“We think a number of spot ETFs will now be approved in Q1-2024 for both BTC and ETH, paving the way for institutional investment,” they said. “Put simply, everything is working as expected,” said the bank in its reiteration today. “BTC’s dominance remains intact – its share of overall digital assets market cap has increased to 50% from 45% in April.”

Bitcoin Fundamental Briefing, November 2023

EXITED ABOUT ETF

So, the ETF topic keeps stable on headlines of all major news agencies for few months already. Traders are becoming a bit tired already, BTC upward action is loosing pace but the long lasted expectation of ETF approvement is still working as inspiring factor and supports market.

Still, by taking a look at recent Binance case and other moments, we suggest that ETF approvement is part of big strategy, aimed on concentration of BTC turnover in one hands and total control by the US regulation authorities of the market. As this process is not over yet, we suggest that SEC will not grant approvement to any ETF in this year. It is also very probable that approvement will be postponed further due to lack of regulation and necessary legal background. Since the US is entering “Presidency run” year, lawmakers could get more on their plates rather than think about cryptocurrency markets. So, in some worst case scenario, it could be postponed on “after election” 2024 period. And this is really big question whether markets have enough patience to care this.

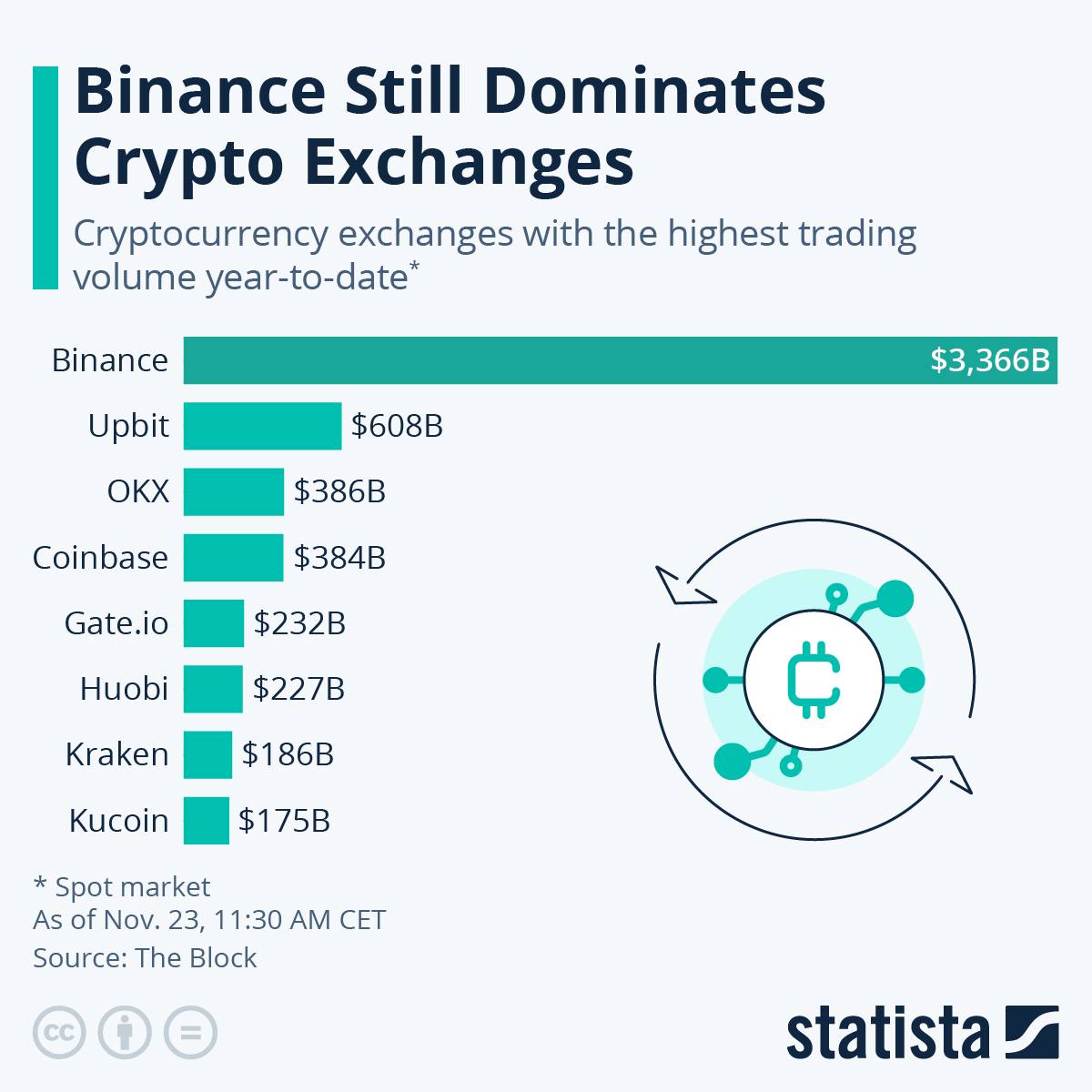

Second factor of postponing is transfer of turnover out from Binance to Coindesk, at least the US clients. For now, Binance is still the largest exchange, and it takes some time when this coins re-positioning will happen.

MARKET OVERVIEW

Bitcoin has now more doubled in value this year in a surprising resurgence from a tumultuous 2022 that had some skeptics predicting the demise of digital assets.

Growing expectations that the US Securities and Exchange Commission will authorize exchange-traded funds that invest directly in the cryptocurrency after a decade of deliberation has fueled a more than 25% rally over the past two weeks.

“Sentiment is clearly bullish as more and more signs start to reveal what appears to be a likely, imminent listing for a spot Bitcoin ETF in the US,” said Darius Tabatabai, co-founder at decentralized exchange Vertex Protocol.

Tabatabai added that the exchange saw a new all-time record for shorts being liquidated over the past 24 hours (26th of Nov), with one of the highest volume days ever.

“Bulls largely came roaring back and brought some much needed optimism to what has been a fairly bleak market for some time,” Tabatabai said.

