Admiral Markets

AdmiralMarkets.com Representative

- Messages

- 95

USD/JPY Pinbar confluence formed

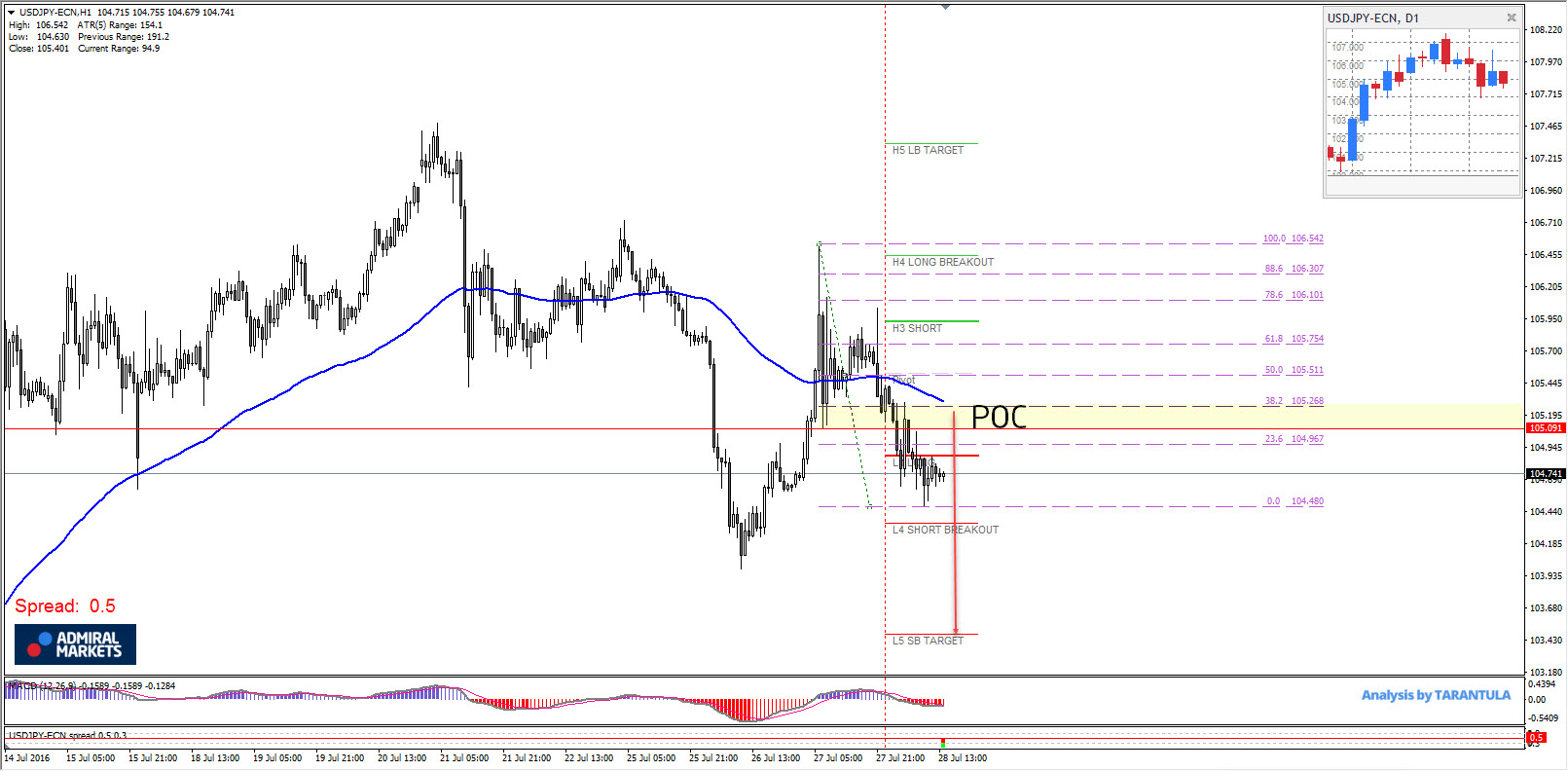

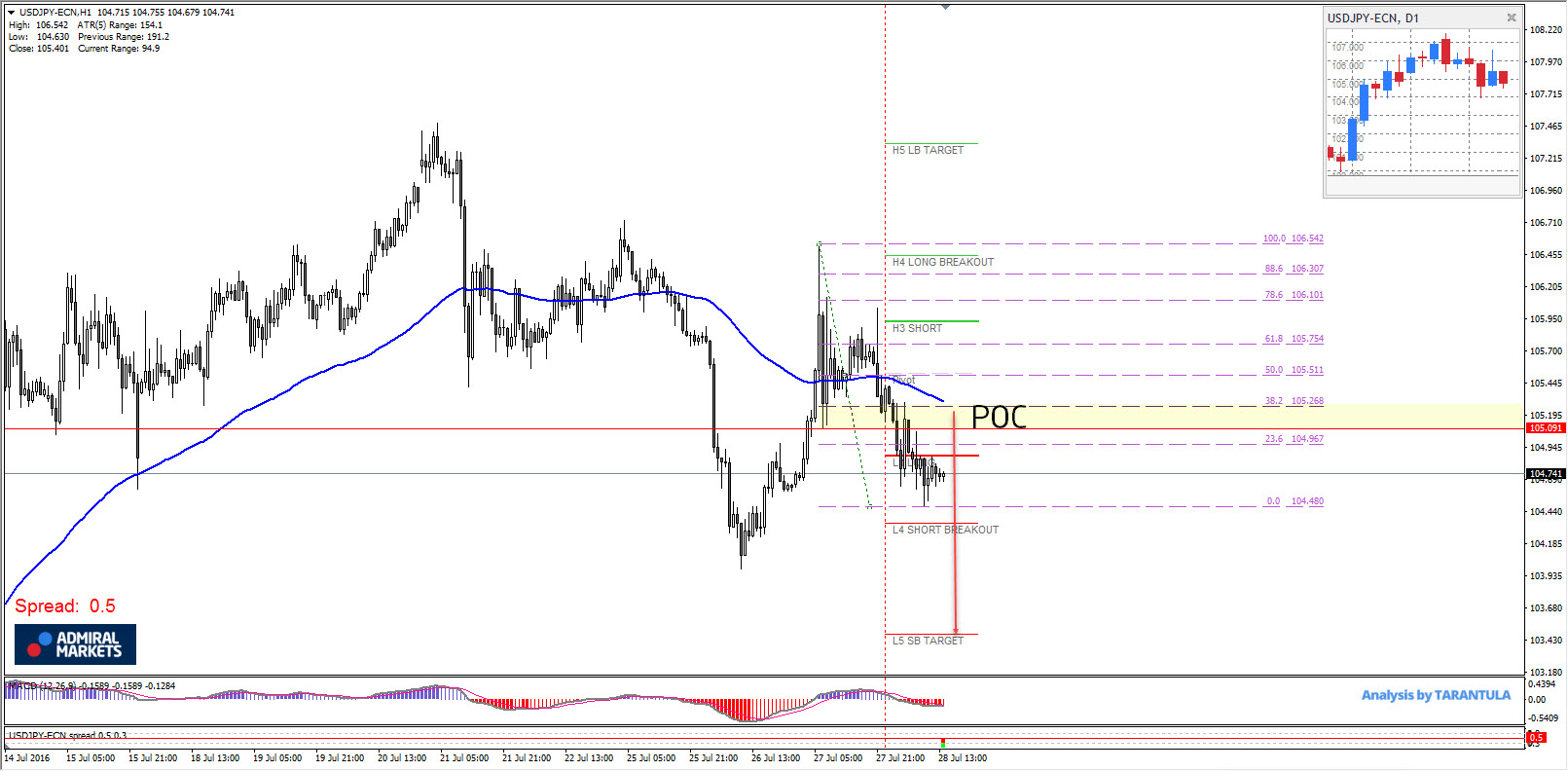

The USD/JPY aka "The Ninja" is in downtrend but after latest reports from BOJ, it has been put into a retracement mode. Abe's stimulus could be up to $354 billion. Technically the retracement is seen on H1 intraday chart and from a short term trading perspective we could see sell on rallies. 105.10-27 is POC zone (38.2, EMA89, Pin bar) and adding to that is 2 huge pin bars slightly above that are important as they mark near term historical sellers. If we see rallies to POC, we might see fresh shorts. If the pair breaks below 104.30 targets are 104.00 and 103.50. Today's important data is scheduled for 12:30 PM GMT is Unemployment claims so I wouldn't be surprised to see the ninja short term selling off 104.80 (L3 camarilla) before the news.

“Original analysis is provided by Admiral Markets”

The USD/JPY aka "The Ninja" is in downtrend but after latest reports from BOJ, it has been put into a retracement mode. Abe's stimulus could be up to $354 billion. Technically the retracement is seen on H1 intraday chart and from a short term trading perspective we could see sell on rallies. 105.10-27 is POC zone (38.2, EMA89, Pin bar) and adding to that is 2 huge pin bars slightly above that are important as they mark near term historical sellers. If we see rallies to POC, we might see fresh shorts. If the pair breaks below 104.30 targets are 104.00 and 103.50. Today's important data is scheduled for 12:30 PM GMT is Unemployment claims so I wouldn't be surprised to see the ninja short term selling off 104.80 (L3 camarilla) before the news.

“Original analysis is provided by Admiral Markets”