Admiral Markets

AdmiralMarkets.com Representative

- Messages

- 95

Technical Update - EURNZD, AUDNZD, NZDCAD and NZDCHF

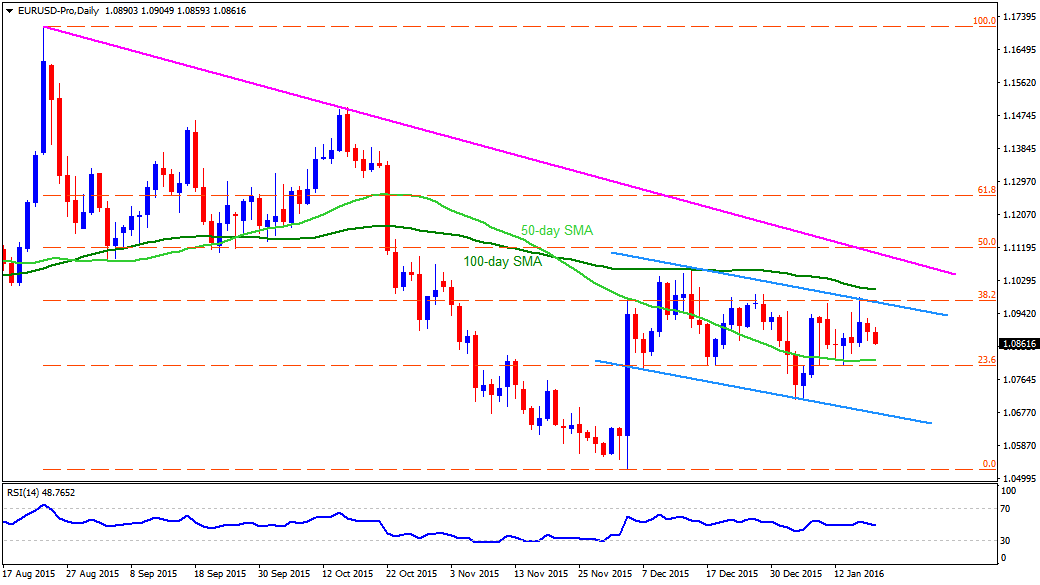

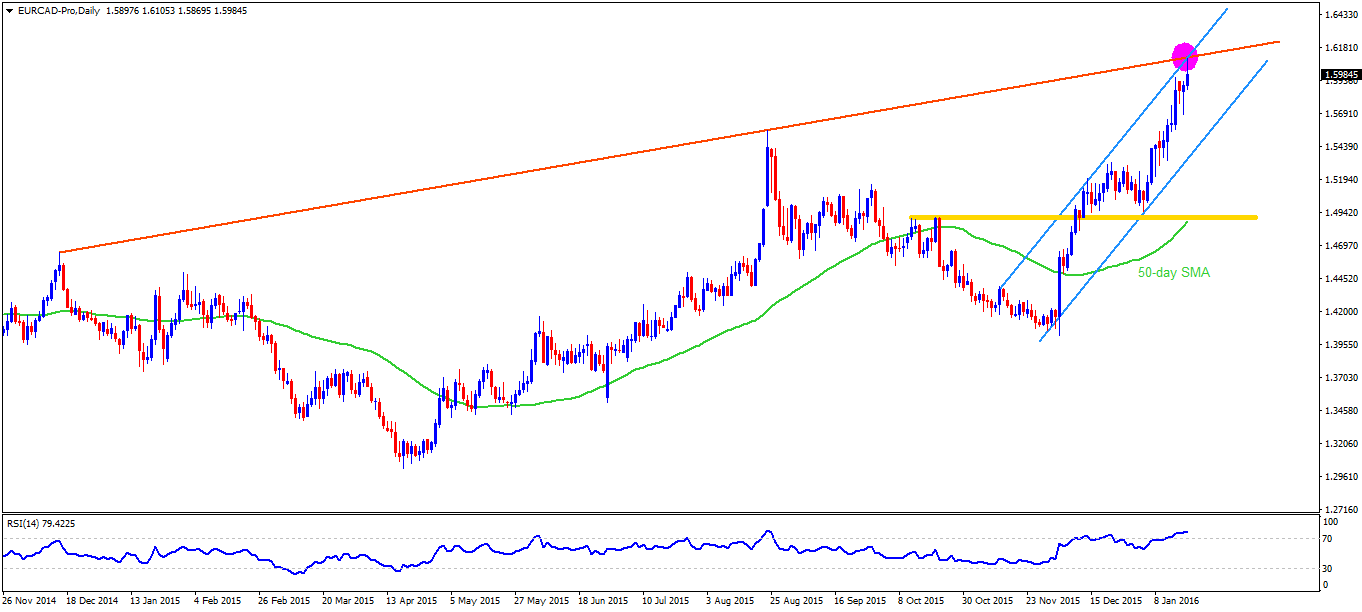

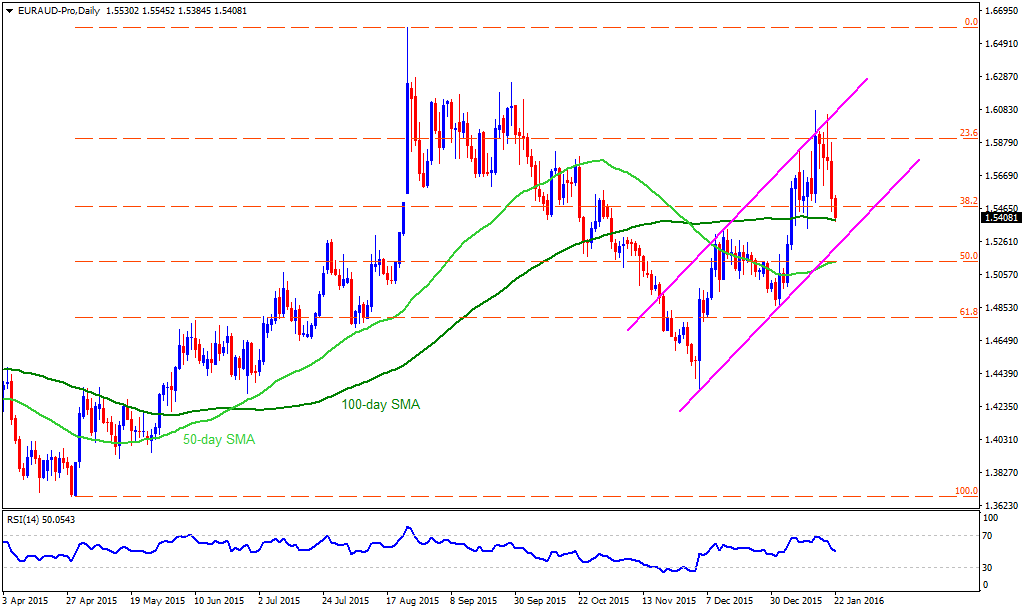

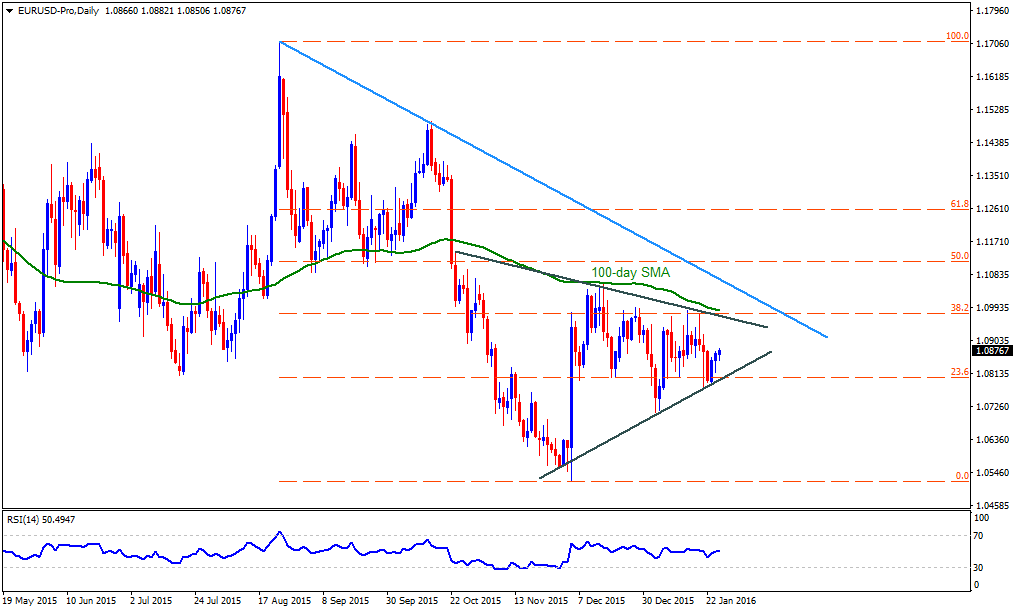

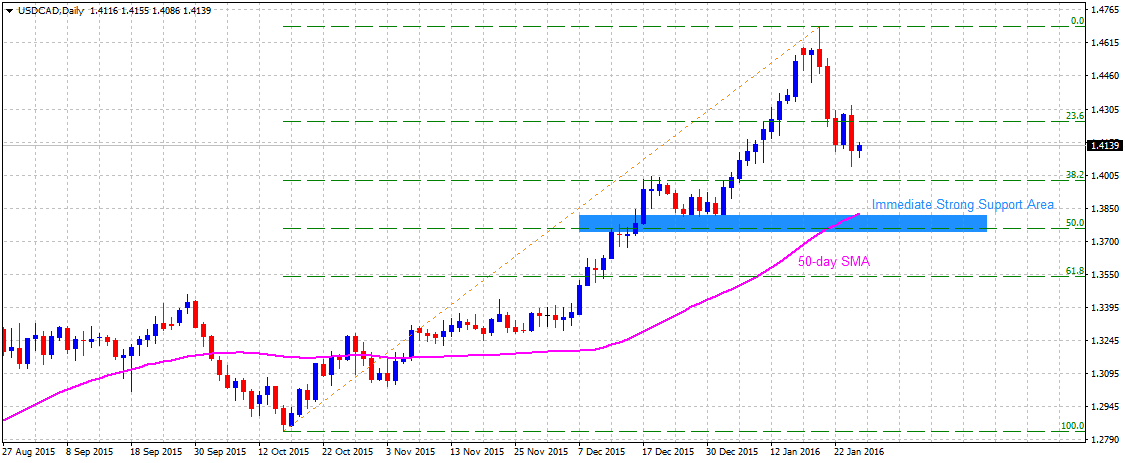

EURNZD

The pair's another rebound from near 61.8% Fib. retracement level of April to August up-move failed to lift it beyond 1.6850 resistance area marked by 100-day SMA and also nearing 38.2% Fib. retracement level. The pair has now dropped back below 1.6500 mark and subsequent weakness below 1.6400 round figure mark support is likely to drag the pair back towards 50% Fib. retracement level support near 1.6300 level. Failure to hold 1.6300 mark support is likely to increase the pair's vulnerability to drift back towards the very important support near 1.5800 mark. On the upside, move above 1.6650 immediate horizontal resistance might continue to face resistance at 100-day SMA region, currently near 1.6750 level. This is followed by resistance at 38.2% Fib. retracement level near 1.6870-80 zone. Sustained strength above 100-day SMA resistance and a subsequent move above 38.2% Fib. retracement level seems to immediately lift the pair beyond 1.7000 mark towards 1.7100-1.7120 horizontal resistance.

