How to Choose Expert Advisor (Forex Robot)

A forex robot or an expert advisor is a piece of computer software that automatically makes trading decisions on behalf of the trader. Forex robots are designed with inbuilt trading rules, which enable them to enter and exit trades without requiring the physical presence of a trader.

Without forex robots, we could still be hooked to the manual way of trading currencies: gluing our eyes on the charts the whole day in search of potential trading opportunities.

With the introduction of expert advisors, forex trading can be easier, less stressful, and more profitable. However, if you choose a wrong forex robot, you cannot enjoy these benefits while using them for executing trades in the market.

Therefore, to avoid losing your hard-earned money, you need to make a good decision before buying an expert advisor for automated trading.

This article will provide some essential tips for correctly choosing a forex robot.

Understanding forex robots

If you are trading manually, you’ll need to develop a trading plan that will define the types of decisions you make in the forex market. Essentially, you’ll be forced to scour the charts continually looking for setups that match your established trading plan.

As a result, manual trading will leave you exhausted and prone to making emotion-based decisions, which can be detrimental.

Imagine gluing your eyes on the computer screen for an entire day without spotting any profitable trading opportunity; what would you do? Some traders, if caught in a such a situation, will become emotional and start entering trades without careful thought. In the end, they can make decisions that wipe out their trading accounts.

However, a forex robot saves you from such hassles. After identifying trading rules, you can simply implant them in a robot. This allows the piece of software to trade on your behalf while you spend your time doing other things.

Let’s say you have a strategy that identifies trading opportunities based on the deviation between the upper band and the lower band in the Bollinger bands indicator.

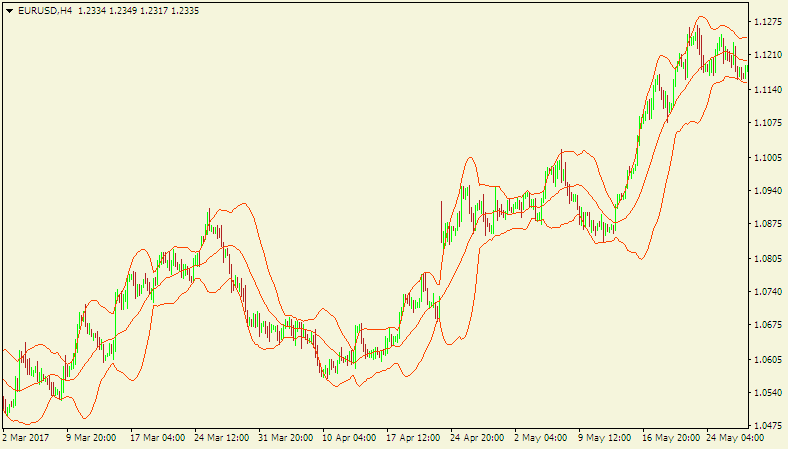

Here is a chart of EUR/USD with the Bollinger band indicator displayed on it.

If you were spotting trading opportunities using the Bollinger band indicator, you could be entering trades whenever the upper and the lower band move far enough away from each other and exiting trades whenever the two bands get too close.

If you were manually trading such a strategy, you could be compelled to watch the charts the entire day waiting for the right Bollinger bands deviation to occur.

However, if you can program the strategy into an expert advisor, you’ll not need to stick your eyes onto the chart all day, since the robot will automatically enter and exit trades whenever the trading conditions are met.

Your trading robot cab also have pre-determined take profit and stop-loss targets. If the trade works as expected and the take profit level is reached, the trade will be exited automatically, and the profits booked. Unless you have another set of rules to close trades, the other possibility is that the stop-loss level will be hit, the trade exited automatically, and the losses booked.

So, doExpert Advisors really work?

If you have a trading robot that has been programmed correctly and sufficiently tested, it can work. However, if you go for a poorly developed EA, which is promoted by its developer’s thirst for quick money, and nothing else, it may not work well.

A trading robot can be developed to carry out various useful trading functions, including:

- Entering trades automatically

- Managing opened trades

- Exiting opened trades

- Giving trade recommendations

- Copying trades from one account to another

With a trading robot, you’ll have the ability to trade 24 hours a day, 5 days a week, something that is impossible with manual trading. After setting it up, the EA will continuously look for trading opportunities, without going for lunch breaks, bathroom breaks, or holidays—ensuring you do not miss profitable opportunities in the market.

The EA will also assist you to dissociate emotions from your trading decisions. One of the primary reasons why most forex traders make losses is from the uncontrolled feelings, such as fear or greed, which impair their trading decisions.

However, such feelings cannot force EAs to move away from the pre-determined trading decisions. The robots are programmed to make trading decisions, without the fear of making losses or the greed of desiring more profits.

Another reason why forex robots work is that they enable you to reduce trading errors. Manual trading is prone to several mistakes, such as erroneously entering trades, placing incorrect position sizes (one type of the famous Fat Finger error), and failing to react quickly to changing market conditions.

