How to trade channels in forex?

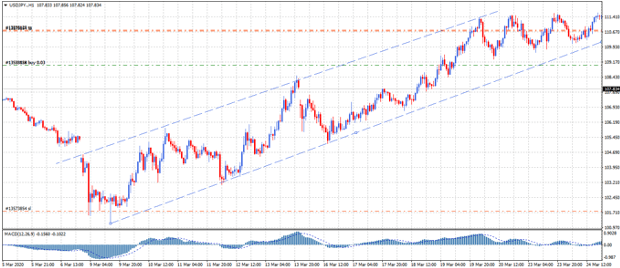

The first step is to draw the channel. To do that, you can either use two trend lines or the channel tool available on most trading platforms. The key rule about channels is that the support and resistance lines are parallel to one another (i.e. have the same angle). If the support line is 30 degrees up, then the same should apply for the resistance line. People draw channels by first drawing one line, either a resistance or a support line, and then drawing a parallel line at the other end.

Prices often move in waves within channels, and thus channels are good tools that help you predict and capture those waves. Channels can be used in both trending markets and sideways markets.

Once you have drawn the channel, it becomes easier to predict price direction. While in sideways markets you can trade in both directions, this is harder and riskier to do in trending markets. In an upward trend, for example, you should not be looking to establish short positions (i.e. sell). In trending markets, it would be safe to assume that markets can extend their movement in one direction against all expectations.

You can use an oscillator (such as the RSI, or the stochastics) to get a pulse of the momentum. Ideally, in sideways markets, you should wait for the price to react decisively to a resistance or a support line, and also see the momentum turning in your favor. This way, you have a confluence of signals that helps increase the success probability of the trade.

As for trends, such as a downtrend, for example, you should wait for the price to go back to the resistance line, and then reverse direction, indicating that it would continue the trend. An oscillator here also helps you identify areas where momentum has turned.

Channels are a great trading tool because it is easy to set stop loss and target levels based on them. The stop loss level is usually below the support line (or above the resistance line), and the target level is usually at the other end of the channel.

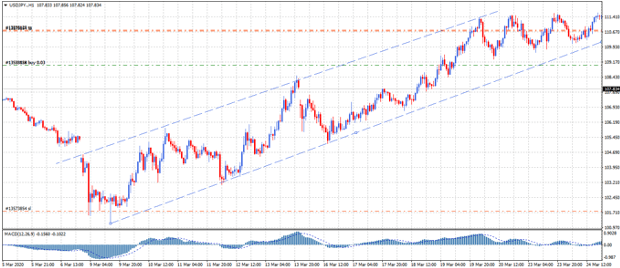

Prices often move in waves within channels, and thus channels are good tools that help you predict and capture those waves. Channels can be used in both trending markets and sideways markets.

Once you have drawn the channel, it becomes easier to predict price direction. While in sideways markets you can trade in both directions, this is harder and riskier to do in trending markets. In an upward trend, for example, you should not be looking to establish short positions (i.e. sell). In trending markets, it would be safe to assume that markets can extend their movement in one direction against all expectations.

You can use an oscillator (such as the RSI, or the stochastics) to get a pulse of the momentum. Ideally, in sideways markets, you should wait for the price to react decisively to a resistance or a support line, and also see the momentum turning in your favor. This way, you have a confluence of signals that helps increase the success probability of the trade.

As for trends, such as a downtrend, for example, you should wait for the price to go back to the resistance line, and then reverse direction, indicating that it would continue the trend. An oscillator here also helps you identify areas where momentum has turned.

Channels are a great trading tool because it is easy to set stop loss and target levels based on them. The stop loss level is usually below the support line (or above the resistance line), and the target level is usually at the other end of the channel.