TIME FOR EVIDENCE

April is a bit specific month for Bitcoin in particular and for cryptocurrencies in general. There are a few reasons for that. First is, we do not have so much events of high importance as we’ve got last month. Appearing ETF and sky hype around it is just to mention. Second is in April market shows strong downside pullback that have not been seen for several months. ATH has been set around 74K and holds since then. Finally, BTC has got big check from geopolitical factors and mostly we could say that this check has failed.

In a short period of Iran-Israel piking, BTC has collapsed and loud screams about equality of BTC to gold have become quieter. Right in this moment more signs of interest rate policy changing have appeared from the Fed and market rapidly starts changing its expectations on future. Shortly speaking, in most friendly scenario we should get the rate cut only by the end of 2024, while most critical scenario even suggests another rate increase. This hardly will be positive to BTC. Now BTC shows tight relation with technical stocks. The US yields are coming very close to the S&P long-term return, turning to direct rival. Recent plunge of Nvidia shares shows that first signs of problems are appeared. Media explains it by impact of geopolitical factors, but we suspect that the fuel for further rally on stock market is coming to an end. And it is a big question how BTC will behave in this new environment.

MARKET OVERVIEW

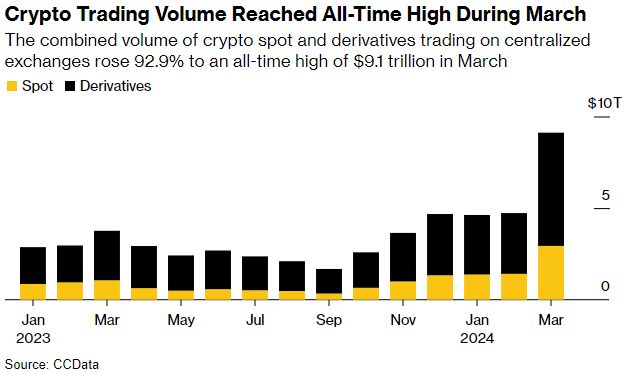

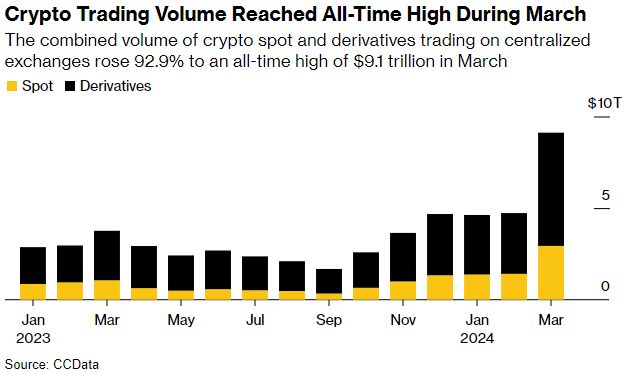

The combined volume of crypto spot and derivatives trading on centralized exchanges almost doubled to an all-time high of $9.1 trillion in March while Bitcoin reached a record, according to a CCData.

Spot trading outpaced the gains seen in derivatives, with volume rising 108% to $2.94 trillion, the highest monthly figure since May 2021, CCData’s March Exchange review report said. Binance, the world’s largest crypto exchange, saw trading volume reach the highest since May 2021, with spot jumping 121% to $1.12 trillion and derivatives increasing 89.7% to $2.91 trillion. “Compared to last month, Binance made the largest gain in market share, with the exchange now accounting for 38.0% of the spot trading volumes on centralized exchanges,” the report said.

“Compared to last month, Binance made the largest gain in market share, with the exchange now accounting for 38.0% of the spot trading volumes on centralized exchanges,” the report said.

Derivatives trading volume also hit a record among exchanges integrated with the CCData API, almost doubling to $6.18 trillion in March.

“This surge occurred as investors and traders speculated on the price action following Bitcoin’s approach toward a new all-time high in March,” the report said.

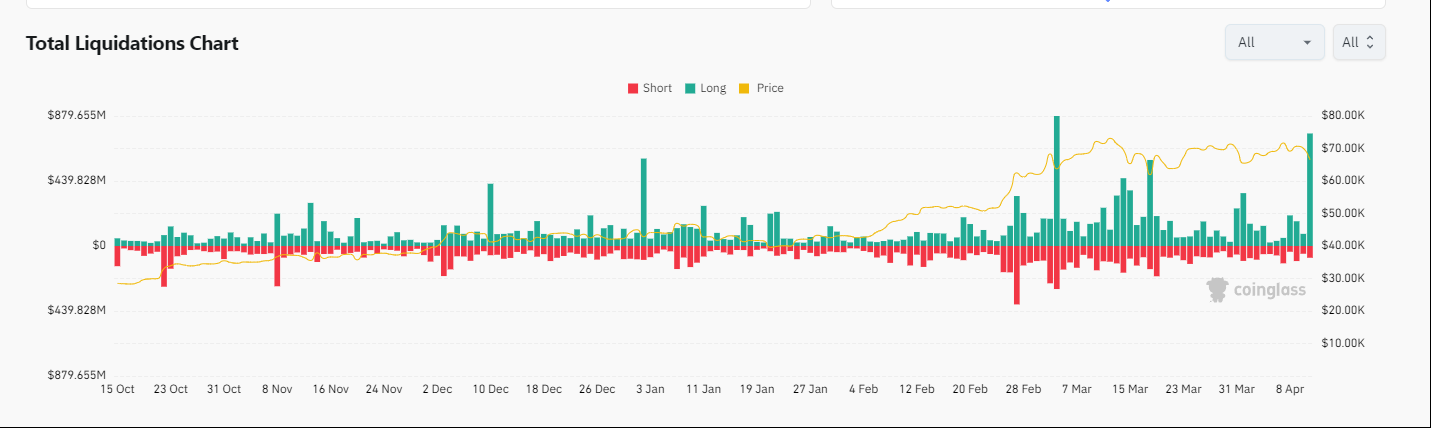

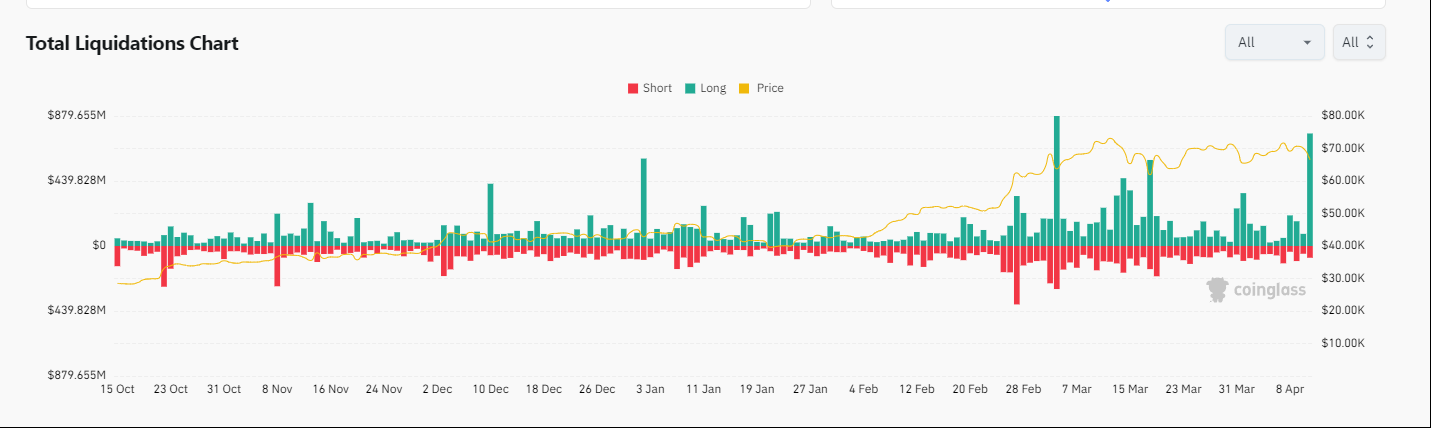

Bitcoin dropped by the most in more than a month on 12 of April, helping to trigger a string of liquidations of speculative crypto positions. Coinglass data show about $780 million worth of bullish crypto wagers were liquidated in the past 24 hours — the largest such drop in a month. The financial world was roiled on Friday by a flare-up in geopolitical risks that spurred a flight to the safest corners of the market such as bonds and the dollar. Bitcoin fell as much as 7.5% to $65,214, before paring losses.

