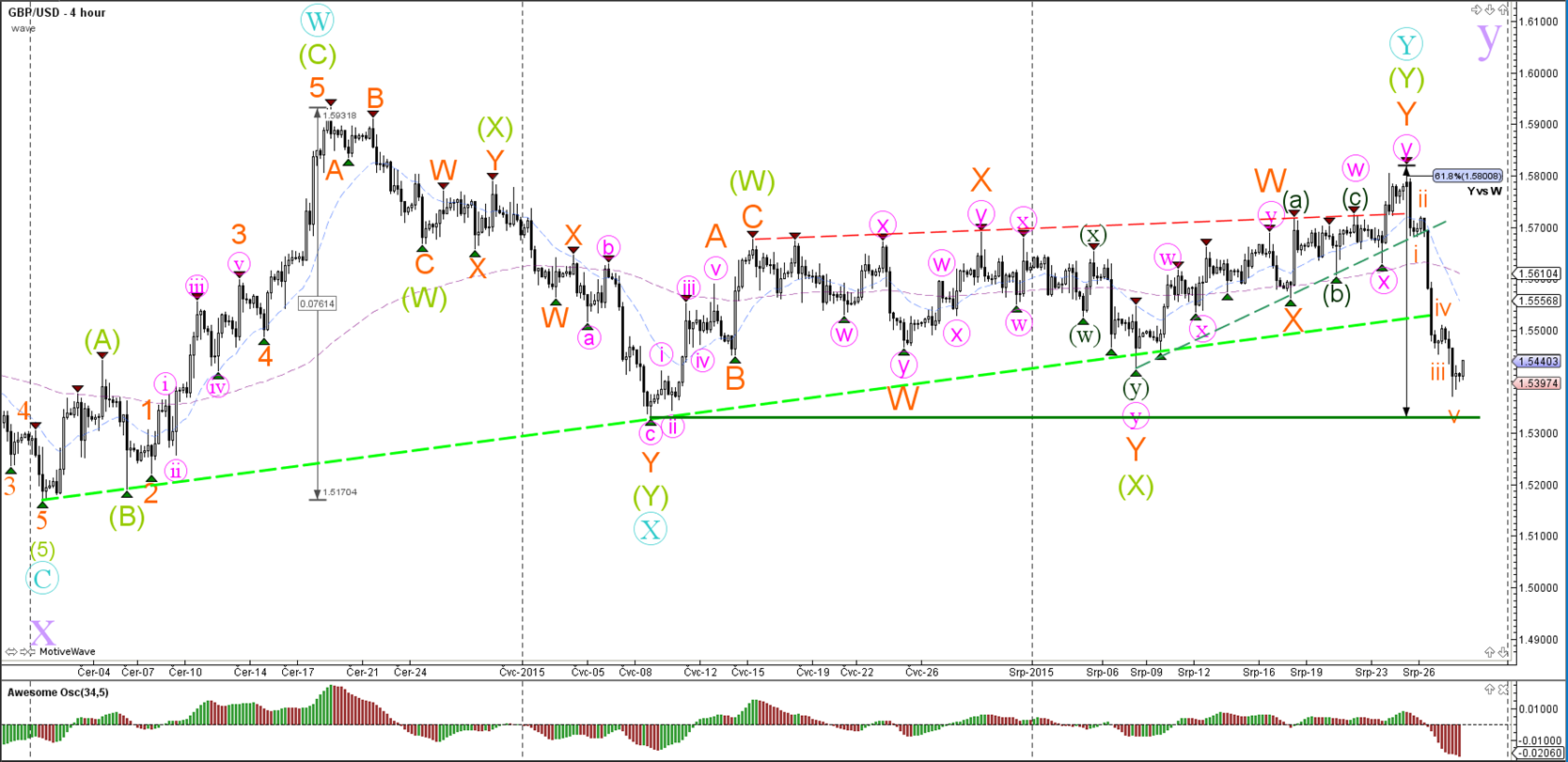

GBP/USD

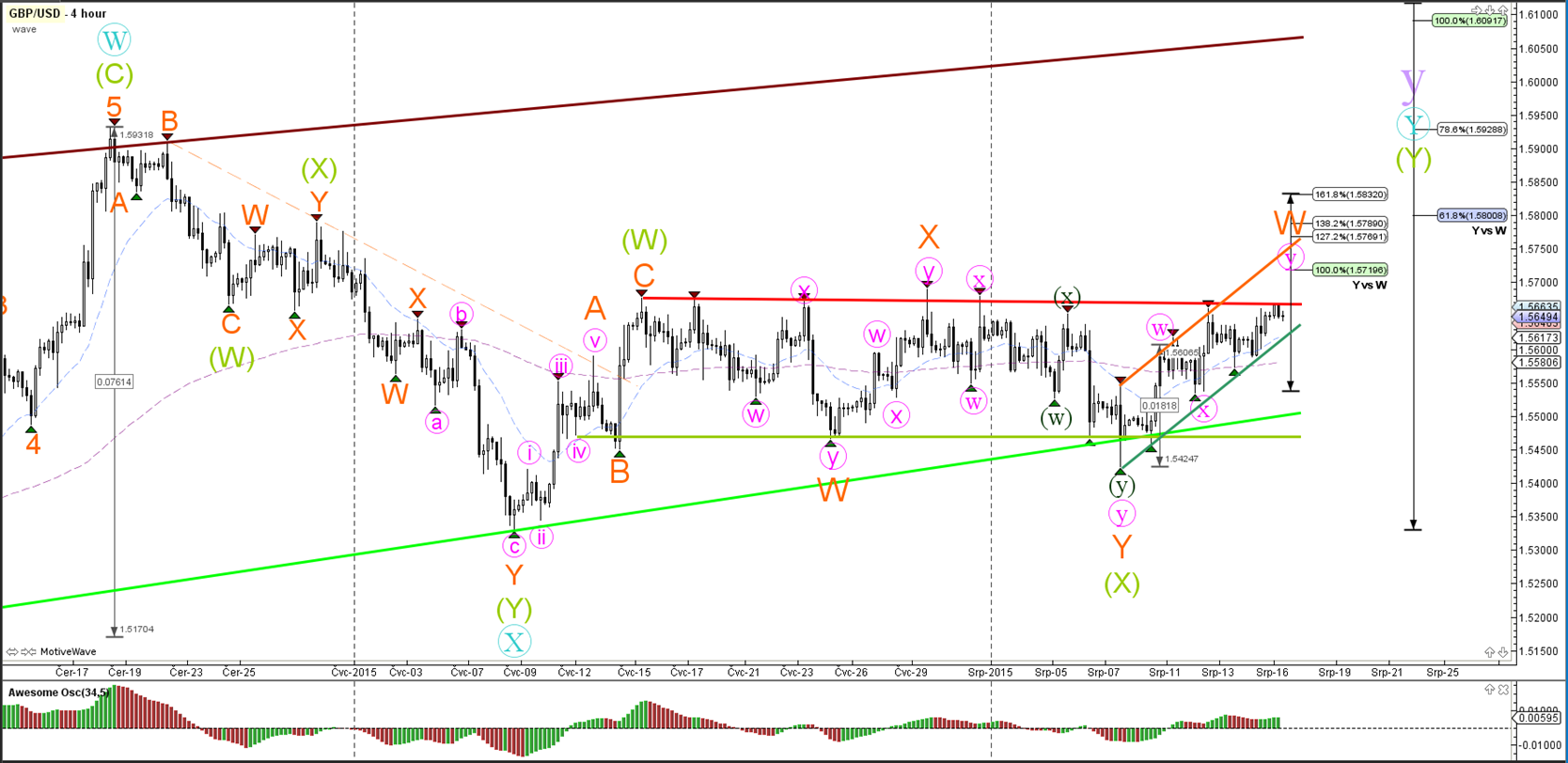

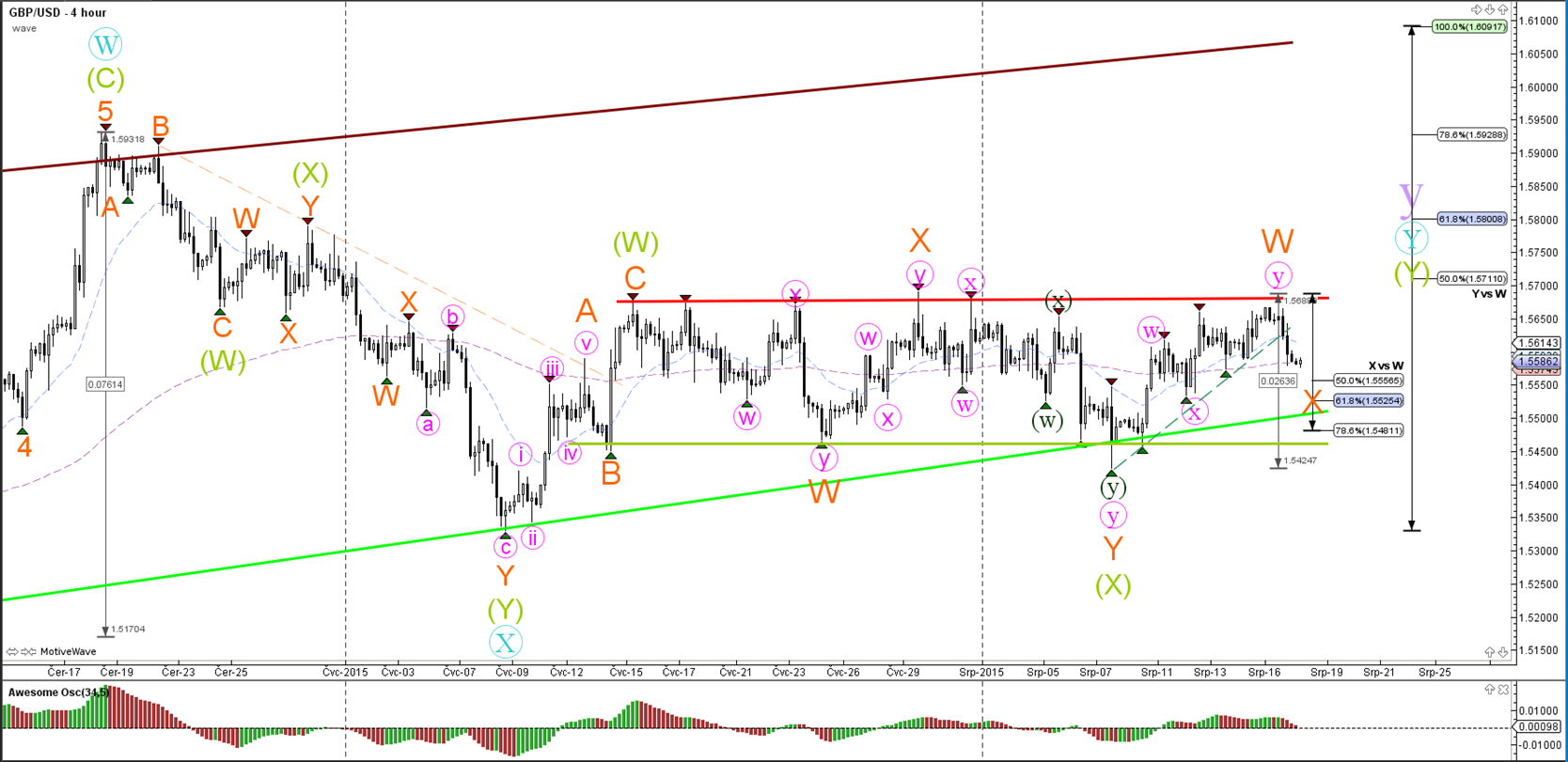

4 hour

The GBP/USD remains positioned in a choppy range (red/green).

