Admiral Markets

AdmiralMarkets.com Representative

- Messages

- 95

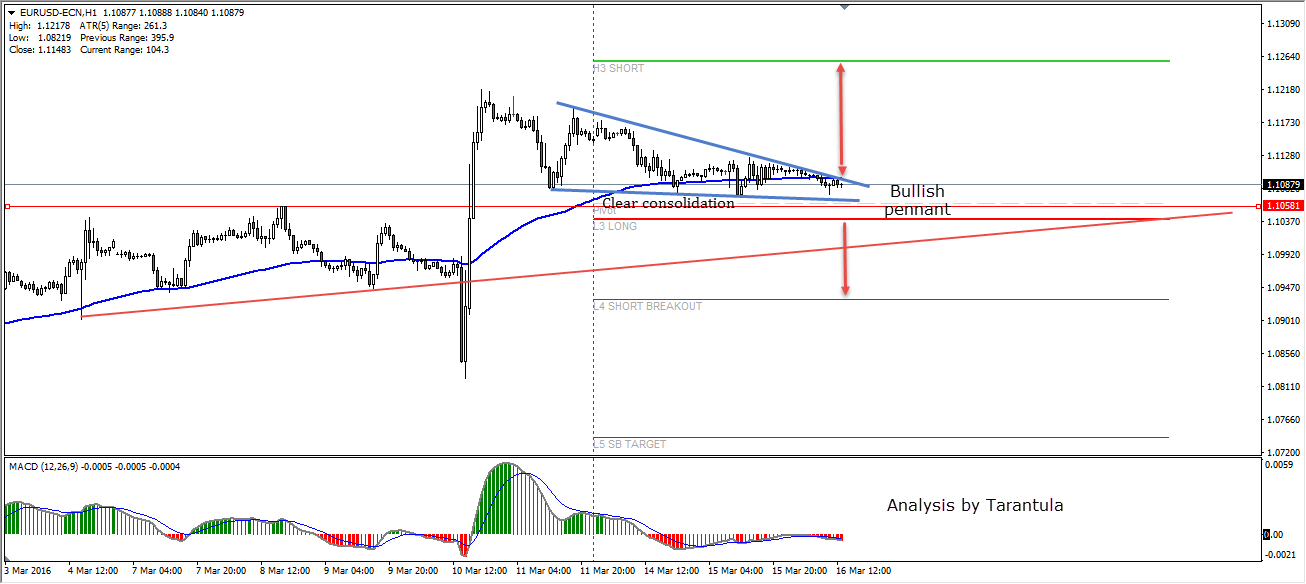

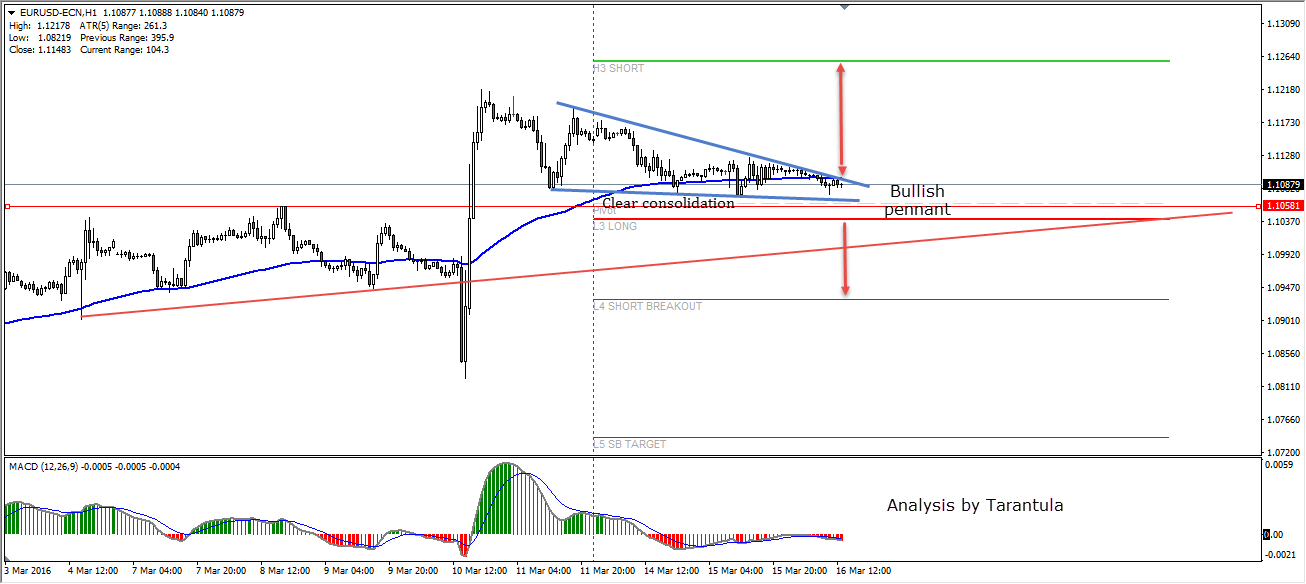

EURUSD PRE FOMC: CONSOLIDATION WITHIN THE BULLISH PENNANT

As I have already explained in my latest FXstreet article I don't expect a rate change on US cash rate and FOMC could be neutral on future rate hikes that will largely be subject to meeting the inflation objectives of the USFRB.

