Commodity Market

Investors from around the world have been trading in the commodities markets for a long time. And, in some parts, such as Japan, it is said that commodity trading started more than 1,000 years ago.

Currently, this old trade is still popular around the globe. Each commodity has a value which can fluctuate depending on various factors, such as supply and demand and geopolitical issues.

Therefore, commodity traders, from individuals to big financial institutions, usually try to make profits in the commodity market by taking advantage of the price fluctuations.

This article gives a simple overview of the world of commodity trading.

What are commodities?

A commodity refers to a good or a product that is produced to satisfy certain needs. Commodities are usually traded in the international markets and are known to be fungible; that is, they are considered to be equivalent regardless of where they are produced. For example, an ounce of gold produced in South Africa will be equivalent in value to an ounce of gold produced in Australia.

Commodities are divided into two major categories: hard and soft commodities. Hard commodities are natural resources which are generated through mining—such as gold, silver, and oil. On the other hand, soft commodities refer to agricultural products or livestock—such as tea, soybeans, and pork.

The primary distinction between the two categories is that soft commodities must be grown or cared for and are sensitive to spoilage, something which affects their market prices.

What Factors Determine Commodity Prices?

Commodity prices are usually more volatile than most other financial assets. An extensive range of factors often affect their prices, and the relevance of every factor differs from commodity to commodity.

Here are some of the major influencers of prices in the commodity market.

1. Climatic conditions

Changes in the weather conditions usually affect the prices of commodities in the market. Whereas the climatic occurrences—such as insufficient rainfall or prolonged droughts—can influence the value of hard commodities, it’s usually the soft commodities that experience the largest effects whenever the changes take place.

Since the production of most soft commodities largely depends on the weather, abrupt changes can impact the availability of agricultural products in the world market, leading to scarcity and driving prices upwards.

The weather patterns frequently affect the supply and demand of the commodities. When the demand is high, and the supply is low, the commodity’s price tends to rise. On the other hand, when the demand is low, and supply is high, the commodities usually decrease in value.

Other natural calamities and disasters, such as earthquakes and tsunami, can also wreak havoc on the value of commodities in the market.

Most commodity traders keep an eye on these conditions and events since they directly affect the value of commodities in the market.

2. Economic and political conditions

The status of a country’s economic and political situation also affects the prices of certain commodities.

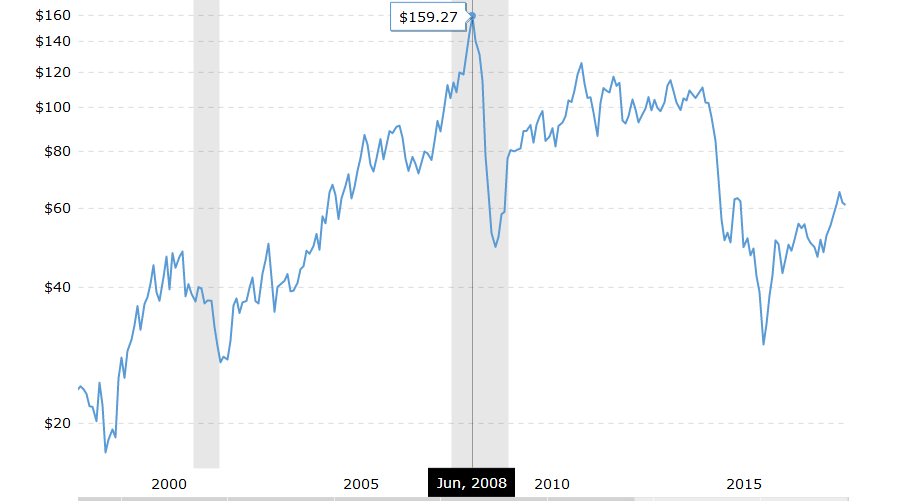

For example, in June 2008, oil prices reached more than $150 a barrel (the highest ever) because of the wars in both Iraq and Afghanistan. The sharp increase in oil prices during this period was mainly because of reduced supply since the regions are two of the largest producers of oil in the world.

Here is a chart from www.macrotrends.net showing what happened.

Furthermore, a weak economic situation can lower the spending capability of consumers, resulting in reduced demand, which reduces the prices of the commodities.

Also, when inflation is relatively high, or there are other economic instabilities, the values of the major commodities tend to increase. Commodities are usually used as a hedge against runaway inflation levels.

So, unlike stocks and currencies, the prices of commodities often rise when inflation rates increase, or when the economy is experiencing downturns.

3. Government policies

If a government enacts a change in its policy, it can have an enormous influence on the value of commodities in the market. For example, if the U.S. government raises its import duty on copper, its price will also increase.

