Bitcoin Fundamental Briefing, March 2024

NEW BOOST IS NEEDED

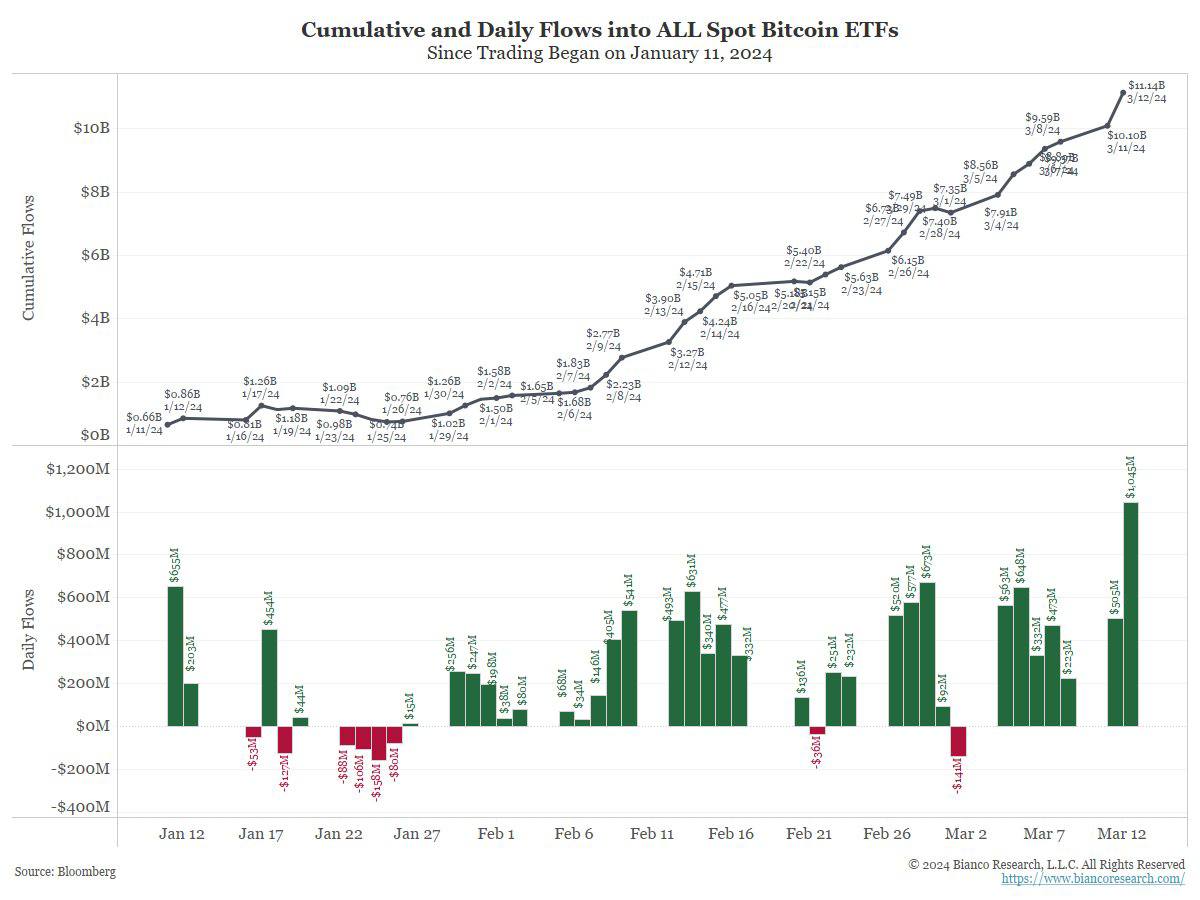

So, the outstanding hype around unprecedented BTC ETF inflows is calming gradually. Investors start watching in the future, having a big count on another two potential boosters – BTC Halving in April and approvement of ETH ETF. As it often happens, in such a moments, many people fall in total euphoria. On a background of such excited conditions, many weird ideas start appearing, to say the least. BTC now should become replacement of everything – cash, gold etc. This is now treated as some absolute wealth preserver, supporting massive households sentiment who run into BTC. And this is talked by educated economist, market professionals, which is actually curious. It seems that FOMO effect totally switch off the rational mind.

