Admiral Markets

AdmiralMarkets.com Representative

- Messages

- 95

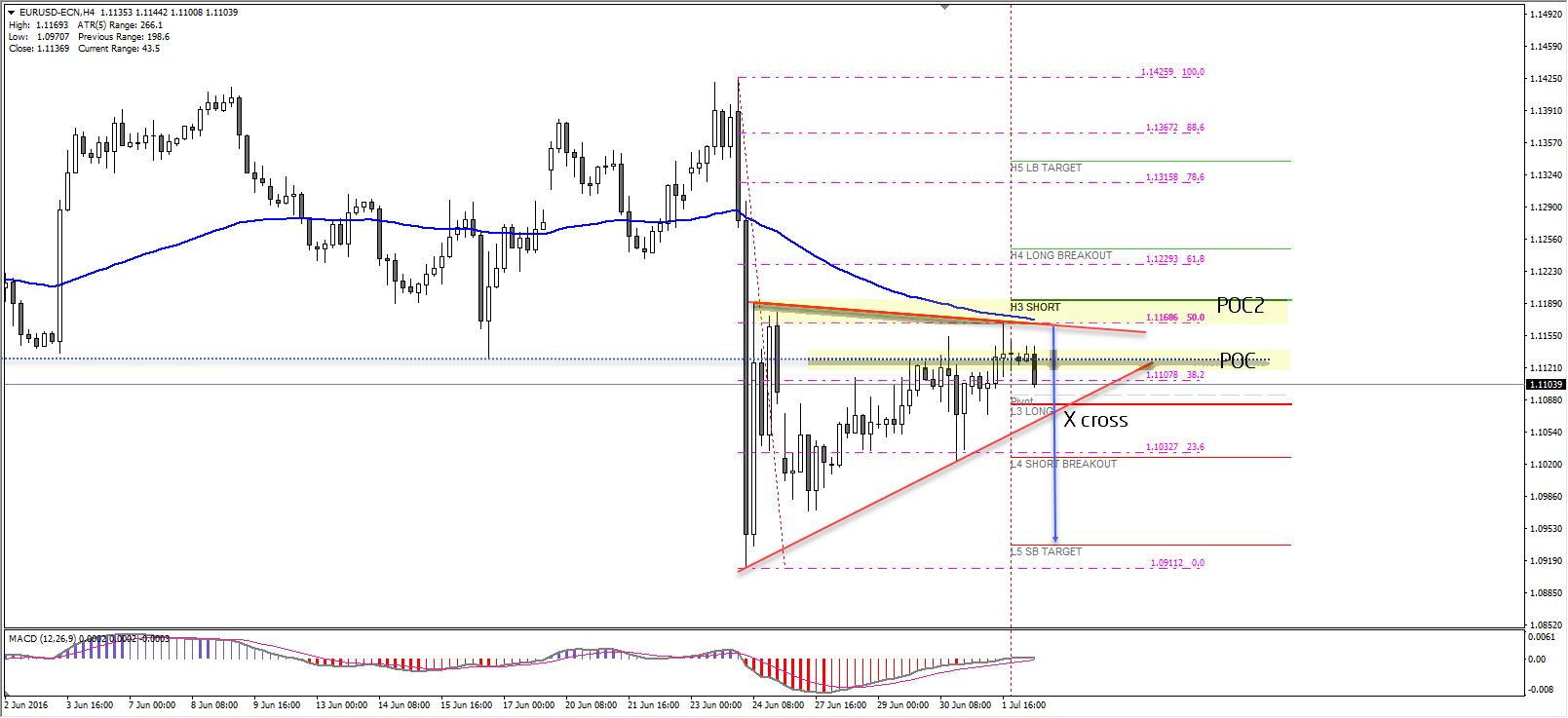

EUR/USD beware of breakaway gap

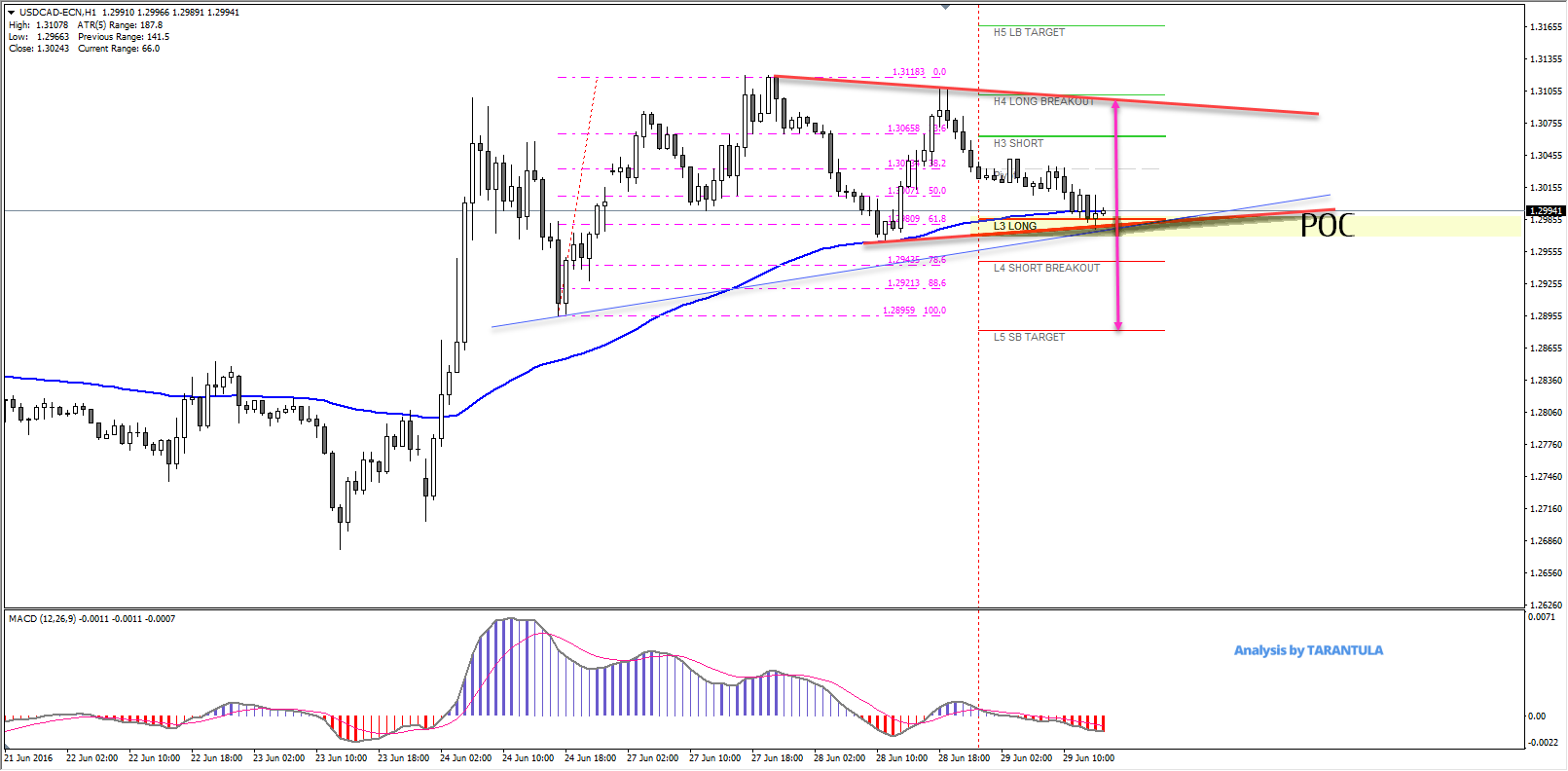

The EUR/USD and most Forex pairs opened with a gap on early Monday. Equities spiked higher as the market has temporarily dismissed the fear of Brexit as the latest Bloomberg reports reduced the Brexit probability to 42%. DAX went up 3.6 % along with FTSE. Equities went so bullish that it was almost like a foregone conclusion on UK referendum (!).

The change of sentiment in the market spiked the EUR/USD towards 1.14, stopping it around 1.1382 level. On the intraday chart we can see the inner trend line making a confluence with a retail gap. 78.6 and V shaped reversal within 1.1270-80 zone. If the pair retraces we might see the close of a bullish gap but if we don't see a retracement soon, this could qualify as the breakaway gap. They show when price is breaking from their trading range with a high volume and momentum. In this case we see inner trend line break after V shaped reversal. If breakaway gap is confirmed, 1.1448 will be the target.

In other scenario if we see the gap close pay attention to POC as we could see renewed buying pressure towards 1.1320, 1.1380 and 1.1448. If the sentiment turns negative again this scenario will be completely reversed and revised with a bearish outlook. It is all about Brexit now so be careful.

“Original analysis is provided by Admiral Markets”

The EUR/USD and most Forex pairs opened with a gap on early Monday. Equities spiked higher as the market has temporarily dismissed the fear of Brexit as the latest Bloomberg reports reduced the Brexit probability to 42%. DAX went up 3.6 % along with FTSE. Equities went so bullish that it was almost like a foregone conclusion on UK referendum (!).

The change of sentiment in the market spiked the EUR/USD towards 1.14, stopping it around 1.1382 level. On the intraday chart we can see the inner trend line making a confluence with a retail gap. 78.6 and V shaped reversal within 1.1270-80 zone. If the pair retraces we might see the close of a bullish gap but if we don't see a retracement soon, this could qualify as the breakaway gap. They show when price is breaking from their trading range with a high volume and momentum. In this case we see inner trend line break after V shaped reversal. If breakaway gap is confirmed, 1.1448 will be the target.

In other scenario if we see the gap close pay attention to POC as we could see renewed buying pressure towards 1.1320, 1.1380 and 1.1448. If the sentiment turns negative again this scenario will be completely reversed and revised with a bearish outlook. It is all about Brexit now so be careful.

“Original analysis is provided by Admiral Markets”