Hi everyone,

I've had a very bad experience with Pepperstone.com over a period of many months. 14/03/2022 - 28/11/2022.

So much so, that I'm now in the process of setting up a "Class/Collective Action claim" against them.

I did post a one star review on Trustpilot 30/11/2022, but as soon as I updated it with, Notice Of Class/Collective Action, my Trustpilot account was locked. Good old Trustpilot, as trustful as a bag of adders. They also deleted part of my review without my prior knowledge or permission.

If anyone wants to see my full review please look below, or hundreds of screen shots as evidence, please let me know.

I went through Pepperstone’s complaints procedure. Complete waste of time, as they failed to comment on any of the “trades of concern”, that they wanted me to provide. They only said that I could complain to the Ombudsman. "Their" initial investigation, just asked for three out of hundreds of examples, and decided that “Pepperstone need not take any action” Whether or not Pepperstone is guilty or not of actual “Market Abuse” They, are still knowingly, and, willingly, supplying retail traders, to a highly manipulated Forex. So at the very least, they are in “Breach Of Duty Of Care” to their clients.

Pepperstone's PDS (Product Disclosure Statement) " 6. Key risks of trading" "6.3 The products that we offer are high risk and can be complex to understand."

Which, implies that with gained or learned knowledge, the trader might make a profit. Whereas nothing, could be further from the truth. Because, when you experience continual stop-hunts and trend reversals as soon as you place a trade, there is no way to make any profit. The trader is effectively setup to lose.

Please see below, Trustpilot "unedited" review which was posted on 30/11/2022. The underlined text is what was deleted. Please see partially deleted review PDF as attachment.

Pepperstone review14.03.2022 - 28.11.2022

First off, these are my opinions, my experiences. I can provide factual evidence, as in, screen shots, which will have my personal details removed.

End of review is an excerpt, (6. Key risks of trading) from Pepperstone’s PDS, (Product Disclosure Statement).

When I first started trading, I naively thought to somewhat increase the savings that I had made throughout my life. Did awful lot of learning, months and months. Did a lot of research on brokers, and after a lot of reading reviews, chose Pepperstone as the best bet.

I practiced trading on demo trading simulators. All a bit pointless. As it turns out, simulators, don’t react and reverse when you make a trade. No, why would they.

I have been enthusiastic in, learning all that I could about ”highly profitable setups”, levels, and fibs, and all the rest of it, ”Levels”, “Impulse waves”, “Pull-backs”, chart patterns, “W”s and“ M”s. They also provide you with “Indicators”, for you to follow as well. So you can look at your e.g. “Stochastic indicator” to spot a reversal.

To be fair I did win a few of the early trades, but slowly and surely, the trades started to go against me. Experiencing trap after trap continuously. The trend isn't your friend after all. The second you back a strong trend or strong setup, instant reversal. Long, Short, doesn’t matter, 95% of trades reverse. Yes, I can understand price reversing for a short period, but a complete trend change nearly every time that I make a trade, is not consistent with the “risks” set out in Pepperstone’s PDS, (Product Disclosure Statement). Please see excerpt below.

For example: Had the risk statement said something like: “It is highly likely, as soon as you make a trade, the price trend, will more than likely reverse, and your Stop-Loss, will more than likely get hit. Resulting in, you losing your capital”. I don’t think that I would have got involved. Because it is highly unlikely that I would make any profit. I can now see, why so many traders don’t make it.

No, this is fraud, plain and simple, by blatant price manipulation, or as the FCA call it “Market Abuse”.

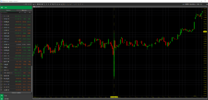

I thought, to take screen shots, of just about every trade that suspiciously reversed. I now have hundreds.

I remember complaining to the guy that Pepperstone assigned to look after me. I won’t mention his name. Such a nice chap, used to phone regularly, until the money went down, never to be heard again.

He said, “Can’t be anything to do with us because we don’t have a dealing desk. We are a Non-dealing desk broker.”

Yes, that may well be, however, I am dealing with you, and you, are at least complicit in, and with, the fraudulent actions and activities, either by yourselves or others.

I will make all of my150++ screen shots that I have taken, available, for anyone, to have a look at if they wish.

Below is an excerpt from Pepperstone’s PDS, (Product Disclosure Statement).

6.Key risks of trading

Margin FX

Contracts and

CFDs

Not trading on a formal

exchange

6.1Trading with us is different to trading on a formal exchange. Unlike the Australian Securities Exchange and other exchanges, there’s no clearing

house for Margin FX Contracts and CFDs, and the performance of a CFD and/or Margin FX Contract by us isn’t “guaranteed” by an exchange or clearinghouse.

6.2 You’re also not buying the Underlying Asset (like a share or the currency), you’re investing in an interest in that Underlying Asset.

Suitability risk

6.3 The products that we offer are high risk and can be complex to understand. It’s critical that you consider your own current circumstances to make sure that these products are suitable for

you. If you don’t understand the key features and risks of the products that we offer, you should seek independent financial advice before you start trading with us.

Volatility risk

6.4 Margin FX and CFDs are derivatives. Derivative markets generally can be highly volatile (i.e. they move up and down in value quite quickly) so the risk that you’ll incur losses when you trade in derivatives Contracts can be substantial.

6.5 High volatility means the market scan be very difficult to predict. This means that you shouldn’t consider any Contract offered by us or any other financial services provider to be a

“safe” trade.

6.6 If the market moves against you, you can find yourself in a position where the money you have on deposit in your Account isn’t enough to maintain yourContract, and you’ll be required to immediately deposit additionalmoney as Margin to keep your Contract Open i.e. to “top up” yourAccount. If you don’t pay the additional money when we require youto, and your Margin drops below 50% of the Margin required tomaintain your current Open Contracts, we are required to Close-Outyour Contracts.

