Kelly Yeung

ATFX.com Representative

- Messages

- 835

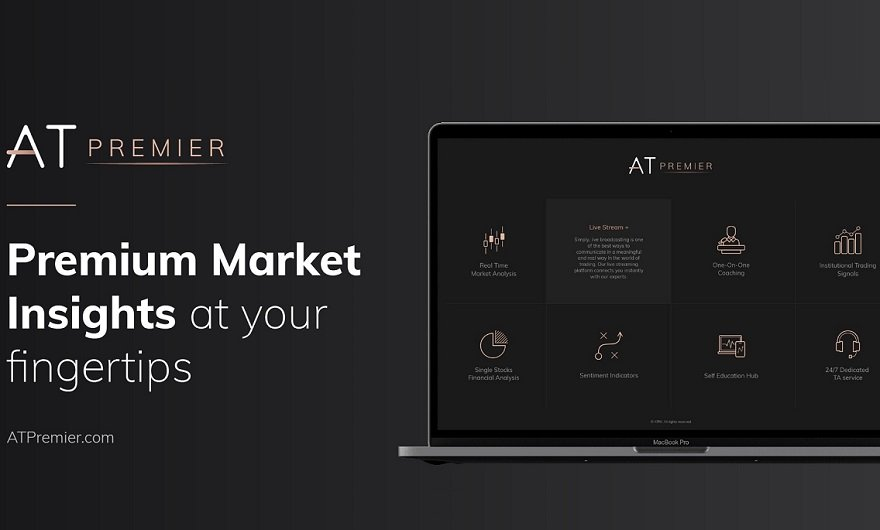

ATFX has just announced the launch of its advanced research and analysis platform – AT Premier. The platform was initially released in the Middle East region. AT Premier was designed as a comprehensive, multi-dimensional, intelligence-delivery platform to provide market analysis, education, signals, news and copy trading.

Powered by dedicated internal intelligence tools, AT Premier, serves as an one-stop solutions hub for beginners, professional traders, market analysts, money managers and introducing brokers.

Ramy Abouzaid, Head of Market Research at ATFX’s middle-east office commented:

“ Our clear aim was to create a simple, easy-to-use yet complete platform where users could digest and act upon sensible intelligence sourced and distilled from a multitude of respected sources.”

Some of the services which power the platform are:

Joe Li, Group Chairman at ATFX added:

“ At ATFX, we constantly endeavor to put our clients at the heart of absolutely everything we do. AT Premier is meant to make a trader’s typically stressful journey a fulfilling and productive one. We have always held the belief that state-of-the-art and even user-friendly technology is only as good as its transparency and effectiveness. Hence, at the very core, AT Premier is a transparent and effective tool to aid and abet the experience and productivity of every entity or individual that takes online trading seriously.”

Other services that enhance AT Premiere include:

ATFX is a co-brand shared by a group entities including:

Powered by dedicated internal intelligence tools, AT Premier, serves as an one-stop solutions hub for beginners, professional traders, market analysts, money managers and introducing brokers.

Ramy Abouzaid, Head of Market Research at ATFX’s middle-east office commented:

“ Our clear aim was to create a simple, easy-to-use yet complete platform where users could digest and act upon sensible intelligence sourced and distilled from a multitude of respected sources.”

Some of the services which power the platform are:

- Real Time Market Analysis – with quick delivery of data and insights being vital for informed trading, ATFX technical analysis feed has been developed as a real-time data center.

- Institutional Signals & AT Sentiment Indicators – A service for advanced traders who want to capture an edge on the markets’ major analytical views and sentimental targets. AT Premier gives trades access to institutional quality data and analysis, presented in a compelling visual manner. The platform provides a derived-data service (DDS) with forecasts constantly updated from over 20 institutions.

- Single Stock Financial Analysis – there is growing interest in trading strong-performing single stocks. Infographics & data analysis produced daily on key companies and portfolios allow traders to make sense of performance nuances in a clear and simple manner.

- Markets Live – ATFX’s live streaming platform, currently set at 40 minutes per day and connects their clients instantly with experts. The service covers the most current and influential topics and insights into market moves and impact.

Joe Li, Group Chairman at ATFX added:

“ At ATFX, we constantly endeavor to put our clients at the heart of absolutely everything we do. AT Premier is meant to make a trader’s typically stressful journey a fulfilling and productive one. We have always held the belief that state-of-the-art and even user-friendly technology is only as good as its transparency and effectiveness. Hence, at the very core, AT Premier is a transparent and effective tool to aid and abet the experience and productivity of every entity or individual that takes online trading seriously.”

Other services that enhance AT Premiere include:

- One-On-One Coaching – ATFX allows premium users access to senior analysts through an efficient appointment management system via video-chat platforms and webinar offerings.

- Self-education Hub – ATFX’s library of digital educational videos is varied, topical and constantly updated to maintain relevance in this age of constant flux.

- 24×5 Dedicated Technical Analysis – A skilled support team has been trained to be at hand to respond in real-time to any technical analysis-led queries that users typically have.