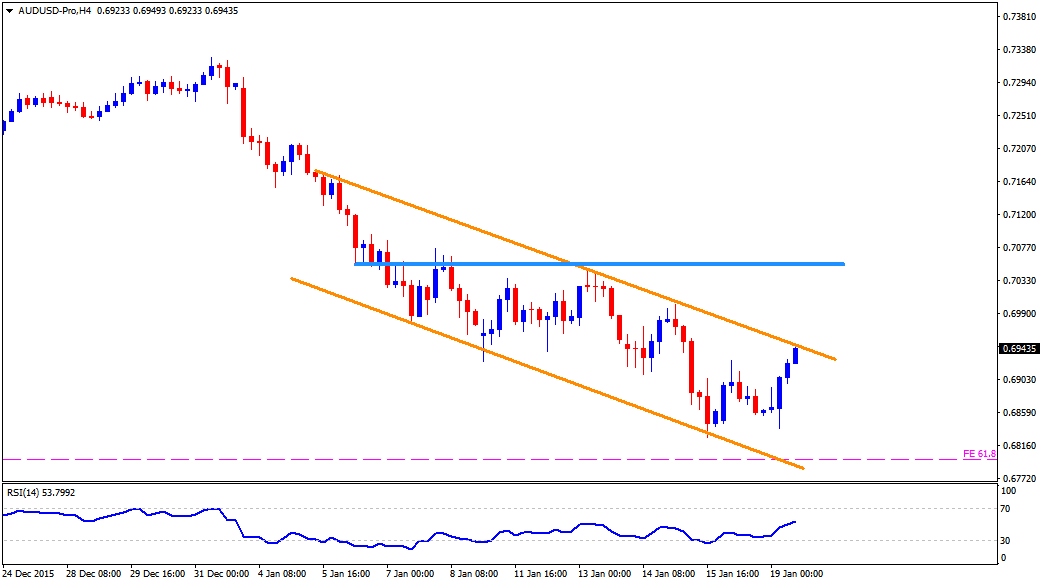

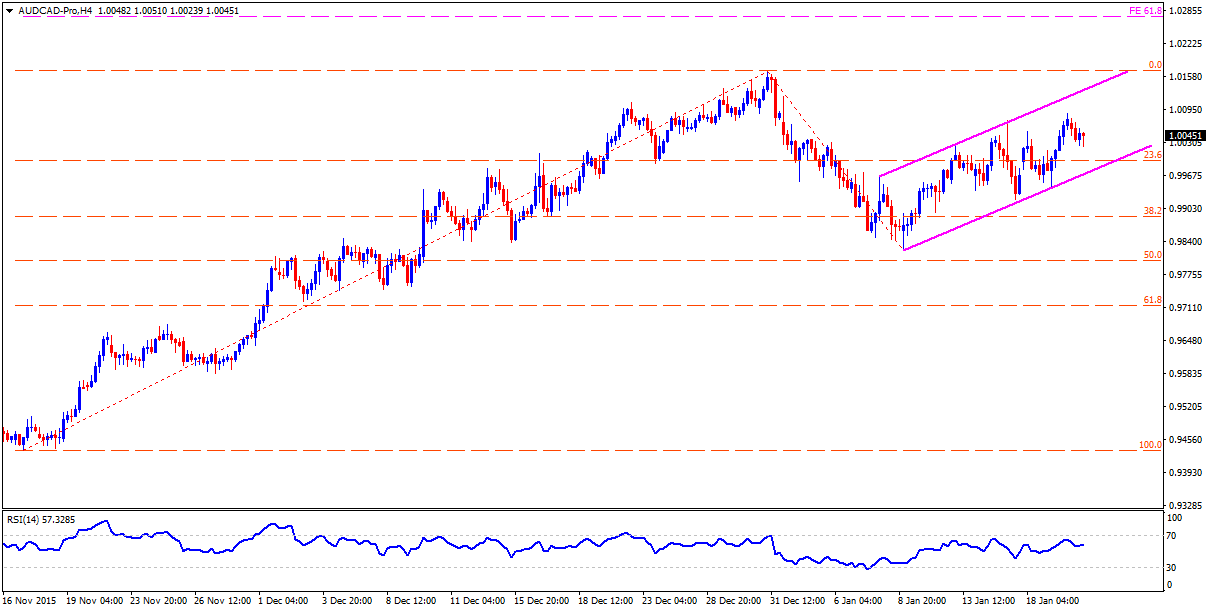

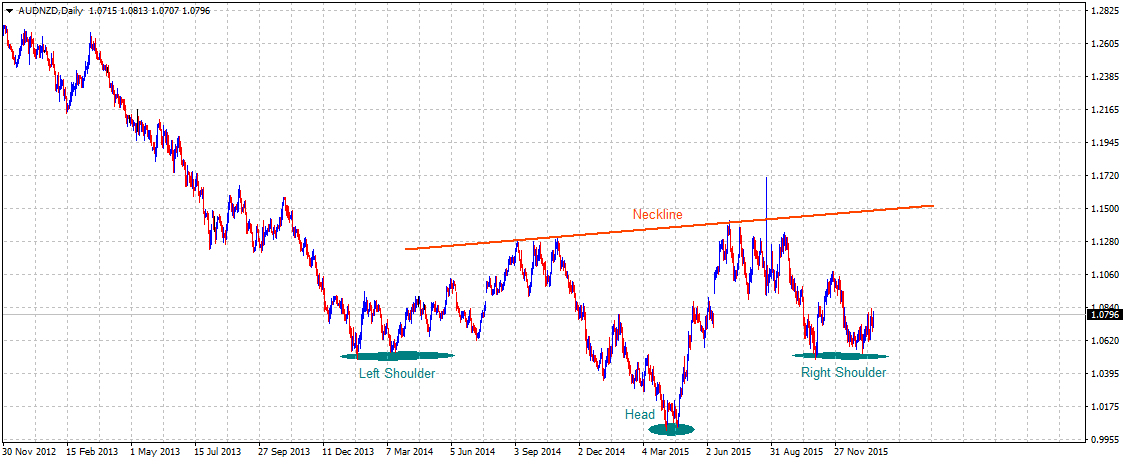

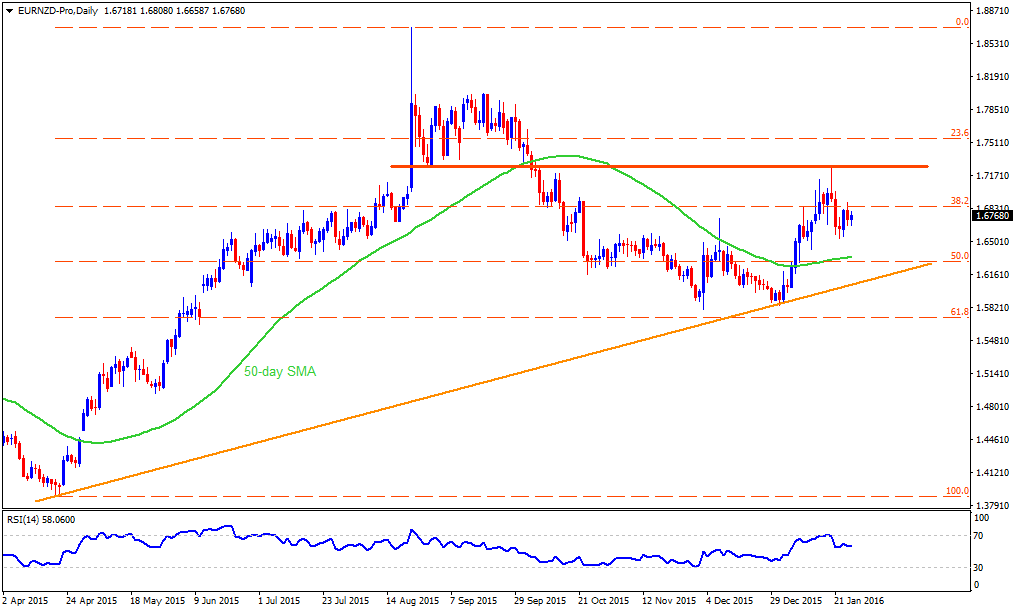

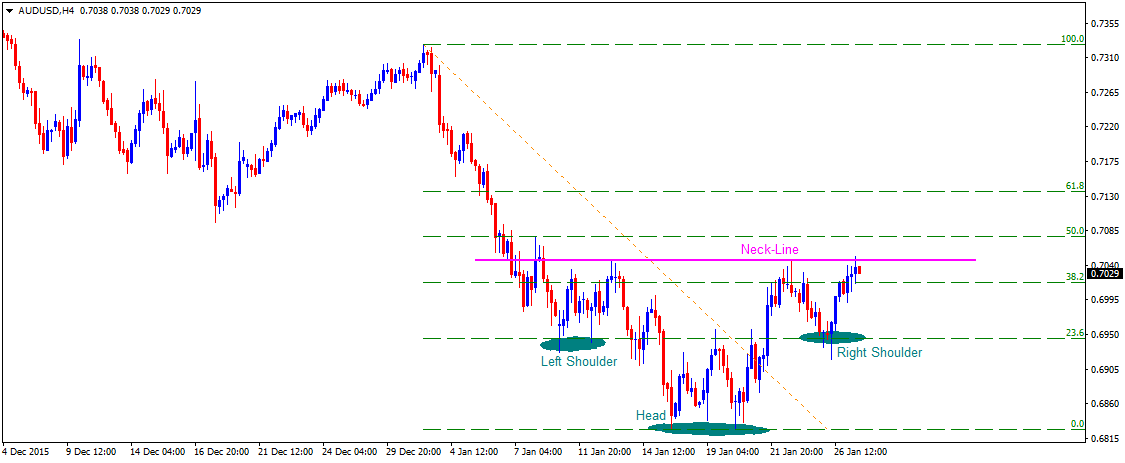

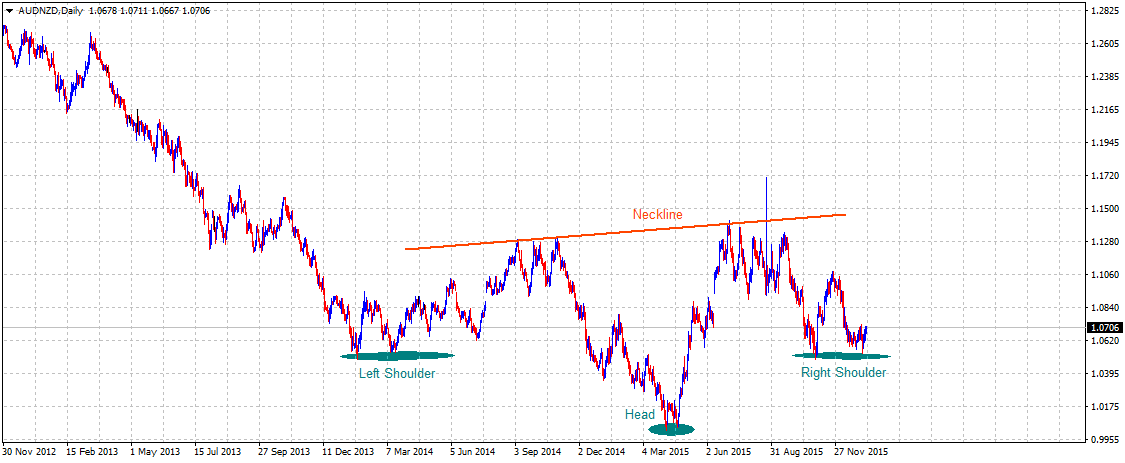

AUDNZD

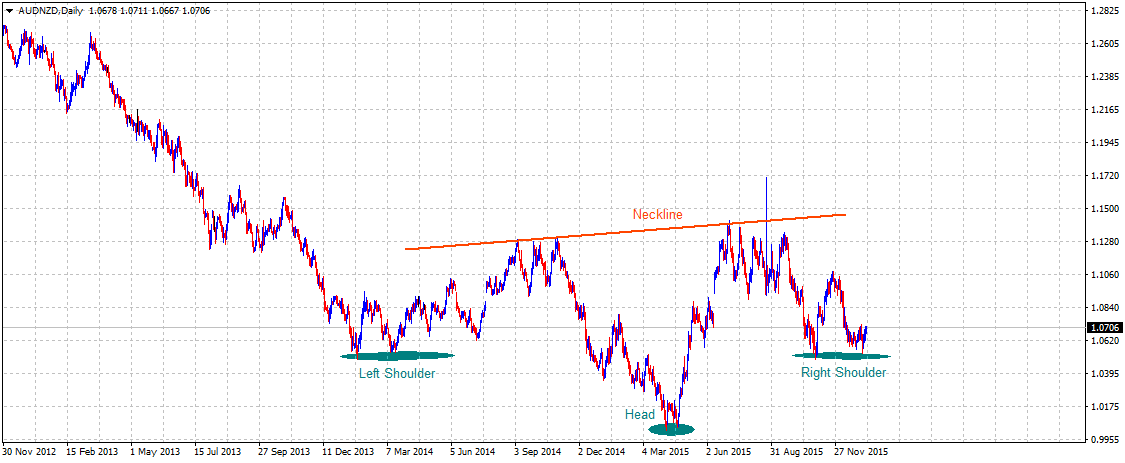

Even as the pair reversed from over two-year high touched in August, it clearly seems to have found a strong support near 1.0500 area. Moreover, the pair also seems to be in the process of forming a bullish reversal Head and Shoulders chart-pattern on daily chart. The pattern, however, is confirmed only once the pair manages to clear an important resistance near 1.1500 level, marked by the Neck-line of the pattern formation. From current levels, sustained trade above 1.0700 mark is likely to accelerate the up-move towards its next major resistance near 1.0900 mark with 1.0800 round figure acting as intermediate resistance. On the downside, 1.0600 mark seems to have emerged as immediate support. However, major downside support continues to remain near 1.0500 mark, which if broken negates the bullish formation and thus, opening room for resumption of the pair's prior weakening trend. Below 1.0500 mark, the pair could immediately drop to test its next support near 1.0350 region.