MARKET OVERVIEW

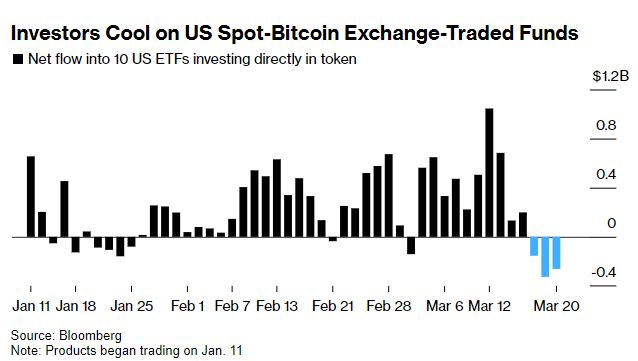

Bitcoin has peeled back more than 10% from its all-time high as the appetite for fledgling spot Bitcoin exchange-traded funds moderates, putting the cryptocurrency on pace for its worse week since August.

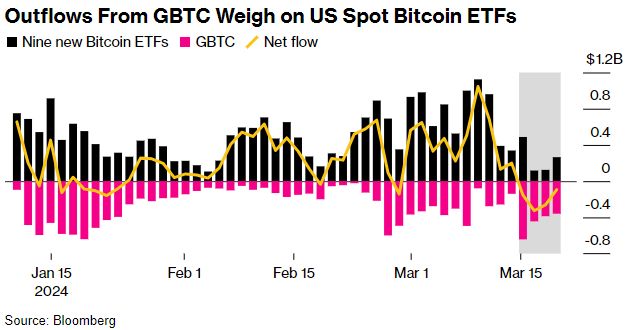

The group of 10 spot Bitcoin ETFs is on track to record its biggest weekly outflow since the products debuted on Jan. 11. Meanwhile, the world’s largest cryptocurrency is set for one of its worst weeks of the year after a roughly 6.5% retreat.

“With BTC approaching 60K off the back of declining ETF flows, liquidations, and speculation of delays in an Ether ETF, the markets are frantically searching for a positive catalyst to support any moves higher,” said Chris Newhouse, DeFi analyst at Cumberland Labs.

Bitcoin “still looks overbought,” JPMorgan Chase and Co. strategists warned, renewing a February call for further declines leading up to April’s highly-anticipated halving event, which will lower the supply of newly minted Bitcoin from miners.

Sustained open interest in CME Bitcoin futures along with declining ETF flows are significant bearish signals for the price of Bitcoin, the strategists led by Nikolaos Panigirtzoglou wrote in a note Thursday.

“The pace of net inflows into spot Bitcoin ETFs has slowed markedly, with the past week seeing a significant outflow,” the strategists wrote. “This challenges the notion that the spot Bitcoin ETF flow picture is going to be characterized as a sustained one-way net inflow. As we approach the halving event this profit taking is more likely to continue, particularly against a positioning backdrop that still looks overbought despite the past week’s correction.”

Last month, the bank predicted that the price of Bitcoin will drift down toward $42,000 after April as “Bitcoin-halving-induced euphoria subsides.” A net $836 million was pulled from the ETFs from Monday through Thursday, reflecting outflows from the Grayscale Bitcoin Trust and a moderation in subscriptions for rival offerings from the likes of BlackRock Inc. and Fidelity Investments.

A net $836 million was pulled from the ETFs from Monday through Thursday, reflecting outflows from the Grayscale Bitcoin Trust and a moderation in subscriptions for rival offerings from the likes of BlackRock Inc. and Fidelity Investments.

Despite Bitcoin setting a record of almost $73,798 on March 14, enthusiasm among retail traders may be waning, according to Naeem Aslam, chief investment officer at Zaye Capital Markets.

“The fact that the rally didn’t really take off from the all-time high like before made many question the strength of the rally,” Aslam said. “The halving is almost here and if this event fails to really keep the momentum going, then it means that we are going to face serious retracement, which means that the price could fall below $50,000.”

Options suggest that traders are bracing for an extended decline in Bitcoin with demand for US exchange-traded funds holding the cryptocurrency beginning to wane.

