Admiral Markets

AdmiralMarkets.com Representative

- Messages

- 95

Technical Outlook: Important JPY Pairs

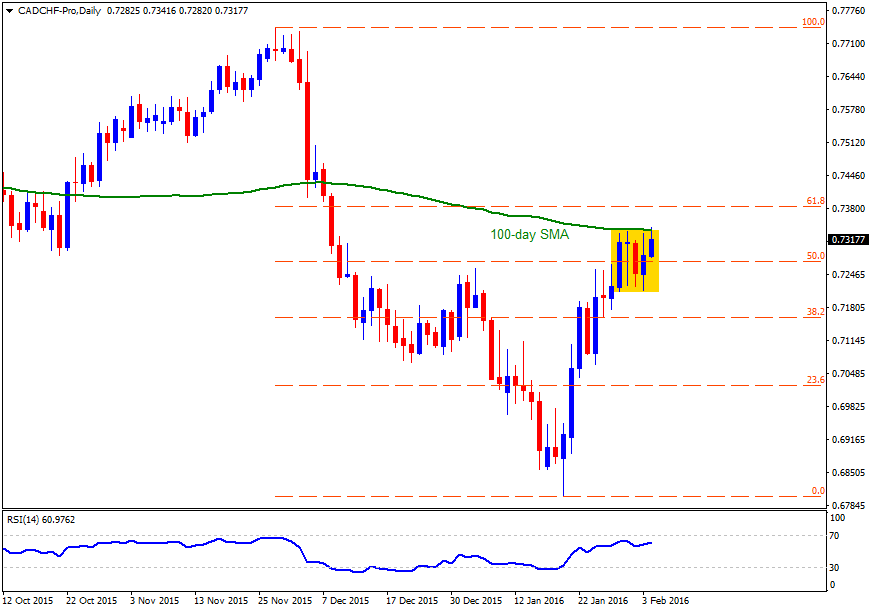

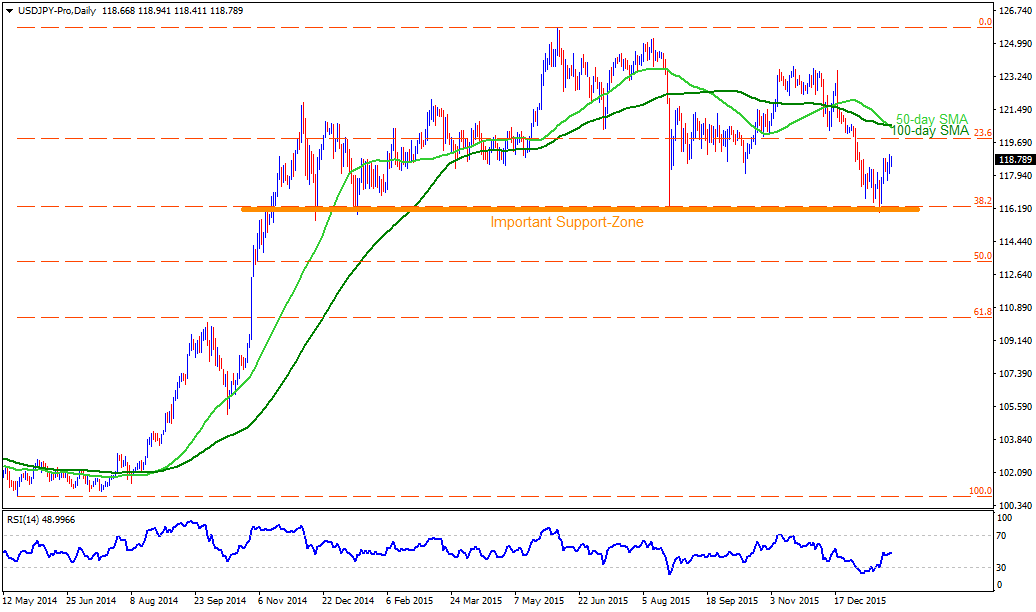

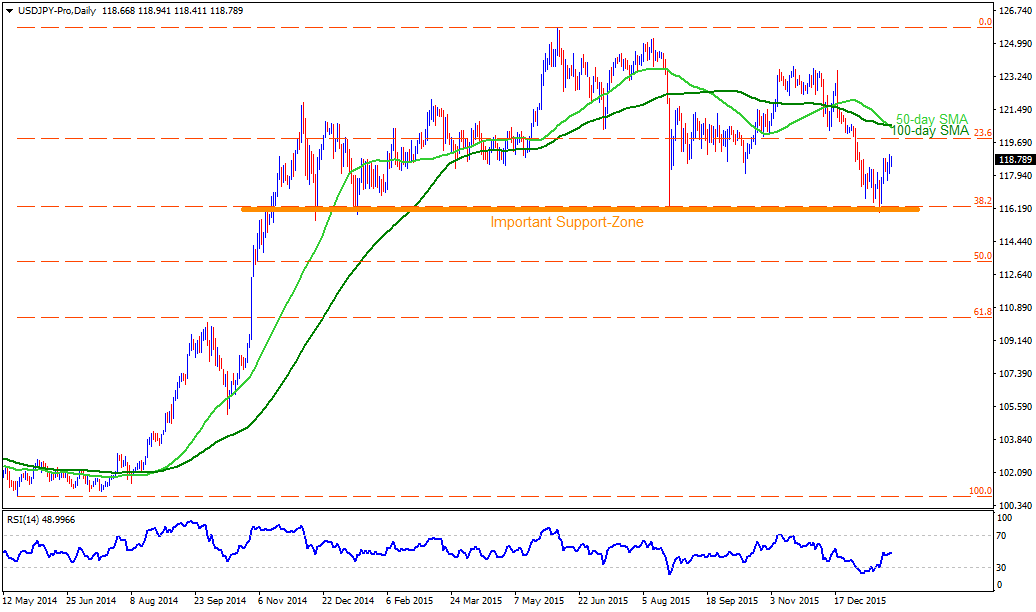

USDJPY

With yet another bounce from the 116.20 – 116.00 horizontal support-zone, encompassing 38.2% Fibonacci Retracement of its May 2014 – June 2015 upside, the USDJPY seems all set to confront the 120.00 round figure mark, nearing the 23.6% Fibo level; however, 50-day & 100-day SMA confluence, near 120.50-60 area, can confine the pair's further advances. Should the pair manage to clear 120.60 on a closing basis, it can quickly rise to 121.85 – 122.00 region, breaking which 123.70-80 is likely important upside numbers that the pair traders can watch. Though, pair's inability to sustain the recent pullback can again fetch it to 117.50 immediate support, breaking which it can be dragged down to 116.20 – 116.00 zone. If the pair drops below 116.00, it becomes weaker enough to test 114.00 mark prior to resting near 113.30, including 50% Fibo while further downside below 113.30 opens the door for the pair's slide towards 110.00 mark, which encompasses 61.8% Fibo level.