4. Events in other markets

The prices of hard commodities are usually related to the events taking place in other markets. For example, fuel prices are often associated with how the manufacturing industry is performing, which points to their relationship with the stock prices.

Another good example is gold. The price of gold is usually associated with the risk appetite present in the forex market. Whenever traders are looking for safe havens, gold’s price often increases.

Additionally, since commodities are often priced in U.S. dollars, the value of the currency can also impact their prices. Usually, the U.S. dollar exhibits an inverse relationship with the price of the commodities.

If the value of the U.S. dollar is rising, the value of the hard commodities will tend to fall and vice versa.

What are the Benefits of Trading Commodities?

a) Ease of trading

Trading commodities is relatively easy because the most critical factor that drives their prices is supply and demand. So, if you understand how supply and demand work to cause the fluctuations in commodity prices, you can find commodity trading to be fairly easy.

Furthermore, the low commission costs in the commodity market allow you to trade without exorbitant fees. As such, you can easily access the commodity market and trade without worrying about having to pay high commissions fees.

Other financial markets, like the forex market, can be difficult to trade because you must study several factors that affect the movement of currency prices. Furthermore, if you do not develop a comprehensive strategy or system, you can complicate your life as a forex trader.

b) Huge profit opportunities

Volatility is the life and breath of the financial markets. Without the constant fluctuations of the prices of the financial assets, trading could be boring and unprofitable. As such, high volatility situations usually present lucrative trading opportunities.

The commodity market can be very volatile, which offers enormous opportunities to place buy and sell orders. For example, it’s estimated that the prices of gold and silver, the most popular hard commodities, fluctuate by about 1.40% and 2.78% daily respectively. On the other hand, the prices of the major currency pairs in the forex market usually move by around 1% daily.

Moreover, concerning long-term price movements, the hard commodities offer excellent opportunities. While the major currency pairs fluctuate by about 30% each year, the commodity market usually experiences movements much larger than that.

In recent years, gold’s price moved by about 70% each year whereas that of silver almost tripled, at about 200%. Therefore, if you invested in gold and silver, you could have earned more profits than trading in other markets.

c) Stepping stone to other markets

The commodity market can offer a great stepping stone to trade in the other markets. Historically, the movements seen in the commodities market have been proved to be related to other markets like the stock market and the forex market.

For example, someone can trade commodity-based currencies based on the happenings in the commodity market. Examples of two currencies that show a positive correlation to the commodity market include the Australian dollar and the Canadian dollar.

Later in this article, we’ll illustrate more on the relationship between the commodity market and the forex market.

d) Important for risk reduction

The commodity market is vital for assisting traders in diversifying their portfolio and reducing risks. Savvy investors often spread their resources across multiple asset classes, instead of “placing all their eggs in a single basket.”

This way, if one asset class does not behave as expected, they can balance the losses with the gains from a profitable asset class. This technique gives traders a peace of mind and an extra layer of security, regardless of what happens.

And, investors have found the commodity market to be suitable for assisting them in diversifying their portfolio and managing risks from other financial markets.

e) Protection against inflation and falling stock prices

The commodity market offers significant protection against inflation. Inflation takes place when the value of currencies weakens over time—which is why having cash in your reserves for a long time is not recommended.

If the loss in value occurs, it only affects the associated currency, while the assets priced in that currency increase in value. Therefore, the commodity market provides a viable alternative to people who want to protect their investments from inflationary pressures.

Moreover, investing in commodities can offer protection if the stock market collapses. Throughout history, there have been periods when the stock markets have fallen nearly to zero, leading to massive losses.

However, the commodity market is often not susceptible to such crashes. Thus, having some investments in the commodity space can safeguard you from the uncertainties of the stock markets.

What are the Risks of Trading Commodities?

a) Increased risks of making losses

Commodity prices usually experience constant changes based on several factors, including supply and demand, weather conditions, and political situation. Therefore, the frequent fluctuations of commodity prices can increase risks of making losses, especially if you are a beginner.

Furthermore, finding information regarding trading commodities is not easy. Although there is plentiful information available on how to trade commodities, most of it is expensive to obtain. Thus, the lack of sufficient free information can increase losses when traders make decisions without any facts.

b) Leverage

Leverage in the commodity market can be a double-edged sword. Although it allows traders to use a small amount of money in their accounts to control a larger investment, it can also amplify losses.

High leverage ratios can encourage poor money management. Ultimately, it can result in extreme risk-taking. Besides increasing the potential for profits, the possibility for losses is also enhanced, as well.

c) Crowded trade positions

In the community trading world, it is known that big commodity funds usually hold huge positions in the market.

This way, they usually can usually cause the prices of commodities to rise. However, whenever they decide to reverse the trades in unison, massive drops in prices are often witnessed, making small traders to experience huge losses.

