Bitcoin Fundamental Briefing, January 2024

Hope springs eternal

Definitely January is a specific month for BTC and all crypto industry. So long expectation of ETF approvement and so upsetting dynamic later on. Of course, here we could say “We warned”, but it is useless. Let’s better take a look what has happened and why BTC performance in January doesn’t fit to market expectations. Maybe everything is not as bad as it seems…

Market overview

Bitcoin fell below $40,000 for the first time since early December as enthusiasm over the launch of exchange traded funds that directly invest in the largest cryptocurrency ebbs.

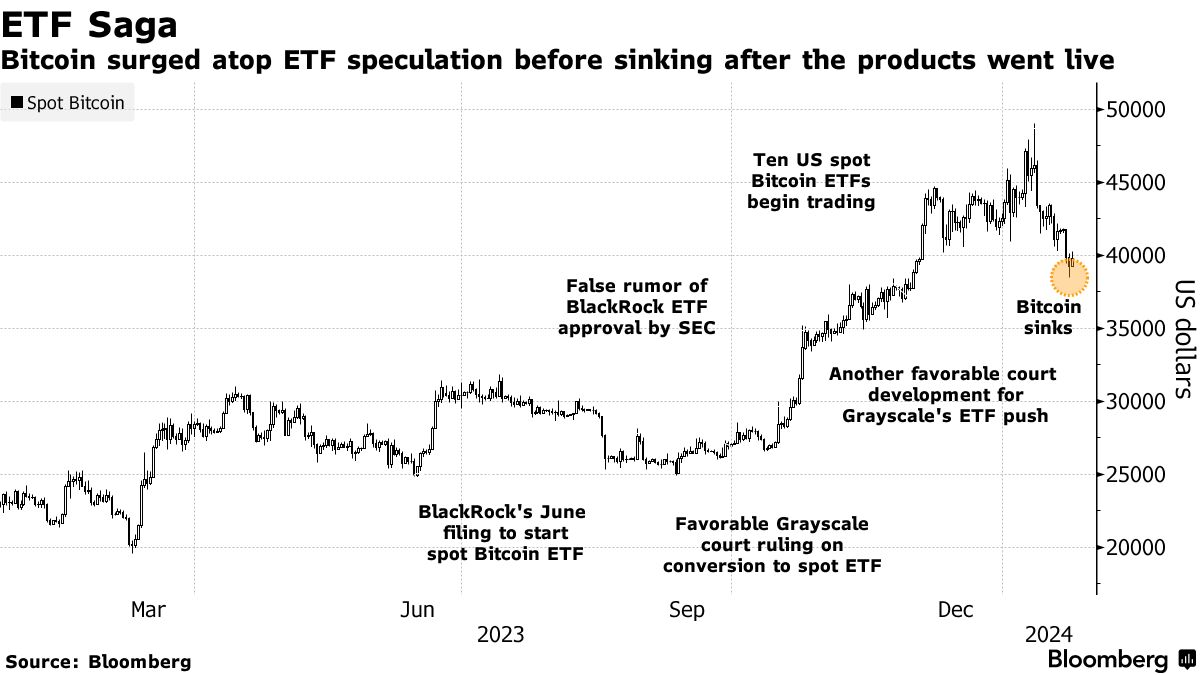

Digital tokens have mostly been on a downward trajectory so far this year after an intense bull-run which saw Bitcoin rising by nearly 160% in 2023, outpacing gold and stocks. Much of that rally was attributed to anticipation of the Securities and Exchange Commission approving launch of spot Bitcoin ETFs in the US. It did so on Jan. 10, allowing almost a dozen issuers to offer spot BTC ETFs. Markets started giving up some of the gains after the SEC’s decision as a sell-the-news trade.

The declines were in stark contrast to positive performance elsewhere, with global equities keep advancing.

“We are seeing weakness across all digital assets, as new ETF inflows have so far failed to offset profit-taking by speculative traders on positions put on prior to the announcement,” said Caroline Mauron, chef executive of digital-asset derivatives liquidity provider Orbit Markets. “While $40,000 might be an important psychological level, we don’t expect a break through to trigger a cascade of liquidation here, and see the next support level around $38,000.”

