Admiral Markets

AdmiralMarkets.com Representative

- Messages

- 95

Technical Update CHF Pairs - USDCHF, CHFJPY and AUDCHF

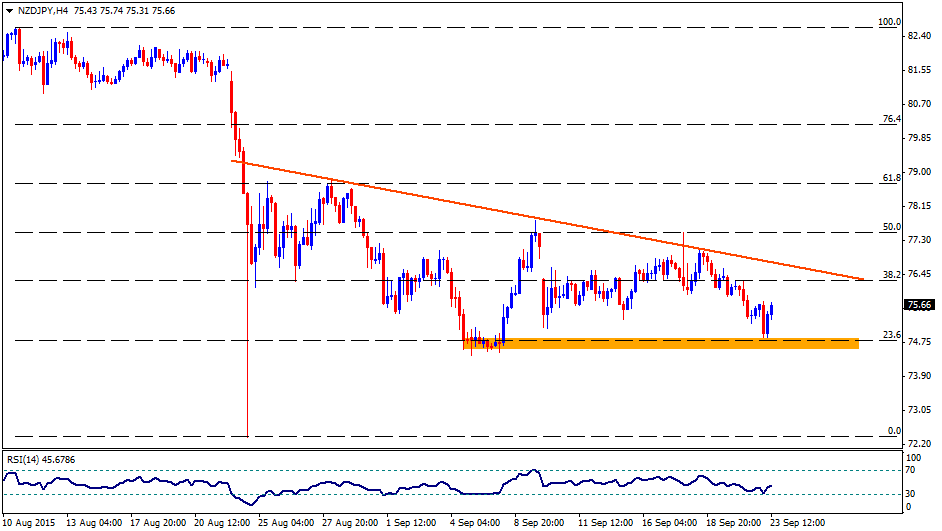

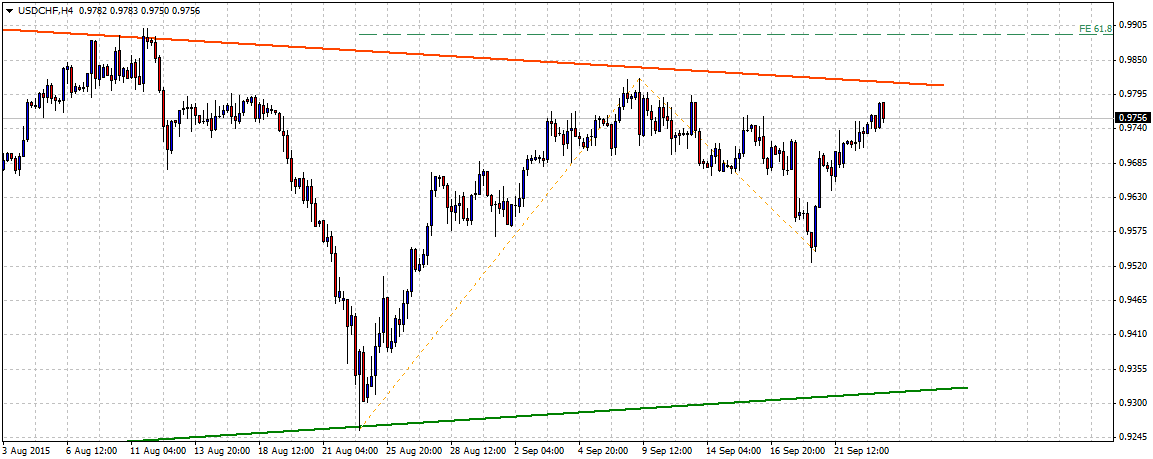

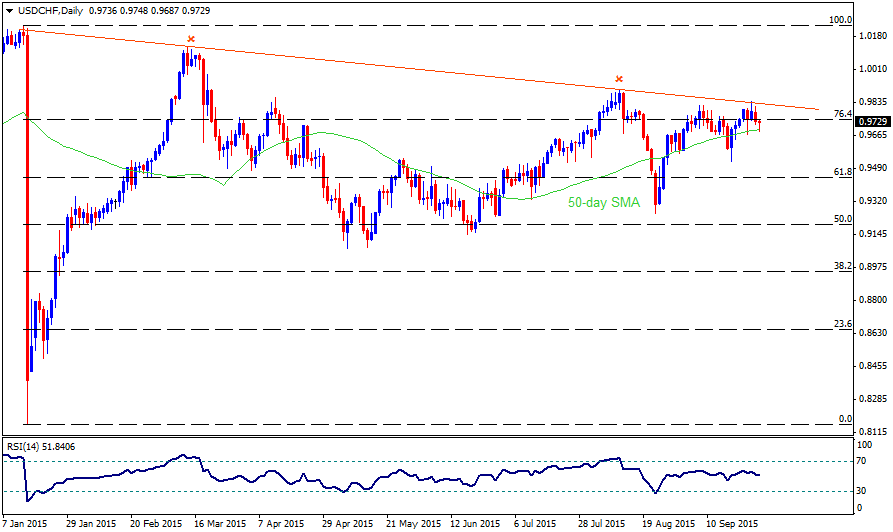

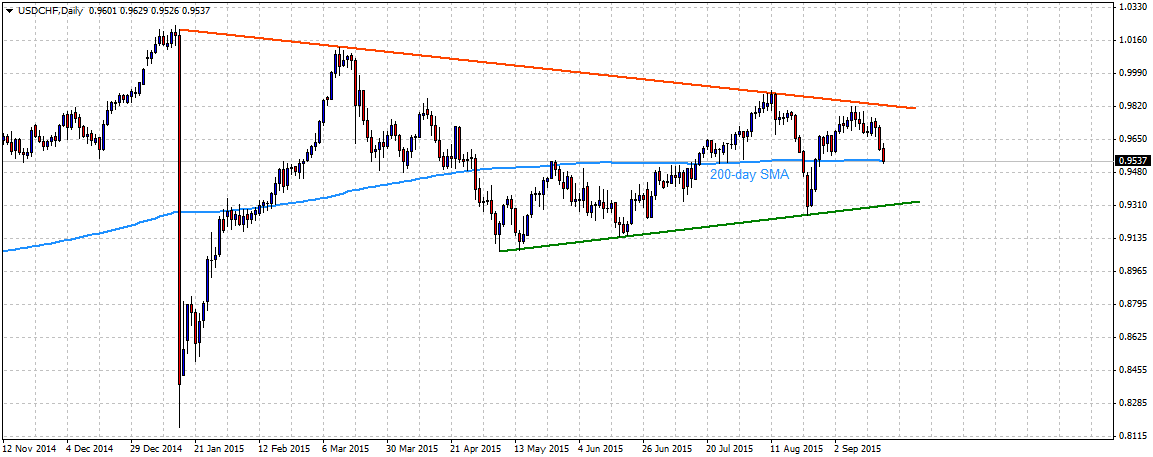

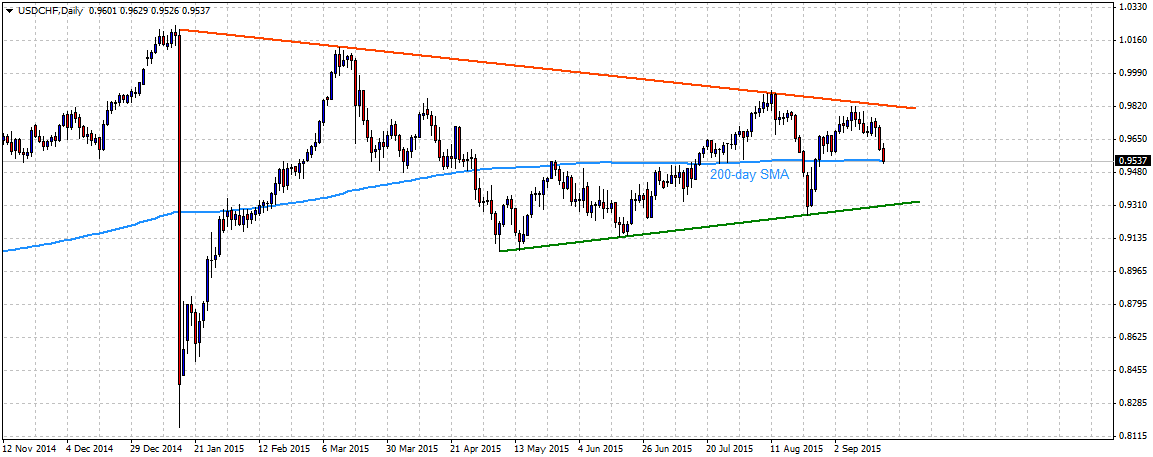

USDCHF

After failing to clear a descending trend-line resistance, the pair on Friday dropped back to retest 200-day SMA support, currently near 0.9540 region. A decisive drop below the 200-day SMA support now seems infuse additional near-term weakness towards retesting a very strong support marked by a short-term ascending trend-line, currently near 0.9300 level. However, should the pair manage to hold and register any recovery from 200-day SMA support, it is likely to confront a strong resistance near 0.9660-80 horizontal zone. Only a decisive move back above this immediate strong resistance might negate any near-term bearish expectations for the pair, thus boosting the pair further towards retesting the upper descending trend-line resistance, currently near 0.9800-0.9820 area. Furthermore, the medium-term direction is unlikely to be clear until the pair continues oscillating within the descending trend-line resistance and ascending trend-line support. Only a decisive break on either side would provide a clear picture of further near-term trajectory for the pair.