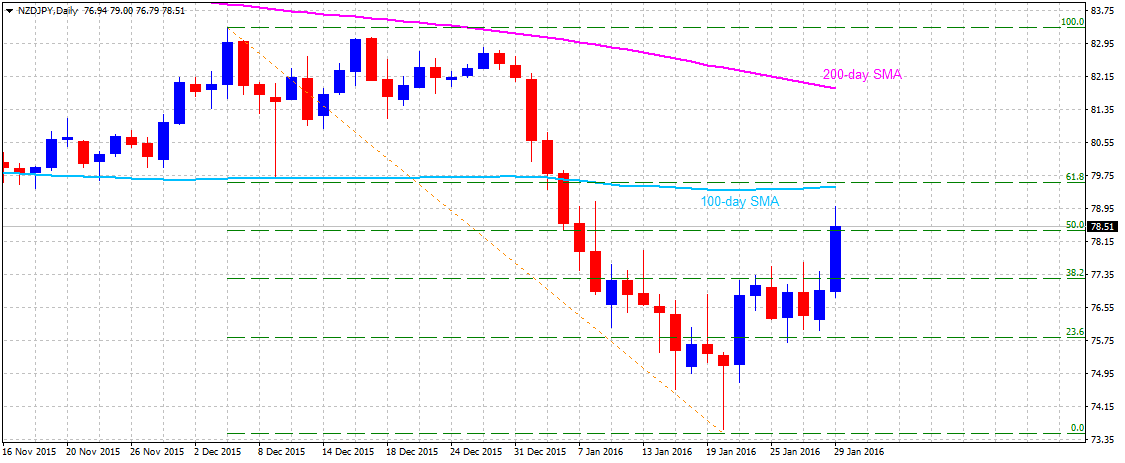

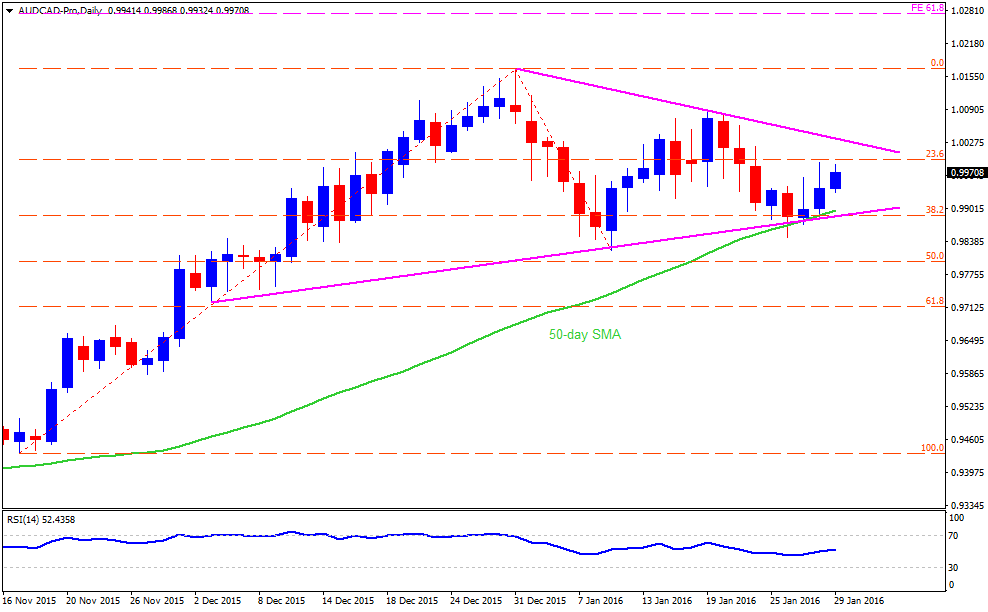

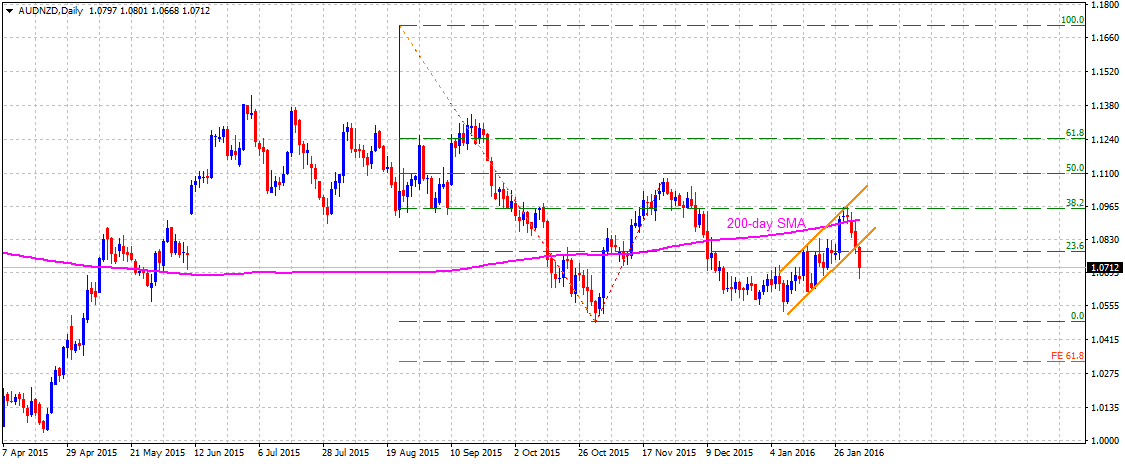

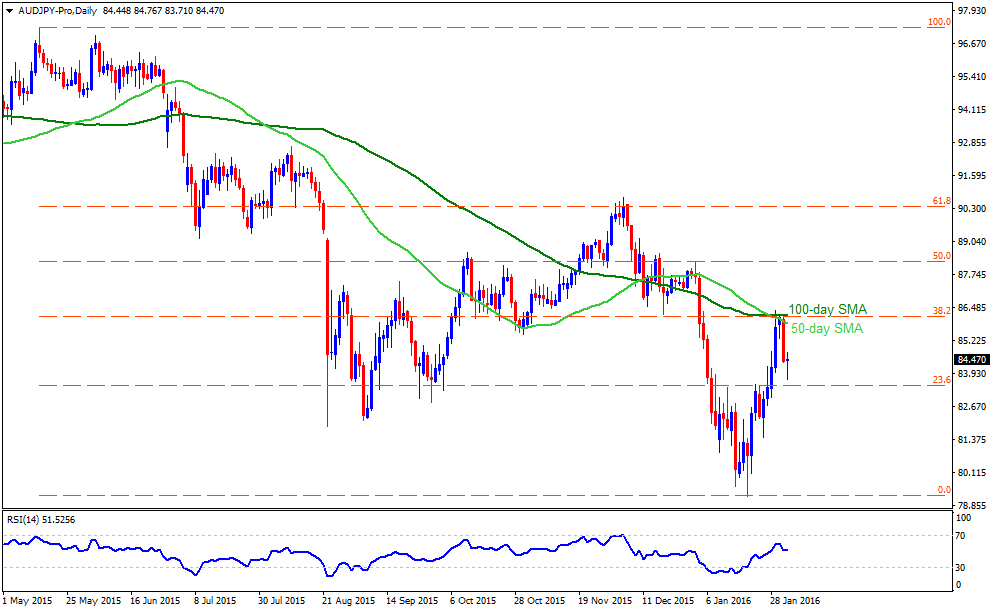

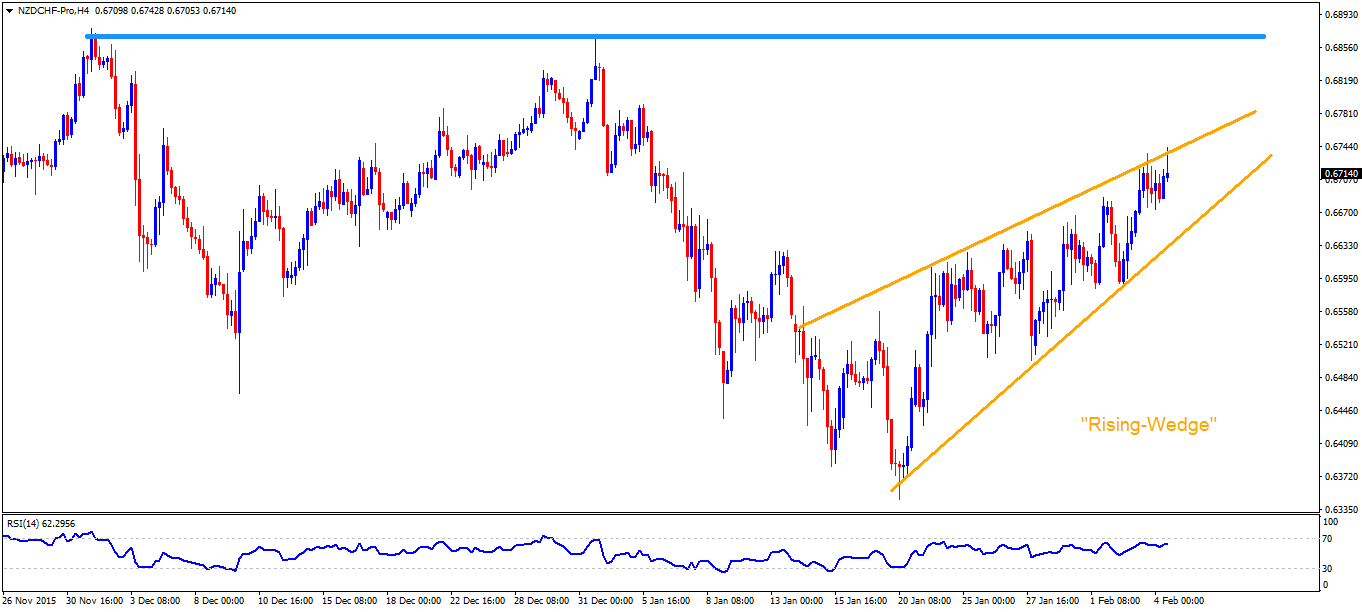

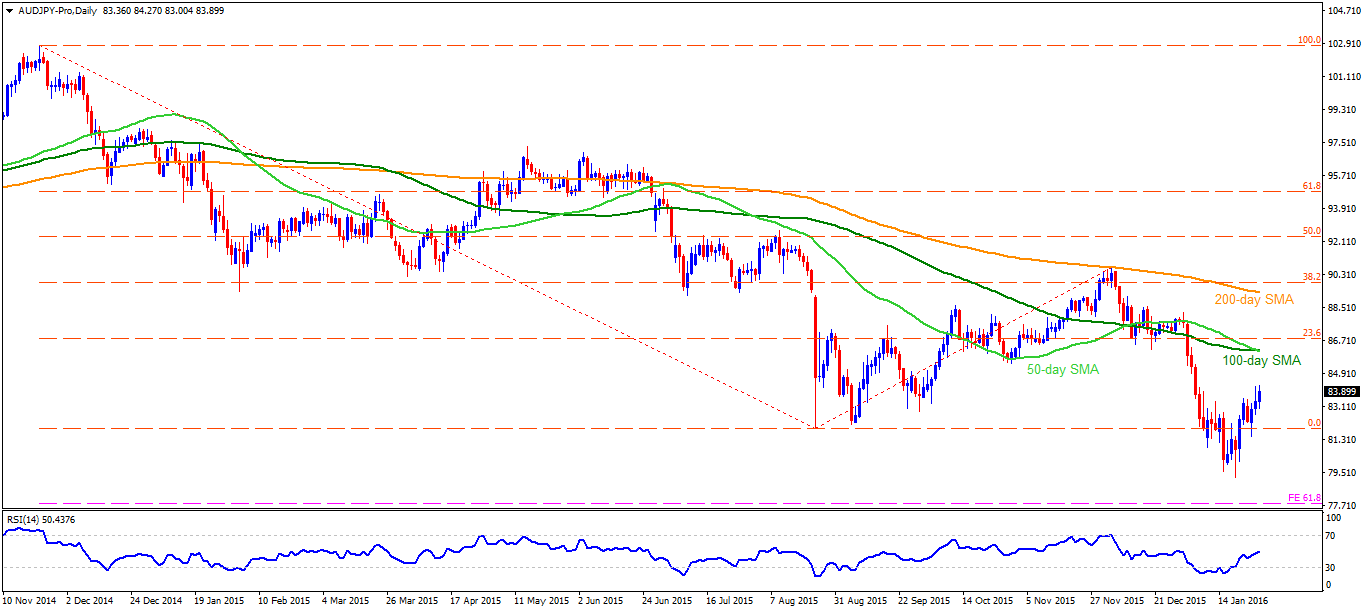

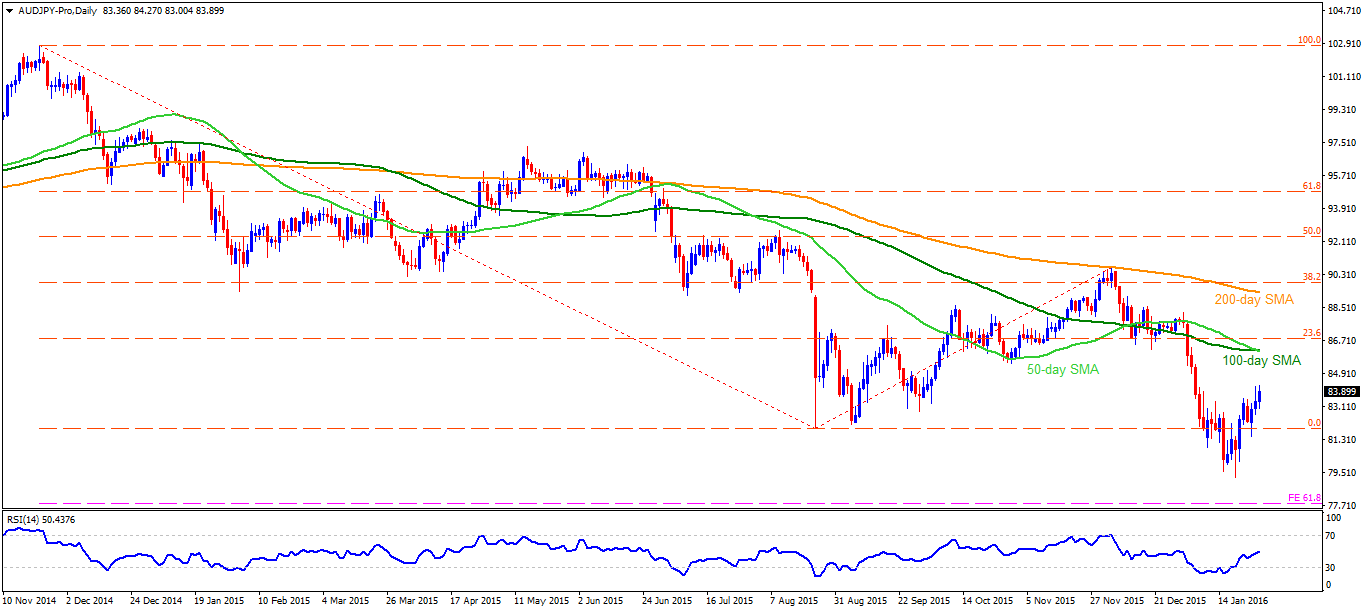

AUDJPY

AUDJPY's recovery from 79.50-40 area seems currently struggling near the 84.00 mark, which if broken, can propel the pair to 85.30-40 and to the 86.15-20 