“Market sentiment has slowed down after the ETF listings for certain, and the use of leverage continues to trend lower indicating cautious positions being opened by traders,” Fadi Aboualfa, head of research at Copper Technologies Ltd., said in an email. “Things are shaping up to be very interesting.”

Thus, bitcoin has fallen over 20% since the Jan. 11 launch of the first exchange-traded funds investing directly in the token as speculators become more cautious about the potential impact of the products.

“As bearish sentiment appears to be prevailing, the next crucial price levels for bitcoin that could provide support are estimated to be between $38,000 and $36,000,” analysts at crypto exchange Bitfinex wrote in the note.

The 10 Bitcoin ETFs have recorded $1.1bn in total net flows so far this month, according to data on the Bloomberg Terminal as of Monday. That includes the impact of Grayscale’s Bitcoin Trust, which has seen nearly $3.5 billion in outflows so far as investors offload long-held stakes, according to the data.

“Over the past two weeks, Bitcoin has been challenged by tougher macro conditions — evidenced by rallying rates and a strengthening dollar — and significant selling pressure from traders unwinding their GBTC arbitrage positions along with the FTX bankruptcy estate offloading assets,” Sean Farrell, head of digital-asset strategy at Fundstrat Global Advisors LLC, wrote in a note.

The disposals by FTX potentially remove a supply overhang, suggesting that the “intense selling pressure from GBTC may soon subside,” Farrell added.

Tokens such as Ether and BNB also fell sharply along with Bitcoin, the largest digital asset, which is roughly $30,000 below its 2021 pandemic-era record of almost $69,000.

“GBTC outflows have created a dynamic in the market that needs to be normalized before we will see true price discovery,” said Leah Wald, chief executive officer of digital-asset investment firm Valkyrie Investments.

Thus, from this review above market expectations become clear – “we need to wait a bit, the drop is temporal and mostly technical. Rally will continue, and now is good time for BTC accumulation.”

Now let’s take a look at some details…

Why BTC is falling?

Bitcoin’s decline since the start of trading of exchange-traded funds that hold the cryptocurrency was driven in part by sales of Grayscale Bitcoin Trust shares, according to SkyBridge Capital founder Anthony Scaramucci.

Selling one Bitcoin product to buy another should not impact Bitcoin’s price, said Zach Pandl, Grayscale’s managing director or research.

Still, shares of GBTC fell 5.2% to $38.58 on Friday. They surged more than 300% last year, compared with an increase of almost 160% for Bitcoin. Investors have pulled over a half of a billion dollars from the Grayscale Bitcoin Trust during its first days of trading as an ETF.

The fund, which won US Securities and Exchange Commission approval to convert to an ETF from a trust last week, has seen outflows totaling about $579 million, according to data compiled by Bloomberg. It’s a stark difference from the other nine spot Bitcoin ETFs, which have pulled in a total of nearly $1.4 billion.

“Thanks to the ETF conversion this is the first time we’ve had clear sight into flows of GBTC,” said James Seyffart, an ETF analyst at Bloomberg Intelligence, who noted that investors may be profit-taking.

The flow data is a more complete look at how the ETF fared in the wake of SEC approval. While over $2.3 billion of GBTC shares changed hands its first day, the outflows now indicate that a portion of that volume was due to selling.

“Grayscale has dominated the market for regulated Bitcoin investing for over a decade. Now that other issuers have come to market, we are naturally seeing some rotation into these new products,” said Zach Pandl, Grayscale’s managing director of research. “Total net inflows into Bitcoin investment products are what matters for prices, not substitution from one product to another.”

The outflows from Grayscale’s ETF aren’t entirely unexpected. Bloomberg Intelligence forecasted that the fund will drain over $1 billion over the coming weeks.

“Lots of this capital will find its way back into other Bitcoin exposures,” Seyffart said.

