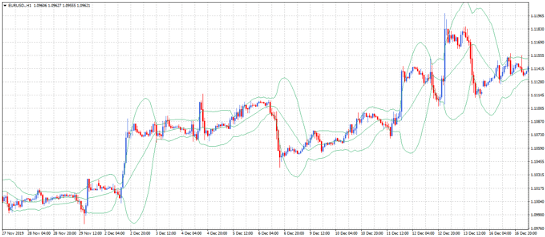

How to use Bollinger bands in forex?

There are many ways to use Bollinger bands in forex. The first way is to use Bollinger bands to detect times when the market is moving in a trend. During such times, the candles often close outside the upper or lower bands. This means that the market is overstretched in one direction. One of the strategies you can implement here is to enter a position when a candle closes outside of one of the bands after a low volatility period. This would mean that the market has moved strongly in one direction.

The best time to enter a position is after a Bollinger band squeeze. The bands usually expand or tighten depending on the range of price movement. When the bands become too tight this would mean low volatility (a squeeze). At this point, you should wait for volatility to return and to see a big candle that closes outside of one of the bands. This would be a good opportunity to catch a trend.

In the other method, you will try to catch a reversal. Based on this approach, you wait for the candlestick to close outside one of the bands. Then you wait for a candle after that to close inside the band. This would usually mean that the price has begun a mean reversion move (although this is not always the case). You can set the stop loss above (or below) the candle that closed outside of one of the bands, and the target at the moving average.

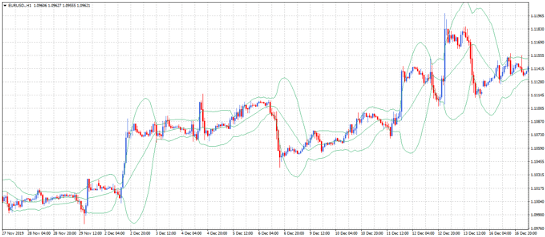

The best time to enter a position is after a Bollinger band squeeze. The bands usually expand or tighten depending on the range of price movement. When the bands become too tight this would mean low volatility (a squeeze). At this point, you should wait for volatility to return and to see a big candle that closes outside of one of the bands. This would be a good opportunity to catch a trend.

In the other method, you will try to catch a reversal. Based on this approach, you wait for the candlestick to close outside one of the bands. Then you wait for a candle after that to close inside the band. This would usually mean that the price has begun a mean reversion move (although this is not always the case). You can set the stop loss above (or below) the candle that closed outside of one of the bands, and the target at the moving average.