Admiral Markets

AdmiralMarkets.com Representative

- Messages

- 95

Impact of FED’s Rate Hike on Forex Market

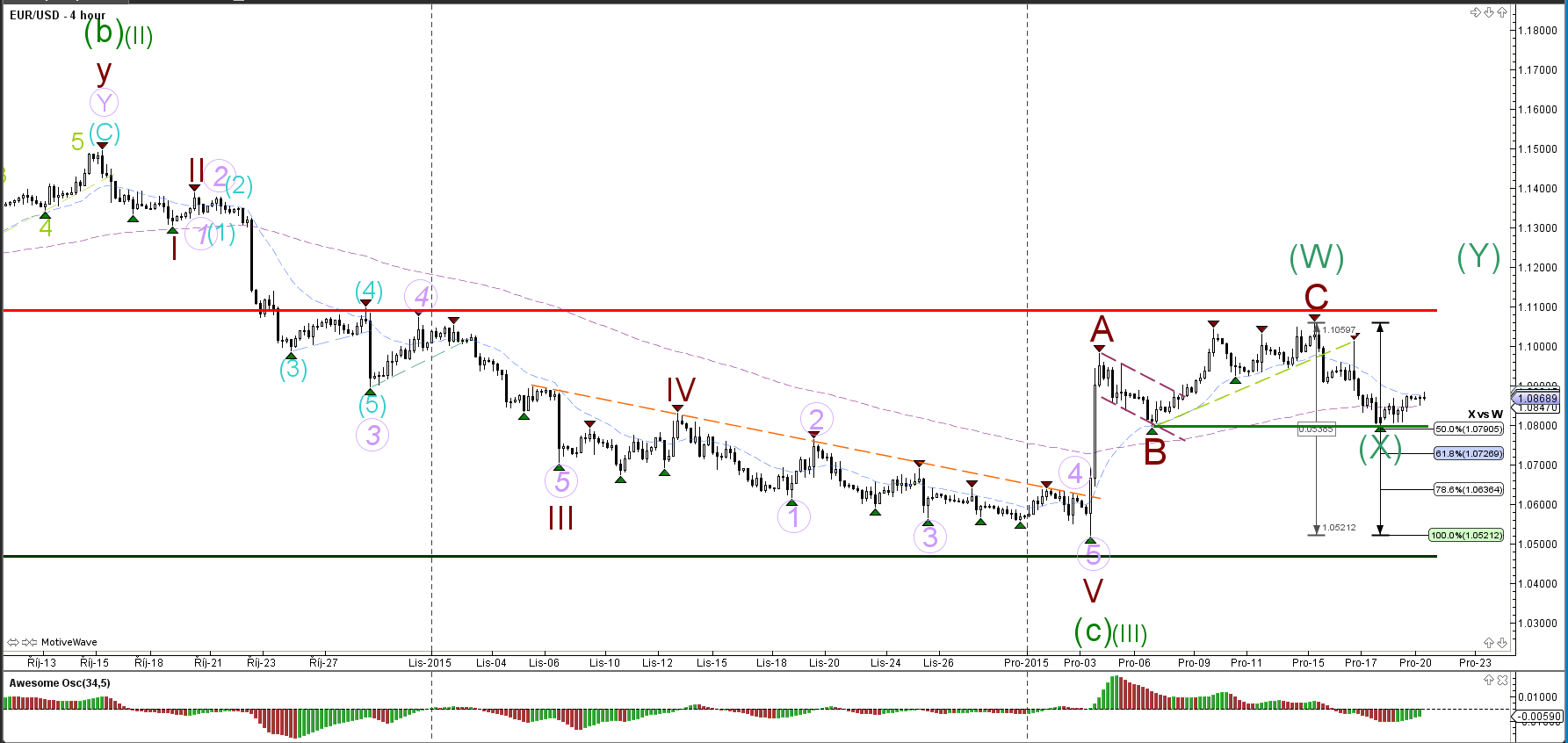

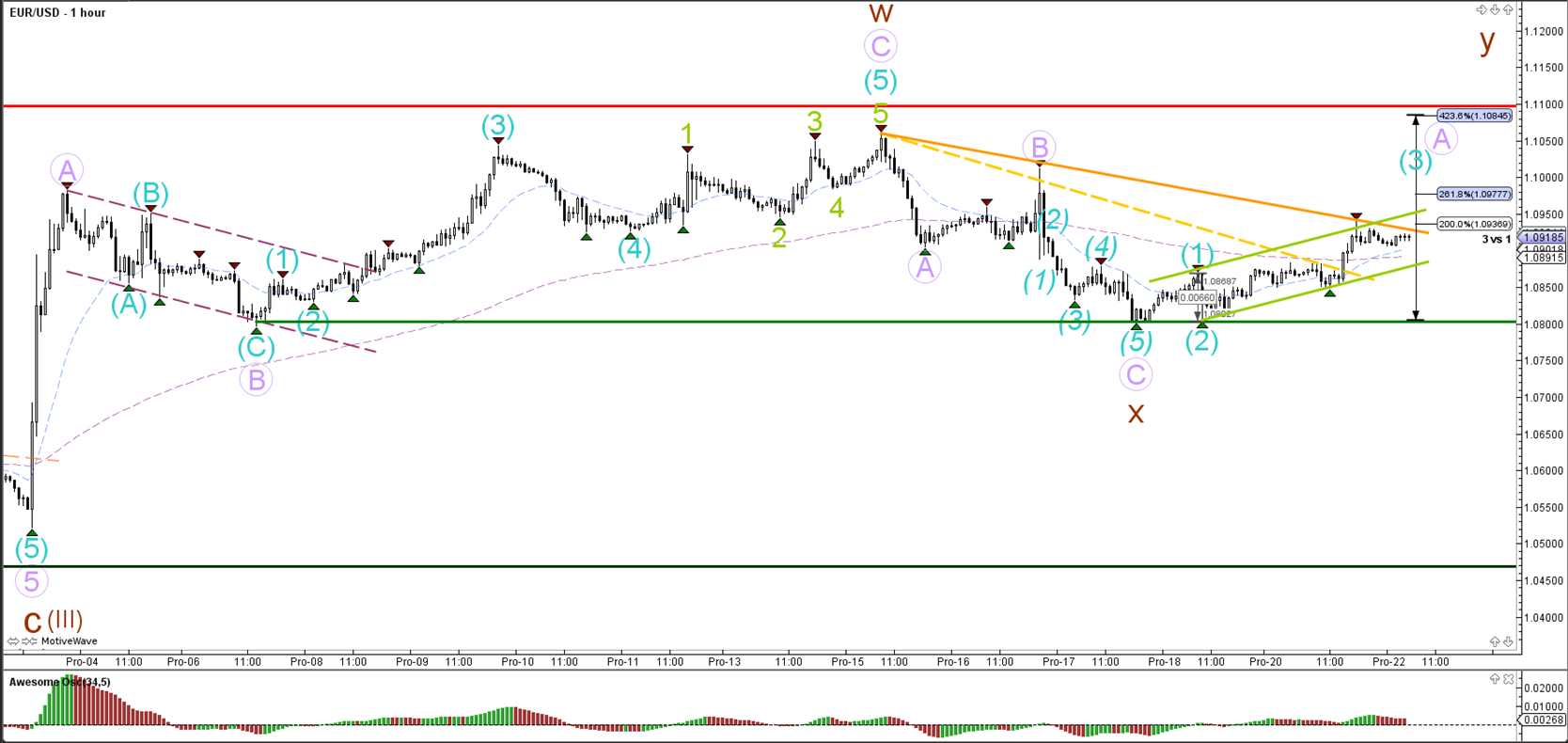

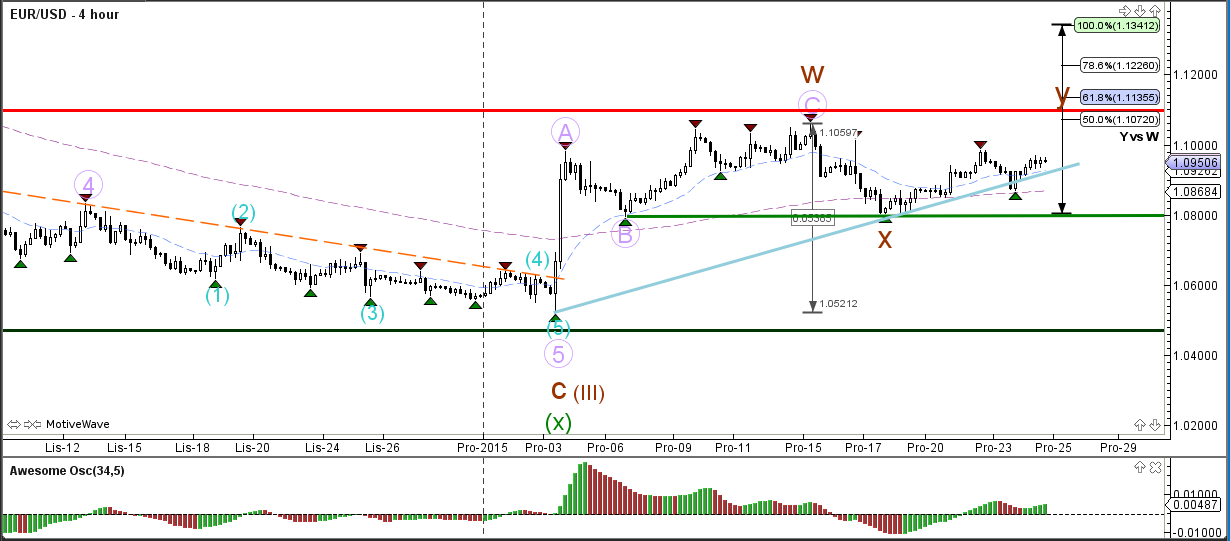

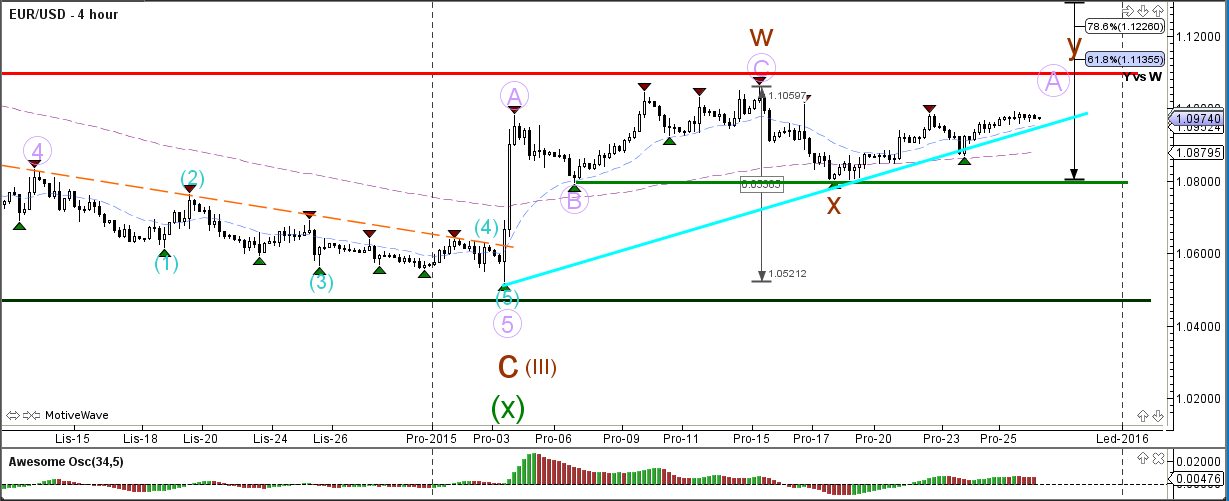

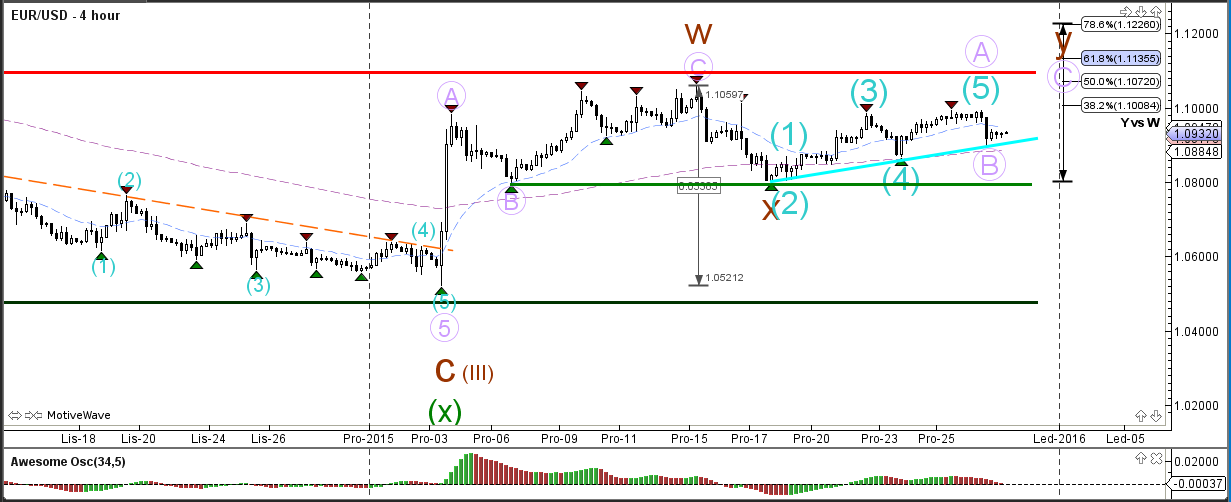

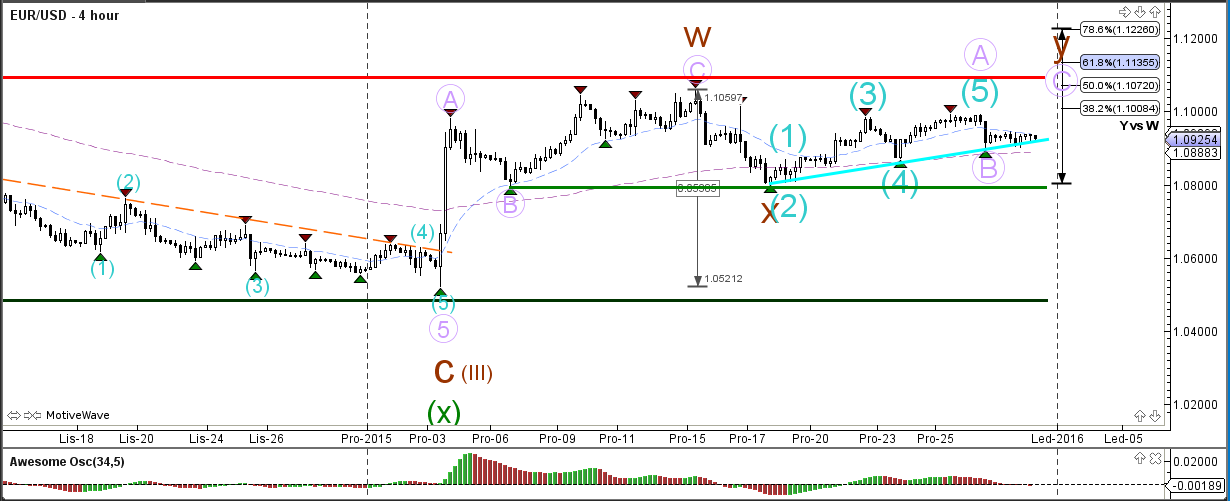

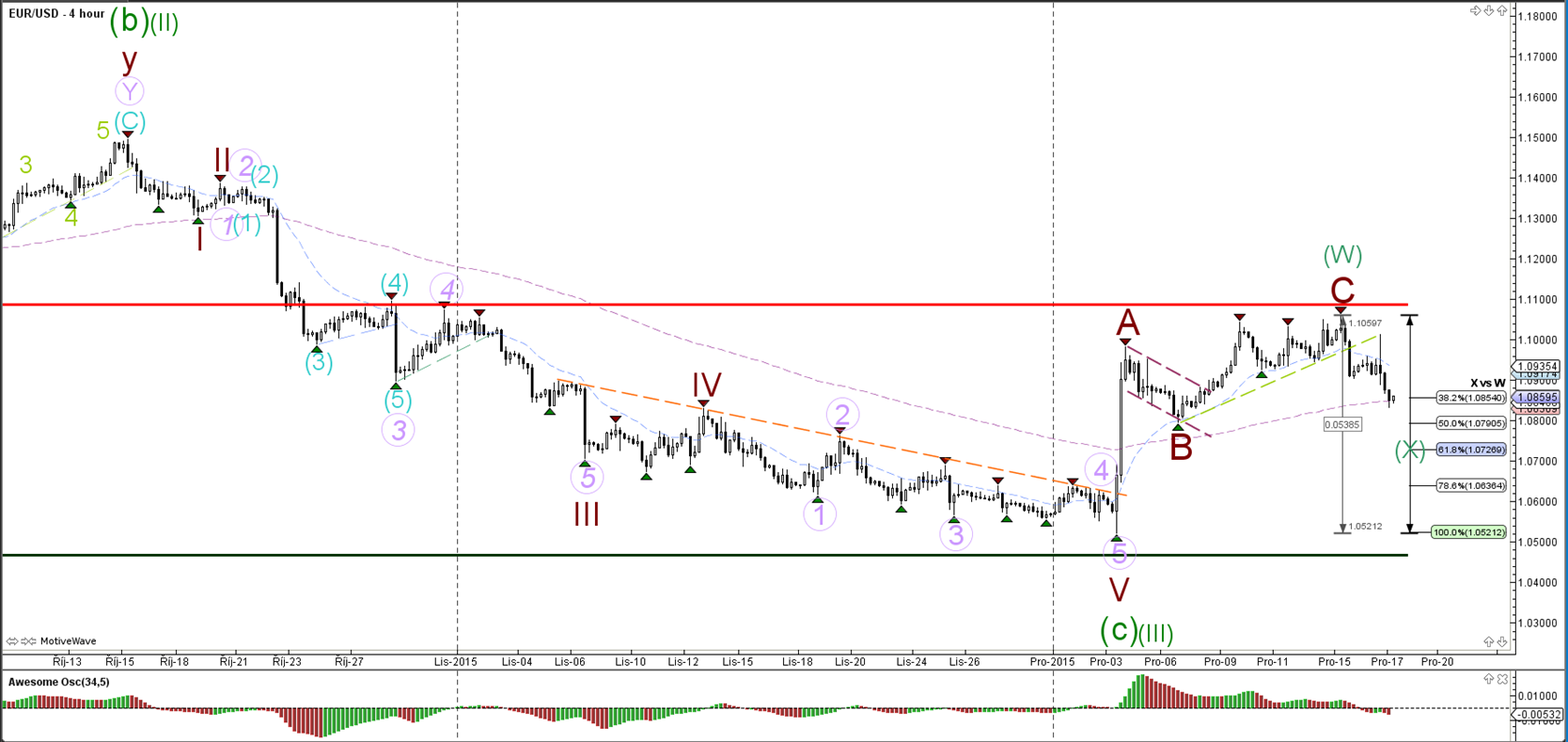

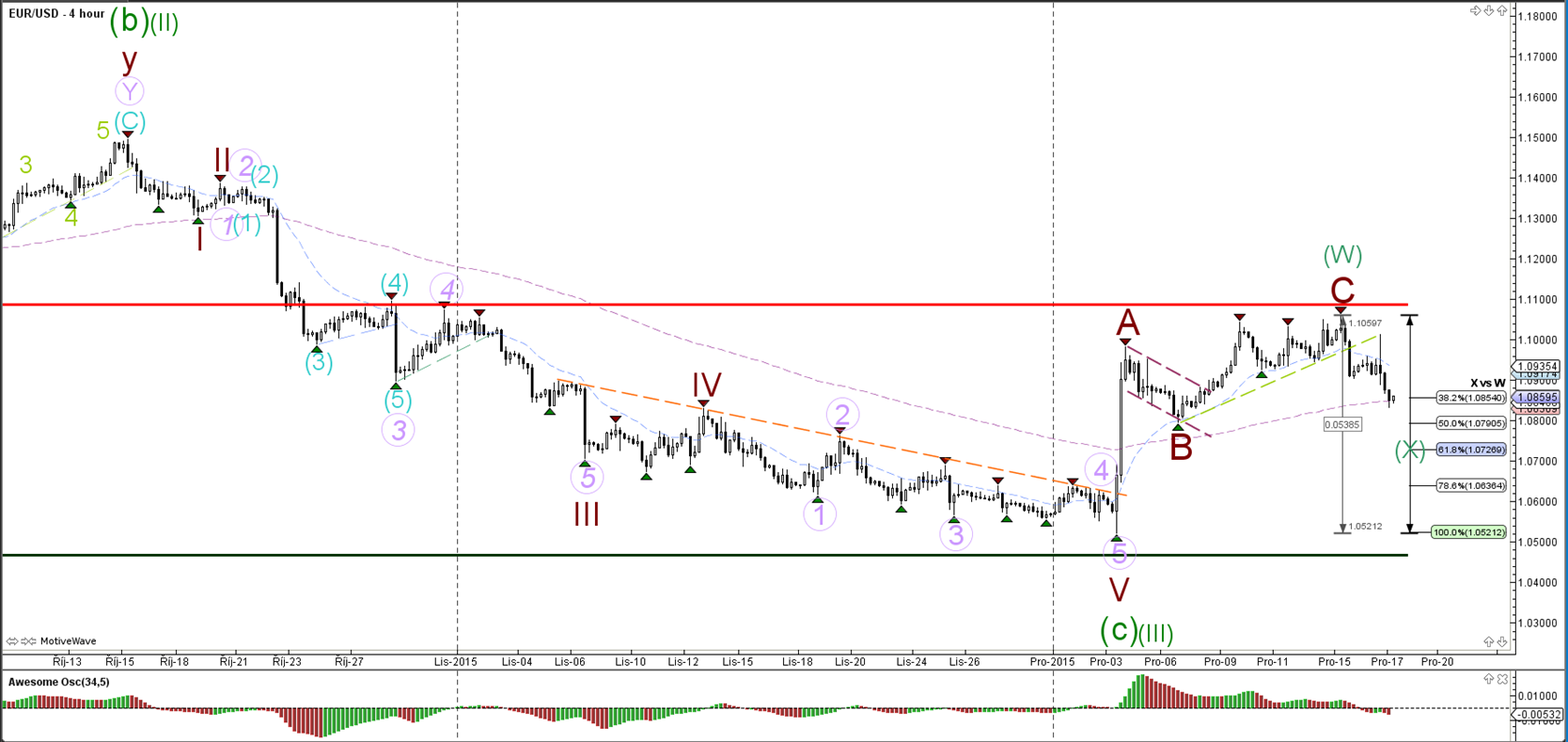

EUR/USD

4 hour

The FED's decision to increase interest rates in the US caused lots of volatility in the market. The EUR/USD moved lower eventually during the news but price is still far away from the current year low. For the moment I am not expecting price to break below this year's low (green line) and hence the wave count is now showing a wave X retracement (green).