Bitcoin put options expiring on March 29 exceeded call options in volume in the past 24 hours. That has nudged the put-to-call ratio, which is a key indicator of market sentiment for the underlying asset, higher, signaling a bearish outlook in the near term, according to data from crypto options exchange Deribit. The strike prices of puts are clustered around $50,000 and $45,000 on the platform. Bitcoin traded at around $63,500 on Friday.

“Today’s market correction is mostly coming on the back of GBTC outflows remaining heavy,” said David Lawant, head of research at crypto prime broker FalconX, referring to the Grayscale Bitcoin Trust. “Spot ETF net inflows data as of yesterday showed the second fourth-day streak of outflows since these products launched on January 11.”

WHAT IS EXPECTED NEXT

Glassnode gives moderately positive assessment of current market conditions, suggesting that majority of metrics are very similar to ones that were signed on previous bullish cycles.

Bitcoin has broken to its fourth cycle all-time-high, rallying above $72k, and pushing sentiment one step closer to Euphoria. The classic wealth transfer from the HODLer cohort to speculators is now well underway, with significant up-ticks in spot profit taking, and demand for futures leverage.

- Numerous metrics indicate a striking similarity to past ATH breaks, where a wealth transfer from old HODLers to new investors and speculators is well underway.

- Realized profit metrics and futures funding rates have also spiked to significantly positive levels, suggesting elevated profit taking and demand for long side leverage.

One of the classic patterns observed during Bitcoin bull markets is a transfer of wealth from old to young. Investors who accumulated BTC at cheaper prices several months to years in the past, tend to accelerate their distribution pressure as new ATHs are reached.

This wealth transfer is once again in play, with the proportion of wealth held by ‘Young coins’ (moved within the last 3-months), increasing by 138% since October 2023. This reflects a net expenditure by longer-term investors who had previously held their coins for at least 3-months.

Overall, this transfer of wealth appears to be following a very similar path to all prior Bitcoin cycles, and represents both a shifting ownership structure, but also the dynamic balance between supply, demand, and price.

Across numerous metrics, the current cycle is surprisingly and eerily similar to previous ATH breaks, with the transfer of wealth from HODLers to new investors and speculators well under way. This dynamic reflects a healthy balance between distribution pressure, and new demand, but also gives us a glimpse into the mechanics which, eventually, go on to establish cyclical tops.

