Admiral Markets

AdmiralMarkets.com Representative

- Messages

- 95

Technical Update: GBPCAD, GBPCHF and CADCHF

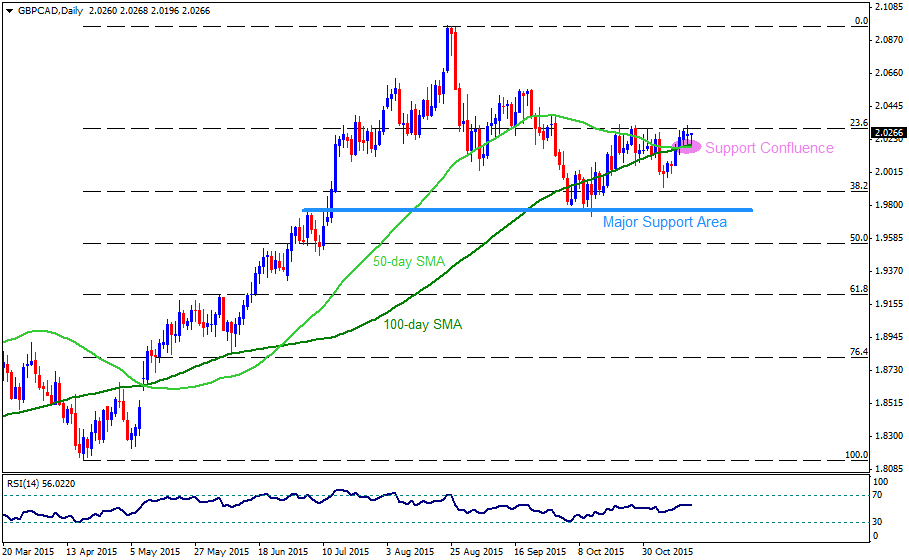

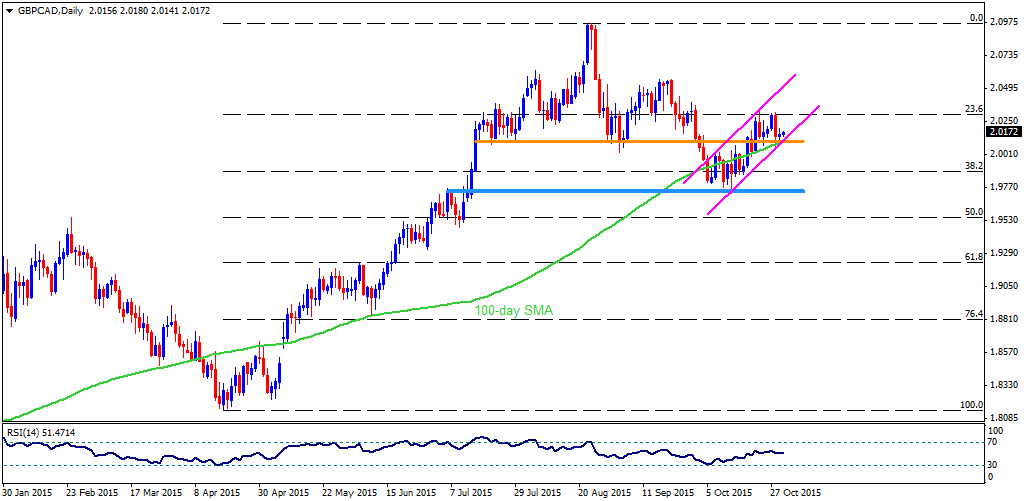

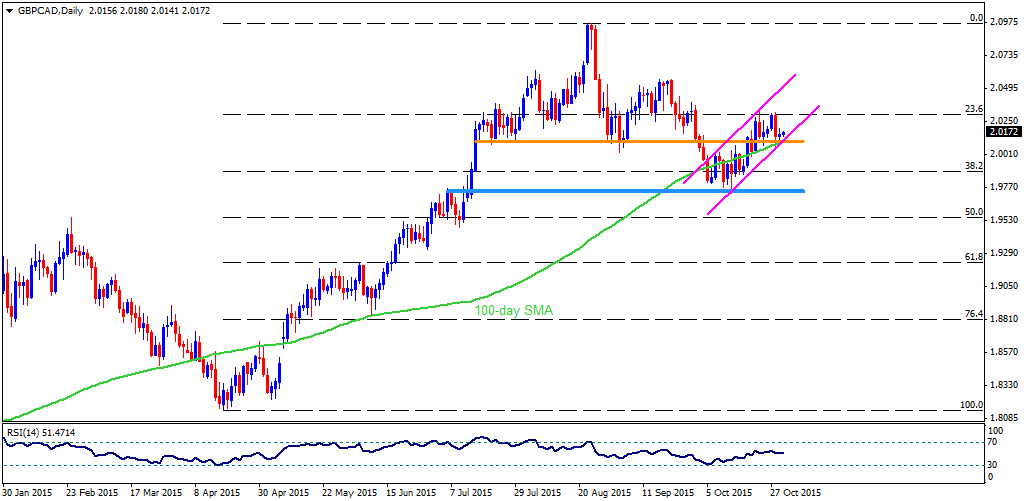

GBPCAD

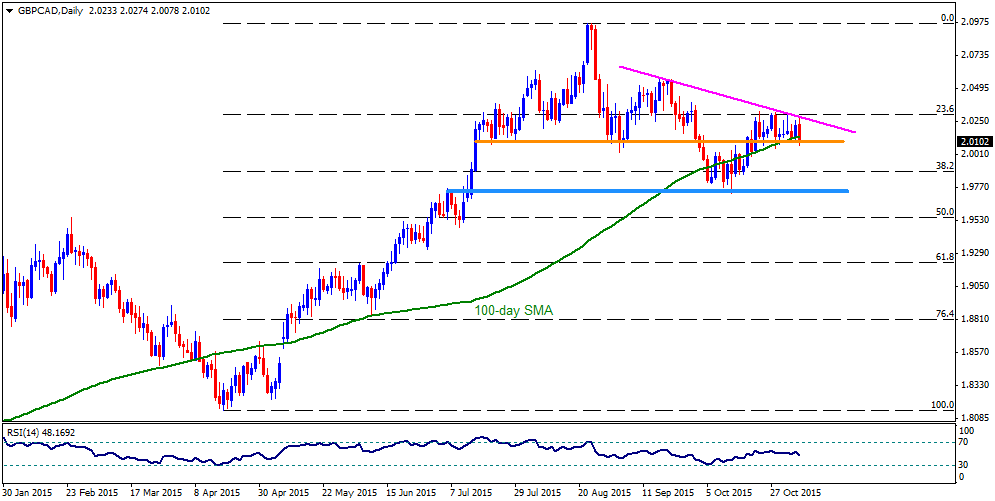

Although, GBPCAD failed to break 2.0300 round figure mark, also encompassing 23.6% Fibo of its April – August rally, the 2.0110 – 2.0100 support area, including 100-day SMA, horizontal support region and lower line of the short-term ascending trend-channel, provides strong downside support to limit the pair's further decline. On the upside, the 2.0300 is likely immediate resistance that the pair can witness during its pullback move, breaking which 2.0500, including the channel resistance may restrict the pair's advance. Should it manage to break 2.0500 on a closing basis, chances of the pair's rally towards 2.0970, including August highs, can't be denied; though, 2.0600 is likely an intermediate resistance for the pair. Alternatively, a daily break below 2.0100 can quickly pull the pair back to 2.0000 psychological magnet and then to 38.2% Fibo, near 1.9900 mark, breaking which 1.9730-50 support-zone may stop the pair's down-turn.

