Admiral Markets

AdmiralMarkets.com Representative

- Messages

- 95

Technical Update - EURJPY, NZDCHF and CADCHF

EURJPY

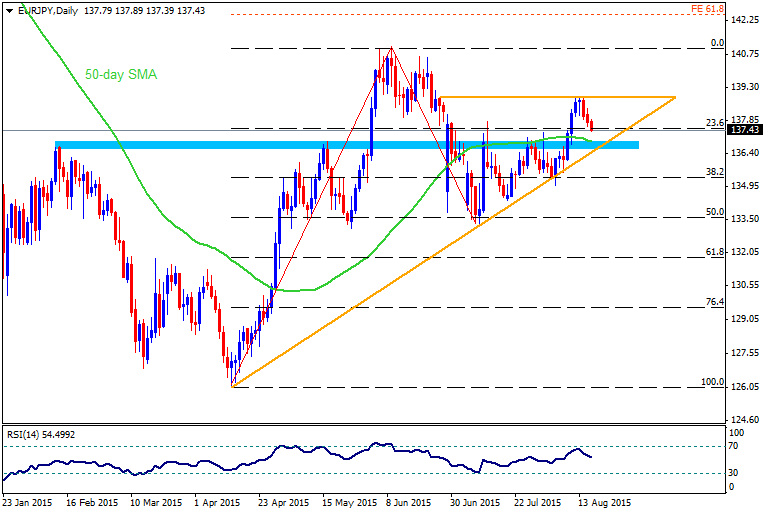

The pair's rebound from 133.30-50 support area representing 50% Fib. retracement level of April to June up-swing, extended beyond 137.50 strong resistance, also coinciding with 23.6% Fib. retracement level. From current levels, the pair seems more likely to move back and sustain its strength above 139.00 round figure mark and extend the near-term upward trajectory towards 2015 daily closing high resistance near 140.50-60 area. Further, a break through 2015 closing high resistance has the potential to provide the required momentum to continue boosting the pair in the near-term towards 61.8% Fib. expansion level resistance near 142.50 level. Meanwhile on the downside, previous resistance near 137.50 level now seems to protect immediate downside. Failure to hold this immediate support could drag the pair back towards testing 38.2% Fib. retracement level support near 135.20-135.00 area.