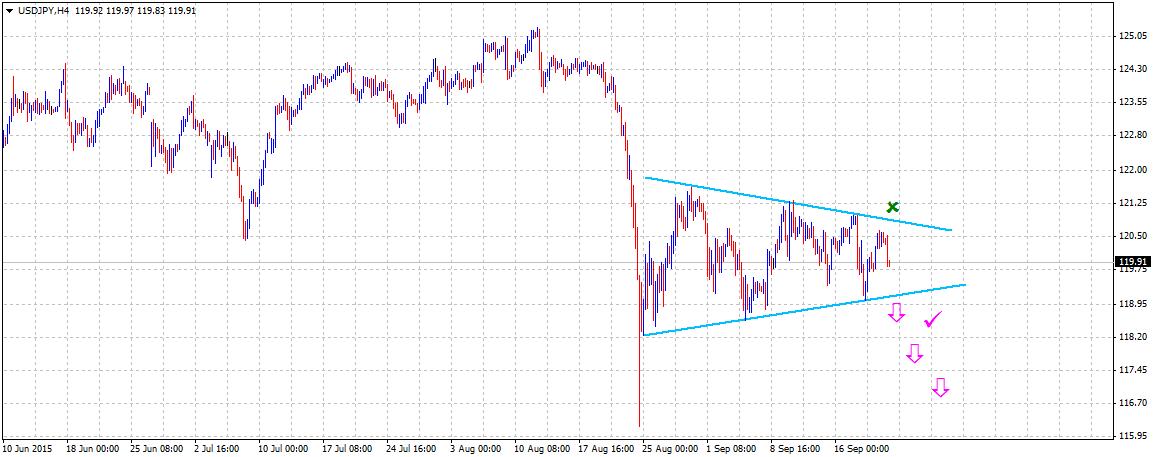

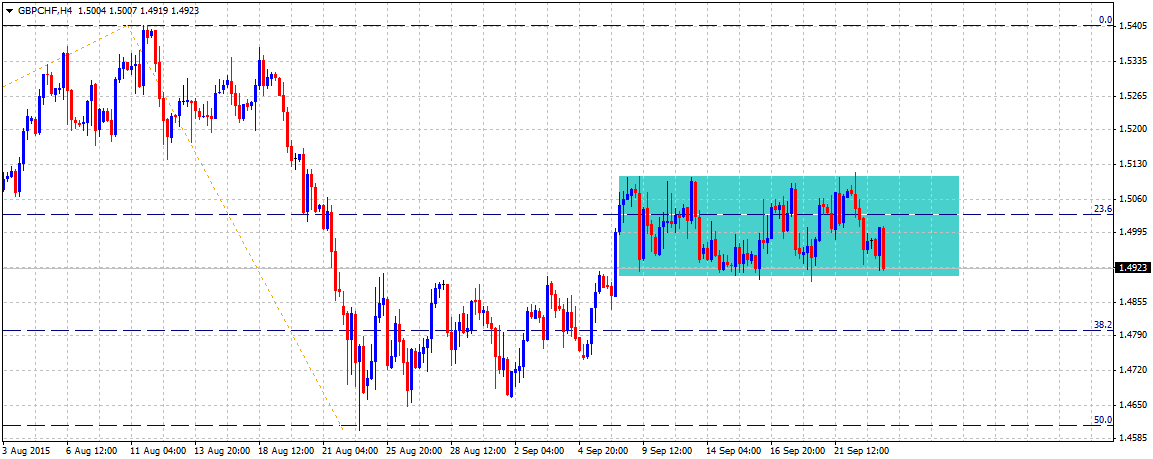

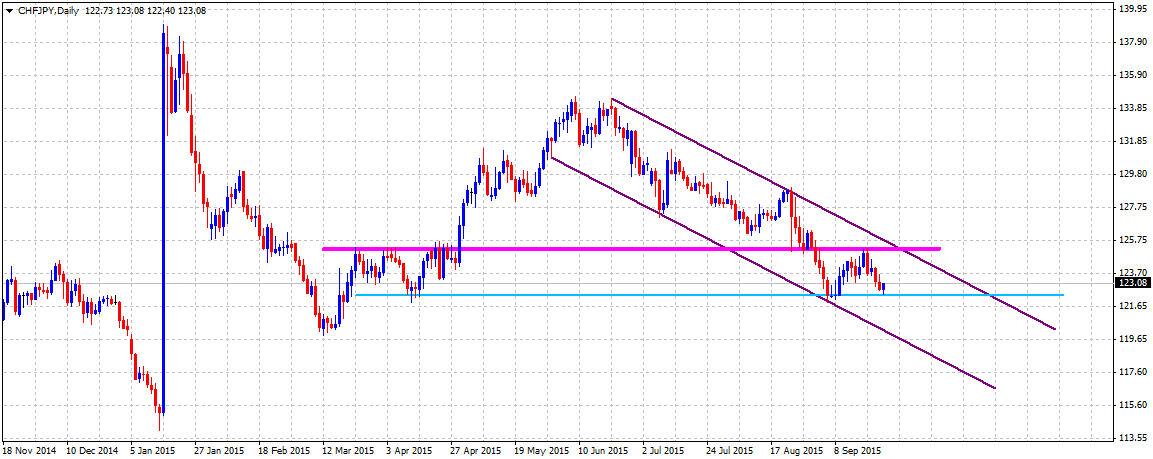

CHFJPY

Rebound from the lower trend-line support of a well-established descending trend-channel now seems to confront strong resistance near 125.00-125.00 area. On a sustained strength above this immediate resistance, the pair is likely to register further recovery immediately towards testing the upper trend-line resistance of the channel, currently near 126.00-126.20 region. A move above this strong resistance is immediately followed by 200-day SMA resistance, currently near 126.60-70 area. Only a decisive break above 126.00 resistance, leading to a further strength above 200-day SMA would confirm a break-out above the channel, thus paving way for additional near-term up-move towards its next horizontal resistance near 128.80-129.00 region. Alternatively, reversal from current resistance area and a subsequent drop back below 124.20-124.00 mark immediate horizontal support, is likely to drag the pair back towards recent daily closing lows support near 122.30-20 region. The fall could further get accelerated towards testing the lower trend-line support of the channel near 121.00-120.80 region.