Ether, the second-biggest cryptocurrency after Bitcoin, was down as much as 12% at one point, the biggest intraday decline since November 2022. It later pared the drop. The token has been under pressure since the Ethereum Foundation revealed last month that it was under scrutiny from the the US Securities and Exchange Commission.

The implied volatility for Bitcoin options jumped last weekend, reversing a downward trend seen in the prior week, Kaiko Research said in a report. An increase generally means market participants are less confident about the direction of prices, said Adam McCarthy, a research analyst at Kaiko.

The original digital asset fell as much as 5% to $59,888, before paring the decline. Bitcoin has dropped by about 18% since it reached a record $73,797 on March 14.

“People are looking to derisk as it remains to be seen if the halving will be a market moving event or a non-event overshadowed by the ETF,” said Nathanaël Cohen, co-founder of INDIGO Fund. “There is an additional macro factor putting more pressure on risk assets (the Middle East tensions).”

The cryptocurrency saw further decline as some investors turned risk adverse amid Iran’s attacks against Israel. Israel launched a retaliatory strike on Iran less than a week after Tehran’s rocket and drone barrage, sending tremors through global markets. A report that nuclear facilities in the Iranian city of Isfahan were safe helped to salve some angst. Traditional havens such as bonds, gold and the dollar trimmed gains, while stocks came off session lows.

Ongoing Israel-Iran violence could lead to a “general risk-off sentiment across crypto,” said Stefan von Haenisch, head of trading at OSL SG Pte. But it might take a “significant move lower” to undo all of the bullishness around the halving, he added.

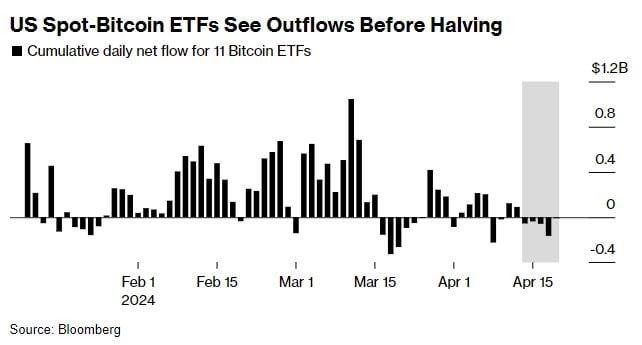

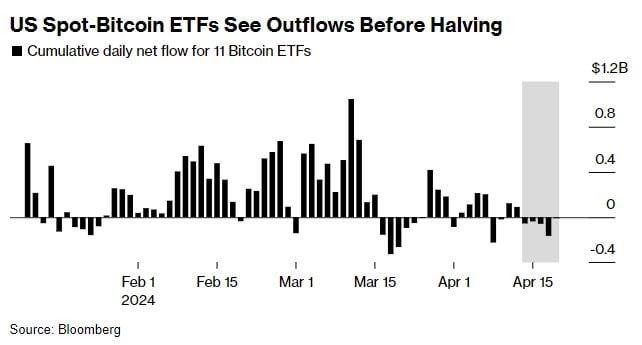

JPMorgan Chase & Co. and Deutsche Bank AG strategists have said that the quadrennial halving is largely already priced in by investors. A batch of three-month-old spot-Bitcoin exchange-traded funds in the US have posted five straight days of net outflows ahead of the event.

A highly anticipated Bitcoin software update called the “halving” has been completed, dealing a potential blow to the companies that make money by ensuring that the digital currency functions smoothly and securely.

“As expected, the halving was fully priced in so price movement was limited,” said Kok Kee Chong, chief executive officer of Singapore-based AsiaNext, a digital-asset exchange for institutional investors. “Now the industry will have to wait and see whether a rally will occur in the coming weeks amid sustained institutional interest.”

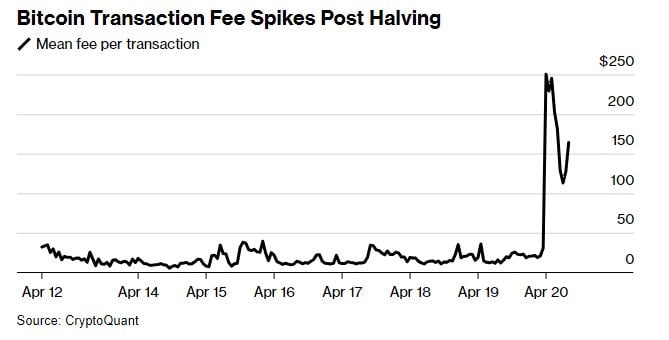

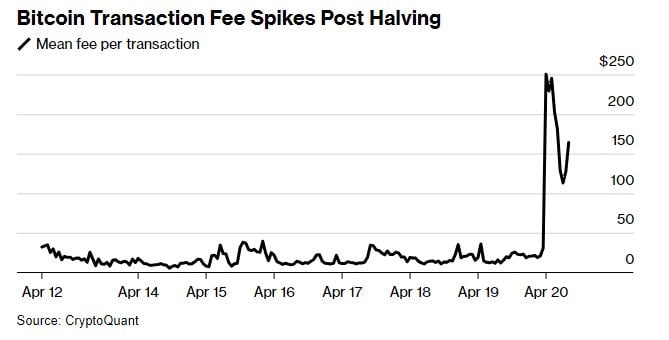

While Bitcoin’s price was little changed following the event, the average transaction fee on the network jumped over 730% to $250 before coming down to $164, data from CryptoQuant shows.

Bullishness toward Bitcoin in the near term may be dampened by macroeconomic influences, such as signals from the Federal Reserve that interest-rate cuts are on hold and conflict in the Middle East, according to Edward Chin, co-founder of Parataxis Capital.

Bullishness toward Bitcoin in the near term may be dampened by macroeconomic influences, such as signals from the Federal Reserve that interest-rate cuts are on hold and conflict in the Middle East, according to Edward Chin, co-founder of Parataxis Capital.