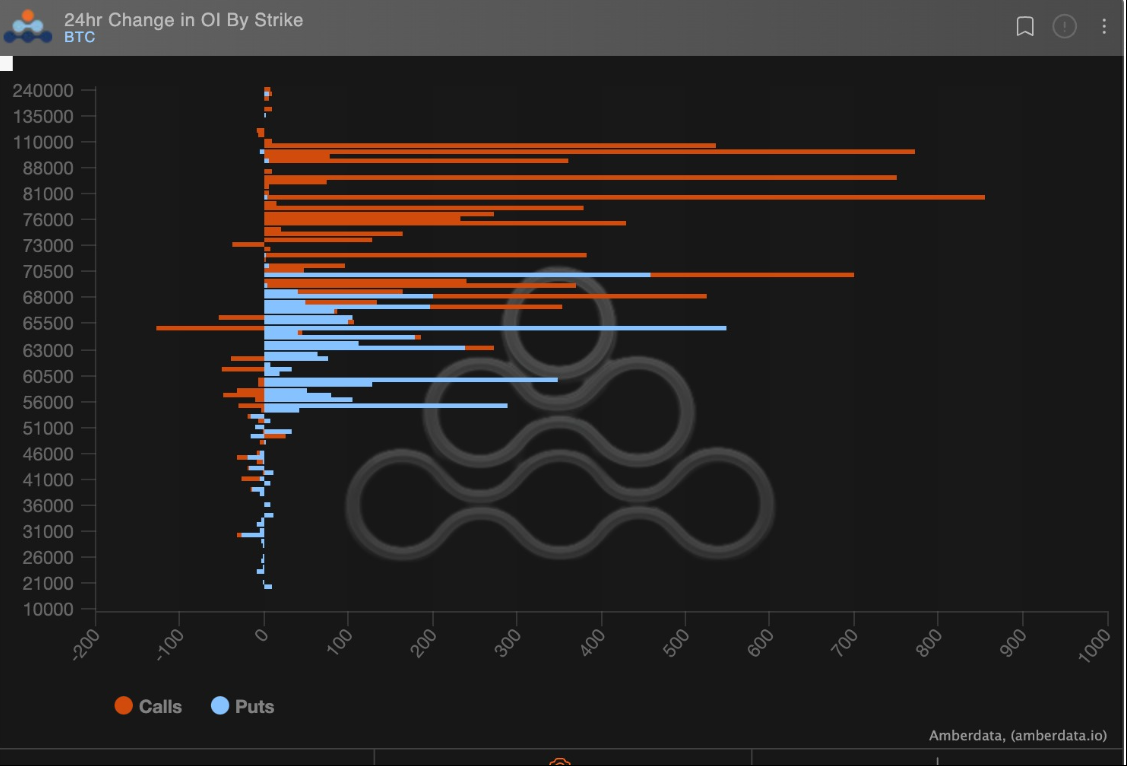

In the options market, the open interest, or the number of outstanding contracts, for call options with strike prices of $80,000 and $100,000 has jumped around 12% each in the last 24 hours, according to data compiled by Amberdata.

“I think $80K by end of month is not crazy,” said Leo Mizuhara, founder and chief executive of decentralized-finance institutional asset management platform Hashnote. “I just think the FOMO players are coming in soon. ETFs have opened up the space to even more retail.”

The current increase in Bitcoin’s price appears to be more spot-driven since the market is much “healthier,” with lower leverage compared to Tuesday, said Luke Nolan, research associate at crypto asset manager CoinShares.

“Open interest is still sky high and there’s still rampant speculation,” said Zaheer Ebtikar, founder of crypto fund Split Capital. “This is generally the hardest part of the crypto cycle as hotter money comes in and pushes valuations the furthest but at the same time increases risk and volatility.”

Bitcoin is set to continue its record-breaking rally and rise above $80,000 as institutional investors pour more money into the crypto-backed exchange-traded funds, according to Binance Chief Executive Officer Richard Teng.

Analysts at research and brokerage firm Bernstein have raised their year-end price target for bitcoin to $90,000 from $80,000 amid improved market dynamics.

“Given general bull market conditions with strong ETF inflows, low miner leverage, and robust network transaction fees this cycle, the halving impact seems relatively mild on the miners, with dollar revenues cushioned,” Gautam Chhugani and Mahika Sapra wrote in a note to clients on Thursday.

On Tuesday, the Bernstein analysts said bitcoin’s recent $10,000 retreat from all-time highs of more than $73,000 to below $63,000 represents a temporary “dip buying opportunity” ahead of the halving.

“We expect the market to consolidate prior to the halving and then expect the overall bull markets to continue,” they said.

Quotes of the first cryptocurrency are unlikely to fall below the $50,000 level, unless “something dramatic” happens. This opinion was expressed by Galaxy Digital CEO Mike Novogratz. He attributed the growth of digital gold to the continuous influx of funds into spot bitcoin ETFs. Until it stops, the first cryptocurrency’s rally will continue.

“As soon as the indicator turns negative, you will see the first real correction. Funding rates are high, and during such periods you should always be prepared for a correction. I don’t think we’ll go back below $50,000 — $ 55,000,” Novogratz said.

According to the expert, digital gold can reach the $100,000 mark. He also questioned whether all spot bitcoin ETFs will ever accumulate more than 20% of the asset’s issuance

“They are currently loading. At some point, the situation will reach a balance. There are many people who still want to store their own BTC or keep it with a foreign custodian if they do not trust the country in which they are located,” explained the CEO of Galaxy Digital.

According to Coinbase experts, the most likely scenario for bitcoin in the coming weeks is trading in a narrow range. The asset will reach a new “price formation territory” with the approach of the next major event in the form of halving, Dong and Han believe.

Meantime, legendary J. Cramer said that BTC has topped. Although there are a lot of skeptics around his forecasts, but, still..

Bitcoin has reached a peak, continued growth is unlikely. This was stated by the ex-manager of the Cramer hedge fund & Co-host of the Mad Money show Jim Kramer.