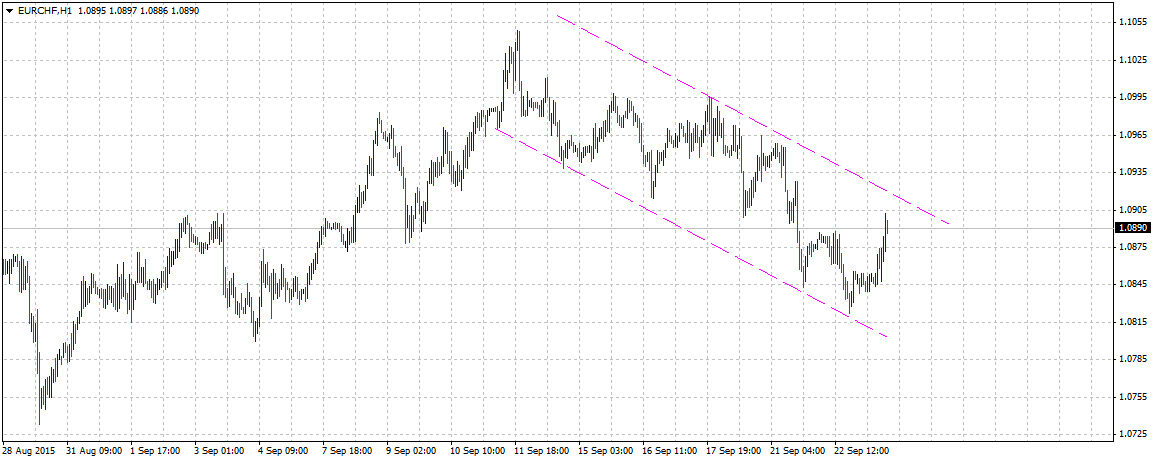

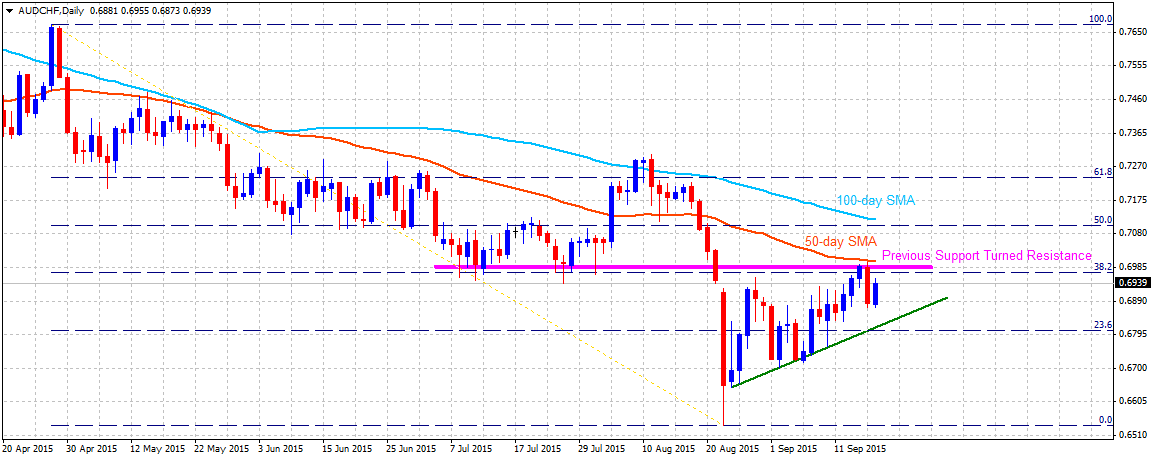

AUDCHF

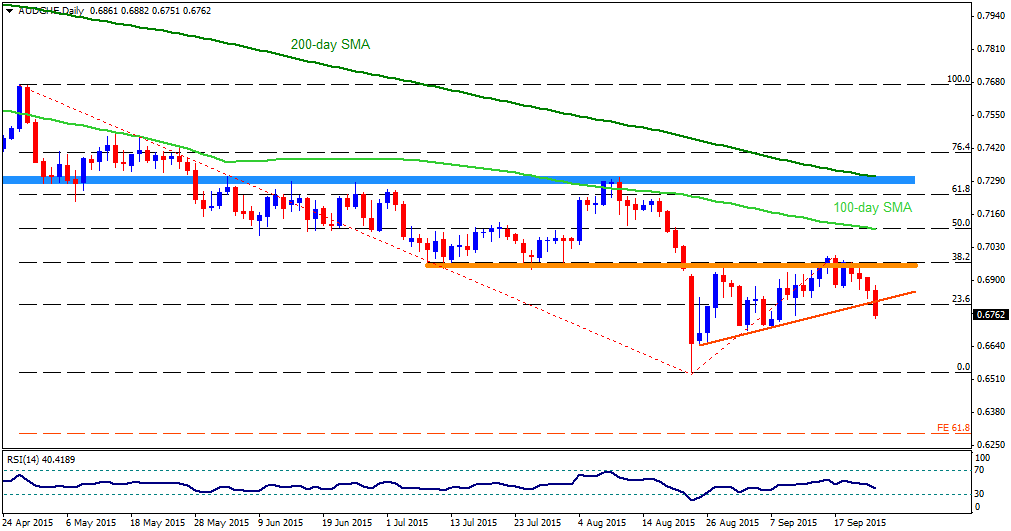

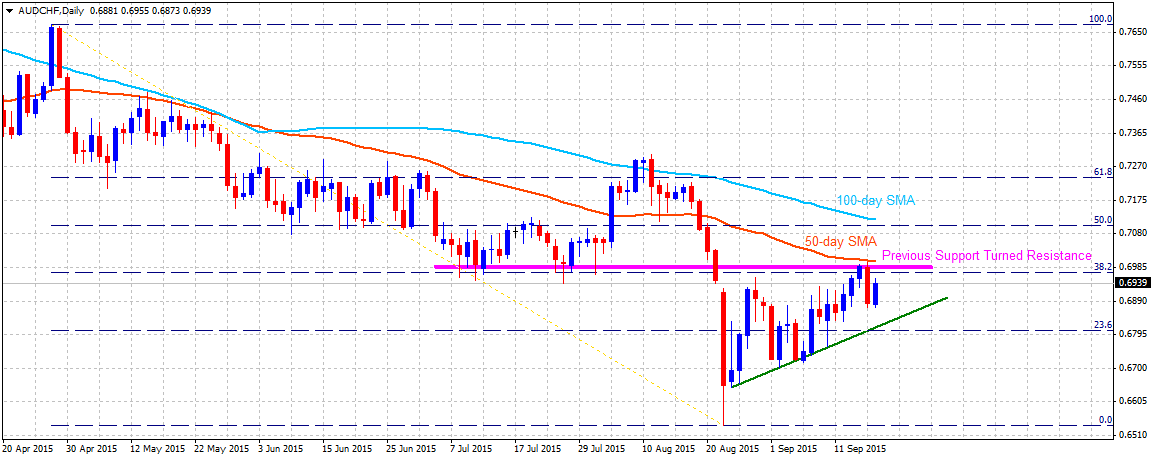

Although the pair is attempting a gradual recovery along a short-term ascending trend-line, it continues to face strong resistance at an important support turned resistance near 0.7000 psychological mark. Should the pair manage to clear this immediate resistance, marking 50-day SMA and also nearing 38.2% Fib. retracement level of April to August down-leg, it seems all set to continue with its recovery trend immediately towards another resistance confluence near 0.7100-0.7120 zone, comprising of 50% Fib. retracement level and 100-day SMA. Meanwhile, reversal from 0.7000 important resistance might find an intermediate minor support near 0.6880-70 zone. But major downside support is marked by the short-term ascending trend-line, currently near 0.6820-0.6800 region, also coinciding with 23.6% Fib. retracement level. Failure to hold this important support is likely to accelerate the fall back towards 0.6720 intermediate support with the downward trajectory expected to continue towards retesting August closing lows support near 0.6650 level.

“Original analysis is provided by Admiral Markets”

USDCHF

After failing to clear a descending trend-line resistance, the pair on Friday dropped back to retest 200-day SMA support, currently near 0.9540 region. A decisive drop below the 200-day SMA support now seems infuse additional near-term