Admiral Markets

AdmiralMarkets.com Representative

- Messages

- 95

Technical Outlook - EURGBP, EURJPY and NZDJPY

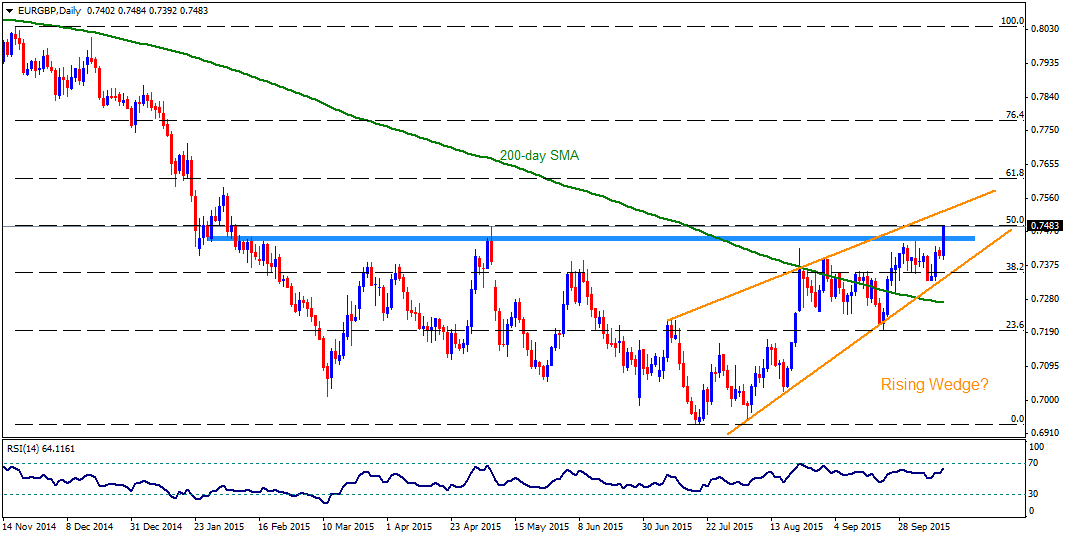

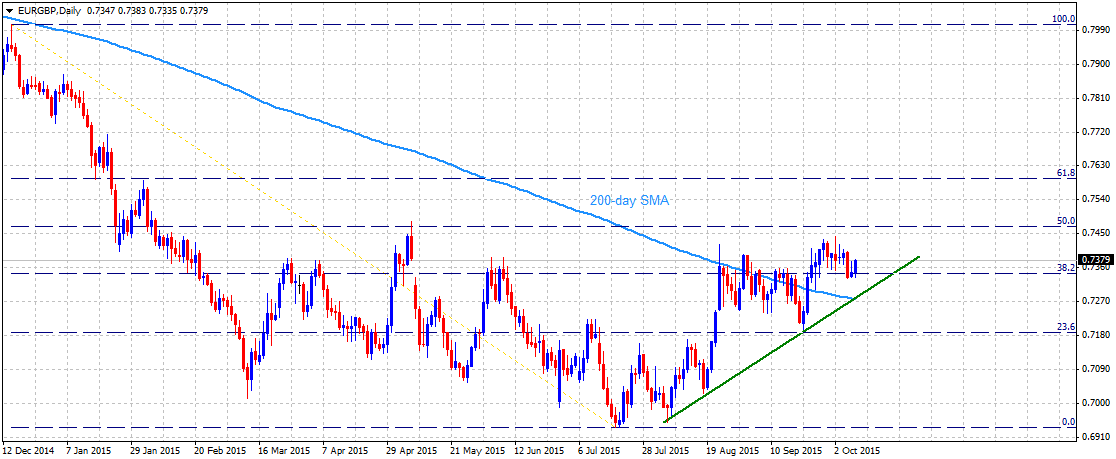

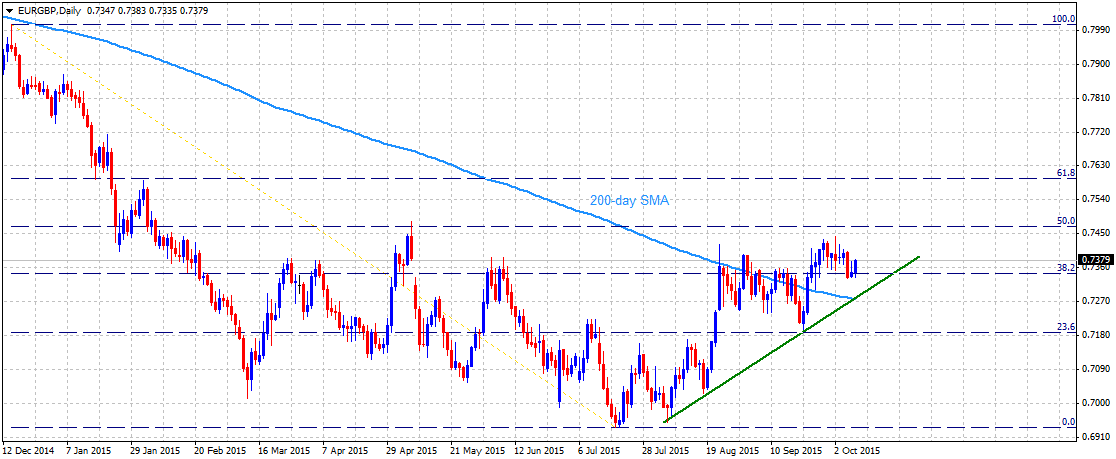

EURGBP

Extending its recovery along a short-term ascending trend-line support, the pair has decisively conquered the very important 200-day SMA hurdle for the first time since Oct. 2013 and subsequently moved above 38.2% Fib. retracement level. This 38.2% Fib. retracement level near 0.7340-30 area now seems to act as immediate support on the downside. Drop below this immediate support is likely to continue finding support at the ascending trend-line, near 0.7280-75 area, which now also coincides with 200-day SMA. Only a decisive weakness below this strong support confluence might negate expectations of any further near-term recovery and drag the pair immediately towards 23.6% Fib. retracement level support near 0.7200-0.7190 zone. Meanwhile, until the pair continues to hold its strength above 38.2% Fib. retracement level and manages to clear 0.7400 round figure mark, it is likely to extend its recovery immediately towards testing 50% Fib. retracement level. The near-term up-move could further get extended towards 0.7595-0.7600 resistance, marking 61.8% Fib. retracement level.