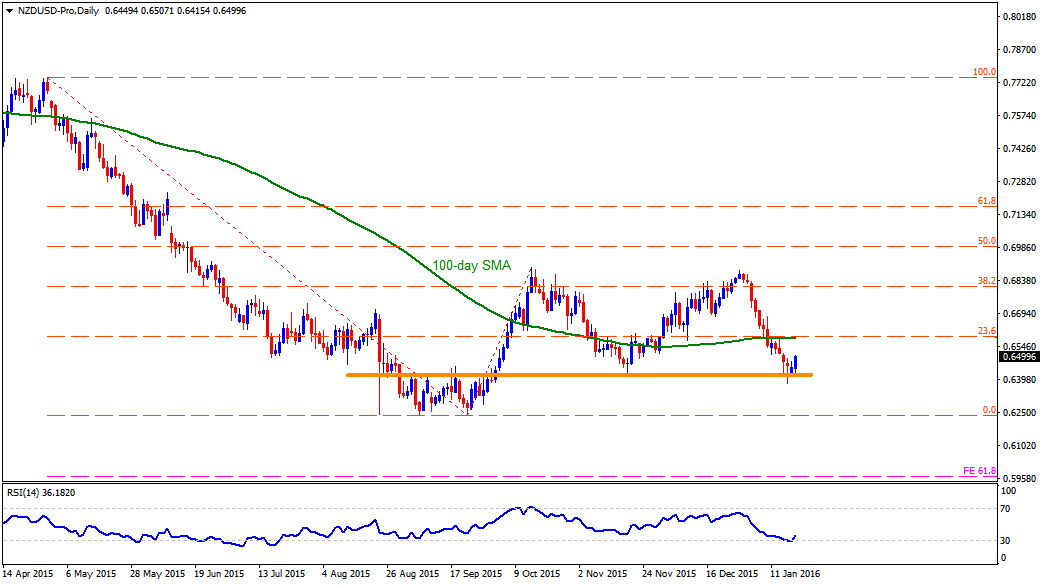

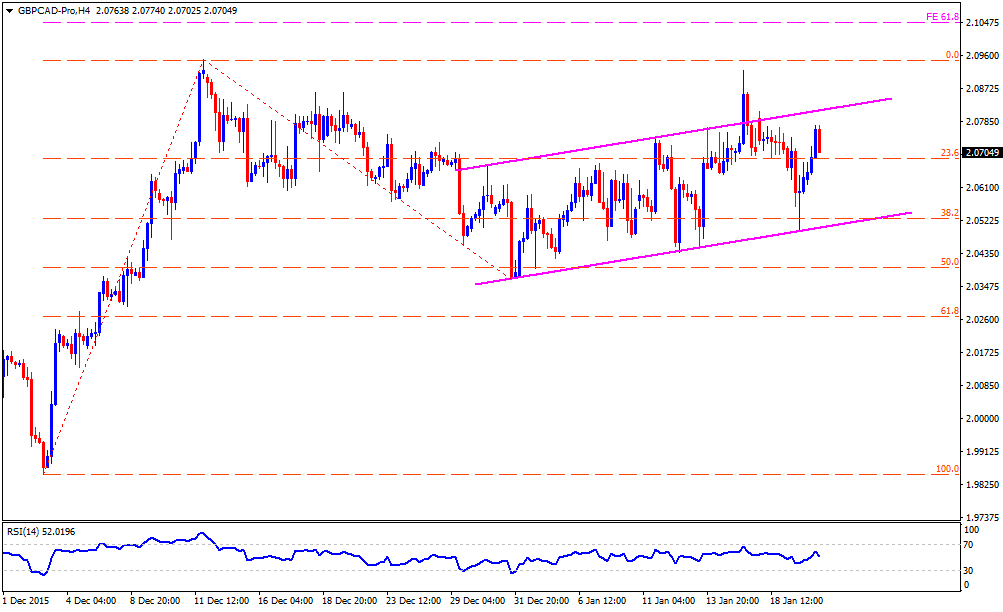

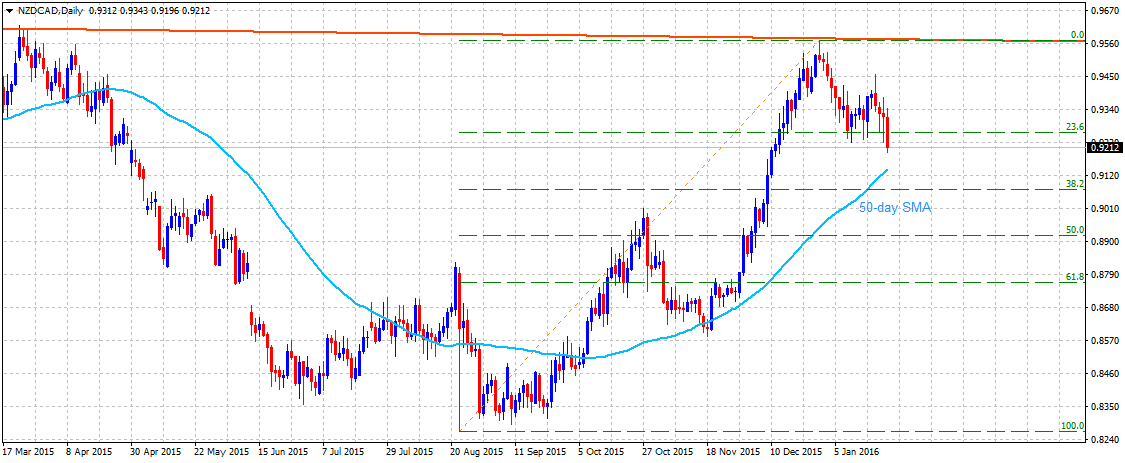

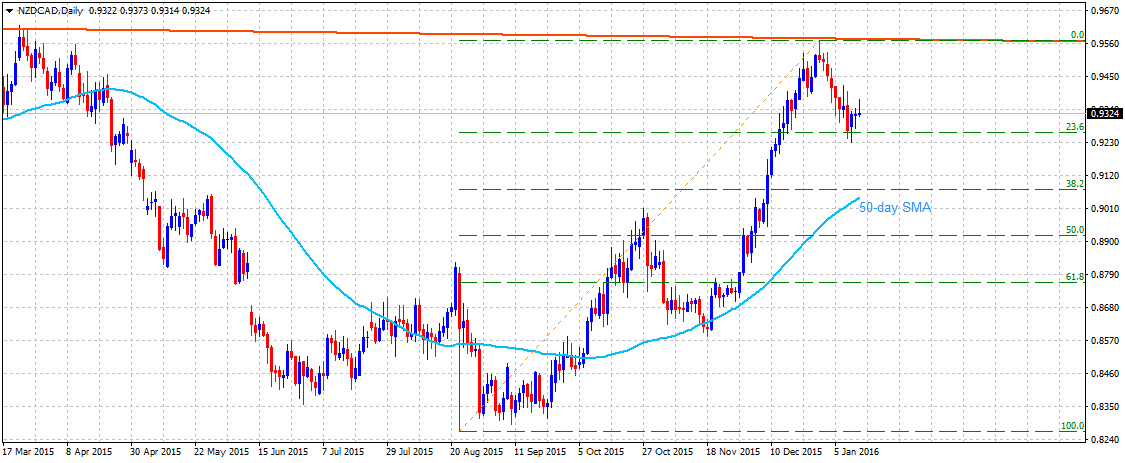

NZDCAD

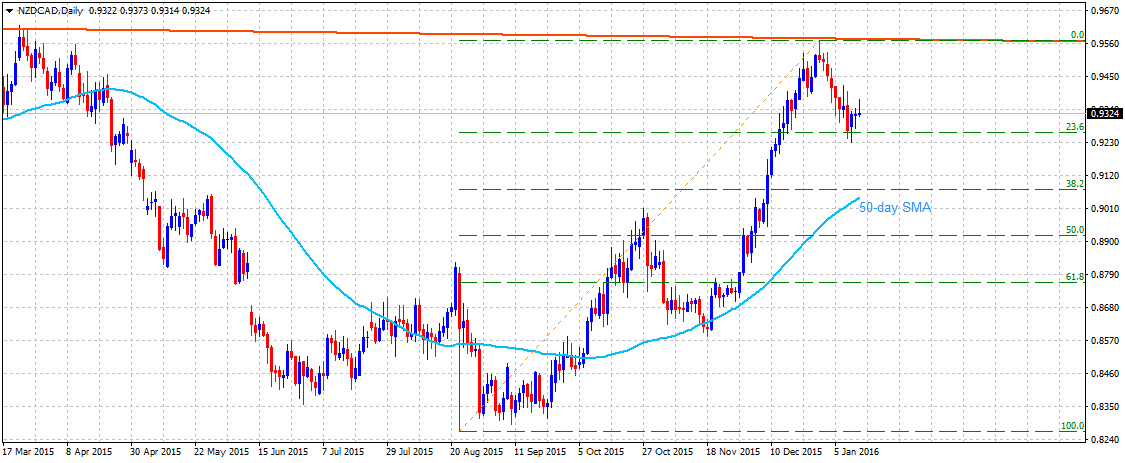

The pair's sharp recovery from August 2015 lows, marking its lowest level since Sept. 2013, seems to face difficulty in clearing a descending trend-line resistance (near 0.9550-60 area) extending from Mar. 2014 highs through Mar. 2015 highs. The pair, however, has managed to find support at 23.6% Fib. retracement level support of Aug. to Dec. 2015 up-swing, near 0.9260-50 area. Weakness below this immediate support is likely to extend the pair's near-term corrective move towards its next major support near 0.9070-50 confluence region, comprising of 38.2% Fib. retracement and 50-day SMA. On the upside, 0.9380-0.9400 area is likely to act as immediate resistance, which if conquered seems to lift the pair back towards its recent closing high level resistance near 0.9500-0.9520 area. Any further up-move beyond 0.9500 mark resistance might continue to be restricted by the descending trend-line resistance near 0.9570 level. Only a decisive break-through beyond this strong resistance opens rooms for further near-term appreciating move for the pair.