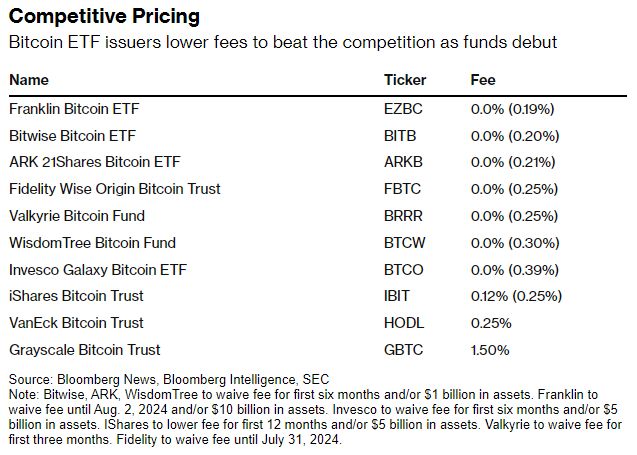

Some investors are fleeing to cheaper spot Bitcoin ETFs. With an expense ratio of 1.5%, GBTC is the most expensive US ETF that invests directly in Bitcoin. The second-most expensive fund, the VanEck Bitcoin Trust, charges 0.25%.

Other spot Bitcoin ETFs have all seen net inflows, with BlackRock’s IBIT pulling in nearly $500 million in its first two days of trading, and Fidelity’s FBTC getting roughly $421 million. The inflows suggest that even outside of potential seed funding from fund issuers, demand is strong for Bitcoin exposure in a physically backed ETF.

“The second thing we are seeing is the bankruptcy estate of FTX is unloading into the ETF announcement,” Scaramucci said. “There is a heavy volume of selling in Bitcoin right now. I do expect the supply overhang to be done in the next six to eight trading days.”

FTX, which was one of the largest crypto exchanges, filed for bankruptcy in 2022 along with a flurry of major crypto companies amid a market crash. It still holds large amounts of crypto assets and is in the process of unwinding.

The estate of bankrupt crypto exchange FTX has sold the majority of its shares in the Grayscale Bitcoin Trust exchange-traded fund in its first three days of trading, according to two people familiar with the matter.

The brokerage Marex Capital Markets has sold more than two-thirds of the 22.28 million shares FTX held, according to one of the people, who asked not to be named because the matter hasn’t been made public. GBTC shares have traded at an average price of around $38.19 since its debut as an ETF, so the sale likely fetched more than $600 million.

Grayscale declined to comment directly on the sales by FTX.

Thus, global demand for cryptocurrency investment products eased last week, with funds seeing $21 million in outflows, according to a report from CoinShares.

In the prior week, crypto funds saw $1.25 billion in inflows after the launch of 10 spot Bitcoin exchange-traded funds in the US. Grayscale Investment’s spot Bitcoin exchange-traded fund (GBTC) drove the decline in the most recent week, with $2.2 billion in withdrawals.

How long BTC will keep falling and what else could happen?

Matt Hougan CEO Bitwise has commented current situation as follows –

The sell-off that is currently taking place in the crypto market was not triggered by the arrival of ETFs. Since ETFs came to market, they have been net buyers of Bitcoin.

The correction was caused by the expectations from the launch of ETFs. The market front-run approval of the BTC ETF by buying spot Bitcoin and betting on derivatives. People expected a huge influx of capital, which in the end they did not receive, and now they are reeling in the bait.

I believe that the market is overestimating the short-term effect of launching ETFs and underestimating the long-term effect.

The biggest US cryptocurrency exchange could fall victim to a slump in Bitcoin and waning enthusiasm for exchange-traded funds that invest directly in the digital token, according to JPMorgan Chase & Co.

“We think the catalyst in Bitcoin ETFs that has pushed the ecosystem out of its winter will disappoint market participants,” analysts led by Kenneth Worthington wrote in a note on Monday, downgrading Coinbase Global Inc. to underweight from neutral.

Coinbase’s shares dropped 3.1% on Tuesday following the downgrade, which marks JPMorgan’s first sell-equivalent rating on the stock since initiating coverage in May 2021.

“We see greater potential for cryptocurrency ETF enthusiasm to further deflate, driving with it lower token prices, lower trading volume, and lower ancillary revenue opportunities for firms like Coinbase,” JPMorgan’s Worthington added.

The analyst maintained his price target of $80 on the stock, which predicted a 38% drop in the shares over the next 12 months from Monday’s close.

Bearish sentiment is rising on Coinbase, which has 12 sell ratings, eight buys and eight holds, according to data compiled by Bloomberg.