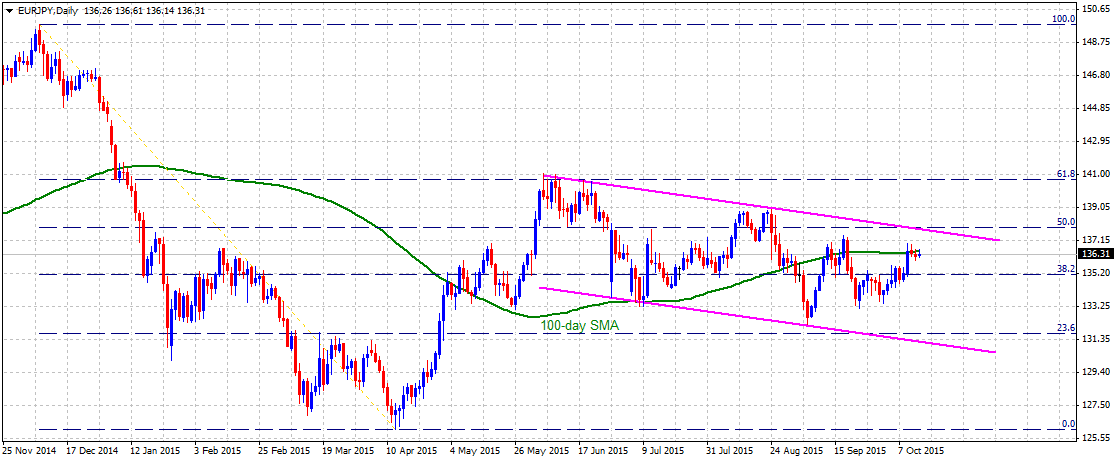

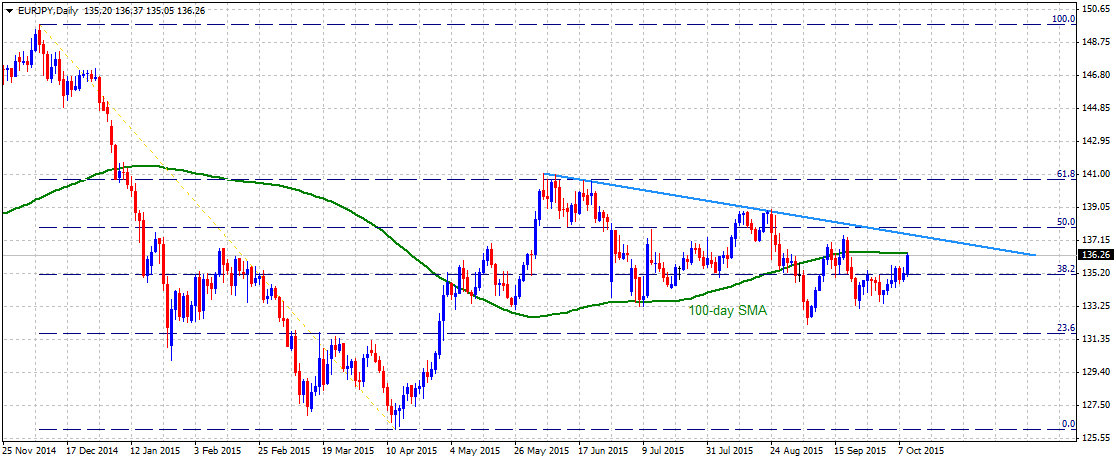

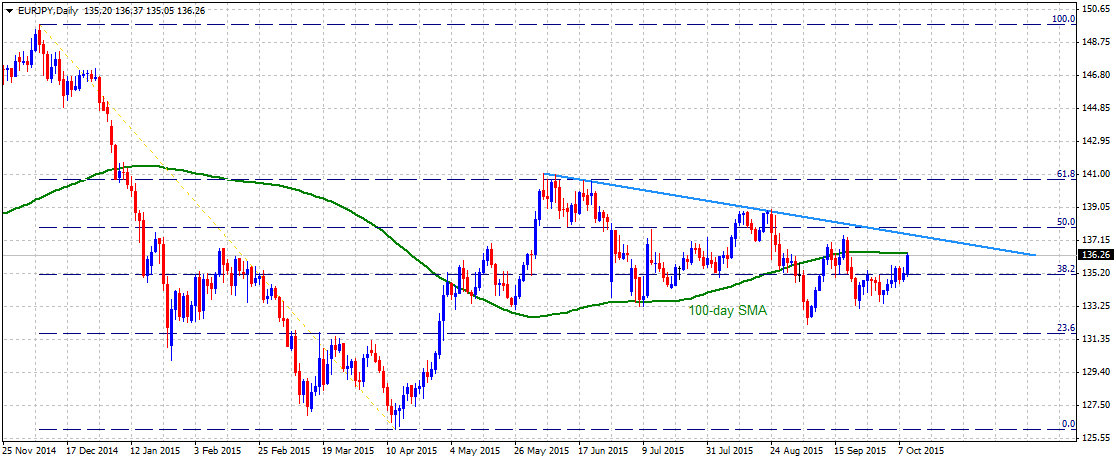

EURJPY

Even as the pair continues with its short-term descending trend, as depicted by a descending trend-channel formation on daily chart, it has managed to move back towards 100-day SMA immediate resistance, near 136.40. Continuing with its momentum, should the pair manage to move above 100-day SMA it is likely to aim back towards testing the upper trend-line of the channel, currently near 137.80-138.00 area, also coinciding with 61.8% Fib. retracement level of Dec. 2014 to April 2015 down-leg. Alternatively, should the pair fail to clear the 100-day SMA immediate hurdle, and drop back below 38.2% Fib. retracement level intermediate support near 135.00 mark, its is likely to resume it's near-term downward trajectory back towards testing 133.20-133.00 intermediate support before heading towards testing the lower trend-line support of the channel, near 131.50 region, also nearing 23.6% Fib. retracement level.

