Wow, what a month. UncleSteve learned some stuff the hard way. But I think I am confirmed enough in my system to leave it unchanged for another month, or rather just tweak it gently.

If you recall, I started trading in August and by the holiday season had lost pretty steadily. I extracted trade data from MT4 and myfxbook.com and dumped it into a pivot table set, that wonderful instrument with which one tortures numbers and tries to make them talk.

My goal is clear, that within a few years I will be able to replace my salary with trading.

Long story short, I came up with a few guidelines for January, which I posted here:

Plan for January:

I will record the basis / signal name & location for every trade

I will look for signals discussed in various places as the top PA signals (rejection bars etc)

I will trade in line with the 200 SMA on whichever chart I enter, unless it is neutral

I will trade in line with the 10 & 20 EMAs on whichever chart I enter

I will set my risk to 5% of my balance or $10, whichever is more, using $/SLD (dollars divided by stop lossdistance)

I will set SL at the last swing + the spread

I will set a trailing stop equal to the distance between entry and stop loss

I will flag weekly swing levels and only enter if entry-to-swing > stop-loss-distance x 4

I will only trade Tuesday night, Wednesday early morning, noon, after work and late at night, Thursday early morning, noon, after work and late at night.

I will trade D1, H4, H1 and M15, and record which chart I used for every trade

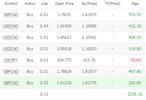

I will only trade USDJPY, NZDUSD, GBPCAD and USDCAD

I will log the characteristics of my pairs every Wednesday and Thursday before I take any trades

I also paid for an EA that has done very well for the past year, called sPhantom. More on that later (you can’t see me but I have a bitter look on my face).

January was one heckuva month. I stuck to my system. Unfortunately the EA operators (it’s actually a trade copier) didn’t stick to theirs! They made a steady string of 10-pip profits for most of the month, but then traded 1 hour before major news events twice, losing drastically each time. And their customer service seems to have disappeared or died.

Bottom line: my own trades went well. If it weren't for the EA trades I would have doubled my account. Oh well, live & learn.

Now I have gotten the EA trades off my chest I’ll stop talking about them, lest I be seen as having a victim mentality!

I know some people talk about not leaving trades open too long due to “exposure” but with trailing stops I don’t really know what that means to me. Some of my trades went wrong and hit my SL, each time losing me exactly what I had risked in dollars; the rest took a few days to reach the point where my trailing stop pulled the SL to the breakeven point.

I didn’t close any trades manually, and some just kept climbing. I spent a few swap dollars but the bottom line is, I started the month with about $300 in my account and ended with over $700.

I made 19 trades in the month, 12 of which closed in profit, so about 63%. In previous months I made many more trades and lost money.

OK, so the question is, where do I go from here? I have made a few decisions:

1. EA’s in my stable will only be

a. Used on profits, not speculation money, and on a separate account

b. Those I can set up and adjust the money management on myself (they can provide the signal, but I will filter the signals and set SL’s and TP’s according to my system)

2. Unless someone can explain why this is wrong, I will continue with the trailing-stop model set to close losing trades ASAP and keep winning trades open as long as possible

3. I think the choice of instruments had more to do with trending conditions than any mystical connection with the charts. I will therefore cautiously add other instruments. To do this I’ll review the D1 charts of all my broker’s pairs with the 200 SMA, and the 10 and 20 EMA’s. I’ll set the zoom level so the 200 SMA is as close as possible to the top-or-bottom-left corner of the chart, and select the instruments that look nicest.

4. I will try to do a better job posting my trades here for approval or ridicule!!

Please leave your comments, I appreciate the insights.