Such errors can be reduced with trading robots. Because the software makes decisions based on the coded rules, EAs are not prone to human errors.

Therefore, EAs work and to benefit from their advantages, you must be prepared to do sufficient background research before committing your funds to making or buying one.

How to choose a forex robot

Correctly selecting an automated trading system can make the difference whether it works for you or not. If you buy an EA or hire a programmer to develop one for you without doing enough homework, you may lose your money.

Here are some tips to assist you to make the right decision.

1. Get proper education

Many traders have fallen to those catchy, spiraling adverts that promise immense instant wealth just by using EAs for trading forex. They make it look so easy to make huge profits. It looks like you’ll instantly be brushing shoulders with the likes of Warren Buffet.

What those advertisements hide is that knowledge is the most crucial resource you need to become successful in this business. With proper education on how the forex market operates, you can easily spot the red flags whenever someone is making unrealistic and farfetched claims.

Most of the scam robot vendors target beginners who still rate forex trading in the same category as other get-rich-quick schemes. However, comprehensive education will equip you with the knowledge you need so that you can avoid falling victim to these scammers.

For example, if you see an advertisement promoting an EA as capable of delivering svery large returns within a short time, then do not waste your money buying it.

2. Carry out a background check

Before purchasing any automated trading system, you should do a thorough background assessment to clear any questions in your mind. FForex Peace Armyor example, if a vendor is purporting that his expert advisor is capable of generating good profits, check if the assertions have been verified by an unbiased third-party website like Forex Peace Army.

If your background check exposes that the EA vendor’s details are not convincing, or they are trying to hide something, then you need to re-evaluate the purchase decision.

You also need to check online reviews about the trading robot. The experience of other traders can help you in making an excellent choice for a forex robot. Disgruntled traders usually use online forums and social media platforms to speak about their grievances.

So, before choosing an EA, do not be afraid to search for those unbiased reviews. If the reviews reveal something fishy, ask questions about it until you have enough reasons to make a sound decision.

Here are some more questions you can ask when performing the background check.

- Is the expert adviser developed by an established and credible programmer?

- Is the EA vendor transparent and upholds ethical business practices?

- Does the vendor provide reliable and secure payment options, which allow you to launch a complaint easily in case things go haywire?

- Is a money-back guarantee offered? This will allow you to get a refund if the EA does not satisfy your needs.

3. Understand the Expert Advisor statistics

Before going for an EA, ensure it has been tested by an independent website such as Forex Peace Army. This way, it will allow you to avoid falling victim of fraudulent purchases.

When an EA has been tested either by a third-party website or by the vendors themselves, there are usually some statistics that indicate its performance. And, if you do not understand the statistics well, you may not select a suitable trading robot.

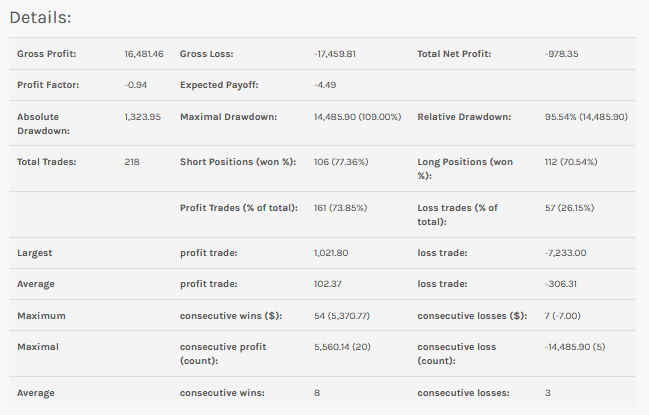

For example, here is a screenshot of the results of a test done by Forex Peace Army on a forex robot.

Apart from the straightforward details, let’s try to understand some of the not-so-common statistical terms.

- The profit factor

This is the most vital statistic because it answers the most critical question: will the trading robot generate positive or negative returns?

It is obtained by getting the ratio of the summation of all the successful trades and the summation of all the unsuccessful trades; it is simply the ratio of gross profit to gross loss.

Therefore, because the profit factor indicates the connection between risk and profit, you should not select an expert advisor with a value of less than 1. It’s advisable to choose an EA with a big profit factor—as much as possible.

- Expected payoff

Also known as expectancy, this statistic forecasts the average amount you can earn per trade. Although the value is based on historical data and provides no guarantee of similar results in the future, it’s useful in showing how the EA is likely to perform.

The expected payoff is computed by getting the difference between the average profit for each trade and the average loss for each trade.

- Drawdown

Drawdown (absolute drawdown, maximal drawdown, or relative drawdown) are essential indicators of risk. These statistics will give you an idea of how the expert advisor performs when it’s in trouble. For example, the maximal drawdown shows the maximum loss since the last highest value.