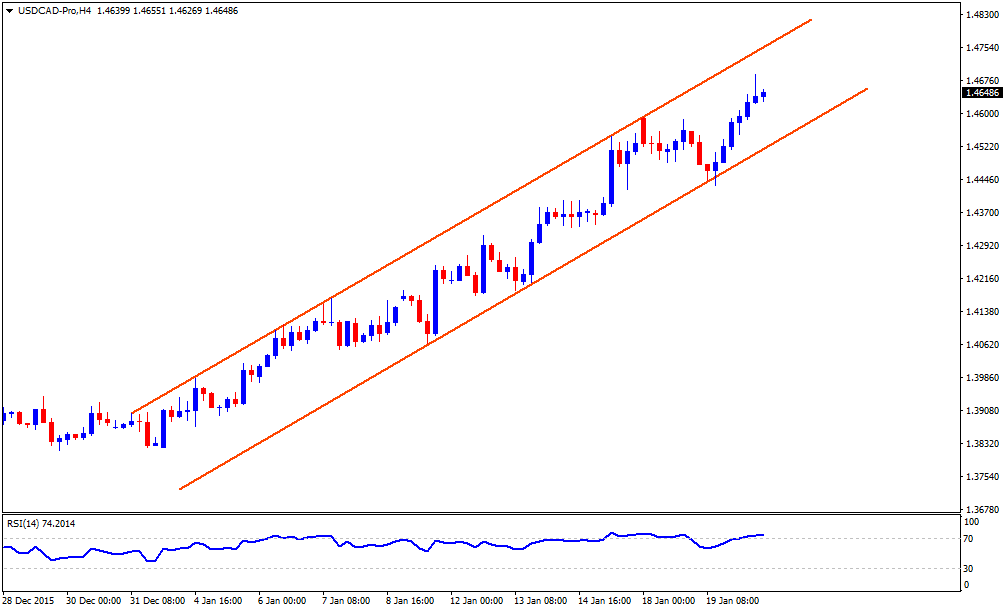

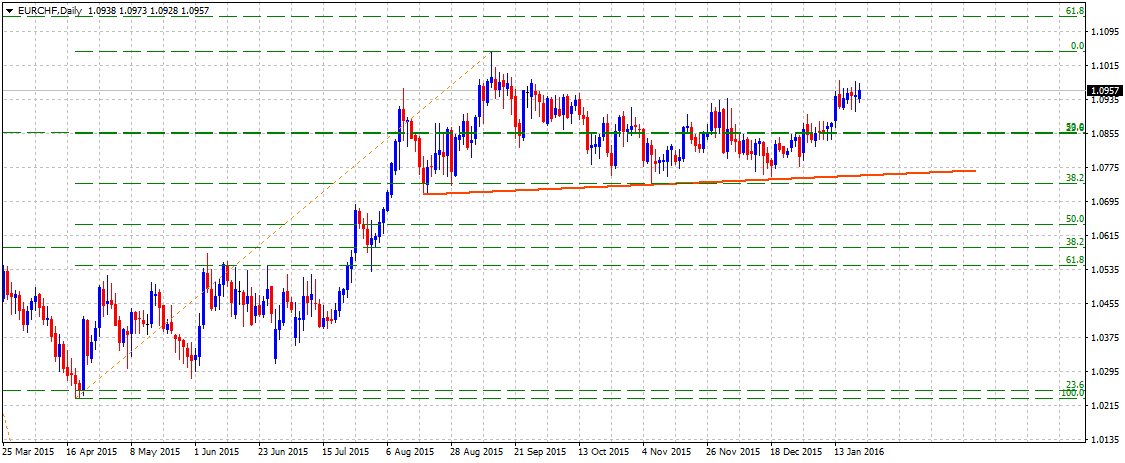

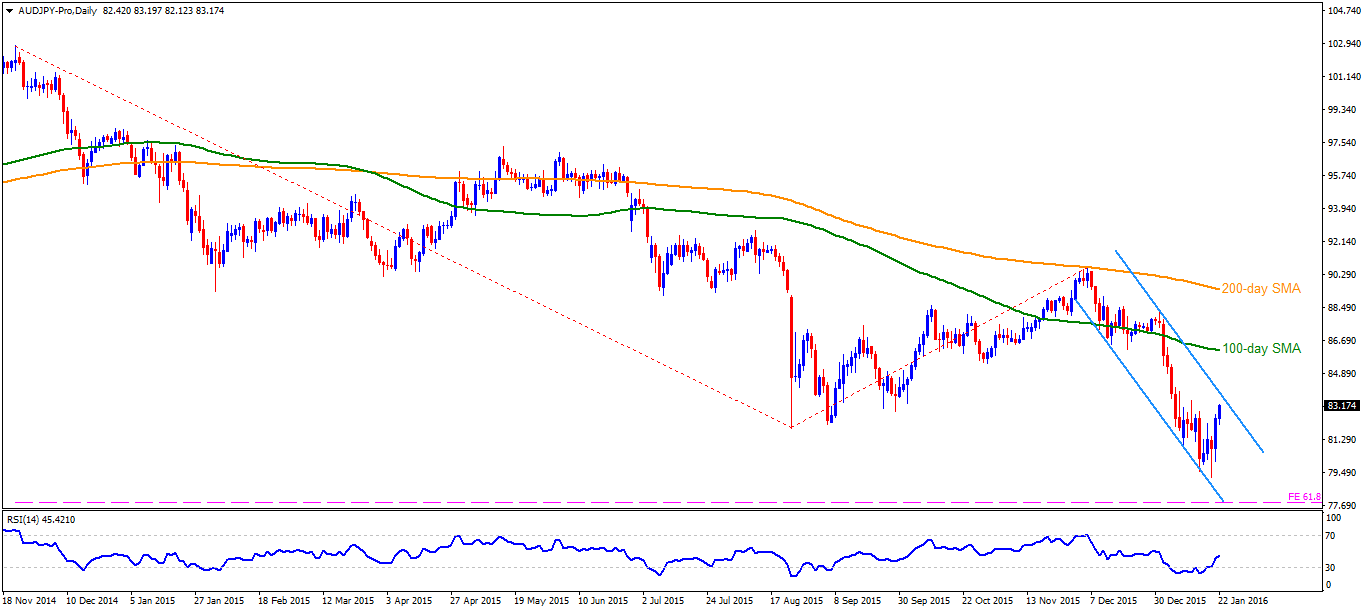

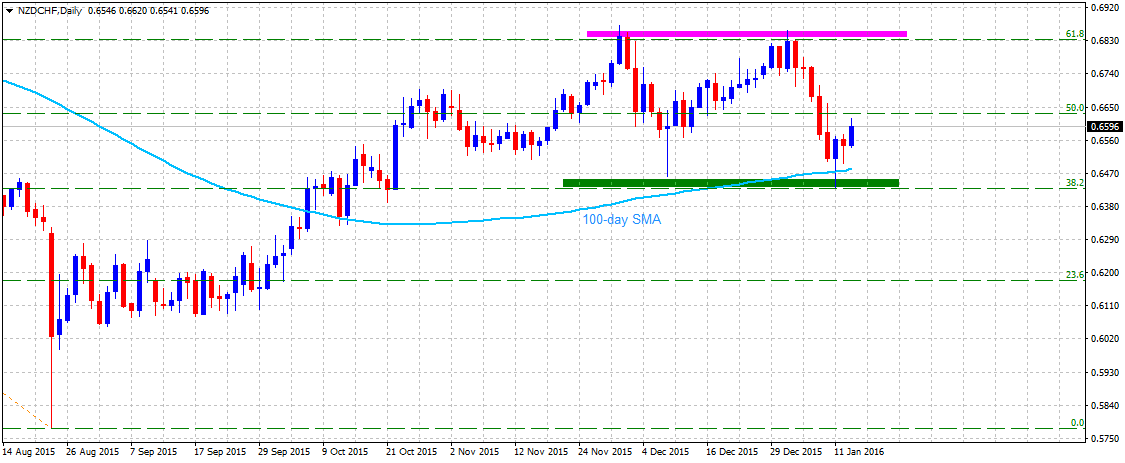

NZDCHF

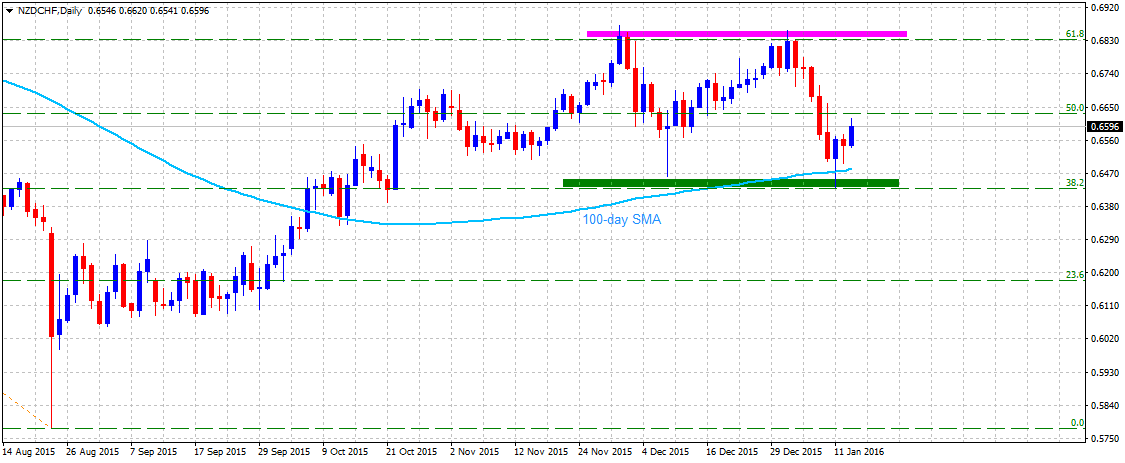

The pair's repeated reversal from 61.8% Fib. retracement level of it's Mar. to Aug. 2015 downfall continues to find support at 38.2% Fib. retracement level near 0.6425-30 area, also coinciding with 100-day SMA. The pair has now moved back to an intermediate resistance level at 50% Fib. retracement near 0.6625 region. Move above this immediate resistance is likely to confirm the near-term range for the pair, thus lifting it back towards 61.8% Fib. retracement level resistance near 0.6850-60 zone. Meanwhile, reversal from current resistance area and a subsequent weakness back below 0.6500 mark is likely to drag it back towards the lower end of the trading range support near 0.6420 area. Decisive break-through below the very important 0.6430-20 support area is likely to trigger a fresh leg of weakness, initially towards 0.6325-20 intermediate support and eventually towards 23.6% Fib. retracement level support near 0.6175-70 area.

“Original analysis is provided by Admiral Markets”

EURNZD

The pair's another rebound from near 61.8% Fib. retracement level of April to August up-move failed to lift it beyond 1.6850 resistance area marked by 100-day SMA and also nearing 38.2% Fib. retracement level. The pair has now dropped back below 1.6500 mark and subsequent weakness below 1.6400 round figure mark support is likely to drag the pair back towards 50% Fib. retracement level support near 1.6300 level. Failure to hold 1.6300 mark support is likely to increase the pair's vulnerability to drift back towards the very important support near 1.5800 mark. On the upside, move above 1.6650 immediate horizontal resistance might continue to face resistance at 100-day SMA region, currently near 1.6750 level. This is followed by resistance at 38.2% Fib. retracement level near 1.6870-80 zone. Sustained strength above 100-day SMA resistance and a subsequent move above 38.2% Fib. retracement level seems to immediately lift the pair beyond 1.7000 mark towards 1.7100-1.7120 horizontal resistance.

AUDNZD

Even as the pair reversed from over two-year high touched in August, it clearly seems to have found a strong support near 1.0500 area. Moreover, the pair also seems to be in the process of forming a bullish reversal Head and Shoulders chart-pattern on daily chart. The pattern, however, is confirmed only once the pair manages to clear an important resistance near 1.1500 level, marked by the Neck-line of the