So JP Morgan confirms the same thing that we’ve said already – ETF could suffocate spot BTC trading, when flows will dry totally. And potentially – not only BTC but ETH as well. Exchange will keep operations but mostly with other tokens and 2nd stream coins that now is around few hundreds already.

Big question remains – is it really just “temporal” effect of ETF launch? And within few months when dust will settle and capital mutual flows will calm down, will BTC market return to its own? Hmmm.

In 2017, legendary investor Jack Bogle famously warned people to “avoid Bitcoin like the plague.” More than six years later, Vanguard Group Inc. is still stoking the crypto world’s ire by sticking to the conservative investing approach of its late founder.

Amid the euphoria unleashed by the long-awaited debut of the first fully fledged Bitcoin exchange-traded funds in the US, Vanguard sparked uproar last week with its pointed decision to refuse to offer the new ETFs on its gigantic trading platform.

#BoycottVanguard started trending on X, accumulating thousands of posts, with users pledging to pull their money from the asset management giant.

Vanguard’s response? To double down. The firm, which controls $8.6 trillion, has not only snubbed Bitcoin-spot products, it’s yanked futures-backed Bitcoin funds from its platform, too. That means it now offers no crypto products whatsoever, unlike its peers.

Meanwhile, cash continues to pour into Vanguard’s lineup. Roughly $4.4 billion has been added to Vanguard’s stable of 84 ETFs in the past week alone, after luring $157 billion in 2023, Bloomberg data show, more than any other asset manager. Vanguard has grown its share of the $8 trillion ETF market for 21 consecutive years, putting it on the cusp of dethroning industry leader BlackRock.

Moreover, publicly available measures of crypto enthusiasm such as SEC filings from publicly traded exchanges and data from crypto data site CoinGecko suggest that demand for digital currencies remains well below its level a few years ago. In 2021, Coinbase reported that quarterly trading volume from consumers hit $177 billion. In its most recent quarter, the figure was $11 billion.

Advocates are betting that the new ETFs, which carry the imprimatur of respected financial institutions and whose low fees make them cheaper than buying crypto directly, will change this perception. But this wager is problematic in two ways.

First, the ETFs could just as well become a competitor to crypto exchanges as a path for them to find new customers, as we’ve shown above.

Coinbase will collect some additional revenue by holding the digital assets for companies that run the ETFs, but that might not make up for the revenue it loses from retail customers who stop buying Bitcoin on their own. Coinbase’s stock is trading almost 30% below its level in late December, when the market started buzzing about a likely SEC approval.

If ETFs are the first step in a journey, where, exactly, are investors supposed to be headed? As Gensler noted, there’s not much one can do with Bitcoin today, and there’s no good reason to think that anyone with a normal investment goal, such as saving for retirement, should put it in their 401(k). THis is why Vanguard said “No”, at least for now.

So far, anybody who followed Armstrong’s advice and bought Bitcoin the day of the SEC approval has lost money. More to the point, there’s no reason to think blockchains will solve the problems associated with the financial system. People buying into Bitcoin ETFs or trying to ride the latest bump in crypto don’t look like participants in a revolution. They look like candidates to be the latest group of bagholders—what traders call losers who overpay for worthless coins.