Bitcoin was in sight of $38,000, a level last seen in May 2022, amid an ongoing rally spurred by expectations of fresh demand for the token from exchange-traded funds. Ether jumped as much as 2% after BlackRock filed with the SEC to list an exchange-traded fund that hold the second-largest cryptocurrency.

While the Securities and Exchange Commission again deferred a decision on whether to approve the first US ETF investing directly in Bitcoin, Bloomberg Intelligence expects the green light for a batch of such funds by the middle of January. The ETFs would make it easier for institutions and mom-and-pop investors to gain exposure to the token.

The SEC had until Nov. 17 to respond to the crypto asset manager’s application, which was filed in September. The regulator said it is delaying the decision to 2024, a move they have already done for a number of other ETF hopefuls.

“It’s really not that surprising, the SEC goes early on decisions like this fairly frequently,” said James Seyffart, an ETF analyst with Bloomberg Intelligence.

The SEC also delayed action on Grayscale’s attempt to launch a new Ether futures ETF. SEC Defers Decisions on Two More Spot Bitcoin ETF Applications – Franklin and Globe X as well.

Bets that the Federal Reserve is done with interest-rate hikes have also lifted crypto prices, which can be sensitive to inflections in the level of liquidity in financial markets.

“The recovery in crypto valuations can continue if real interest rates peak and we continue to see progress toward spot ETF approvals in the US market,” Zach Pandl, managing director of research at crypto fund provider Grayscale Investments LLC, wrote in a note.

One conundrum for investors is whether the climb in Bitcoin this year already discounts the likely impact of spot ETFs. The approval may be “baked into the price” but the question is how much inflow the ETFs will attract, Sui Chung, chief executive officer of digital-asset index provider CF Benchmarks, said on Bloomberg Television.

Diversification benefits are driving the conversation over Bitcoin investment given the token’s lack of correlation with assets like stocks over longer periods, he said.

“People haven’t given up on the ETF coming out,” said Leo Mizuhara, founder and CEO of DeFi institutional asset manager Hashnote.

“We are referring to the current Bitcoin rallies internally as, ‘nothing for sale’ rallies, said Stephane Ouellette, co-founder and chief executive of FRNT Financial. “On even the slightest positive news, whether ETF related or otherwise, Bitcoin is seeing very little resistance to the upside and is having the propensity to ‘gap.’ The dynamic speaks to the impressively strong price base Bitcoin has developed post-FTX.”

Cryptocurrencies also appear to be benefitting from an evolving economic outlook. With stocks rising and bond yields falling, the appetite for riskier assets such as crypto is seen rising.