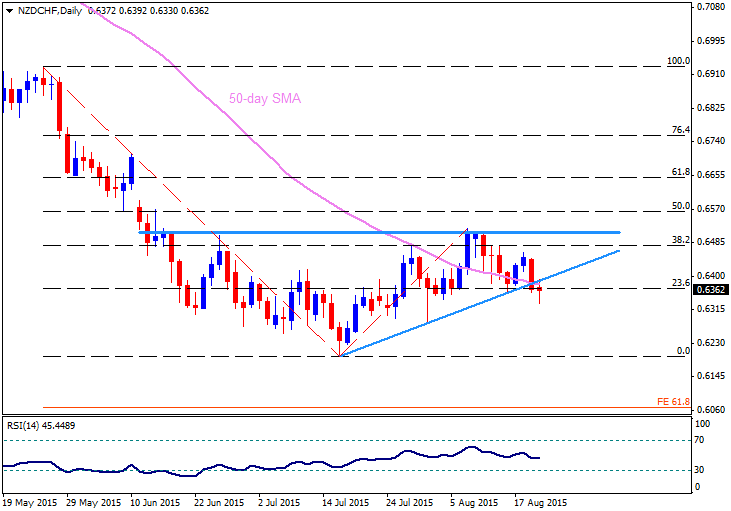

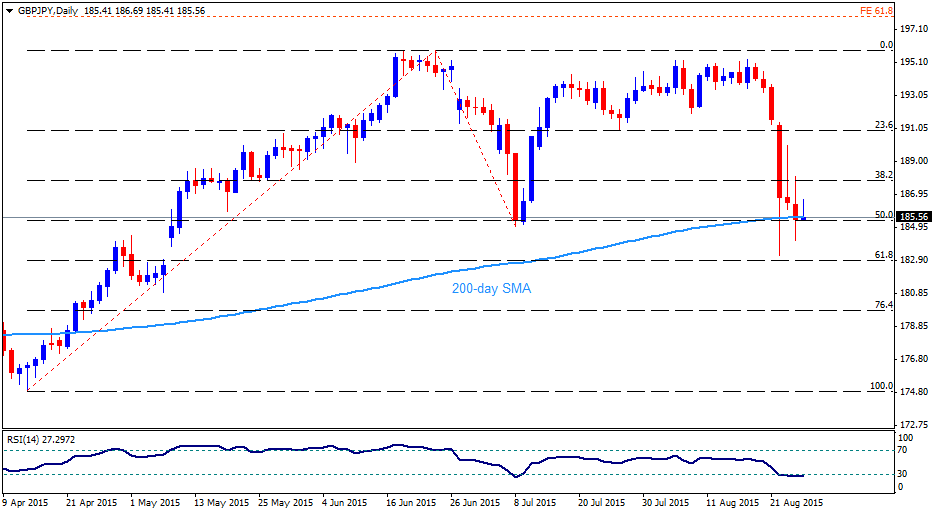

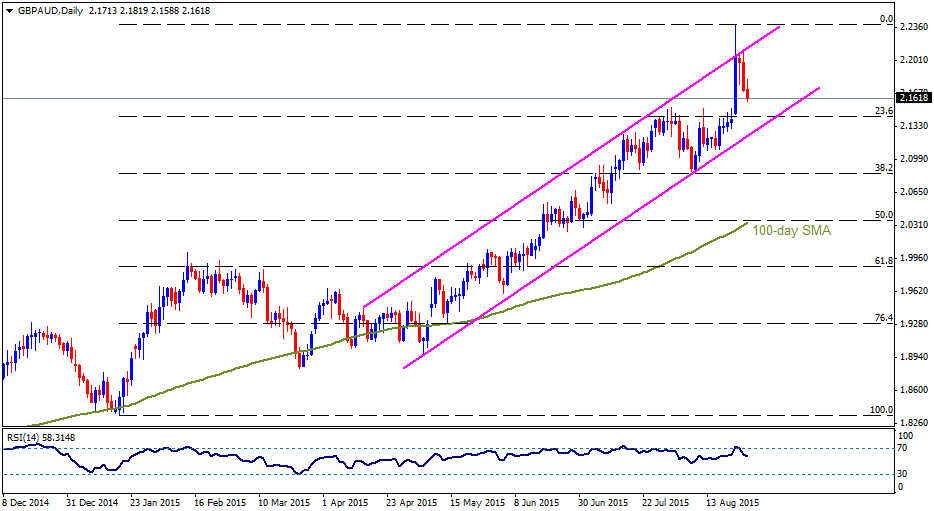

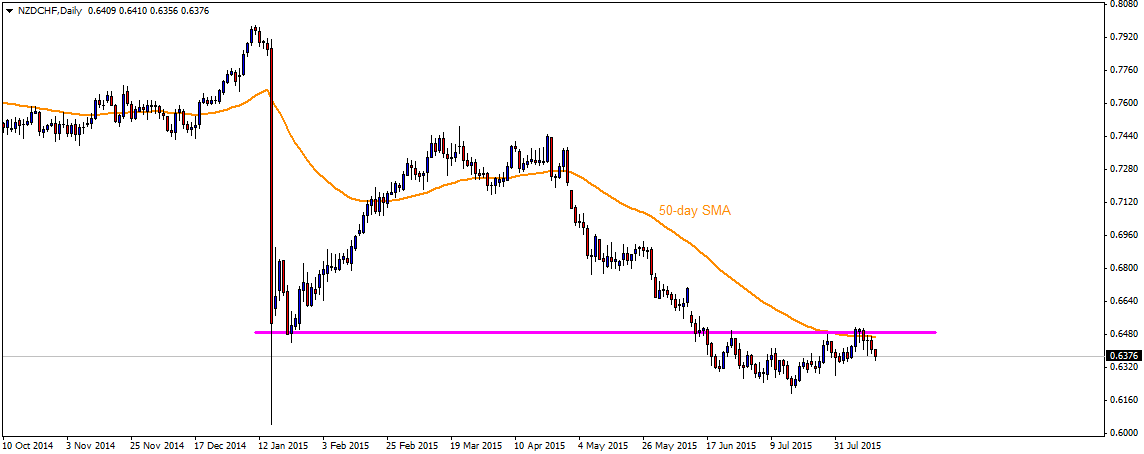

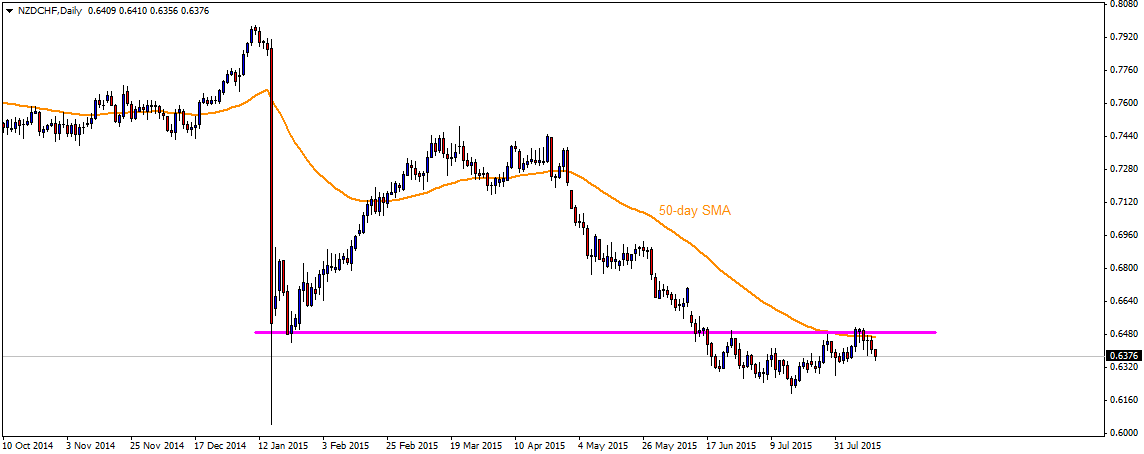

NZDCHF

The pair once again failed to clear its previous support now turned immediate hurdle near 0.6490-0.6500 mark, also coinciding with 50-day SMA. Subsequently the pair dropped to retest 0.6350 intermediate support and is currently making an attempt to move back above 0.6400 mark. Should the pair fail to move back above 0.6400 mark and decisively weaken below 0.6350 support, it seems to move back towards retesting recent lows support near 0.6220-0.6210 area and possibly even drift lower towards Jan. 15 lows support near 0.6050-40 zone. Alternatively strength above 0.6400 mark is likely to confront immediate resistance near 0.6450 level, which is closely followed by a strong resistance near 0.6490-0.6500 area, nearing 50-day SMA. A decisive move above 0.6500 mark strong resistance now seems to continue extending support for further up-move for the pair towards its next major resistance near 0.6700 region.

CADCHF

On daily chart, the pair seems to have moved within a short-term descending trend-channel and is drifting lower after testing the upper trend-line resistance of the channel. From current levels, the pair seems to continue drifting lower to test 0.7420-10 intermediate horizontal support, which if broken might force the pair back towards testing the lower trend-line support of the channel, currently near 0.7300-0.7290 area. However, should the pair manage to hold 0.7400 mark and subsequently strengthen above 0.7470 level, it might continue facing strong resistance at the upper trend-line resistance of the channel, currently near 0.7530 area. A decisive strength above 0.7530 resistance, marking a break-through the descending channel, is likely to trigger a short-covering rally immediately towards 0.7600 round figure mark resistance, which could further get extended towards its next major resistance near 0.7650-60 zone.

“Original analysis is provided by Admiral Markets”

EURJPY

