Forex Forecast and Cryptocurrencies Forecast for 26 February – 02 March 2018

First, a review of last week’s forecast. It should be noted that the forecast for bitcoin and other cryptocurrency pairs proved to be almost 100% correct.

- EUR/USD. Recall that, in the short term, only a third of experts expected this pair to fall. When shifting from the weekly forecast to medium-term forecast, however, the number of supporters of the US currency strengthening increased from 30% to 65%. The dollar decided to get ahead of the events and, starting from Monday, dragged the pair down. Analysts named the levels 1.2335 and 1.2235 as targets. The pair ended up reaching the first of them, and almost got to the second one, fixing the local bottom at 1.2259. It then turned and completed the week in zone 1.2295;

- A similar forecast was given for GBP/USD. And just as in the case of EUR/USD, in the medium term, the number of bears' supporters increased from 35% to 60%. Only 10% of oscillators on D1 now signaled that the pair was oversold, which meant a fall would only be expected in early March. However, the pair managed to lose 175 points from Monday to Thursday. However, afterwards the euro won back most of the losses, and the pair completed the trading session at 1.3965;

- USD/JPY. Here experts' opinions about the breakdown of the lower line of the mid-term side corridor 108.00-114.75 were divided almost equally. 45% considered it to be an unrealistic scenario and expected the pair to turn upwards. 20% of the oscillators agreed with this, signaling that it was oversold. The weekly chart shows that the pair did indeed almost reach the horizon of 108.00, after which the forces of the bulls dried up, and it rolled back 110 points lower, indicating a new level of support / resistance at 106.90;

- We now move to cryptocurrencies. It is known that the primary task in this forecast is to determine trends. Here the forecast turned out to be 100% accurate. As for the goals, because of the unusually high volatility of these pairs, it is more appropriate to talk not about levels, but about support / resistance zones, which have a fairly wide range. Even so, the forecast turned out to be quite accurate here as well:

- Giving a forecast for bitcoin (BTC/USD), in mid-January we called the $10,000 zone as one of the key zones. It is around this horizon that the pair has been fluctuating all the time. As for the weekly forecast, it looked like this: growth to the 10,500-11,000 zone, followed by a reversal and fall to 9,470. Indeed, the pair went north in the first half of the week, reaching the level of 11,750. However, by Wednesday, it was already possible to observe a double, and sometimes a triple divergence on the charts of many oscillators. And soon there followed a trend reversal, as a result of which the pair fell to the level of 9.555;

- Ethereum (ETH/USD): according to the forecast, it would first increase to 1,000, then decrease to 775-840. In reality, it showed growth to 975.80, then a reversal and a decline to 783.80;

- Litecoin (LTC/USD): according to the forecast, it would first increase to 250, then turn and return to level 220, and in case of a breakthrough, drop to 165. It ended up growing to 251, then turned and fell to 180;

- Ripple (XRP/USD): the forecast indicated growth to 1.164, and then a turn and return to the support at 0.83, or even 0.77. It ended up growing to 1.143, then the turn and fall to the level of 0.79.

As for the forecast for the coming week, summarizing the opinions of a number of analysts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