pattern formation. From current levels, sustained trade above 1.0700 mark is likely to accelerate the up-move towards its next major resistance near 1.0900 mark with 1.0800 round figure acting as intermediate resistance. On the downside, 1.0600 mark seems to have emerged as immediate support. However, major downside support continues to remain near 1.0500 mark, which if broken negates the bullish formation and thus, opening room for resumption of the pair's prior weakening trend. Below 1.0500 mark, the pair could immediately drop to test its next support near 1.0350 region.

NZDCAD

The pair's sharp recovery from August 2015 lows, marking its lowest level since Sept. 2013, seems to face difficulty in clearing a descending trend-line resistance (near 0.9550-60 area) extending from Mar. 2014 highs through Mar. 2015 highs. The pair, however, has managed to find support at 23.6% Fib. retracement level support of Aug. to Dec. 2015 up-swing, near 0.9260-50 area. Weakness below this immediate support is likely to extend the pair's near-term corrective move towards its next major support near 0.9070-50 confluence region, comprising of 38.2% Fib. retracement and 50-day SMA. On the upside, 0.9380-0.9400 area is likely to act as immediate resistance, which if conquered seems to lift the pair back towards its recent closing high level resistance near 0.9500-0.9520 area. Any further up-move beyond 0.9500 mark resistance might continue to be restricted by the descending trend-line resistance near 0.9570 level. Only a decisive break-through beyond this strong resistance opens rooms for further near-term appreciating move for the pair.

NZDCHF

The pair's repeated reversal from 61.8% Fib. retracement level of it's Mar. to Aug. 2015 downfall continues to find support at 38.2% Fib. retracement level near 0.6425-30 area, also coinciding with 100-day SMA. The pair has now moved back to an intermediate resistance level at 50% Fib. retracement near 0.6625 region. Move above this immediate resistance is likely to confirm the near-term range for the pair, thus lifting it back towards 61.8% Fib. retracement level resistance near 0.6850-60 zone. Meanwhile, reversal from current resistance area and a subsequent weakness back below 0.6500 mark is likely to drag it back towards the lower end of the trading range support near 0.6420 area. Decisive break-through below the very important 0.6430-20 support area is likely to trigger a fresh leg of weakness, initially towards 0.6325-20 intermediate support and eventually towards 23.6% Fib. retracement level support near 0.6175-70 area.

“Original analysis is provided by Admiral Markets”