Admiral Markets

AdmiralMarkets.com Representative

- Messages

- 95

Technical Overview - Important CAD Pairs

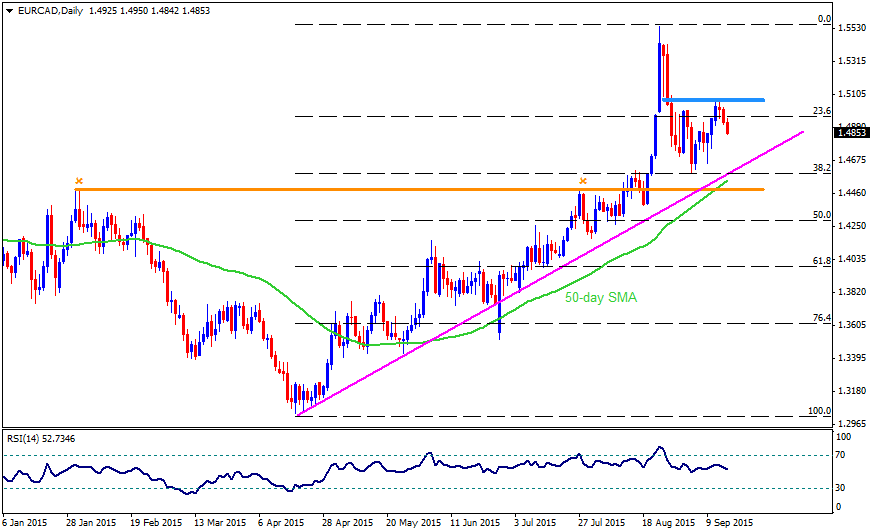

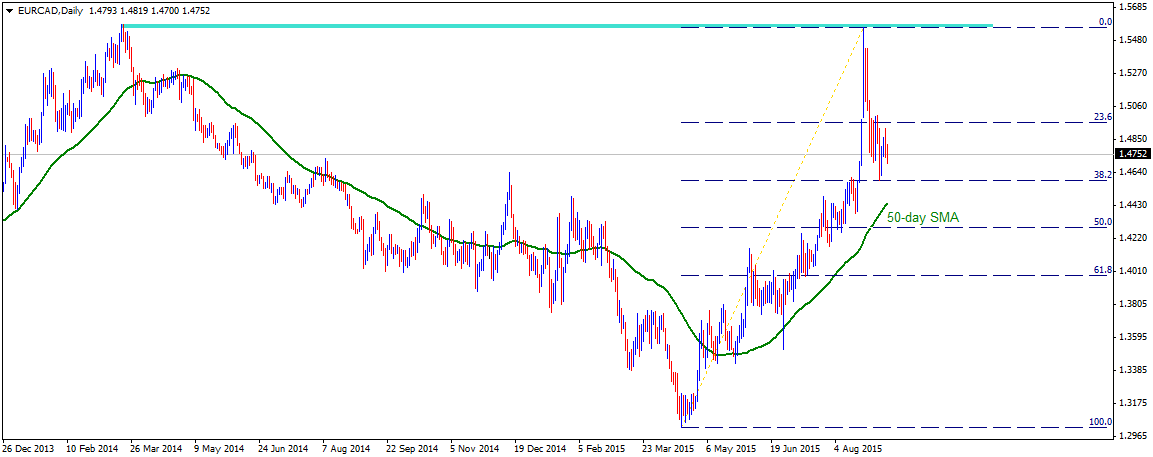

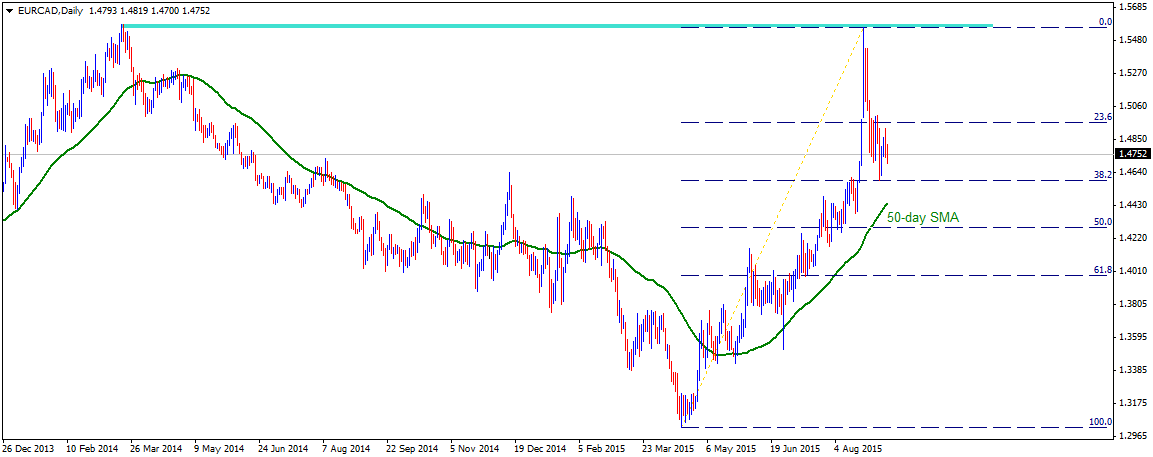

EURCAD

Although the pair made a big up-move from nearly 2-year low touched in April, the momentum failed to lift the pair beyond March 2014 highs. Reversal from 1.5560-80 resistance, however, seems to have found some support near 1.4600-1.4580 area, representing 38.2% Fib. retracement level of its April to August up-move, and is currently holding above 1.4700 mark. Should the pair resume its corrective move and drop back below 1.4700 mark, it seems likely to retest 1.4600-1.4580 support area. Further, decisive weakness below 1.4600 support now seems to open room for extension of the near-term weakening trend towards 50% Fib. retracement level support near 1.4300-1.4285 zone, with 50-day SMA near 1.4460-50 area acting as intermediate support. Meanwhile on the upside, 1.4860-80 horizontal zone seems to provide immediate resistance. This is closely followed by a strong resistance near 1.4980-1.5000 psychological mark, also nearing 23.6% Fib. retracement level. Only a sustained strength above this strong resistance might negate any near-term bearish expectations, thus paving way for continuing the near-term upward trajectory towards back towards 2015 daily closing high resistance near 1.5400-20 region.

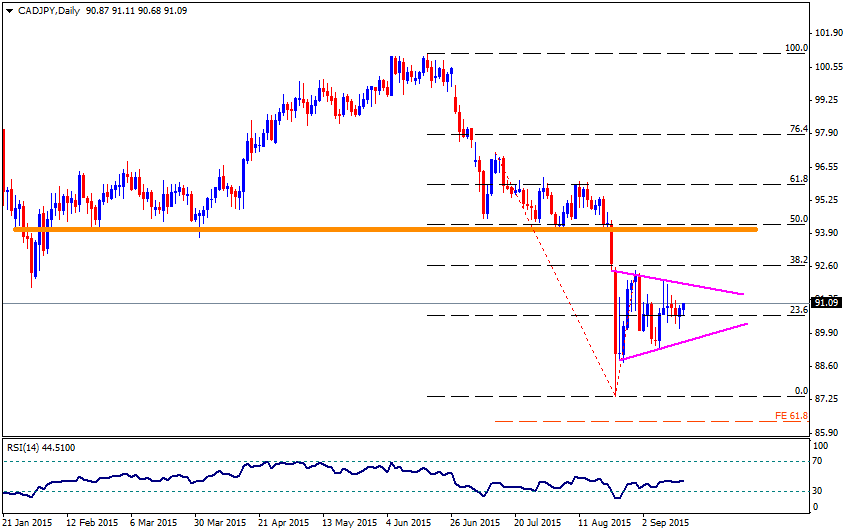

CADJPY