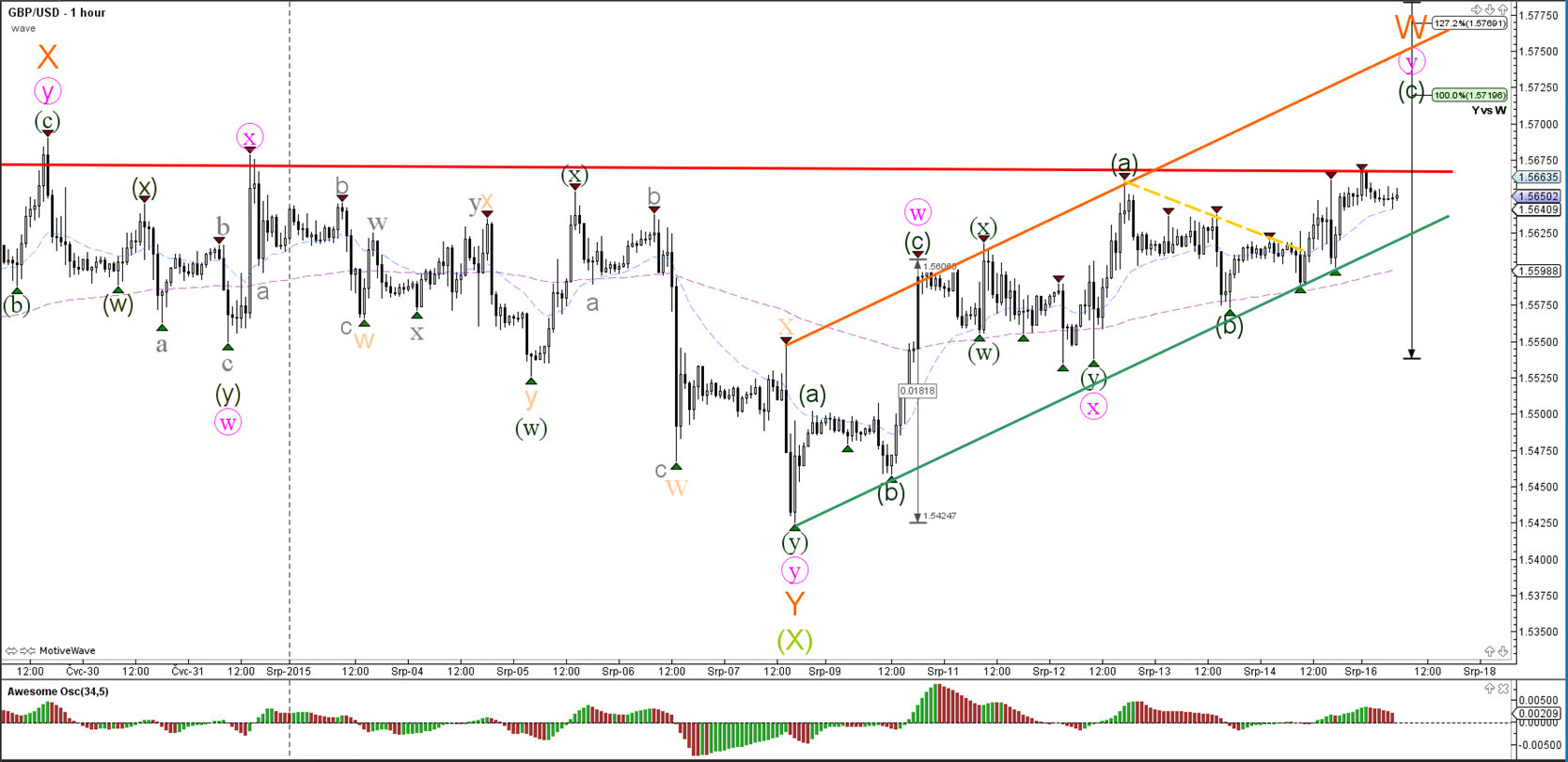

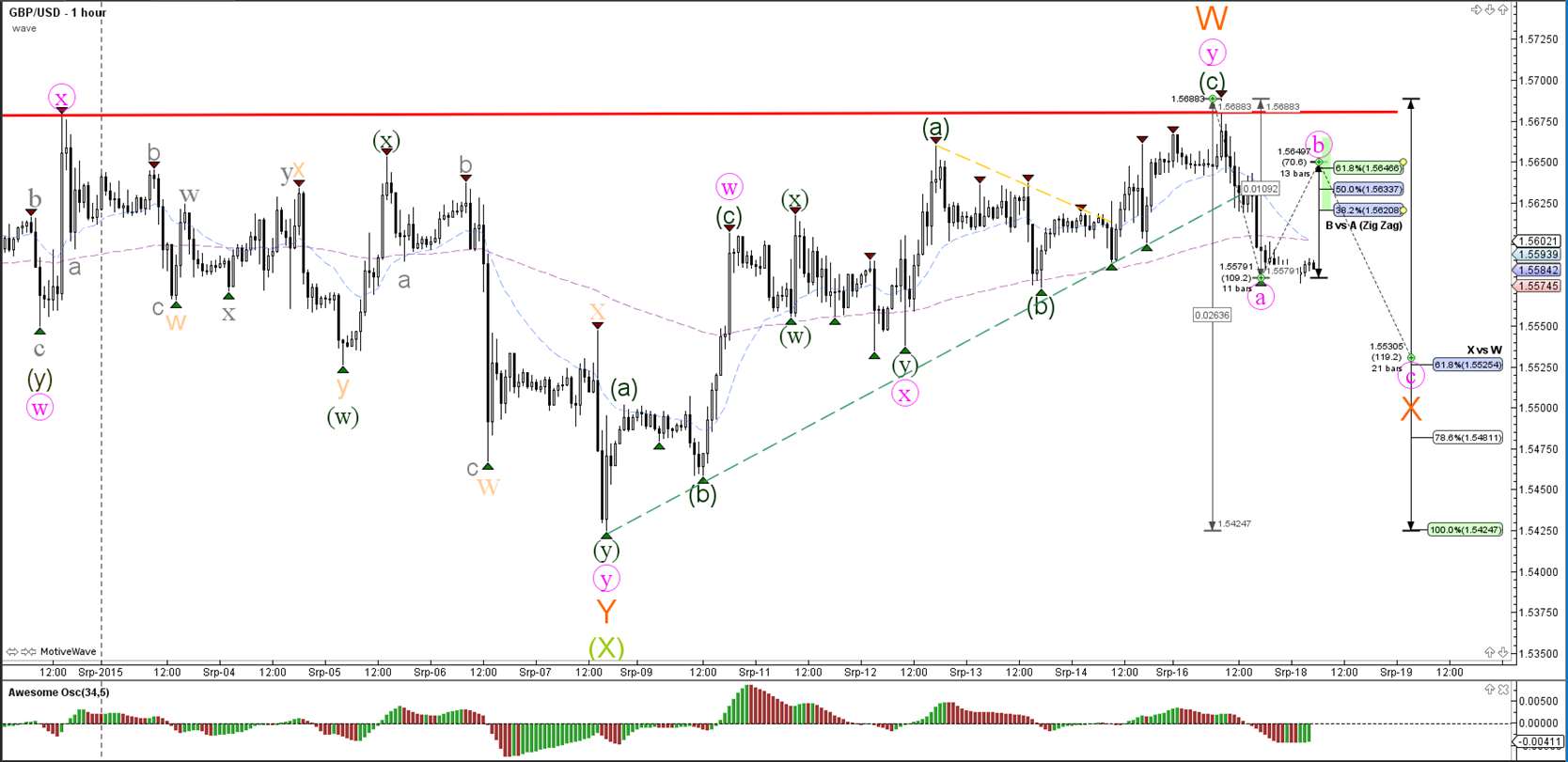

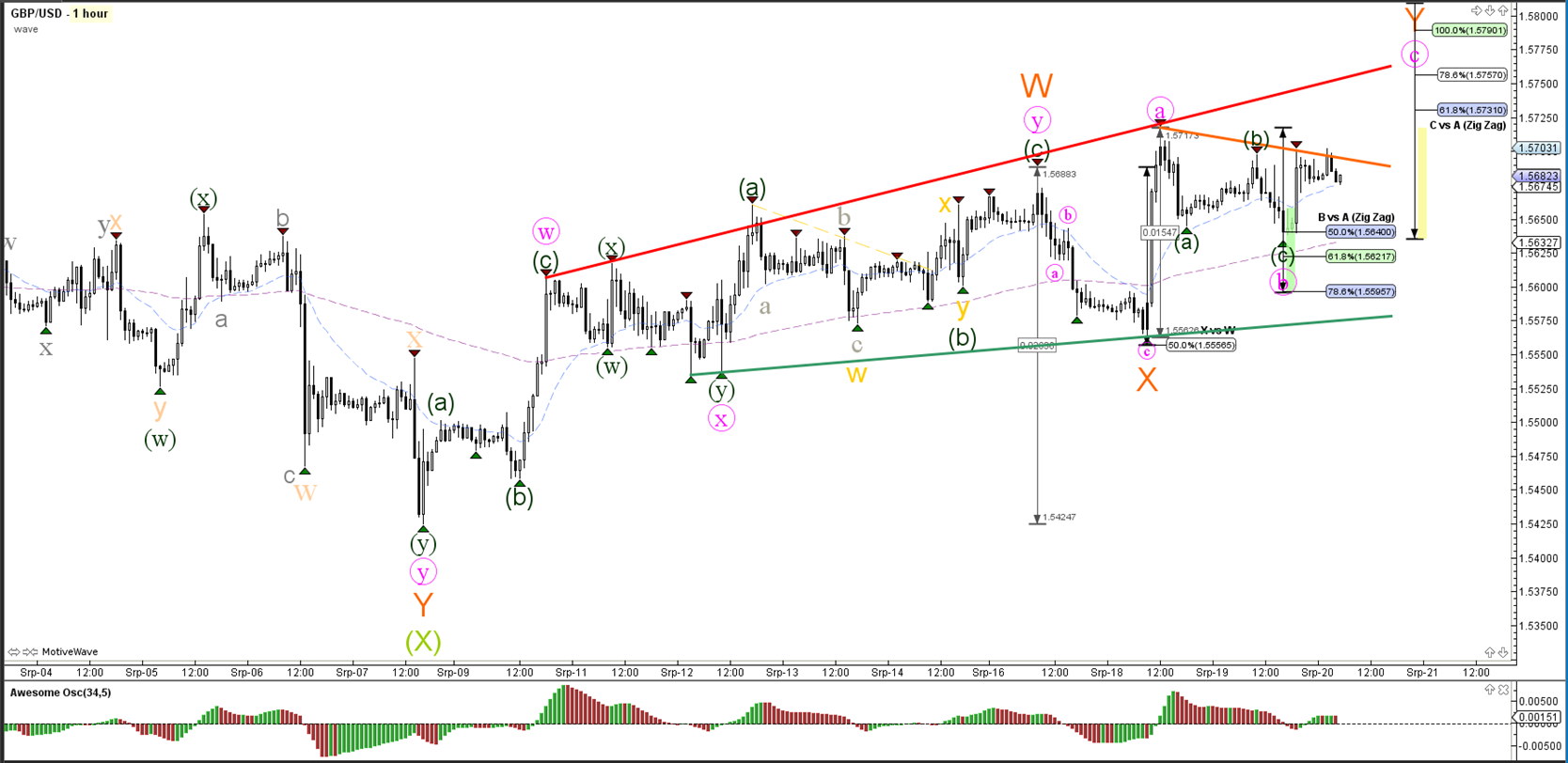