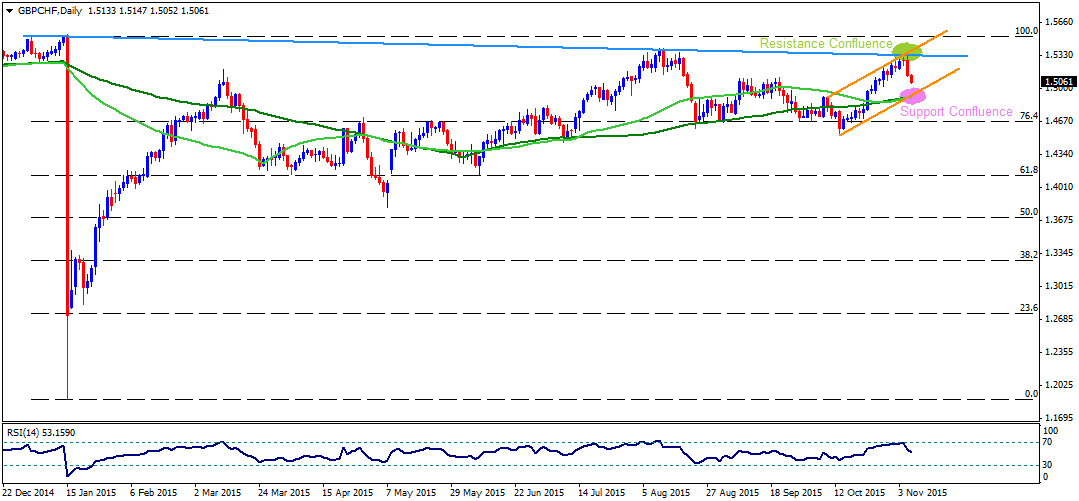

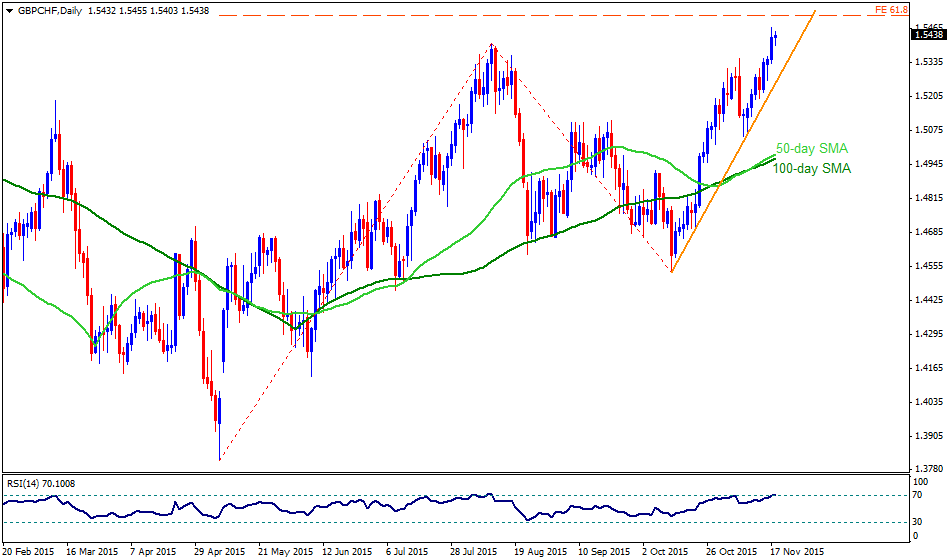

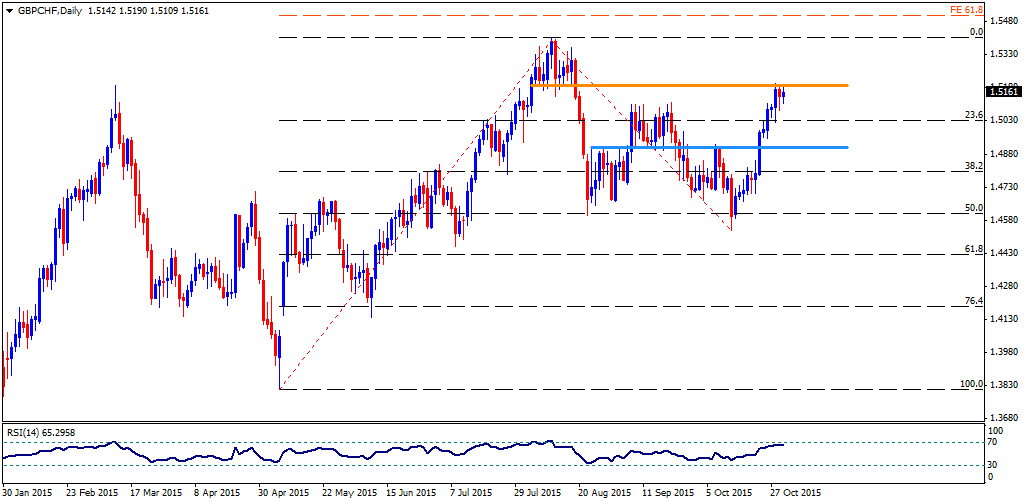

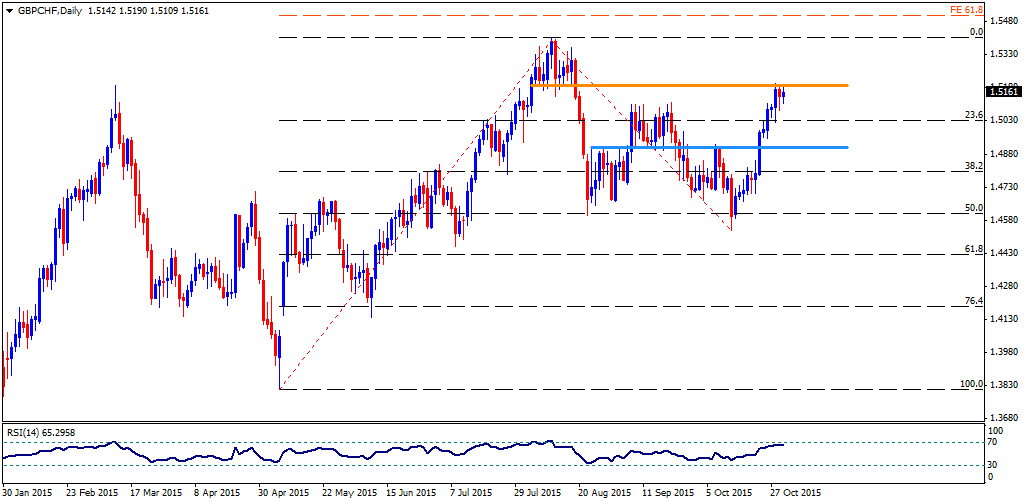

GBPCHF

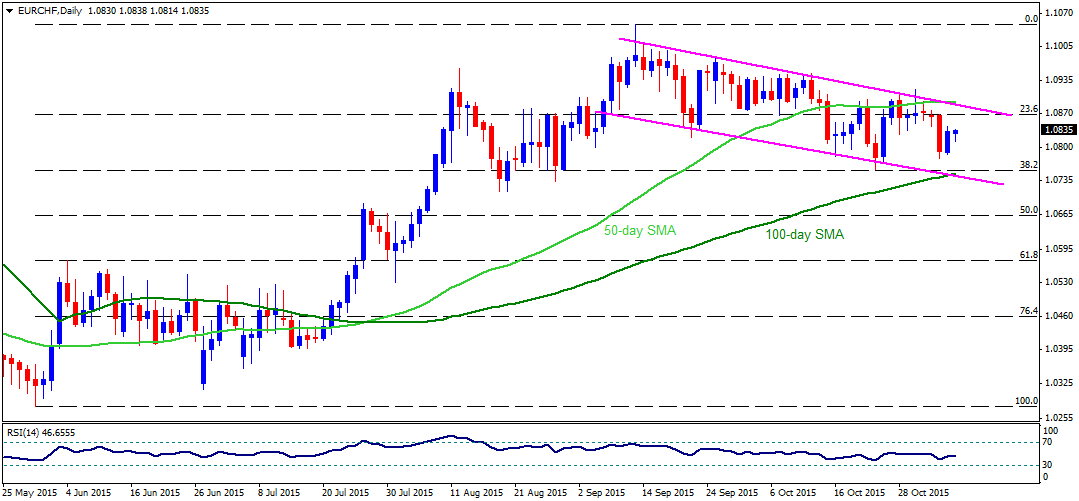

Following its reversal from 1.4500 area, the GBPCHF managed to register considerable up-move, fueling the pair towards highest levels in more than two months during early weekdays; however, 1.5185 – 1.5200 horizontal resistance region restricted its further advance. Should the pair fails to break the 1.5200 mark on a daily closing basis, it can quickly decline to 23.6% Fibo of its May – August up-run, around 1.5030, breaking which the pair becomes weaker enough to aim for 1.4910 – 1.4900 horizontal support region and to the 38.2% Fibo, near 1.4800 round figure mark. Meanwhile, pair's ability to surpass 1.5200 can trigger immediate run to 1.5310, breaking which 1.5400, near the August highs, and the 61.8% FE of the said rally, around 1.5500 round figure mark, are likely consecutive resistances that the pair should witness during its successive advance.