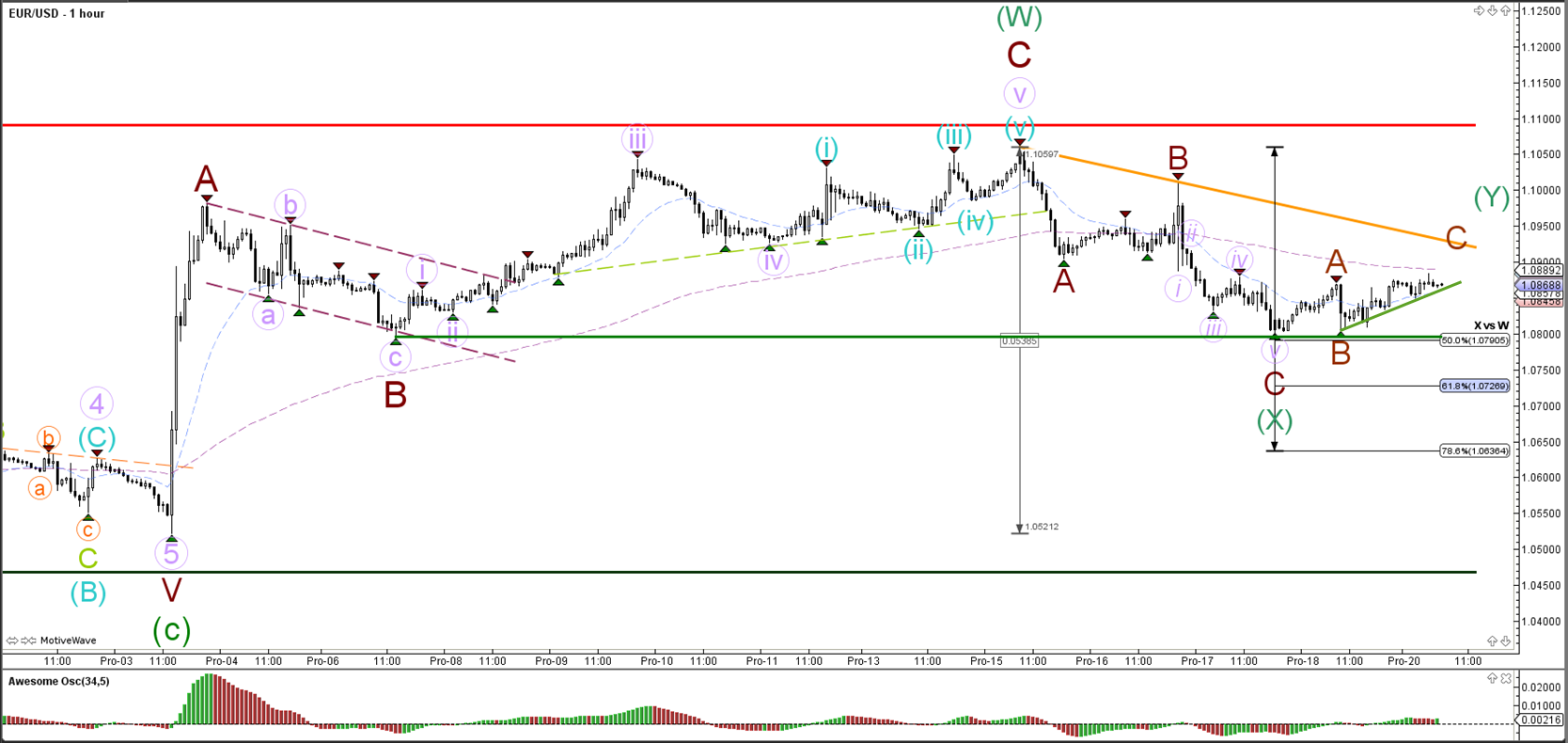

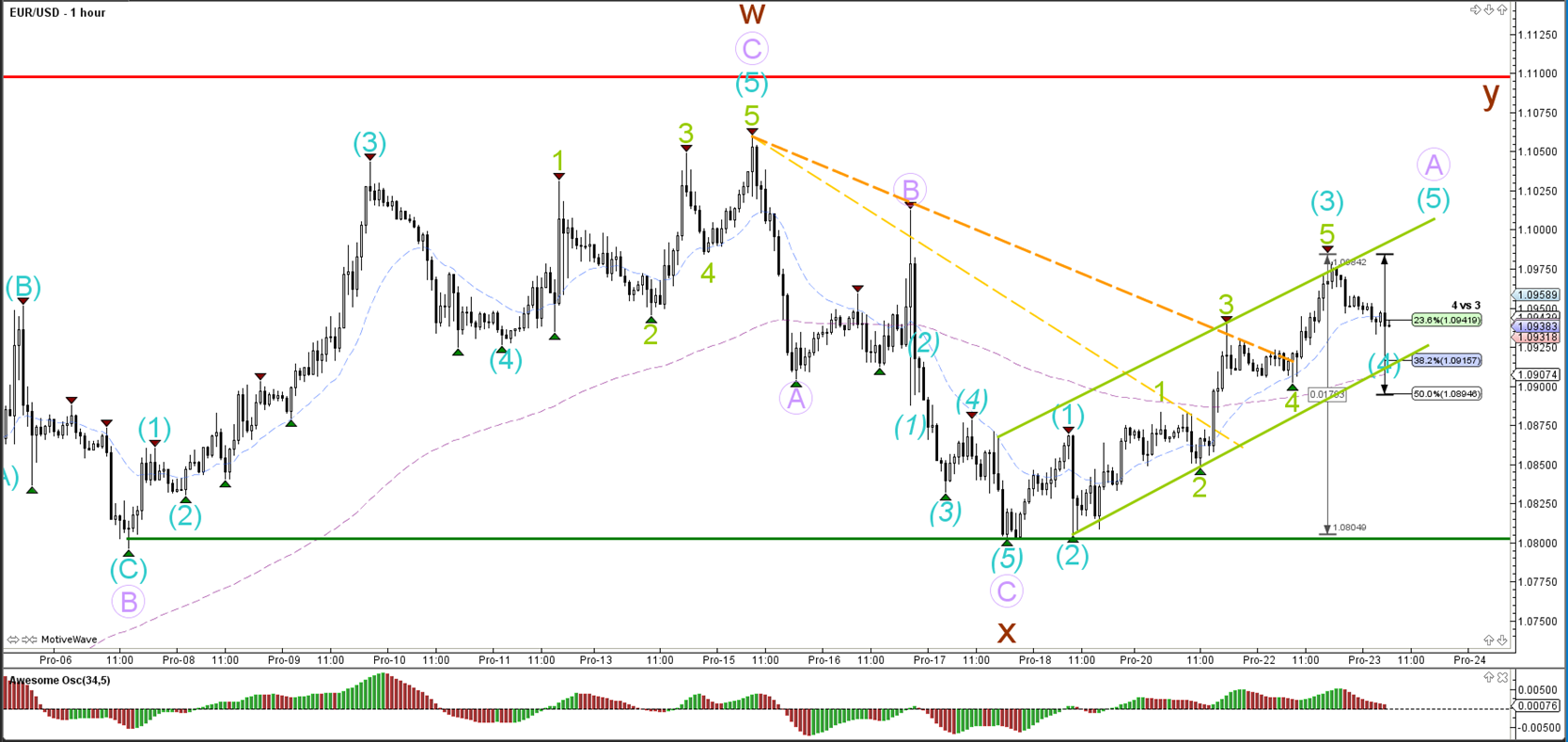

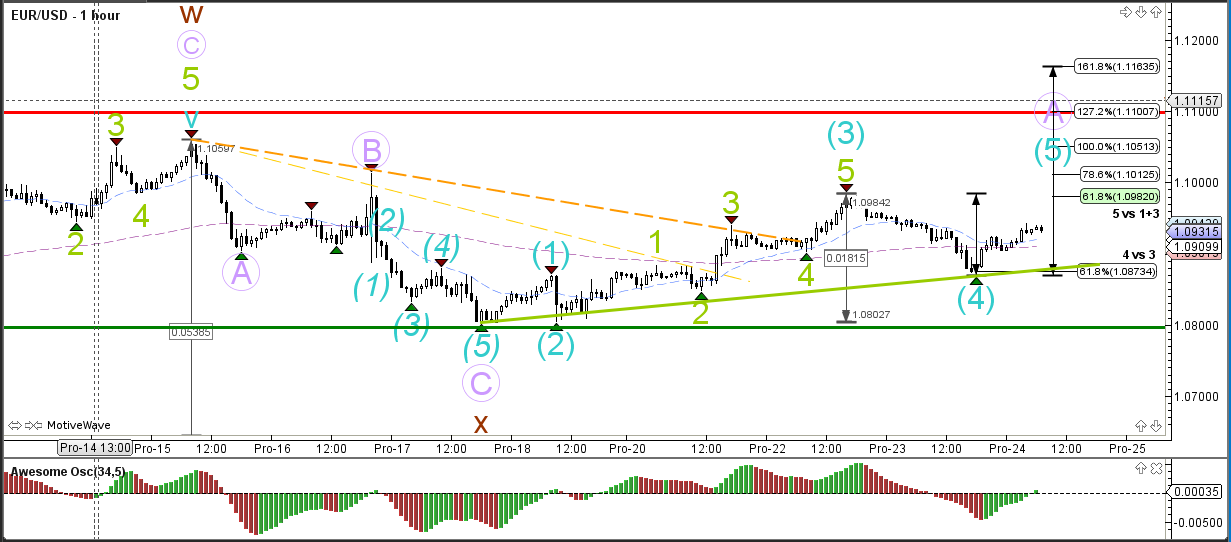

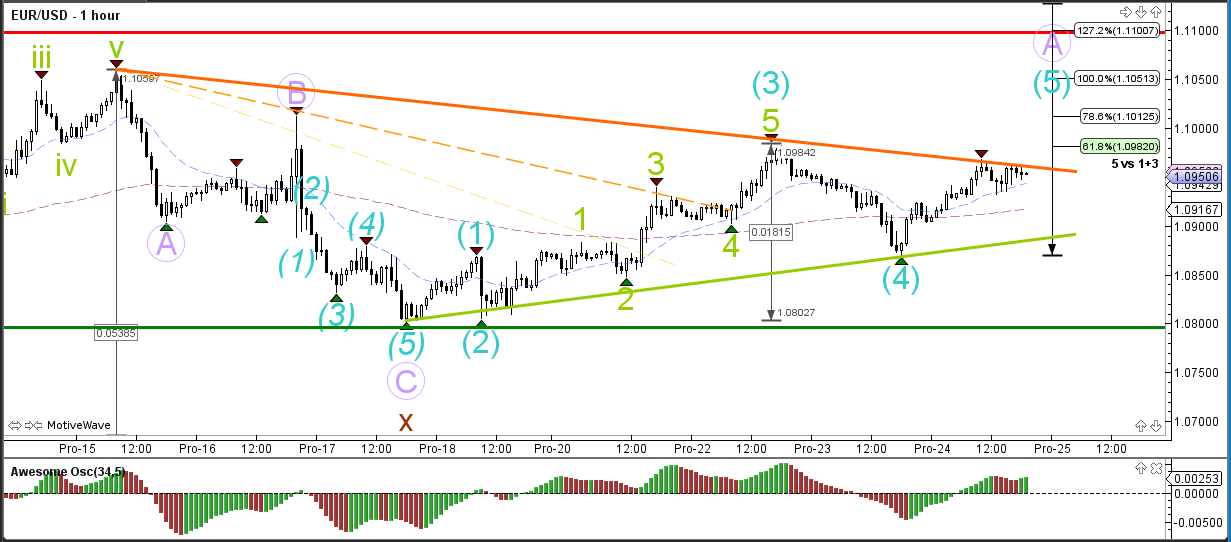

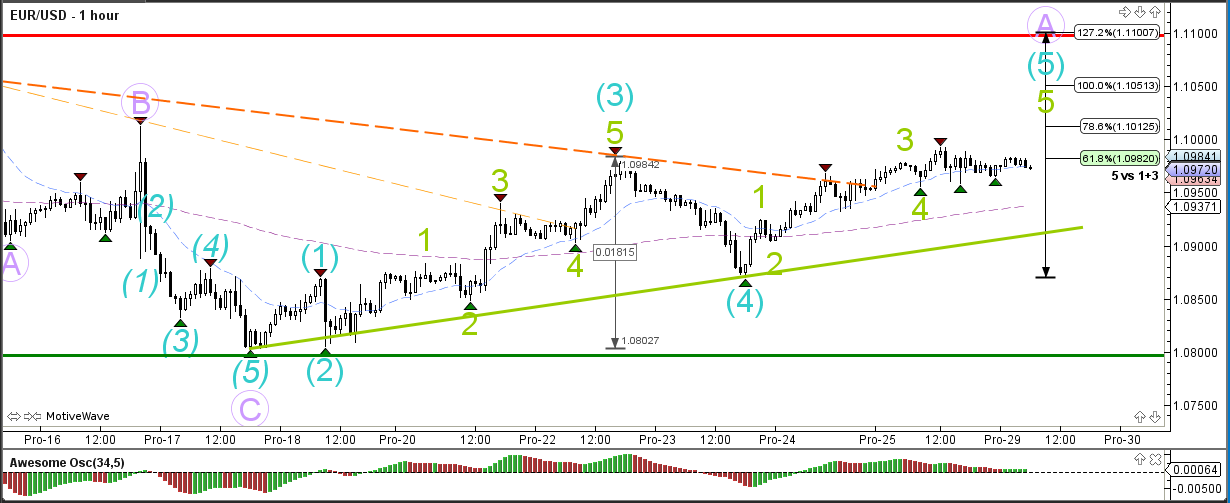

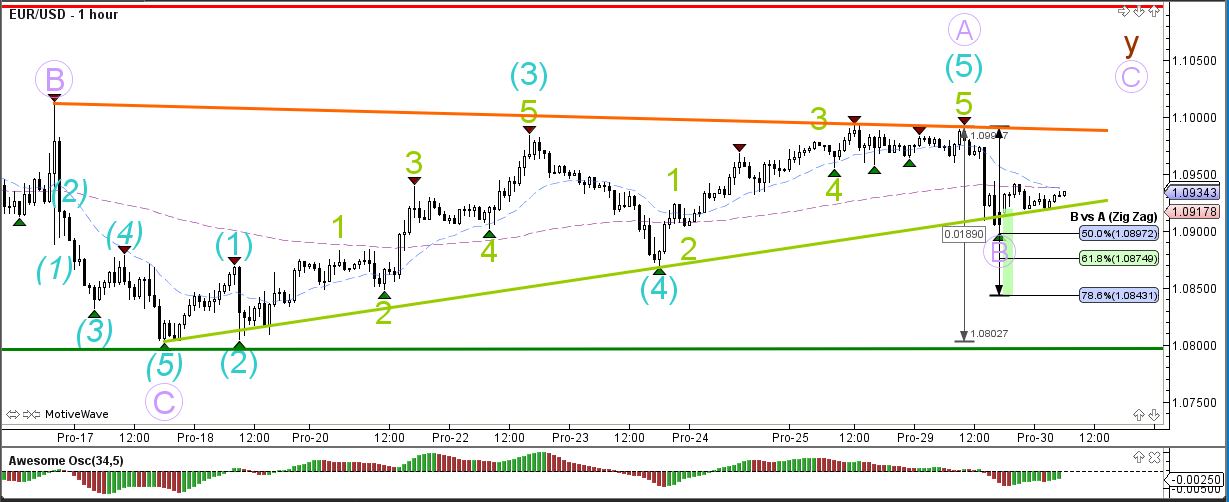