FORECASTS

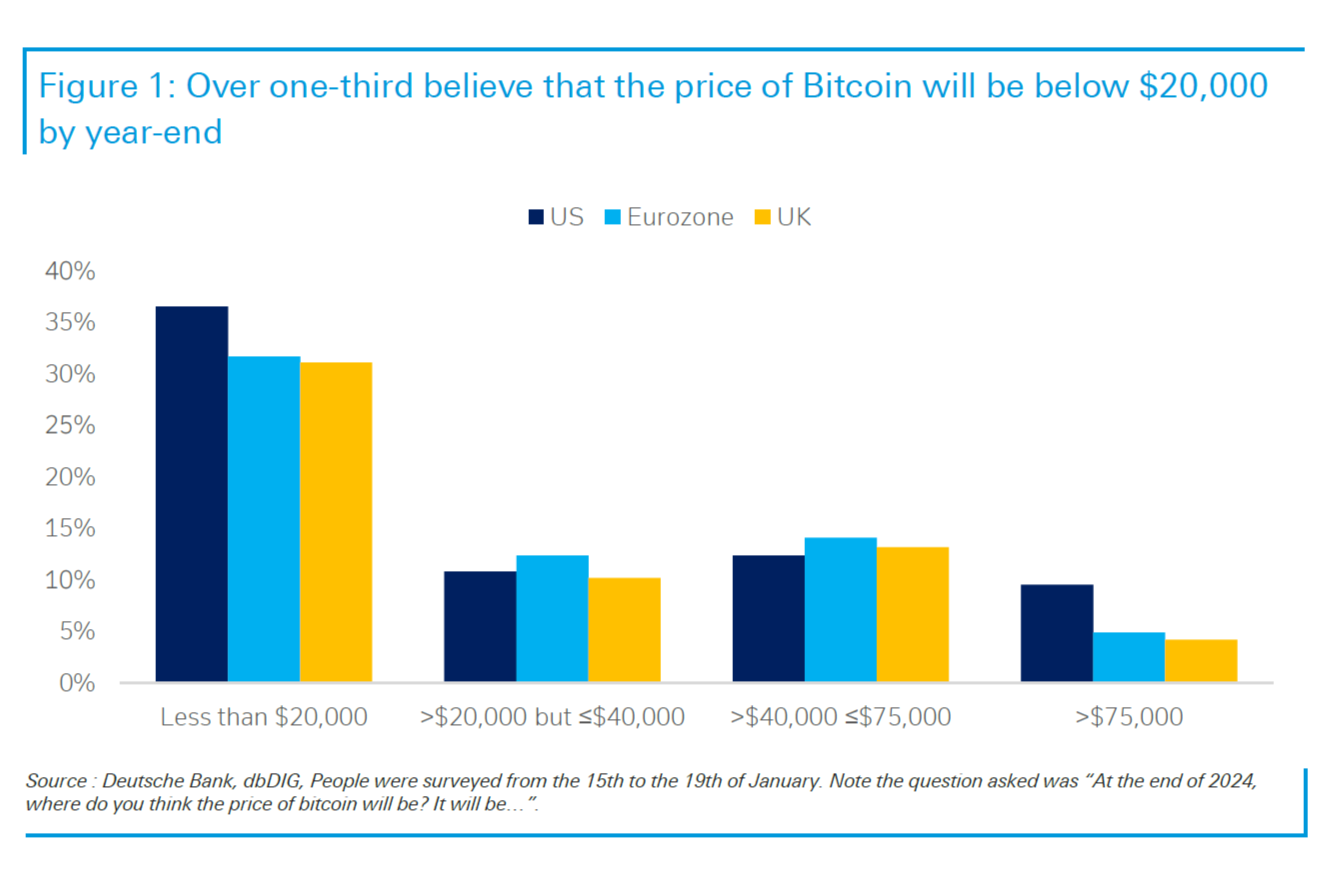

The world’s largest cryptocurrency broke beneath $40,000 yesterday, and many retail investors believe it is heading even lower by year-end, according to a Deutsche Bank Research report.

Over one-third of people surveyed think that Bitcoin will fall below $20,000 by next January, according to the report. About 15% of people said they expect the price will be between $40,000 and $75,000 by year-end.

The survey, conducted between Jan. 15 to Jan. 19, asked 2,000 people in the US, UK and the Eurozone about their views on Bitcoin’s price and volatility.

Arthur Hayes expects 30% retracement in BTC.

Simply put, I have deployed enough capital, meaning sold fiat and bought crypto, for this stage of the cycle. I am preparing for a vicious washout of all the crypto tourists in March of this year. My biggest positions are Bitcoin and Ether, representing ~70% of my portfolio.

I expect Bitcoin to experience a healthy 20% to 30% correction from whatever level it has attained by early March. The washout could be even more severe if the slate of US-listed spot Bitcoin ETFs has already commenced trading. Imagine if the anticipation of hundreds of billions of fiat flowing into these ETFs at a future date propels Bitcoin above $60,000 and close to its 2021 all-time high of $70,000. I could easily see a 30% to 40% correction due to a dollar liquidity rug pull. This is why I cannot buy Bitcoin until these March decision dates have passed.