What is the Relationship Between Commodity Market and Forex Market?

As earlier mentioned, there exists a relationship between the two markets. That is why most traders use the happenings in the commodity market to assist them in identifying trading opportunities in the forex market.

The U.S. dollar often moves oppositely to the hard commodities, especially gold and silver. If the value of the U.S. dollar is rising, the price of gold will fall and vice versa.

Gold is usually viewed as a safeguard against economic uncertainties. So, when the U.S. dollar is weak, it leads many investors into dumping the dollar in favor of gold, leading to its rise in value.

Here is a chart from www.macrotrends.net showing the inverse relationship between the U.S. dollar index (orange color) and the price of gold (blue color) for the previous 20 years.

Another strong relationship exists between the price of oil and USD/CAD. Canada is one of the largest exporters of oil in the world. In fact, Canada is the biggest supplier of oil to the United States. As such, the price of oil and the quantity it can export directly impact Canada’s economy.

Therefore, the price of oil exhibits a negative correlation with the USD/CAD. If oil’s price increases, USD/CAD decreases, and vice versa.

Lastly, it’s essential to note that gold often shows a positive correlation with the price of AUD/USD. If gold’s price increases, AUD/USD also increases and vice versa.

Australia is the third-biggest exporter of gold in the world; therefore, the price of the commodity directly impacts its revenues.

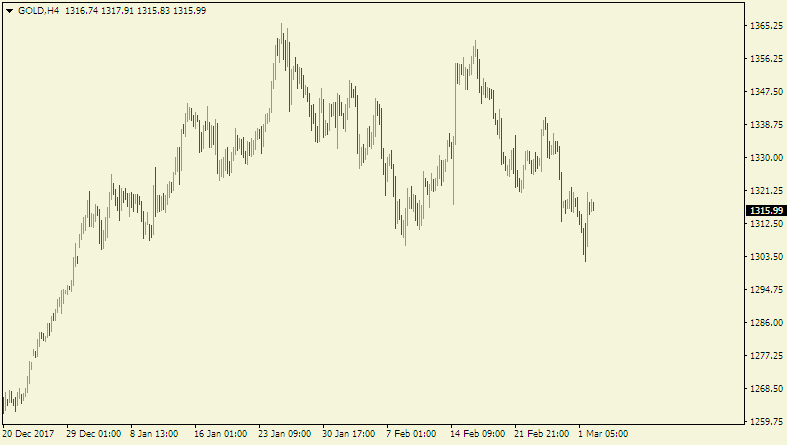

Here is a chart of AUD/USD.

Here is a chart of gold during the same period.

Conclusion

Commodity market offers traders with exciting opportunities to make profits. Trading in the market has several benefits that will assist you to grow your investments.

Even if you are a forex trader, you can still study the events in the commodity market to help you make sound and profitable trade decisions.

Importantly, to avoid losing your hard-earned money in commodity trading, you should adequately understand how the market operates and practice proper risk management.

Happy trading!

Author Profile

Fat Finger

My name is Phat Fin Ge, but most people just call me Fat Finger or Mr. Finger.

Many years ago, I was a trader on the Hong Kong Stock Exchange. I became so successful that my company moved me to their offices on Wall Street. The bull market was strong, but my trading gains always outperformed market averages, until that fateful day.

On October 28th, 1929, I tried to take some profits after Charles Whitney had propped up the prices of US Steel. I was trying to sell 10,000 shares, but my fat finger pressed an extra key twice. My sell order ended up being for 1,290,000 shares. Before I could tell anyone it was an error, everyone panicked and the whole market starting heading down. The next day was the biggest stock market crash ever. In early 1930, I was banned from trading for 85 years.

I went back to Hong Kong to work at my family's goldfish store. Please come and visit us at Phat Goldfish in Kowloon, only a 3 minute walk from the C2 MTR entrance.

I thought everyone would forget about me and planned to quietly return to trading in 2015. To my horror, any error in quantity or price which cause a problem kept getting blamed on Fat Finger, even when it was a mix up and not an extra key being pressed. For example, an error by a seller on the Tokyo Stock Exchange was to sell 610,000 shares at ¥6 instead of 6 shares at ¥610,000. That had nothing to do with me or with how fat the trader's finger was, but everyone kept yelling, "Fat Finger! Fat Finger!" In 2016, people blamed a fat finger for a 6% drop in the GBP. It really was a combination of many things, none to do with me or anyone else who had a wider than average finger.

Now that I can trade again, I'm finding forex more interesting than stocks. I've been doing some research on trading forex and other instruments and I'll be sharing it here.

If you see any typing errors, you can blame those on my fat finmgert. If you see any strange changes in price, it's not my fault.

Info

561 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, April 2024 Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023