Admiral Markets

AdmiralMarkets.com Representative

- Messages

- 95

Technical Update - GBPJPY, NZDJPY and NZDCAD

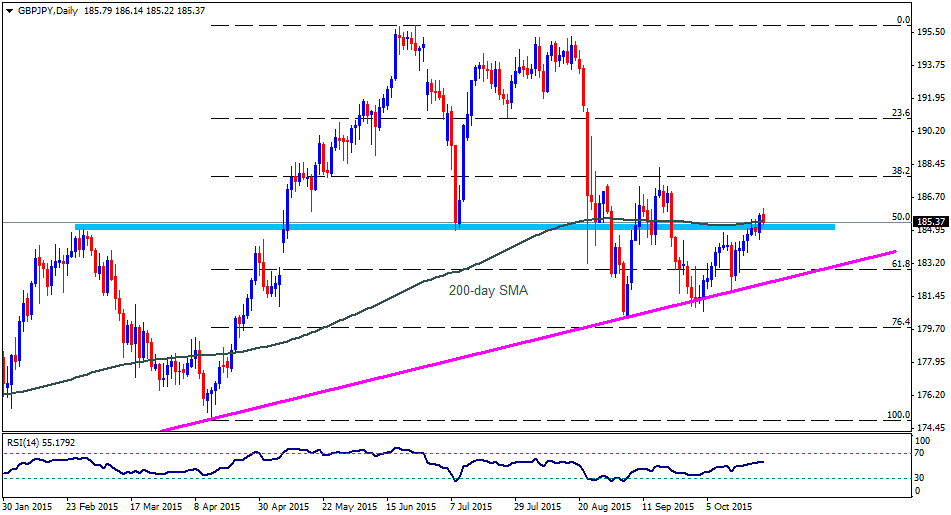

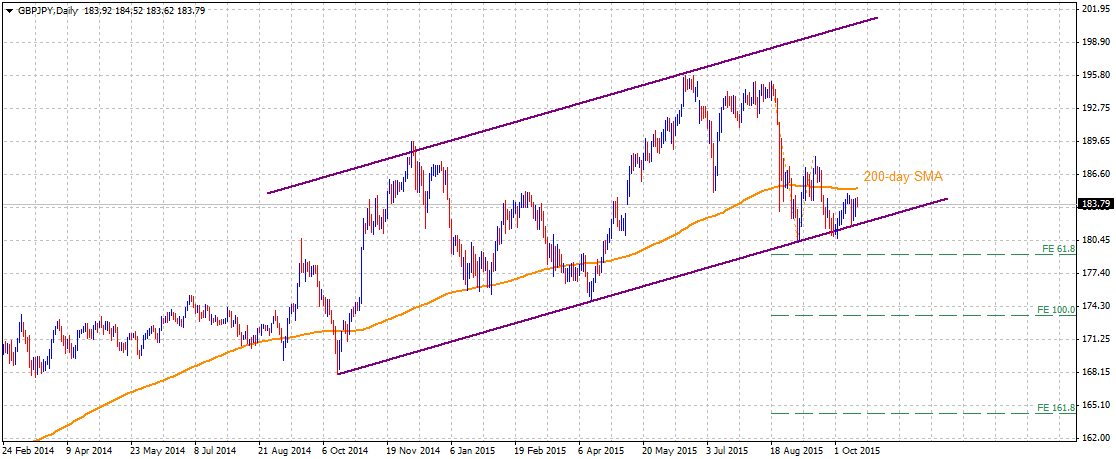

GBPJPY

The pair continues to hold the lower trend-line support of a well-established ascending trend-channel formation on daily chart. However, rebound from the lower trend-line support, currently near 182.00 mark now seems to face strong hurdle at 200-day SMA region, currently near 185.00-20 area. A decisive strength back above 200-day SMA now seems to reaffirm the prospects of extending the bounce back towards 188.00 mark horizontal resistance. Alternatively, a decisive break below the lower trend-line support seems to immediately drag the pair below its immediate strong support near 180.70-50 area and also below 180.00 psychological mark towards testing 179.00 mark support. Moreover, the break below the ascending trend-channel, held since the last quarter of 2014, is likely to increase the pair's vulnerability to continue drifting lower in the near-term.

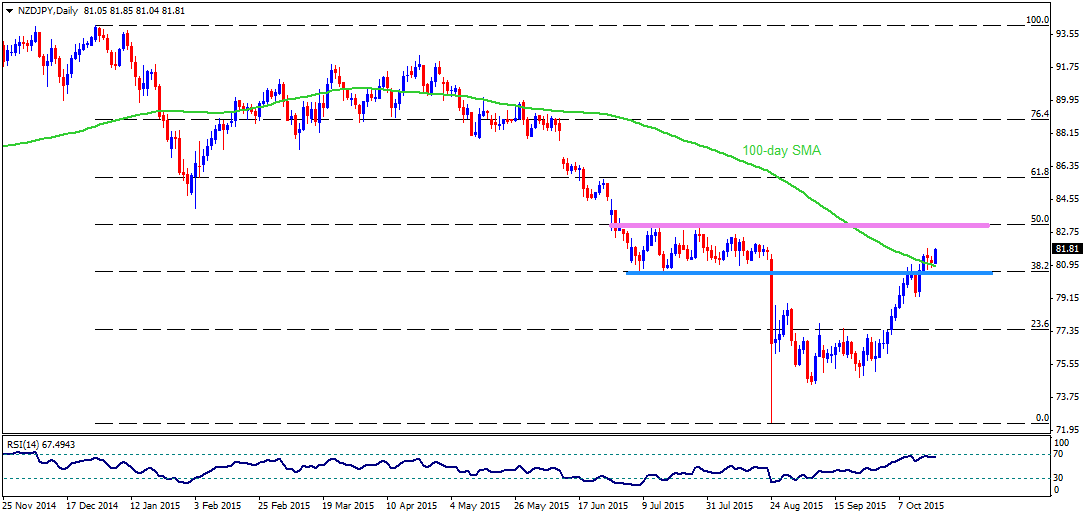

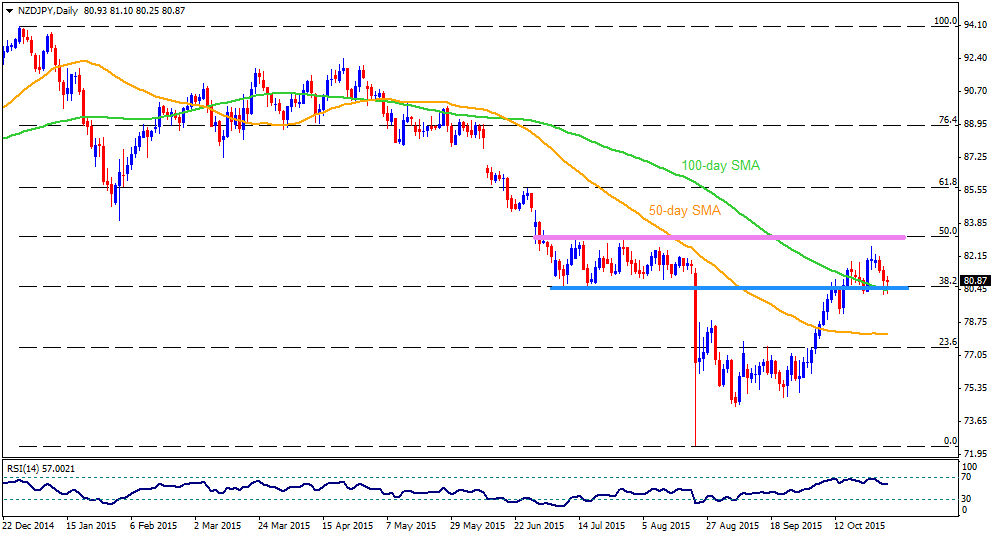

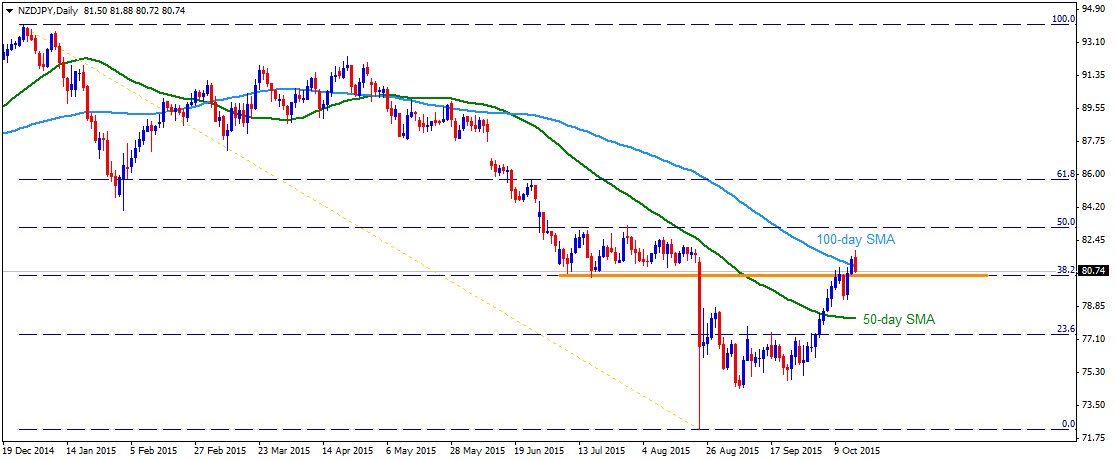

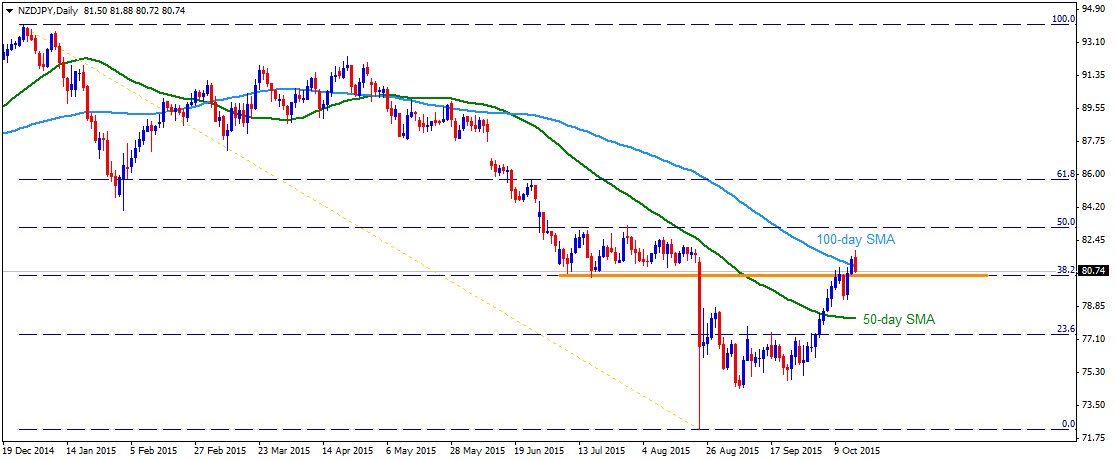

NZDJPY

The pair's recovery momentum from its lowest level since Jan 2013 lifted the pair beyond 50-day SMA for the first time since May 2015. The pair subsequently cleared an important resistance near 80.50 level marking 38.2% Fib. retracement level of Dec. 2014 to Aug. 2015 down-fall. The pair, however, is now facing difficulty in sustaining its strength above 100-day SMA and now seems to be headed back to 80.50 resistance turned immediate support level. Should the pair fail to hold this immediate support, it could possibly be headed back towards testing 79.30-20 horizontal support, which now seems to have emerged as important downside support for the pair. Meanwhile, rebound from 80.50 support area and (or) a sustained strength above 100-day SMA region, near 81.00 mark, now seems to open room for continuation of the near-term upwards trajectory towards its next major resistance near 83.00-10 area, marking 50% Fib. retracement level.

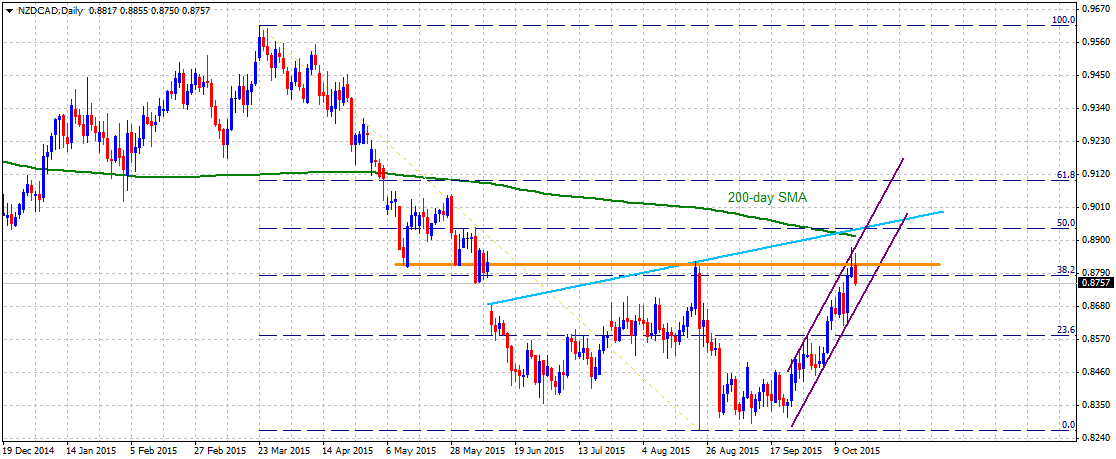

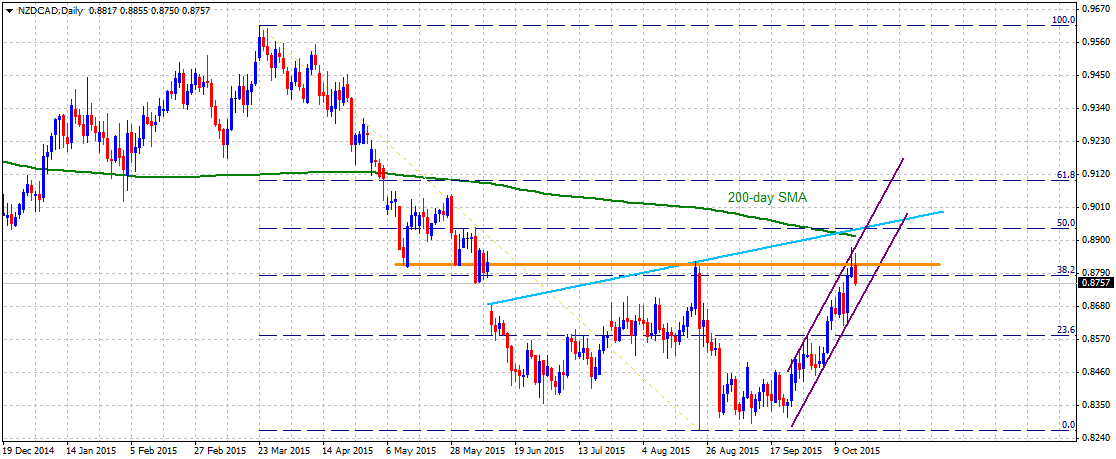

NZDCAD

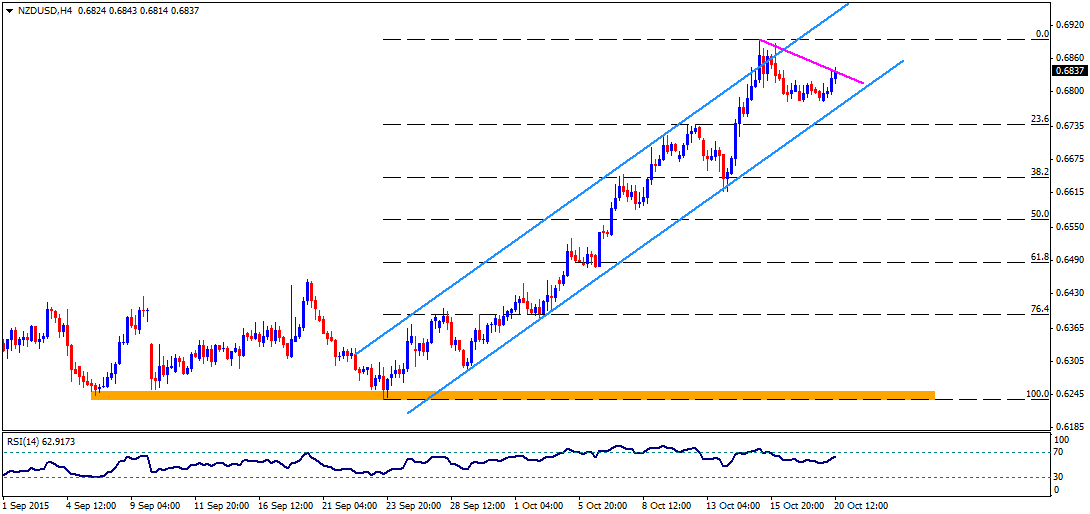

Although on short-term chart the pair seems to move higher within an ascending trend-channel formation, but the momentum still failed to provide the required strength to conquer 0.8800-0.8820 previous support turned strong resistance area. From current level, the pair seems to extend its reversal from a strong resistance area towards its next major support near 0.8720-0.8700 area, marking the lower trend-line support of the channel. Failure to hold this immediate strong support seems to trigger renewed near-term weakness for the pair and drag it to retest sub-0.8600 level support, marked by 23.6% Fib. retracement level. Intermediate support is pegged near 0.8650 horizontal area. Meanwhile on the upside sustained strength above 0.8820 strong resistance now seems to pave way for extension of the near-term ascending trend, towards testing the very important resistance confluence near 0.8930-0.8950 zone. This strong resistance confluence comprises of 50% Fib. retracement level, an ascending trend-line resistance, the upper trend-line resistance of the channel and also nearing 200-day SMA.