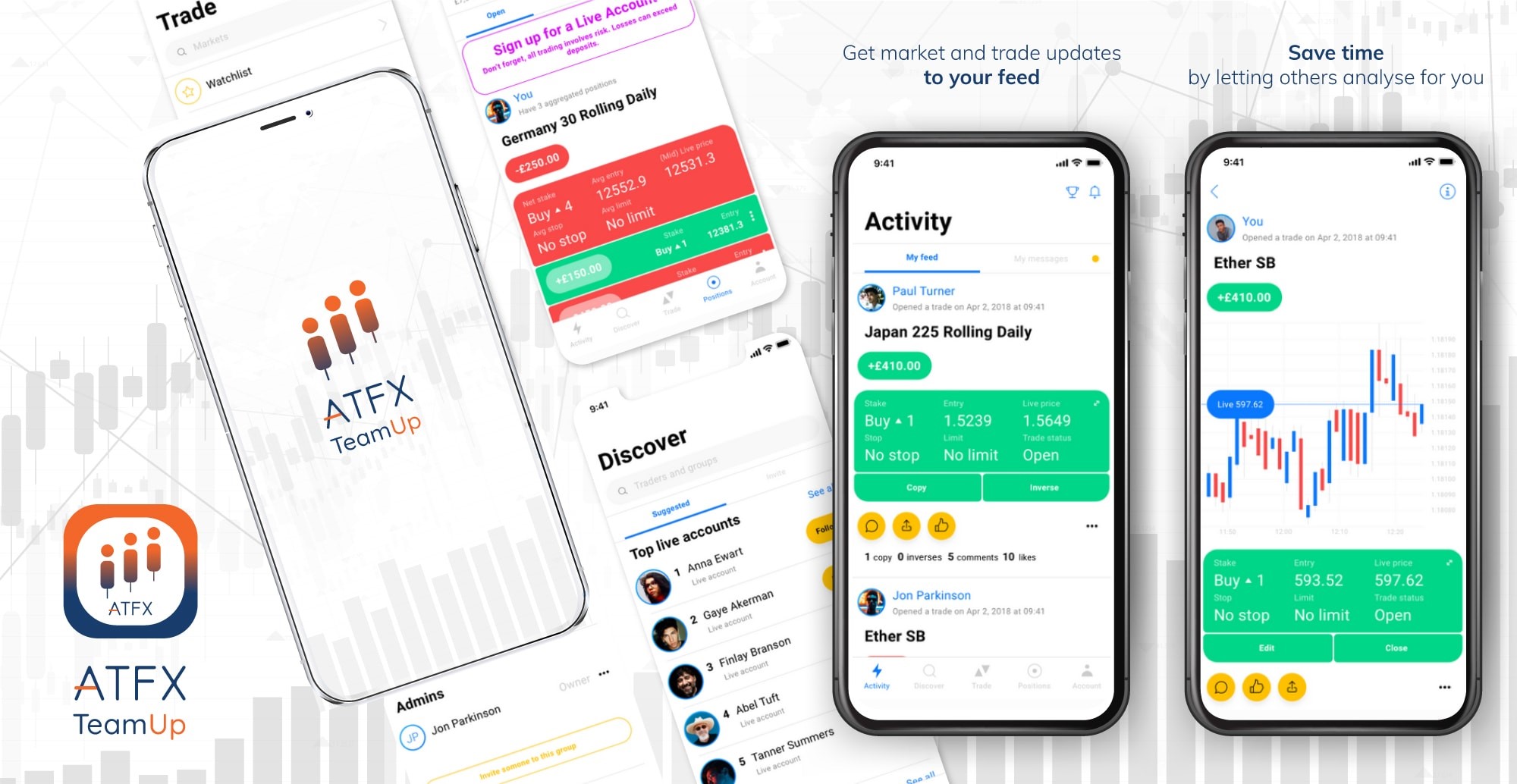

- Copy Trading – AT Premier’s Copy Trading platform aims to serve professional money managers and traders to share their performance with their own private network as well as other AT Premier portal users so that they can generate extra income for themselves.

ATFX is a co-brand shared by a group entities including:

- AT Global Markets (UK) Ltd is authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom with registration number 760555. The Registered Office: 1st Floor, 32 Cornhill, London EC3V 3SG, United Kingdom.

- AT Global Markets LLC is a Limited Liability Company in Saint Vincent and the Grenadines with company number 333 LLC 2020. The Registered Office: 1st Floor, First St. Vincent Bank Bldg, James Street, Kingstown, St. Vincent and the Grenadines.

- ATFX Global Markets (CY) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) under the license no. 285/15. The Registered Office: 159 Leontiou A' Street, Maryvonne Building Office 204, 3022, Limassol, Cyprus.

- AT Global Markets Intl Ltd is authorized and regulated by the Financial Services Commission with license Number C118023331. The Registered Office: Suite 207, 2nd Floor, The Catalyst, Silicon Avenue, 40 Cybercity, 72201 Ebène, Republic of Mauritius.