I've had a very bad experience with Pepperstone.com over a period of many months. 14/03/2022 - 28/11/2022.

So much so, that I'm now in the process of setting up a "Class/Collective Action claim" against them.

I did post a one star review on Trustpilot 30/11/2022, but as soon as I updated it with, Notice Of Class/Collective Action, my Trustpilot account was locked. Good old Trustpilot, as trustful as a bag of adders. They also deleted part of my review without my prior knowledge or permission.

If anyone wants to see my full review please look below, or hundreds of screen shots as evidence, please let me know.

I went through Pepperstone’s complaints procedure. Complete waste of time, as they failed to comment on any of the “trades of concern”, that they wanted me to provide. They only said that I could complain to the Ombudsman. "Their" initial investigation, just asked for three out of hundreds of examples, and decided that “Pepperstone need not take any action” Whether or not Pepperstone is guilty or not of actual “Market Abuse” They, are still knowingly, and, willingly, supplying retail traders, to a highly manipulated Forex. So at the very least, they are in “Breach Of Duty Of Care” to their clients.

Pepperstone's PDS (Product Disclosure Statement) " 6. Key risks of trading" "6.3 The products that we offer are high risk and can be complex to understand."

Which, implies that with gained or learned knowledge, the trader might make a profit. Whereas nothing, could be further from the truth. Because, when you experience continual stop-hunts and trend reversals as soon as you place a trade, there is no way to make any profit. The trader is effectively setup to lose.

Please see below, Trustpilot "unedited" review which was posted on 30/11/2022. The underlined text is what was deleted. Please see partially deleted review PDF as attachment.

Pepperstone review14.03.2022 - 28.11.2022

First off, these are my opinions, my experiences. I can provide factual evidence, as in, screen shots, which will have my personal details removed.

End of review is an excerpt, (6. Key risks of trading) from Pepperstone’s PDS, (Product Disclosure Statement).

When I first started trading, I naively thought to somewhat increase the savings that I had made throughout my life. Did awful lot of learning, months and months. Did a lot of research on brokers, and after a lot of reading reviews, chose Pepperstone as the best bet.

I practiced trading on demo trading simulators. All a bit pointless. As it turns out, simulators, don’t react and reverse when you make a trade. No, why would they.

I have been enthusiastic in, learning all that I could about ”highly profitable setups”, levels, and fibs, and all the rest of it, ”Levels”, “Impulse waves”, “Pull-backs”, chart patterns, “W”s and“ M”s. They also provide you with “Indicators”, for you to follow as well. So you can look at your e.g. “Stochastic indicator” to spot a reversal.

To be fair I did win a few of the early trades, but slowly and surely, the trades started to go against me. Experiencing trap after trap continuously. The trend isn't your friend after all. The second you back a strong trend or strong setup, instant reversal. Long, Short, doesn’t matter, 95% of trades reverse. Yes, I can understand price reversing for a short period, but a complete trend change nearly every time that I make a trade, is not consistent with the “risks” set out in Pepperstone’s PDS, (Product Disclosure Statement). Please see excerpt below.

For example: Had the risk statement said something like: “It is highly likely, as soon as you make a trade, the price trend, will more than likely reverse, and your Stop-Loss, will more than likely get hit. Resulting in, you losing your capital”. I don’t think that I would have got involved. Because it is highly unlikely that I would make any profit. I can now see, why so many traders don’t make it.

No, this is fraud, plain and simple, by blatant price manipulation, or as the FCA call it “Market Abuse”.

I thought, to take screen shots, of just about every trade that suspiciously reversed. I now have hundreds.

I remember complaining to the guy that Pepperstone assigned to look after me. I won’t mention his name. Such a nice chap, used to phone regularly, until the money went down, never to be heard again.

He said, “Can’t be anything to do with us because we don’t have a dealing desk. We are a Non-dealing desk broker.”

Yes, that may well be, however, I am dealing with you, and you, are at least complicit in, and with, the fraudulent actions and activities, either by yourselves or others.

I will make all of my150++ screen shots that I have taken, available, for anyone, to have a look at if they wish.

Below is an excerpt from Pepperstone’s PDS, (Product Disclosure Statement).

6.Key risks of trading

Margin FX

Contracts and

CFDs

Not trading on a formal

exchange

6.1Trading with us is different to trading on a formal exchange. Unlike the Australian Securities Exchange and other exchanges, there’s no clearing

house for Margin FX Contracts and CFDs, and the performance of a CFD and/or Margin FX Contract by us isn’t “guaranteed” by an exchange or clearinghouse.

6.2 You’re also not buying the Underlying Asset (like a share or the currency), you’re investing in an interest in that Underlying Asset.

Suitability risk

6.3 The products that we offer are high risk and can be complex to understand. It’s critical that you consider your own current circumstances to make sure that these products are suitable for

you. If you don’t understand the key features and risks of the products that we offer, you should seek independent financial advice before you start trading with us.

Volatility risk

6.4 Margin FX and CFDs are derivatives. Derivative markets generally can be highly volatile (i.e. they move up and down in value quite quickly) so the risk that you’ll incur losses when you trade in derivatives Contracts can be substantial.

6.5 High volatility means the market scan be very difficult to predict. This means that you shouldn’t consider any Contract offered by us or any other financial services provider to be a

“safe” trade.

6.6 If the market moves against you, you can find yourself in a position where the money you have on deposit in your Account isn’t enough to maintain yourContract, and you’ll be required to immediately deposit additionalmoney as Margin to keep your Contract Open i.e. to “top up” yourAccount. If you don’t pay the additional money when we require youto, and your Margin drops below 50% of the Margin required tomaintain your current Open Contracts, we are required to Close-Outyour Contracts.