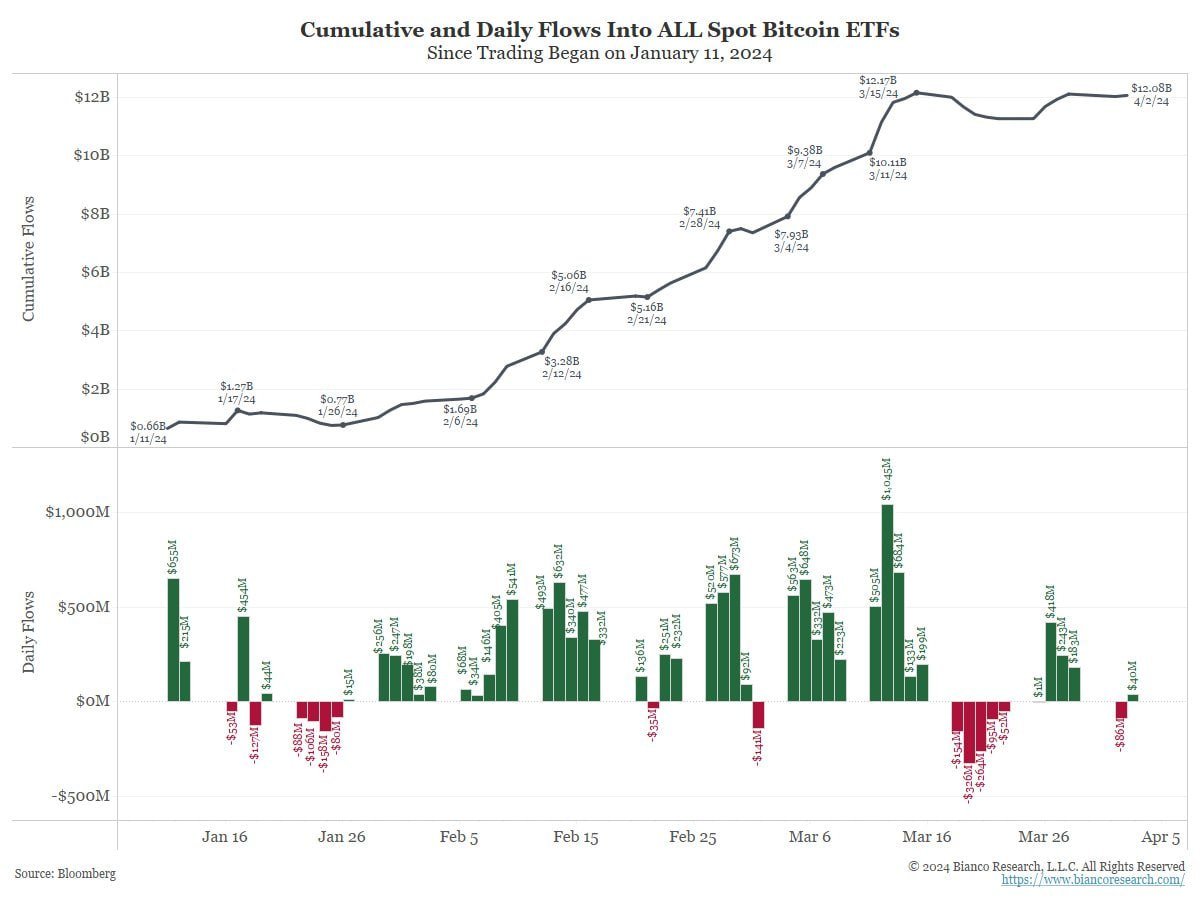

“We are likely to chop a bit over the coming quarter until there is clarity on the macro front,” Chin said. “During that time, the primary driver of price will likely continue to be ETF fund flows.”

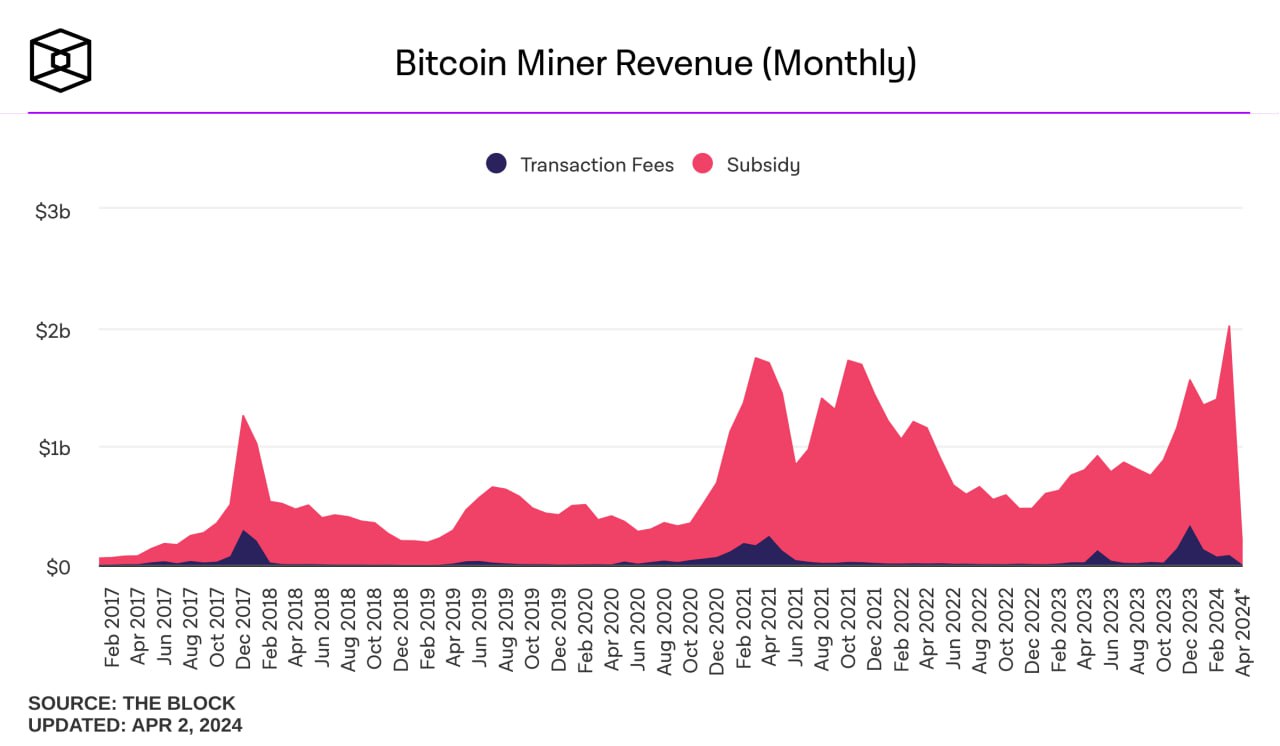

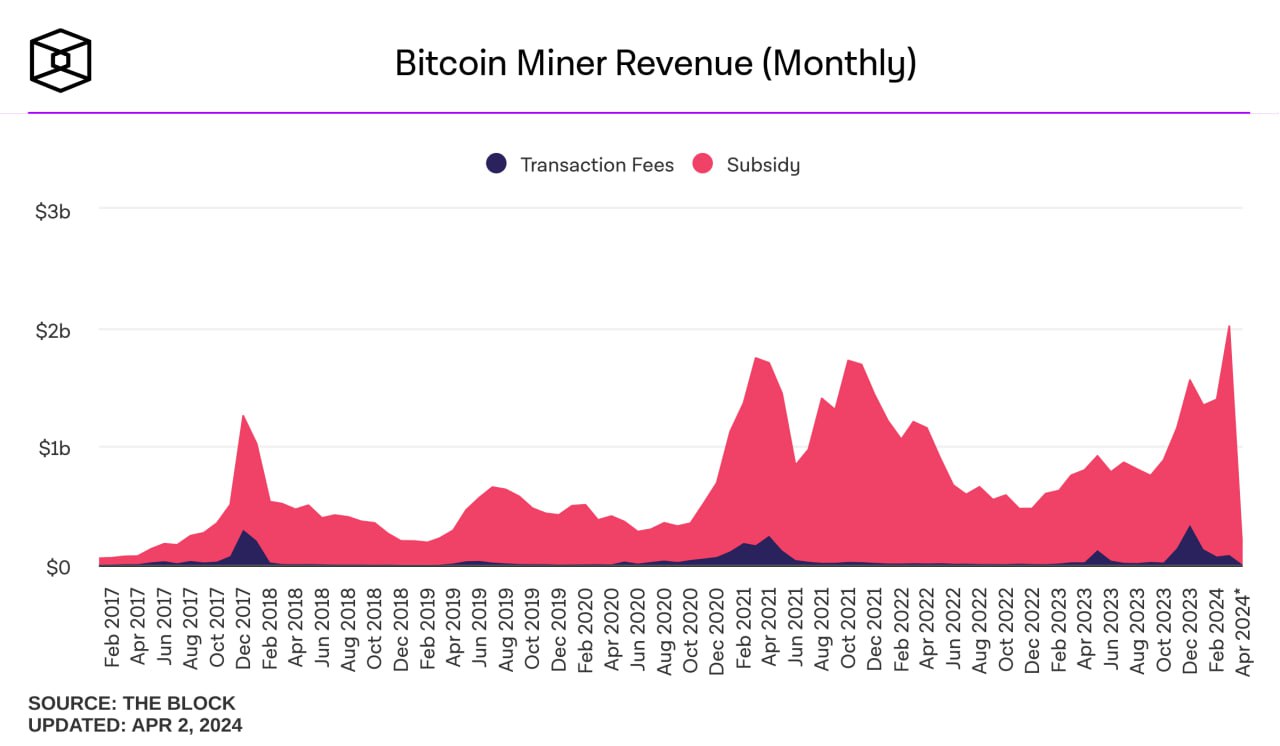

The main impact from the halving is expected to be on Bitcoin mining companies rather than the actual price of the cryptocurrency. The blockchain update is poised to wipe out billions of dollars in annual revenue for miners, though the effect will be mitigated if the cryptocurrency’s price continues to rise.