However, Matt Hougan, chief investment officer of Bitwise Asset Management, said while short-term forecasts in crypto are difficult to predict, the digital asset’s long-term prospects appear nothing but positive.

“If you look over the next year, it’s hard not to be really bullish on crypto and on Bitcoin,” Hougan said. “We’ll see new all-time highs.”

BlackRock Inc. is looking to launch an exchange-traded fund that would be centered on Ether, helping to spur a rally in the second-largest cryptocurrency.

Nasdaq, the exchange that BlackRock is working with on the ETF, on Thursday submitted what’s known as a 19b-4 form, marking the next step in the process to get such a fund launched. The Wall Street behemoth had earlier registered paperwork in Delaware for the fund, according to documents posted to the Delaware Department of State Division of Corporations website.

The price of Ether rose as much as 11% , crossing above $2,000 and hitting the highest level since April, data compiled by Bloomberg show. VanEck, Invesco, 21Shares and others have filings for spot-Ether ETFs as well.

Speaking about proper regulation of cryptocurrencies, Michael Novogratz doesn’t expect US lawmakers to make headway on regulating the crypto sector before the 2024 election, speaking ahead of anticipated approval by the Securities and Exchange Commission of the first American exchange-traded fund to directly hold Bitcoin.

“I don’t think anything gets done this side of the election. But there are plenty of smart guys in Washington,” Novogratz, the founder and chief executive officer of Galaxy Digital Holdings Ltd., said on the New York-based company’s third-quarter earnings conference call.

Matthew J. Maley, chief market strategist at Miller Tabak + Co., LLC, said that geopolitical strains are also contributing to the rally.

“I think investors are thinking that the increase in geopolitical hotspots in the world is raising the odds crypto will be an important currency quicker than they thought previously,” Maley said.

While Bitcoin prices might experience a short-term price pullback, the currency is poised to continue rising over the long term, according to James Butterfill, head of research at CoinShares.

“Before the ETF hype, Bitcoin’s price closely mirrored the expected probabilities of a December rate hike,” Butterfill said. “As these probabilities decrease in light of increasing treasury yields, it seems it could further support prices, poising to shape the next bull market for Bitcoin over the longer term.”

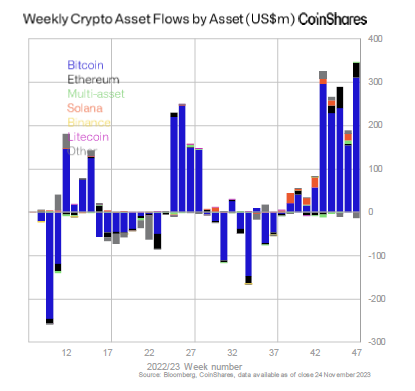

Anticipation of an eventual US spot Bitcoin exchange-traded fund has helped to spur inflows into digital-asset investment products for a ninth consecutive week, the largest run since the crypto bull market in late 2021.

Those products, such as trusts and exchange-traded products, saw inflows of $346 million last week, with Canada and Germany contributing to 87% of the total, according to CoinShares.

“The combination of price rises and inflows have now pushed up total assets under management to $45.3 billion, the highest in over one and half years,” the report said.

Bitcoin products raked in $312 million last week(24-27th of Nov), pushing inflows to over $1.5 billion since the start of the year. Ether products saw $34 million in inflows last week, almost negating outflows all of 2023.

DERIVATIVE MARKET

A burst of activity in Bitcoin derivatives has evoked memories of the period in late 2021 when the token surged to an all-time high.

Variables such as the cost of perpetual futures trades and options open interest point to a revival in speculative gusto for Bitcoin, which has more than doubled in price this year in a partial rebound from a 2022 rout.

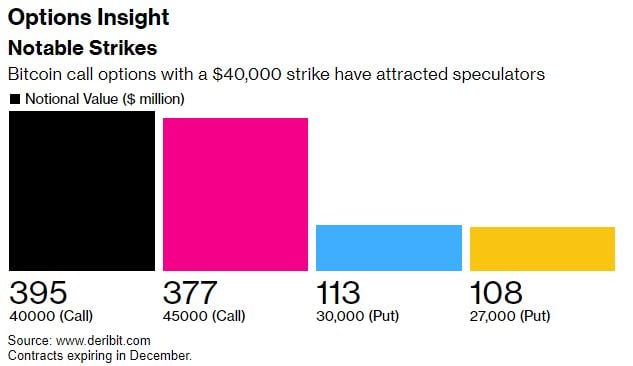

A spokesperson for Deribit, the largest crypto options exchange, said the notional value of Bitcoin options open interest on the platform reached a record of roughly $14.9 billion earlier this week. That topped the $14.4 billion achieved in October 2021 just before Bitcoin hit its high of almost $69,000. Open interest refers to outstanding contracts that have yet to be settled.

