SOLID ECN LLC

Solid ECN Representative

- Messages

- 514

BTC USD - monetary pressure on the token may continue

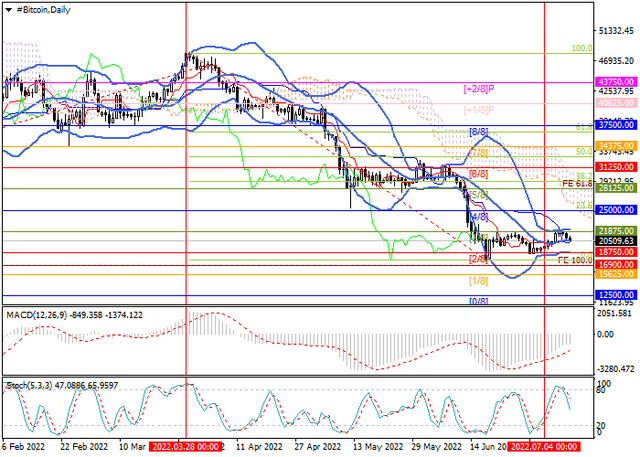

The cryptocurrency sector remains under pressure due to the tightening of the US Federal Reserve's monetary policy and the industry's general problems associated with a significant decrease in the capitalization of market leaders. Investors reacted negatively to the June data of the US labor market, believing that they would remove the last concerns of US Federal Reserve officials and force them to increase the rate again by 75 percentage points, which will lead to additional strengthening of the dollar. In public speeches, representatives of the crypto-currency community are trying to calm each other, stating that the current "crypto winter" will play in favor of the market but this looks like an attempt to find at least something good in the current difficult situation for the sector.

The potential for a further decline in digital assets will remain.

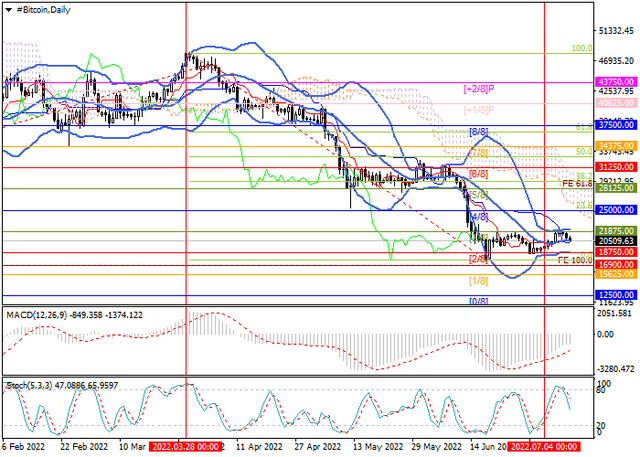

The trading instrument is testing the middle line of Bollinger Bands 20500 but the key "bearish" is 18750, the breakdown of which allows further decline to 15625 and 12500 and 10000.00. The breakout of 21875 (the upper line of Bollinger bands) allows growth to 25000(Fibonacci correction 23.6%), 28125.

Resistance levels: 21875, 25000, 28125, 31250 | Support levels: 18750, 15625, 12500, 10000

The potential for a further decline in digital assets will remain.

The trading instrument is testing the middle line of Bollinger Bands 20500 but the key "bearish" is 18750, the breakdown of which allows further decline to 15625 and 12500 and 10000.00. The breakout of 21875 (the upper line of Bollinger bands) allows growth to 25000(Fibonacci correction 23.6%), 28125.

Resistance levels: 21875, 25000, 28125, 31250 | Support levels: 18750, 15625, 12500, 10000