Admiral Markets

AdmiralMarkets.com Representative

- Messages

- 95

EUR/USD & GBP/USD at Invalidation Levels for Waves 2 & B

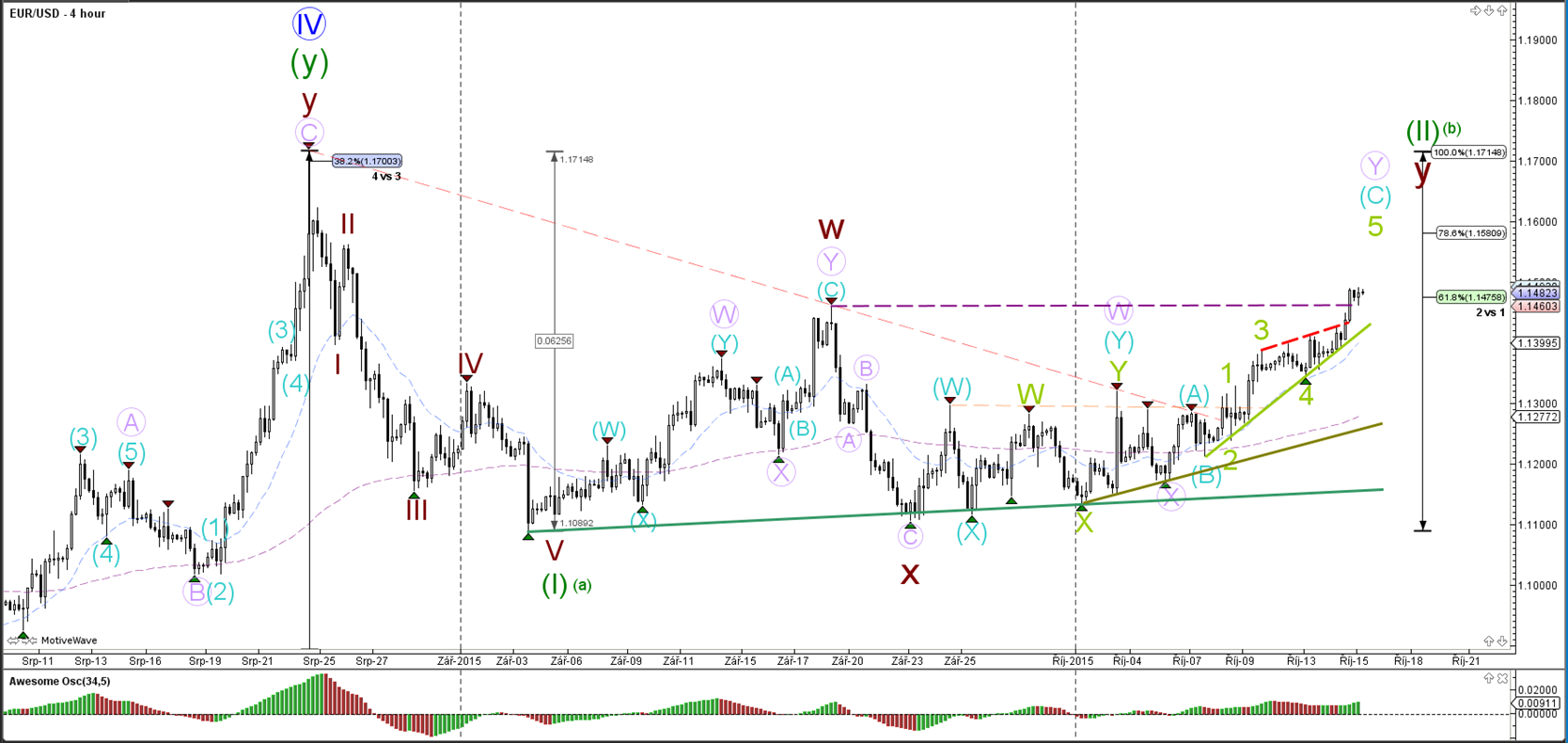

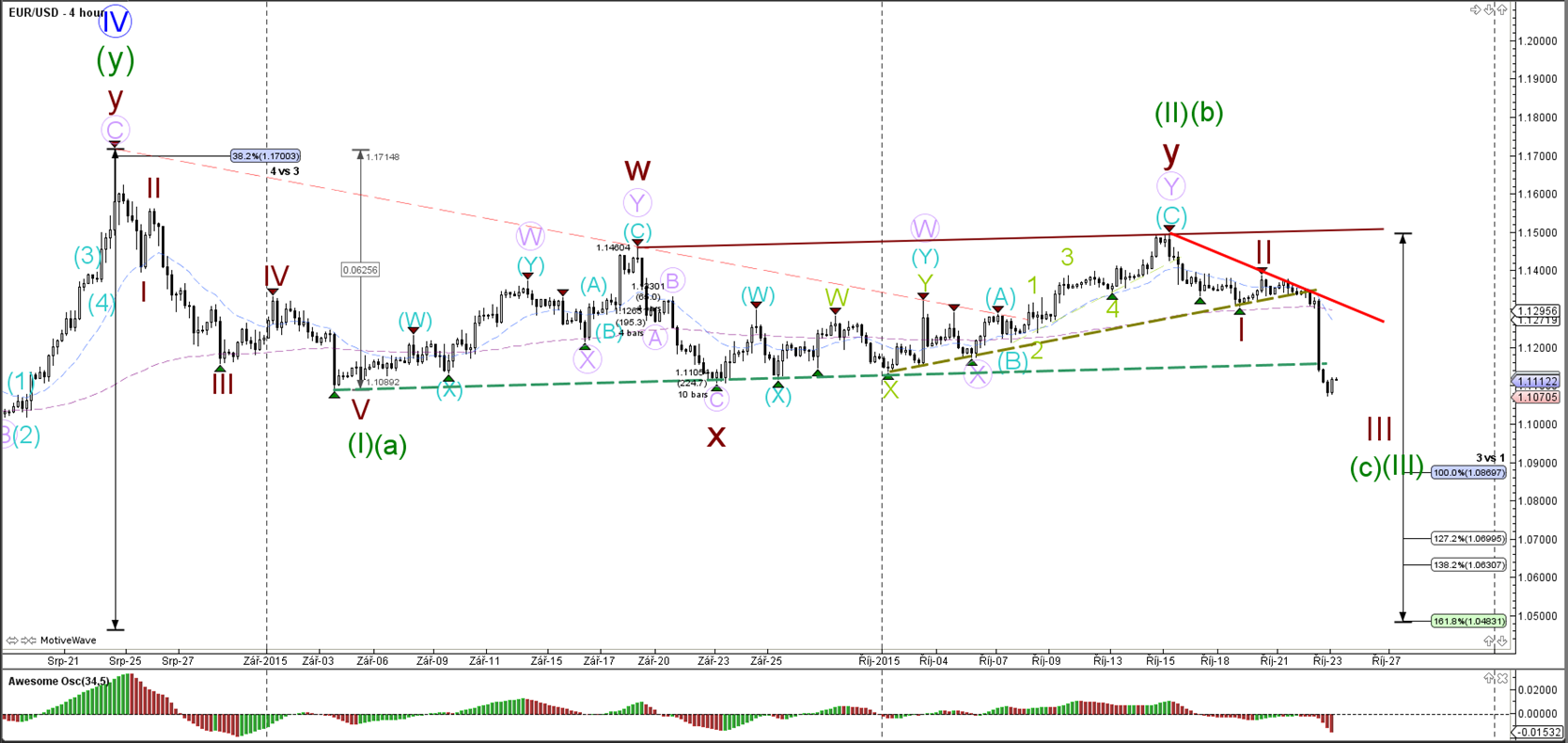

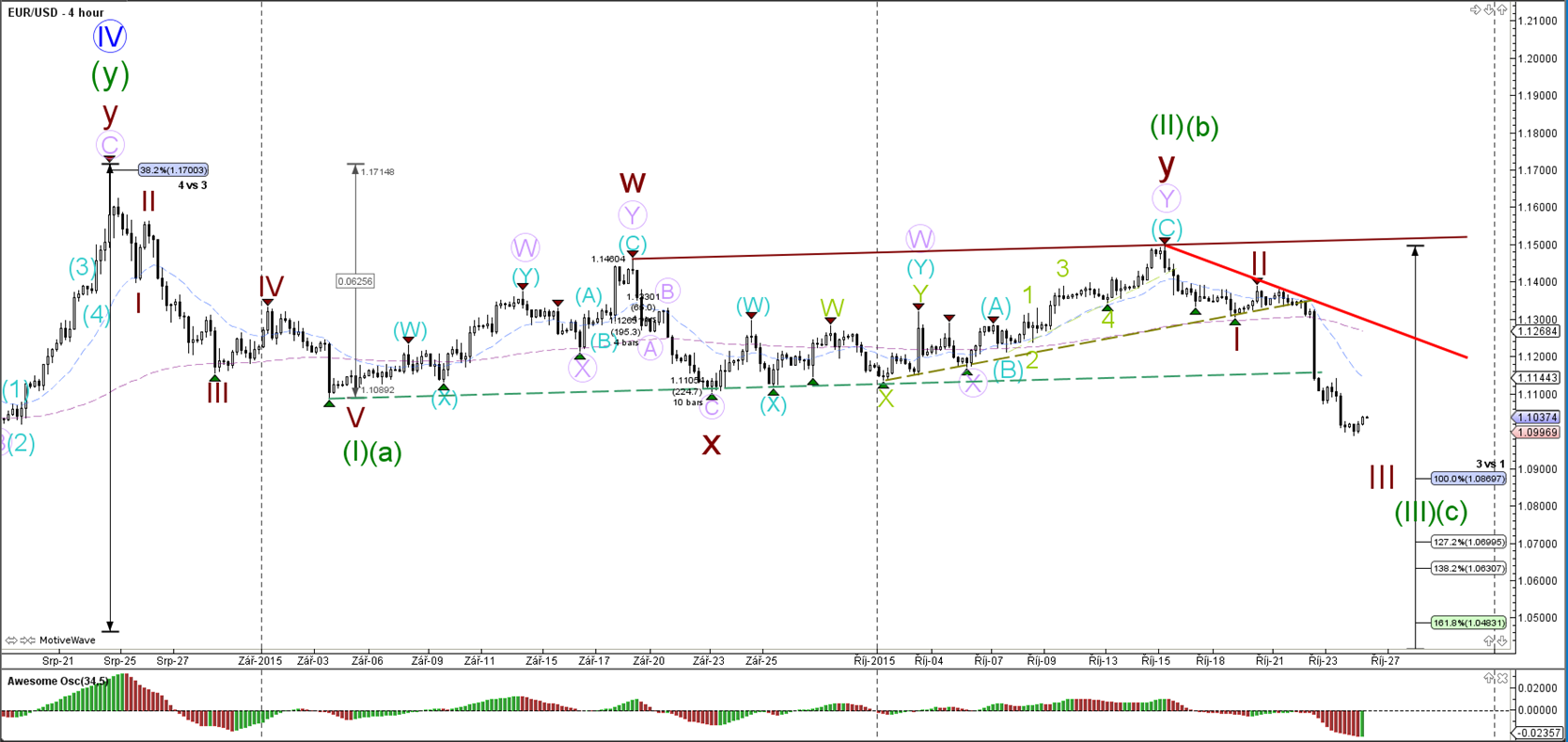

EUR/USD

4 hour

The EUR/USD has shown a deep pullback within the potential wave 2 (brown) up to the 88.6% Fibonacci retracement level. A break above the purple line invalidates the current wave 1-2 (brown) structure.