“Crypto call options were in strong demand for the past few weeks,” said Caroline Mauron, co-founder of digital-asset derivatives liquidity provider Orbit Markets. While some traders placed leveraged bets on a “large breakout” to $100,000 or beyond, the more immediate test is the $38,000 level, she said.

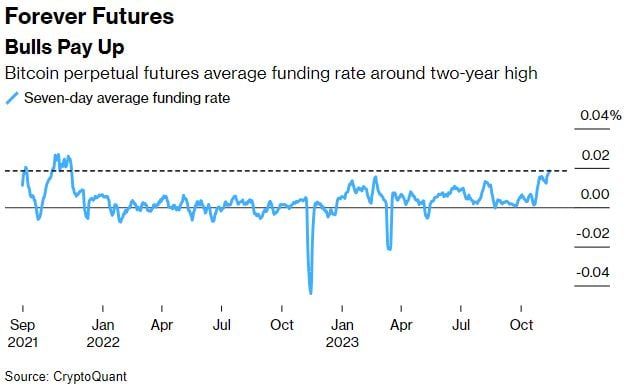

Perpetual futures are among the most popular Bitcoin derivatives as they have no set expiry date. Exchanges use the so-called funding rate to align the contracts to the underlying spot price. In bullish periods the rate tends to be positive, indicating traders betting on gains are prepared to pay funds to speculators who are short, as a cost of maintaining their positions.

The rolling, seven-day average funding rate for Bitcoin perpetual futures through Nov. 15 was around levels last seen in the final quarter of 2021, a period when Bitcoin was rallying toward its zenith, according to CryptoQuant data spanning a range of digital-asset exchanges.

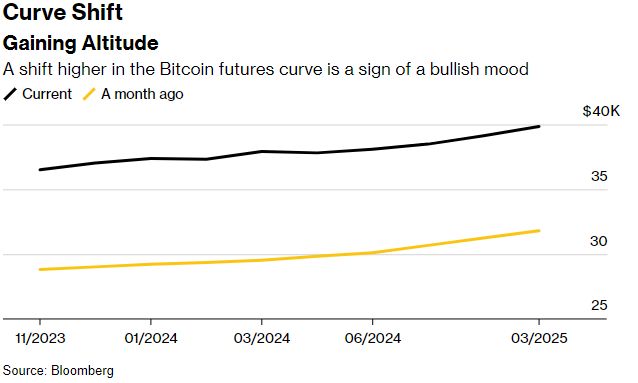

Traders analyze Bitcoin futures curves for clues about the price outlook. The entire curve based on CME Group Inc. contracts has shifted upward compared with the pattern seen a month ago. Whereas the curve back than sloped up to almost $32,000 for the farthest contract, it now rises to nearly $40,000.

The notional value of Bitcoin futures open interest on the CME, the world’s leading derivatives exchange, recently surpassed the equivalent figure for Binance. Binance is the largest crypto exchange but faces a web of regulatory probes in key jurisdictions, including the US.

CME open interest for Bitcoin futures reached $4 billion on Friday versus $3.8 billion on Binance, Coinglass figures show.

The growth in CME open interest relative to Binance “suggests a more substantial institutional participation in using futures to obtain long exposure to Bitcoin,” said Le Shi, head of trading at market making and algorithmic trading firm Auros.

Figures from Deribit show a preponderance of bullish options bets on Bitcoin hitting $40,000 and even $45,000 by the end of December. Given that the traders selling the call options are willing to take the other side of the wager, that suggests $40,000 could become a key test area for Bitcoin’s rally.

BINANCE TURMOIL

Binance and Chief Executive Officer Changpeng Zhao pleaded guilty to criminal charges two weeks ago, admitting they failed to take basic anti-money laundering steps that are the bedrock of government efforts to check the flow of dirty money worldwide. Binance will pay $4.3 billion, while Zhao will step down as CEO and pay a $50 million fine.

