Admiral Markets

AdmiralMarkets.com Representative

- Messages

- 95

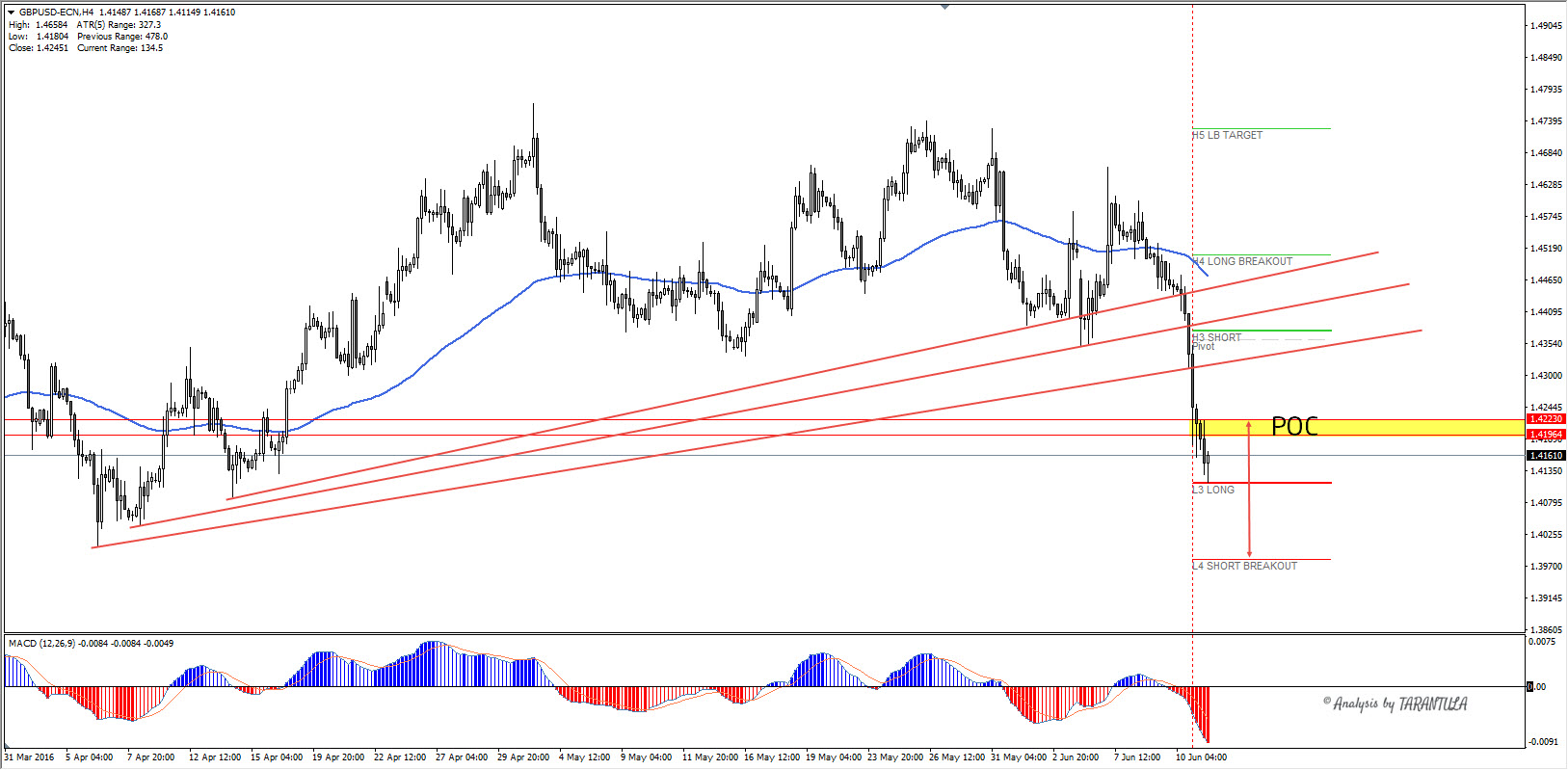

GBP/USD is proceeding higher with a strong momentum

Our previous GBPUSD predictions came true, though after a bigger pullback and the pair has made a strong bounce to the upside. Again, fears of Brexit diminished and the pound has been bought on dips.