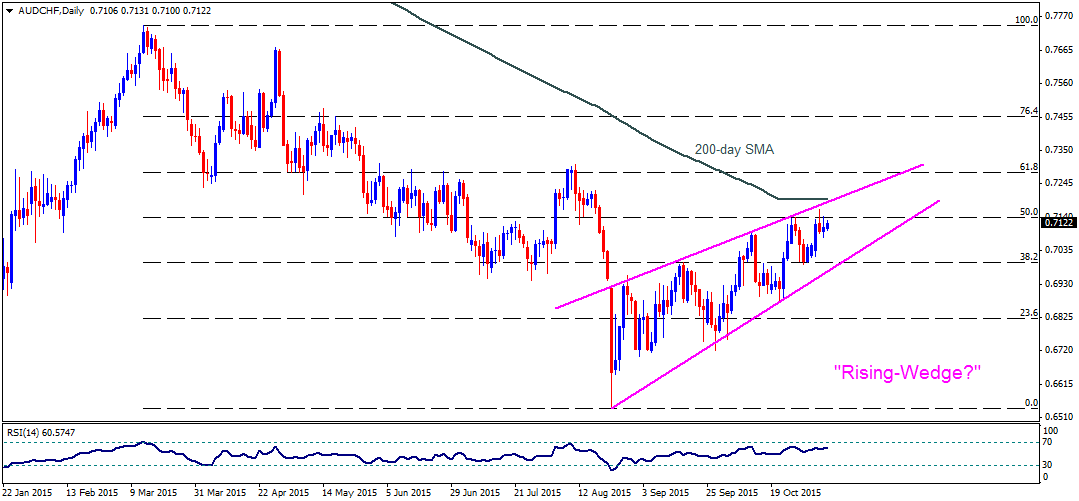

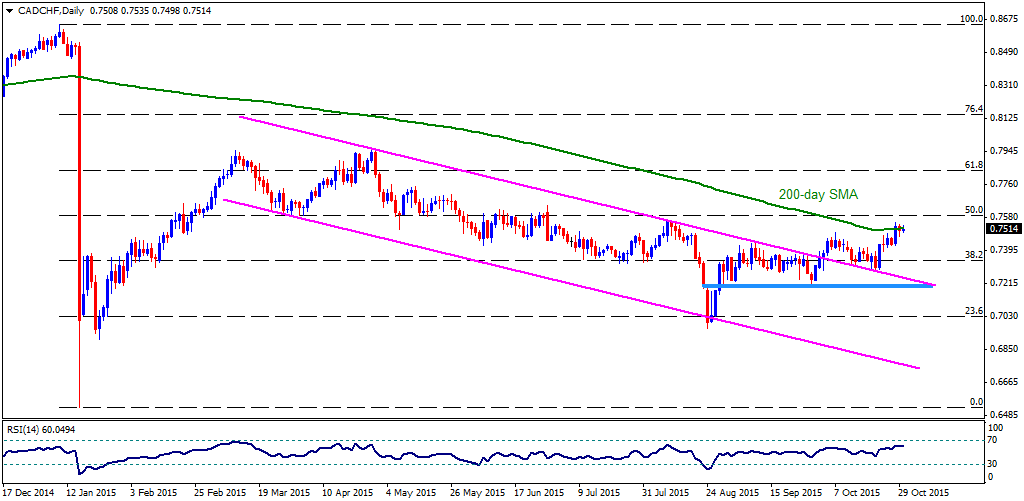

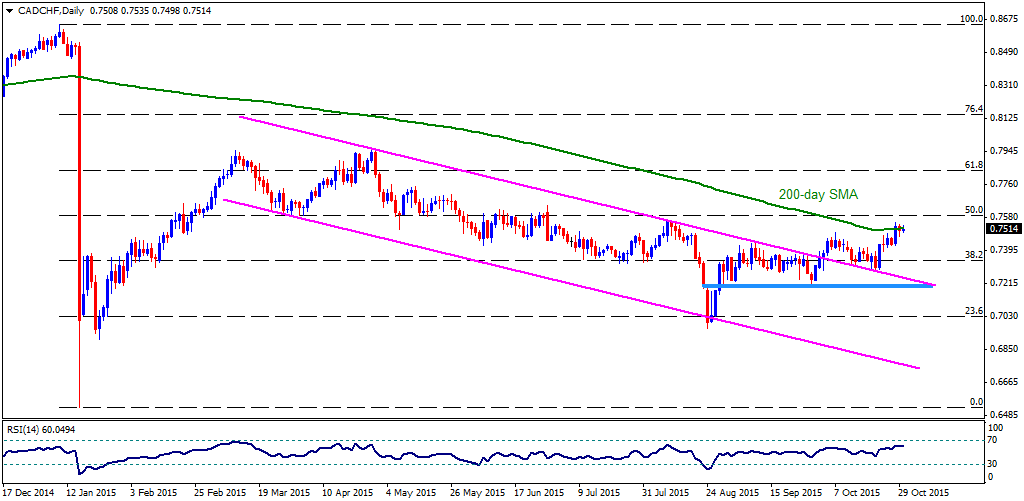

CADCHF

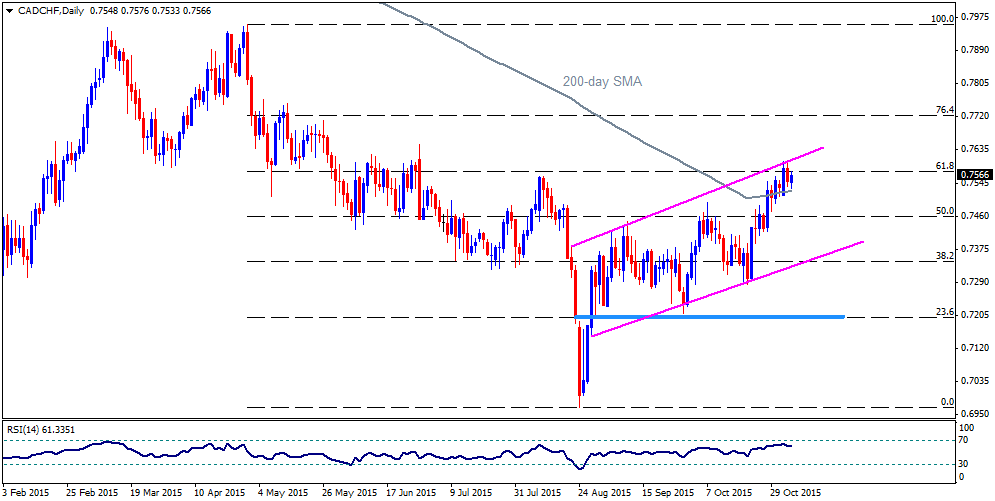

Sustained break of seven month old descending trend-channel favored the CADCHF rally towards the highest levels since early August; though, 200-day SMA, presently near 0.7520, limits the pair's additional rise, indicating the pair's pullback to 0.7400 round figure mark. Should the pair keep trading down below 0.7400, 38.2% Fibo of its January plunge, near 0.7330 and the channel resistance-turned-support, near 0.7245, are likely following supports that it could witness during its down-turn. Moreover, a break below 0.7245 can witness 0.7200 – 0.7195 as strong horizontal support to limit the pair's further downside, breaking which chances of its quick plunge to 23.6% Fibo, near 0.7020, can't be denied. On the other hand, a daily close above 0.7520, can make the pair witness 50% Fibo, near 0.7585, and the 0.7655-60 resistance area before it could rally to 0.7750 and the 0.7830 levels.

“Original analysis is provided by Admiral Markets”

GBPCAD

