How to use pivot points in forex?

Pivot points help traders establish a bias. In that sense, if the price is below all pivot points, then this can be a good selling opportunity, although a confirmation signal is needed. Similarly, if the price is above all pivot points, then this can be a good buying opportunity if another confirmation signal can be found.

If the price goes down to touch a pivot point then bounces strongly off of that point, then this may be a good opportunity to establish a long position (i.e. buy). If the price had broken out of a trend line earlier and is also bouncing off of a pivot point, then this offers you a confluence of meaningful technical levels.

Pivot points can be used as support and resistance levels. They indicate which levels the price is likely to react to. The most commonly used pivot points are the daily pivot points, as they indicate intraday levels that can be useful to active day traders.

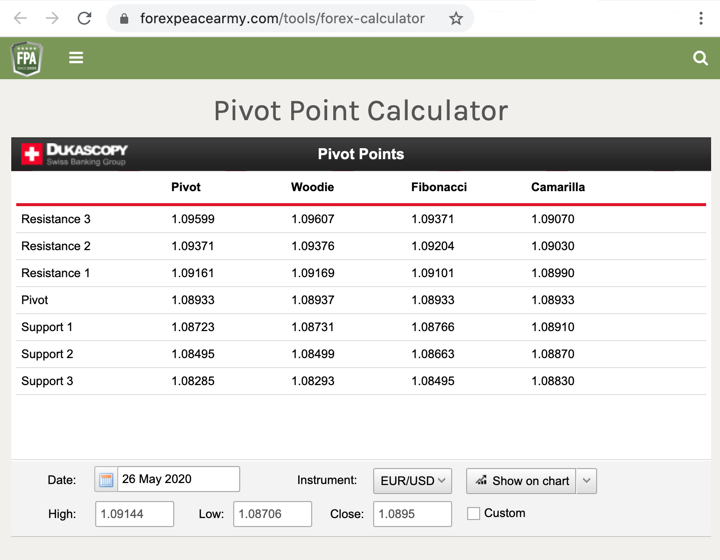

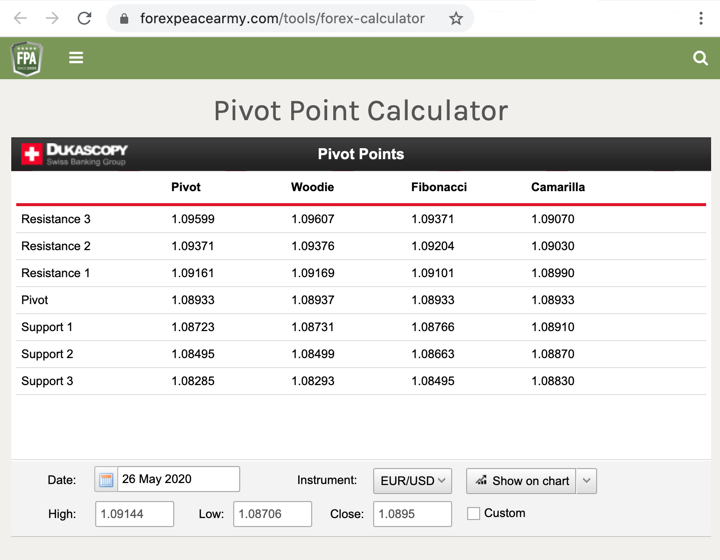

ForexPeaceArmy.com features Pivot Point Calculator in its set of tools for traders.

Pivot points can also be used with indicators such as the Ichimoku cloud. If the cloud is offering you a sell signal and the price had touched a pivot point going up then declined strongly, it would be a good technical setup. Those points can also be used with oscillators such as the RSI. If the price bounced off of pivot point and reversed direction (from declining to rising, for example), and the RSI was in oversold territories and then exited that territory, then it is a good buying opportunity.

In general, pivot points can be used with a wide variety of tools, provided that the price shows a reaction to them. With proper risk management, they can help you catch strong moves.

If the price goes down to touch a pivot point then bounces strongly off of that point, then this may be a good opportunity to establish a long position (i.e. buy). If the price had broken out of a trend line earlier and is also bouncing off of a pivot point, then this offers you a confluence of meaningful technical levels.

Pivot points can be used as support and resistance levels. They indicate which levels the price is likely to react to. The most commonly used pivot points are the daily pivot points, as they indicate intraday levels that can be useful to active day traders.

ForexPeaceArmy.com features Pivot Point Calculator in its set of tools for traders.

Pivot points can also be used with indicators such as the Ichimoku cloud. If the cloud is offering you a sell signal and the price had touched a pivot point going up then declined strongly, it would be a good technical setup. Those points can also be used with oscillators such as the RSI. If the price bounced off of pivot point and reversed direction (from declining to rising, for example), and the RSI was in oversold territories and then exited that territory, then it is a good buying opportunity.

In general, pivot points can be used with a wide variety of tools, provided that the price shows a reaction to them. With proper risk management, they can help you catch strong moves.