zone which comprises of 50-day & 100-day SMA. Given the pair's ability to surpass 86.20, it becomes capable enough to target 88.00 round figure mark; though, pair's extended rise beyond 88.00 might be capped by 200-day SMA level of 89.30, breaking which it can rally to 90.70-80 region. On the downside, 82.70 and the August lows of 81.90 are likely nearby supports for the pair to break before it could re-test the 81.30 and the 79.50-40 zone. Moreover, pair's continued downside below 79.40 can drag it down to 61.8% FE level of 77.80.

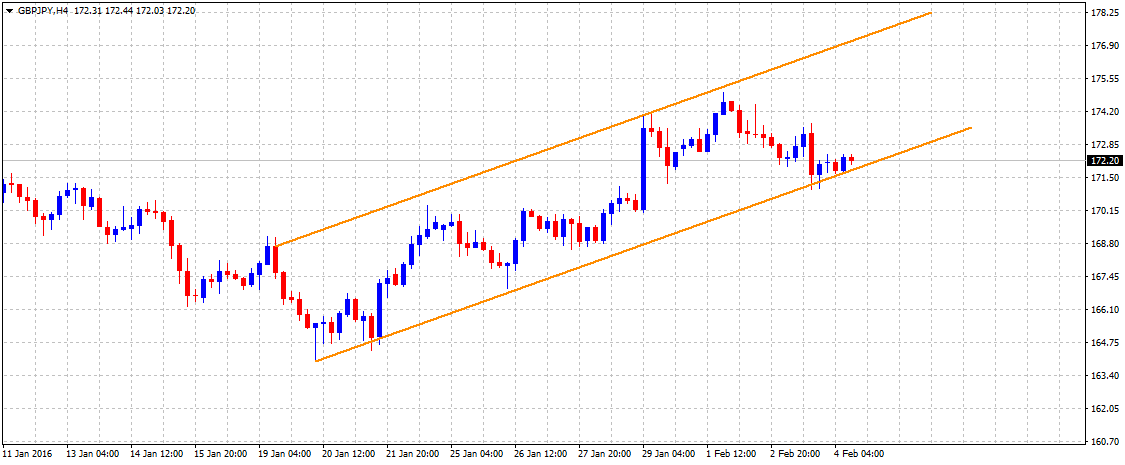

CADJPY

While bounce from two-month old descending trend-channel, coupled with 100% FE of June – August 2015 downside, fueled the CADJPY towards breaking the channel resistance, the pair currently holds its breath near 61.8% FE level of 84.70, breaking which it can rise to 86.30 while an extended up-move beyond 86.30 can propel it to 87.20-40 support-zone, including 50-day SMA & August lows. If the pair manages to clear 87.40, it can stretch the north-run to 88.80 – 89.00 area. Meanwhile, the pair's pullback from the present levels can be confined by the 82.50 immediate support, breaking which renewed downside pressure can drag the pair to 81.00 and the 100% FE level of 79.40. If at all the pair continue dipping below 79.40, chances of its plunge to 76.50 can't be denied.