Binance Holdings Ltd. had such lax controls over cryptocurrency transactions on its exchange that terrorists, hackers and sanctions violators used it for years to move billions of dollars, US prosecutors said.

The stunning turn of events means Zhao, the most powerful crypto figure in the world, faces prison time and will no longer run the industry’s largest exchange. It comes after a multiyear investigation by federal prosecutors and the fraud conviction earlier this month of Sam Bankman-Fried, the disgraced founder of the collapsed FTX exchange.

Employees at Binance were engaged in a wide array of misconduct, and many were aware of the consequences of allowing millions of illegal transactions, according to the Justice Department and the Treasury Department’s Financial Crimes Enforcement Network, or FinCEN.

“Binance turned a blind eye to its legal obligations in the pursuit of profit,” Treasury Secretary Janet Yellen said in a statement. “Its willful failures allowed money to flow to terrorists, cyber-criminals, and child abusers through its platform.”

A major legal crackdown on Binance, crypto’s largest exchange, has long been one of the industry’s greatest fears due to the impact that losing its outsized slice of volumes would have on markets. But after two years of bankruptcies, fraud scandals and general mayhem elsewhere in the industry, it seems there’s little that can faze investors anymore.

But Binance issue is not all. The US Securities and Exchange Commission accused crypto exchange Kraken of securities-law violations, less than a year after unveiling a $30 million settlement with the firm over other alleged conduct. The SEC also argued that the firm was operating as an exchange, broker, dealer and a clearing agency — all without the proper registration. The agency has sued the Coinbase and Binance digital-asset platforms for similar alleged failures, accusations both companies dispute.

“We allege that Kraken made a business decision to reap hundreds of millions of dollars from investors rather than coming into compliance with the securities laws,” Gurbir Grewal, the SEC’s enforcement chief, said in a statement. “That decision resulted in a business model rife with conflicts of interest that placed investors’ funds at risk.”

PREDICTIONS

“2024 is going to be a year of institutional adoption, primarily through the Bitcoin ETF,” said M. Novogratz. “As institutions get more comfortable, as the government gives its seal of approval that Bitcoin is a thing, you’re going to see the rest of the allocators starting to look at things outside of that and so money will flow into the space. It will probably take until 2025 for all this investment in tokenization and wallets really start to show up.”

He also predicted that the Federal Reserve would opt to cut interest rates in the first quarter of next year, which when combined with subsequent crypto regulation, would further support the industry’s growth over the next 18 months.

Bitcoin Remains on Track for $100K by Year-End 2024: Standard Chartered

Things are going as expected, according to Standard Chartered Bank, reiterating its April forecast that bitcoin (BTC) would reach $100,000 by the end of 2024.

The next catalyst, wrote the bank’s Geoff Kendrick and team, will be the approvals of several U.S.-based spot bitcoin ETFs, which they expect “are likely to come sooner than expected.”

“You may not like Bitcoin as much as we do, but a dispassionate view of Bitcoin as a commodity, suggests a turn of the cycle,” Chhugani wrote. “A good idea is only as good as its timing – SEC approved ETFs by world’s top asset managers (BlackRock, Fidelity et al), seems imminent.”

The prediction came in a note where Chhugani initiated coverage on several bitcoin mining firms, saying that the bitcoin “halving” in April 2024 — in which bitcoin rewards will be halved as part of a planned and recurring event baked into the currency’s underlying code — will force “losing miners” to be “washed out,” paving the way for big gains by the survivors.

Bitcoin could reach $47,000 by the end of November, SynFutures co-founder says

“Last week has cemented October’s reputation as ‘Uptober,’ with bitcoin witnessing nearly a 29% increase in value,” Lin said in a statement shared with The Block. “Even more interesting is that when we look at historical data, November tends to be even better than October, with an average return of over 35% in bitcoin. If this November were to deliver similar returns, we could see BTC reach around $47,000.”

Particularly noteworthy is a spike in spot volume, with a marked increase in large transactions exceeding $100,000, according to the SynFutures co-founder.

“This is a clear indicator of heightened institutional interest, as big players are seemingly consolidating their positions in digital assets, specifically bitcoin,” Lin said. “If we look at last week’s asset inflow, we can see a massive increase, with nearly $325 million flowing into the sector, almost $300 million of which went into bitcoin.”

Options data also reflects the bullish market mood.