Following a break below an important support near 92.00 mark and a subsequent drop to the lowest level since Jan. 2013, the pair witness some pull-back from lower levels to retest the important support break-point. The support break-point now turned immediate strong resistance, near 92.00 mark, also coincides with 38.2% Fib. retracement level of June to August sharp fall. Hence, from current levels the pair seems more likely to resume its downward trajectory. However, a decisive strength back above 92.00 mark might negate the bearish outlook and is likely to boost the pair further in the near-term towards testing its next resistance near 94.00-94.20 area, marking 50% Fib. retracement level. On the immediate downside, 23.6% Fib. retracement level near 90.50 level seems to provide immediate support. Failure to hold this support now seems to drag the pair back towards testing 89.00 mark support, also coinciding with recent daily closing low levels.

AUDCAD

The pair is attempting some recovery from its lowest level since July 2010, touched earlier in Sept., and has now moved within a short-term ascending trend-channel formation on 1-hourly chart. However, if taken in conjunction with its fall from August highs, the ascending channel could possibly constitute towards formation of a continuation Flag chart-pattern. However, considering that the pair has already cleared 23.6% Fib. retracement level of Aug.-Sept. downfall, it could possibly make an attempt to build on to it pull-back towards testing a support turned immediate strong resistance near 0.9375 level, comprising of the upper trend-line of the ascending channel and 38.2% Fib. retracement level. 23.6% Fib. retracement level, also coinciding with the lower trend-line support of the channel, near 0.9290 level now seems to protect immediate downside. A decisive weakness below this immediate support might trigger resumption of the weakening trend, thus dragging the pair immediately towards 0.9200 horizontal support.

