SOLID ECN LLC

Solid ECN Representative

- Messages

- 515

Decline within the general market trend

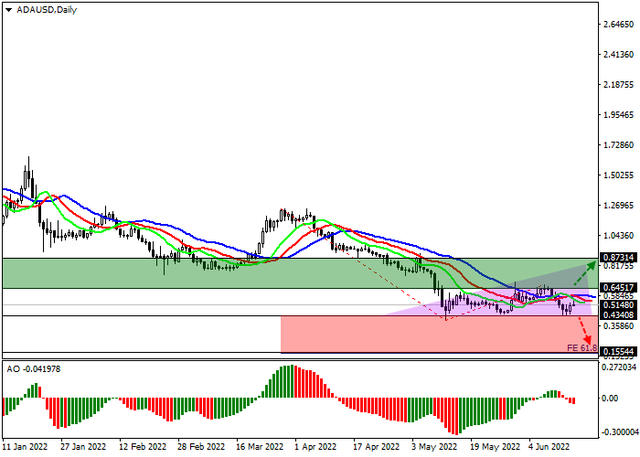

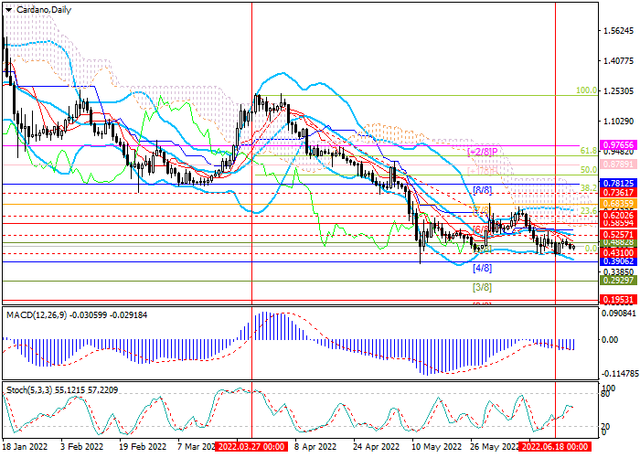

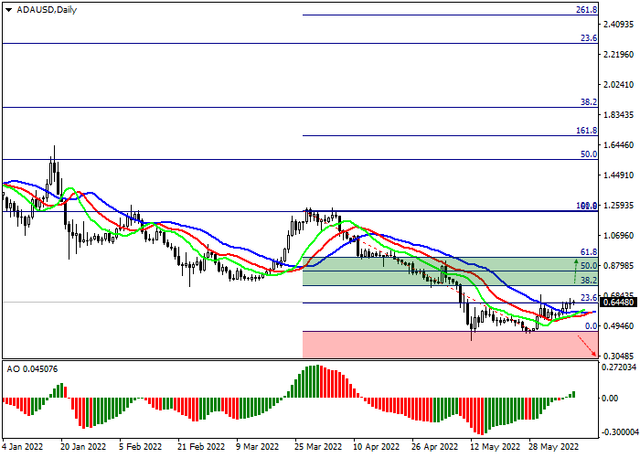

ADAUSD is actively declining as part of the general market dynamics, being at 0.6448.

On the global chart of the asset, the price is trading in a stable downtrend, turning into a full-fledged trend at the end of March after overcoming the Fibonacci 61.8% full retracement level at 1.2230. However, recently the quotes have been actively rising, having reached the level of an initial Fibonacci retracement of 23.6% at 0.6400, in case of fixing above which the local growth will continue until reaching the level of a complete Fibonacci retracement of 61.8% (0.9298).

Technical indicators confirm a likely upside scenario, reversing towards growth: fast EMAs on the Alligator indicator have already crossed the signal line from below and began to expand the range of fluctuations, while the AO oscillator histogram has moved into the buy zone, having overcome the zero level, and continuing to form rising bars.

Resistance levels: 0.7480, 0.9298 | Support levels: 0.4546, 0.3