Stan NordFX

NordFX Representative

- Messages

- 716

Forex Forecast for EURUSD, GBPUSD, USDJPY and USDCHF for 27 November - 1 December 2017

To begin with, a few words about the forecast for the previous week, which turned out to be accurate either fully or 90% accurate for all four currency pairs:

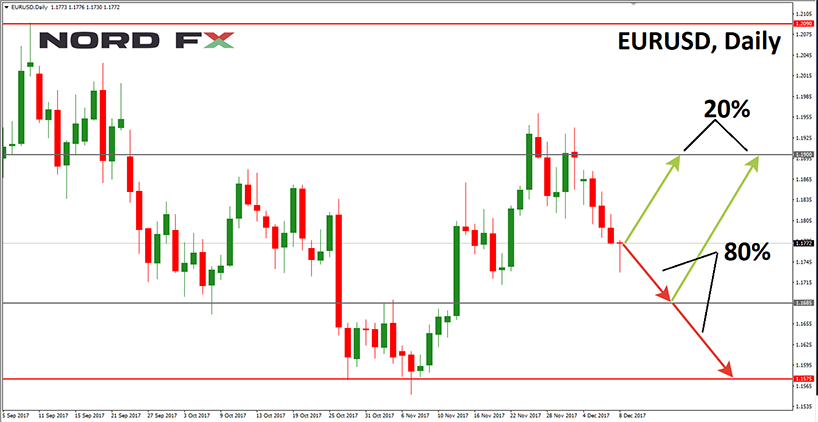

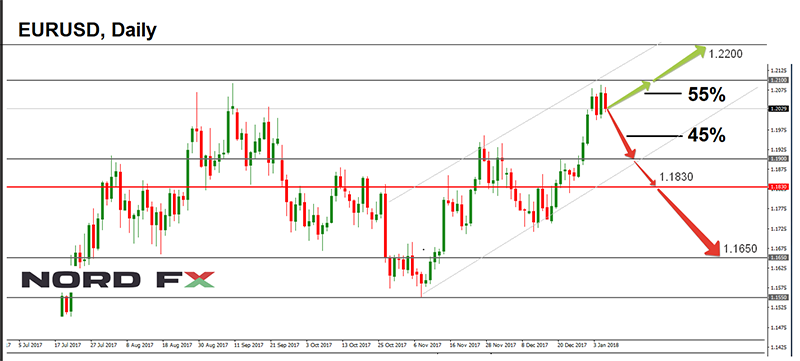

- Regarding EUR/USD, we named the forecast based on graphical analysis as the most promising one last week. Our decision was not a mistaken one. Recall that, according to readings on H4, the pair was expected to spend some time moving in the side corridor in the 1.1700 to 1.1860 range. After hitting the lower border of this channel, it was expected to sharply rise. This is exactly what happened: having designated a local minimum at the level of 1.1712 and being propelled by Trump's decision regarding North Korea and news from the US Federal Reserve, the pair started heading north on 21 November. It reached its maximum at 1.1943 by the end of the week;

- Giving a forecast for GBP/USD, 60% of analysts were inclined to believe that it would linger for some time in the central zone of the medium-term side channel, which began in late September - early October. As for the remaining 40% of experts, supported by almost 90% of the indicators, they expected the pair to leave this zone and go to the upper border of the channel.

This scenario was implemented with 100% accuracy: until the middle of the week, the pair had struggled to stay close to the center of the medium-term corridor, using its Pivot Point as support, and then rushed up, reaching the October maximum at 1.3338 on Friday;

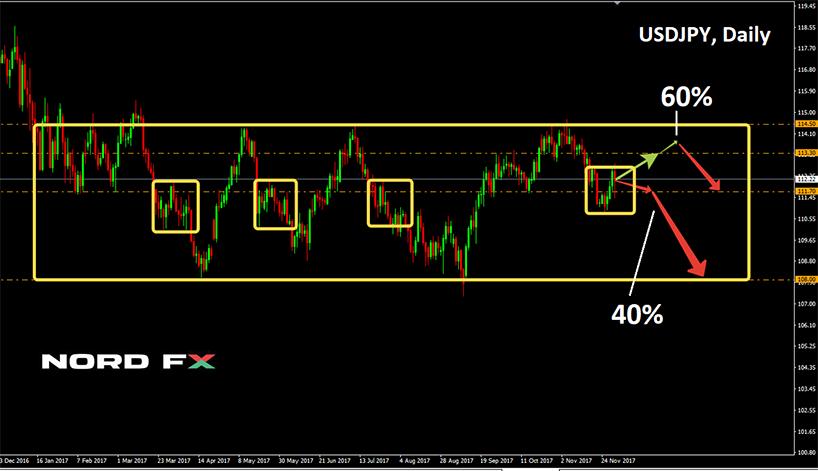

- USD/JPY. Most experts (75%), supported by an absolute majority of indicators (90%), stated that the pair would necessarily test the support in the Pivot Point area of the medium-term 108.00-114.50 side channel. This forecast was also fully correct. Having broken through the level of 111.70, the pair found the week’s minimum at 111.05, after which it fought back up, meeting the weekend in the zone 111.50;

- The forecast for USD/CHF was correct as well. 0.9940 was indicated as the nearest resistance. As predicted by 60% of experts and 75% of indicators, the pair rebounded from this level and went south. 0.9800 was identified as a target, and the pair froze near it by the end of the week.

As for the forecast for the coming week, summarizing the opinions of analysts from a number of banks and brokerages, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- 65% of experts predict further weakening of the dollar and the growth of EUR/USD to at least 1.2000. The next resistance levels are 1.2045 and 1.2090, which were the August peaks. Both graphical analysis and 100% of trend indicators agree with this forecast. As for the oscillators, almost a third signal that the pair is overbought. 35% of analysts are talking about a possible downwards correction: according to them, the pair may fall to the support at 1.1855, and in the event of its breakthrough, to the 1.1800 area;

- 70% of experts, graphical analysis on D1 and 100% of indicators agree that the dollar will continue to fall relative to the British pound as well. In their view, the upward trend of the GBP/USD that began in January 2017 will continue, and the pair will rush to the September high in the 1.3650 zone. The nearest resistance is 113.25.

An alternative forecast, supported by 30% of analysts, suggests that, having reached the upper boundary of the "autumn" medium-term channel of 1.3035-1.3335, the pair should return to its Pivot Point at 1.3200;

- The dollar’s weakening, according to 70% of experts, will also concern the USD/JPY. The pair’s target is in the 110.00-110.50 area. However, in the medium term the picture changes: here 65% of analysts vote for the pair's rise to 112.00-113.45, and then to 114.45. Graphical analysis and several oscillators on D1 also testify in favor of such a development;

- Southwards and only southwards: this is what 70% experts, graphical analysis on D1, 100% of trend indicators, as well as 80% of oscillators on H4 and D1 suggest. The support levels are 0.9750, 0.9675 and 0.9560.

As for graphical analysis, it joins 20% of oscillators in indicating that before falling, the pair may temporarily rise to 0.9865.

Finally, 30% analysts strongly disagree with the bears' supporters: according to them, the pair is expected to return to 1.0000 in the near future.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited.

#eurusd #gbpusd #usdjpy #usdchf #forex #forex_example #signals #forex #cryptocurrencies #bitcoin

https://nordfx.com/