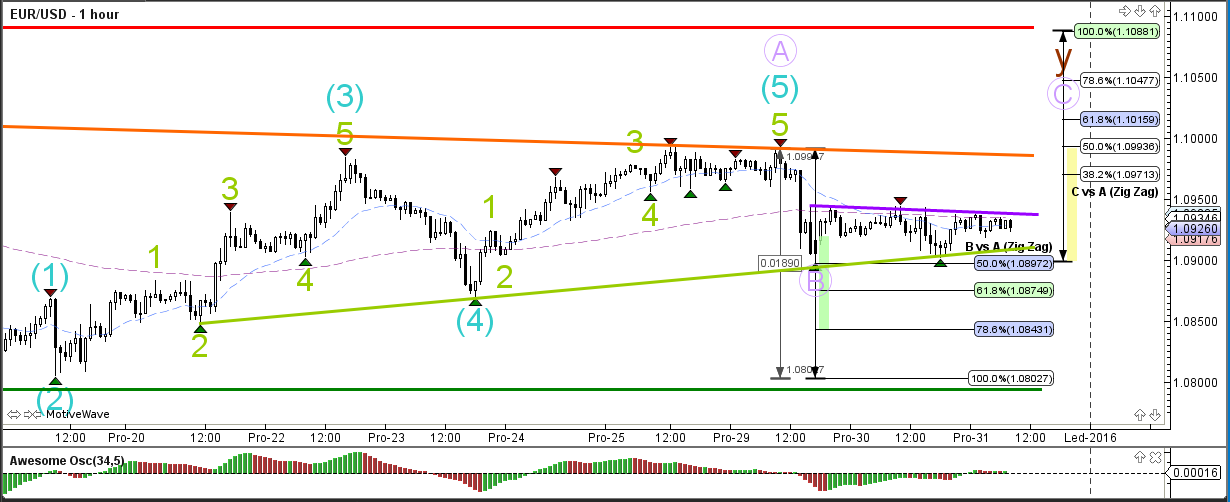

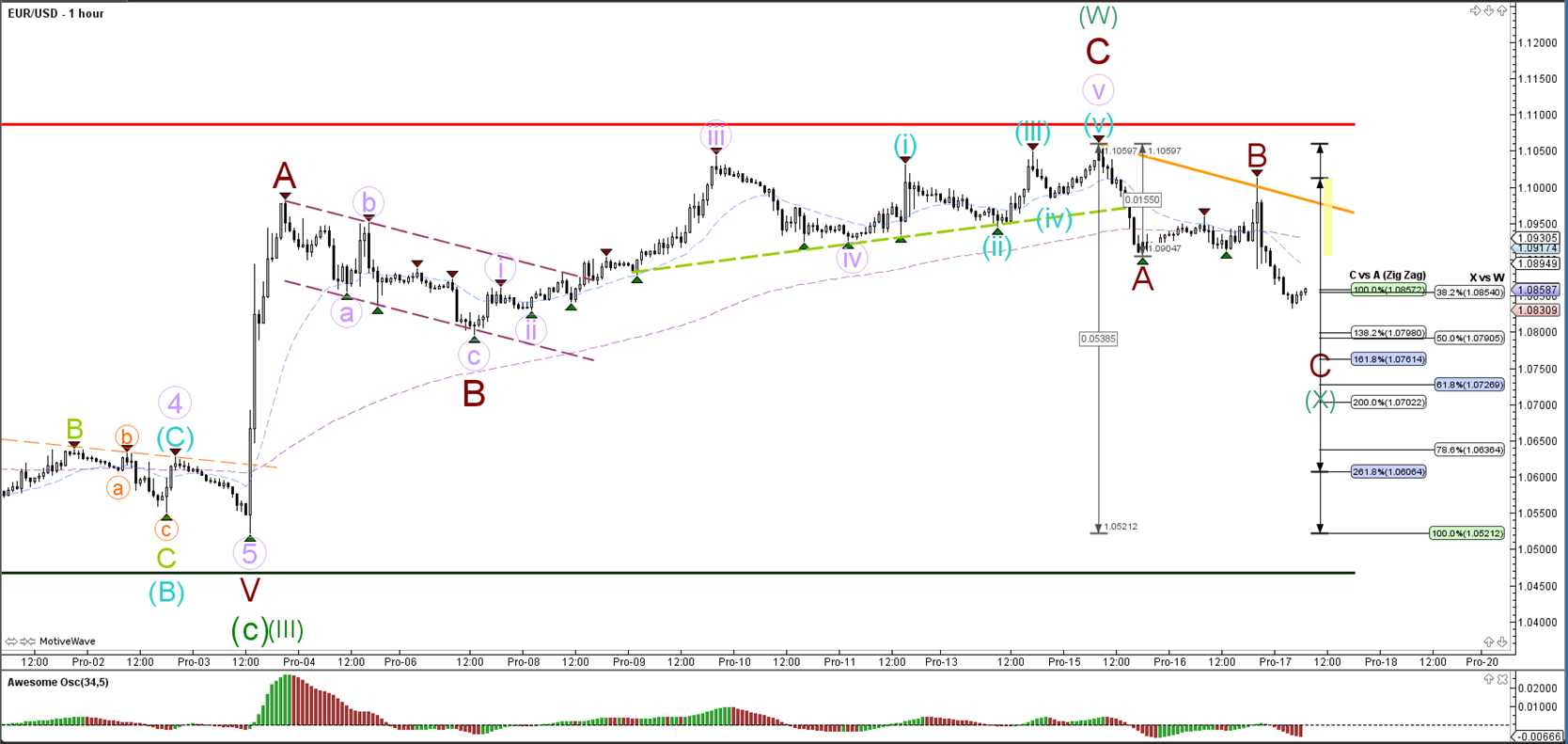

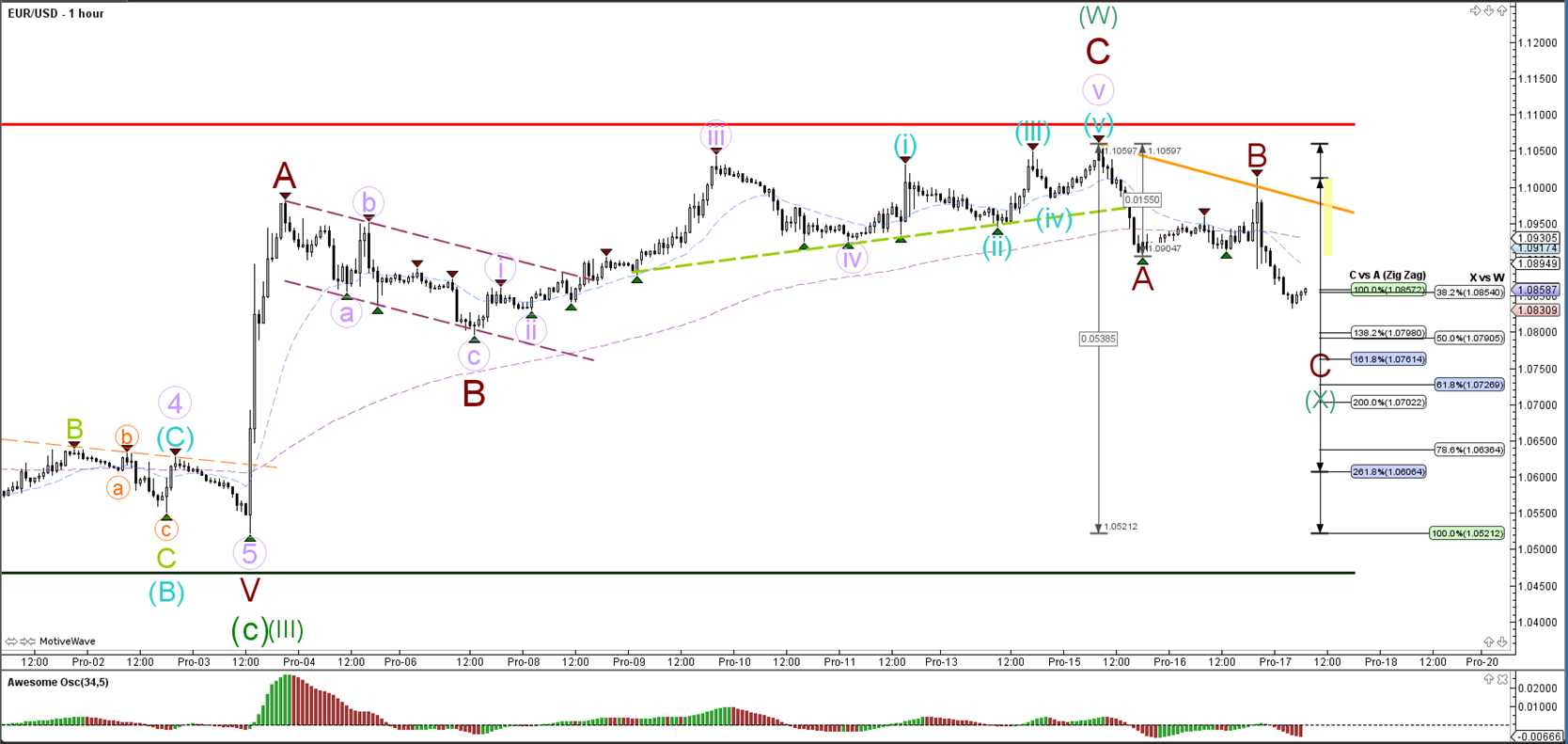

1 hour

The EUR/USD bearish price action has been slow and therefore the wave count is showing an ABC zigzag rather than a 123 (brown).