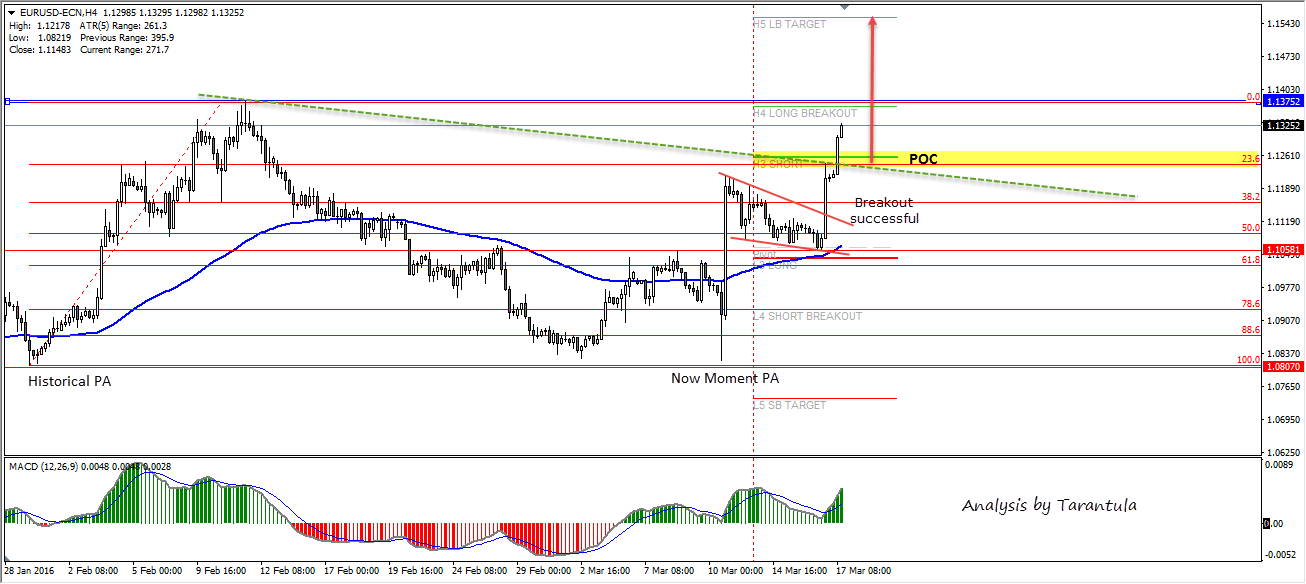

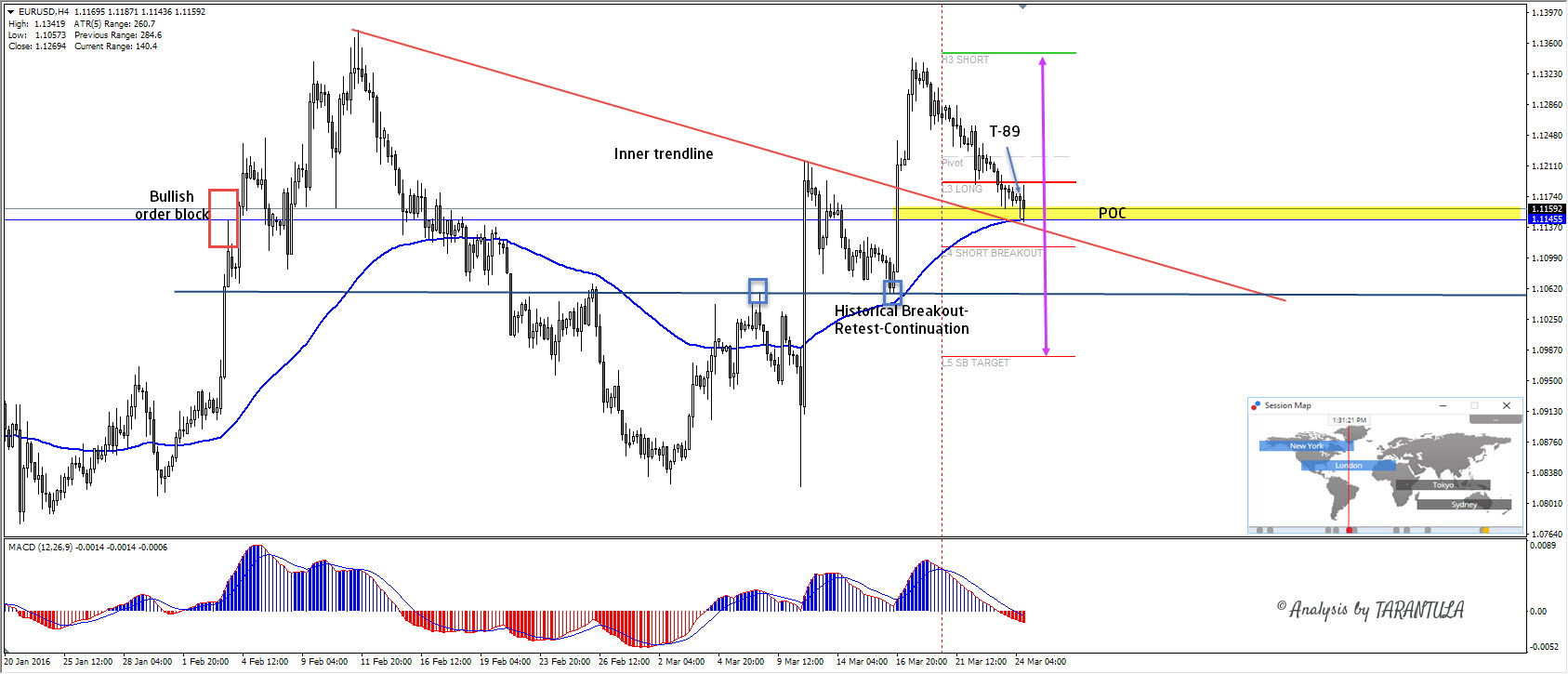

Technically EURUSD is showing a bullish pennant (EMA89, previous double top,WPP, L3) and we can CLEARLY see the consolidation within the pennant that suggests investors are waiting for FOMC decision. After the decision volatility should spike and EURUSD will move. There are 2 possible scenarios. Below 1.1055 EURUSD is berish targeting 1.1015 and 1.0985 zones. If the pair spikes above 1.1125 than we could see 1.1190 and 1.1250 subsequently. Whatever the decision will be we should watch the H1 chart and the break of the consolidation below or above the pennant.

“Original analysis is provided by Admiral Markets”

As I have already explained in my latest FXstreet article I don't expect a rate change on US cash rate and FOMC could be neutral on future rate hikes that will largely be subject to meeting the inflation objectives of the USFRB.

Technically EURUSD is showing a bullish pennant (EMA89, previous double top,WPP, L3) and we can CLEARLY see the consolidation within the pennant that suggests investors are waiting for FOMC decision. After the decision volatility should spike and EURUSD will move. There are 2 possible scenarios. Below 1.1055 EURUSD is berish targeting 1.1015 and 1.0985 zones. If the pair spikes above 1.1125 than we could see 1.1190 and 1.1250 subsequently. Whatever the decision will be we should watch the H1 chart and the break of the consolidation below or above the pennant.

“Original analysis is provided by Admiral Markets”