Julia NordFX

NordFX Representative

- Messages

- 145

Forex Forecast for EURUSD, GBPUSD, USDJPY and USDCHF for August 21 - 25, 2017

First, a review of last week’s forecast:

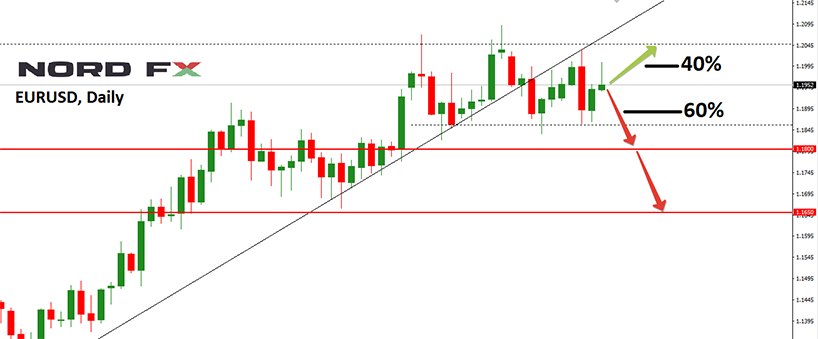

- EUR/USD. Only 35% of experts expected the pair to fall. However, graphical analysis and a number of oscillators on D1 sided with them. The support at 1.1685 was named as the nearest goal: it was reached by the pair by mid Tuesday. After that, the pair made several more attempts to break through this level, and it even managed to drop 25 points. This was not a true breakthrough, however, and the pair returned to the Pivot Point of the last two weeks in the 1.1755 zone. Thus, the week’s decline was only about 70 points;

- GBP/USD. 45% of analysts voted for the fall of this pair last week. As for the medium term, 65% of them sided with the bears. The pair itself went ahead of the curve and by Tuesday evening it lost 170 points. There, the bears' forces dried up, and it initiated a lateral movement along the 1.2875 Pivot Point, near which it completed the weekly session;

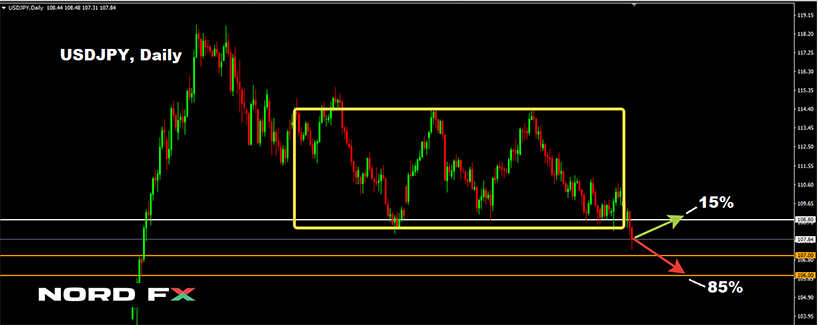

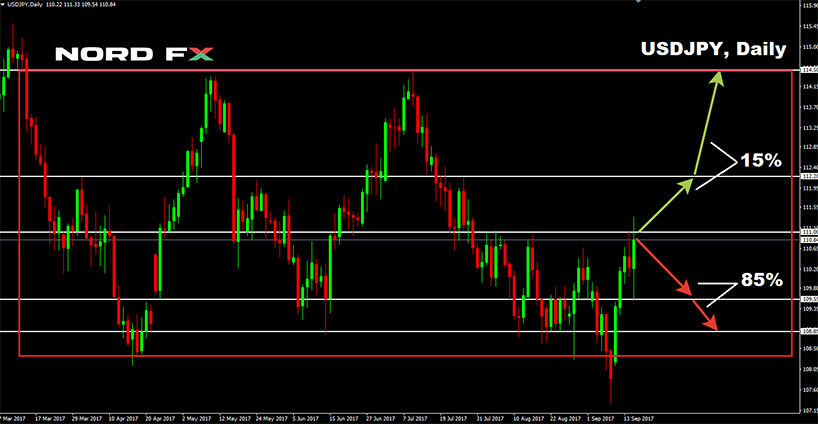

- Oscillators on H4 and D1 warned that USD/JPY was oversold. Graphical analysis also expected a correction. The rebound did indeed happen: the pair reached the height of 110.94 by the middle of the week, after which it turned sharply and returned to the values of the beginning of the week. As a result, the week’s chart looks like an isosceles triangle, at the base of which the support zone 108.90-109.20 is located;

- A similar triangle can be seen on the USD/CHF chart. As with the case of USD/JPY, a number of oscillators were giving signals that the pair was oversold, and one of the scenarios assumed its rise to resistance 0.9700, and in the event of its breakdown, another 70 points higher. That's exactly what happened: the pair reached 0.9765, and then left southwards to finish the week near a strong support/resistance zone at 0.9650, where it first visited back in March 2008.

***

As for the forecast for the coming week, summarizing the opinions of analysts from a number of banks and brokerages, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. Like last week, the views of most experts (60%) face northwards, with the remaining 40% voting for the fall of the pair. Approximately the same alignment of forces can be observed with indicators on both H4 and D1. The support levels are 1.1685, 1.1600 and 1.1475. The resistance levels are 1.1845, 1.1910, 1.2010. As for the graphical analysis on D1, according to its readings, the pair will first move in the descending channel, and then, having reached the bottom at the level of 1.1610, it will turn and will go north again;

- Speaking about the future of the pair GBP/USD pair, 55% of analysts, supported by the absolute majority of indicators (80%), as well as graphical analysis on D1, vote for its fall to 1.2760. After that, the pair should change the trend to an ascending one.