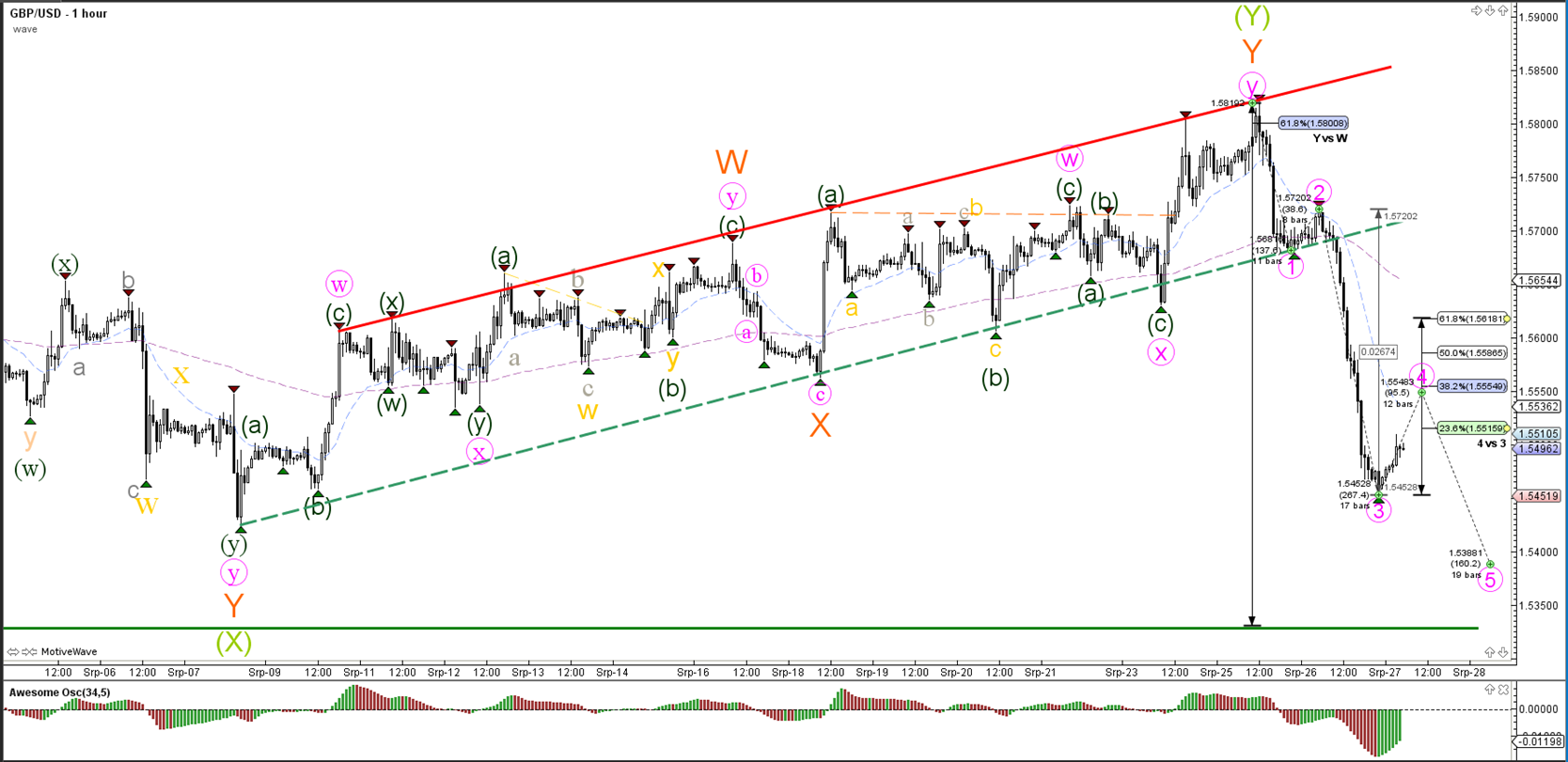

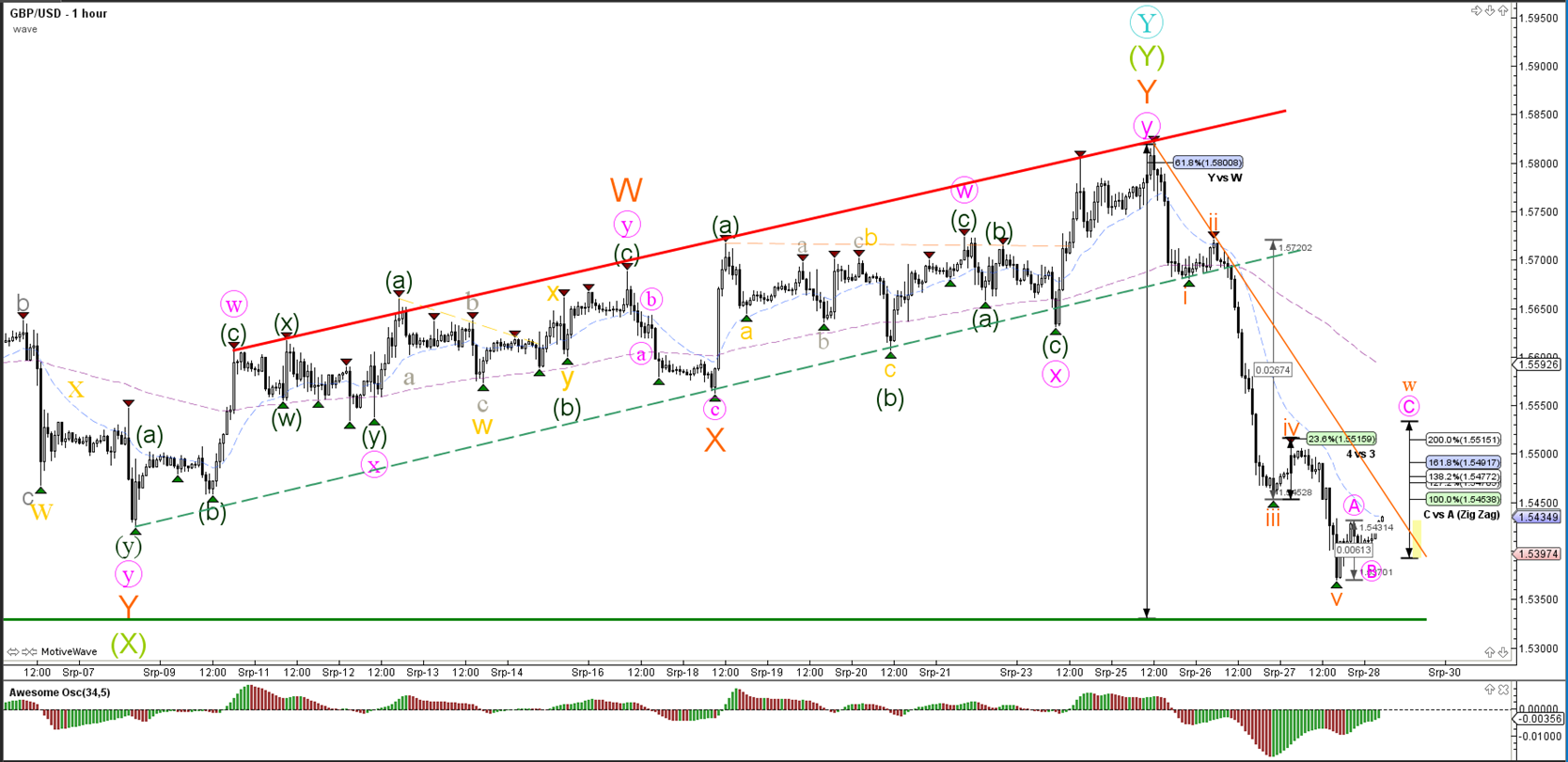

1 hour

The GBP/USD made a bearish retracement back to the bottom of the uptrend channel (green). The ABC (dark green) wave count is invalidated if price breaks below the 100% point.