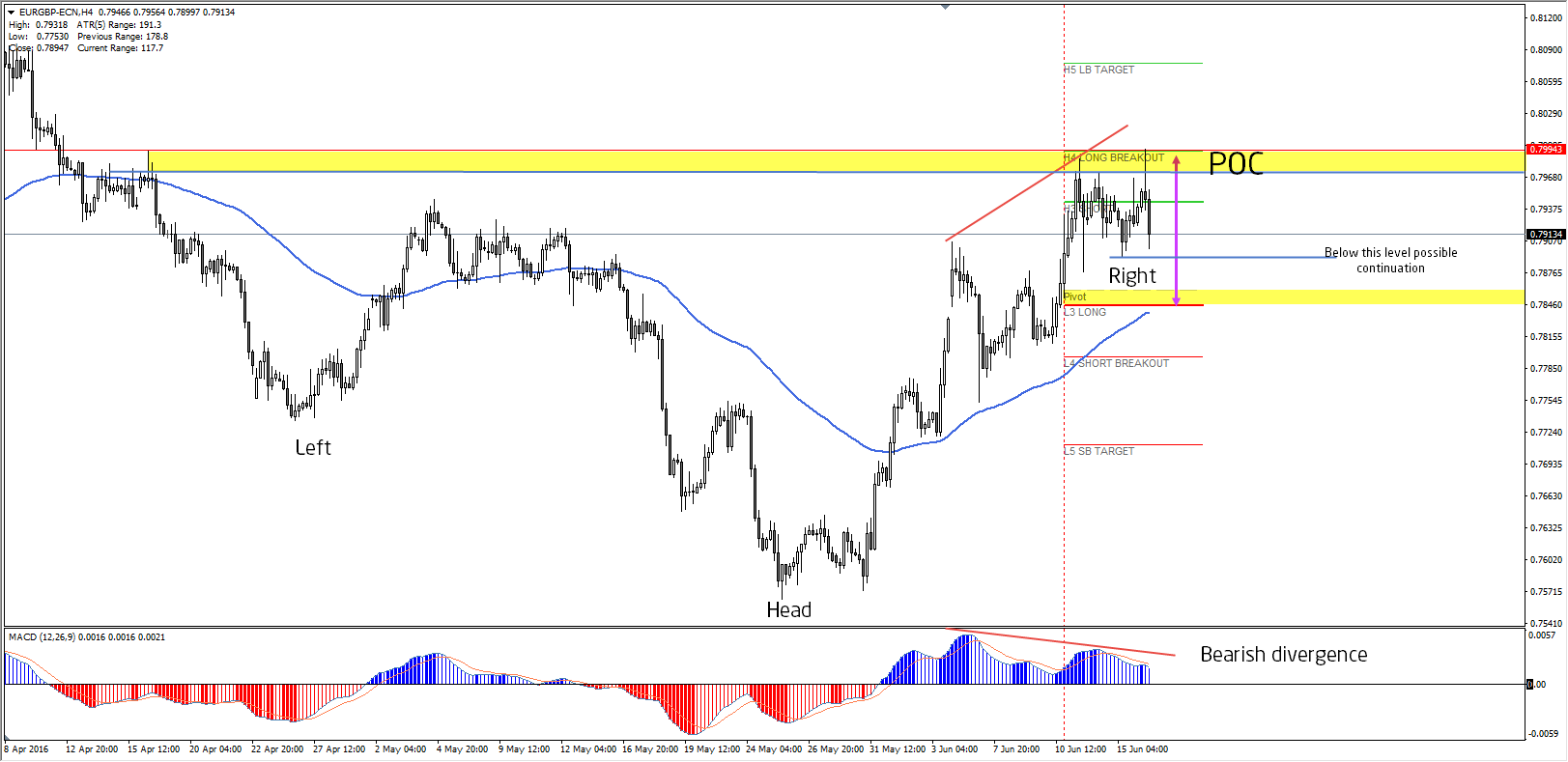

Today's Second Estimate GDP came as expected and it is important because it measures a change in the inflation-adjusted value of all goods and services produced by the economy. Technically GBPUSD has made a form of ascending scallop pattern. POC (DPP, L3, 61.8, double top breakout) comes within 1.4660-70 zone and pullbacks toward the zone could be used for long trades. The targets are 1.4740 and 1.4770. If the pair breaks 1.4770 with a strong momentum or we see a 4h close above it, next target is 1.4825.

“Original analysis is provided by Admiral Markets”

Our previous GBPUSD predictions came true, though after a bigger pullback and the pair has made a strong bounce to the upside. Again, fears of Brexit diminished and the pound has been bought on dips.

Today's Second Estimate GDP came as expected and it is important because it measures a change in the inflation-adjusted value of all goods and services produced by the economy. Technically GBPUSD has made a form of ascending scallop pattern. POC (DPP, L3, 61.8, double top breakout) comes within 1.4660-70 zone and pullbacks toward the zone could be used for long trades. The targets are 1.4740 and 1.4770. If the pair breaks 1.4770 with a strong momentum or we see a 4h close above it, next target is 1.4825.

“Original analysis is provided by Admiral Markets”