An alternative point of view is shared by 45% of experts and graphical analysis on H4. In their opinion, the pair will go up from the very beginning of the week, basing on the support of 1.2840 The nearest targets are 1.2950 1.3025 and 1.3125;

- As for the USD/JPY, we can expect with a high degree of probability that, before reaching the April 2017 low (108.12), the pair, as was the case in the previous two cycles, will stay in the sideways trend for a while, fluctuating in the range 108.80-110.30. Approximately 40% of analysts and graphical analysis on H4 agree with this version. As for the indicators, 95% of them, as well as 35% of experts, continue to insist on the rapid fall of the pair. The goal is the same, the horizon of 108.00.

The growth of the pair to the area of 112.00 and above is expected by only 25% of analysts at the moment. However, if we move to the medium-term forecast, their number increases to 75%;

- And the last pair of our review is USD/CHF. The fall of this pair to the area of 0.9440-0.9500 is still expected by 60% of experts and the overwhelming majority (about 85%) of trend indicators and oscillators. The remaining 40% of analysts, together with graphical analysis on H4 and D1, do not exclude the fall of the pair and believe that for this to happen the pair must first reach the resistance at 0.9765.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited.

#eurusd, #gbpusd, #usdjpy, # forex, # forex_forecast, #forex signals, # binary_options

https://nordfx.com/

First, a review of last week’s forecast:

- EUR/USD. Only 35% of experts expected the pair to fall. However, graphical analysis and a number of oscillators on D1 sided with them. The support at 1.1685 was named as the nearest goal: it was reached by the pair by mid Tuesday. After that, the pair made several more attempts to break through this level, and it even managed to drop 25 points. This was not a true breakthrough, however, and the pair returned to the Pivot Point of the last two weeks in the 1.1755 zone. Thus, the week’s decline was only about 70 points;

- GBP/USD. 45% of analysts voted for the fall of this pair last week. As for the medium term, 65% of them sided with the bears. The pair itself went ahead of the curve and by Tuesday evening it lost 170 points. There, the bears' forces dried up, and it initiated a lateral movement along the 1.2875 Pivot Point, near which it completed the weekly session;

- Oscillators on H4 and D1 warned that USD/JPY was oversold. Graphical analysis also expected a correction. The rebound did indeed happen: the pair reached the height of 110.94 by the middle of the week, after which it turned sharply and returned to the values of the beginning of the week. As a result, the week’s chart looks like an isosceles triangle, at the base of which the support zone 108.90-109.20 is located;

- A similar triangle can be seen on the USD/CHF chart. As with the case of USD/JPY, a number of oscillators were giving signals that the pair was oversold, and one of the scenarios assumed its rise to resistance 0.9700, and in the event of its breakdown, another 70 points higher. That's exactly what happened: the pair reached 0.9765, and then left southwards to finish the week near a strong support/resistance zone at 0.9650, where it first visited back in March 2008.

***

As for the forecast for the coming week, summarizing the opinions of analysts from a number of banks and brokerages, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. Like last week, the views of most experts (60%) face northwards, with the remaining 40% voting for the fall of the pair. Approximately the same alignment of forces can be observed with indicators on both H4 and D1. The support levels are 1.1685, 1.1600 and 1.1475. The resistance levels are 1.1845, 1.1910, 1.2010. As for the graphical analysis on D1, according to its readings, the pair will first move in the descending channel, and then, having reached the bottom at the level of 1.1610, it will turn and will go north again;

- Speaking about the future of the pair GBP/USD pair, 55% of analysts, supported by the absolute majority of indicators (80%), as well as graphical analysis on D1, vote for its fall to 1.2760. After that, the pair should change the trend to an ascending one.

An alternative point of view is shared by 45% of experts and graphical analysis on H4. In their opinion, the pair will go up from the very beginning of the week, basing on the support of 1.2840 The nearest targets are 1.2950 1.3025 and 1.3125;

- As for the USD/JPY, we can expect with a high degree of probability that, before reaching the April 2017 low (108.12), the pair, as was the case in the previous two cycles, will stay in the sideways trend for a while, fluctuating in the range 108.80-110.30. Approximately 40% of analysts and graphical analysis on H4 agree with this version. As for the indicators, 95% of them, as well as 35% of experts, continue to insist on the rapid fall of the pair. The goal is the same, the horizon of 108.00.

The growth of the pair to the area of 112.00 and above is expected by only 25% of analysts at the moment. However, if we move to the medium-term forecast, their number increases to 75%;

- And the last pair of our review is USD/CHF. The fall of this pair to the area of 0.9440-0.9500 is still expected by 60% of experts and the overwhelming majority (about 85%) of trend indicators and oscillators. The remaining 40% of analysts, together with graphical analysis on H4 and D1, do not exclude the fall of the pair and believe that for this to happen the pair must first reach the resistance at 0.9765.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited.

#eurusd, #gbpusd, #usdjpy, # forex, # forex_forecast, #forex signals, # binary_options

https://nordfx.com/