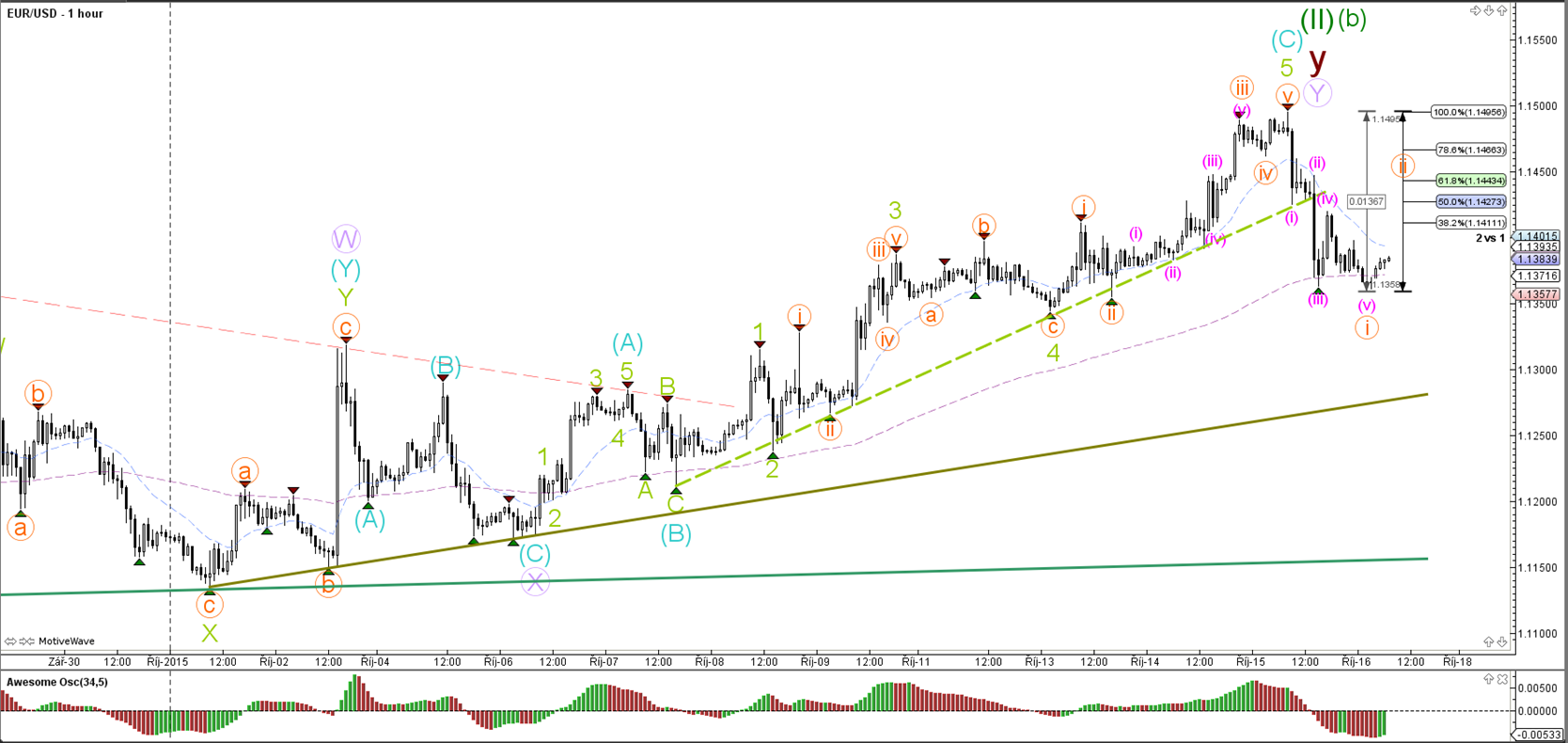

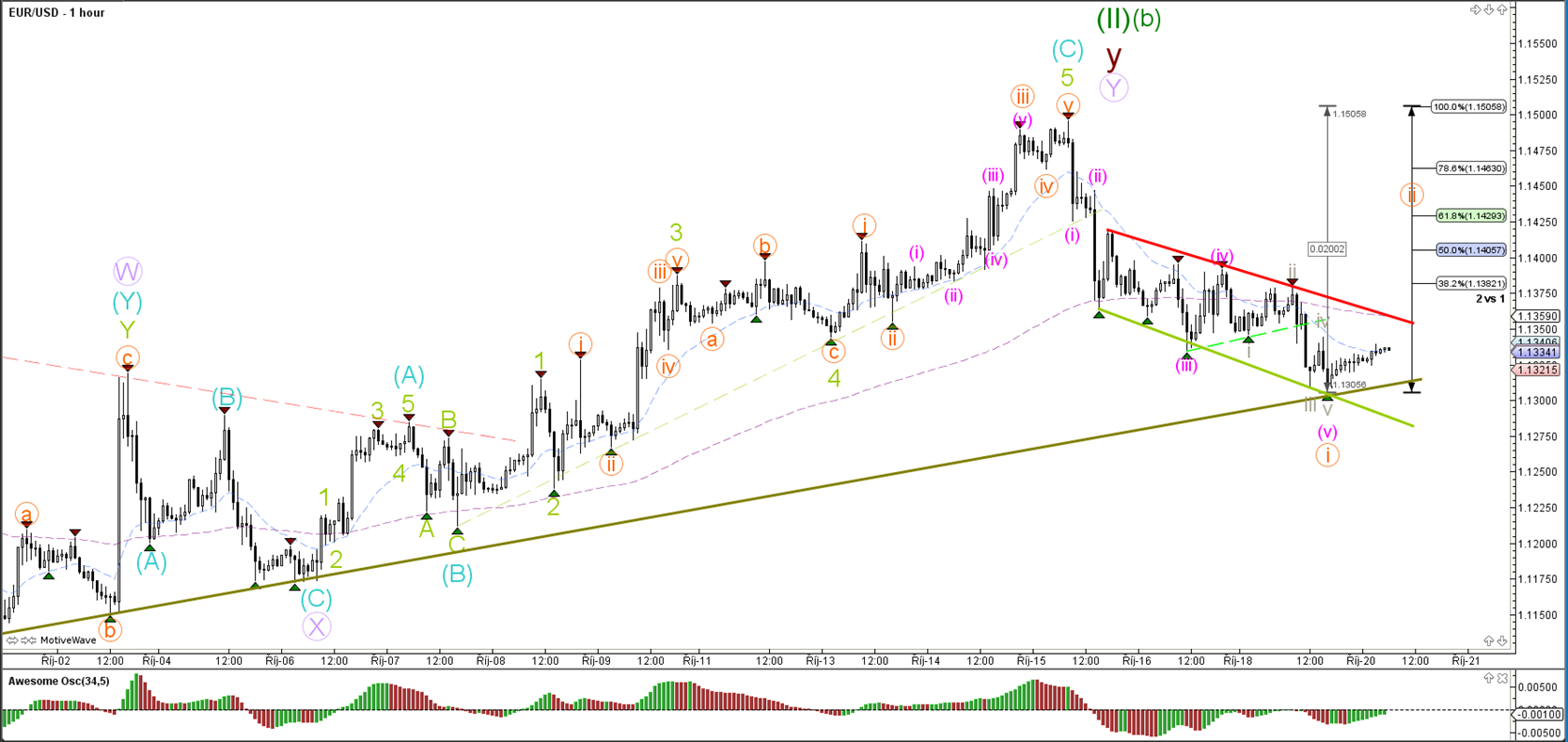

1 hour

The EUR/USD made one more bullish push yesterday which could be explained by a wave 4 and 5 (green). Currently there is a rising wedge (red/green lines) chart pattern taking place on the 1 hour chart, which is most often a reversal signal. A break of the various support levels confirms the bearish potential, whereas a break above resistance invalidates the wave 2 (brown).