The pair's rebound from 133.30-50 support area representing 50% Fib. retracement level of April to June up-swing, extended beyond 137.50 strong resistance, also coinciding with 23.6% Fib. retracement level. From current levels, the pair seems more likely to move back and sustain its strength above 139.00 round figure mark and extend the near-term upward trajectory towards 2015 daily closing high resistance near 140.50-60 area. Further, a break through 2015 closing high resistance has the potential to provide the required momentum to continue boosting the pair in the near-term towards 61.8% Fib. expansion level resistance near 142.50 level. Meanwhile on the downside, previous resistance near 137.50 level now seems to protect immediate downside. Failure to hold this immediate support could drag the pair back towards testing 38.2% Fib. retracement level support near 135.20-135.00 area.

NZDCHF

The pair once again failed to clear its previous support now turned immediate hurdle near 0.6490-0.6500 mark, also coinciding with 50-day SMA. Subsequently the pair dropped to retest 0.6350 intermediate support and is currently making an attempt to move back above 0.6400 mark. Should the pair fail to move back above 0.6400 mark and decisively weaken below 0.6350 support, it seems to move back towards retesting recent lows support near 0.6220-0.6210 area and possibly even drift lower towards Jan. 15 lows support near 0.6050-40 zone. Alternatively strength above 0.6400 mark is likely to confront immediate resistance near 0.6450 level, which is closely followed by a strong resistance near 0.6490-0.6500 area, nearing 50-day SMA. A decisive move above 0.6500 mark strong resistance now seems to continue extending support for further up-move for the pair towards its next major resistance near 0.6700 region.

CADCHF

On daily chart, the pair seems to have moved within a short-term descending trend-channel and is drifting lower after testing the upper trend-line resistance of the channel. From current levels, the pair seems to continue drifting lower to test 0.7420-10 intermediate horizontal support, which if broken might force the pair back towards testing the lower trend-line support of the channel, currently near 0.7300-0.7290 area. However, should the pair manage to hold 0.7400 mark and subsequently strengthen above 0.7470 level, it might continue facing strong resistance at the upper trend-line resistance of the channel, currently near 0.7530 area. A decisive strength above 0.7530 resistance, marking a break-through the descending channel, is likely to trigger a short-covering rally immediately towards 0.7600 round figure mark resistance, which could further get extended towards its next major resistance near 0.7650-60 zone.

“Original analysis is provided by Admiral Markets”