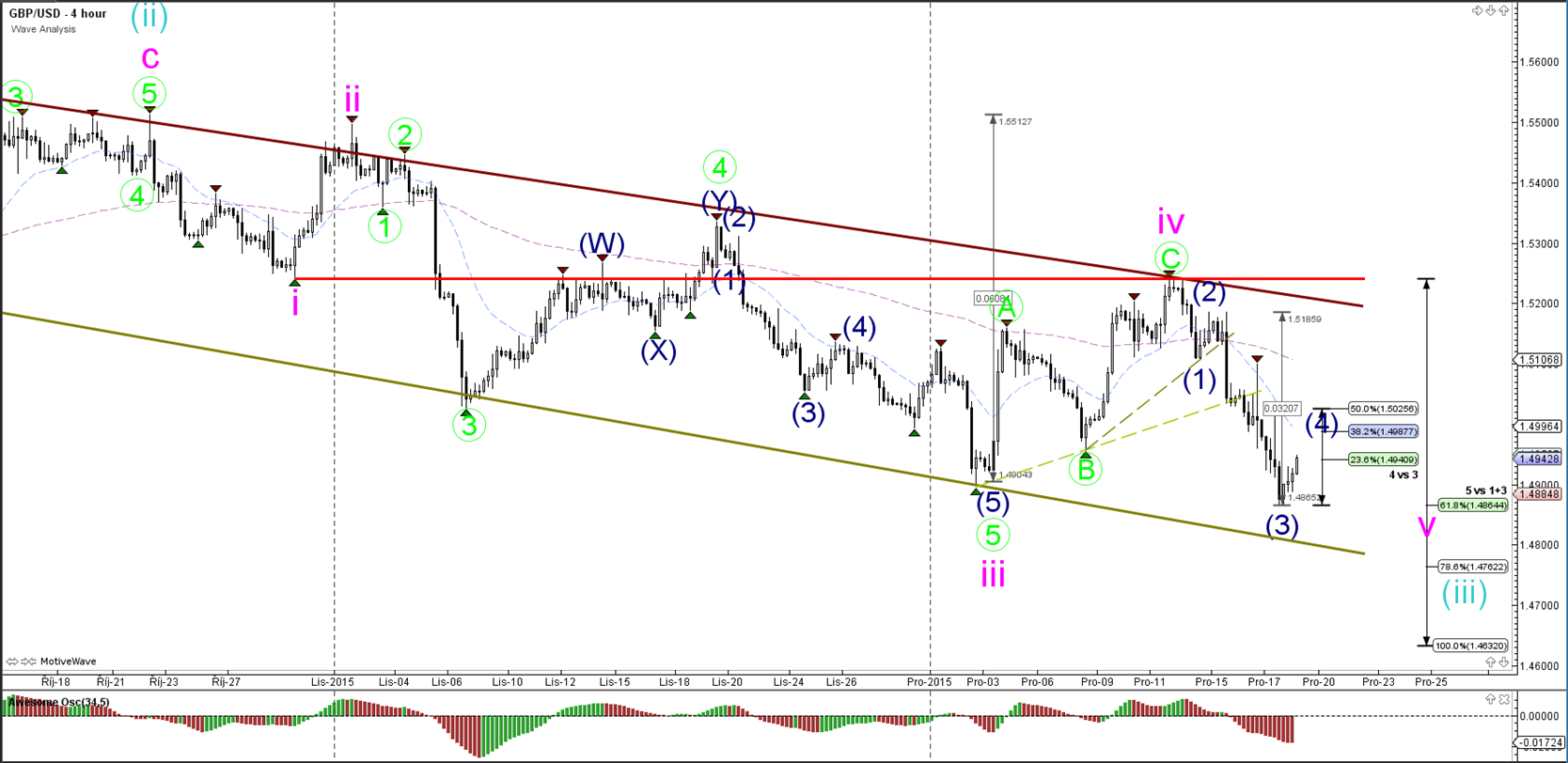

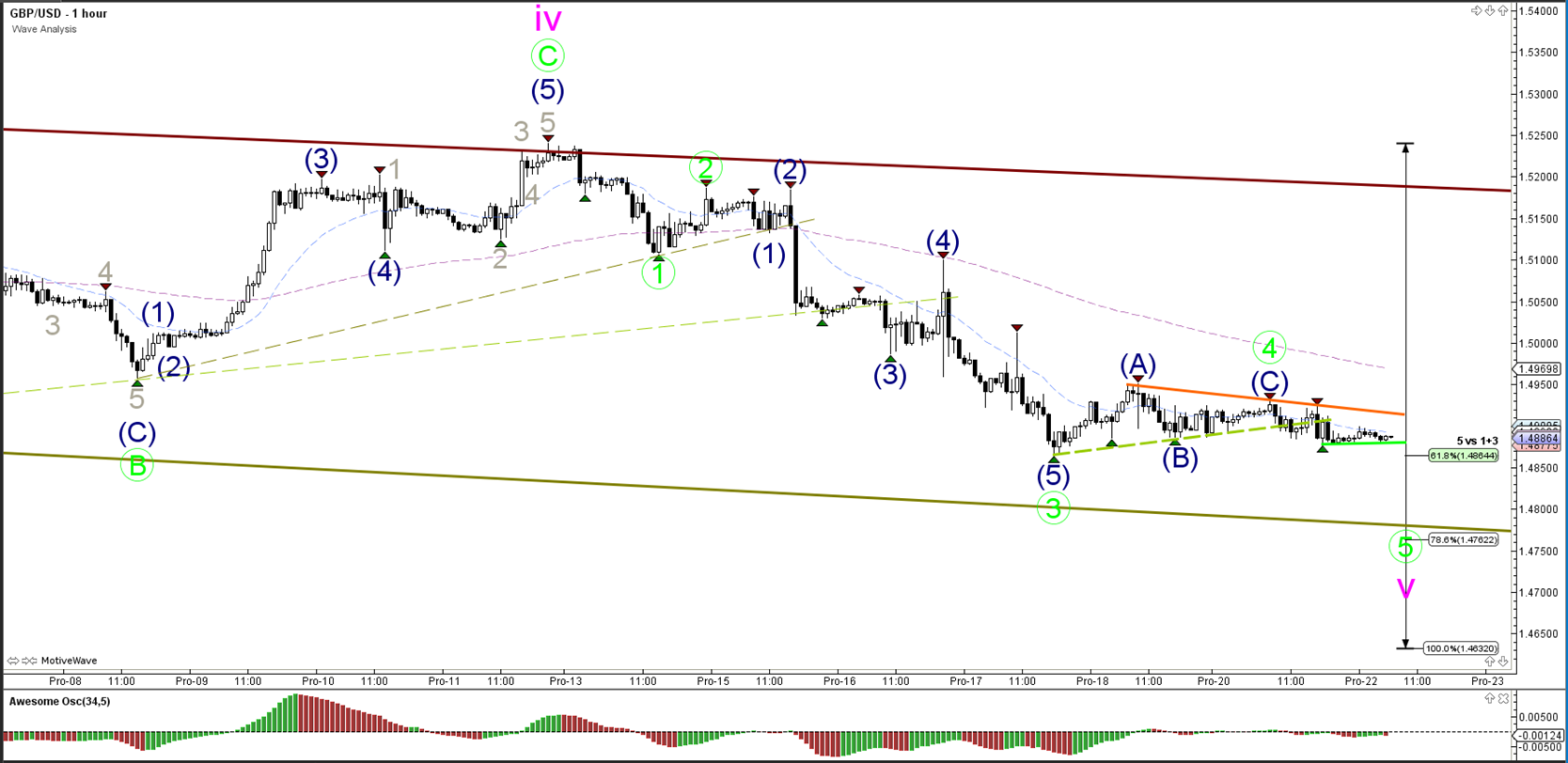

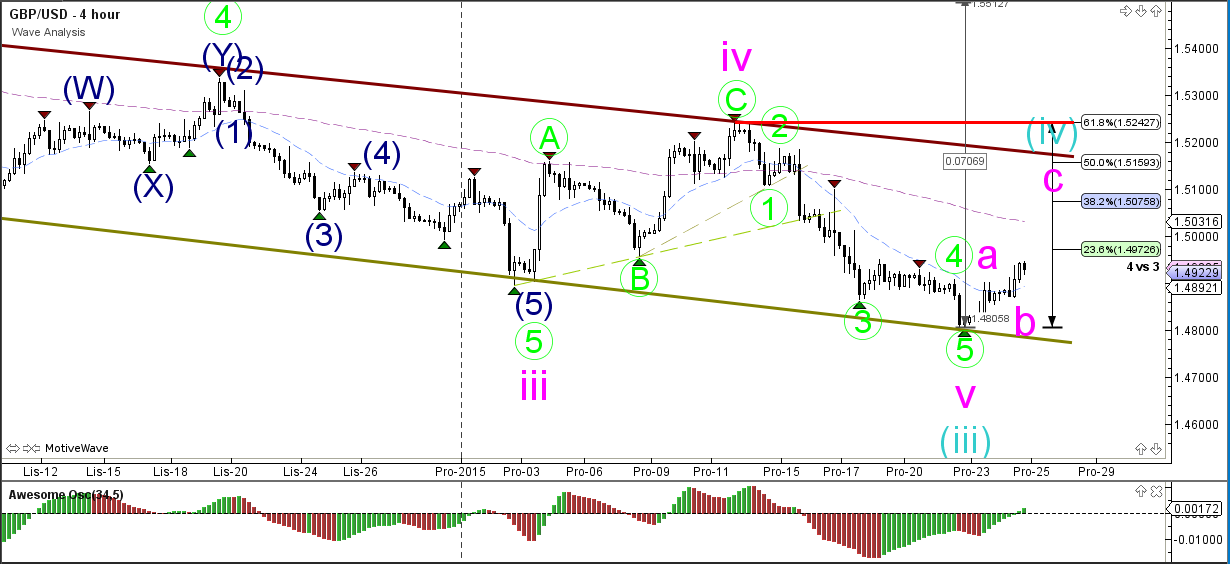

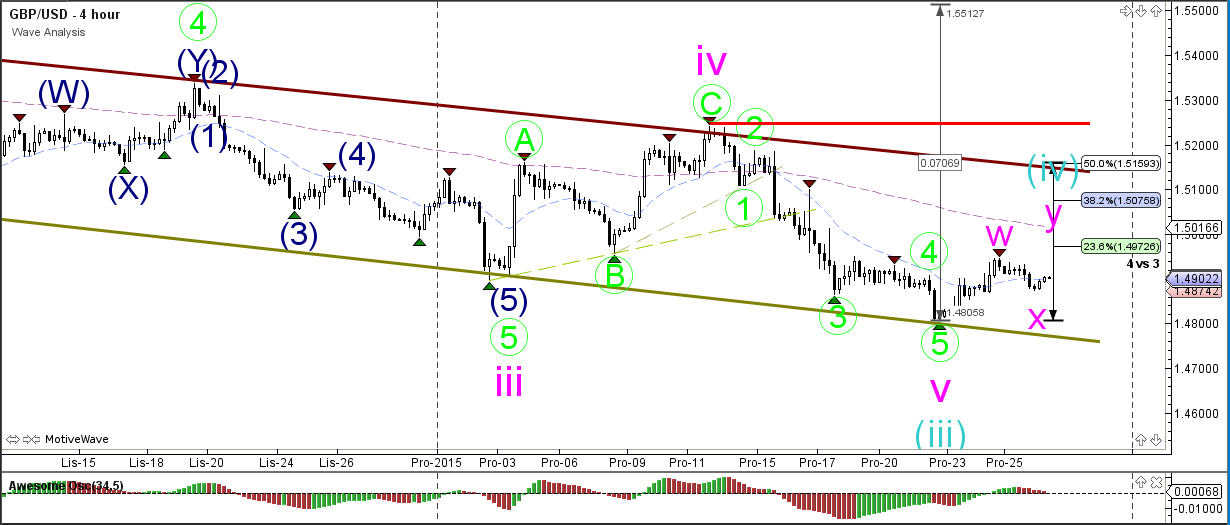

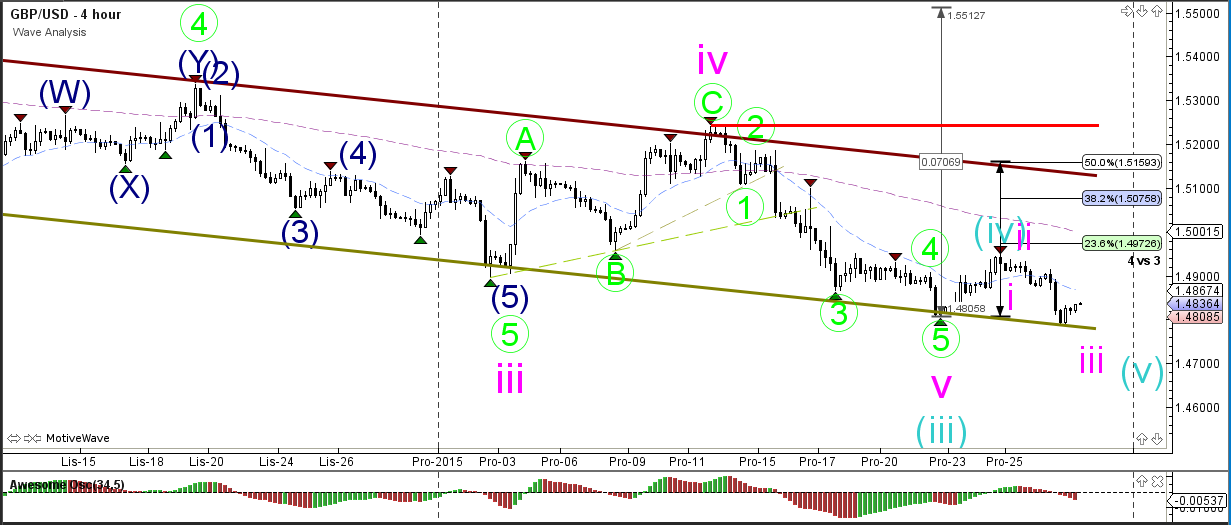

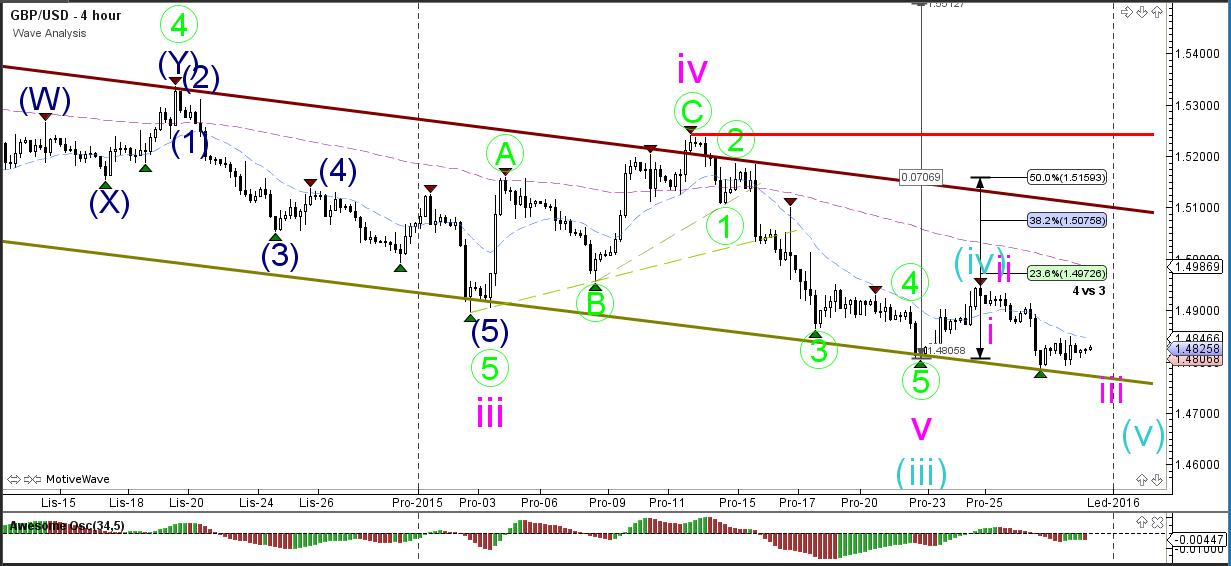

GBP/USD

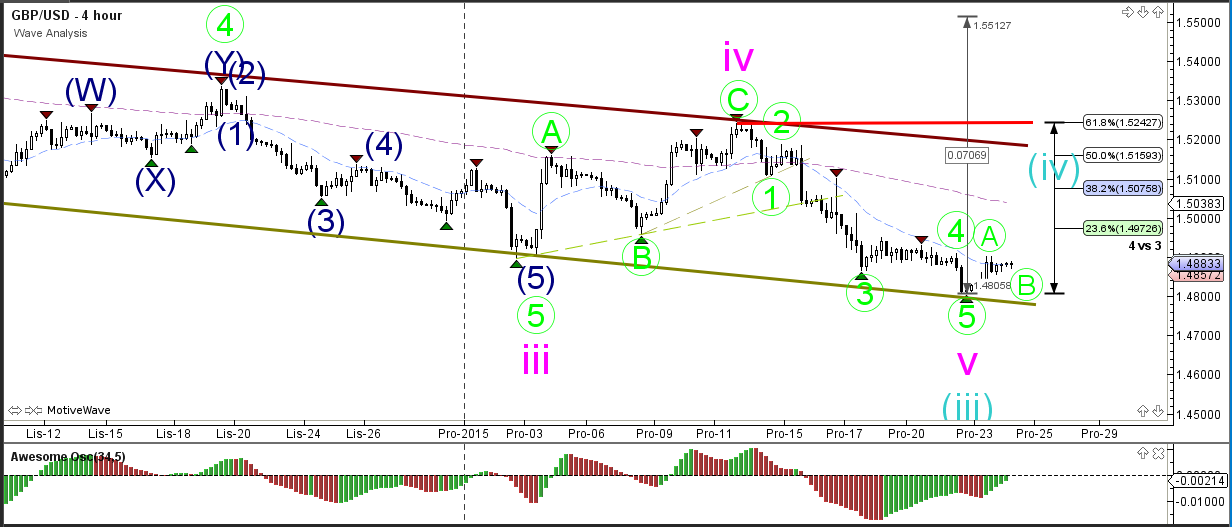

4 hour

The FED's decision to increase interest rates in the US caused lots of volatility in the market but the GBP/USD has managed to make a bearish turn at the top of the channel and is now breaking below support within the downtrend channel.