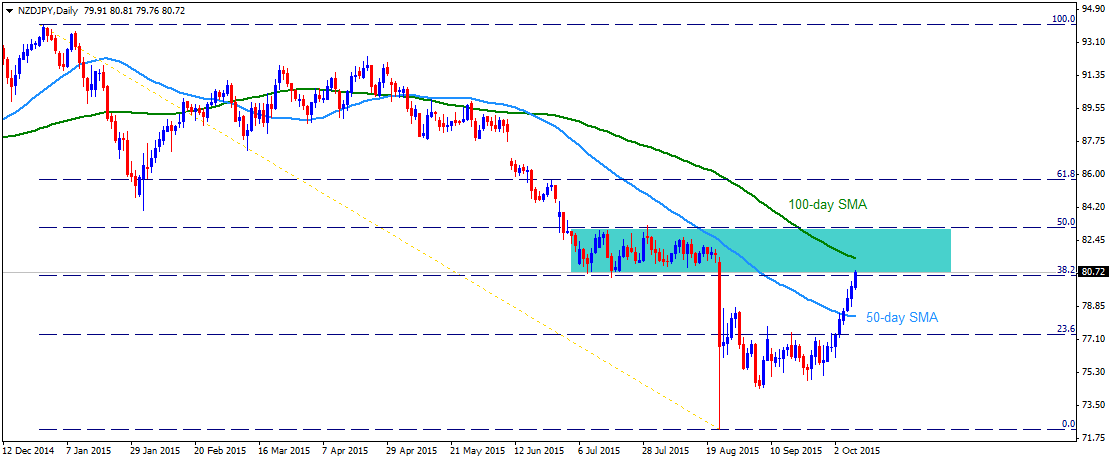

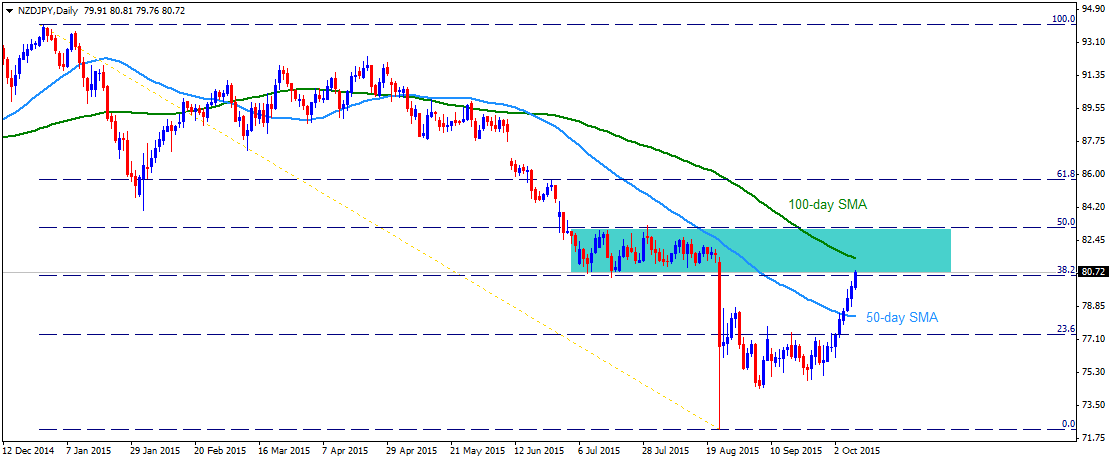

NZDJPY

Although the pair has managed to register a meaningful recovery from August lows to move back above 50-day SMA for the first time since May 2015, it is yet to clear its previous trading range break-down point now turned immediate resistance near 80.80 level (close to 38.2% Fib. retracement level of Dec. 2014 to Aug. 2015 sharp fall). A move above this support turned resistance is likely to confront resistance at 100-day SMA, currently near 81.40-45 area, which if cleared has the potential to lift the pair back towards 83.00 mark resistance, coinciding with 50% Fib. retracement level. Meanwhile, reversal from current resistance area now seems to find immediate support near 80.00 psychological mark. Weakness below 80.00 mark seems get extended but is likely to be limited by 50-day SMA support, currently 78.40-20 area. The 50-day SMA now seems to have emerged as a strong support on the downside.

“Original analysis is provided by Admiral Markets”

EURGBP

Extending its recovery along a short-term ascending trend-line support, the pair has decisively conquered the very important 200-day SMA hurdle for the first time since Oct. 2013 and subsequently moved above 38.2% Fib. retracement level. This 38.2% Fib. retracement level near 0.7340-30 area now seems to act as immediate support on the downside. Drop below this immediate support is likely to continue finding support at the ascending trend-line, near 0.7280-75 area, which now also coincides with 200-day SMA. Only a decisive weakness below this strong support confluence might negate expectations of any further near-term recovery and drag the pair immediately towards 23.6% Fib. retracement level support near 0.7200-0.7190 zone. Meanwhile, until the pair continues to hold its strength above 38.2% Fib. retracement level and manages to clear 0.7400 round figure mark, it is likely to extend its recovery immediately towards testing 50% Fib. retracement level. The near-term up-move could further get extended towards 0.7595-0.7600 resistance, marking 61.8% Fib. retracement level.