By the end of March, we will be back on schedule. Bad Gurl Yellen and her duck Powell will once again have confirmed there is nothing they won’t do to safeguard the fiat solvency of the Pax Americana financial system. With that brief bit of market turmoil out of the way, crypto can again gush higher amid speculation as to the effect of the impending Bitcoin block reward halving. As such, I shall resume selling T-bills for Bitcoin and other cryptos.

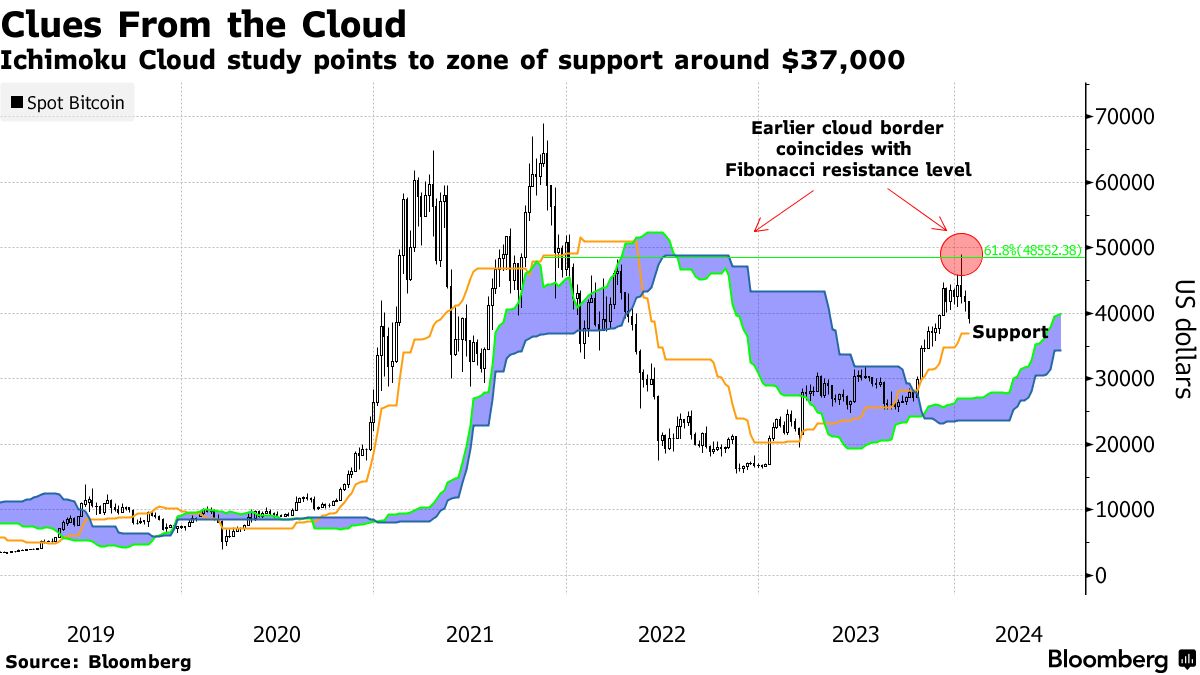

Technical analysis using chart patterns signals a possible base for Bitcoin at $36,000 to $38,000 and even a renewed climb if those levels hold.

Bitcoin jumped 157% last year in anticipation of the ETFs as well as looser monetary policy before sinking this month. That’s “classic buy the rumor, sell the fact” behavior but the funds, plus the prospect of interest-rate cuts, remain props for the token, said Tony Sycamore, a market analyst at IG Australia Pty.

The latest Bitcoin sell-off is the fourth time over the past year or so when the token shed around 20%. “We’re seeing renewed interest from counterparties to put on bullish positions at these levels,” said Mauron, whose firm Orbit Markets is a provider of liquidity for digital-asset derivatives.

An Ichimoku Cloud study — which uses mathematical formulas to help define areas of resistance and support — indicates a possible cushion for Bitcoin around $37,000. Near-term stabilization would be a “natural” development at this stage, Katie Stockton, founder of Fairlead Strategies LLC, wrote in a note.

Elliott Wave studies posit that markets are prone to repeating wave patterns. Applying the technique to Bitcoin suggests a base for the token at $36,000 to $38,000 before a fifth wave re-ignites the rally that began last year.