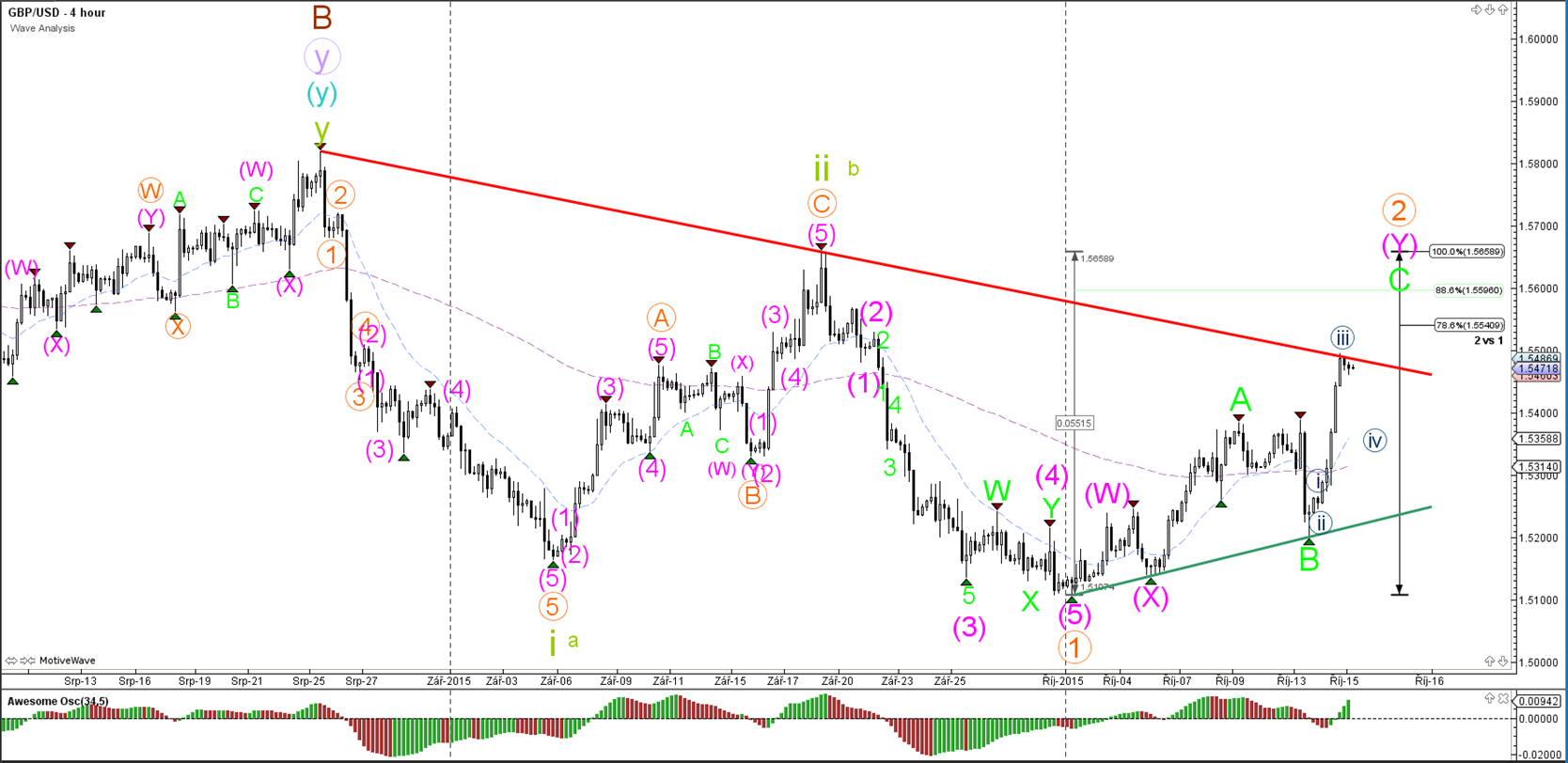

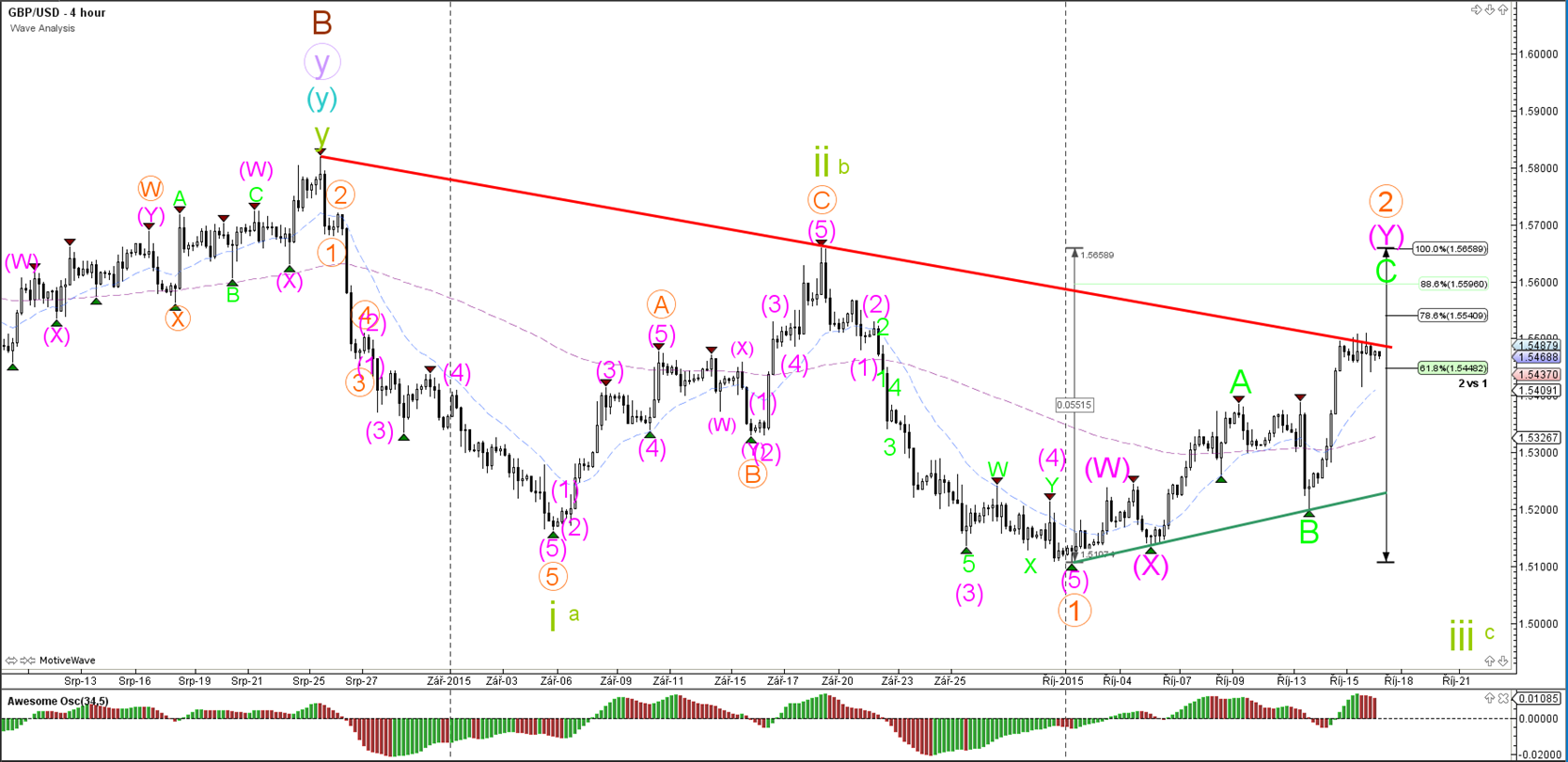

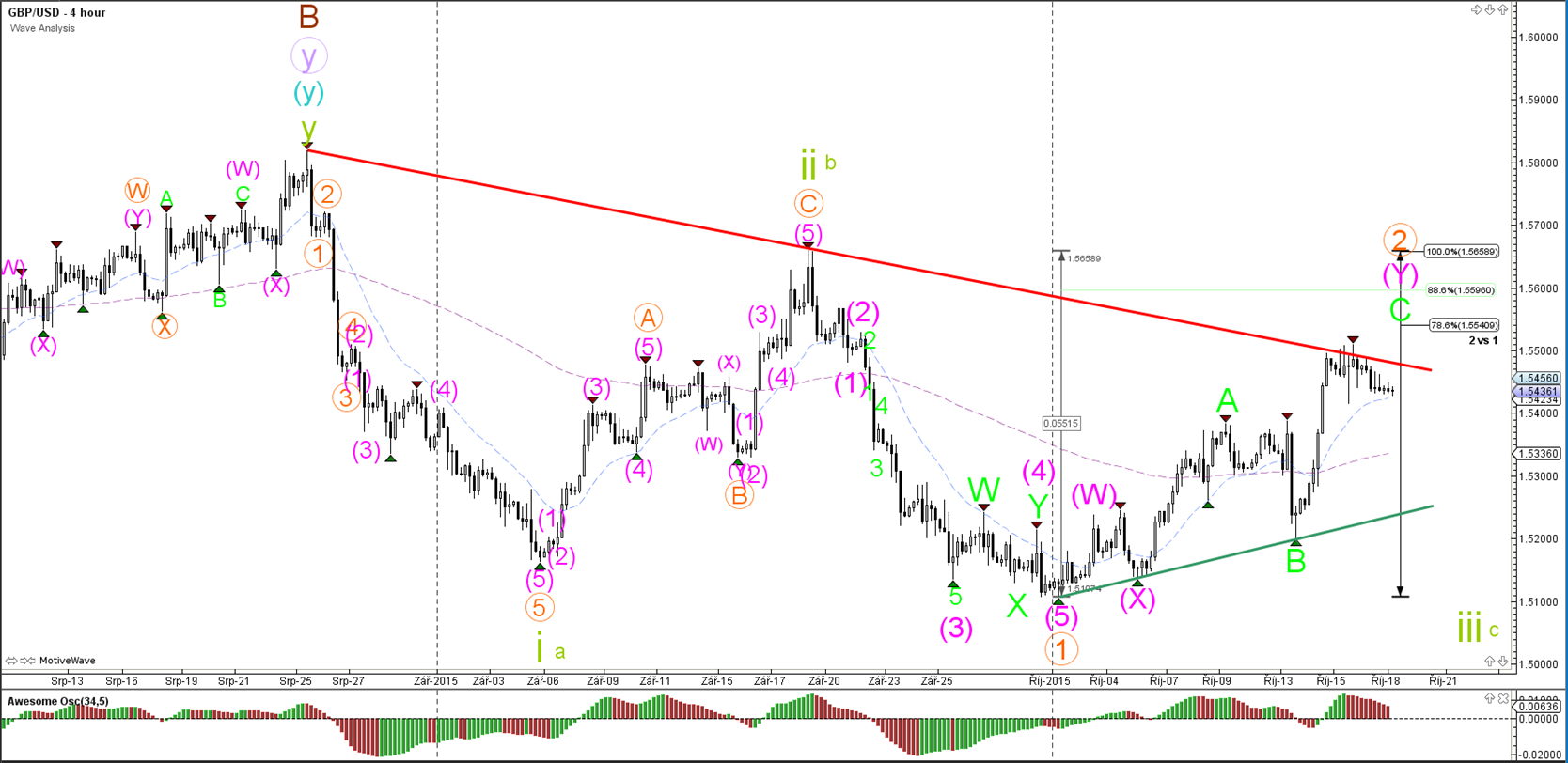

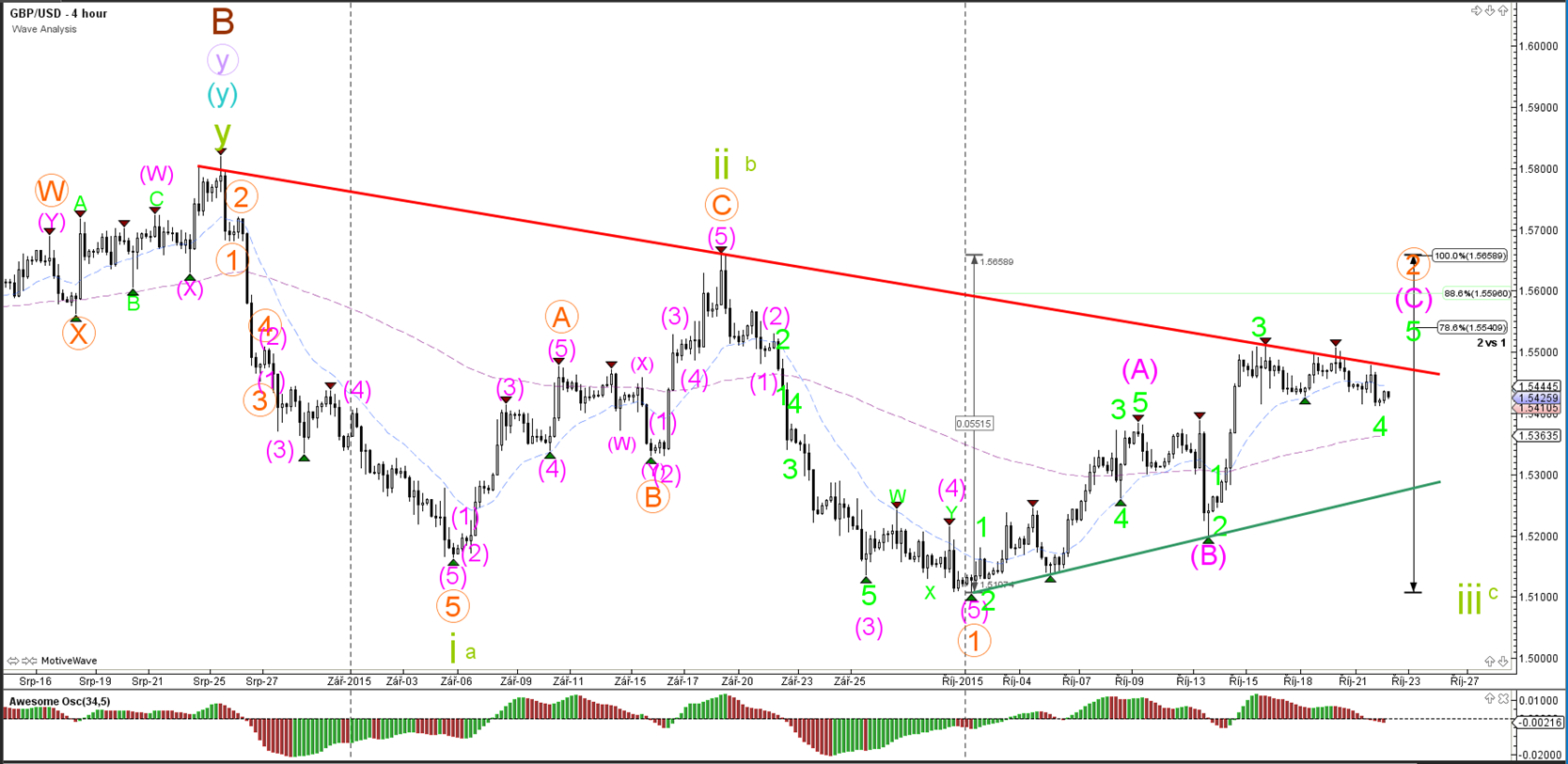

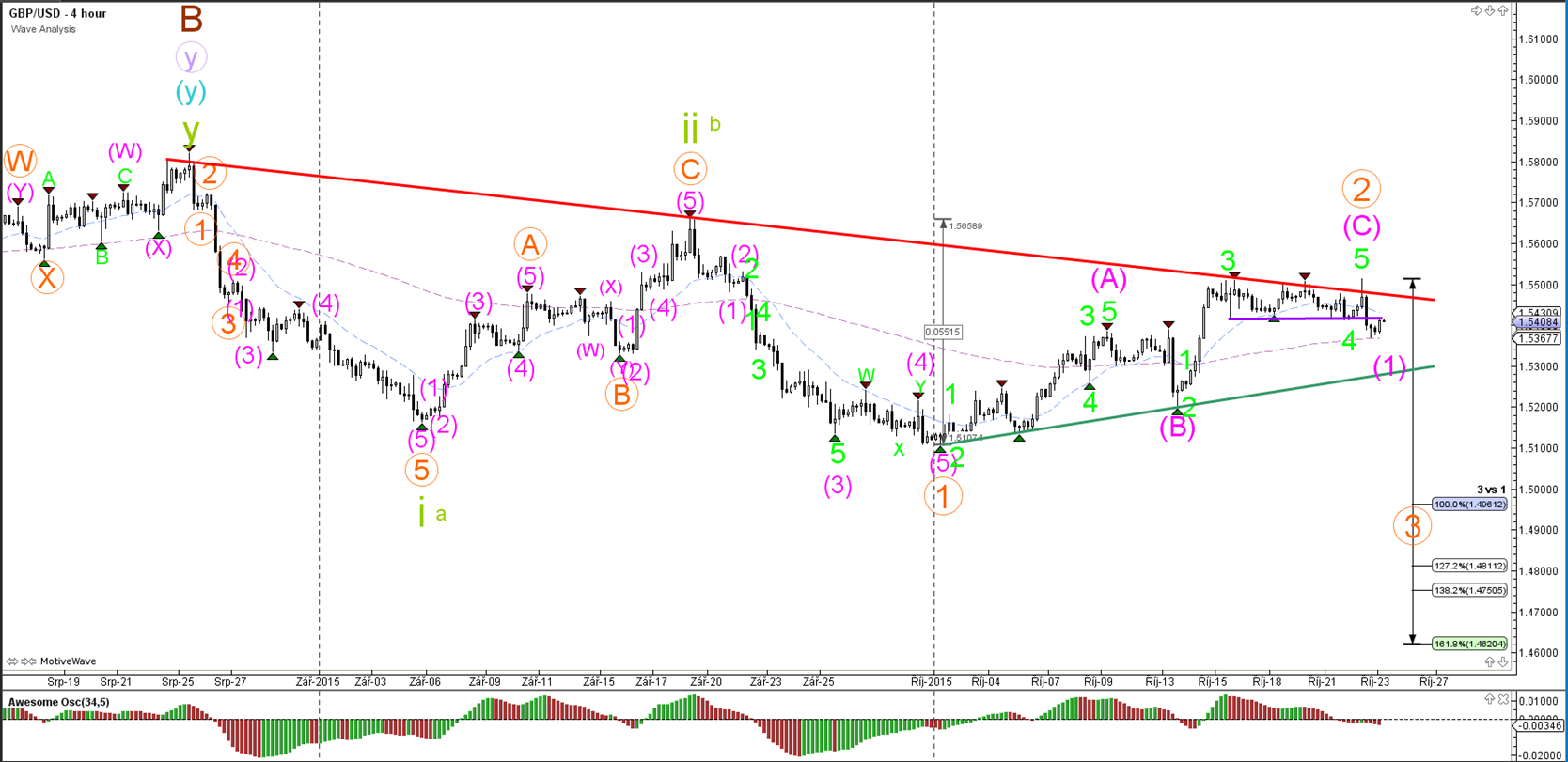

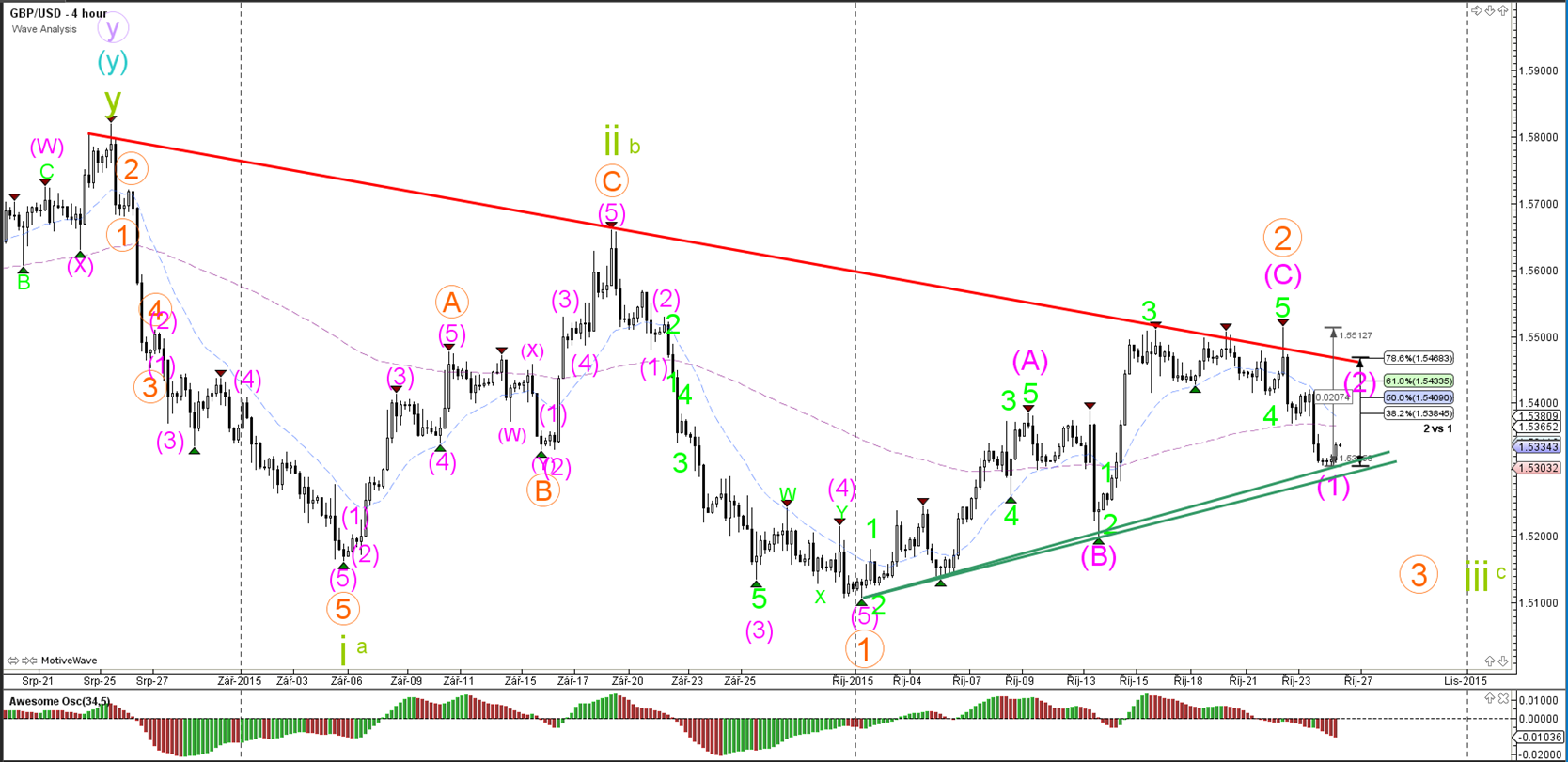

GBP/USD

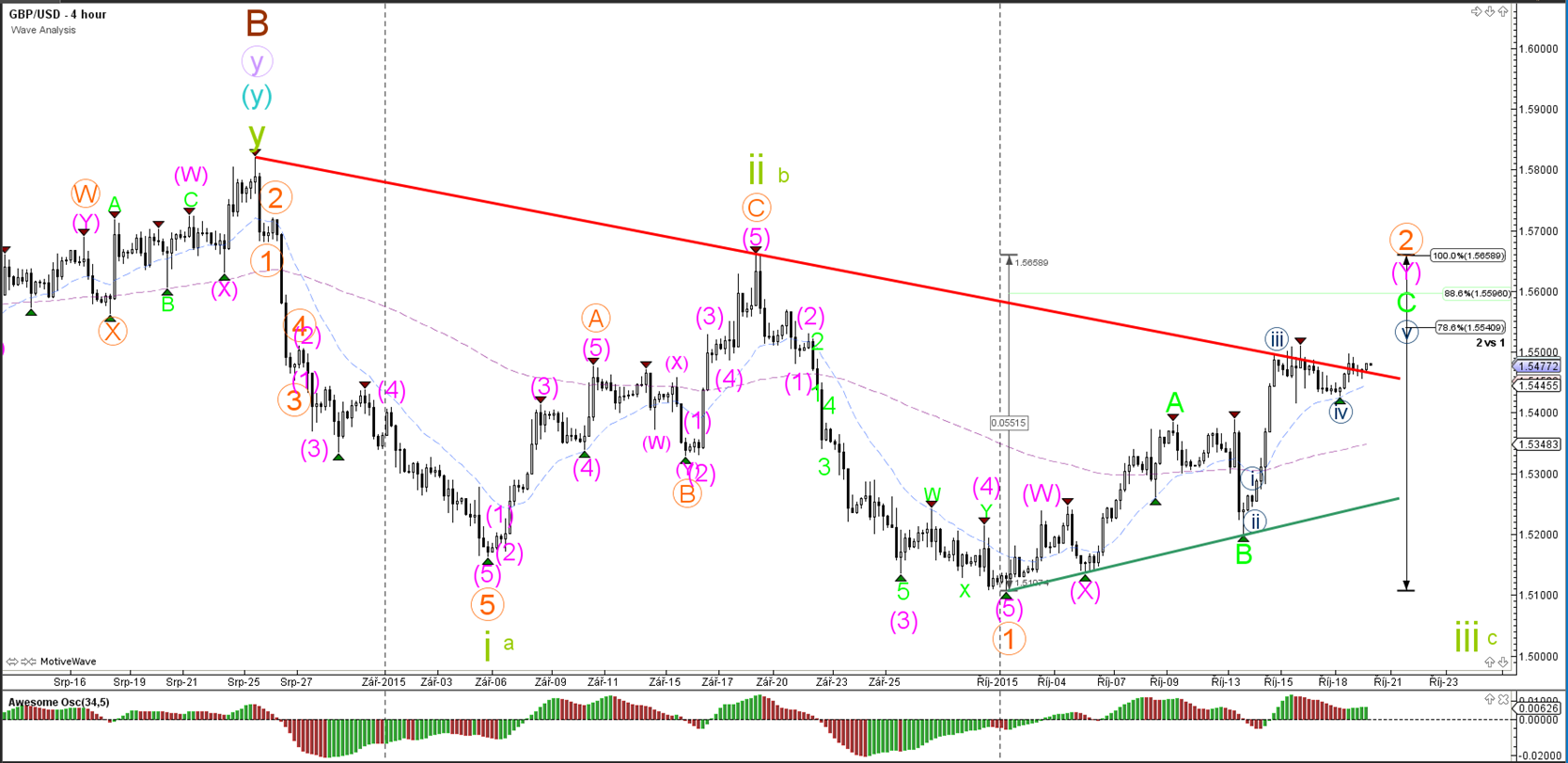

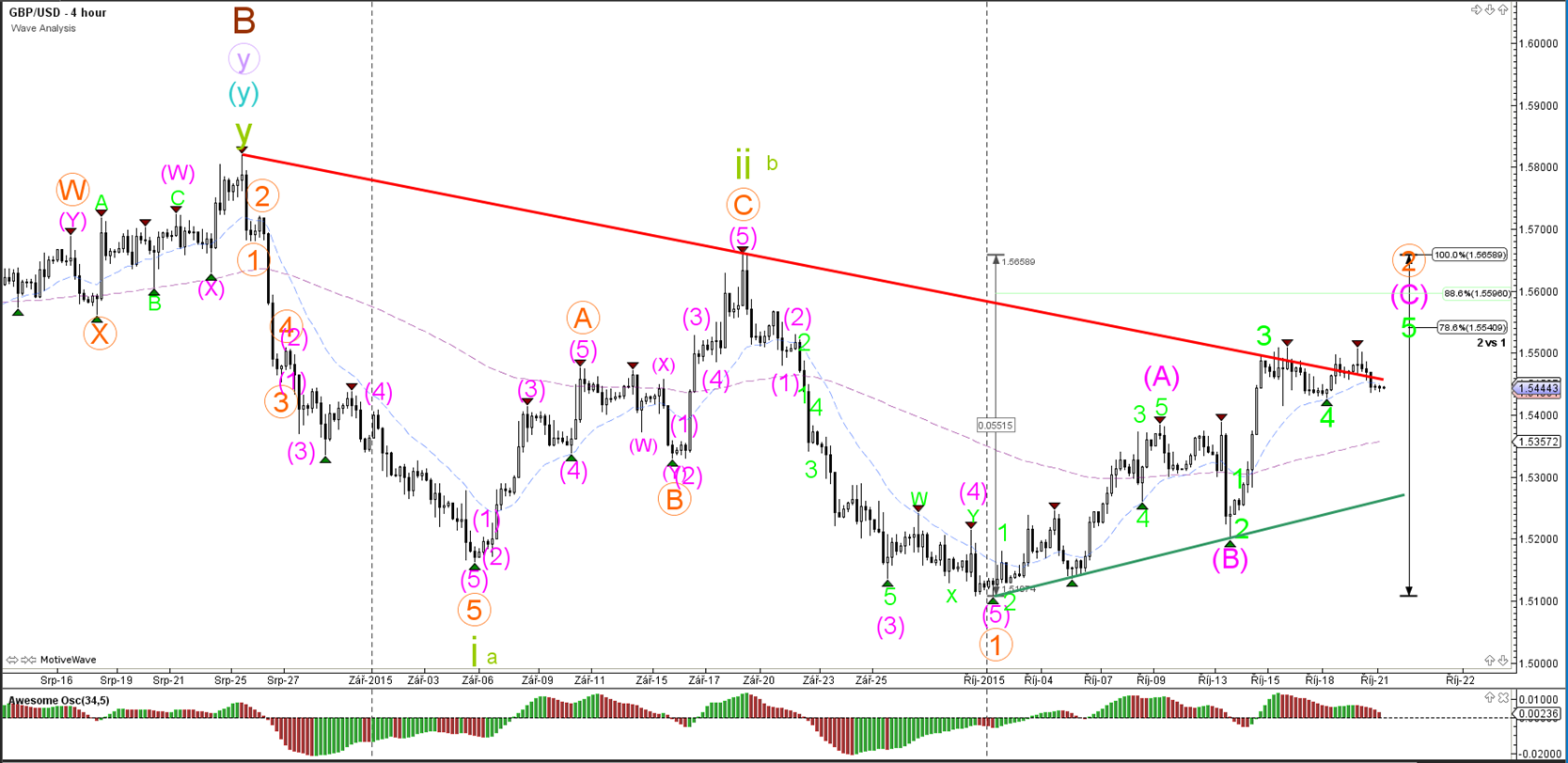