EURJPY

Even as the pair continues with its short-term descending trend, as depicted by a descending trend-channel formation on daily chart, it has managed to move back towards 100-day SMA immediate resistance, near 136.40. Continuing with its momentum, should the pair manage to move above 100-day SMA it is likely to aim back towards testing the upper trend-line of the channel, currently near 137.80-138.00 area, also coinciding with 61.8% Fib. retracement level of Dec. 2014 to April 2015 down-leg. Alternatively, should the pair fail to clear the 100-day SMA immediate hurdle, and drop back below 38.2% Fib. retracement level intermediate support near 135.00 mark, its is likely to resume it's near-term downward trajectory back towards testing 133.20-133.00 intermediate support before heading towards testing the lower trend-line support of the channel, near 131.50 region, also nearing 23.6% Fib. retracement level.

NZDJPY

Although the pair has managed to register a meaningful recovery from August lows to move back above 50-day SMA for the first time since May 2015, it is yet to clear its previous trading range break-down point now turned immediate resistance near 80.80 level (close to 38.2% Fib. retracement level of Dec. 2014 to Aug. 2015 sharp fall). A move above this support turned resistance is likely to confront resistance at 100-day SMA, currently near 81.40-45 area, which if cleared has the potential to lift the pair back towards 83.00 mark resistance, coinciding with 50% Fib. retracement level. Meanwhile, reversal from current resistance area now seems to find immediate support near 80.00 psychological mark. Weakness below 80.00 mark seems get extended but is likely to be limited by 50-day SMA support, currently 78.40-20 area. The 50-day SMA now seems to have emerged as a strong support on the downside.

“Original analysis is provided by Admiral Markets”