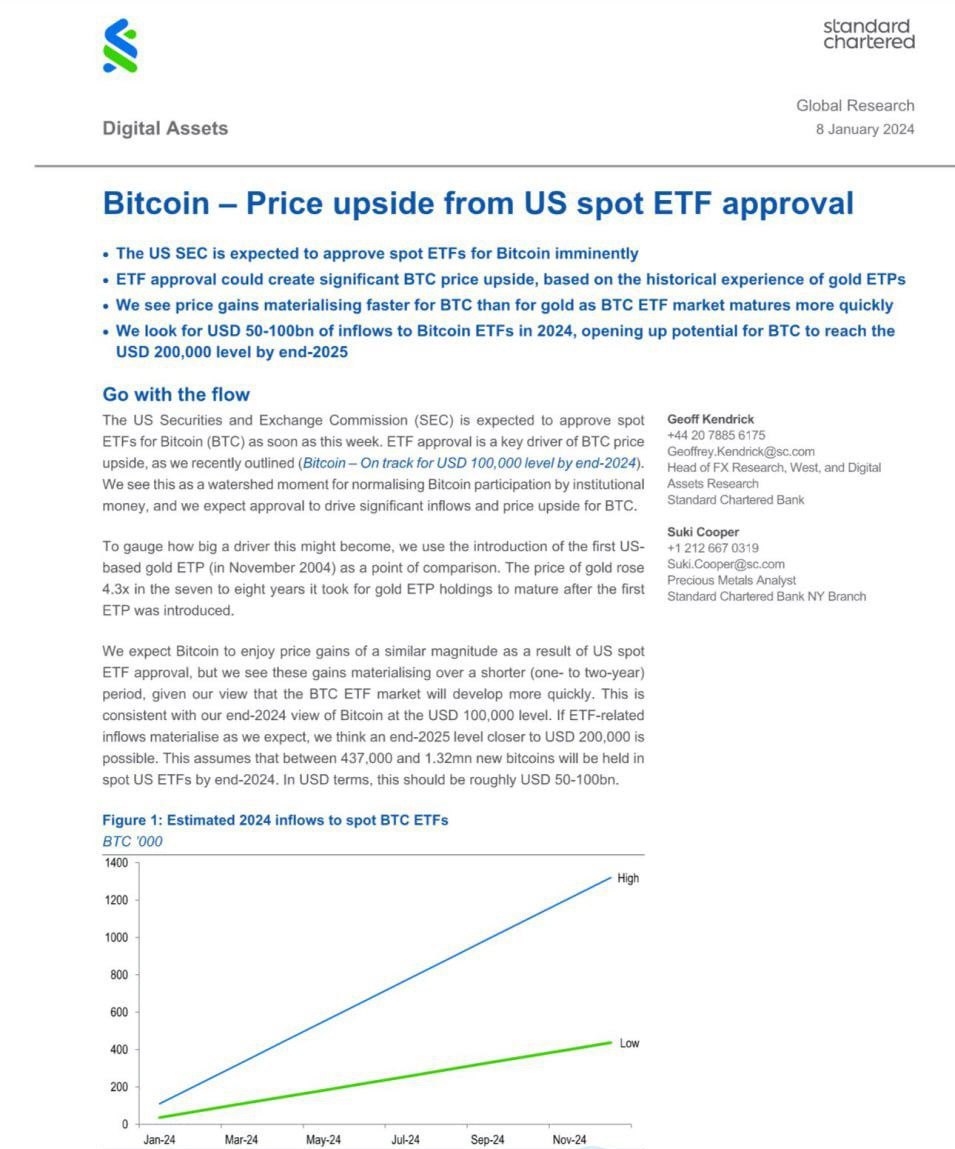

Finally, the screen fro Standard Chartered Report with BTC forecast:

CONCLUSION

Let’s start from the most simple and practical one. As BTC ETH hype is over, the ETH one should come on a first stage. King is dead. Long live the King…

Currently it is widely expected the approvement of ETH ETF somewhere in March. In general, Glassnode tells the same in their most recent report.

So, if participation in BTC ETF hype has brought you good fruits – ETH is also the one that it makes sense to think about.

Now to more complicated stuff… In fact, what is the question that makes thrilling everybody? The rally. Will it happen or not and when it will happen. When big whales start blowing big bubble on cryptocurrencies.