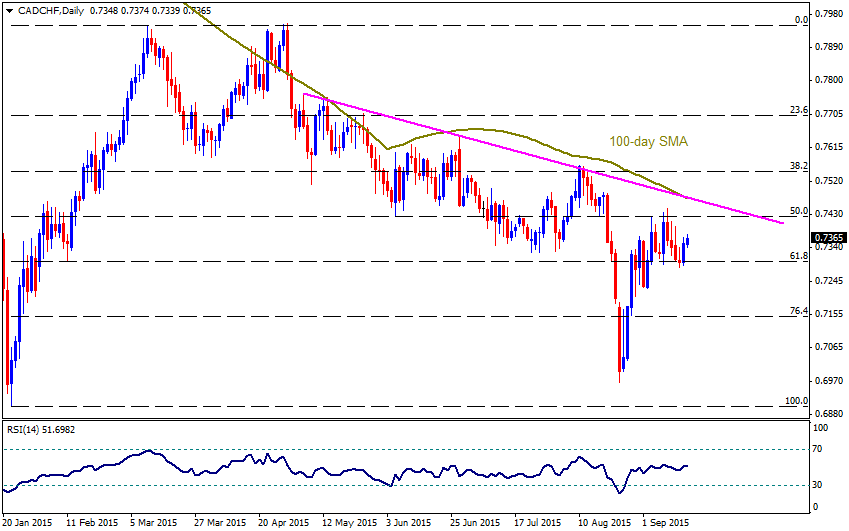

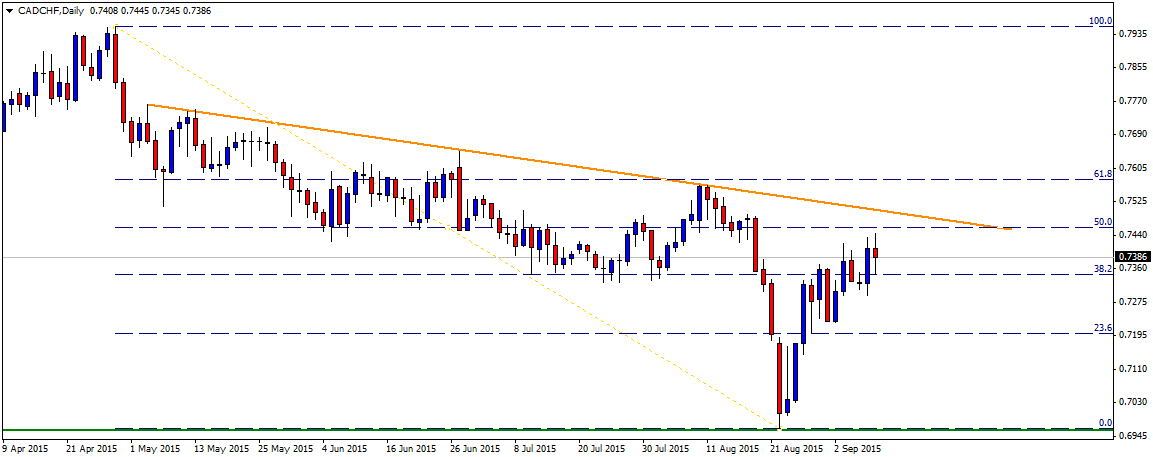

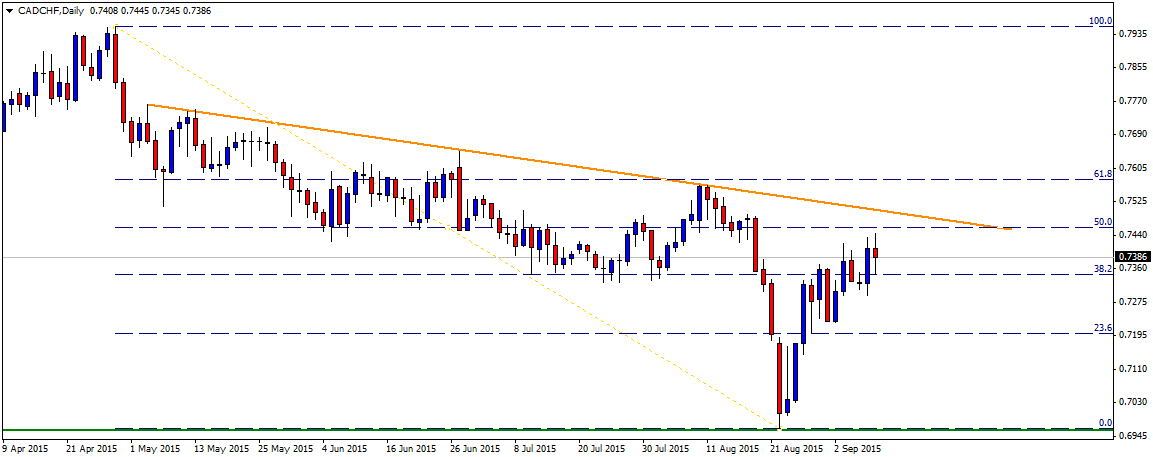

CADCHF

The pair managed to hold and bounce from an important support near 0.6970-50 area, marking 2015 daily closing lows. From current levels, the pair seems to be headed towards an intermediate resistance near 0.7450 representing 50% Fib. retracement level of April to August down-leg. The bounce could further get extended towards testing a descending trend-line resistance, currently near 0.7500 mark. Further, a decisive strength above 0.7500 mark now seems to trigger an immediate short-covering move towards 61.8% Fib. retracement level resistance near 0.7600 level. Meanwhile, a drop back below 38.2% Fib. retracement level immediate support near 0.7350-40 zone is likely to drag the pair back towards 0.7230 support area, nearing 23.6% Fib. retracement level. A sustained weakness below 0.7230 support, leading to a subsequent weakness below 0.7170 is likely to confirm retest of 0.7000 important psychological mark support.

“Original analysis is provided by Admiral Markets”

EURCAD

Although the pair made a big up-move from nearly 2-year low touched in April, the momentum failed to lift the pair beyond March 2014 highs. Reversal from 1.5560-80 resistance, however, seems to have found some support near 1.4600-1.4580 area, representing 38.2% Fib. retracement level of its April to August up-move, and is currently holding above 1.4700 mark. Should the pair resume its corrective move and drop back below 1.4700 mark, it seems likely to retest 1.4600-1.4580 support area. Further, decisive weakness below 1.4600 support now seems to open room for extension of the near-term weakening trend towards 50% Fib. retracement level support near 1.4300-1.4285 zone, with 50-day SMA near 1.4460-50 area acting as intermediate support. Meanwhile on the upside, 1.4860-80 horizontal zone seems to provide immediate resistance. This is closely followed by a strong resistance near 1.4980-1.5000 psychological mark, also nearing 23.6% Fib. retracement level. Only a sustained strength above this strong resistance might negate any near-term bearish expectations, thus paving way for continuing the near-term upward trajectory towards back towards 2015 daily closing high resistance near 1.5400-20 region.

CADJPY