IS IT REALLY SO CLOUDLESS?

We see here two major sources of the risk. First one is market risk, second is infrastructure risk. They are related to each other, because new structure of the market is becoming the source for the market risk.

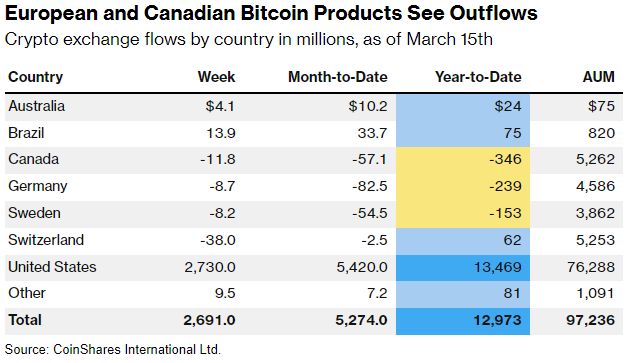

What is really going on? It is simple US government via its authorities such as SEC and NFTC, authorized exchanges (Coinbase) and controlled dealers – 11 largest ETF, aka BlackRock&Co is taking total control over the market.

“American investors, who had previously managed to buy Bitcoin-ETPs on other exchanges, are highly likely candidates to have repatriated their investment dollars to US ETFs,” Ouellette said. Romantically independence of crypto industry has gone forever. After destruction of all major rivals of Coinbase, such as Binance and sweeping it out from the US market, Coinbase is becoming the only structure that is used for price setting, settlement of BTC and major depository for BTC accounting. IT is not surprising that after long period of operational losses last quarter it has turned to profit.

Romantically independence of crypto industry has gone forever. After destruction of all major rivals of Coinbase, such as Binance and sweeping it out from the US market, Coinbase is becoming the only structure that is used for price setting, settlement of BTC and major depository for BTC accounting. IT is not surprising that after long period of operational losses last quarter it has turned to profit.