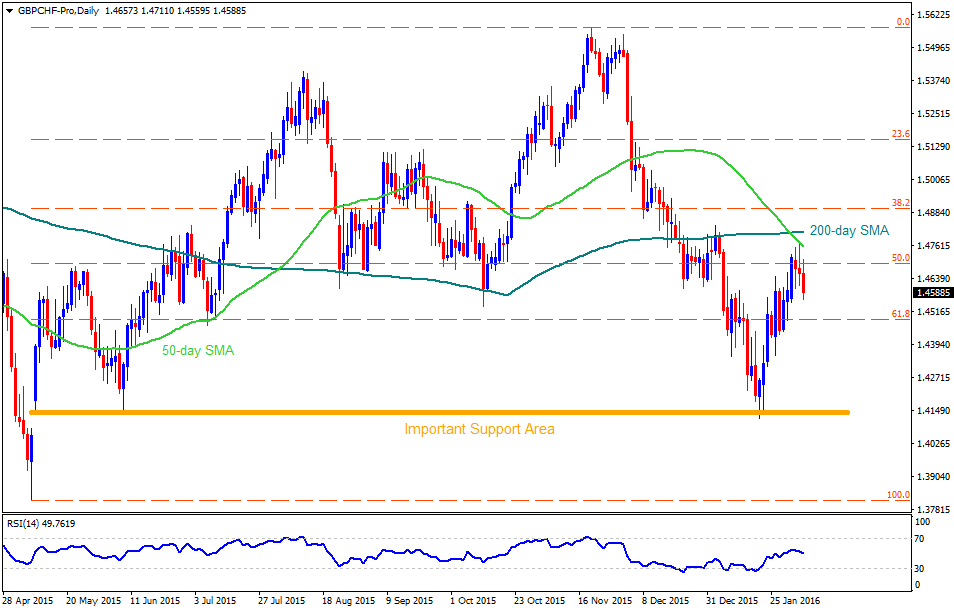

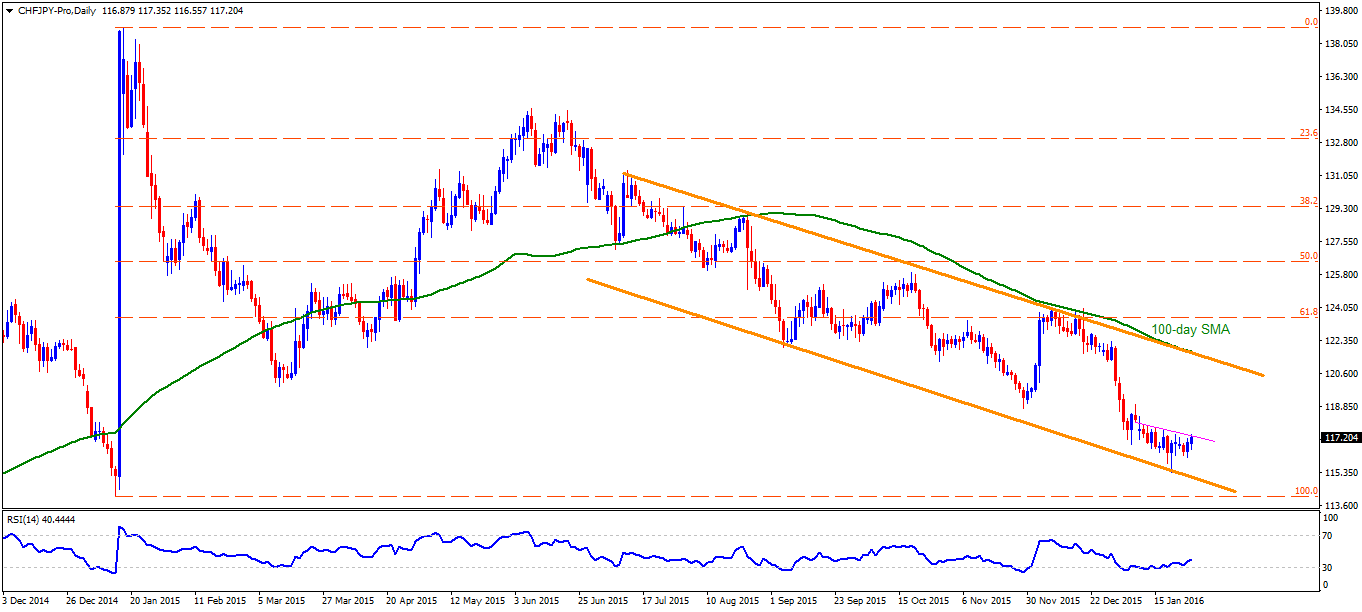

CHFJPY

Even if the CHFJPY manage to bounce from six month old descending trend-channel support, descending trend-line resistance, near 117.15-20, restricts the pair's immediate advances. Should the pair surpass 117.20 on a closing basis, 119.00 and the 120.40-50 are expected consecutive upside numbers that the pair bears might have to wait for before the important 121.60-70 zone, including 100-day SMA and the channel resistance, give rise to chances of fresh pullback by the pair. Alternatively, 116.00 might entertain the immediate short-side of the pair, breaking which the channel support, presently at 115.00, followed by the January lows of 114.00, are likely important support numbers that the pair might hold. If the pair continue on its southward trajectory below 114.00, it can revisit the October 2014 lows, around 111.00 mark.