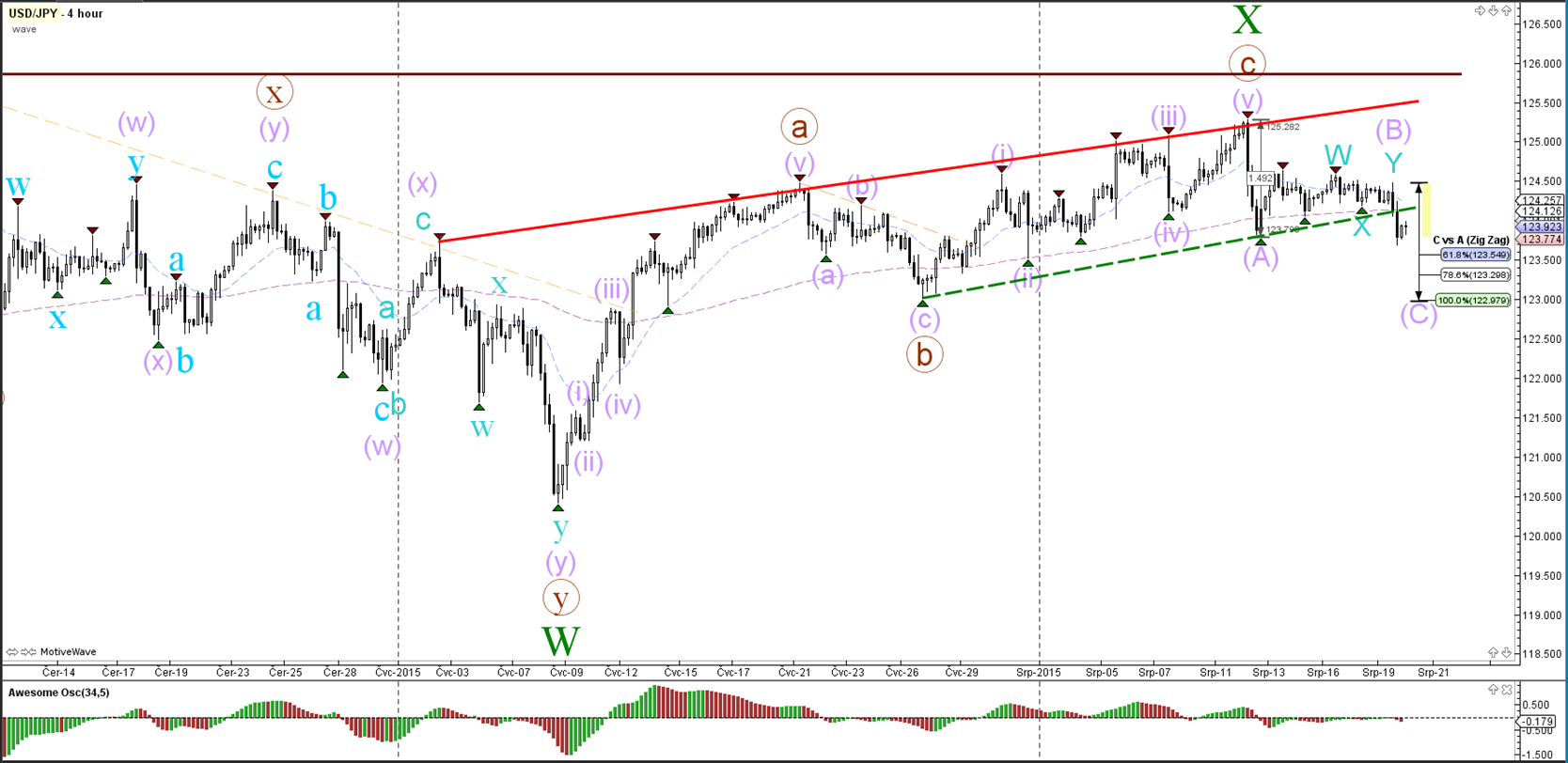

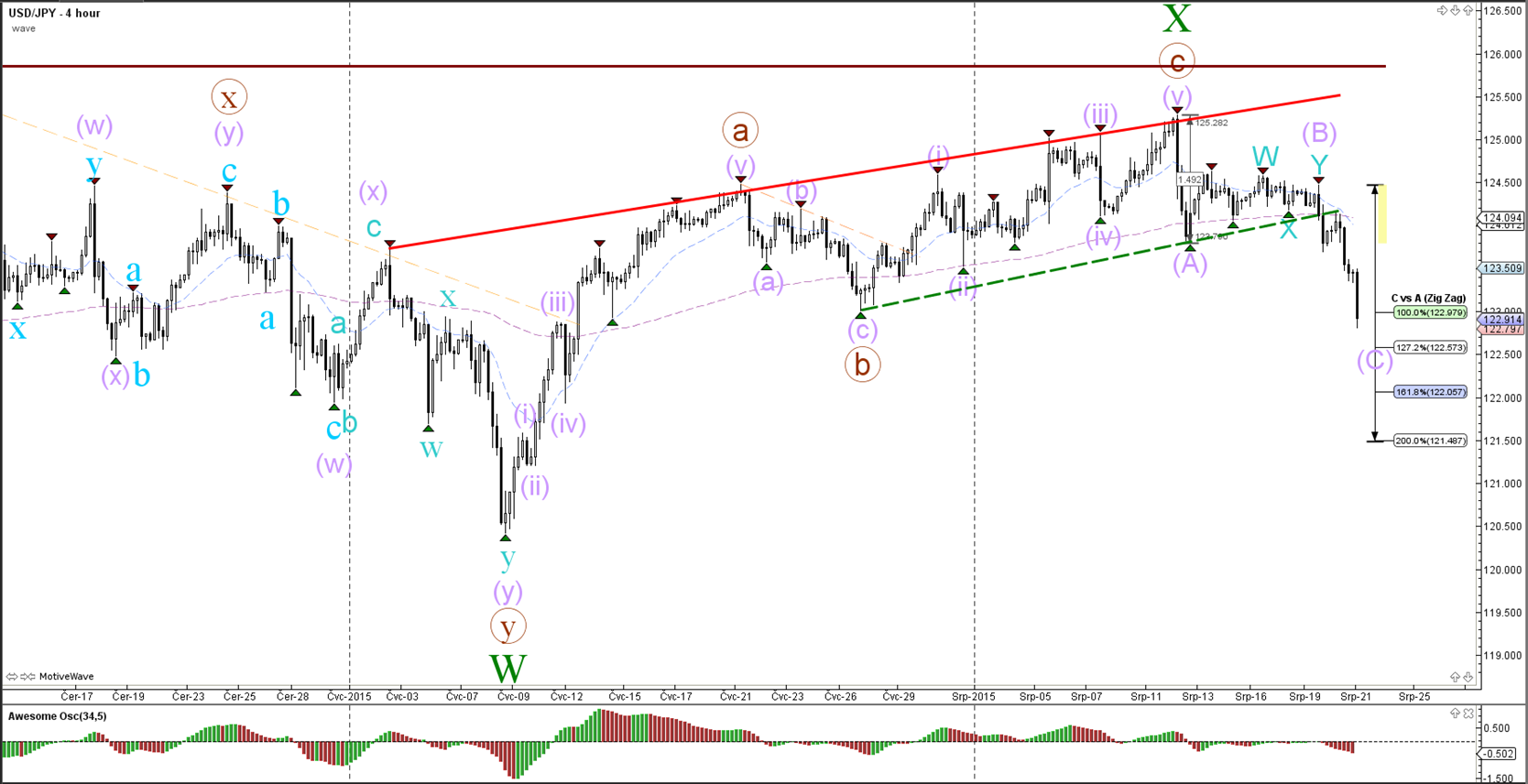

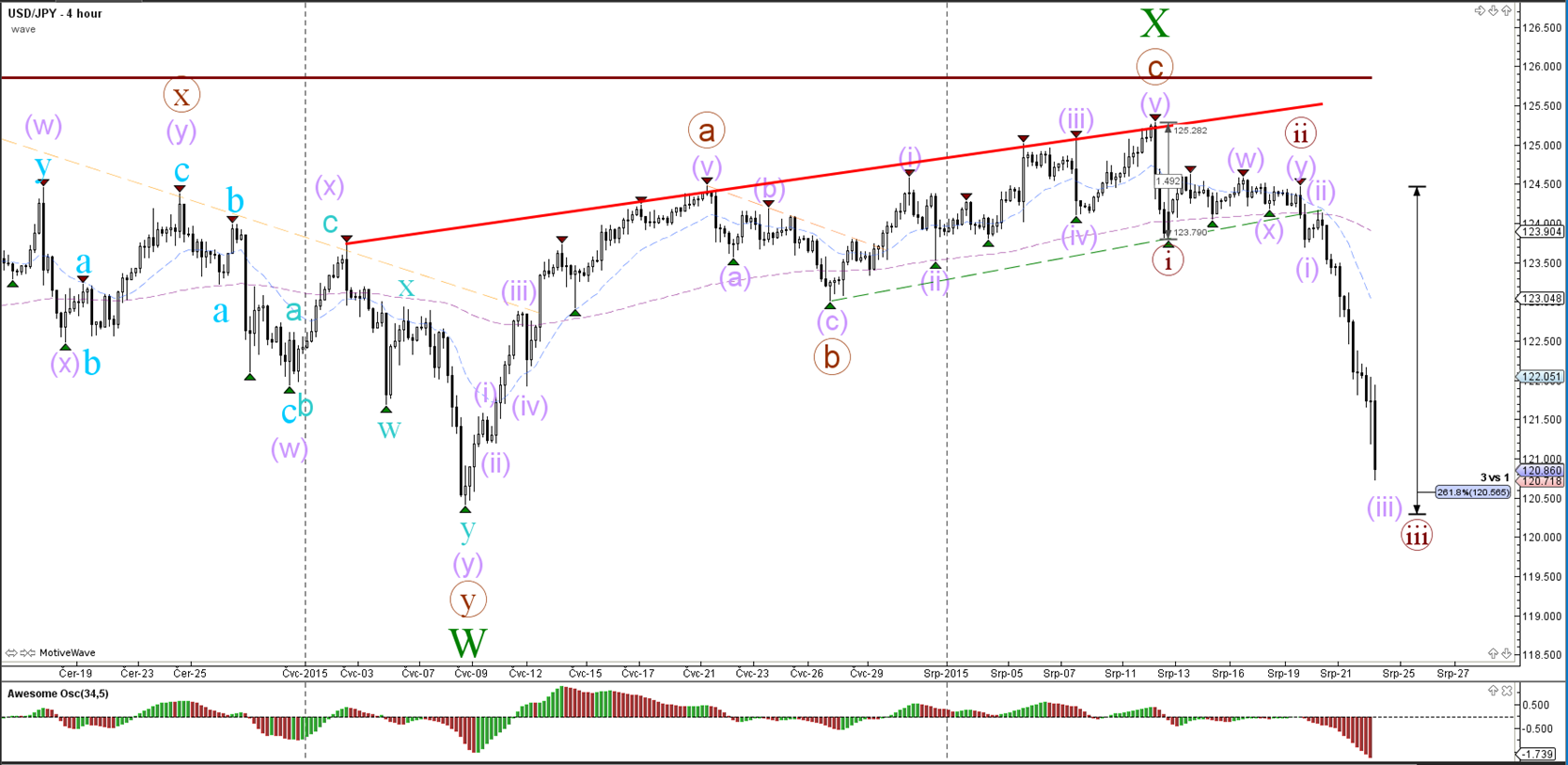

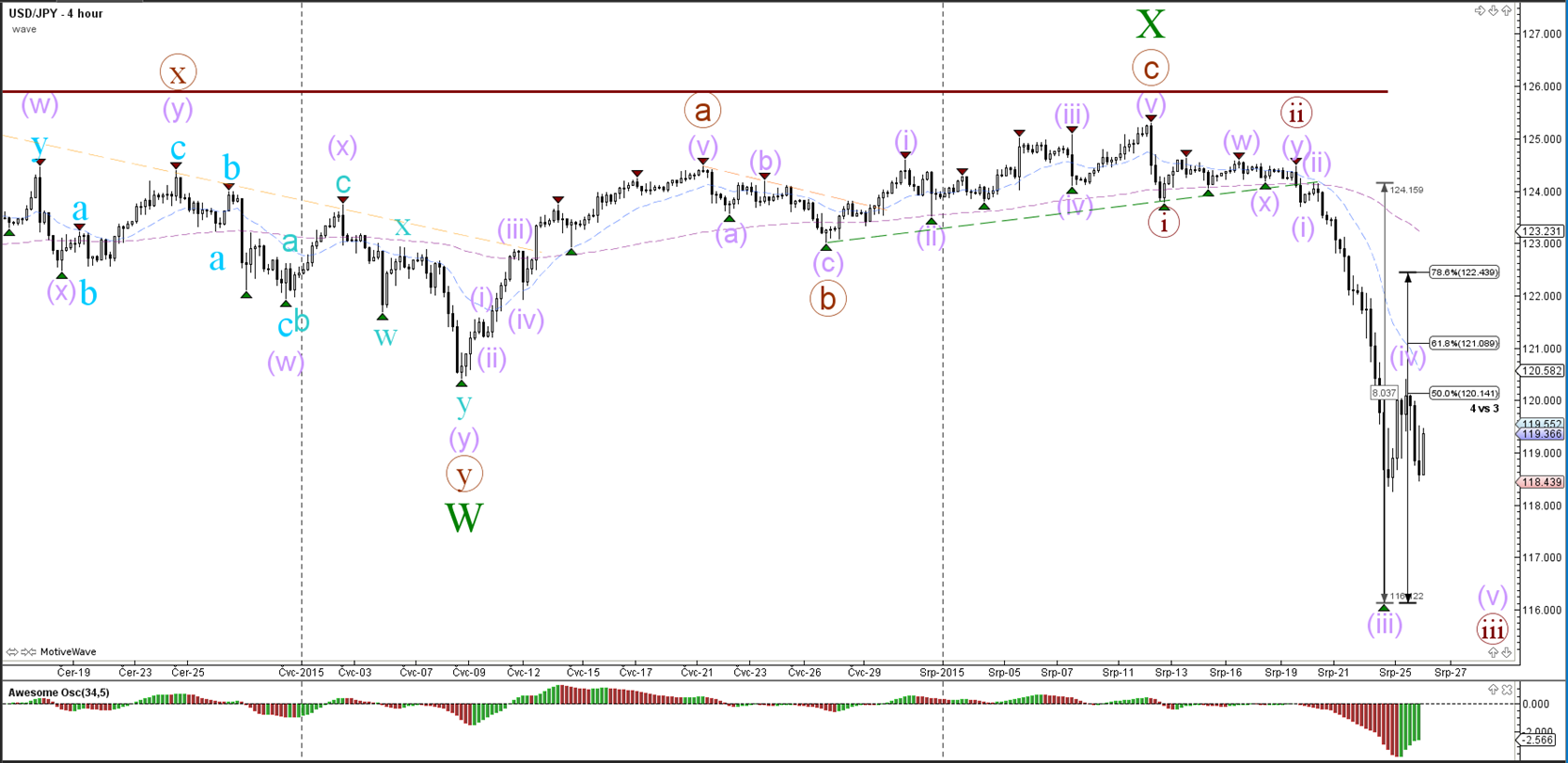

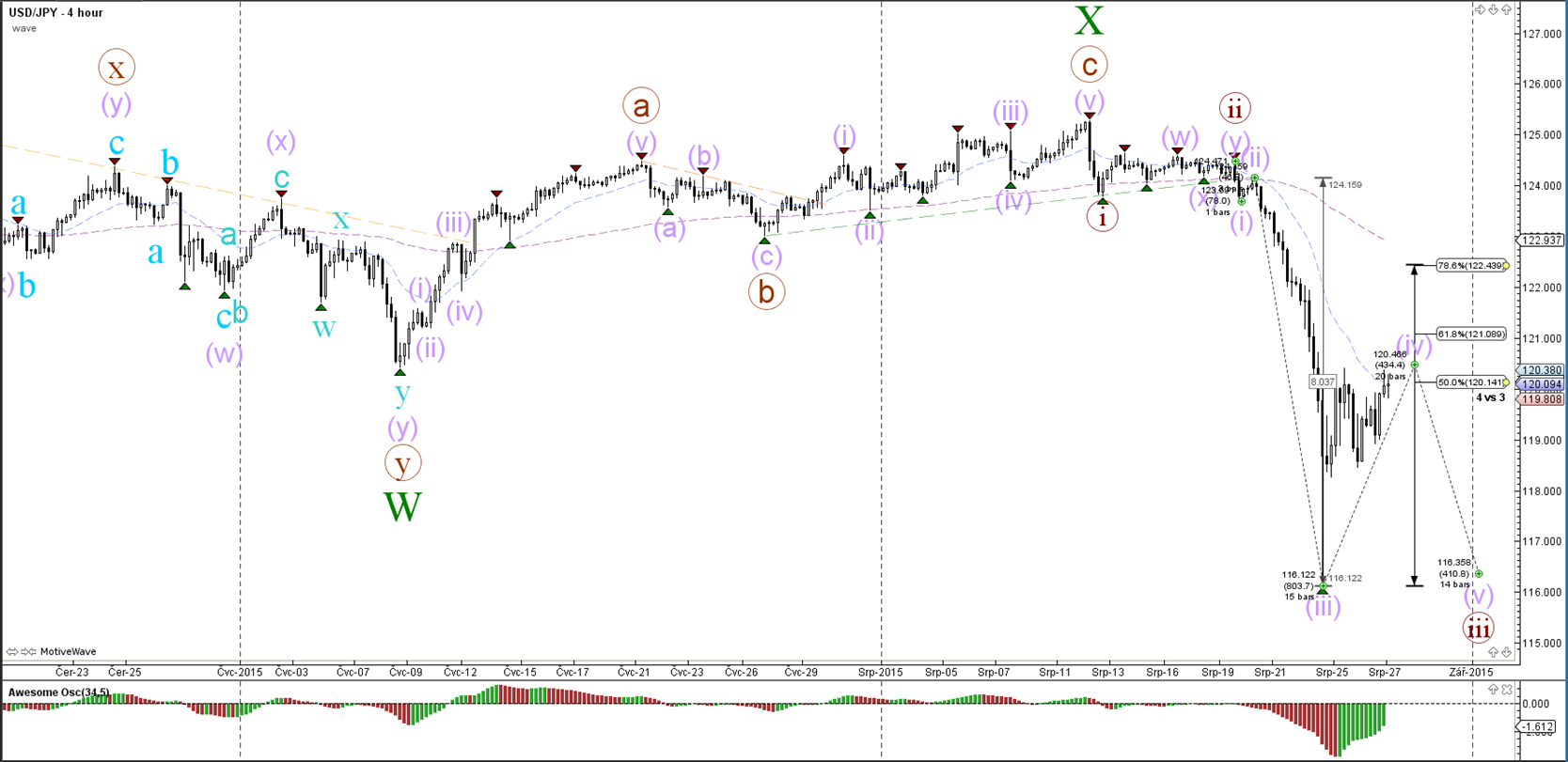

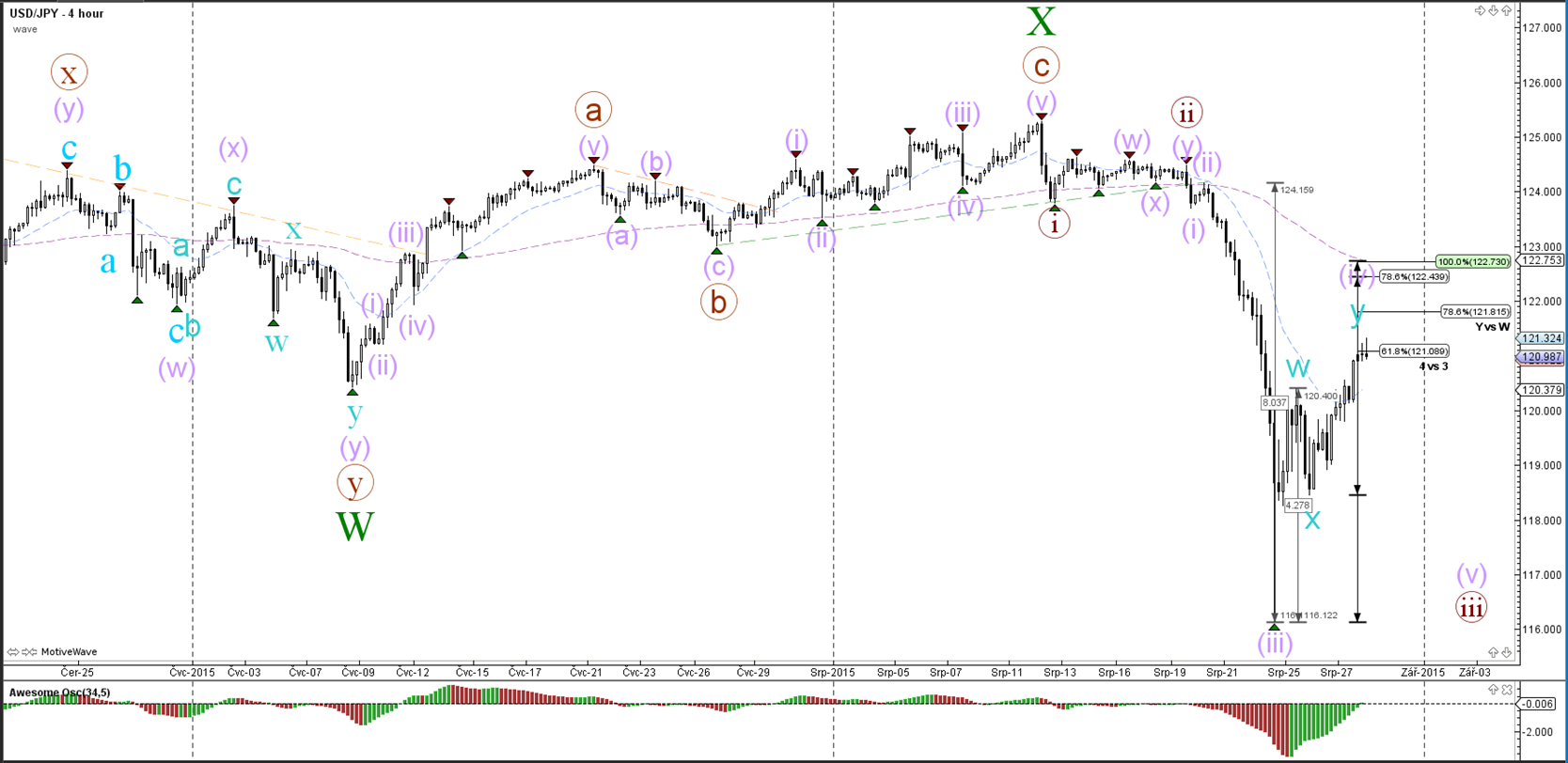

USD/JPY

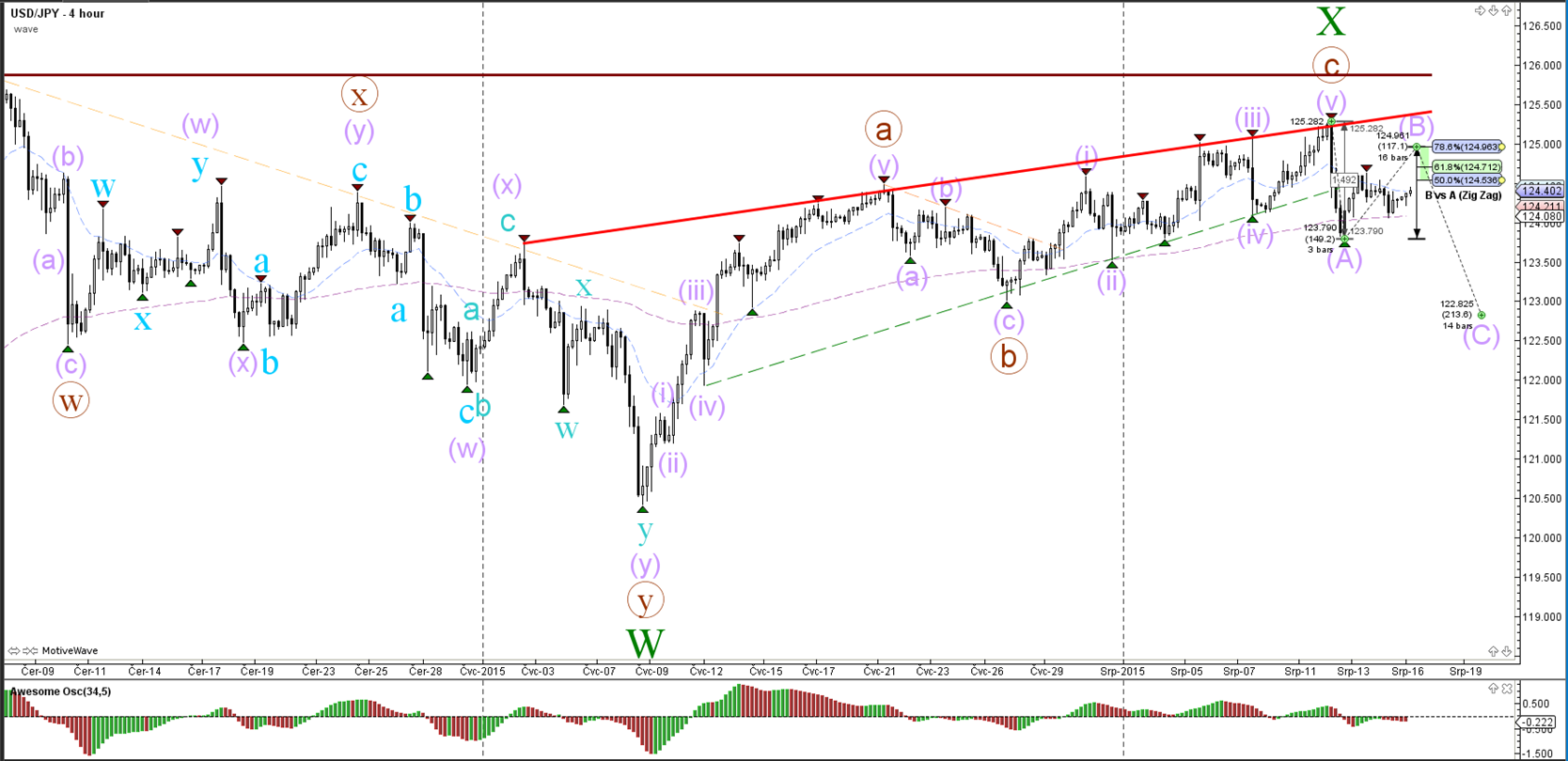

4 hour

The USD/JPY broke below the support trend line (dotted green) close to the major top (brown). This could indicate a potential ABC correction with an invalidation level at the beginning of wave A (purple).

“Original analysis is provided by Admiral Markets”

EUR/USD

4 hour

The EUR/USD broke above the internal resistance (red) within a bigger wedge (brown/green) which could be explained by a WXY wave pattern (purple). The top of wedge (brown) could be a major resistance spot.

1 hour

The EUR/USD bounced at the 38.2% Fibonacci retracement level of wave X (purple) and could be moving up as part of wave Y (purple).

GBP/USD

4 hour

The GBP/USD remains positioned in a choppy range (red/green).

1 hour

The GBP/USD made a bearish retracement back to the bottom of the uptrend channel (green). The ABC (dark green) wave count is invalidated if price breaks below the 100% point.

USD/JPY

4 hour

The USD/JPY broke below the support trend line (dotted green) close to the major top (brown). This could indicate a potential ABC correction with an invalidation level at the beginning of wave A (purple).

“Original analysis is provided by Admiral Markets”