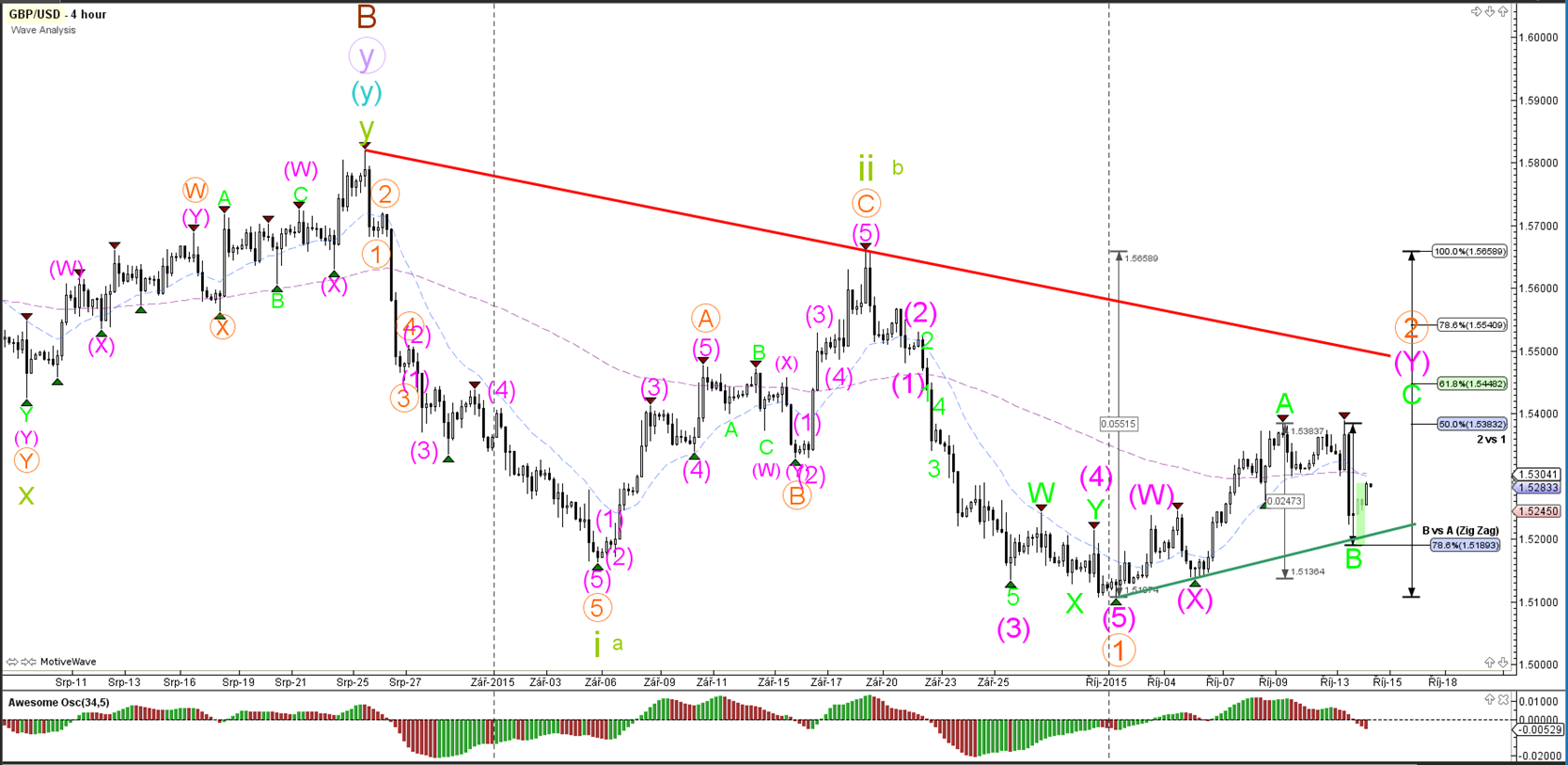

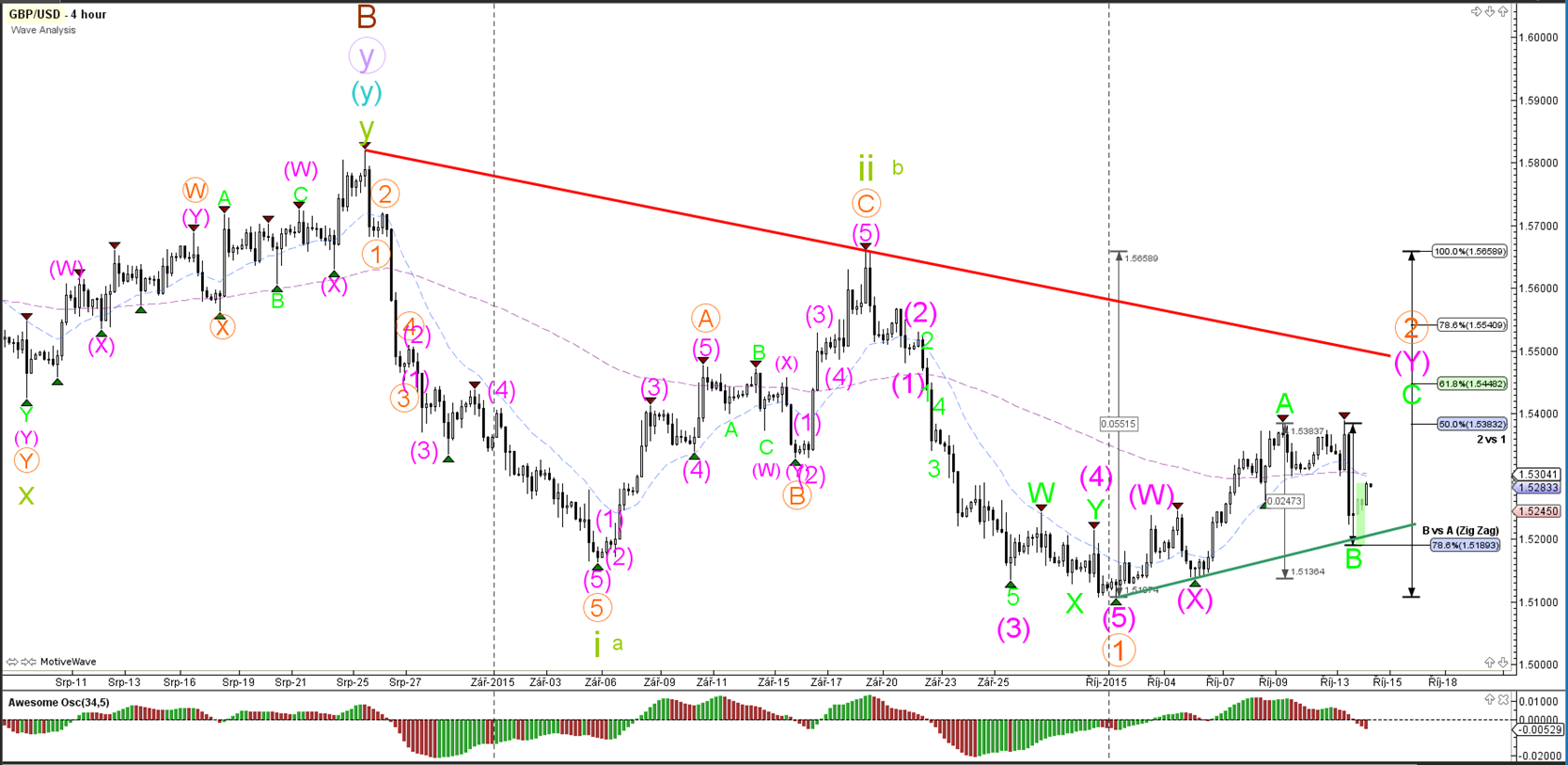

4 hour

The GBP/USD posted a deep bearish retracement yesterday down to the 78.6% Fibonacci retracement level. A break below the support trend line (green) invalidates the wave B (green) and indicates that wave 2 (orange) has been most likely completed at the recent top (where wave A is now).

