Peter,

I think you have a good assessment here but you miss big on one major point.

If you look at ZuluTrade (Cyprus), Axiory (Belize), Ayondo (UK), eToro (Cyprus/UK), and all the other Social Managed Companies IN good regulations, they all still never last more then a couple years.

The companies you named here lost as well, but their regulation really isn't what I would be focusing on, here's what I would remember -

Bank traders achieve 15-20% a year for institutional investors (pension funds, HNW people, etc).

If you are going to RISK your money with one of these types of trading programmes on any of the websites mentioned on FPA, the risk is 90% change you will eventually lose big. What you cannot therefore do is then later scream "SCAM!" when you knew there was enormous risk.

100%+ a year is impossible to last forever. Period.

#FmrBrokerExecutive

I agree with you that, social trading and retail program are high risks. I have traded on Etoro in my earlier years, it's just marketing and not really beneficial for copiers, often the leverage involved and inconsistency leading to huge eventual losses. I personally also don't use MQL5 or ZuluTrade etc, because as long as the returns are more than 20-40% P.A, and DD more than 10%, I would already be very cautious. I would rather trade myself than to risk with someone I don't even know. Even HotForex PAMM, I have seen many traders with huge negative floats and eventual margin call, because true analytics weren't shown but boosted ROI and not absolute gains concurrently. There are many trading results with 100-1000% gains but mere 1-20% Abs gains but nordhill is very smart they don't the master account lump with investor's account to prevent such thing from happening.

Often people are blinded by false advertising and disregarded the risks here. Your point is about the inherent risks involved in High ROI Investment Programme with the lack of risk management practice versus why institutional traders and clients prefer much lower ROI as it is more sustainable and practical with their large sum of money involved.

My earlier points are targeting on the security of investment, but your point of ROI is obvious too, too good to be true simply and the inherent risks, investors are disregarding.

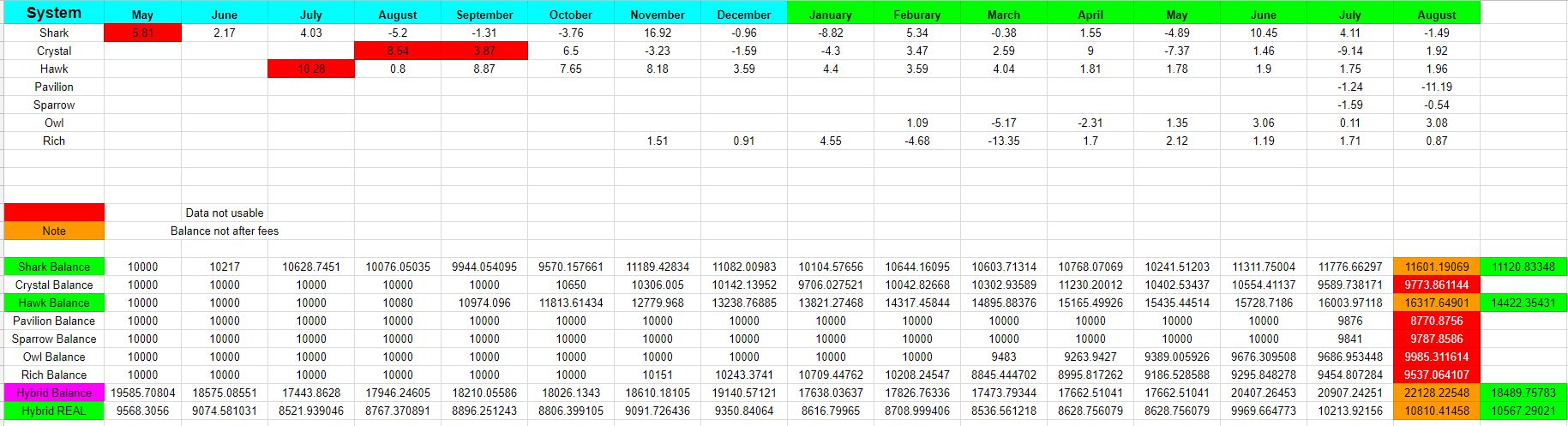

I did some analysis and will talk about 2 things here.

Point 1 - http://www.myfxbook.com/members/nordhillcapital/pavilion-fx/1959815

Pavillion was recently launched - As usual when they launched it always go downhill.

There are a few possibilities

- Unlucky timing for investors

- Because track record was fake and plotted so investors will never dream of the past ROI gain

- They want to make losses to cover up for "Fake Plan"

- Traders too stressful to deliver

Anyone can proceed to Pavilion track record and visit all last year's data and history - In case they start hiding Pavilion track record, click export PDF on their myfxbook.

This is very unethical of a managed account company. The past trading record like what #FmrBrokerExecutive mentioned is too absurd for a sustainable growth for investors. Those who were higher risk on pavilion had a very bad month in August 2017 so far based on their myfxbook. These burns would already cover up for the " Hawk Plan " they promised to give to investors.

The Draw-down associated is more than 100% during last year, especially the time when GBP pairs were trading in a very risky period.

The pavilion had more than 20% gain consistently every month but once they reached this year the ROI deflated and also started losing money the minute it is launched.

There is something very fishy on this, I hope #Kelix who invested in Pavilion can share results.

If you see carefully, there were huge losses last year during that period, but it is very likely the track record were doctored to cover up for the original account which was margin called.

The inflated balances introduction had lowered the shown DD, but the actual DD last year was 80-100%. This may not be 100% accurate but running custom analysis on myfxbook always see much visible DD compared to what's shown. Can go back in time to study the analysis of their trade history.

Point 2 - Would appreciate if past investors can tell exactly which date which trading product was launched and effectively ready for investment. Sometimes, fake managed companies will keep jerking up ROIs until there are sufficient AUMs, then they start making it less ROI or trade real, as they want to accumulate more funds first onto a trading product.

- Timing of each product exactly launched

- The timing of each past product exactly de-listed ( old programs such as In 2014 Nordhill (has name Sfx-funds) promote PremiumFx, Mirrorfx strategies. After big losses strategies removed. When Gorilla, Hyper, Hybrid have losses in 2016, strategies changed.)

This hypothesis doesn't show a 30% fee cut after HWM months achieved, it's just for illustration purpose. If anyone wants a more thorough analysis, one has to show which period they joined and the actual ROI.

This is to give an analytical view of how their trading program was doing. As a nordhillcapital investor, if you invest on other trading product other than godlike " hawk ", you are very likely to lose money over time. Money is safer on godlike product " hawk ".

Question to all previous investors: The exact date anyone can join.

- Shark

- Crystal

- Hawk

- Pavilion

- Sparrow

- Owl

- Rich

Food for thoughts.

The purpose of this analysis is to indicate that, only hawk is " ok " to be invested but is it real? That bags the question.

Yet the broker is in SVG which meant they can plot results, and also explained why they can give 100-1000% Roi track record but the minute it started running LIVE, it doesn't have similar trading behavior as compared to prior, this is very misleading and make people think this is a very good ROI plan but end up the actual is the opposite.