“Original analysis is provided by Admiral Markets”

USDJPY

With yet another bounce from the 116.20 – 116.00 horizontal support-zone, encompassing 38.2% Fibonacci Retracement of its May 2014 – June 2015 upside, the USDJPY seems all set to confront the 120.00 round figure mark, nearing the 23.6% Fibo level; however, 50-day & 100-day SMA confluence, near 120.50-60 area, can confine the pair's further advances. Should the pair manage to clear 120.60 on a closing basis, it can quickly rise to 121.85 – 122.00 region, breaking which 123.70-80 is likely important upside numbers that the pair traders can watch. Though, pair's inability to sustain the recent pullback can again fetch it to 117.50 immediate support, breaking which it can be dragged down to 116.20 – 116.00 zone. If the pair drops below 116.00, it becomes weaker enough to test 114.00 mark prior to resting near 113.30, including 50% Fibo while further downside below 113.30 opens the door for the pair's slide towards 110.00 mark, which encompasses 61.8% Fibo level.

AUDJPY

AUDJPY's recovery from 79.50-40 area seems currently struggling near the 84.00 mark, which if broken, can propel the pair to 85.30-40 and to the 86.15-20 zone which comprises of 50-day & 100-day SMA. Given the pair's ability to surpass 86.20, it becomes capable enough to target 88.00 round figure mark; though, pair's extended rise beyond 88.00 might be capped by 200-day SMA level of 89.30, breaking which it can rally to 90.70-80 region. On the downside, 82.70 and the August lows of 81.90 are likely nearby supports for the pair to break before it could re-test the 81.30 and the 79.50-40 zone. Moreover, pair's continued downside below 79.40 can drag it down to 61.8% FE level of 77.80.

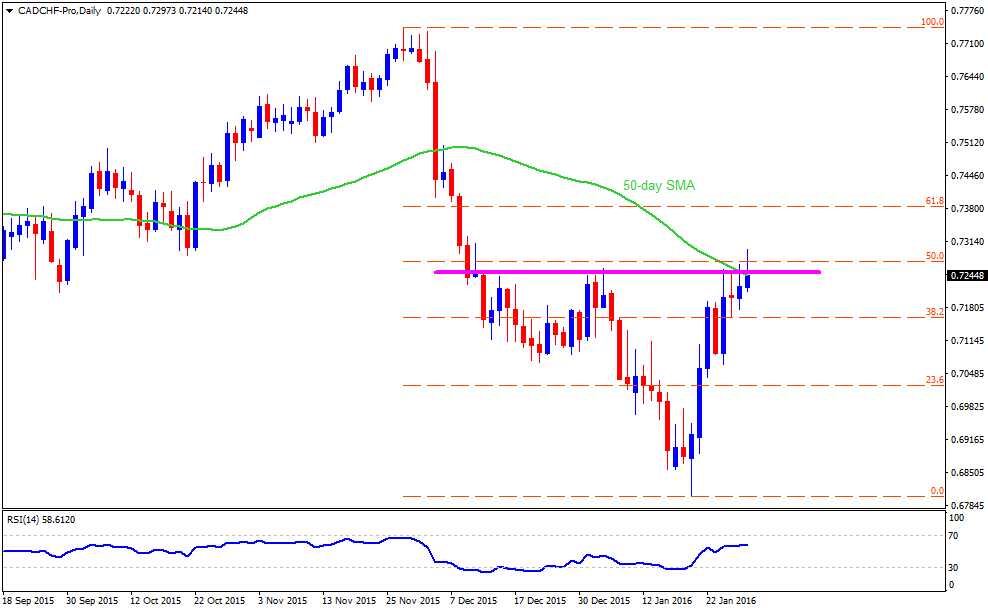

CADJPY

While bounce from two-month old descending trend-channel, coupled with 100% FE of June – August 2015 downside, fueled the CADJPY towards breaking the channel resistance, the pair currently holds its breath near 61.8% FE level of 84.70, breaking which it can rise to 86.30 while an extended up-move beyond 86.30 can propel it to 87.20-40 support-zone, including 50-day SMA & August lows. If the pair manages to clear 87.40, it can stretch the north-run to 88.80 – 89.00 area. Meanwhile, the pair's pullback from the present levels can be confined by the 82.50 immediate support, breaking which renewed downside pressure can drag the pair to 81.00 and the 100% FE level of 79.40. If at all the pair continue dipping below 79.40, chances of its plunge to 76.50 can't be denied.