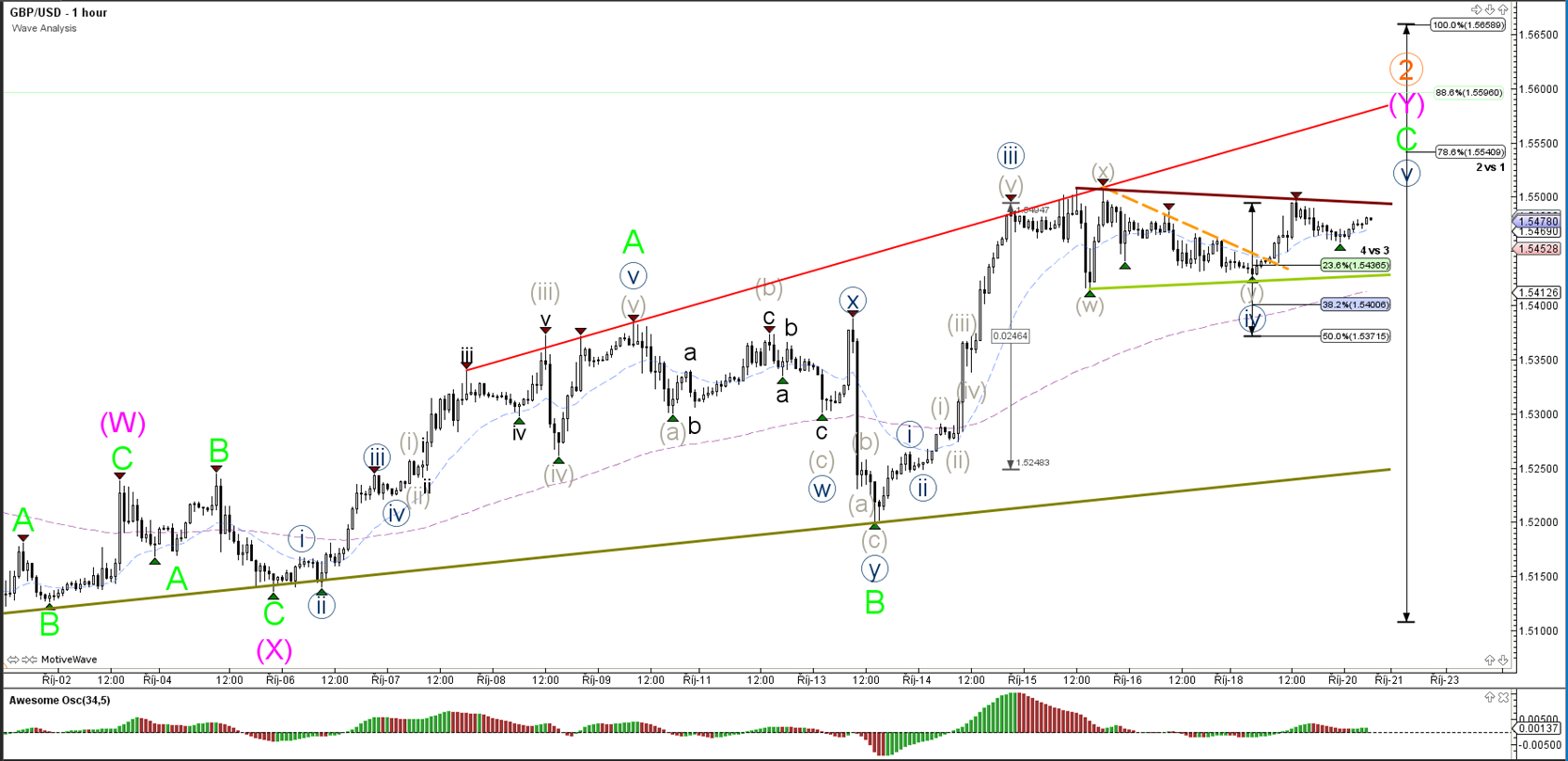

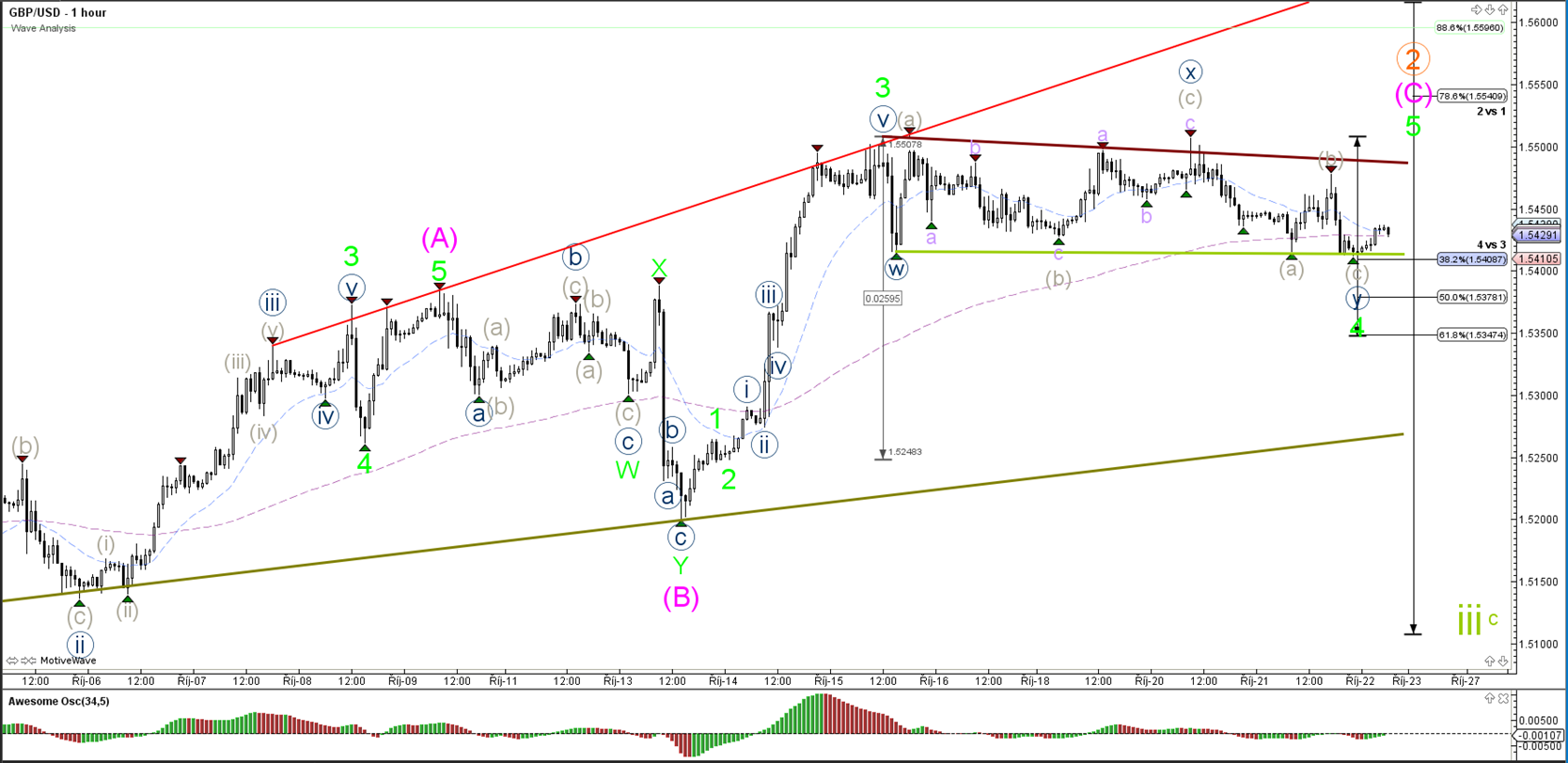

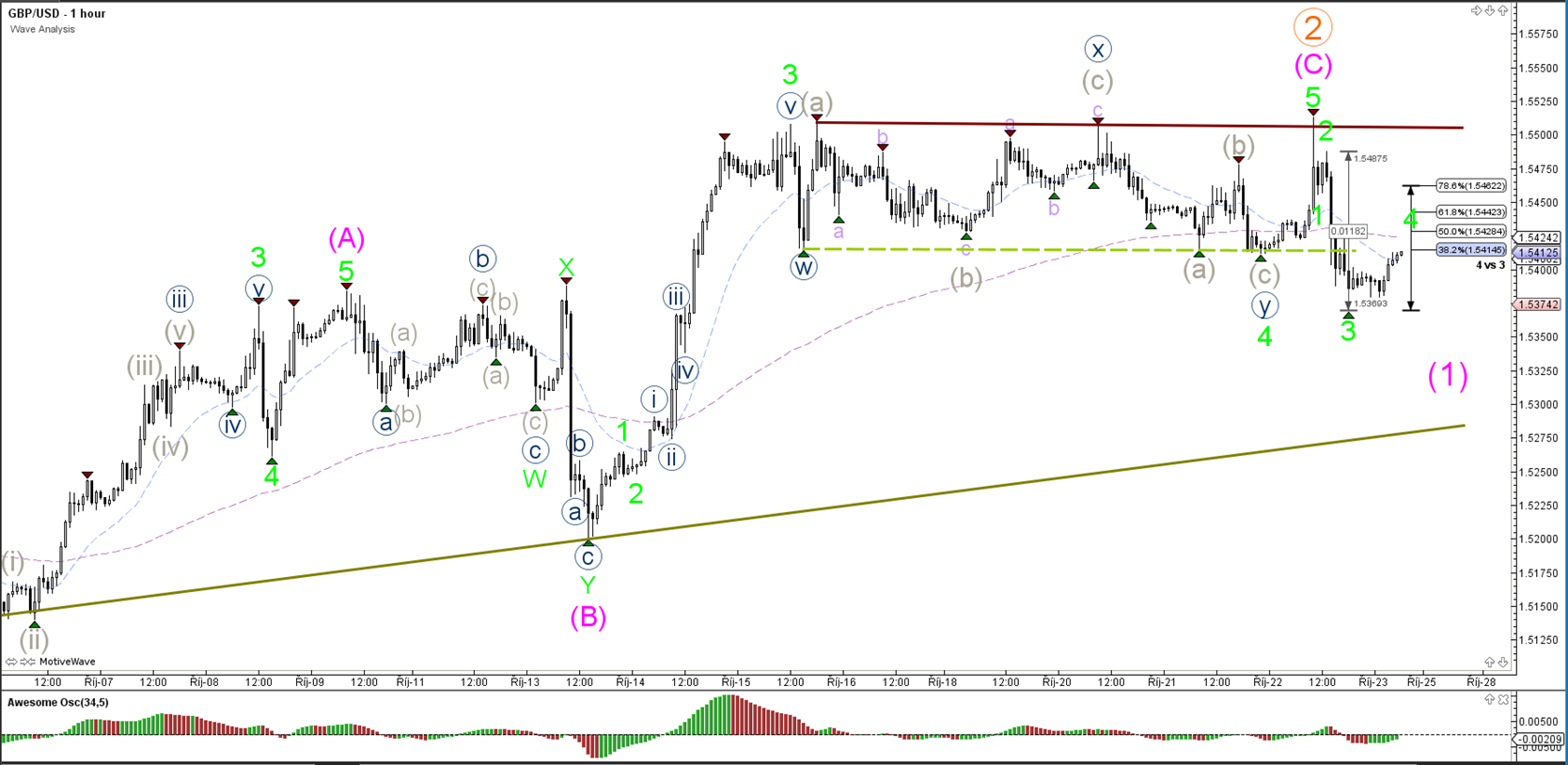

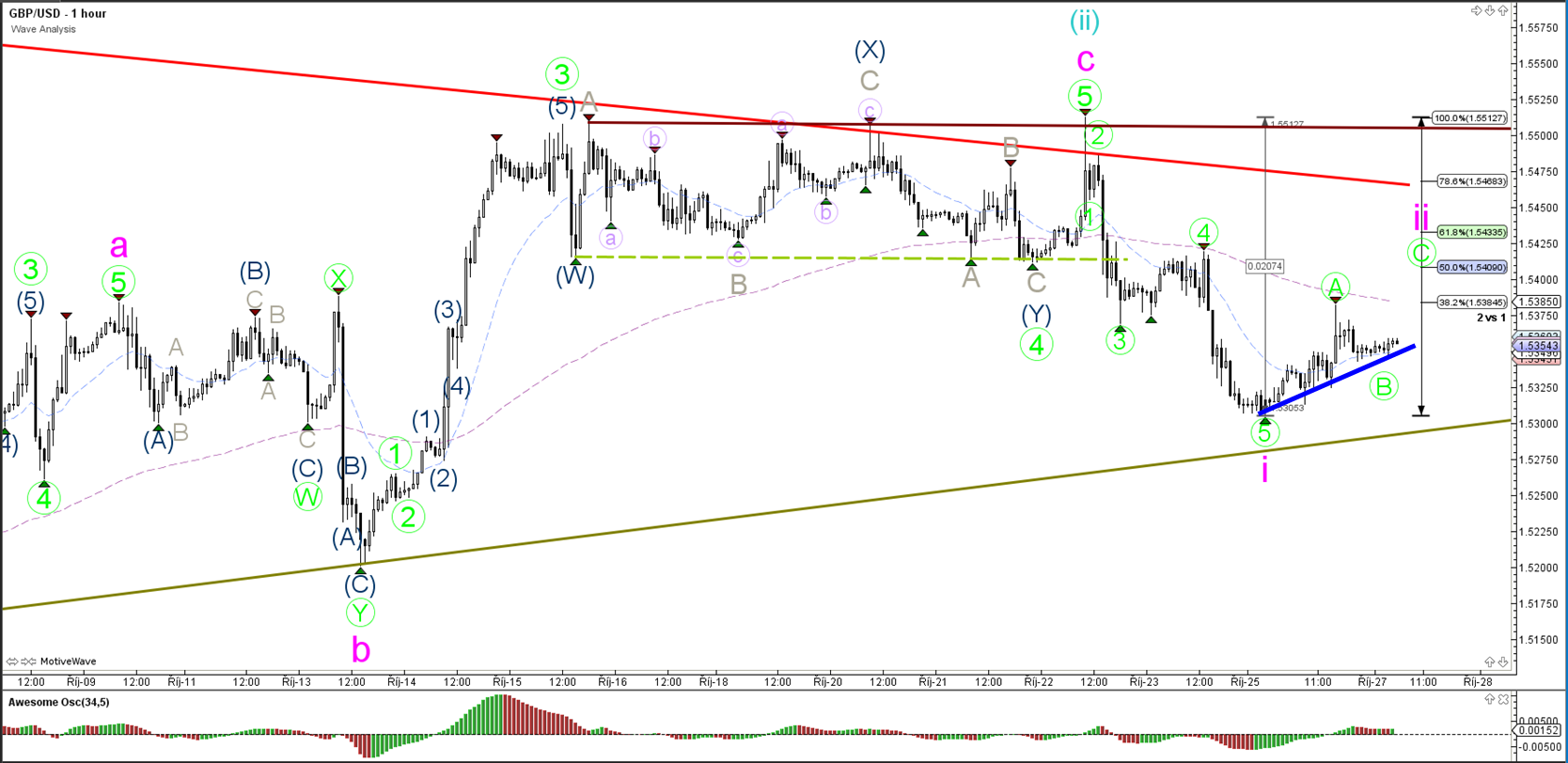

1 hour

The GBP/USD bounced at support (green) and price could have space up to the 100% Fibonacci target if price manages to break above the 61.8% Fibonacci target and then top (red).