Although, GBPCAD failed to break 2.0300 round figure mark, also encompassing 23.6% Fibo of its April – August rally, the 2.0110 – 2.0100 support area, including 100-day SMA, horizontal support region and lower line of the short-term ascending trend-channel, provides strong downside support to limit the pair's further decline. On the upside, the 2.0300 is likely immediate resistance that the pair can witness during its pullback move, breaking which 2.0500, including the channel resistance may restrict the pair's advance. Should it manage to break 2.0500 on a closing basis, chances of the pair's rally towards 2.0970, including August highs, can't be denied; though, 2.0600 is likely an intermediate resistance for the pair. Alternatively, a daily break below 2.0100 can quickly pull the pair back to 2.0000 psychological magnet and then to 38.2% Fibo, near 1.9900 mark, breaking which 1.9730-50 support-zone may stop the pair's down-turn.

GBPCHF

Following its reversal from 1.4500 area, the GBPCHF managed to register considerable up-move, fueling the pair towards highest levels in more than two months during early weekdays; however, 1.5185 – 1.5200 horizontal resistance region restricted its further advance. Should the pair fails to break the 1.5200 mark on a daily closing basis, it can quickly decline to 23.6% Fibo of its May – August up-run, around 1.5030, breaking which the pair becomes weaker enough to aim for 1.4910 – 1.4900 horizontal support region and to the 38.2% Fibo, near 1.4800 round figure mark. Meanwhile, pair's ability to surpass 1.5200 can trigger immediate run to 1.5310, breaking which 1.5400, near the August highs, and the 61.8% FE of the said rally, around 1.5500 round figure mark, are likely consecutive resistances that the pair should witness during its successive advance.

CADCHF

Sustained break of seven month old descending trend-channel favored the CADCHF rally towards the highest levels since early August; though, 200-day SMA, presently near 0.7520, limits the pair's additional rise, indicating the pair's pullback to 0.7400 round figure mark. Should the pair keep trading down below 0.7400, 38.2% Fibo of its January plunge, near 0.7330 and the channel resistance-turned-support, near 0.7245, are likely following supports that it could witness during its down-turn. Moreover, a break below 0.7245 can witness 0.7200 – 0.7195 as strong horizontal support to limit the pair's further downside, breaking which chances of its quick plunge to 23.6% Fibo, near 0.7020, can't be denied. On the other hand, a daily close above 0.7520, can make the pair witness 50% Fibo, near 0.7585, and the 0.7655-60 resistance area before it could rally to 0.7750 and the 0.7830 levels.

“Original analysis is provided by Admiral Markets”