weakness towards retesting a very strong support marked by a short-term ascending trend-line, currently near 0.9300 level. However, should the pair manage to hold and register any recovery from 200-day SMA support, it is likely to confront a strong resistance near 0.9660-80 horizontal zone. Only a decisive move back above this immediate strong resistance might negate any near-term bearish expectations for the pair, thus boosting the pair further towards retesting the upper descending trend-line resistance, currently near 0.9800-0.9820 area. Furthermore, the medium-term direction is unlikely to be clear until the pair continues oscillating within the descending trend-line resistance and ascending trend-line support. Only a decisive break on either side would provide a clear picture of further near-term trajectory for the pair.

CHFJPY

Rebound from the lower trend-line support of a well-established descending trend-channel now seems to confront strong resistance near 125.00-125.00 area. On a sustained strength above this immediate resistance, the pair is likely to register further recovery immediately towards testing the upper trend-line resistance of the channel, currently near 126.00-126.20 region. A move above this strong resistance is immediately followed by 200-day SMA resistance, currently near 126.60-70 area. Only a decisive break above 126.00 resistance, leading to a further strength above 200-day SMA would confirm a break-out above the channel, thus paving way for additional near-term up-move towards its next horizontal resistance near 128.80-129.00 region. Alternatively, reversal from current resistance area and a subsequent drop back below 124.20-124.00 mark immediate horizontal support, is likely to drag the pair back towards recent daily closing lows support near 122.30-20 region. The fall could further get accelerated towards testing the lower trend-line support of the channel near 121.00-120.80 region.

AUDCHF

Although the pair is attempting a gradual recovery along a short-term ascending trend-line, it continues to face strong resistance at an important support turned resistance near 0.7000 psychological mark. Should the pair manage to clear this immediate resistance, marking 50-day SMA and also nearing 38.2% Fib. retracement level of April to August down-leg, it seems all set to continue with its recovery trend immediately towards another resistance confluence near 0.7100-0.7120 zone, comprising of 50% Fib. retracement level and 100-day SMA. Meanwhile, reversal from 0.7000 important resistance might find an intermediate minor support near 0.6880-70 zone. But major downside support is marked by the short-term ascending trend-line, currently near 0.6820-0.6800 region, also coinciding with 23.6% Fib. retracement level. Failure to hold this important support is likely to accelerate the fall back towards 0.6720 intermediate support with the downward trajectory expected to continue towards retesting August closing lows support near 0.6650 level.

“Original analysis is provided by Admiral Markets”