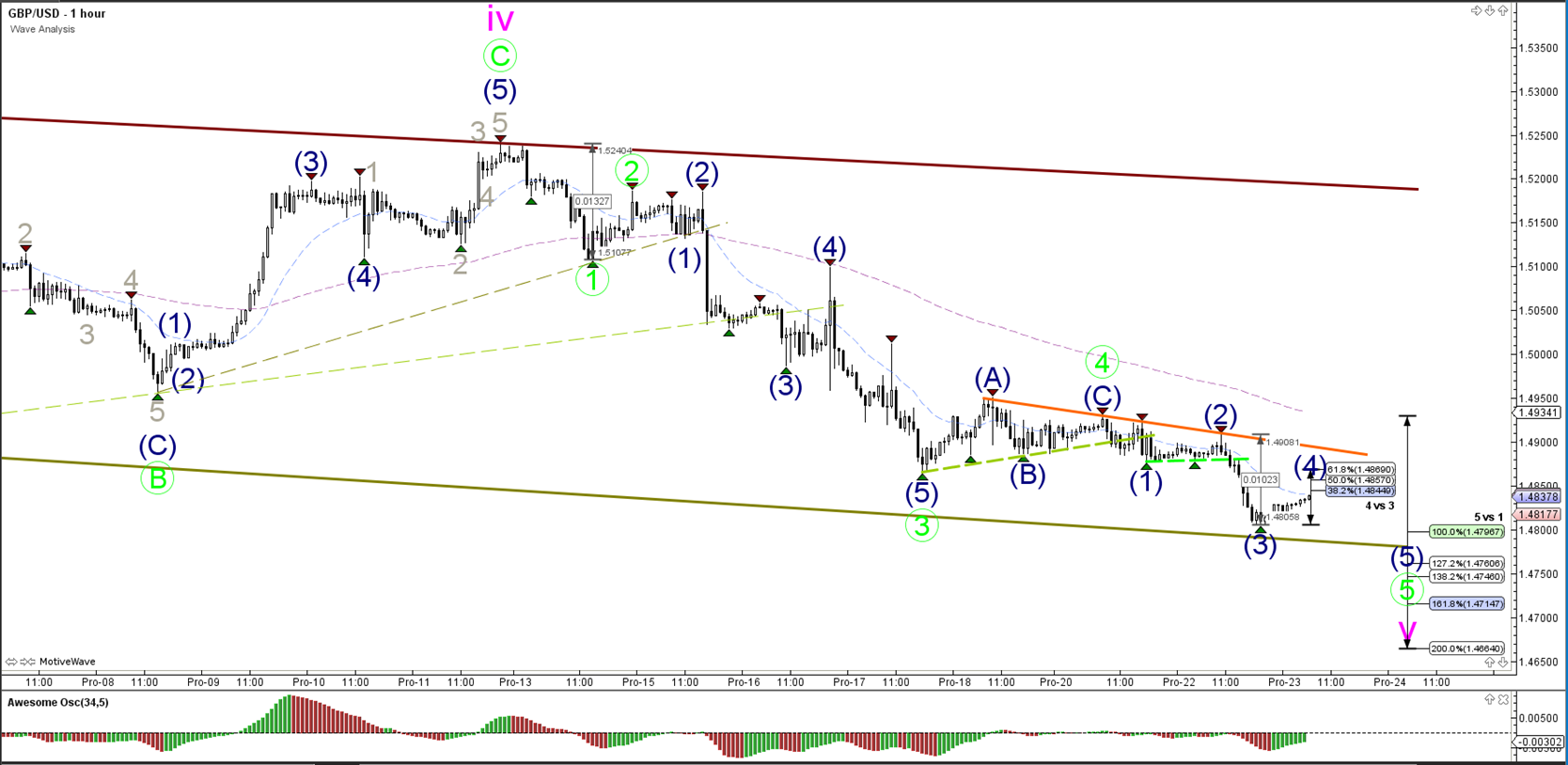

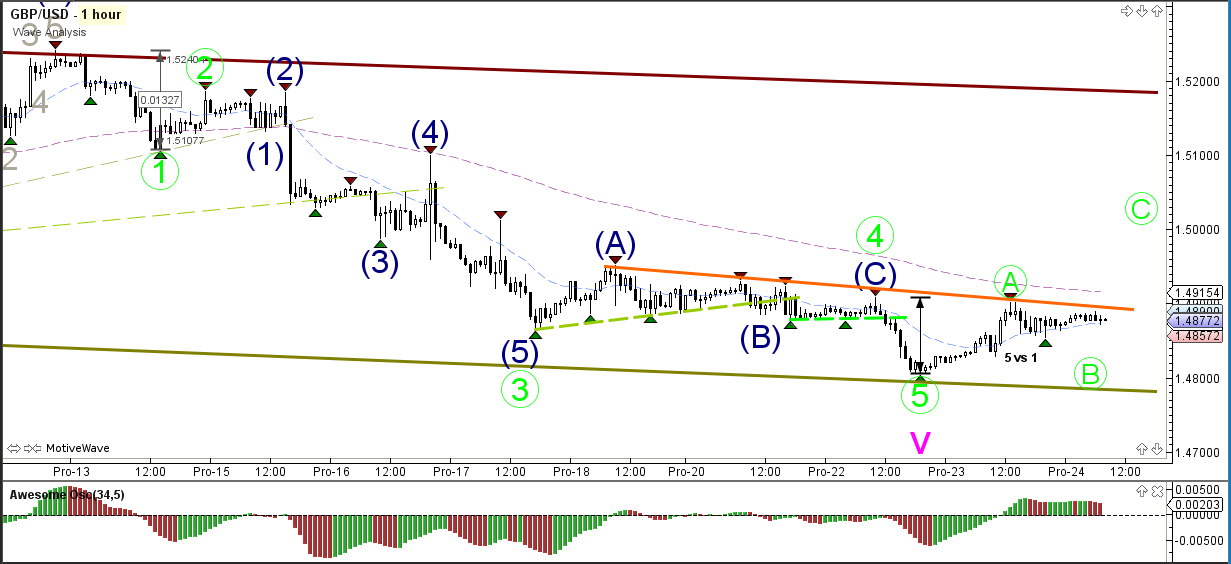

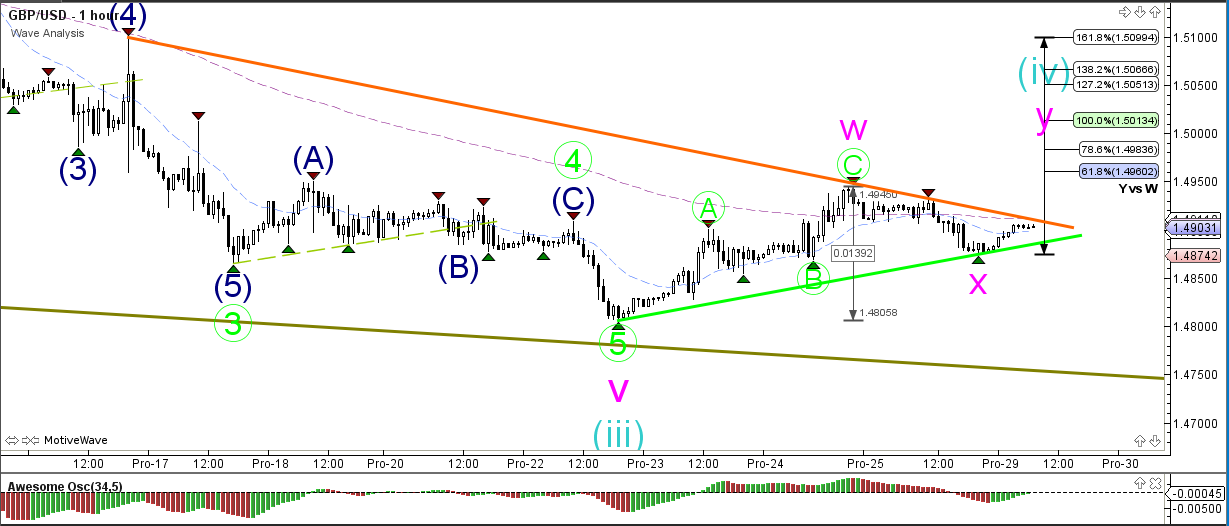

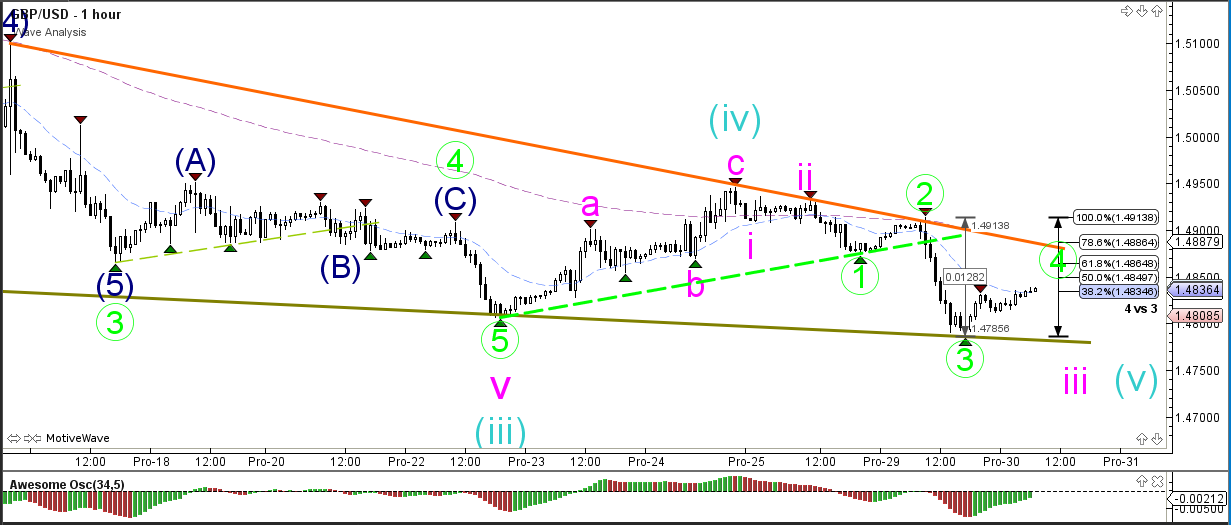

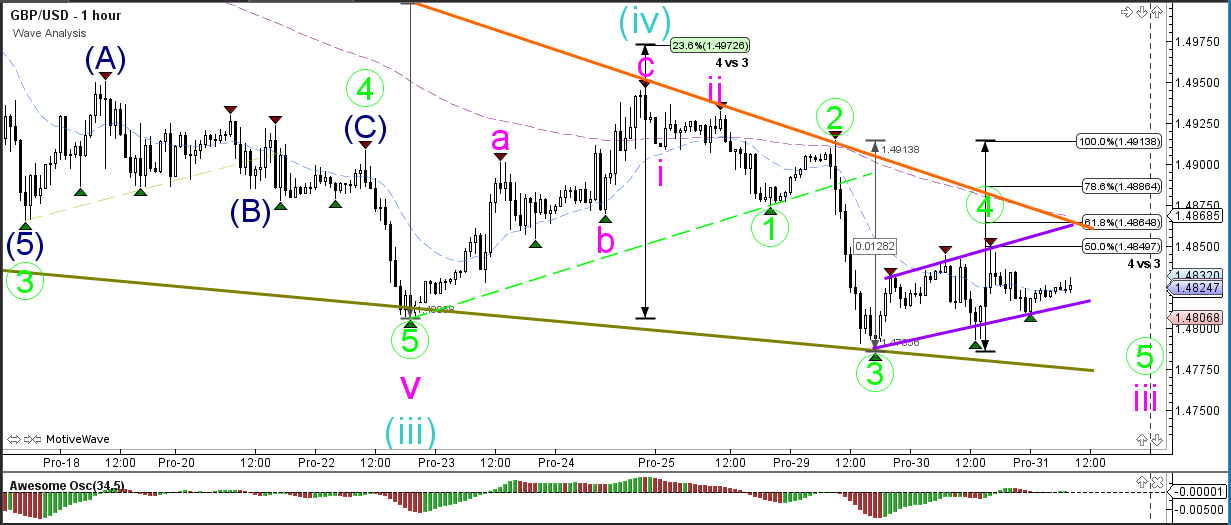

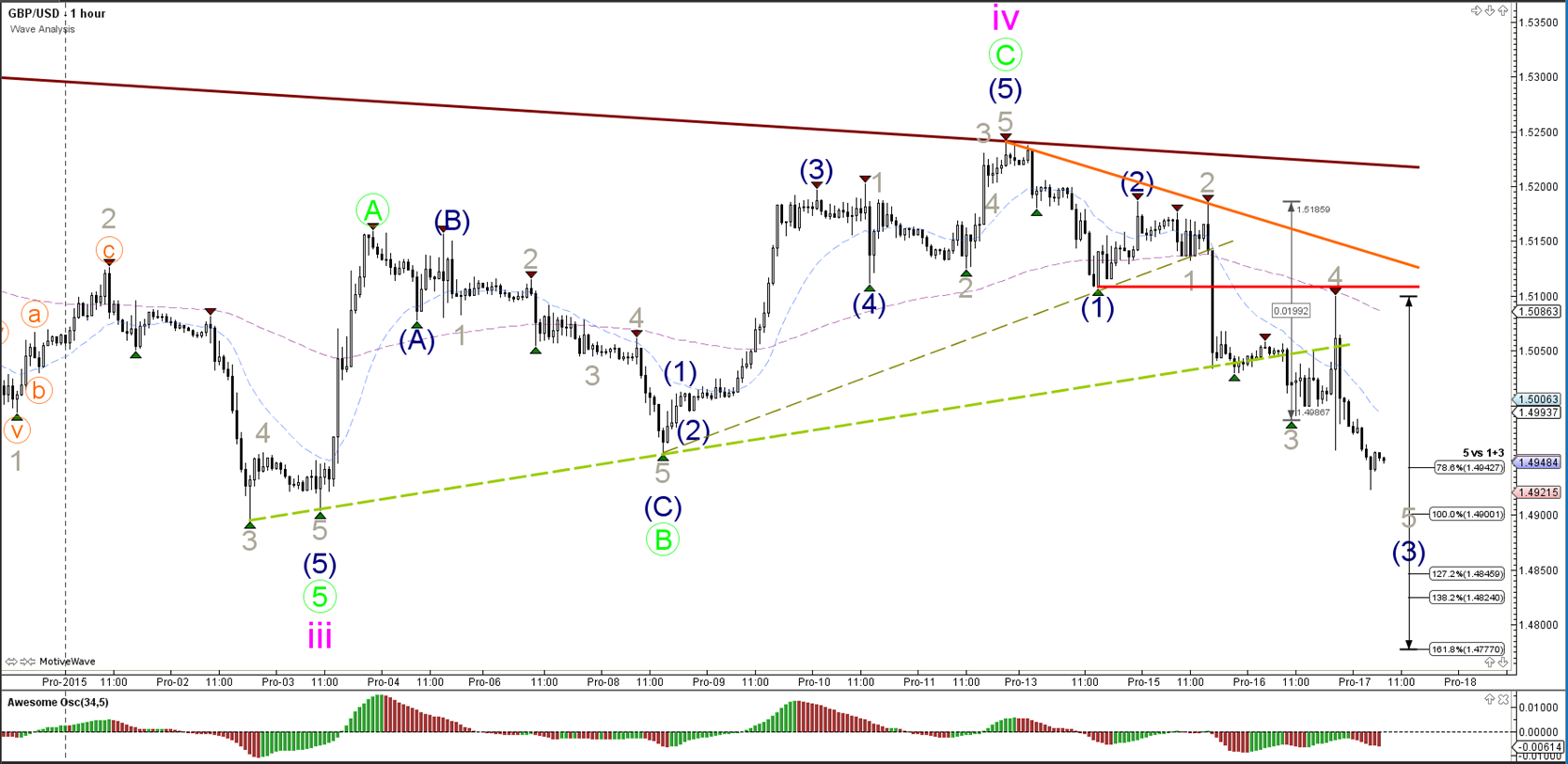

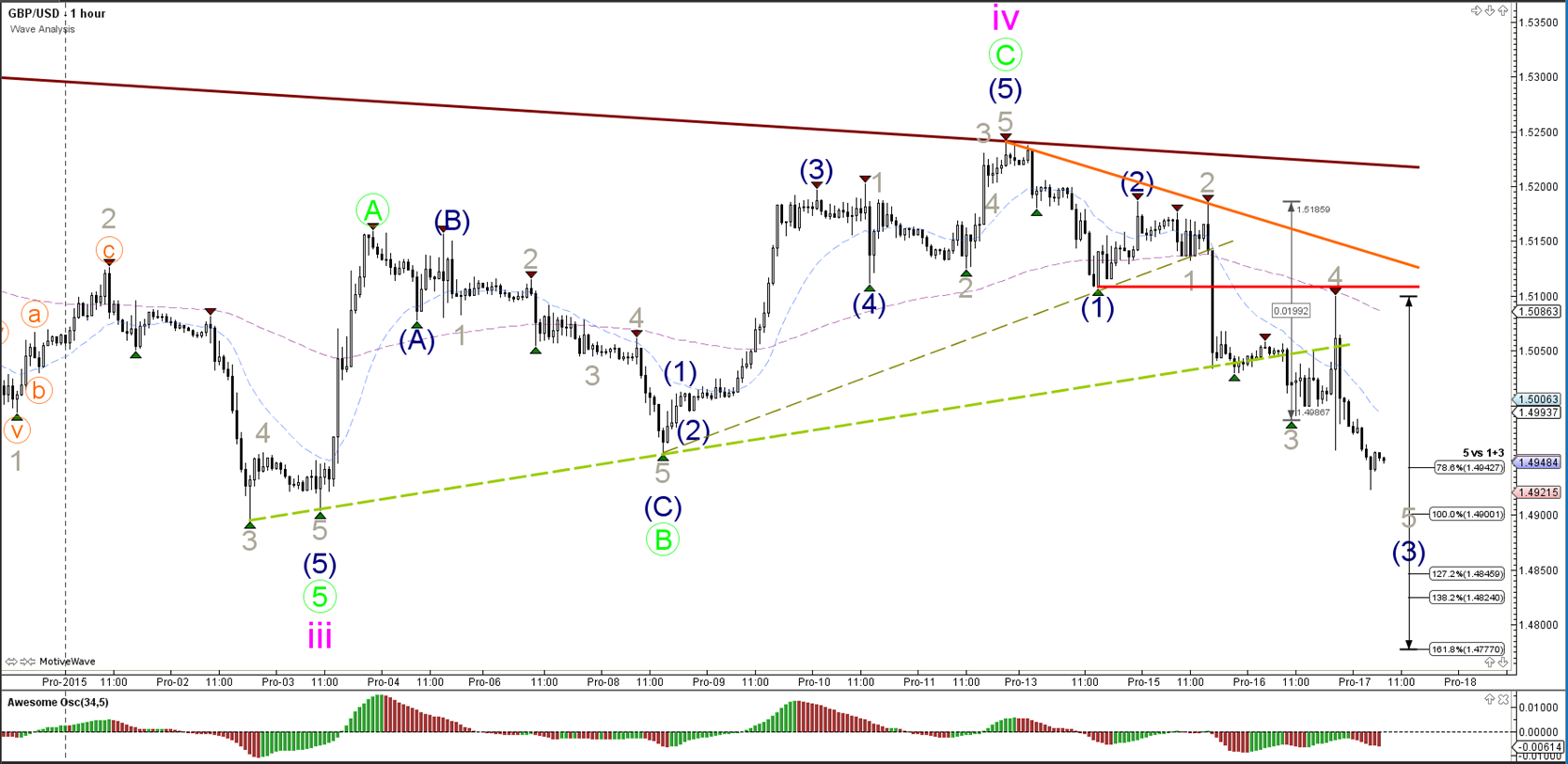

1 hour

The GBP/USD broke below the support trend line (dotted green) and is moving lower to the targets of wave 5 (blue) of wave 3 (grey).