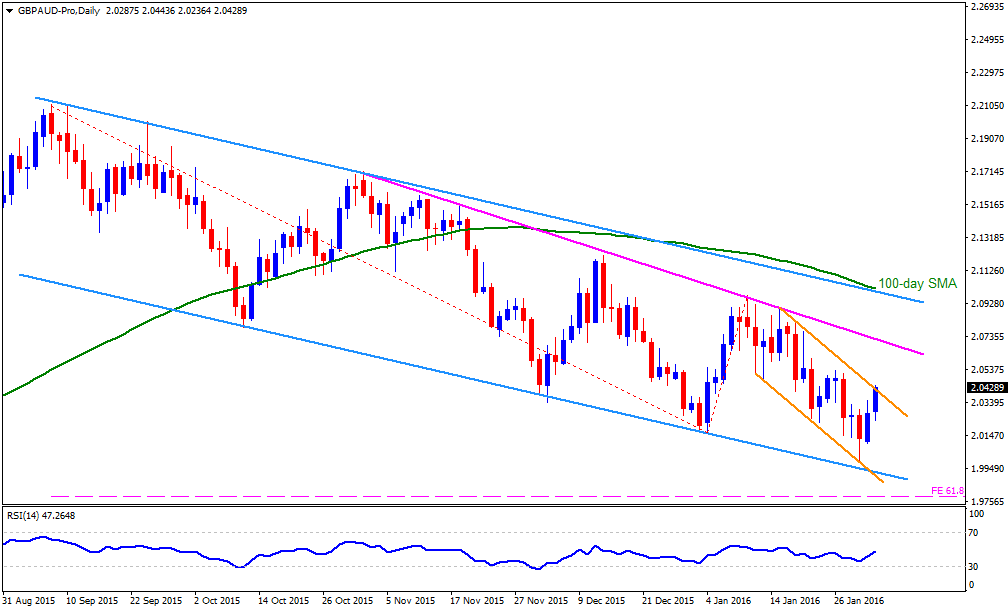

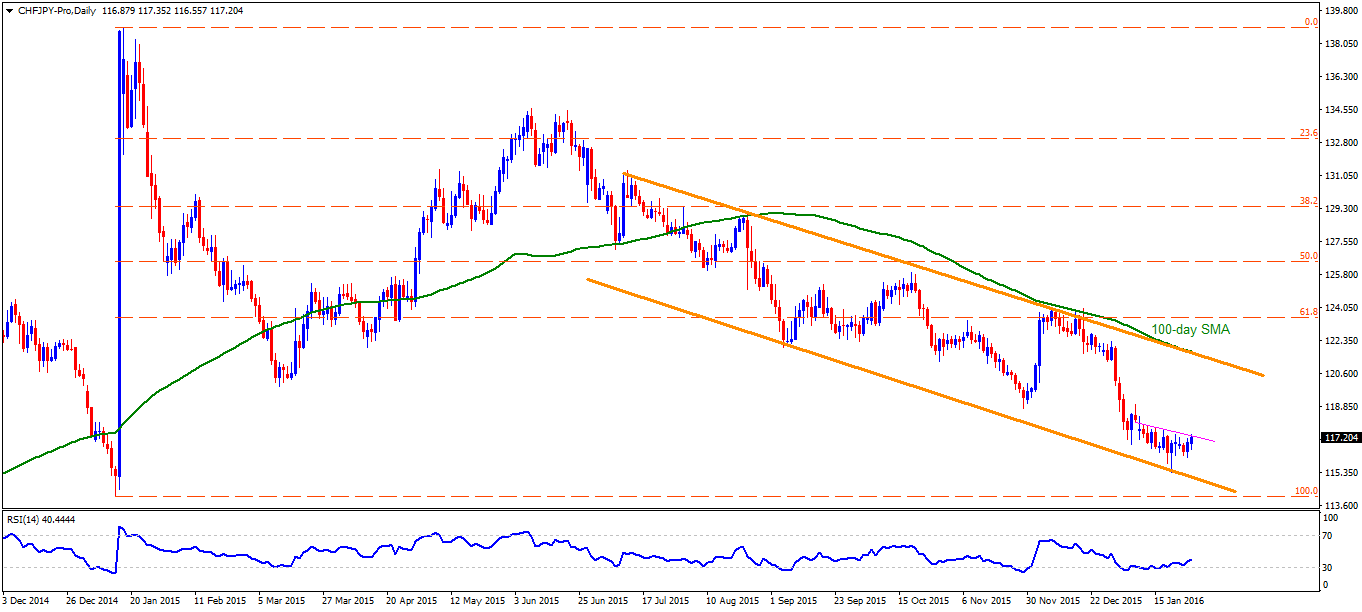

CHFJPY

Even if the CHFJPY manage to bounce from six month old descending trend-channel support, descending trend-line resistance, near 117.15-20, restricts the pair's immediate advances. Should the pair surpass 117.20 on a closing basis, 119.00 and the 120.40-50 are expected consecutive upside numbers that the pair bears might have to wait for before the important 121.60-70 zone, including 100-day SMA and the channel resistance, give rise to chances of fresh pullback by the pair. Alternatively, 116.00 might entertain the immediate short-side of the pair, breaking which the channel support, presently at 115.00, followed by the January lows of 114.00, are likely important support numbers that the pair might hold. If the pair continue on its southward trajectory below 114.00, it can revisit the October 2014 lows, around 111.00 mark.

“Original analysis is provided by Admiral Markets”