HubuFX

HubuFX Representative

- Messages

- 36

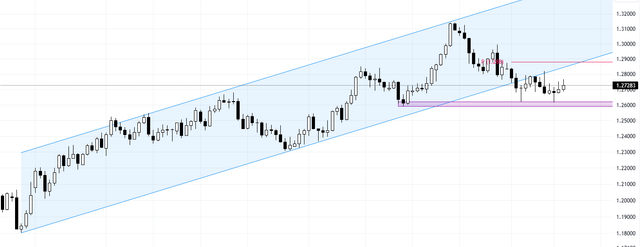

EURUSD: Downtrend Continues, But Bulls Have a Chance at R2

The EURUSD pair is trading in a downtrend and has broken below the 55 Moving Average and the pivot line at 1.099. This suggests that the decline is likely to continue, with the next target being S1 at 1.093 and S2 at 1.086. These levels coincide with the lower line of the channel.

Overall, the outlook for EURUSD is bearish, but there are some bullish factors that could support the price. The 1.035 and 1.1049 levels provide support, and if the price closes above this zone, the bulls could target R2 at 1.112. Traders should be cautious and wait for a clear breakout before taking a position.

The EURUSD pair is trading in a downtrend and has broken below the 55 Moving Average and the pivot line at 1.099. This suggests that the decline is likely to continue, with the next target being S1 at 1.093 and S2 at 1.086. These levels coincide with the lower line of the channel.

Overall, the outlook for EURUSD is bearish, but there are some bullish factors that could support the price. The 1.035 and 1.1049 levels provide support, and if the price closes above this zone, the bulls could target R2 at 1.112. Traders should be cautious and wait for a clear breakout before taking a position.

Fundamental factors for EURUSD:

- ECB President Lagarde to speak at Jackson Hole symposium. ECB President Christine Lagarde will be speaking at the Jackson Hole symposium today. Her speech is closely watched by markets for any clues about the future of monetary policy in the eurozone.

- German industrial production data. German industrial production data for July is due to be released today. Economists are expecting a decline of 0.5% from the previous month. A weak reading could weigh on the euro.

- US retail sales data. US retail sales data for July is due to be released tomorrow. Economists are expecting a strong increase of 0.8% from the previous month. A strong reading could boost the dollar.