JPMorgan expects the sector to consolidate, with publicly-traded firms gaining market share.

The next halving is set to take place in 2028 and the reward will be reduced to 1.5625 from 3.125 for a miner that successfully processes a block of transaction data. The average time to finish a block is around 10 minutes. There are expected to be 64 Bitcoin halvings before the 21 million cap is reached sometime around 2140, at which point halvings will cease and the blockchain will stop issuing new tokens.

So, this in short what has happened this month. Now let’s take a look how investors treat these events and what forecasts they make…

MARKET EXPECTATIONS

Mostly rhetoric is positive, majority foresee new ATH and competing who will set higher target level. All of them are very similar in background – institutional demand, decreasing of BTC free float due ETF accumulation and less mining reward. Here are just a few to name some:

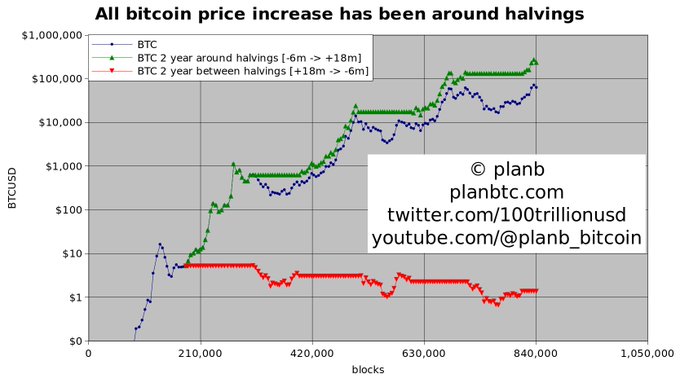

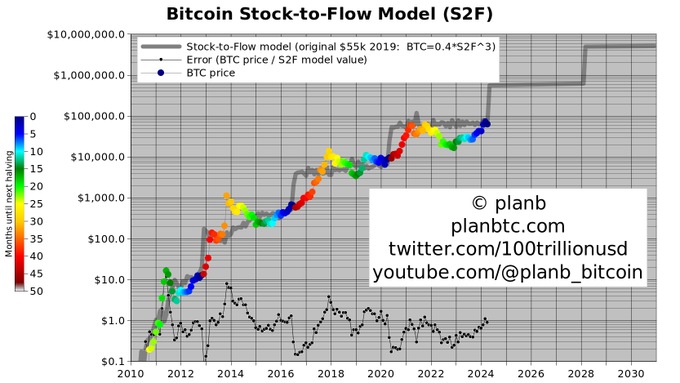

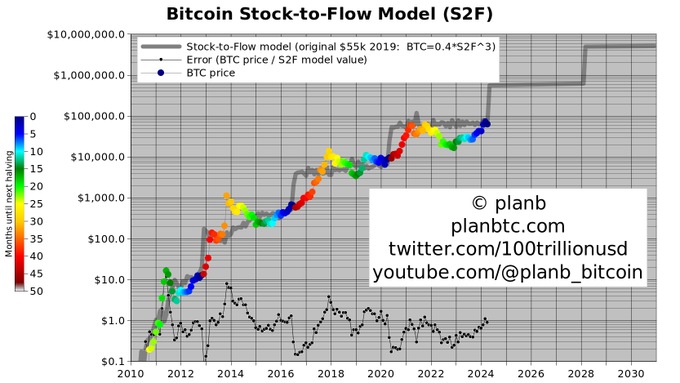

Appealing to S2F model system he suggests 1 Mln marking in two years:

Bitcoin’s recent price surge is unrelated to the upcoming halving and mainly attributed to the inflows into spot Bitcoin exchange-traded funds (ETFs), argues Hao Yang, head of financial products at Bybit, who told Cointelegraph:

“Considering [the] halving and price trends from a very rigorous quantitative point of view, there is no evidence supporting a positive correlation between the halving event and BTC price. But history can be interpreted in many different ways. I certainly hope for $435,000 by 2028 but won’t put too much into it.”

A six-figure BTC price appears even more possible if Bitcoin ETFs overtake gold ETFs, which is something that could happen in the next two years, according to a Feb. 26 research report from Bloomberg analyst Eric Balchunas.

Additionally, Bitcoin ETFs are growing at a much quicker pace than gold ETFs did when they first appeared in 2004. In fact, Bitcoin is “speed running” gold’s price fivefold, says Sam Wouters, the head of contact at River, who wrote in a March 29 X post:

“Bitcoin is basically just 5x speed running gold’s trajectory. The last 10 years of Bitcoin look a bit like a squished version of gold’s last 50. No wonder some people get salty.”

But different opinions are also exist.

First is, analysts identify 60K Level as vital for short-term performance. Quant writes in research that If the price breaks below $60,000, we might witness a decline to $52,000 before a subsequent rise.