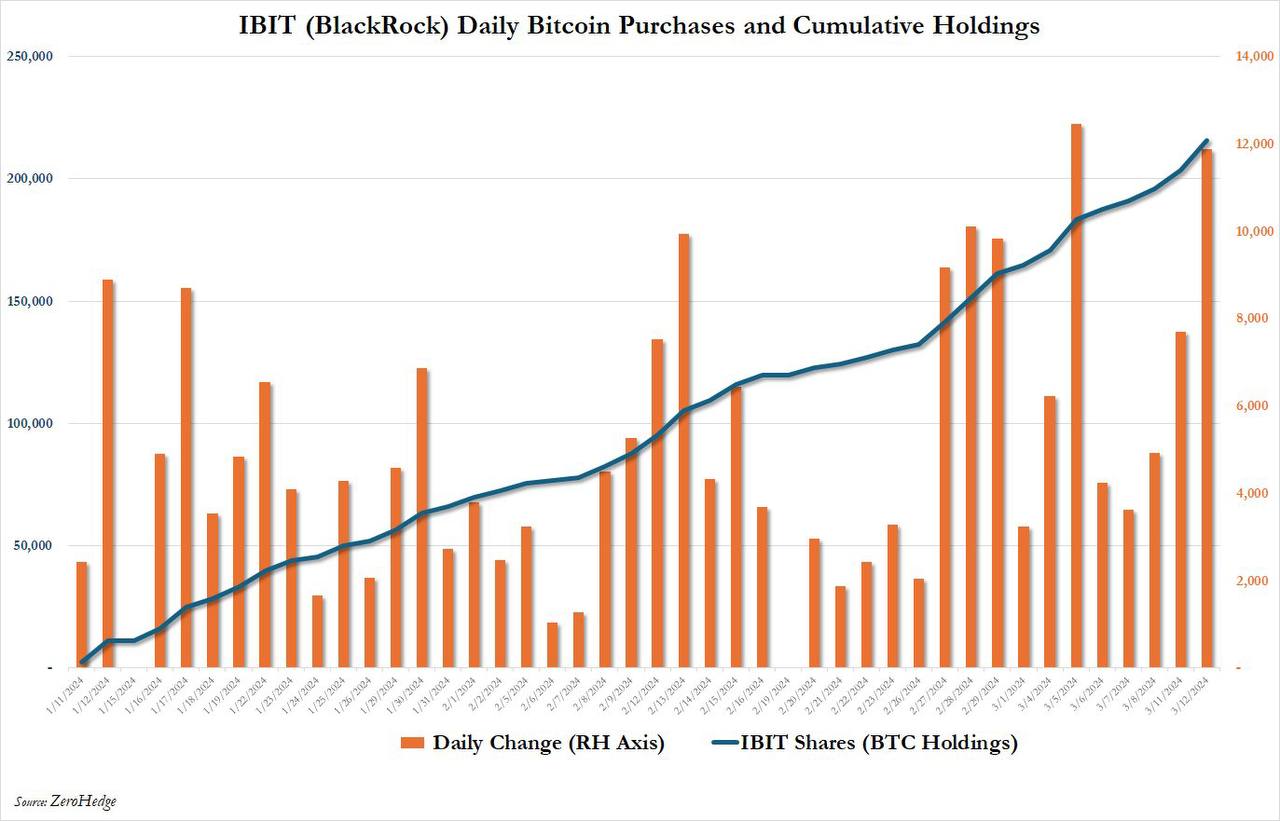

With an accumulation of BTC a few ETFs could, in fact control the market. As on stock market, it is not necessary to own 51% to control the stock. It is enough to have largest pack on the market if other stakes are diluted among big amount of investors. Here is the same story. BlackRock is buying any deep on BTC market right now. Even cumulative stake around 20% of total flow of BTC will be enough to totally control it.

Zerohedge recently reported that they are observing an artificial decrease in BTC prices – a targeted dump of BTC futures and record purchases on spot and through ETFs at reduced prices. The Blackrock ETF bought a record amount of BTC .

BlackRock is buying every deep to accumulate BTC:

This parallel reality starts looking dangerous. Everything about Bitcoin is beautifully done. BlackRock rules. First they have cleared the way and took control of the stablecoins. Then they have broken the resistance of the US Securities Commission. Now Bitcoin may be an asset, but it is clearly not the one that will protect against everything.

This is just a financial instrument that could be run anywhere until the organizers of this race buy up real assets. They have created several ETFs where assets are purchased. And logically, if there is a constant influx of people willing to invest in this ETF, then it is necessary to buy bitcoins.

Now the question is: does a correction in Bitcoin begin to 60 or 50… maybe. Or is it a local decline with an upward trend. I don’t know whether this year it will be 100K or $125K. But they can definitely push it to $300K in a few years. Judging by the fact that they created the derivatives market industry around it. And the US banks have made a call to the Fed to let them keep BTC.

It was in 2021 when the trading turnover on the derivatives market exceeded the turnover on the spot market. This essentially cannot be the case, but last week it happened again. This suggests that parallel reality rules and wins.

It is relatively safe to speculate until major indicators of global collapse, such as Swiss Franc stands calm.

As for the entire cryptocurrency market, we can say that if there is a real coin that no one confiscates, then this means that this is really some kind of protection. And now 280,000 confiscated bitcoins have been found. And since they can be confiscated, then what a decentralized asset it is. Bitcoin is a common financial speculative asset that artificially has been given some value.

Now they try to avoid market control dilution. An investigation has been started against the Ethereum Foundation . Details are unknown. SEC postpones consideration of VanEck’s ETH spot ETF application

As it was said in the movie – “Only one should remain”. Everything is correct, everything is logical. Stablecoins will also be squeezed and only BTC will stay to grab all funds, because everything else will be regulated as securities, not commodities. Don’t trust JPMorgan, only the prophet.

Domination on BTC market is also becoming a political tool. The crypto lobby is putting US political candidates on notice: Side with us or risk defeat at the ballot box.

Thus, this structural risk leads to the market risk – that the price of BTC has no relation to reality, can’t be forecasted, can’t be valued. Many respectable analysts and economists start speaking about this more and more often.

Markets are showing characteristics of a bubble in the record-setting surge by tech’s so-called Magnificent Seven stocks and the all-time highs in cryptocurrencies, according to Bank of America Corp. Chief Investment Strategist Michael Hartnett.

