UncleSteve

Corporal

- Messages

- 114

Let's discuss learning from mistakes. I did already post this at Babypips, but I finf subtle differences in the audience. I need all the help I can get, and would like feedback on my ideas.

I'm 120 days in, and the trading year is all but over. The exchanges aren't dead yet, but nothing is moving.

I became a trader August 23rd while on vacation, and did very well for about 3 days. I had traded demo for a couple of months but real money made me focus.

I very quickly learned that more indicators is not more success, and discovered Price Action.

Frankly I haven't done that well, but in my day job I'm a systems analyst and I am going to analyze my performance and create a trading plan for January based on the things that worked.

The main thing I have learned is that it is extremely hard to stick to a system, because a system usually stops you from trading (and usually, rightly so!).

For the month of January then, I will stick entirely to 1 system and log my results. I will take into account the stats of my successes to date, develop a plan, and stick to it.

Successful trade features:

Wednesday and Thursday have been my best days

Highest % of wins was between 5-7 AM and 9-10 AM closing after an average of 7.5 hours

Longs on Tuesday & Wednesday were the only trades I averaged a profit

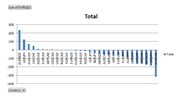

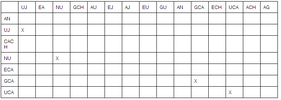

I won over 50% of trades in UJ, EA, NU, GCH, AU, EJ, AJ, EU, GU, AN, GCA, ECH, UCA, ACH, EG

I made a profit on AN, UJ, CACH, NU, ECA, GCA, and UCA only.

Only USDJPY, NZDUSD, GBPCAD and USDCAD fall into both categories.

As I said I discovered Price Action, but I didn't really record the signals I found, and sometimes after a loss I couldn't find the ones I had traded.

Plan for January:

I will record the basis / signal name & location for every trade

I will look for signals discussed in various places as the top PA signals (rejection bars etc)

I will trade in line with the 200 SMA on whichever chart I enter, unless it is neutral

I will trade in line with the 10 & 20 EMAs on whichever chart I enter

I will set my risk to 5% of my balance or $10, whichever is more, using $/SLD (dollars divided by stop loss distance)

I will set SL at the last swing + the spread

I will set a trailing stop equal to the distance between entry and stop loss

I will flag weekly swing levels and only enter if entry-to-swing > stop-loss-distance x 4

I will only trade Tuesday night, Wednesday early morning, noon, after work and late at night, Thursday early morning, noon, after work and late at night.

I will trade D1, H4, H1 and M15, and record which chart I used for every trade

I will only trade USDJPY, NZDUSD, GBPCAD and USDCAD

I will log the characteristics of my pairs every Wednesday and Thursday before I take any trades

It's hard to discipline myself but I believe this will give me a better shot at success; does anyone else do anything like this?

What do you think?

I'm 120 days in, and the trading year is all but over. The exchanges aren't dead yet, but nothing is moving.

I became a trader August 23rd while on vacation, and did very well for about 3 days. I had traded demo for a couple of months but real money made me focus.

I very quickly learned that more indicators is not more success, and discovered Price Action.

Frankly I haven't done that well, but in my day job I'm a systems analyst and I am going to analyze my performance and create a trading plan for January based on the things that worked.

The main thing I have learned is that it is extremely hard to stick to a system, because a system usually stops you from trading (and usually, rightly so!).

For the month of January then, I will stick entirely to 1 system and log my results. I will take into account the stats of my successes to date, develop a plan, and stick to it.

Successful trade features:

Wednesday and Thursday have been my best days

Highest % of wins was between 5-7 AM and 9-10 AM closing after an average of 7.5 hours

Longs on Tuesday & Wednesday were the only trades I averaged a profit

I won over 50% of trades in UJ, EA, NU, GCH, AU, EJ, AJ, EU, GU, AN, GCA, ECH, UCA, ACH, EG

I made a profit on AN, UJ, CACH, NU, ECA, GCA, and UCA only.

Only USDJPY, NZDUSD, GBPCAD and USDCAD fall into both categories.

As I said I discovered Price Action, but I didn't really record the signals I found, and sometimes after a loss I couldn't find the ones I had traded.

Plan for January:

I will record the basis / signal name & location for every trade

I will look for signals discussed in various places as the top PA signals (rejection bars etc)

I will trade in line with the 200 SMA on whichever chart I enter, unless it is neutral

I will trade in line with the 10 & 20 EMAs on whichever chart I enter

I will set my risk to 5% of my balance or $10, whichever is more, using $/SLD (dollars divided by stop loss distance)

I will set SL at the last swing + the spread

I will set a trailing stop equal to the distance between entry and stop loss

I will flag weekly swing levels and only enter if entry-to-swing > stop-loss-distance x 4

I will only trade Tuesday night, Wednesday early morning, noon, after work and late at night, Thursday early morning, noon, after work and late at night.

I will trade D1, H4, H1 and M15, and record which chart I used for every trade

I will only trade USDJPY, NZDUSD, GBPCAD and USDCAD

I will log the characteristics of my pairs every Wednesday and Thursday before I take any trades

It's hard to discipline myself but I believe this will give me a better shot at success; does anyone else do anything like this?

What do you think?