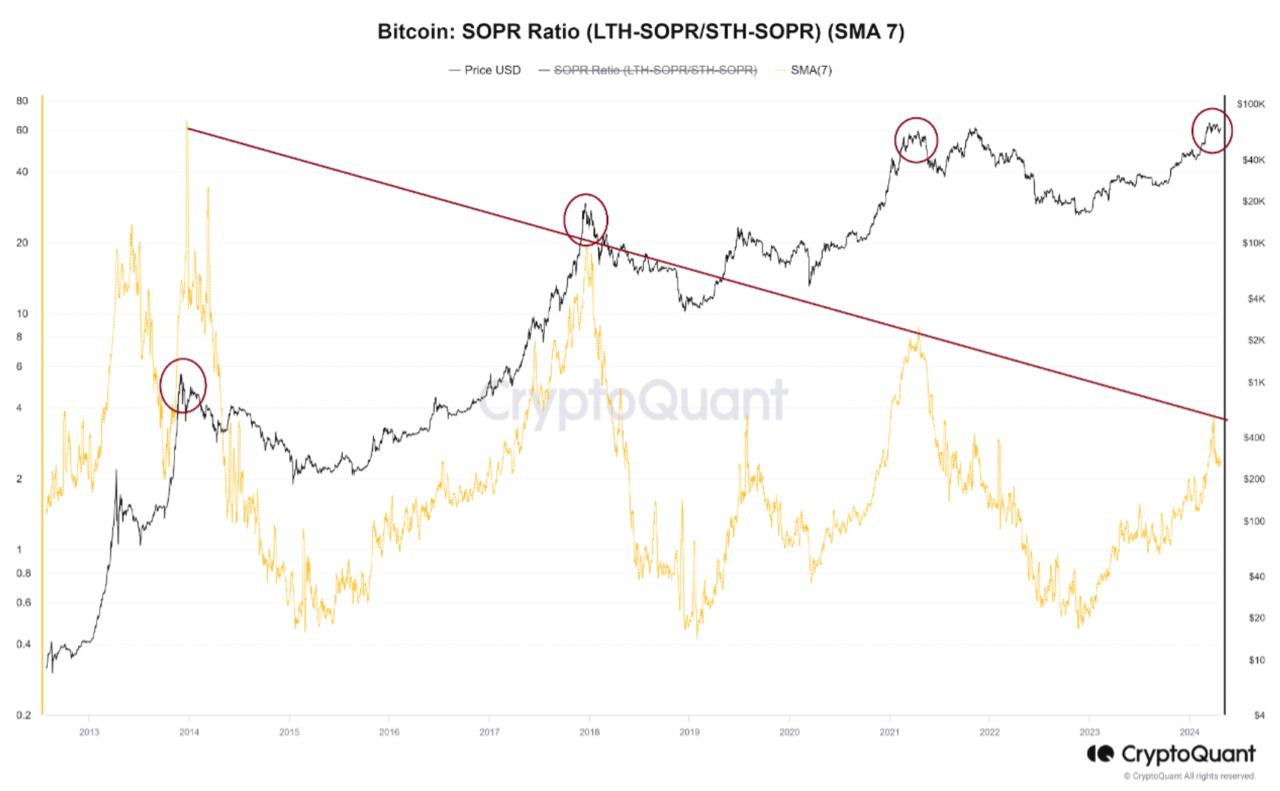

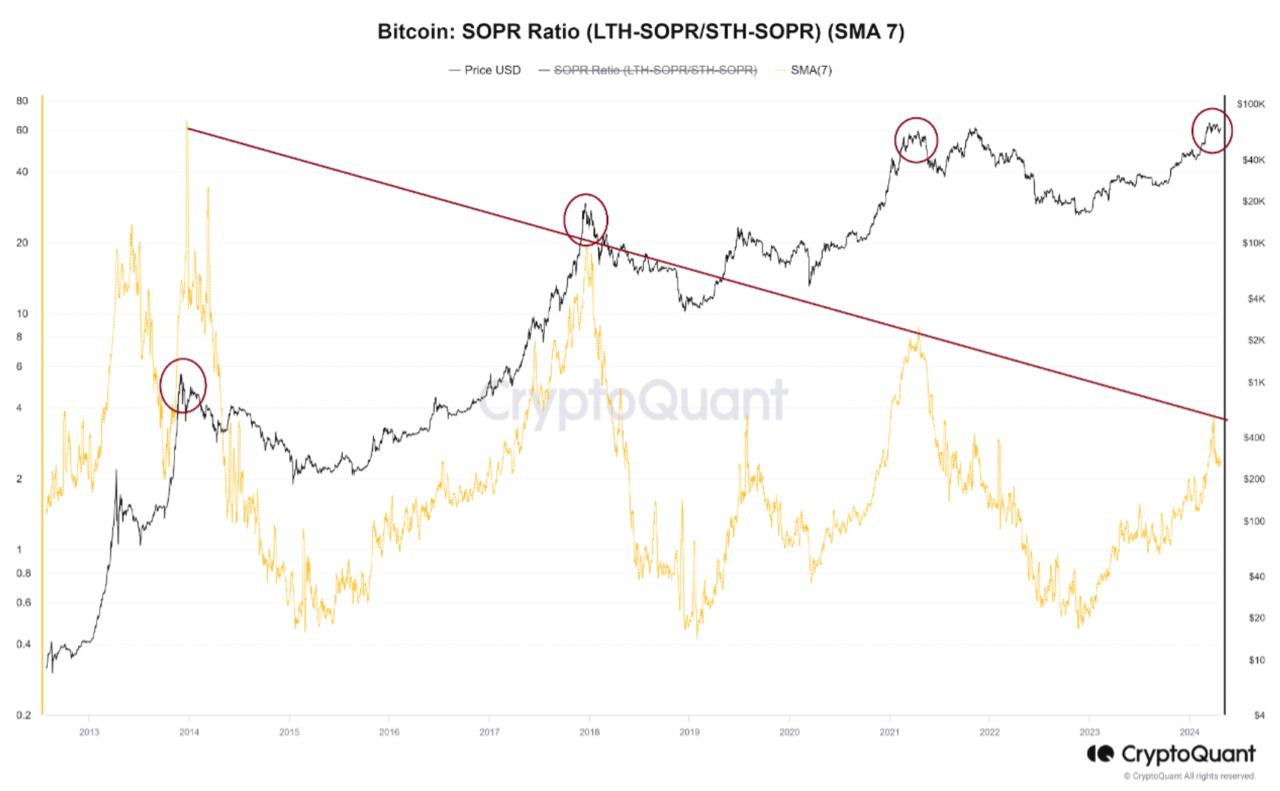

While long-term holders are taking profits.

“Such patterns hint at the likelihood of long-term investors capitalizing on price ascents to realize profits, shedding light on the possible impacts of such profit-taking on market conditions.

“Such patterns hint at the likelihood of long-term investors capitalizing on price ascents to realize profits, shedding light on the possible impacts of such profit-taking on market conditions.

Not only Quant Analysts but P. Schiff was talking about 60K level as well:

If Bitcoin ETFs are really going to send Bitcoin to $100K or higher, why are all the Bitcoin related equities in bear markets? For example, COIN is down 21%, GLXY is down 26%, MSTR down is 33%, WGMI is down 41%, MARA is down 55%, $BITF is down 56%, and $HIVE is down 61%.

JPMorgan bank sees downside for the world’s largest cryptocurrency after the halving because the market is still in overbought conditions, according to its analysis of open interest in bitcoin futures.

Furthermore, the cryptocurrency price of about $61,200 is still above the bank’s volatility-adjusted comparison with gold, which sets it at $45,000, and its projected production cost of $42,000 after the halving. The bitcoin production cost has historically acted as a lower boundary for BTC prices.

JPMorgan also notes that venture-capital funding remains subdued despite the recent crypto market resurgence.

The bitcoin halving could be a “buy the rumor, sell the news” event, according to the CEO of a crypto payments solution provider.

“With more sophisticated market participants and institutional investors in this market cycle, we may see a case of ‘buy the rumor, sell the news’ for this halving,” Coinify CEO Rikke Staer said in an email sent to The Block.

These miners might be forced to sell existing bitcoin holdings to cover electricity costs, equipment maintenance, and other operational expenses,” she added. This can create a negative feedback loop, where lower prices force more miners to sell, further depressing the price,” she said.

A ratio comparing the price of Bitcoin, the largest digital asset, with second-ranked Ether hints at a possible waning of risk appetite in crypto. The ratio scaled 20 this week and reached the highest level since April 2021, reflecting more resilient demand for the oldest cryptocurrency rather than the smaller rival.

This pattern could be “a very early signal” of FOMO — or fear of missing out — morphing into “fear” if Ether is viewed as a proxy for sentiment toward smaller tokens, crypto asset trading company QCP Capital wrote in a note on Friday.

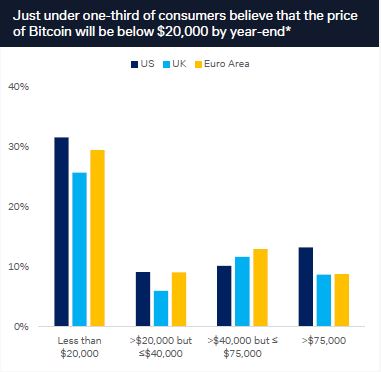

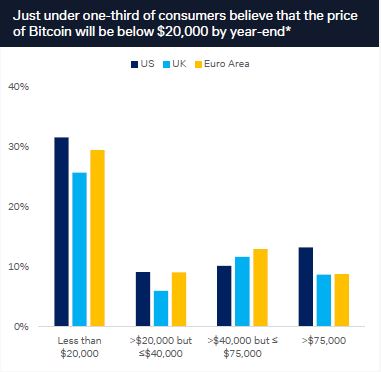

Consumers are divided over Bitcoin’s staying power, with about one-third expecting the world’s largest cryptocurrency to slide below $20,000 by the end of the year, according to a survey by Deutsche Bank.

Some 40% of respondents were confident about Bitcoin thriving over the next few years but 38% expected it to disappear. At the same time, less than 1% considered crypto a fad, the survey conducted over March showed.

Jim Rogers, renowned for his expertise in commodities like gold and silver, remains deeply skeptical about cryptocurrencies’ long-term prospects. Speaking at the India Today conclave, Rogers expressed his reservations, stating,

“I’m very skeptical of crypto. I don’t expect it to last. It’s been fabulous for some people now. Not for me, but I do not see any long-term value in cryptocurrency. I have more confidence in the future in real things that people can use than I do in Bitcoin,” he remarked. “Whether it’s rice or sugar doesn’t matter. I know that rice will always have value. It has always, I do not know that Bitcoin will always have value.”

Asserting his stance further, Rogers predicted the eventual demise of Bitcoin, stating, “Bitcoin will disappear and go to zero someday.” He contrasted this with the enduring value of commodities like sugar, saying, “The value of sugar is not going to disappear and go to zero someday.

Rogers remains unconvinced of its potential to usurp traditional safe-haven assets like gold and silver.