“As of Nov. 3, the top two options with the largest open interest are the 40,000 December call and the 45,000 December call. Even the 50,000 December call option has over 5,000 BTC open interest,” Lin noted. “This suggests a large number of people are willing to bet that bitcoin will be significantly higher in two months than what it is today.”

Glassnode – Keeping A Firm Grip

The volume of Bitcoin supply in profit has reached the levels last was seen 2 years ago as the market came off the Nov 2021 ATH. However, the magnitude of unrealized profit held within these coins remains modest, and thus far insufficient to motivate long-term holders to lock in profits.

- As the market trades at yearly highs, over 83.6% of the Bitcoin coin supply are now held in profit, being the highest level since November 2021 (near the ATH).

- However, the magnitude of unrealized profit held, measured as the delta between spot price and the coins cost basis, remains modest.

- The degree of unrealized profit held by investors is thus far an insufficient incentive to motivate long-term holder to spend, keeping the overall supply relatively tight.

With price re-testing yearly highs, the percentage of the supply held in profit has reached 83% of the total circulating supply. From a statistical standpoint, this is historically significant, being well above the all-time mean value (74%) and pushing towards the higher band of +1 standard deviation 90%.

When this indicator trades above this upper band, it has historically aligned with the market entering the early stages of a bull market’s “Euphoric phase.”

Unlike the prior coin volume metrics, the magnitude of Unrealized Profit has not yet reached a statistically high level coincident with the heated stages of the bull market. It is currently trading at the all-time mean level of 49%, significantly lower than the extreme levels of 60%+ seen in the euphoria phase of past bull markets.

This suggests that whilst a significant volume of the supply is in profit, most have a cost basis, which is only moderately below the current spot price.

Another remarkable phenomena is the increasing divergence between the supply held by long-term holders and short-term holders. This dynamic indicates the existing holders have become increasingly unwilling to part with their holdings, as they historically wait for the market to break to a new price ATH .This can be interpreted as investors requiring a higher unrealized profit (magnitude) before ramping up their distribution pressure.

Glassnode Conclusion

With the recent price rally, the volume of coins in profit has reached the levels that last was seen 2 years ago as the market came off the Nov 2021 ATH. However, the magnitude of unrealized profit held within these coins remains modest, and thus far insufficient to motivate long-term holders to lock in profits.

WHAT REMAINS UNDER CURTAIN

First thing that we would like to consider is attack on Binance. Formally the US authorities have found reasons for public accusation of the exchange, but we suggest that reasons stand different.

Few months ago we talked about big plan aimed on centralization of crypto-market. We agree, maybe it is not possible totally, and, here and there still will remain some P2P transfers in some secondary coins. But, on 90% market will become centralized. It looks like follows. There will be just two exchanges that will control turnover of crypto derivatives, which is CME and cash crypto + ETF, which is Coinbase. Control will be achieved via global transnational whales – BlackRock and Co. They, in turn, will be controlled by the Fed, SEC, CFTC etc. We suggest that this plan should turn to active stage as soon as the US lawmakers will prepare all necessary legislation to manage crypto world.

To concentrate market in the hands of only american companies, the US has to eliminate all rivals. Despite turmoil around Binance – it is still the largest exchange in the world and the US has to fix this “disproportion”, which it actively does right now. Despite that it was 1Bln outflows in 24 Hrs, after scandal has become public, Binance is still 10 times larger than Coinbase.

So, the US has decided this problem. Apparently, that ’s what it turned out to be. Only without buying a stake in Binance by some American investor. The promising US market is clearly divided, so only American exchanges will now receive their share of commissions from crypto trading.

It doesn’t matter that applications for ETFs involve using Coinbase both as an exchange and as a custodian. In any case, there would be an increase in turnover on all exchanges in general.

In principle, the story of Bayer’s loss in an American court, that this story is all links in one chain and teaches us that if in a particular legal state you do not have a local protection, then you can be legally forced to pay a huge fine and destroy your business . Because although everyone has completely similar risks and gray areas, for some reason it is mainly foreign investors who are punished for them.

Second question is Deribit, which dominates in derivative market. We suggest that it will become the next victim of the US domestic policy over regulation on crypto market. Maybe we will not see as hard measures as against Binance, but they simply could initiate some “restrictive” legal steps that let to trade derivatives only via CME, for example.

