Today at 06/012019 IC markets have executed my but stops 23.61usd above the market my other buy stop with 18.61 usd above my other buy stop 13.61usd my other buy stop 7.61usd and lar one 1.61usd. For example Gold market opened with gap at around 1561 and I had buy stop at 1562 but they executed it at 1585.61usd. My other buy stops are also executed at same level with huge slippage moreover they closed my positions once gold backs up I lost my capital plus my profits. When I wrote to them they say slippage is normal. Even we had more slippage on 2015. Be aware.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

IC MARKETS HUGE SLIPPAGE SCAM

- Thread starter Fxdetail

- Start date

Today at 06/012019 IC markets have executed my buy stops 23.61usd above the market my other buy stop with 18.61 usd above my other buy stop 13.61usd my other buy stop 7.61usd and last one 1.61usd. For example Gold market opened with gap at around 1561 and I had buy stop at 1562 but they executed it at 1585.61usd. My other buy stops are also executed at same level with huge slippage moreover they closed my positions once gold backs up I lost my capital plus my profits. When I wrote to them they say slippage is normal. Even we had more slippage on 2015. Be aware.

fxtrendtrader

Private, 1st Class

- Messages

- 46

Same happened with me as well, same answer....

AnhDinh

Recruit

- Messages

- 2

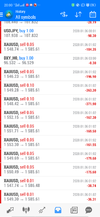

Attachments

compu-forex

Master Sergeant

- Messages

- 255

Fxdetail,

I'm sorry but I don't see the scam here. The gold price was driven by events in Iraq. The price action where the price went from 1551 to 1588 in the space of 2 minutes is common to several brokers, as is the gap. This is an exceptional jump. That is because the smart money was not shorting gold, so there would have been a shortage of limit sell orders required to execute your trade.

Now I can't be sure if you were trading the events in the middle east but trading on news is dangerous at the best of times......trading it over the weekend is suicide, especially with a stop order which is given to slippage. I would be surprised if the execution you described above was limited to just IC Markets.

AnhDinh,

Same for your stop losses. A stoploss is simply a buy stop on an existing sell trade. Just because the price opened at a certain level there is no guarantee that there is sufficient liquidity to cover buy stops. There is a reason liquidity dries up over the weekend. It is extremely risky to have positions open whilst the market is closed for 2 days when major events are unfolding around the world.

In terms of not being able to withdraw funds, you ran your account into negative equity and you have agreed with the broker that they may offset the negative balance with funds from your other accounts. It is clearly laid out in their terms and conditions.

I'm sorry but I don't see the scam here. The gold price was driven by events in Iraq. The price action where the price went from 1551 to 1588 in the space of 2 minutes is common to several brokers, as is the gap. This is an exceptional jump. That is because the smart money was not shorting gold, so there would have been a shortage of limit sell orders required to execute your trade.

Now I can't be sure if you were trading the events in the middle east but trading on news is dangerous at the best of times......trading it over the weekend is suicide, especially with a stop order which is given to slippage. I would be surprised if the execution you described above was limited to just IC Markets.

AnhDinh,

Same for your stop losses. A stoploss is simply a buy stop on an existing sell trade. Just because the price opened at a certain level there is no guarantee that there is sufficient liquidity to cover buy stops. There is a reason liquidity dries up over the weekend. It is extremely risky to have positions open whilst the market is closed for 2 days when major events are unfolding around the world.

In terms of not being able to withdraw funds, you ran your account into negative equity and you have agreed with the broker that they may offset the negative balance with funds from your other accounts. It is clearly laid out in their terms and conditions.

4evermaat

2nd Lieutenant

- Messages

- 2,709

@Fxdetail

1) did you screen record the session so that others could visually see how the slippage occurred? (bandicam / thundersoft screen recorders). This is similar to dash cam / surveillance video footage that can capture the whole sequence.

If you do not have video of the session, can you at least provide the journal logs? Here is a quick tutorial on how to gather these logs:

View attachment FPA gather mt4 journal logs into 1 zip file.mp4

Zip them and upload them here.

Zip them and upload them here.

2) Did you leave a review of your experience? https://www.forexpeacearmy.com/forex-reviews/8264/icmarkets-forex-brokers?per-page=50

3) you will be able to invite @IC Markets to this thread formally by using the invite tool at the top/bottom of your thread. Here are the instructions on how to invite: https://www.forexpeacearmy.com/comm...how-to-invite-a-company-to-your-thread.58438/

note: You must wait 96 hours from your thread start date/time for the button to be visible.

Can you each open your own scam alert thread and submit evidence there please?

1) did you screen record the session so that others could visually see how the slippage occurred? (bandicam / thundersoft screen recorders). This is similar to dash cam / surveillance video footage that can capture the whole sequence.

If you do not have video of the session, can you at least provide the journal logs? Here is a quick tutorial on how to gather these logs:

View attachment FPA gather mt4 journal logs into 1 zip file.mp4

Zip them and upload them here.

Zip them and upload them here.

2) Did you leave a review of your experience? https://www.forexpeacearmy.com/forex-reviews/8264/icmarkets-forex-brokers?per-page=50

3) you will be able to invite @IC Markets to this thread formally by using the invite tool at the top/bottom of your thread. Here are the instructions on how to invite: https://www.forexpeacearmy.com/comm...how-to-invite-a-company-to-your-thread.58438/

note: You must wait 96 hours from your thread start date/time for the button to be visible.

Same happened with me as well, same answer....

.......

The same with me.

The open price was 1561.08 but my stoploss was filled at 1585.61.

They even dont let me withdraw money from my other accounts.

Can you each open your own scam alert thread and submit evidence there please?

Last edited:

4evermaat

2nd Lieutenant

- Messages

- 2,709

@compu-forex what is really needed is video of all the sessions, or at least some journal logs for the days in question. Here is an example

Video/logs like this can really help show a more complete picture of what the broker and trader were doing at the disputed time.

Video/logs like this can really help show a more complete picture of what the broker and trader were doing at the disputed time.

isten

Recruit

- Messages

- 15

I think @compu-forex is right, this is not a scam.

I was long on WTI Spot Oil, my TP was 63.40 and after the markets open on Monday morning IC-Markets closed my position at 63.79

So they give me 39 Pips positiv slipage.

Regards isten

I was long on WTI Spot Oil, my TP was 63.40 and after the markets open on Monday morning IC-Markets closed my position at 63.79

So they give me 39 Pips positiv slipage.

Regards isten

Similar threads

- Replies

- 7

- Views

- 355

- Replies

- 2

- Views

- 6K

- Replies

- 23

- Views

- 9K

Problem

FTMO SCAMMED ME

- Replies

- 8

- Views

- 57