“I don’t think that Bitcoin is going to replace gold and I don’t think it’s going to replace silver,” he remarked. “Maybe I’m wrong. Maybe I should sell all of my gold and silver and buy Bitcoin. But as far as I can see, most people in the world understand gold and silver, but most do not understand Bitcoin.”

WHAT DO WE THINK ABOUT ALL THIS STUFF

First thing that seems too evident is massive euphoria around halving, ETF’s etc. Now a lot of talking that as mining cost has raised to ~50-53K, BTC will never drop below it. Otherwise it will be not profitable to mine it and generation of new blocks will stop. But this is totally absurd. BTC easily could drop below 53K leading to bankruptcy of small mining companies and market consolidation. So, that majority of new mined coins will start accumulating in fewer hands of larger mining companies. That’s all same amount of coins will be distributed among less amount of miners. Correspondingly, halving has no relation to the price performance of the coin and all forecasts, based on it hardly deserve any attention.

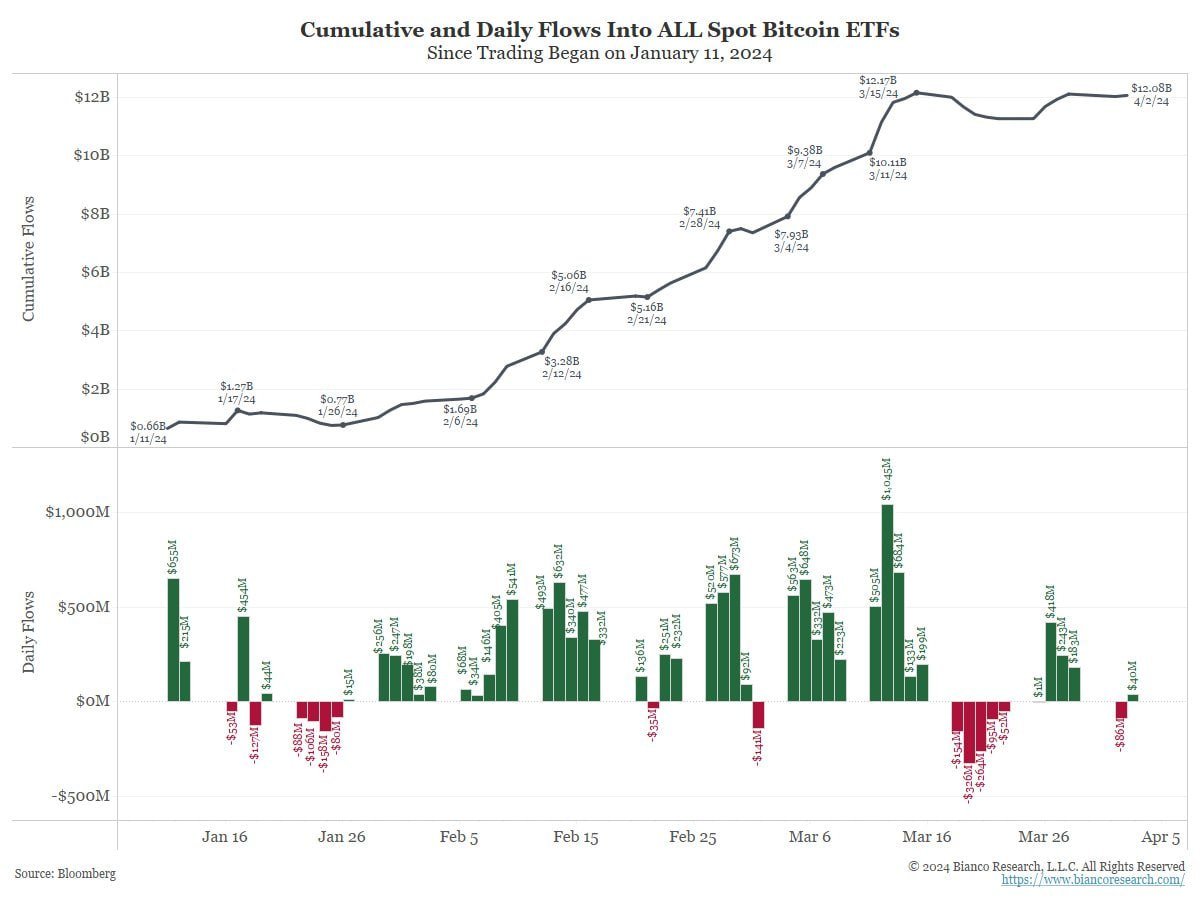

Next one is ETF. We see that hype around this topic is calm down a bit. If we take a look at cash flows – they stabilize. Overall flows for the spot bitcoin ETFs have slowed since peaking at a net daily inflow of $1.05 billion on March 12, as bitcoin approached its latest all-time high of $73,836, according to The Block’s data dashboard.

Second big myth that seems also wrong is explosive demand for ETF. AS it was mentioned above – 5 times faster than on Gold ETFs. But this is not quite correct. In fact, fast flows to ETF was equal to fast outflows from Trust funds, mostly from Grayscale. This explains why it is slowing right now. Otherwise, if it would be “new money” they should keep flowing. But occasionally inflows slowdown at the same moment as outflows from Grayscale fund.

Not everything cloudless about institutional demand. In fact, it stands at very low level. Take a look at BTC share in portfolios – maximum around 0.5%. This is very small value. Thus there were no massive adoption of BTC as respectable investing instrument happened yet:

It means that all demand mostly comes from individuals. Matt Hougan, CIO Bitwise tells mostly the same. Day 19 of 20 talking with Fin. consultants and family offices about Bitcoin. Conclusions:

● Inflows into the BTC ETF will continue for years. The reason for this is the different speed of decision-making on the allocation of funds to the Bitcoin ETF. Some Finnish consultants have already invested 3% of their clients’ portfolio in BTC, and some have not even started to think about it yet and they will have to go through hundreds more due-diligence procedures. The practice of gold ETFs has shown that the market took 7 years to form. For Bitcoin, this period will be shorter, but will still take years.

● Investor demand in the UK is significantly lower than in the US. The market there is at an even earlier stage.

● The paradigm with allocation of 1% in BTC has changed to 3%+. Almost every investor I spoke to invested at least 3% in Bitcoin. Conservative investors are currently targeting 1%, but for private capital 3% is far from the limit.

JPMorgan tells the same – analysts warn of potential downside risk as crypto venture capital funding remains “subdued” this year despite market rebound. The relative tepid flow of venture capital funding into the crypto industry this year, despite the recent crypto market resurgence, presents a downside risk, according to JPMorgan analysts.

“Our various proxies for crypto VC flows look rather subdued YTD [year to date] relative to previous years,” JPMorgan analysts, led by Nikolaos Panigirtzoglou, wrote in a report on Thursday. “We had previously argued that a recovery in crypto VC flows is a necessary condition for a sustained recovery in crypto markets, so in our minds, the subdued VC flows YTD pose a downside risk.”

Meantime, It is big informational attack on investors’ mind is started. Big whales load heavy artillery and start pressing people with necessity to put 3+% of assets in BTC. BlackRock CEO said he is very optimistic about BTC’s long-term viability. Professional and high-net-worth investors are considering allocating 3% of their portfolio to investing in BTC – CIO Bitwise

Basically, the propaganda works. True, historically we were talking about “companies and individuals should invest 2% of their assets in BTC,” but here it’s already 3%. But conspiracy theories tell us that this is all because the number of potential holes is 300+ trillion. dollars of global financial assets turned out to be more than everyone expected.