With inflation re-accelerating, growth a little soft and risk assets unscathed, “that is very symptomatic of a bubble mentality,” Hartnett said Thursday in a Bloomberg TV interview. Characteristics of a bubble can be seen in prices, the pace of the moves, in valuations and in the narrowness of the gaining assets.

“I think that’s representative of a feeling that the Fed is losing credibility, that the Fed seems very determined to cut interest rates before it reaches its 2% inflation target. Цhile the bubble isn’t necessarily about to pop, there are some ominous signs from US economic data, said Hartnett, who sees evidence that the labor market is cracking. “The labor market is what can take a soft landing and make it a hard landing very quickly.”

Bitcoin was “undercut by the rise in US yields and the US dollar that followed the hot producer-price inflation data,” Tony Sycamore, a market analyst at IG Australia Pty, wrote in a note.

Traders should brace for a global withdrawal of liquidity, which will usher in more market volatility, according to Gavekal Research.

“The hard reality of bull markets is that market advances need money to come in from somewhere,” wrote Louis-Vincent Gave of Gavekal Research. “Yet more new drags on global liquidity are going to appear in coming months.”

These include a draining of the Fed’s reserve repo facility, more issuance of US Treasuries, the end to a decline in oil inventories and the potential repatriation of cash to Japan by domestic institutions after its central bank raises interest rate.

“From both the demand and supply sides, the broad global liquidity environment seems set to change radically in the coming weeks and months,” Gave wrote in a report. “This should make for greater market volatility and should prove particularly dangerous for today’s various overstretched and richly-valued assets.”

CONCLUSION

Crypto market is changing its nature before our eyes. We already talked about it in previous reports, but it is spinning up. If to not get bored with all this stuff and just take a look at technical picture, analysis above clear shows the range. Rational expectations stand now around $90-100K marking on average. Technical target that we could confirm points on 85K, so 90-100K levels seems OK, as it also confirmed by options market.

To the downside, 50K level is considered on average, JP Morgan speaks about ~42K. From the technical point of view – both levels are more or less acceptable. 50K, in fact, is just 30% retracement, which is absolutely normal. Personally I would start worry if BTC drops under 35K.

It means that until it wobbles in this wide range bullish context will be intact and we could take part in all this speculative games.

Speaking about investments and using BTC for wealth preservation I wouldn’t consider BTC by few reasons. First is, from valuation point of view it has no intrinsic value as it doesn’t generate any cashflows (nor potential CF), it is not an art piece and it is not Nature product – it is made by humans. Its value is justified by massive mind of society, a kind of “Bigger fool” who is ready to buy it at higher price. Formally numerous amount of BTC could be made more, and it is highly likely that once all 21M of BTC will be mined out, we will get BTC#2 in some way on the same principle. This is a big game with a big money and the major players would like to continue. “The King is Dead – Long lives the King”

Second is – market is too narrow and soon will be totally controlled by the US. Taking in consideration two moments of hard economical situation in the US and precedent of regular freezing and confiscation of assets, using law as a tool to destroy competitors (recall Binance), legally BTC also looks not attractive.

Finally, BTC is not a physical asset that makes it fragile and exposed to physical destruction. Any transfer of BTC could be made only via the net.

All these reasons makes us think that BTC stands nowhere near the gold and other physical commodities, or art pieces in terms of wealth preservation. We suggest that this idea mostly the result of massive media propaganda who has to assure individuals and households in exceptional feature of BTC.

Of course, our humble opinion is not the truth of last resort. Your own conclusion on this subject you could make by yourself.

Author Profile

Sive Morten

At the Forex Peace Army, he is known as an author of Forex Military School, which quite unique free forex trading course. We do not know of any other free forex trading education covering such a broad spectrum of forex market concepts in such details while keeping it easy to understand and practically use.

As if that wasn't enough, he is the part of the Shoulders of Giants Program. He shares with his fellow traders at FPA his view and forcast of the Gold Market, Currency Market, and Crypto Market in form of weekly analytics and daily video updates.

* Complete Forex Trading Course by Sive Morten >>

* Sive Morten Forex , Gold , and Crypto Analysis >>

Info

37 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, April 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023 Bitcoin Fundamental Briefing, November 2023