Already in 2019 Tim McCourt, head of alternative investment products at the Chicago Mercantile Exchange (CME), said that he expects crypto traders to start moving their capital to a regulated exchange, leaving platforms such as Deribit and BitMEX, which originally originate from the cryptocurrency space, but still carry high risks and are characterized by a low level of security.

Commenting on the November data leak of 30,000 BitMEX users, McCourt said:: “When users see incidents like this, they start coming to CME because it’s proven, transparent, and regulated.”

The cornerstone of this strategy are ETFs. They have to buy all available spot BTC, ETH and other more or less attractive crypto coins. When they achieve this, they start to issue shares backed by pool of BTC, ETH etc. This is how ETF works. Since BTC mining is going to an end and we get the halving again as soon as next year, very soon this target will be achieved and it will be the problem to buy spot BTC.

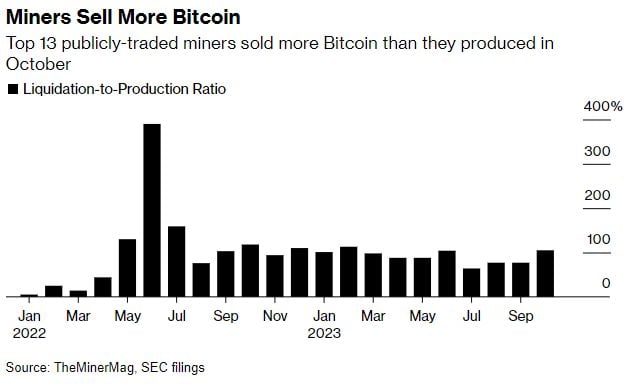

In fact, big whales already start preparing for ETF approvement. They are buying coins directly from miners to not raise BTC price on spot market. You just could take a look at Hash rate…

” Hash rate is skyrocketing. So what do miners know that investors don’t? BTC’s mining difficulty valuation rose to $35,000 yesterday.”

THE BOTTOM LINE:

As you could see, the major driving factors stand absolutely in different sphere, not where everybody are trying to see them. Of course, our primary interest – how it will impact on BTC price. In short-term – positively, just because of technical factors.

The departure of Binance will result in an outflow of Bitcoins from this exchange, which many used as a wallet. There are now more than 500 thousand bitcoins on spot Binance, which is about 70% of all bitcoins on all spot exchanges.

Therefore, it is beneficial for the price of the BTC that the Americans’ BTC (of course, out of 500+ thousand, this is only a significant part) migrate to their own cold wallets. Please note that after the collapse of FTX, exchange reserves fell and did not recover, that is, the most logical outflow from falling exchanges is to wallets, and not to other exchanges.

In short, this is simply a decrease in the supply of Bitcoin on the exchange ahead of a potential future surge in demand for Bitcoin due to the launch of the ETF.

Longer-term perspective is not as obvious, because not everybody have enough patience to wait until the end of 2024. We suspect that lawmakers will be busy with Presidents run through the whole year and hardly will prepare something for crypto markets until November 2024.