And if suddenly the stock market begins to fall or even simply stops growing, then there will be no support for demand. It will be necessary to look for some other methods, and these methods clearly do not include revaluation of gold, of which the population actually has little in their hands. Why not continue to pump crypto? Moreover, the cost of production after halving is increased to 55 thousand dollars…

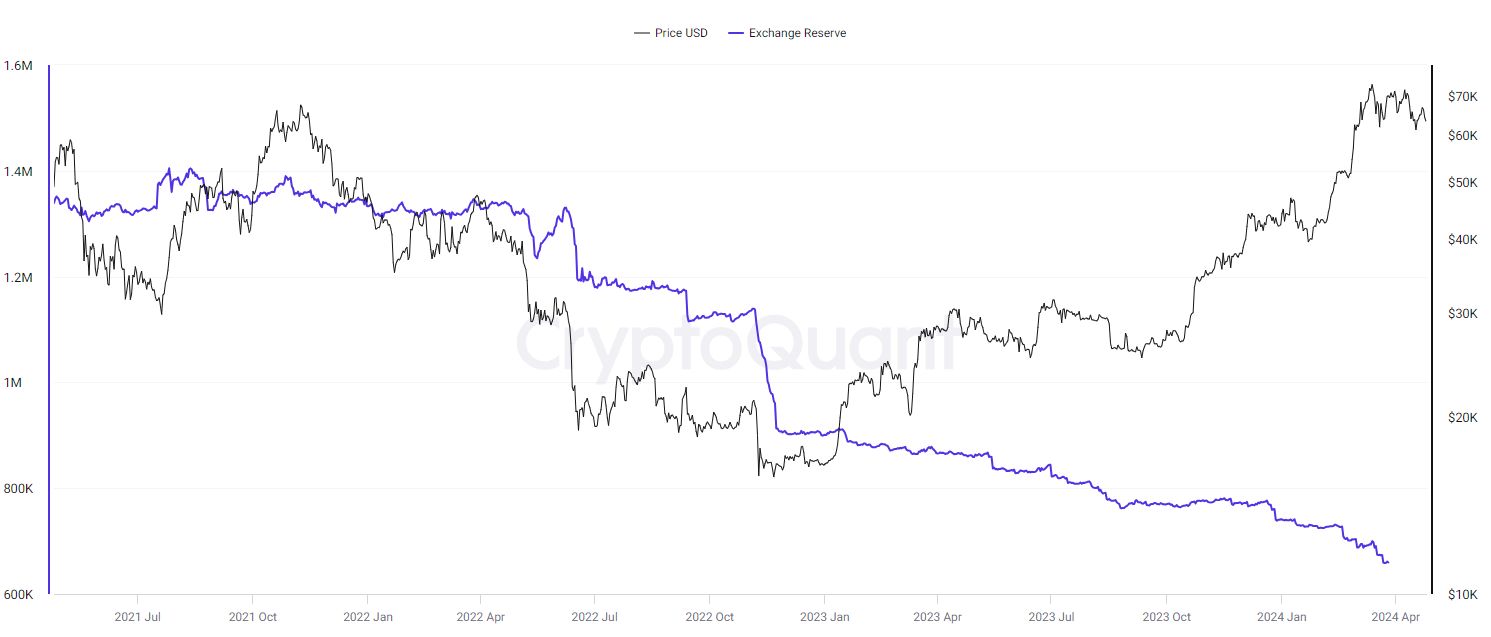

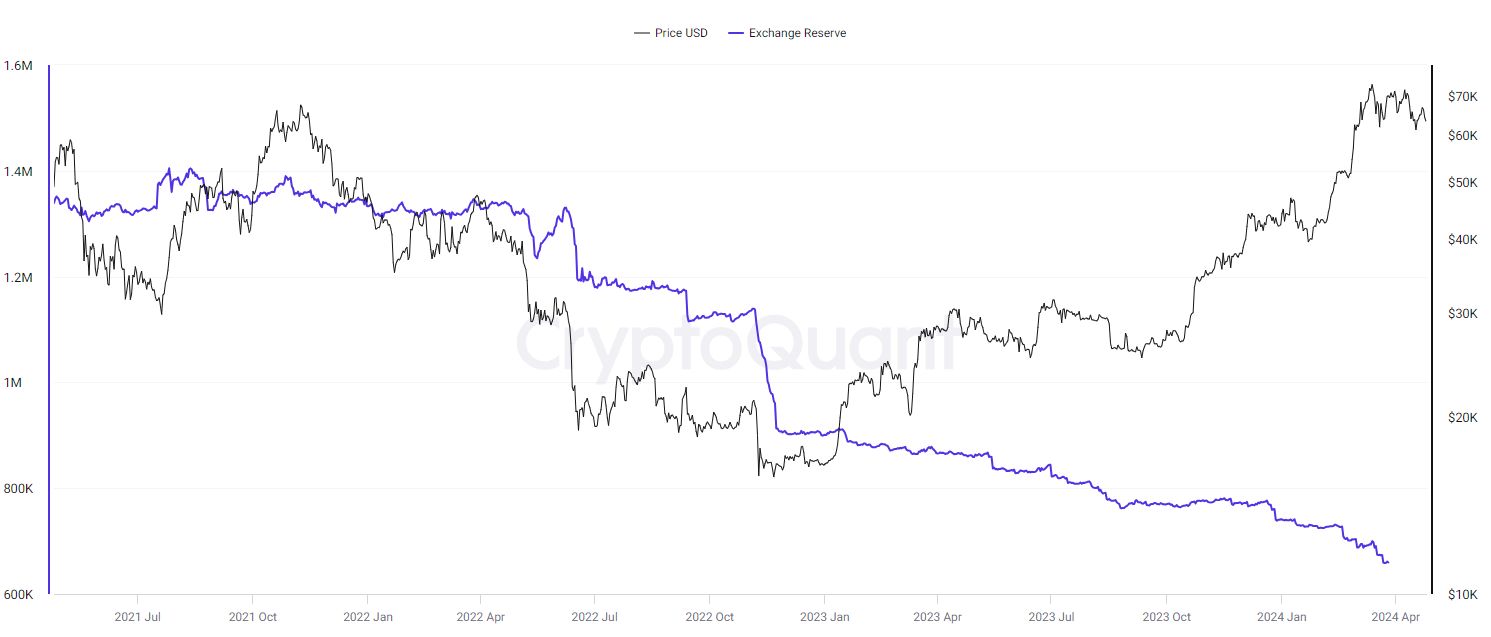

Meantime, there are less and less bitcoins on spot exchanges. To date, there are already 660 thousand pieces – a drop of 15% from the moment before the launch of the ETF.

And this despite the fact that investors continue to run out Grayscale, which puts pressure on the market. According to ByBit analysis – Bitcoin reserves on exchanges may run out in 9 months.

“Bitcoin reserves on all centralized exchanges are depleting too quickly. There are only 2 million bitcoins left, and with a daily influx of $500 million into the spot Bitcoin ETFs, 7,142 coins will leave the exchanges every day. As a result, it will take only 9 months to use up all the remaining reserves “.

CONCLUSION:

Big myths on crypto market are falling one by another. First, it was suggested that BTC should replace gold soon, but after Israel-Iran conflict starts – BTC somehow starts moving in “wrong” direction, i.e. down and not together with Gold. Where is the “safe haven” feature, gold replacement etc.? These talks have become quieter.

Indeed, In conditions of extreme concentration of optimists, going beyond all reasonable boundaries, the crypto market shows the vector of developments.

Over the two days of conflict, Bitcoin dropped for 15.8% (from the maximum to the minimum in two days). ETH (-21.2%) and BNB (-19.9%). In all the rest, it’s a real hell – a group of highly capitalized coins (SOL, XRP, ADA, AVAX, MATIC, DOT, TON) went down by 33-36% in two days, all other crypto scams went down by 35-50%.

Before this, the crypto had been on a downward trajectory for the entire month, which led to the resetting of the enchanting growth from February 7 to March 15 for most trash coins, and many had already gone to the level of October-December last year.

In two days, excluding BTC and ETH, the crypto market plummeted by more than 30% (min/max), which was one of the strongest drops in history. Since 2020, the crypto market has fallen comparable or more only 4 times (05/12/2022, 05/19/2021, 02/23/2021, 03/13/2020).

Taking into account open interest and a drop weighted by trading volumes, there has been a stronger collapse in the entire history of the crypt only once – May 2021.

The volume of liquidations on the largest exchanges, representing more than 60% of the derivatives market, exceeded $2 billion in two days, which is a record in history. Usually massive liquidation is followed by stabilization, but here it rained for two days. What gold replacement are you talking about?