People do not like to count. That’s why these questions are appearing.

No one have tried to make real estimates on what will happen to the price of the BTC after ETFs approvement. What kind of influx of money into these funds is possible?

Everybody saw cosmic estimates like 30 trillion. dollars, but have not seen any real estimates. And this, in fact, is the most important thing for understanding the price movement when holders leave after approval. If it will be 100 billion dollars, then it will be necessary to buy 2.3 million bitcoins. It doesn’t matter anymore who will sell. There are simply no such numbers of bitcoins on the exchanges right now. Total 2 million pieces left, and only 700 thousand are on spot exchanges, the rest are on derivatives.

Let’s say It will be 10 billion dollars. Then it is not yet very clear what will happen. Because for some reason no one is considering the counter-impulse from those who are waiting for ETF approval and plan to buy non-ETF BTC . For example, on exchanges there is $18 billion worth of free money in stablecoins alone, waiting for something.

Don’t forget about the opportunity to move the price in any direction by buying and selling settlement futures on Chicago. Here the direction depends only on the investing volumes.

And no one can reliably predict the macroeconomic situation at the beginning of 2024. In short, everyone talks smartly about something, but in reality, no one knows the future. That’s why they are covered with disclaimers. This is the first moment that have to say. Besides, now we see obviously the opposite impact on BTC price.

Still, for the truth sake, we have to say that the inclusion of reputable firms in the distribution system of the BTC spot ETF suggests, that there are more and more parties interested in the success and growth of the price of BTC, and fewer and fewer opponents, which opens up ten-year prospects – Goldman Sachs is in talks to become an authorized participant in BlackRock and Grayscale’s spot BTC ETFs

Rumors, of course, are just such rumors, but, if they turn out to be true, indicate that they have agreed on dividing the pie. More precisely, it became clear that they agreed and even JP Morgan (despite criticism of the crypt from Dimon) gave the share. But here the seasoned reptilians from Goldman were given a clearing. In general, if you can’t win – try to lead it. Still, ESG shares were also made into ETFs and where are they now? Jakobi ETF… has made any revolution as well…

Second is, concerning bubble. These thoughts of my colleague, but I totally agree with him. To start blowing bubble on some asset, it is necessary to do that this asset belongs to the one who blows the bubble. ETF is just has started, so we can’t say that this is possible already – big bulk of currency is still in free float. The capitalization of crypto is too small – ~$800 Bln in BTC and another $750-800 Bln all the rest. It is not suitable for the bubble, at least right now.

Let’s go further. The US needs to refinance around $11 Trln dollars this year, with budget deficit standing around 5+% already. Why they will start making rival for their debt market, so that people start sending money there? Especially as they do not control this market yet.

As an indicator of a theoretical chance for bubble in crypto we could point the average term of the US debt and yield curve inversion. Once the US will resolve problems with debt somehow, say, they will increase the average term and normalize the slope of the yield curve – bubble theoretically could become possible. And if rally starts on BTC at this moment, we could expect very extended upside journey.

But for now we suggest that bubble is hardly possible. We would say even more – big whales have to accumulate the major part of BTC floats. But how to achieve this? They have to absorb all new mined BTC and need to force people to sell. This, in turn, possible, if strong collapse will be organized. Taking it all together, including recent market reaction on ETF approvement, we suggest that this scenario is not worse than the idea of the rally and has equal or even better chances to happen… It means that we should not hurry up with buying BTC right now. As illustration of this statement and some add-on, take a look at the chart below:

Author Profile

Sive Morten

At the Forex Peace Army, he is known as an author of Forex Military School, which quite unique free forex trading course. We do not know of any other free forex trading education covering such a broad spectrum of forex market concepts in such details while keeping it easy to understand and practically use.

As if that wasn't enough, he is the part of the Shoulders of Giants Program. He shares with his fellow traders at FPA his view and forcast of the Gold Market, Currency Market, and Crypto Market in form of weekly analytics and daily video updates.

* Complete Forex Trading Course by Sive Morten >>

* Sive Morten Forex , Gold , and Crypto Analysis >>

Info

170 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, April 2024 Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023 Bitcoin Fundamental Briefing, November 2023