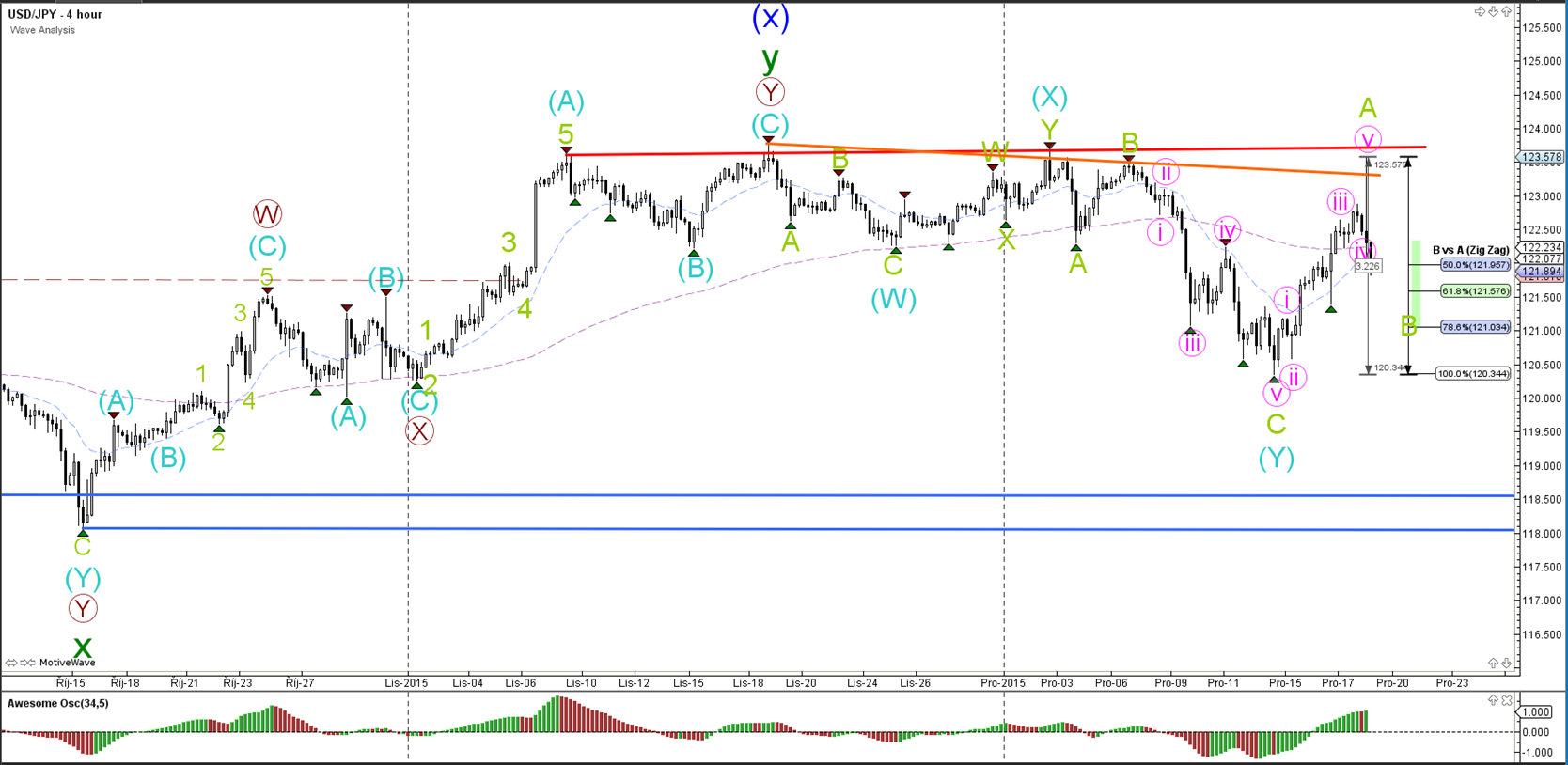

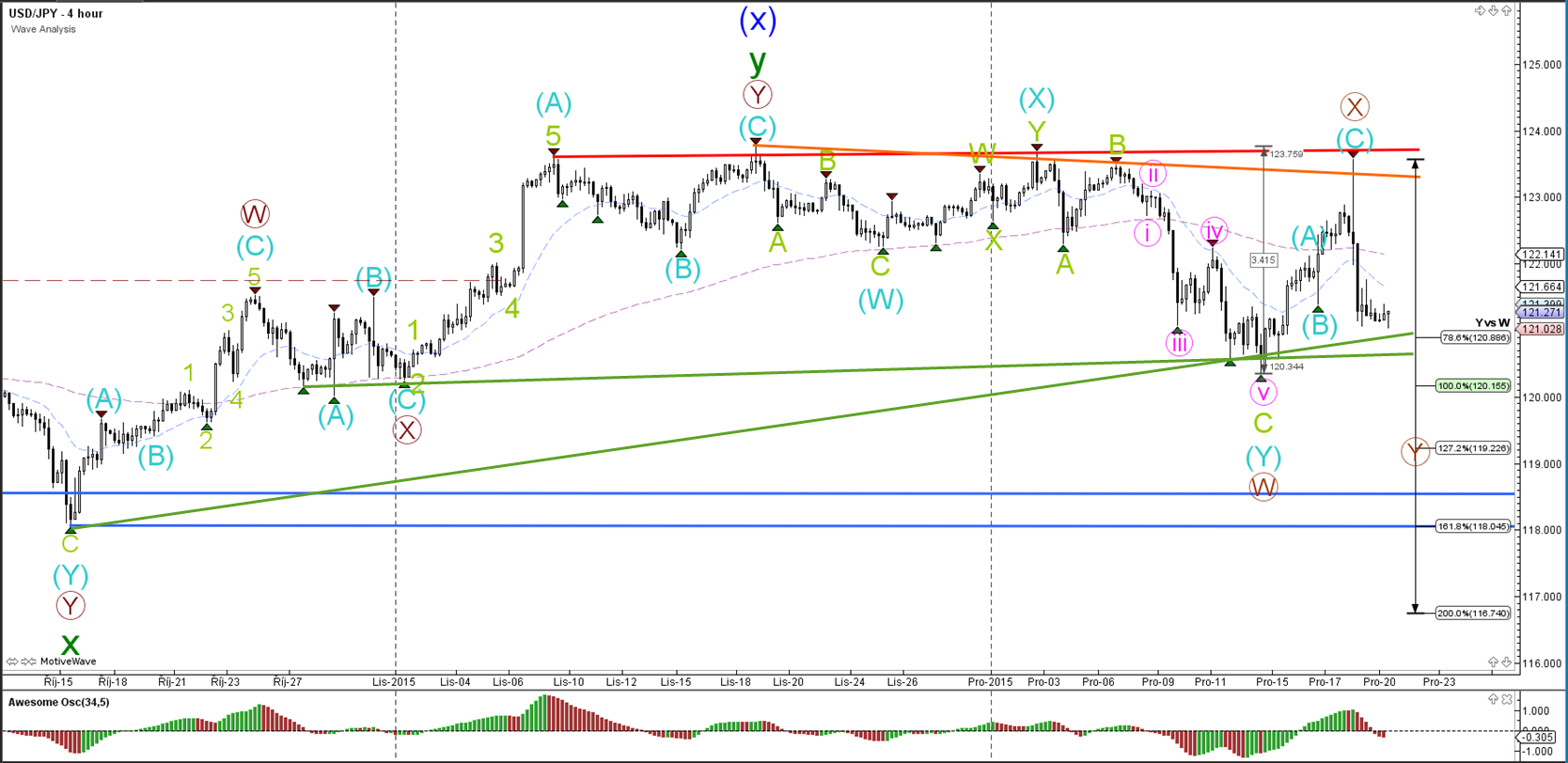

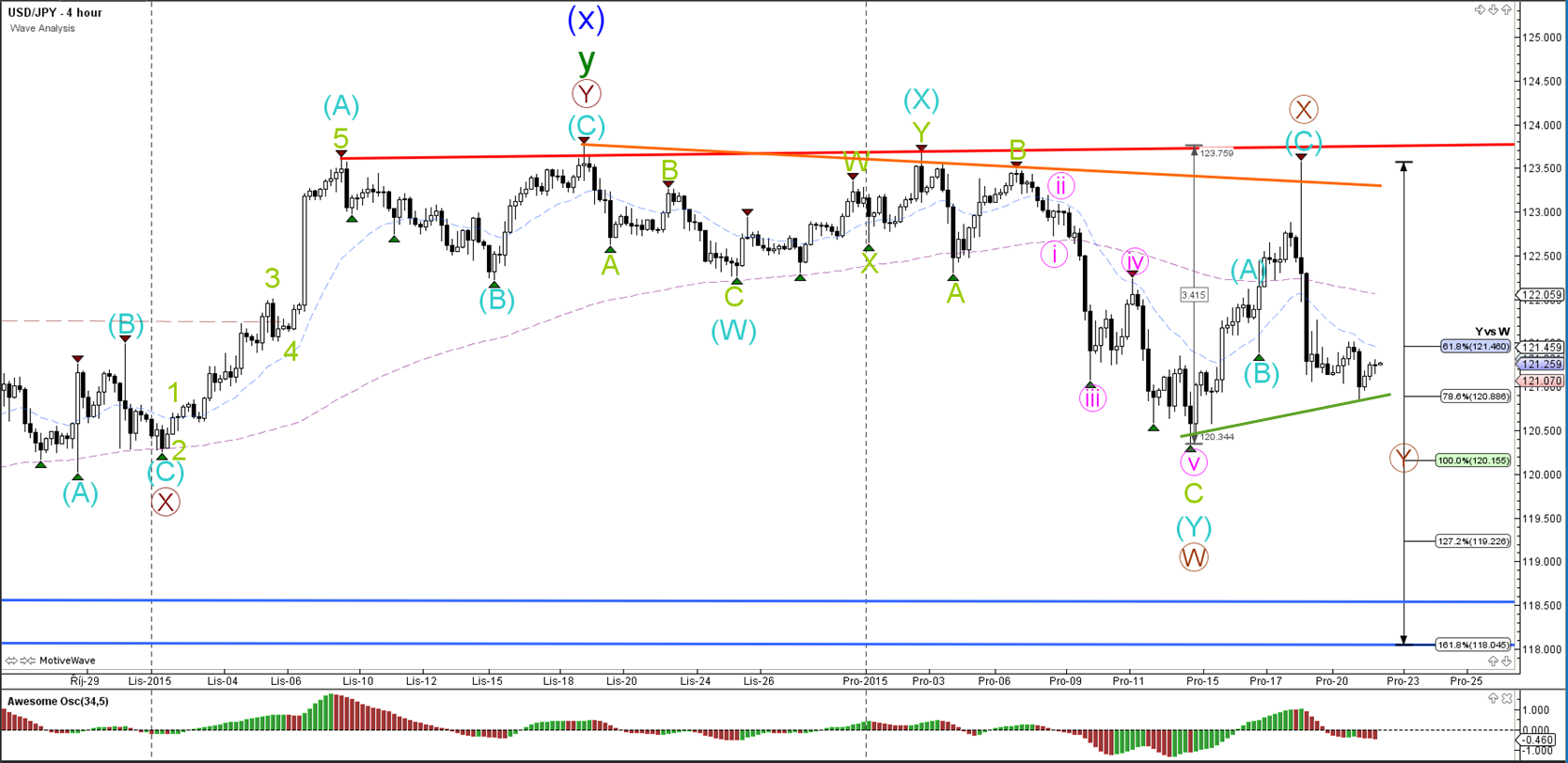

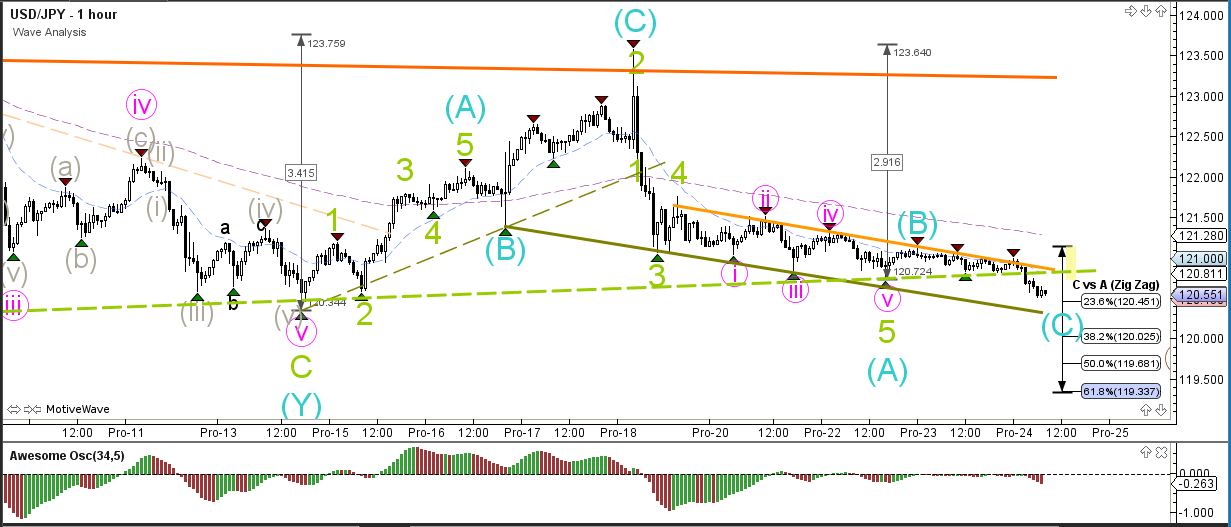

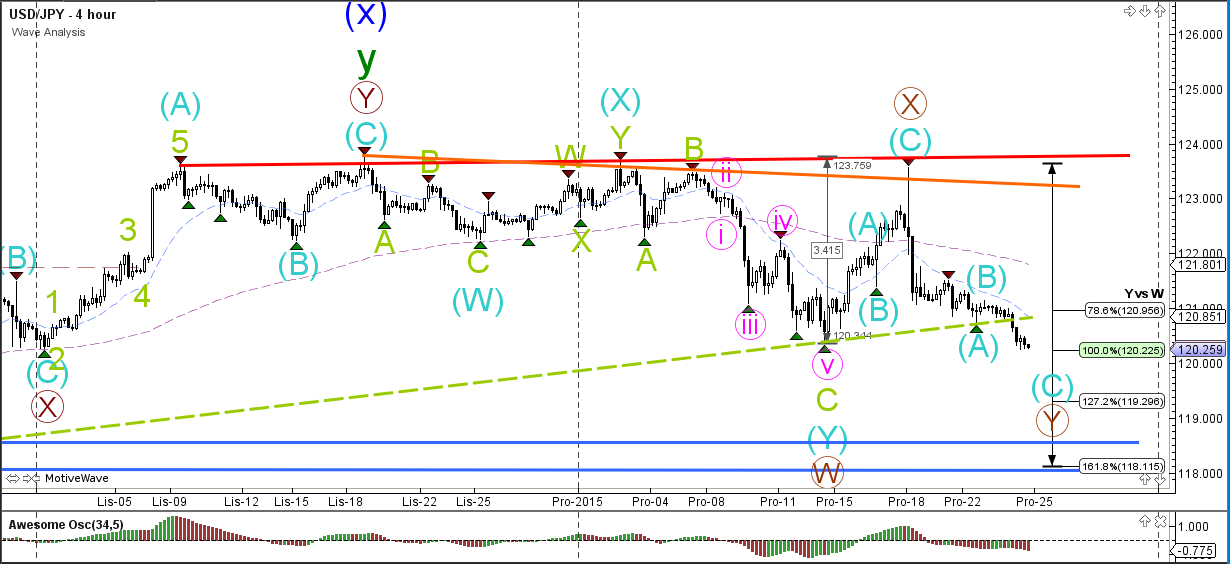

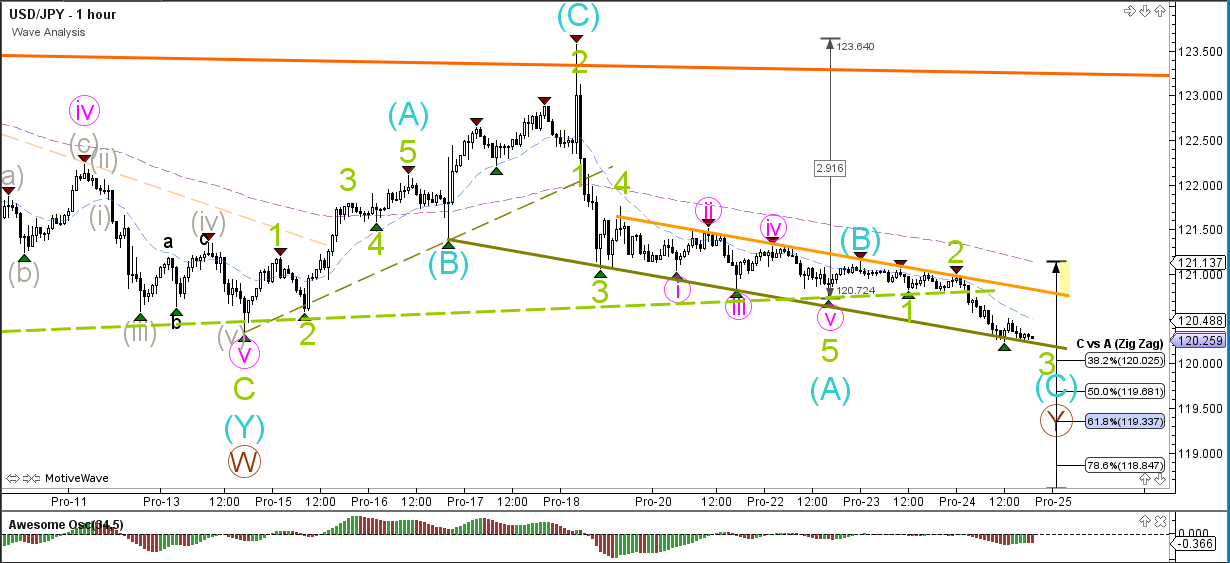

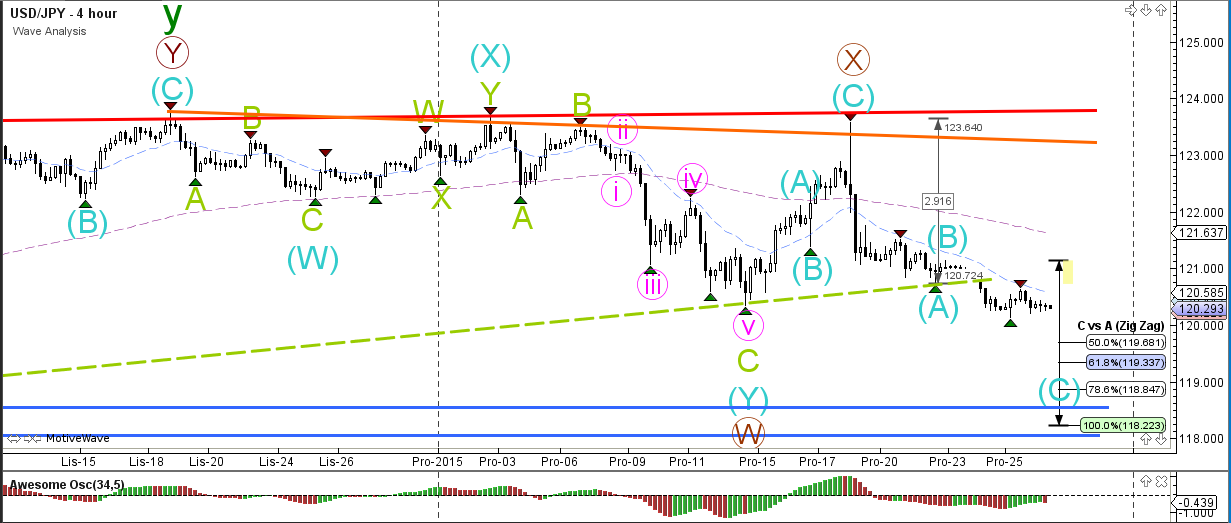

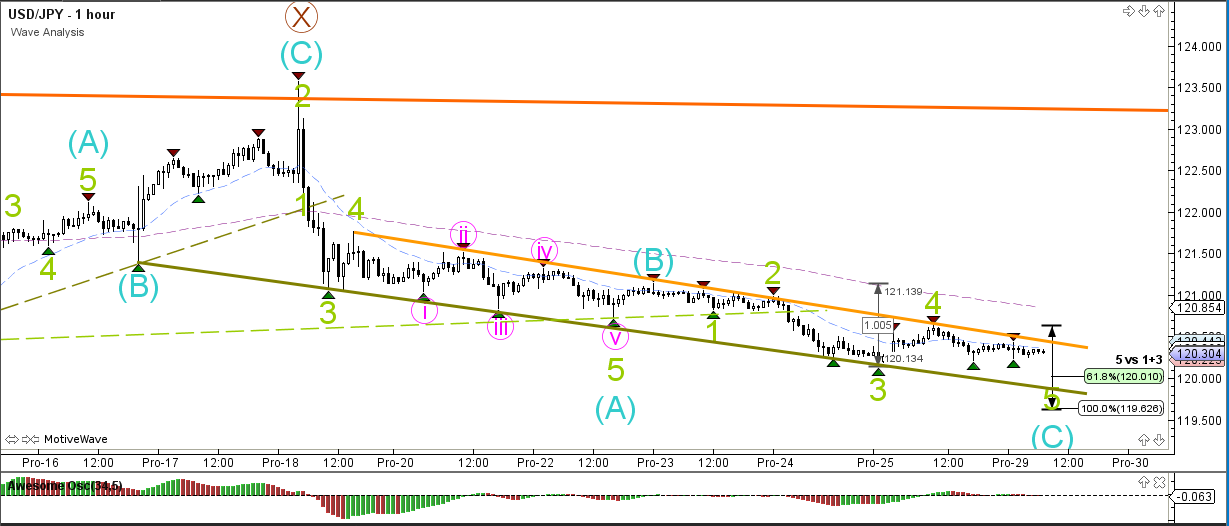

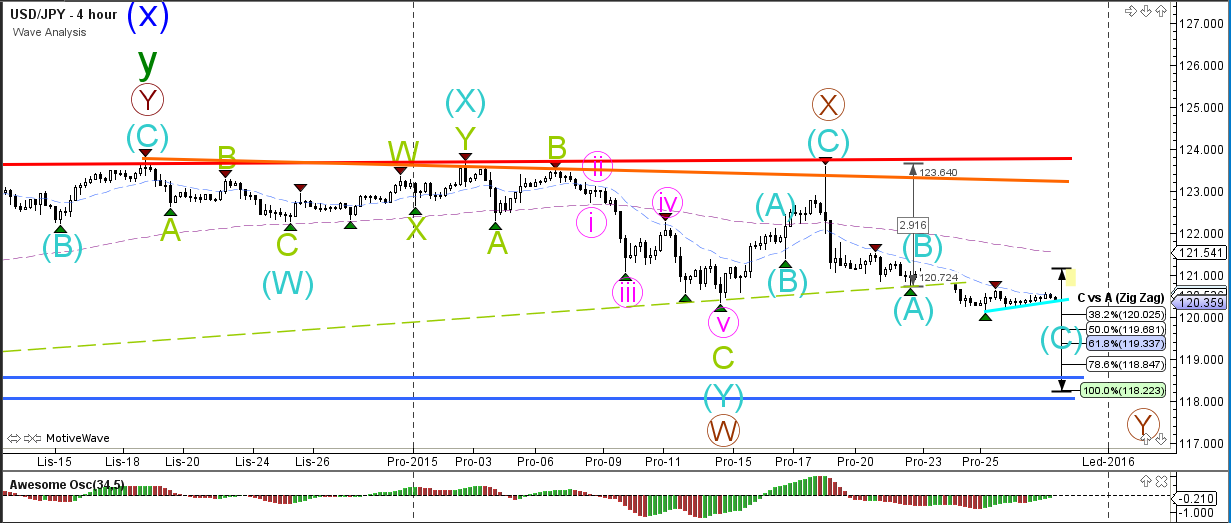

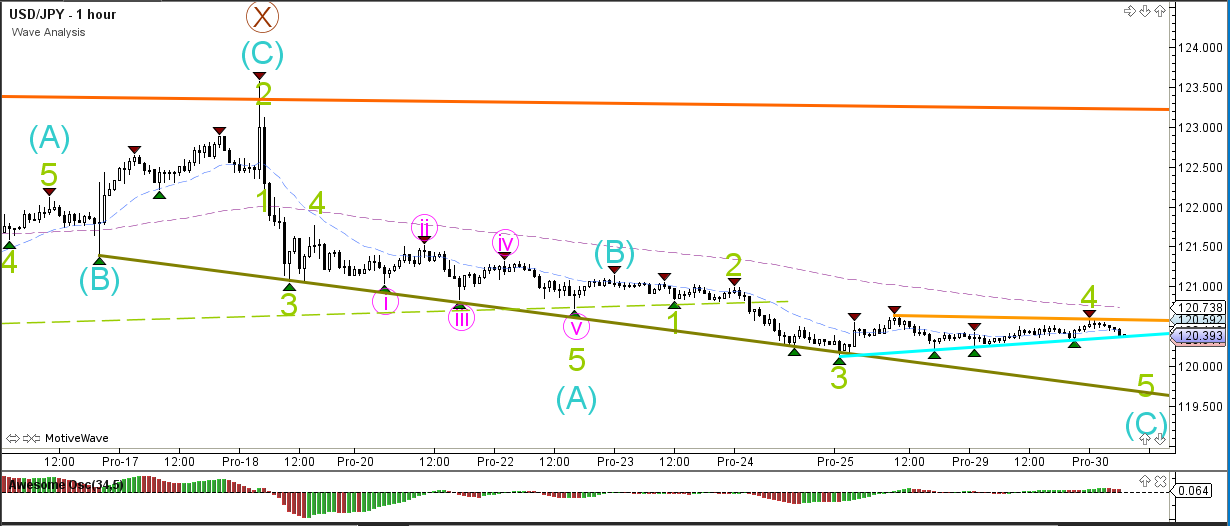

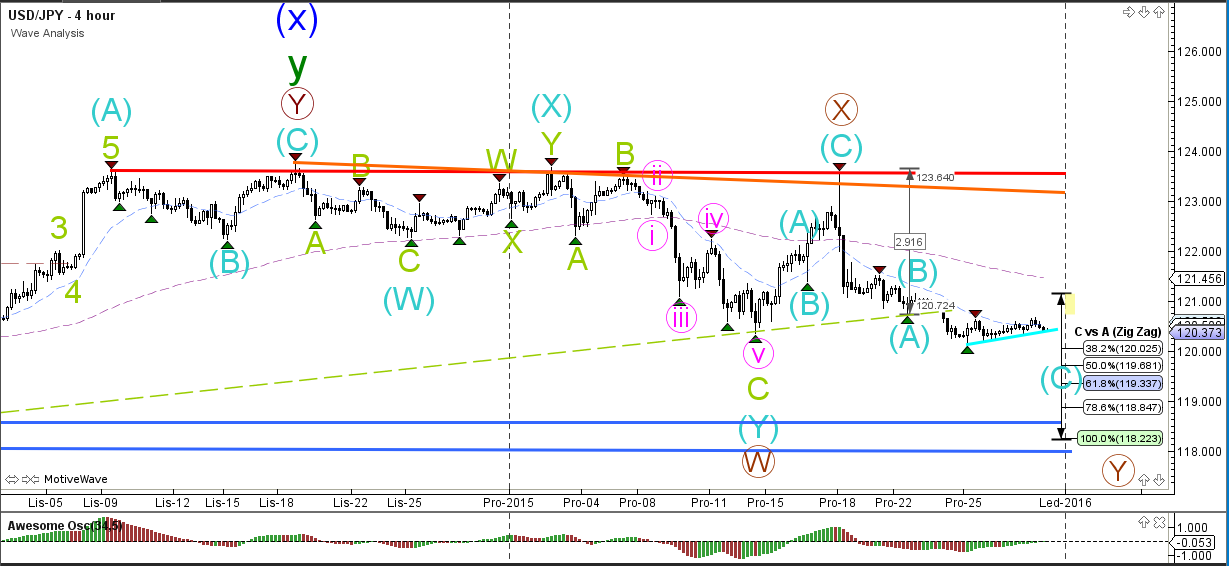

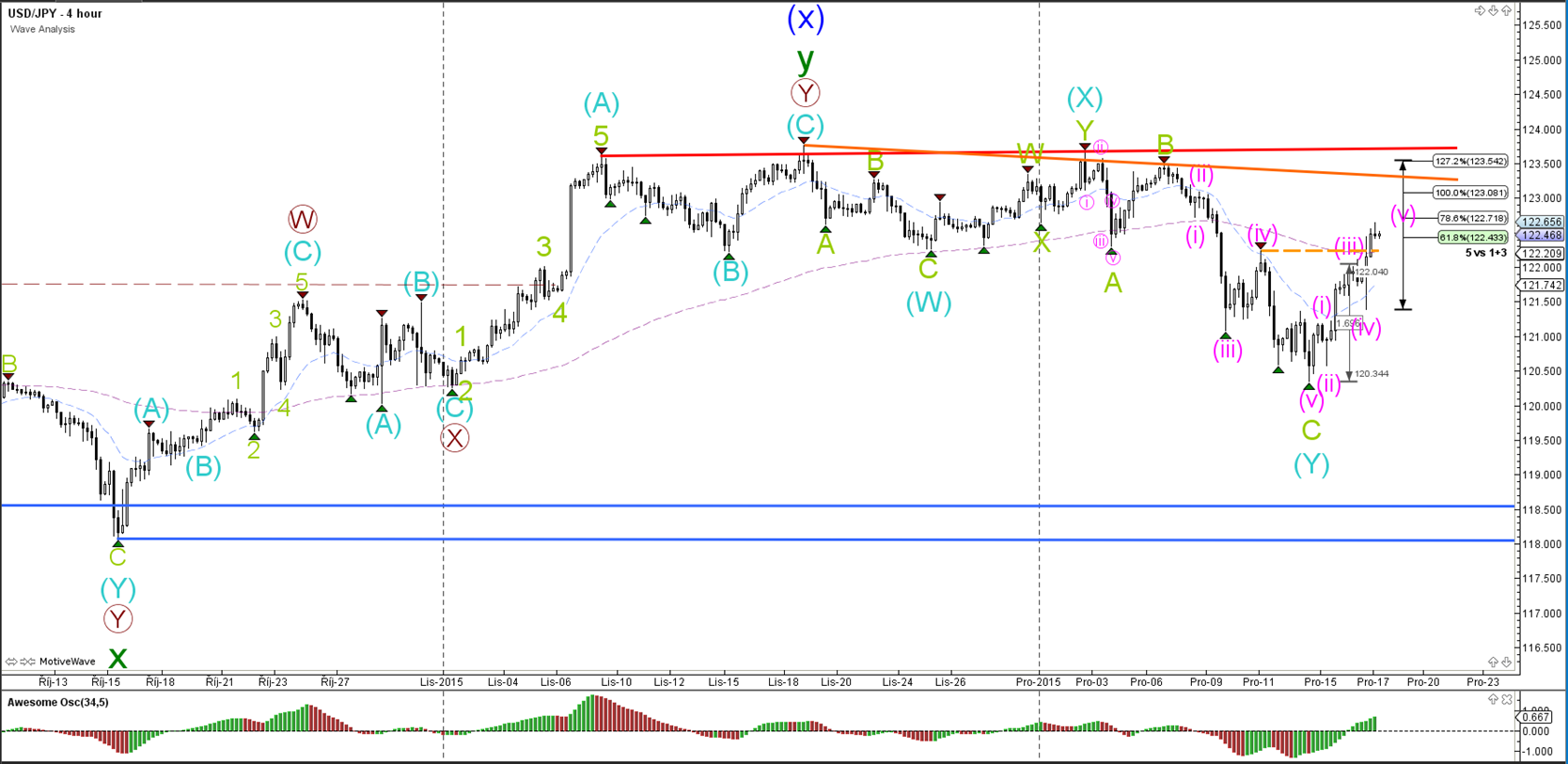

USD/JPY

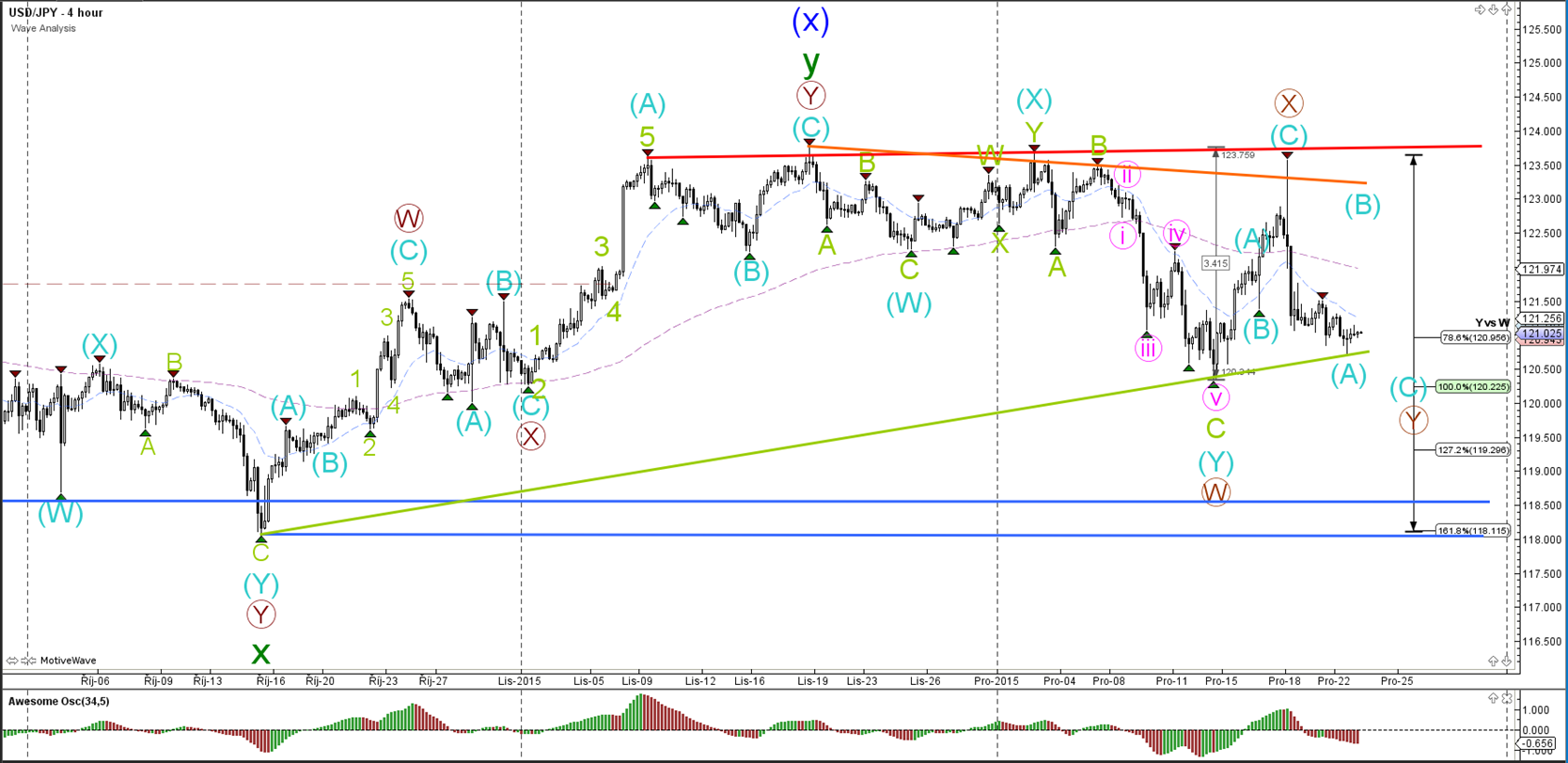

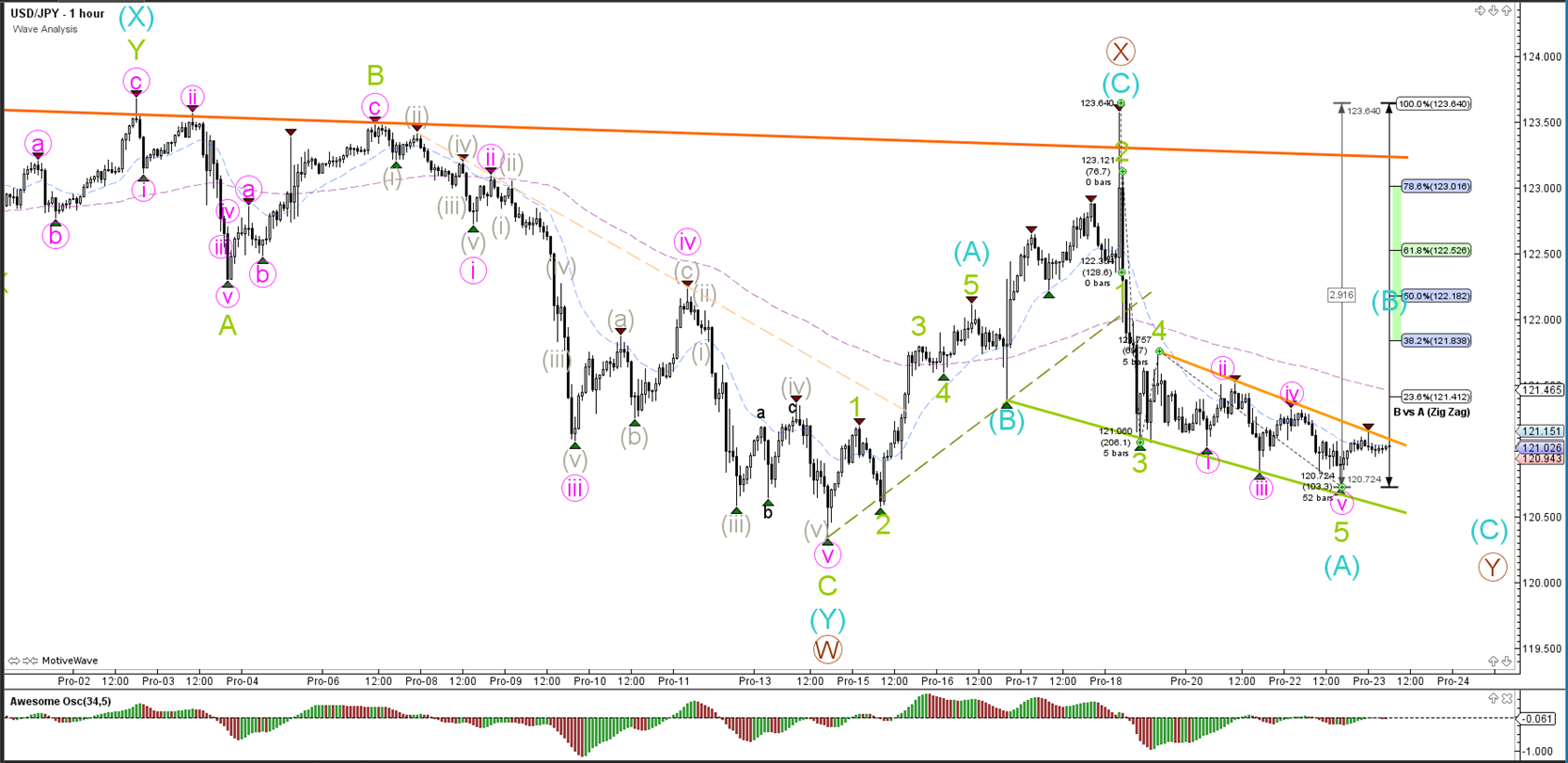

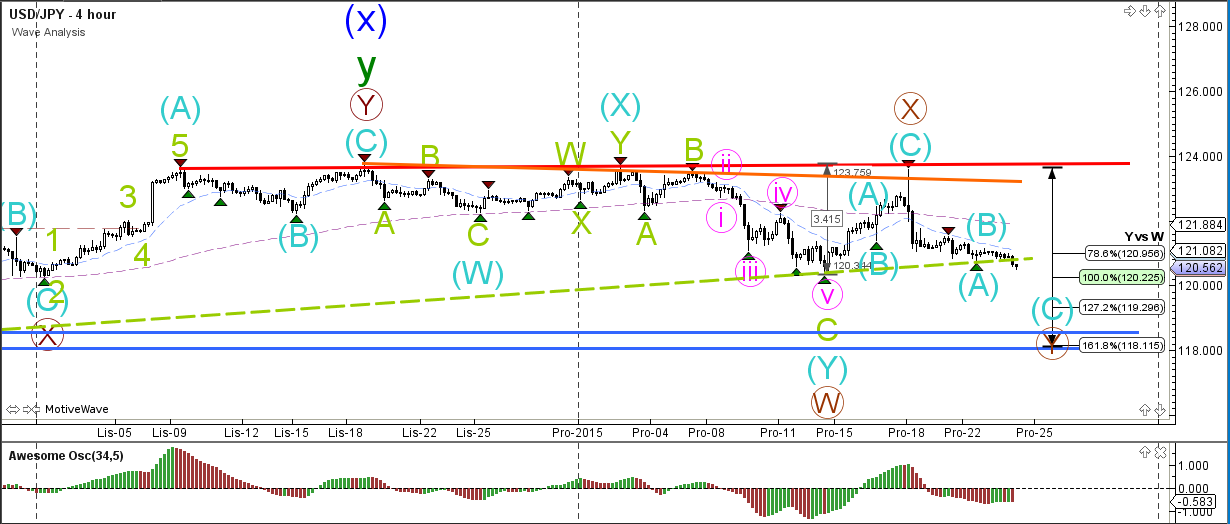

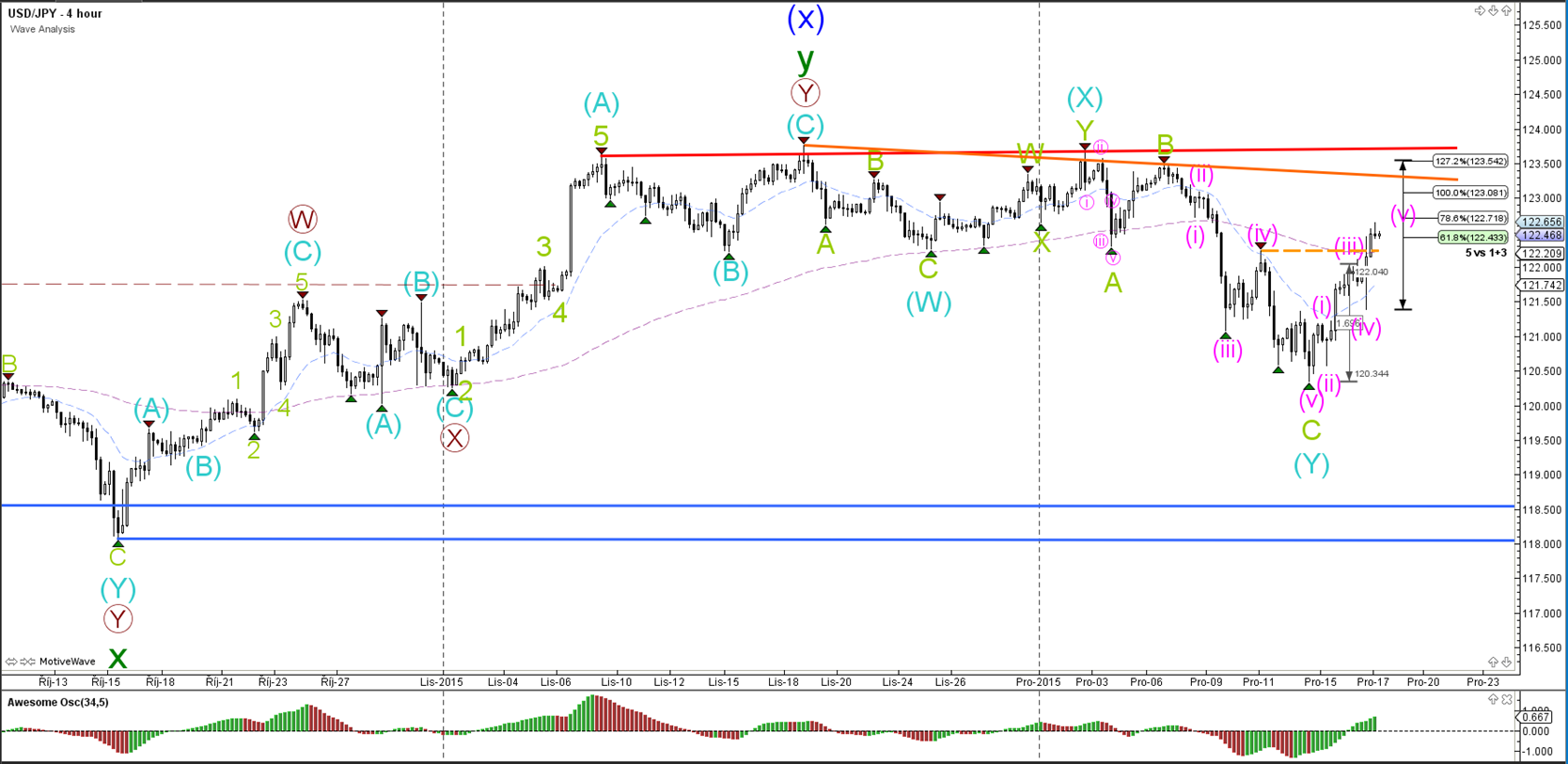

4 hour