Following a break below an important support near 92.00 mark and a subsequent drop to the lowest level since Jan. 2013, the pair witness some pull-back from lower levels to retest the important support break-point. The support break-point now turned immediate strong resistance, near 92.00 mark, also coincides with 38.2% Fib. retracement level of June to August sharp fall. Hence, from current levels the pair seems more likely to resume its downward trajectory. However, a decisive strength back above 92.00 mark might negate the bearish outlook and is likely to boost the pair further in the near-term towards testing its next resistance near 94.00-94.20 area, marking 50% Fib. retracement level. On the immediate downside, 23.6% Fib. retracement level near 90.50 level seems to provide immediate support. Failure to hold this support now seems to drag the pair back towards testing 89.00 mark support, also coinciding with recent daily closing low levels.

AUDCAD

The pair is attempting some recovery from its lowest level since July 2010, touched earlier in Sept., and has now moved within a short-term ascending trend-channel formation on 1-hourly chart. However, if taken in conjunction with its fall from August highs, the ascending channel could possibly constitute towards formation of a continuation Flag chart-pattern. However, considering that the pair has already cleared 23.6% Fib. retracement level of Aug.-Sept. downfall, it could possibly make an attempt to build on to it pull-back towards testing a support turned immediate strong resistance near 0.9375 level, comprising of the upper trend-line of the ascending channel and 38.2% Fib. retracement level. 23.6% Fib. retracement level, also coinciding with the lower trend-line support of the channel, near 0.9290 level now seems to protect immediate downside. A decisive weakness below this immediate support might trigger resumption of the weakening trend, thus dragging the pair immediately towards 0.9200 horizontal support.

CADCHF

The pair managed to hold and bounce from an important support near 0.6970-50 area, marking 2015 daily closing lows. From current levels, the pair seems to be headed towards an intermediate resistance near 0.7450 representing 50% Fib. retracement level of April to August down-leg. The bounce could further get extended towards testing a descending trend-line resistance, currently near 0.7500 mark. Further, a decisive strength above 0.7500 mark now seems to trigger an immediate short-covering move towards 61.8% Fib. retracement level resistance near 0.7600 level. Meanwhile, a drop back below 38.2% Fib. retracement level immediate support near 0.7350-40 zone is likely to drag the pair back towards 0.7230 support area, nearing 23.6% Fib. retracement level. A sustained weakness below 0.7230 support, leading to a subsequent weakness below 0.7170 is likely to confirm retest of 0.7000 important psychological mark support.

“Original analysis is provided by Admiral Markets”