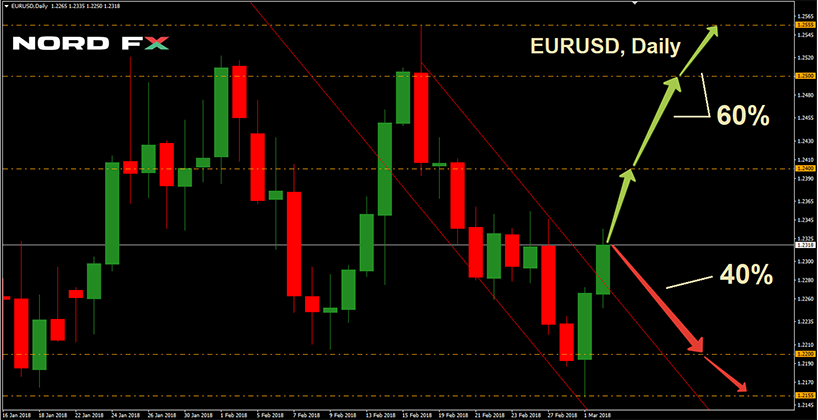

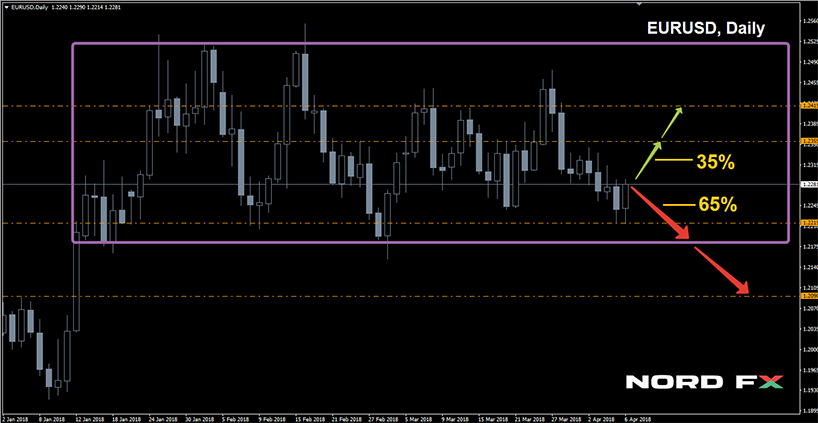

- EUR/USD. Almost 70% of experts, supported by the overwhelming majority of indicators, expect the pair to continue falling, identifying 1.2200 and 1.2165 as the nearest support levels. The following support is at 1.2070.

When moving to the medium-term forecast, the proportion of bears decreases from 70% to 45%. Half of the trend indicators and oscillators on D1 have already taken a neutral position, and graphical analysis on the daytime time frame points directly northwards: it believes that the pair will first reach the resistance at 1.2550, and in case of its breakthrough, will rush to 1.2685;

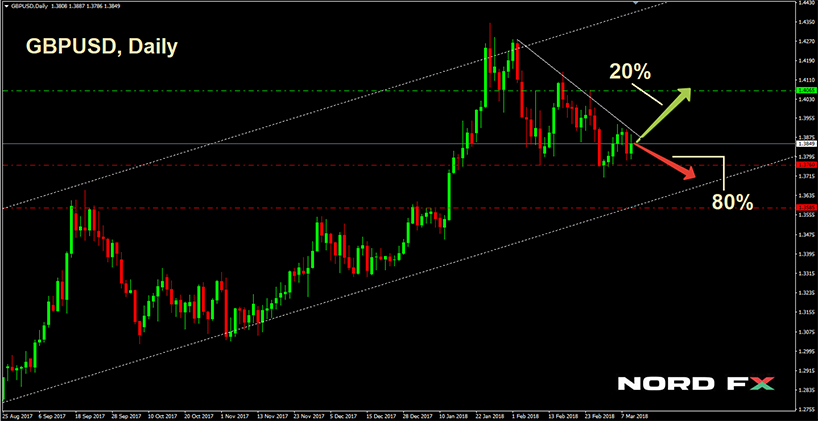

- GBP/USD. Most indicators here are painted green. The opinions of analysts are divided exactly in half: 50% support the fall of the pair, 50% support its growth. When it comes to graphical analysis, H4 displays movement in the 1.3835-1.4145 lateral channel. When moving to D1, the pair's oscillation range expands to 1.3765-1.4345.

It should be noted that in the medium term, almost 70% of experts are already voting for the pair’s decline, expecting the pair to return to 1.3300-1.3550;

- USD/JPY. For the second week in a row, experts are unable to reach a consensus regarding the breakthrough of the lower line of the medium-term side corridor 108.00-114.75. Only 5% of the oscillators so far signal that the pair is oversold. However, 30% of analysts, supported by graphical analysis on H4 and D1, still consider the breakthrough to be a false alarm and expect the pair to return to 107.80-108.00, and then even higher to the resistance at 109.85.

As for most experts, they believe the pair will certainly once again test the support at 105.54 and, in the event of its breakthrough, will rush to 104.30. In the medium term, they believe it will go even further to the 2016 low in the 98.99-101.20 zone;

- and, finally, the main asset of the cryptocurrency market, bitcoin. Experts, supported by volume indicators and oscillators, believe that BTC/USD will continue its decline until the middle of the week, reaching a local bottom in the 8,400-9,040 zone, after which a trend reversal will follow. The pair will then return to the levels of 9,900-11,000.

Analysts believe that similar dynamics can be expected from the rest of the cryptocurrency pairs NordFX makes available for trading (ETH/USD, LTC/USD, XRP/USD, etc.). They believe the downtrend will continue until the end of February, followed by a rebound and a return to the highs of the previous week.

Dear traders, NordFX offers you the opportunity to trade cryptocurrencies with unrivalled leverage of 1: 1000.

Deposits in USD and bitcoin.

https://nordfx.com/promo/tradecrypto.html

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited.

#eurusd #gbpusd #usdjpy #usdchf #forex #forex_example #signals #forex #cryptocurrencies #bitcoin

https://nordfx.com/