The FED's decision to increase interest rates in the US caused lots of volatility in the market but in the end a bullish 5 wave pattern emerged (pink). The 5 wave pattern has changed the bearish count from a potential A to the current C (green) of Y (blue).

“Original analysis is provided by Admiral Markets”

EUR/USD

4 hour

The FED's decision to increase interest rates in the US caused lots of volatility in the market. The EUR/USD moved lower eventually during the news but price is still far away from the current year low. For the moment I am not expecting price to break below this year's low (green line) and hence the wave count is now showing a wave X retracement (green).

1 hour

The EUR/USD bearish price action has been slow and therefore the wave count is showing an ABC zigzag rather than a 123 (brown).

GBP/USD

4 hour

The FED's decision to increase interest rates in the US caused lots of volatility in the market but the GBP/USD has managed to make a bearish turn at the top of the channel and is now breaking below support within the downtrend channel.

1 hour

The GBP/USD broke below the support trend line (dotted green) and is moving lower to the targets of wave 5 (blue) of wave 3 (grey).

USD/JPY

4 hour

The FED's decision to increase interest rates in the US caused lots of volatility in the market but in the end a bullish 5 wave pattern emerged (pink). The 5 wave pattern has changed the bearish count from a potential A to the current C (green) of Y (blue).

“Original analysis is provided by Admiral Markets”