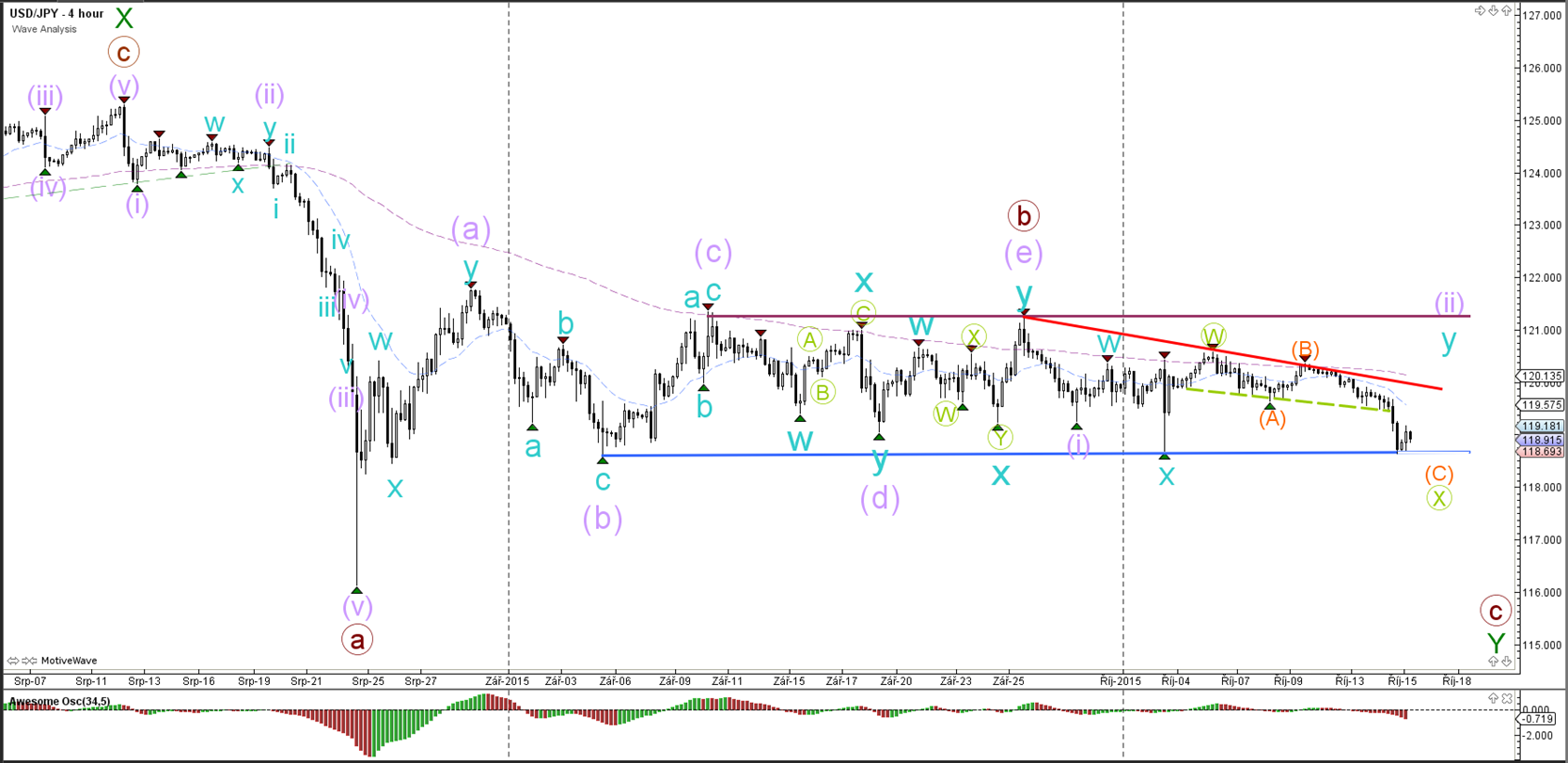

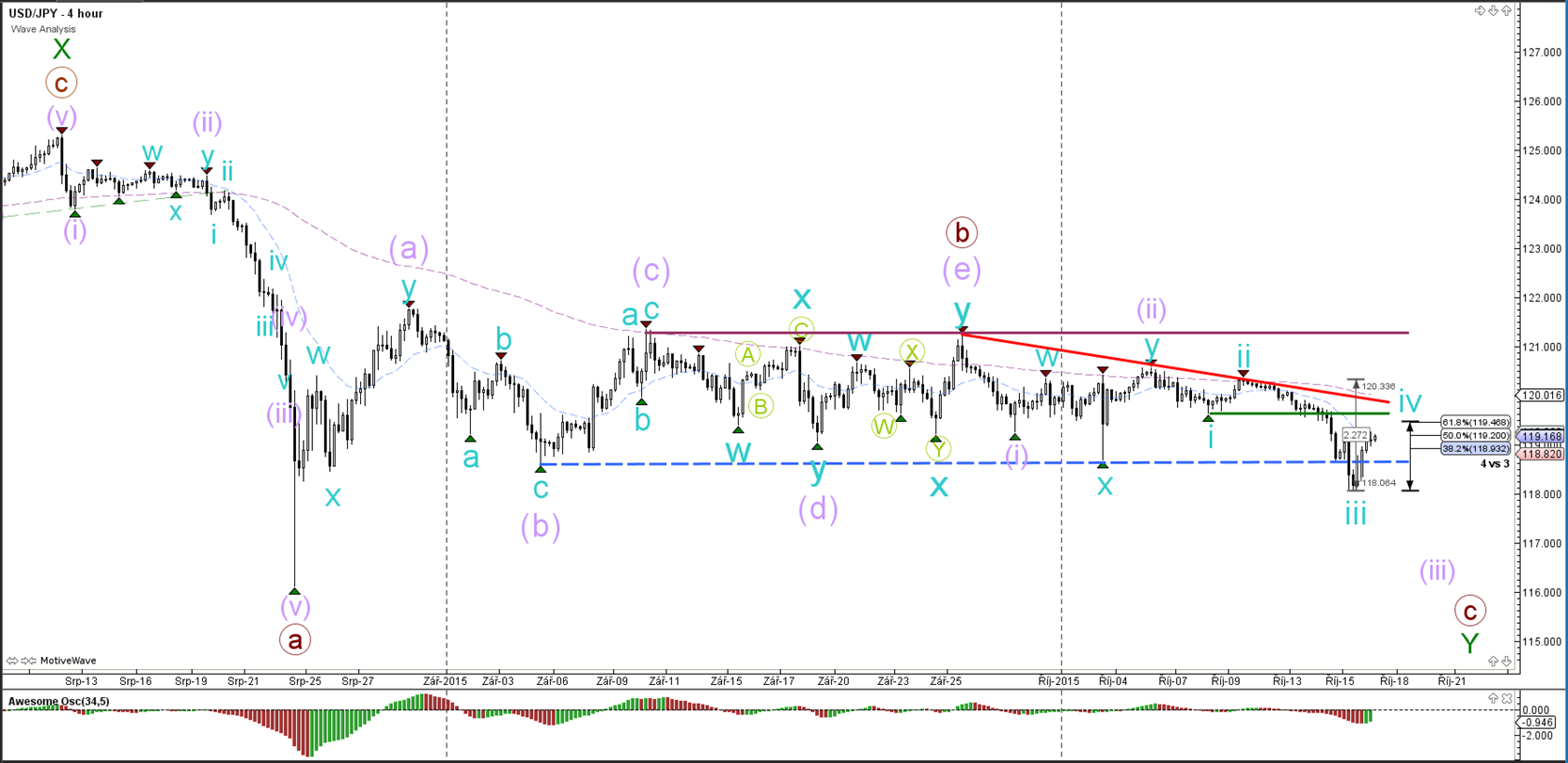

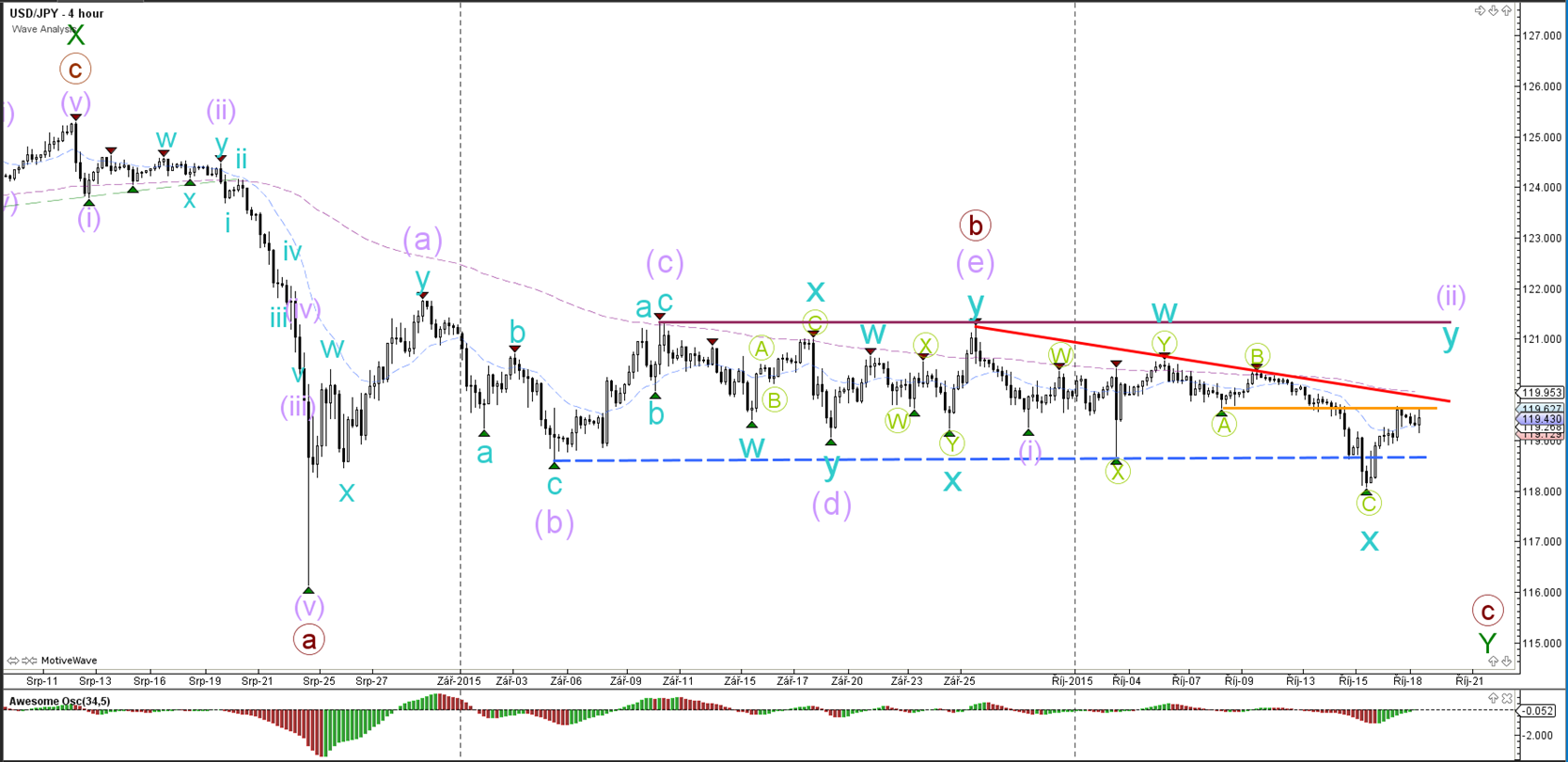

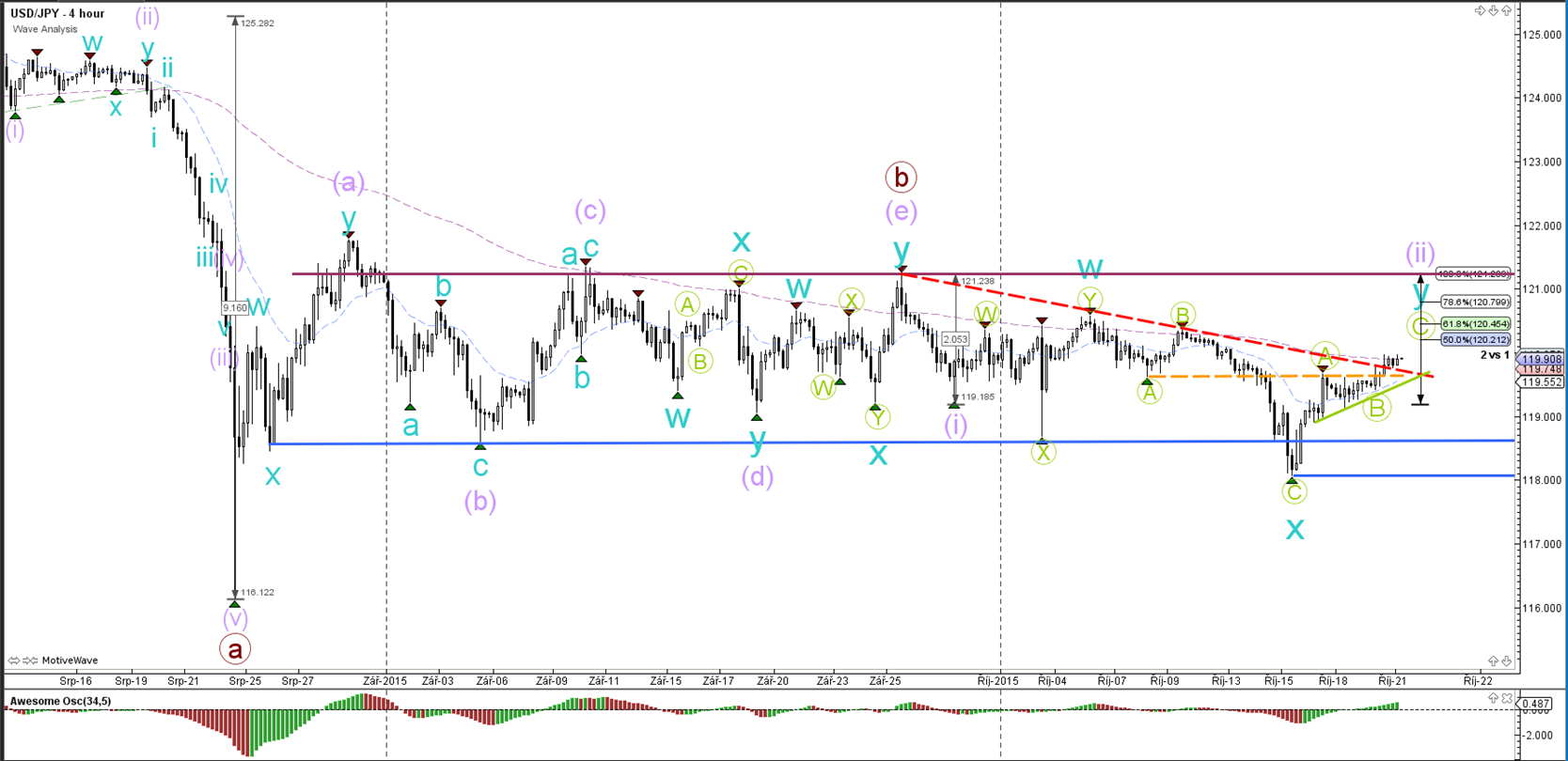

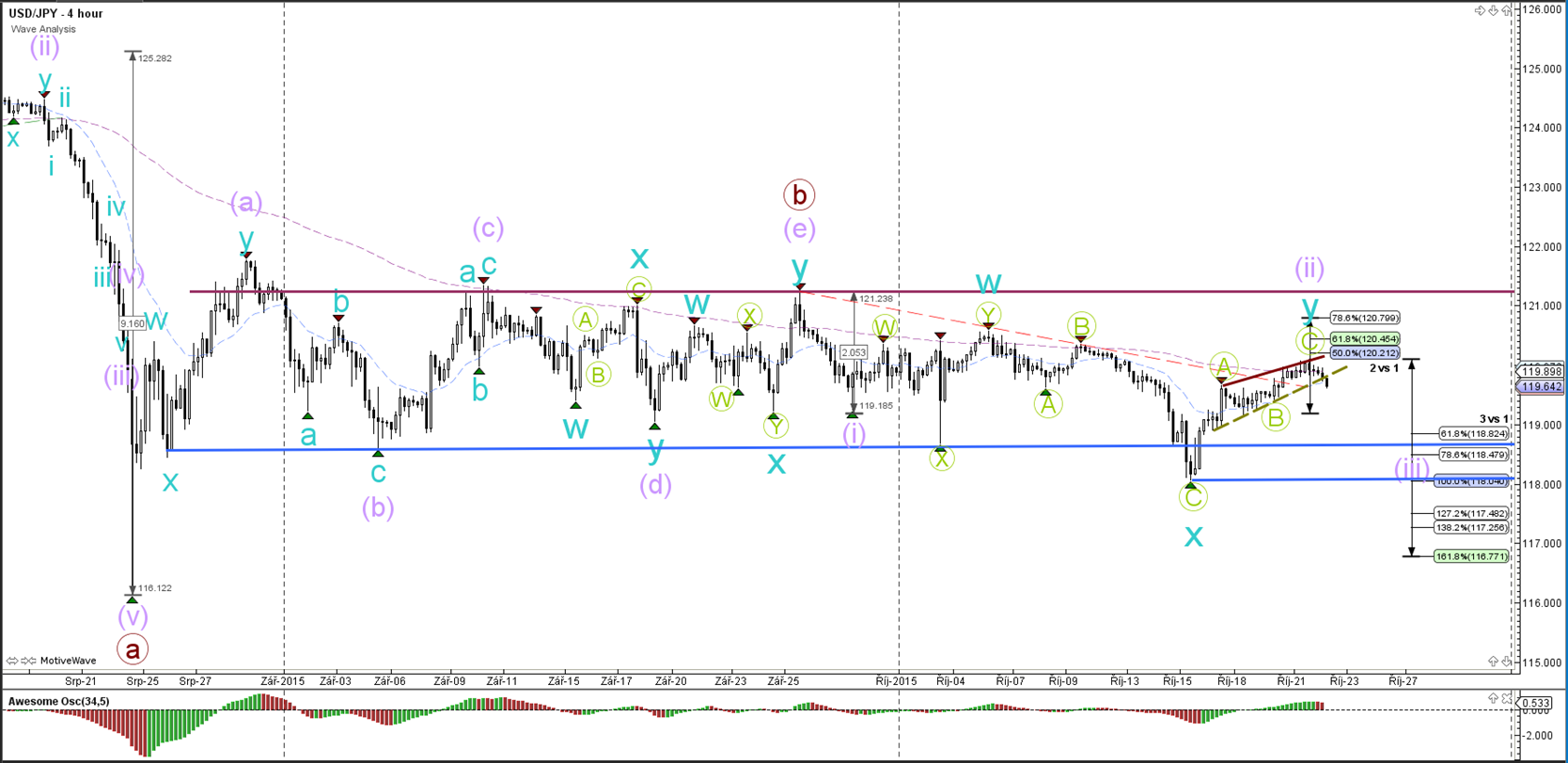

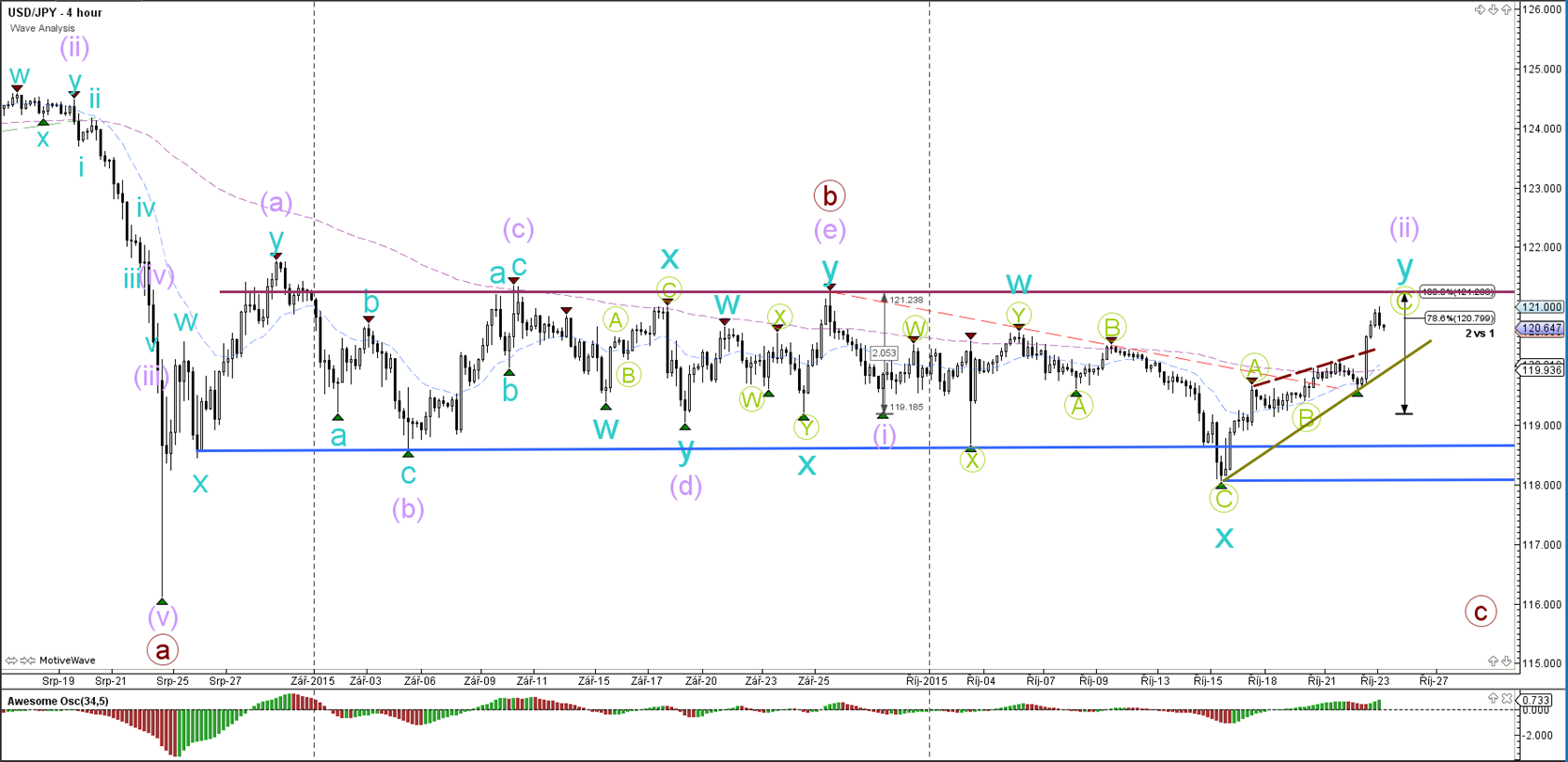

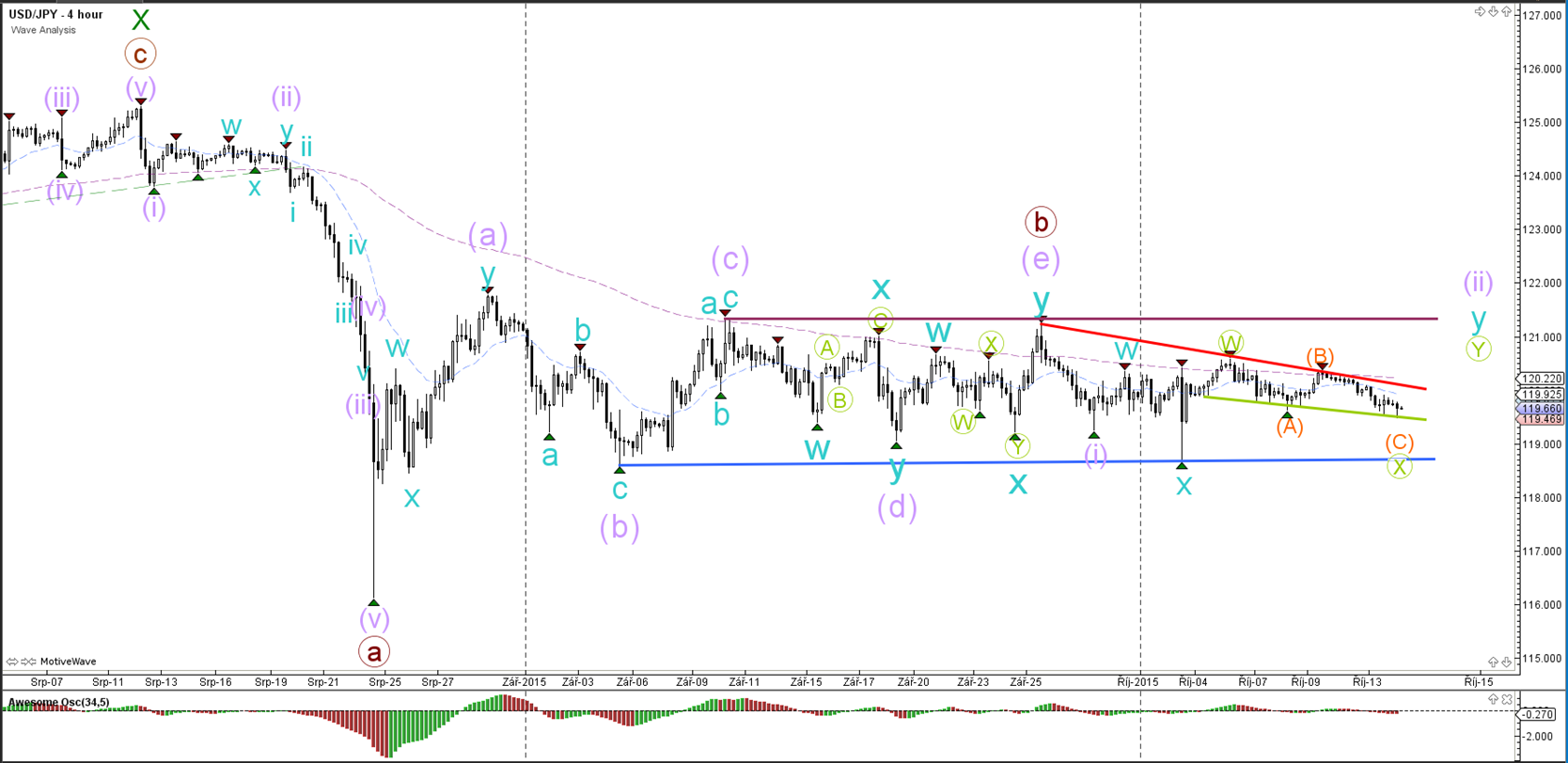

USD/JPY

4 hour

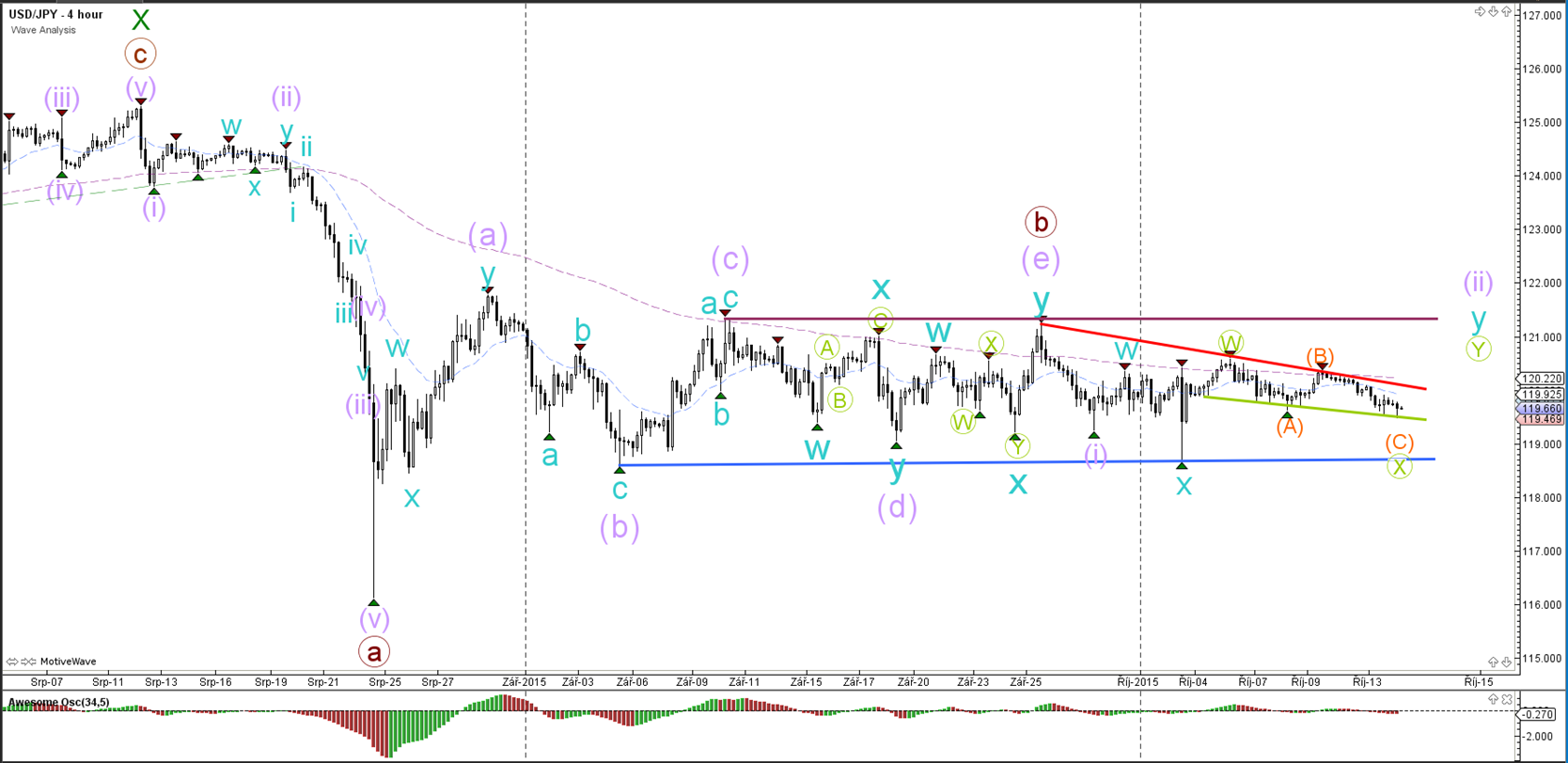

The USD/JPY remains very choppy and price action has significantly slowed down.

“Original analysis is provided by Admiral Markets”

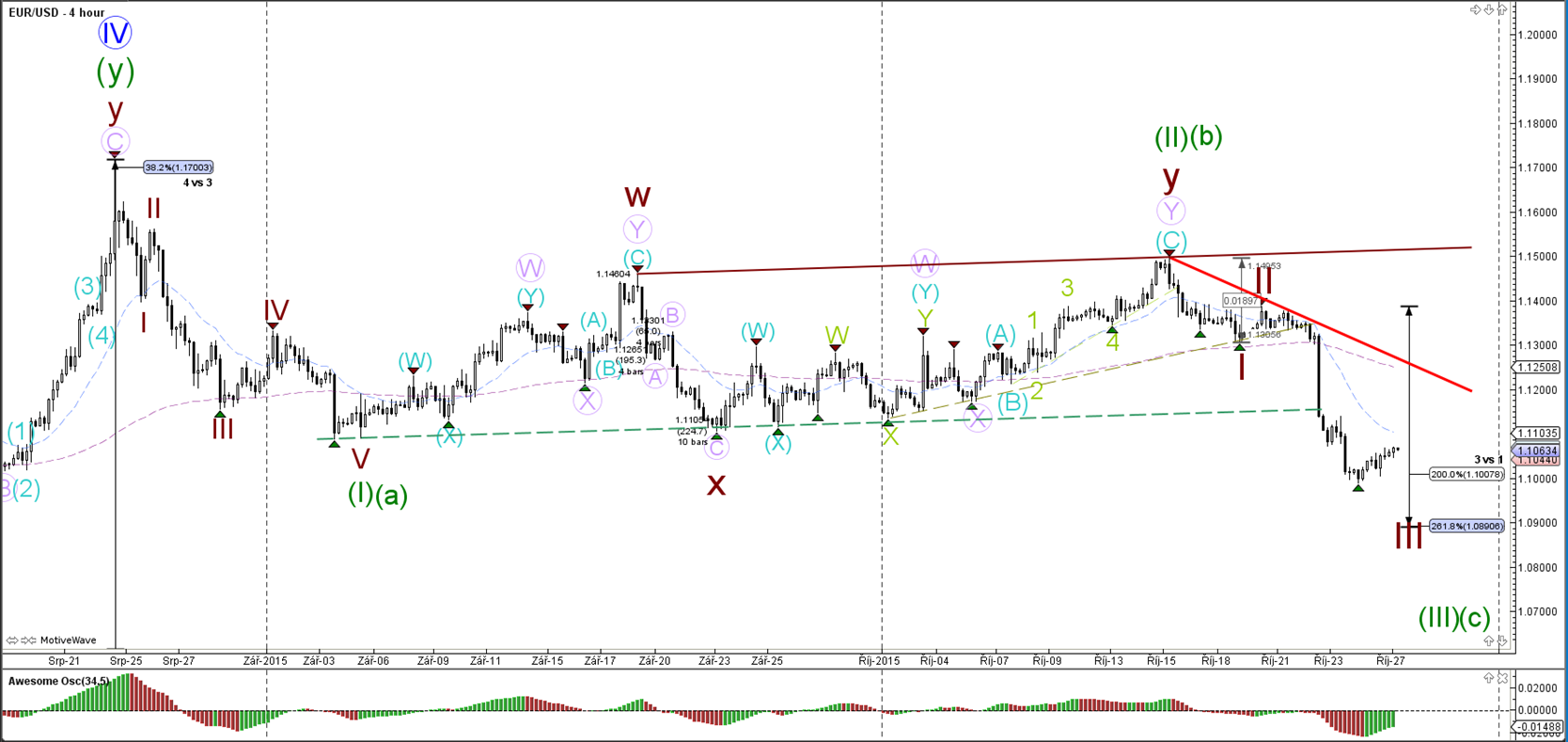

EUR/USD

4 hour

The EUR/USD has shown a deep pullback within the potential wave 2 (brown) up to the 88.6% Fibonacci retracement level. A break above the purple line invalidates the current wave 1-2 (brown) structure.

1 hour

The EUR/USD made one more bullish push yesterday which could be explained by a wave 4 and 5 (green). Currently there is a rising wedge (red/green lines) chart pattern taking place on the 1 hour chart, which is most often a reversal signal. A break of the various support levels confirms the bearish potential, whereas a break above resistance invalidates the wave 2 (brown).

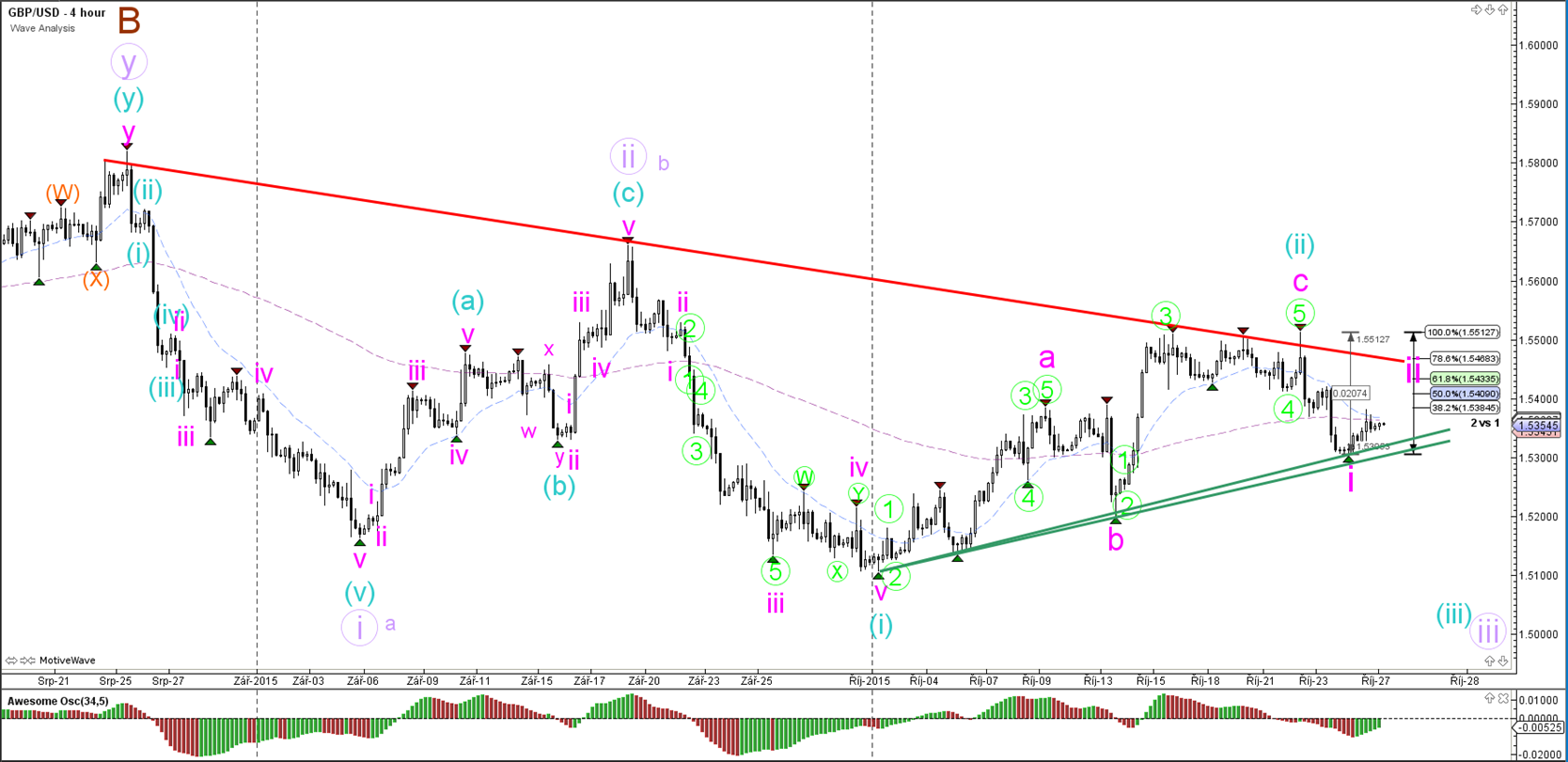

GBP/USD

4 hour

The GBP/USD posted a deep bearish retracement yesterday down to the 78.6% Fibonacci retracement level. A break below the support trend line (green) invalidates the wave B (green) and indicates that wave 2 (orange) has been most likely completed at the recent top (where wave A is now).

1 hour

The GBP/USD bounced at support (green) and price could have space up to the 100% Fibonacci target if price manages to break above the 61.8% Fibonacci target and then top (red).

USD/JPY

4 hour

The USD/JPY remains very choppy and price action has significantly slowed down.

“Original analysis is provided by Admiral Markets”