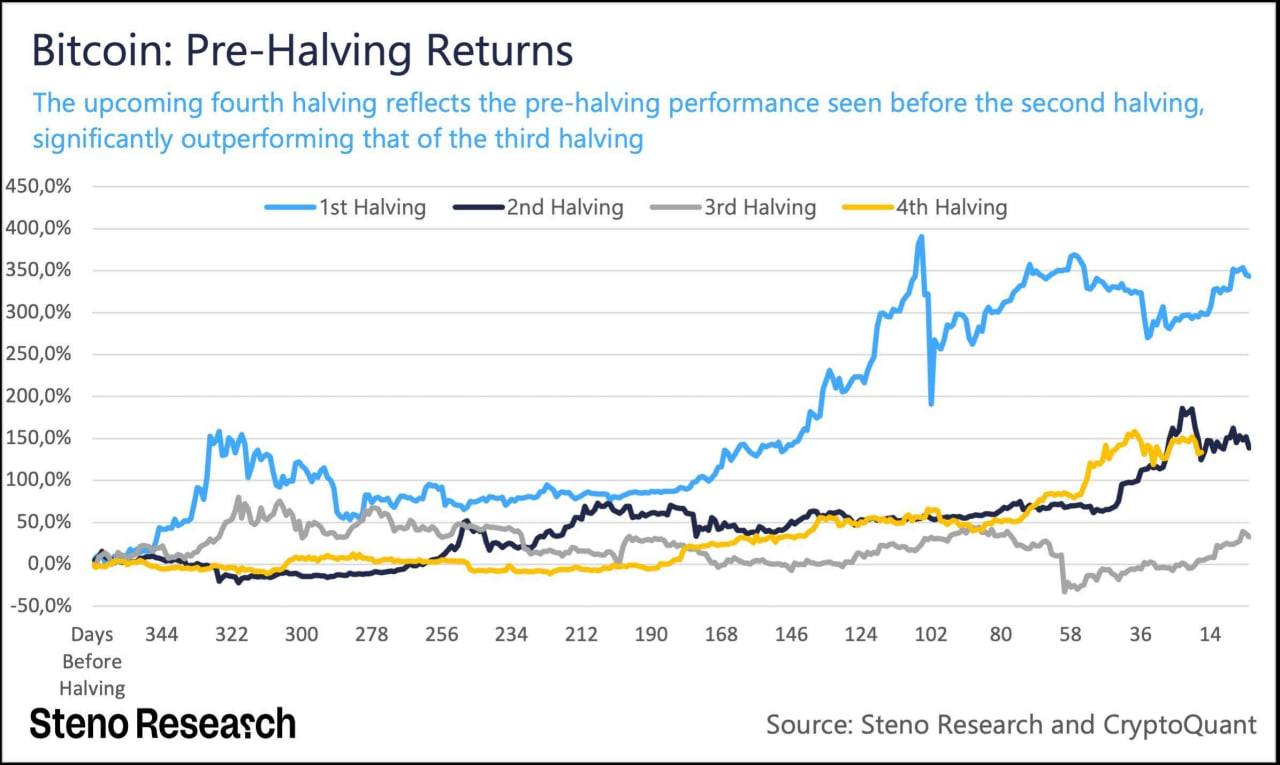

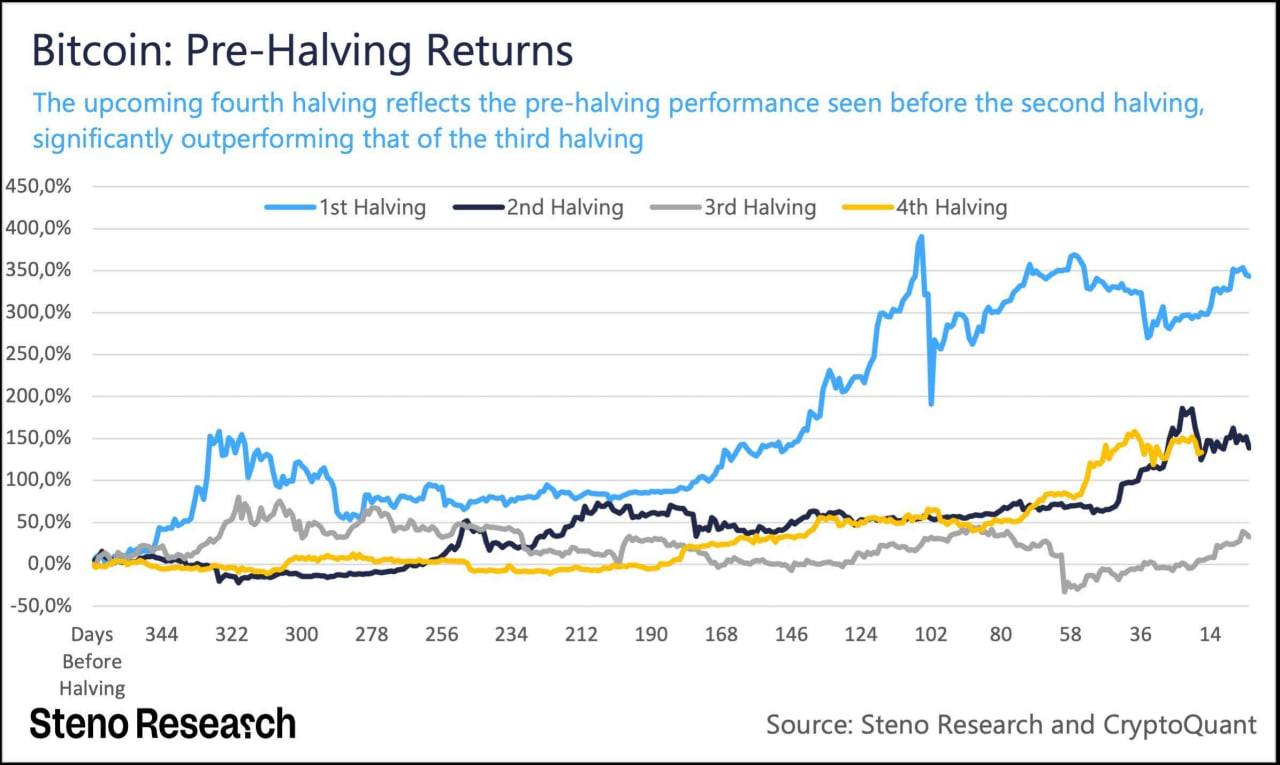

Second is halving that it should boost the price. But, as we’ve shown above, in reality it has limited relation to the price performance of BTC.

Third is huge continues demand from institutional investors that constantly should push price higher to not ever seen levels. Now we see that interest is weak and nobody hurry up to buy BTC for all cash. The interest of investors will depend on stability and clarity of price action, the volatility of the assets. All these features are at extreme levels in BTC. That’s being said –

- Crypto shows the direction of speculative capital.

- After an insane pump in February-March, the crypto market went into the strongest despondency in history on the wave of hype and widespread advertising two weeks earlier, which symbolizes the high degree of vulnerability of markets to the realization of black swans (hello S&P 500 with a record concentration of bulls in history).

- Crypto has never been and will never be a defensive asset – in its pure form, a speculative surrogate in an aggravated form.

- Everything is extremely unstable. Any unforeseen event will immediately destabilize the financial markets, and given the extreme involvement in buying in stocks, the consequences can be extremely dramatic.

- There are no safe haven assets other than gold, commodities, and high-margin companies with low debt and long history, provided adequate multiples.

- With coming acceleration in inflation, the pressure on BTC market will increase. As it provides no “safe haven” protection as it provides no protection from inflation as well.

That’s being said, the best approach is to ignore big hype, try to stay aside from any FOMO propaganda, keep healthy skepticism and rely more on common sense rather than on Media zombifying reports. We consider targets below 100K as potentially possible, and even have personal long term 88K target. At the same time, we do not exclude deeper retracement in nearest few months, at least to 50-52K area and ignore any emotional forecasts.