A volatile EA will have a higher drawdown, which signifies that it poses a greater risk, and therefore may be unsuitable for trading. Consequently, you should carefully analyze these statistics before committing your money in purchasing a robot.

4. Carry out your own tests

As much as you may rely on third-party tests to verify the profitability of trading robots, it’s essential that you also carry out your own tests.

In some situations, the vendors may manipulate the trading results of the forex robots. With the fake backtested results, you may be convinced to buy the robot, but end up making losses.

Therefore, if you purchase a robot blindly without going the extra mile of trying it for yourself, you may be the loser, after all.

For example, if the forex robot has a trial version or the vendor offers another less superior version of the robot at a lower price, you can try it in a demo account or a micro account. This way, you can test in real time before you make a final decision whether or not to buy the full version at a higher price.

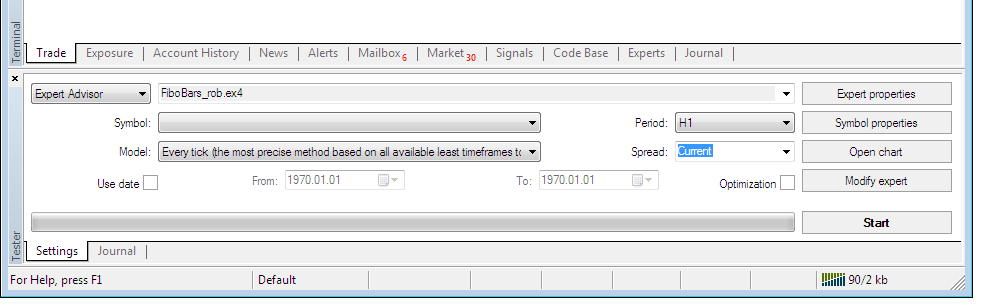

Also, you can use the inbuilt strategy tester tool found in the MT4 trading platform for testing the performance of the EA.

Here is a screenshot of the strategy tester tool.

Even though it’s not possible to forecast the future, particularly in the forex world, using historical data in the MT4 platform will allow you to gauge the profitability of the robot. If the backtested results are poor, then exposing the EA to live trading conditions could be disastrous.

Furthermore, carrying out your own tests will assist you to determine whether the trading robot suits your needs and preferences. With the ever-changing forex market conditions (trending, sideways trend, volatile), selecting a suitable robot is not enough.

You should understand how the forex expert advisor works so that you can quickly modify the settings to suit the changing market conditions. If you go for a complicated robot that is not intuitive, you may make an improper adjustment to its parameters and blow up your trading account.

Conclusion

Appropriately choosing a forex robot is critical to your success as a trader. If you do not invest your time and resources in making the best decision, you may fail to realize the benefits of trading forex using expert advisors.

If you apply the tips outlined in this article, you will undoubtedly make a good choice and attain the objectives of your trading career.

Happy trading!

Author Profile

Fat Finger

My name is Phat Fin Ge, but most people just call me Fat Finger or Mr. Finger.

Many years ago, I was a trader on the Hong Kong Stock Exchange. I became so successful that my company moved me to their offices on Wall Street. The bull market was strong, but my trading gains always outperformed market averages, until that fateful day.

On October 28th, 1929, I tried to take some profits after Charles Whitney had propped up the prices of US Steel. I was trying to sell 10,000 shares, but my fat finger pressed an extra key twice. My sell order ended up being for 1,290,000 shares. Before I could tell anyone it was an error, everyone panicked and the whole market starting heading down. The next day was the biggest stock market crash ever. In early 1930, I was banned from trading for 85 years.

I went back to Hong Kong to work at my family's goldfish store. Please come and visit us at Phat Goldfish in Kowloon, only a 3 minute walk from the C2 MTR entrance.

I thought everyone would forget about me and planned to quietly return to trading in 2015. To my horror, any error in quantity or price which cause a problem kept getting blamed on Fat Finger, even when it was a mix up and not an extra key being pressed. For example, an error by a seller on the Tokyo Stock Exchange was to sell 610,000 shares at ¥6 instead of 6 shares at ¥610,000. That had nothing to do with me or with how fat the trader's finger was, but everyone kept yelling, "Fat Finger! Fat Finger!" In 2016, people blamed a fat finger for a 6% drop in the GBP. It really was a combination of many things, none to do with me or anyone else who had a wider than average finger.

Now that I can trade again, I'm finding forex more interesting than stocks. I've been doing some research on trading forex and other instruments and I'll be sharing it here.

If you see any typing errors, you can blame those on my fat finmgert. If you see any strange changes in price, it's not my fault.

Info

3394 Views 0 CommentsComments

Table of Contents

Recent

-

The Future of Money: How Bitcoin is Changing Personal Finance Skills Bitcoin Fundamental Briefing, April 2024 Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders