HubuFX

HubuFX Representative

- Messages

- 36

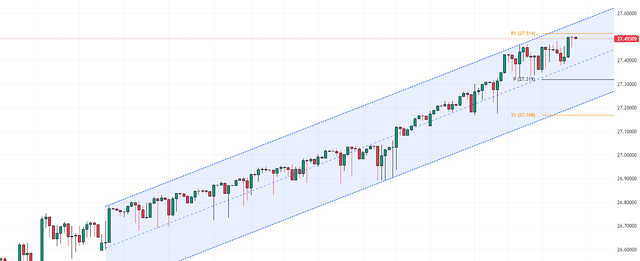

NZDUSD Technical Analysis

The NZDUSD currency pair is currently trading beneath the pivotal 0.595 mark, with the RSI indicator lingering below the 50 level, indicating a bearish market strength. The pair is navigating within an ascending channel, which is typically viewed as a corrective phase following the pair's recent downturn.

The lower boundary of this declining channel plays a crucial role in resuming the bearish outlook. As NZDUSD is trading below the pivot point and with the price remaining under this level, there's a likelihood of a further decline towards the 0.591 support level. This scenario underscores the importance of monitoring these key levels and market indicators in your trading strategy.

The NZDUSD currency pair is currently trading beneath the pivotal 0.595 mark, with the RSI indicator lingering below the 50 level, indicating a bearish market strength. The pair is navigating within an ascending channel, which is typically viewed as a corrective phase following the pair's recent downturn.

The lower boundary of this declining channel plays a crucial role in resuming the bearish outlook. As NZDUSD is trading below the pivot point and with the price remaining under this level, there's a likelihood of a further decline towards the 0.591 support level. This scenario underscores the importance of monitoring these key levels and market indicators in your trading strategy.