“Original analysis is provided by Admiral Markets”

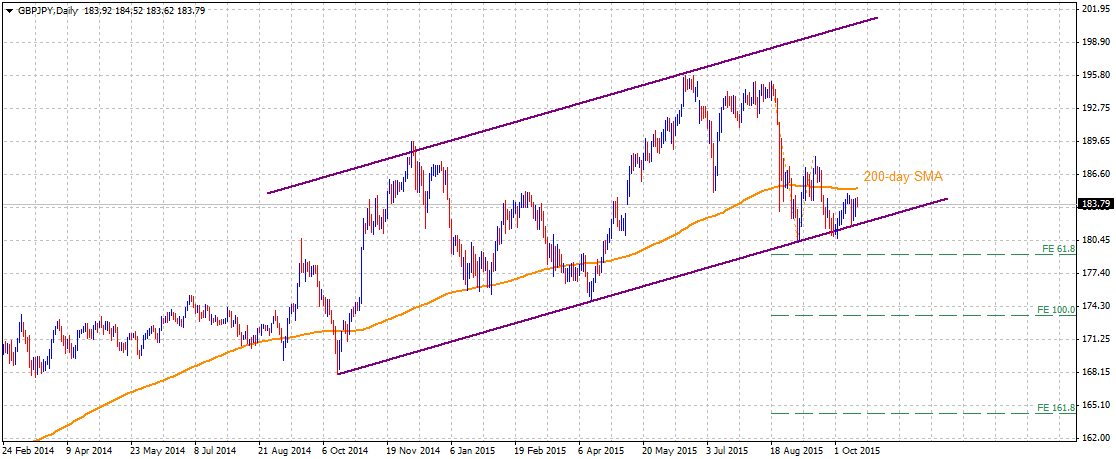

GBPJPY

The pair continues to hold the lower trend-line support of a well-established ascending trend-channel formation on daily chart. However, rebound from the lower trend-line support, currently near 182.00 mark now seems to face strong hurdle at 200-day SMA region, currently near 185.00-20 area. A decisive strength back above 200-day SMA now seems to reaffirm the prospects of extending the bounce back towards 188.00 mark horizontal resistance. Alternatively, a decisive break below the lower trend-line support seems to immediately drag the pair below its immediate strong support near 180.70-50 area and also below 180.00 psychological mark towards testing 179.00 mark support. Moreover, the break below the ascending trend-channel, held since the last quarter of 2014, is likely to increase the pair's vulnerability to continue drifting lower in the near-term.

NZDJPY

The pair's recovery momentum from its lowest level since Jan 2013 lifted the pair beyond 50-day SMA for the first time since May 2015. The pair subsequently cleared an important resistance near 80.50 level marking 38.2% Fib. retracement level of Dec. 2014 to Aug. 2015 down-fall. The pair, however, is now facing difficulty in sustaining its strength above 100-day SMA and now seems to be headed back to 80.50 resistance turned immediate support level. Should the pair fail to hold this immediate support, it could possibly be headed back towards testing 79.30-20 horizontal support, which now seems to have emerged as important downside support for the pair. Meanwhile, rebound from 80.50 support area and (or) a sustained strength above 100-day SMA region, near 81.00 mark, now seems to open room for continuation of the near-term upwards trajectory towards its next major resistance near 83.00-10 area, marking 50% Fib. retracement level.

NZDCAD

Although on short-term chart the pair seems to move higher within an ascending trend-channel formation, but the momentum still failed to provide the required strength to conquer 0.8800-0.8820 previous support turned strong resistance area. From current level, the pair seems to extend its reversal from a strong resistance area towards its next major support near 0.8720-0.8700 area, marking the lower trend-line support of the channel. Failure to hold this immediate strong support seems to trigger renewed near-term weakness for the pair and drag it to retest sub-0.8600 level support, marked by 23.6% Fib. retracement level. Intermediate support is pegged near 0.8650 horizontal area. Meanwhile on the upside sustained strength above 0.8820 strong resistance now seems to pave way for extension of the near-term ascending trend, towards testing the very important resistance confluence near 0.8930-0.8950 zone. This strong resistance confluence comprises of 50% Fib. retracement level, an ascending trend-line resistance, the upper trend-line resistance of the channel and also nearing 200-day SMA.

“Original analysis is provided by Admiral Markets”