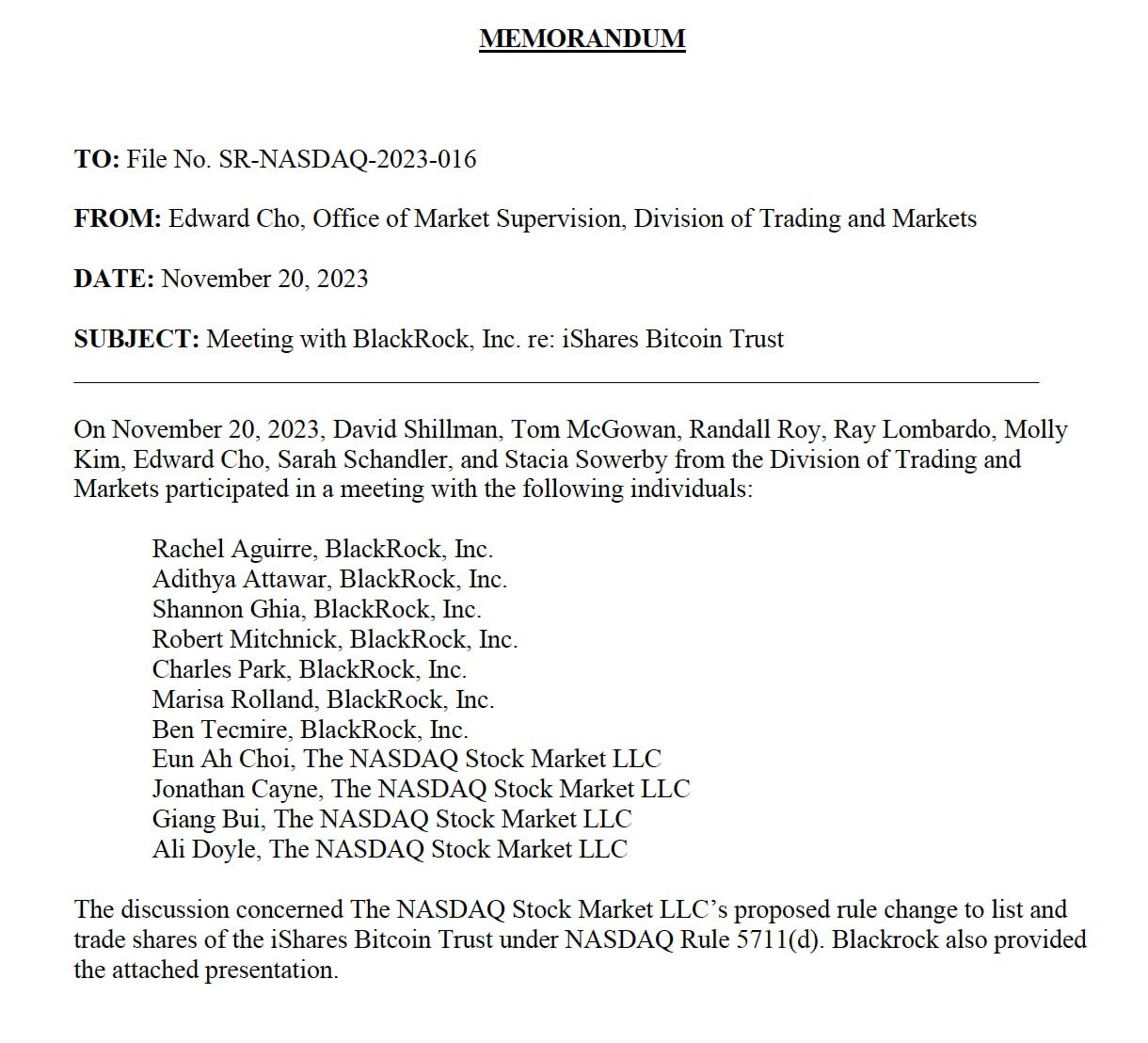

The SEC has published memorandums formally confirming negotiations with BlackRock and Grayscale on issues related to the listing of spot BTC-ETFs

But, honestly, the more we have the show called “BTC ETF approval”, the more concern that it results in ETF registration denials followed by a crypto winter. Moreover, this event will not happen soon, by the end of next year, for example. That is, a year of uncertainty in which speculators will unload and only the most convinced will remain. Or knowledgeable. Besides, as we’ve mentioned last time – we have ETF’s in EU and Hong Kong but they do not excite investors too much.

But, honestly, the more we have the show called “BTC ETF approval”, the more concern that it results in ETF registration denials followed by a crypto winter. Moreover, this event will not happen soon, by the end of next year, for example. That is, a year of uncertainty in which speculators will unload and only the most convinced will remain. Or knowledgeable. Besides, as we’ve mentioned last time – we have ETF’s in EU and Hong Kong but they do not excite investors too much.

That’s being said, BTC could climb more in near term as due Binance outflows as due anticipation of softer Fed policy. We consider 40-42K area as achievable and reasonable. But longer-term perspective remains blur.

Author Profile

Sive Morten

At the Forex Peace Army, he is known as an author of Forex Military School, which quite unique free forex trading course. We do not know of any other free forex trading education covering such a broad spectrum of forex market concepts in such details while keeping it easy to understand and practically use.

As if that wasn't enough, he is the part of the Shoulders of Giants Program. He shares with his fellow traders at FPA his view and forcast of the Gold Market, Currency Market, and Crypto Market in form of weekly analytics and daily video updates.

* Complete Forex Trading Course by Sive Morten >>

* Sive Morten Forex , Gold , and Crypto Analysis >>

Info

314 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, April 2024 Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023